Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

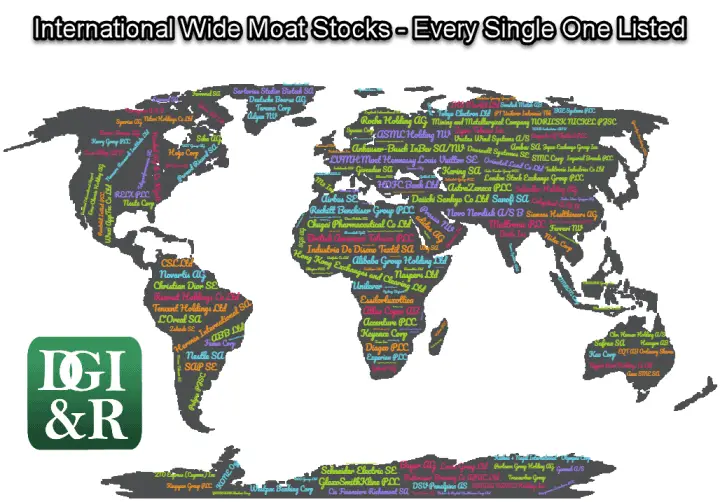

Wide moat companies are a natural starting point for investors looking for high-quality stocks.

To help with this search, I used Morningstar to find all 190 International wide moat stocks.

I have separate articles on Canadian and US wide moat stocks, so for this article International means all countries except Canada and the USA.

You can check out the other articles in this wide moat series here:

- What is a Moat? With 5 Canadian Wide Moat Examples

- Why Invest in Wide Moat Stocks?

- 3 Ways to Find Wide Moat Stocks

- Each & Every Wide Moat Stock in Canada

- Every Wide Moat Stock in the USA

- International Wide Moat Stocks – Every Single One Listed (This is the article you are currently reading)

- 8 Canadian Dividend Growth Wide Moat Stocks

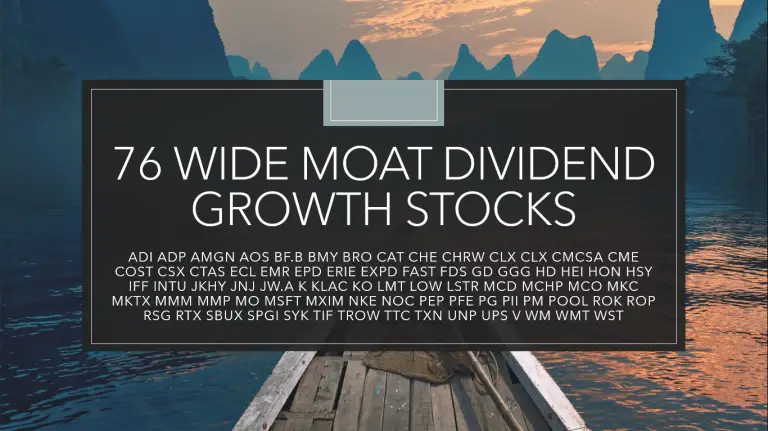

- 76 US Wide Moat Dividend Growth Stocks

- 23 International Wide Moat Dividend Growth Stocks

- 100 Canadian Narrow Moat Stocks

- 44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Ok, let’s get to the list of every International wide moat stock.

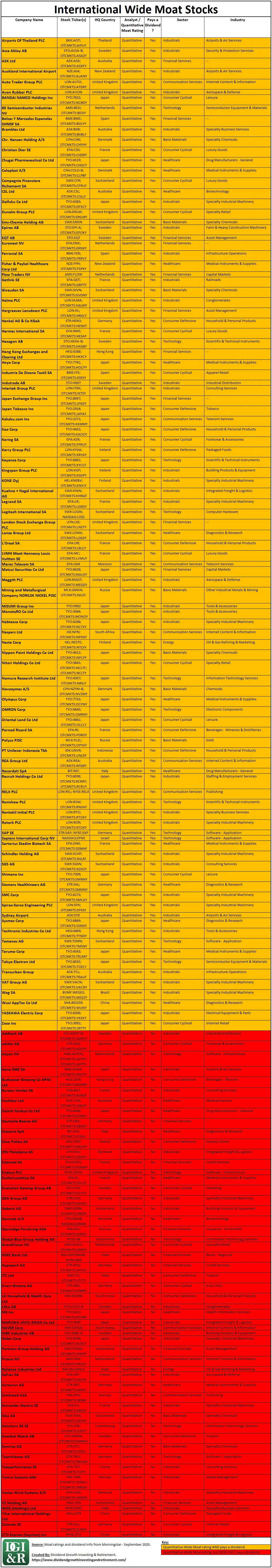

37 International Wide Moat Stocks from Morningstar Analyst Ratings

Here are the first 37 companies.

These are all the International stocks with wide moat ratings from analysts.

The other 153 companies will come later, once I’ve had a chance to go over the difference between an analyst vs. quantitative wide-moat rating.

Remember, this is every wide moat company and not all of them pay a dividend.

A breakdown, which includes whether the company pays a dividend, the sector, the industry, and the headquarter country comes after this list.

Drum roll, please…

As of September 2020

- ABB Ltd (SWX:ABBN; NYSE:ABB)

- Accenture PLC (NYSE:ACN)

- Airbus SE (EPA:AIR; OTCMKTS:EADSY)

- Alibaba Group Holding Ltd (HKG:9988; NYSE:BABA)

- Allegion PLC (NYSE:ALLE)

- Ambev SA (BVMF:ABEV3; NYSE:ABEV)

- Anheuser-Busch InBev SA/NV (NYSE:BUD; EBR:ABI)

- ASML Holding NV (AMS:ASML; NASDAQ:ASML)

- AstraZeneca PLC (LON:AZN; NYSE:AZN)

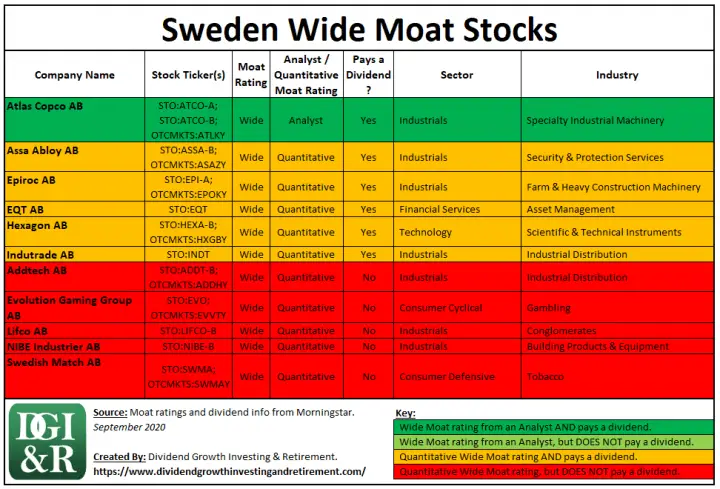

- Atlas Copco AB (STO:ATCO-A; STO:ATCO-B; OTCMKTS:ATLKY)

- BAE Systems PLC (LON:BA; OTCMKTS:BAESY)

- Baidu Inc (NASDAQ:BIDU)

- Bayer AG (ETR:BAYN; OTCMKTS:BAYRY)

- British American Tobacco PLC (LON:BATS; NYSE:BTI)

- Core Laboratories NV (NYSE:CLB)

- Dassault Systemes SE (EPA:DSY; OTCMKTS:DASTY)

- Diageo PLC (LON:DGE; NYSE:DEO)

- Experian PLC (LON:EXPN; OTCMKTS:EXPGY)

- Fanuc Corp (TYO:6954; OTCMKTS:FANUY)

- Ferrari NV (BIT:RACE; NYSE:RACE)

- GlaxoSmithKline PLC (LON:GSK; NYSE:GSK)

- Grupo Aeroportuario del Centro Norte SAB de CV (BMV:OMAB; NASDAQ:OMAB)

- Grupo Aeroportuario del Pacifico SAB de CV (BMV:GAPB; NYSE:PAC)

- Grupo Aeroportuario del Sureste SAB de CV (BMV:ASURB; NYSE:ASR)

- IHS Markit Ltd (NYSE:INFO)

- Imperial Brands PLC (LON:IMB; OTCMKTS:IMBBY)

- Julius Baer Gruppe AG (SWX:BAER; OTCMKTS:JBAXY)

- Medtronic PLC (NYSE:MDT)

- Nestle SA (SWX:NESN; OTCMKTS:NSRGY)

- Novartis AG (SWX:NOVN; NYSE:NVS)

- Novo Nordisk A/S (CPH:NOVO-B; NYSE:NVO)

- Reckitt Benckiser Group PLC (LON:RB; OTCMKTS:RBGLY)

- Roche Holding AG (SWX:RO; OTCMKTS:RHHBY)

- Sanofi SA (EPA:SAN; NASDAQ:SNY)

- Tencent Holdings Ltd (HKG:0700; OTCMKTS:TCEHY)

- Unilever (AMS:UNA; LON:ULVR; NYSE:UN; NYSE:UL)

- Westpac Banking Corp (ASX:WBC; NYSE:WBK)

And here is the break down:

And there you have it, every International wide moat stock.

But not so fast …

There are an additional 153 stocks that have a wide moat quantitative rating vs. a wide moat rating made by a real person (an analyst), like the ones above.

Before I share these last 153 stocks, I have a few words of caution. Well, maybe more than a few …

265 Words Of Caution on Wide Moat Quantitative Ratings

When trying to determine if a company has a wide moat, a quantitative rating is less reliable than a rating made by an analyst.

For stocks that aren’t covered by Morningstar analysts they give a quantitative rating – basically a computer formula figures it out instead of a person.

Or as Morningstar puts it:

“Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.”

Quantitative ratings are good for some things, but understanding a company’s competitive advantages and how sustainable they are, isn’t necessarily one of them.

Warren Buffett said in the 1999 Berkshire Hathaway annual meeting that (emphasis added):

“No formula in finance tells you that the moat is 28 feet wide and 16 feet deep. That’s what drives the academics crazy. They can compute standard deviations and betas, but they can’t understand moats. Maybe I’m being too hard on the academics.”

I think this comment still holds true and who am I to argue with one of the greatest investors of all-time.

If Warren Buffett thinks understanding a moat is difficult for academics used to creating a formula for everything, then I don’t think quantitative moat ratings are going to be as reliable as the analyst ones.

Bottom line: I put more weight in the Morningstar moat ratings that are made by analysts compared to the quantitative ratings.

153 International Wide Moat Stocks From Morningstar Quantitative Ratings

OK, now that I’ve got my warning out of the way, here are the remaining 153 wide moat stocks using Morningstar’s quantitative ratings.

A breakdown, which includes whether the company pays a dividend, the sector, the industry, and the headquarter country comes after this list.

As of September 2020

- Addtech AB (STO:ADDT-B; OTCMKTS:ADDHY)

- adidas AG (ETR:ADS; OTCMKTS:ADDYY)

- Adyen NV (AMS:ADYEN; OTCMKTS:ADYEY; OTCMKTS:ADYYF)

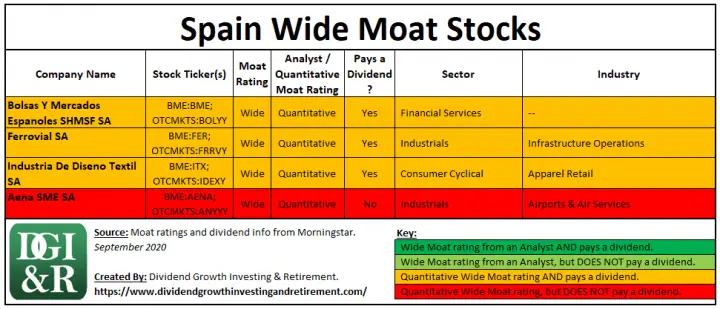

- Aena SME SA (BME:AENA; OTCMKTS:ANYYY)

- Airports Of Thailand PLC (BKK:AOT; OTCMKTS:AIPUY)

- Assa Abloy AB (STO:ASSA-B; OTCMKTS:ASAZY)

- ASX Ltd (ASX:ASX; OTCMKTS:ASXFY)

- Auckland International Airport (NZE:AIA; OTCMKTS:AUKNY)

- Auto Trader Group PLC (LON:AUTO; OTCMKTS:ATDRY)

- Avon Rubber PLC (LON:AVON)

- BANDAI NAMCO Holdings Inc (TYO:7832; OTCMKTS:NCBDY)

- BE Semiconductor Industries NV (AMS:BESI; OTCMKTS:BESIY)

- Bolsas Y Mercados Espanoles SHMSF SA (BME:BME; OTCMKTS:BOLYY)

- Brambles Ltd (ASX:BXB; OTCMKTS:BXBLY)

- Budweiser Brewing Co APAC Ltd (HKG:1876; OTCMKTS:BDWBY)

- Bureau Veritas SA (EPA:BVI; OTCMKTS:BVRDF)

- Chr. Hansen Holding A/S (CPH:CHR; OTCMKTS:CHYHY)

- Christian Dior SE (EPA:CDI; OTCMKTS:CHDRY)

- Chugai Pharmaceutical Co Ltd (TYO:4519; OTCMKTS:CHGCY)

- Compagnie Financiere Richemont SA (SWX:CFR; OTCMKTS:CFRUY)

- Cochlear Ltd (ASX:COH; OTCMKTS:CHEOY)

- Coloplast A/S (CPH:COLO-B; OTCMKTS:CLPBF)

- CSL Ltd (ASX:CSL; OTCMKTS:CSLLY)

- Daifuku Co Ltd (TYO:6383; OTCMKTS:DFKCY)

- Daiichi Sankyo Co Ltd (TYO:4568; OTCMKTS:DSNKY)

- Deutsche Boerse AG (ETR:DB1; OTCMKTS:DBOEY)

- Diasorin SpA (BIT:DIA; OTCMKTS:DSRLF)

- Dino Polska SA (WSE:DNP; OTCMKTS:DNOPY)

- DSV Panalpina AS (CPH:DSV; OTCMKTS:DSDVY)

- Dunelm Group PLC (LON:DNLM; OTCMKTS:DNLMY)

- Edenred SA (EPA:EDEN; OTCMKTS:EDNMY)

- Ems-Chemie Holding AG (SWX:EMSN)

- Endava PLC (NYSE:DAVA)

- Epiroc AB (STO:EPI-A; OTCMKTS:EPOKY)

- EQT AB (STO:EQT)

- EssilorLuxottica SA (EPA:EL; OTCMKTS:ESLOY)

- Euronext NV (EPA:ENX; OTCMKTS:ERNXY)

- Evolution Gaming Group AB (STO:EVO; OTCMKTS:EVVTY)

- Ferrovial SA (BME:FER; OTCMKTS:FRRVY)

- Fisher & Paykel Healthcare Corp Ltd (NZE:FPH; OTCMKTS:FSPKY)

- Flow Traders NV (AMS:FLOW)

- GEA Group AG (ETR:G1A; OTCMKTS:GEAGY)

- Geberit AG (SWX:GEBN; OTCMKTS:GBERY)

- Genmab A/S (CPH:GMAB; NASDAQ:GMAB)

- Getlink SE (EPA:GET; OTCMKTS:GRPTY)

- Givaudan SA (SWX:GIVN; OTCMKTS:GVDNY)

- Gjensidige Forsikring ASA (FRA:XGJ; OTCMKTS:GJNSY)

- Global Blue Group Holding AG (NYSE:GB)

- GrandVision NV (AMS:GVNV; OTCMKTS:GRRDY)

- Halma PLC (LON:HLMA; OTCMKTS:HALMY)

- Hargreaves Lansdown PLC (LON:HL; OTCMKTS:HRGLY)

- HDFC Bank Ltd (NSE:HDFCBANK; NYSE:HDB)

- Henkel AG & Co KGaA (ETR:HEN3; OTCMKTS:HENKY)

- Hermes International SA (EPA:RMS; OTCMKTS:HESAY)

- Hexagon AB (STO:HEXA-B; OTCMKTS:HXGBY)

- Hong Kong Exchanges and Clearing Ltd (HKG:0388; OTCMKTS:HKXCY)

- Hoya Corp (TYO:7741; OTCMKTS:HOCPY)

- Hypoport AG (ETR:HYQ; OTCMKTS:HYPOF)

- Industria De Diseno Textil SA (BME:ITX; OTCMKTS:IDEXY)

- Indutrade AB (STO:INDT)

- Intertek Group PLC (LON:ITRK; OTCMKTS:IKTSY)

- ITC Ltd (NSE:ITC; OTCMKTS:ITCTY)

- Japan Exchange Group Inc (TYO:8697; OTCMKTS:JPXGY)

- Japan Tobacco Inc (TYO:2914; OTCMKTS:JAPAY)

- Kakaku.com Inc (TYO:2371; OTCMKTS:KKMMY)

- Kao Corp (TYO:4452; OTCMKTS:KAOOY)

- Kering SA (EPA:KER; OTCMKTS:PPRUY)

- Kerry Group PLC (LON:KYGA; OTCMKTS:KRYAY)

- Keyence Corp (TYO:6861; OTCMKTS:KYCCF)

- Kingspan Group PLC (LON:KGP; OTCMKTS:KGSPY)

- Knorr-Bremse AG (ETR:KBX; OTCMKTS:KNRRY)

- KONE Oyj (HEL:KNEBV; OTCMKTS:KNYJY)

- Kuehne + Nagel International AG (SWX:KNIN; OTCMKTS:KHNGF)

- Legrand SA (EPA:LR; OTCMKTS:LGRDY)

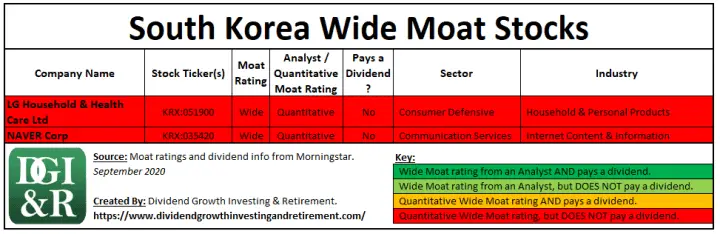

- LG Household & Health Care Ltd (KRX:051900)

- Lifco AB (STO:LIFCO-B)

- Logitech International SA (SWX:LOGN; NASDAG:LOGI)

- London Stock Exchange Group PLC (LON:LSE; OTCMKTS:LNSTY)

- Lonza Group Ltd (SWX:LONN; OTCMKTS:LZAGY)

- L’Oreal SA (EPA:OR; OTCMKTS:LRLCY)

- LVMH Moet Hennessy Louis Vuitton SE (EPA:MC; OTCMKTS:LVMUY)

- M3 Inc (TYO:2413; OTCMKTS:MTHRF)

- Maroc Telecom SA (EPA:IAM)

- MARUWA UNYU KIKAN Co Ltd (TYO:9090)

- Matsui Securities Co Ltd (TYO:8628; OTCMKTS:MAUSY)

- Meggitt PLC (LON:MGGT; OTCMKTS:MEGGY)

- Mining and Metallurgical Company NORILSK NICKEL PJSC (MCX:GMKN; OTCMKTS:NILSY)

- MISUMI Group Inc (TYO:9962)

- MonotaRO Co Ltd (TYO:3064; OTCMKTS:MONOY)

- Nabtesco Corp (TYO:6268; OTCMKTS:NCTKY)

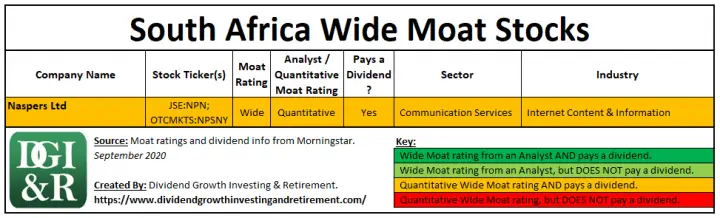

- Naspers Ltd (JSE:NPN; OTCMKTS:NPSNY)

- NAVER Corp (KRX:035420)

- Neste Corp (HEL:NESTE; OTCMKTS:NTOIY)

- NIBE Industrier AB (STO:NIBE-B)

- Nidec Corp (TYO:6594; OTCMKTS:NJDCY)

- Nippon Paint Holdings Co Ltd (TYO:4612; OTCMKTS:NPCPF)

- Nitori Holdings Co Ltd (TYO:9843; OTCMKTS:NCLTF; OTCMKTS:NCLTY)

- Nomura Research Institute Ltd (TYO:4307; OTCMKTS:NRILY)

- Novozymes A/S (CPH:NZYM-B; OTCMKTS:NVZMY)

- Olympus Corp (TYO:7733; OTCMKTS:OCPNY)

- OMRON Corp (TYO:6645; OTCMKTS:OMRNY)

- Oriental Land Co Ltd (TYO:4661; OTCMKTS:OLCLY)

- Partners Group Holding AG (SWX:PGHN; OTCMKTS:PGPHF)

- Pernod Ricard SA (EPA:RI; OTCMKTS:PDRDY)

- Polyus PJSC (MCX:PLZL; OTCMKTS:OPYGY)

- Prosus NV (AMS:PRX; OTCMKTS:PROSY)

- PT Unilever Indonesia Tbk (IDX:UNVR; OTCMKTS:UNLRY)

- REA Group Ltd (ASX:REA; OTCMKTS:RPGRY)

- Recordati SpA (BIT:REC)

- Recruit Holdings Co Ltd (TYO:6098; OTCMKTS:RCRRF; OTCMKTS:RCRUY)

- Reliance Industries Ltd (NSE:RELIANCE)

- RELX PLC (LON:REL; NYSE:RELX)

- Renishaw PLC (LON:RSW; OTCMKTS:RNSHY)

- Rentokil Initial PLC (LON:RTO; OTCMKTS:RTOKY)

- Rotork PLC (LON:ROR; OTCMKTS:RTOXY)

- Safran SA (EPA:SAF; OTCMKTS:SAFRY)

- SAP SE (ETR:SAP; NYSE:SAP)

- Sapiens International Corp NV (NASDAQ:SPNS)

- Sartorius AG (ETR:SRT; OTCMKTS:SARTF)

- Sartorius Stedim Biotech SA (EPA:DIM; OTCMKTS:SDMHF)

- Schibsted ASA (FRA:XPG; OTCMKTS:SBSNF)

- Schindler Holding AG (SWX:SCHP; OTCMKTS:SHLRF)

- Schneider Electric SE (EPA:SU; OTCMKTS:SBGSY)

- SGS AG (SWX:SGSN; OTCMKTS:SGSOY)

- Shimano Inc (TYO:7309; OTCMKTS:SMNNY)

- Siemens Healthineers AG (ETR:SHL; OTCMKTS:SMMNY)

- Sika AG (SWX:SIKA; OTCMKTS:SXYAY)

- SMC Corp (TYO:6273; OTCMKTS:SMCAY)

- Solutions 30 SE (EPA:S30; OTCMKTS:SLNTY)

- Spirax-Sarco Engineering PLC (LON:SPX; OTCMKTS:SPXSF)

- Swedish Match AB (STO:SWMA; OTCMKTS:SWMAY)

- Sydney Airport (ASX:SYD)

- Symrise AG (ETR:SY1; OTCMKTS:SYIEY)

- Sysmex Corp (TYO:6869; OTCMKTS:SSMXY)

- TeamViewer AG (ETR:TMV; OTCMKTS:TMVWY)

- Techtronic Industries Co Ltd (HKG:0669; OTCMKTS:TTNDY)

- Teleperformance SE (EPA:TEP; OTCMKTS:TLPFY)

- Temenos AG (SWX:TEMN; OTCMKTS:TMSNY)

- Terumo Corp (TYO:4543; OTCMKTS:TRUMY)

- Tokyo Electron Ltd (TYO:8035; OTCMKTS:TOELY)

- Tomra Systems ASA (FRA:TMR; OTCMKTS:TMRAY; OTCMKTS:TMRAF)

- Transurban Group (ASX:TCL; OTCMKTS:TRAUF)

- VAT Group AG (SWX:VACN; OTCMKTS:VACNY)

- Vestas Wind Systems A/S (CPH:VWS; OTCMKTS:VWDRY)

- VZ Holding AG (SWX:VZN)

- Weg SA (BVMF:WEGE3; OTCMKTS:WEGZY)

- WNS (Holdings) Ltd (NYSE:WNS)

- Wuxi AppTec Co Ltd (SHA:603259; OTCMKTS:WUXIF)

- YASKAWA Electric Corp (TYO:6506; OTCMKTS:YASKY)

- Yihai International Holdings Ltd (HKG:1579)

- Zalando SE (ETR:ZAL; OTCMKTS:ZLNDY)

- Zozo Inc (TYO:3092; OTCMKTS:SRTTY)

- ZTO Express (Cayman) Inc (NYSE:ZTO)

And here is the break down:

Every International Wide Moat Stock Sorted By Country

Putting it all together, there are a total of 190 wide moat international stocks from 30 different countries.

Here’s the summary by country.

Country List

Use the links below to jump ahead to the countries you are interested in.

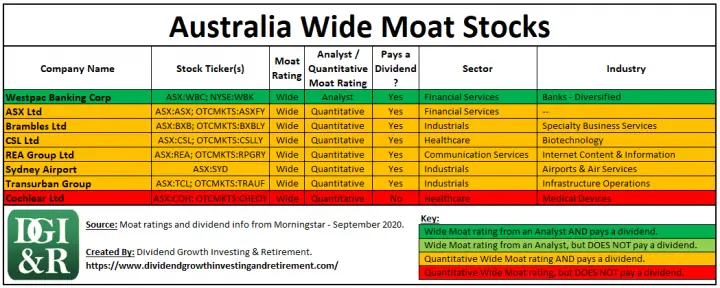

Australia

[Back to List of All Countries] [Back to Table of Contents]

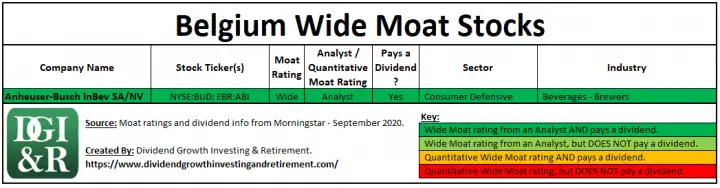

Belgium

[Back to List of All Countries] [Back to Table of Contents]

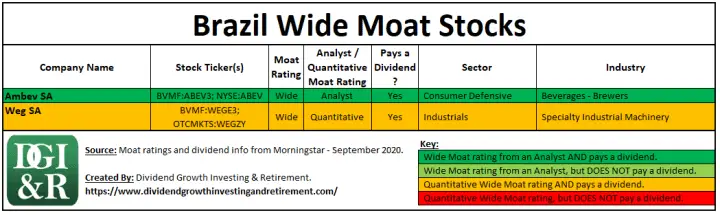

Brazil

[Back to List of All Countries] [Back to Table of Contents]

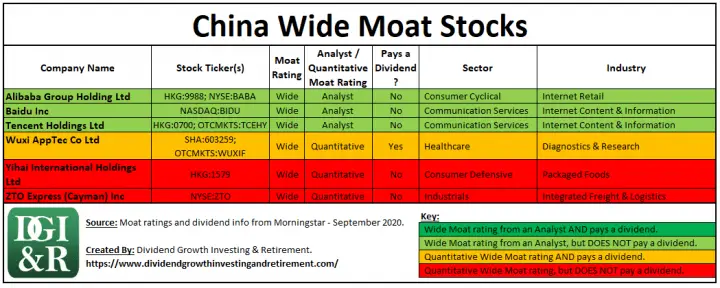

China

[Jump to Hong Kong] [Back to List of All Countries] [Back to Table of Contents]

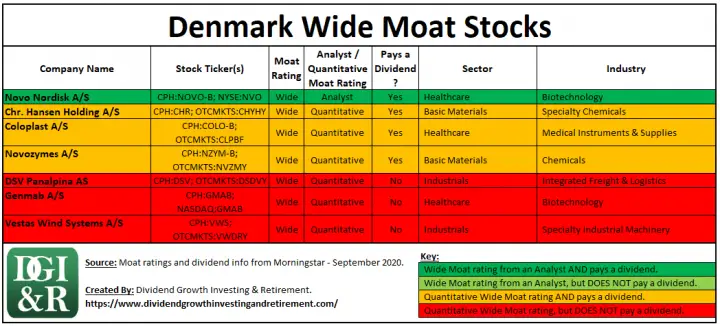

Denmark

[Back to List of All Countries] [Back to Table of Contents]

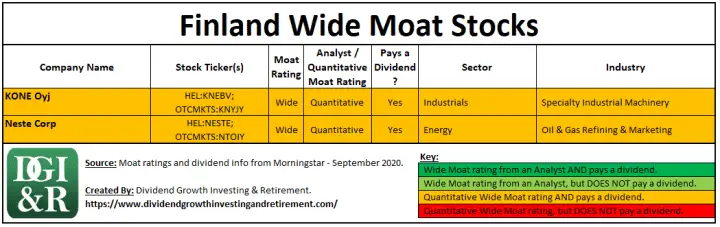

Finland

[Back to List of All Countries] [Back to Table of Contents]

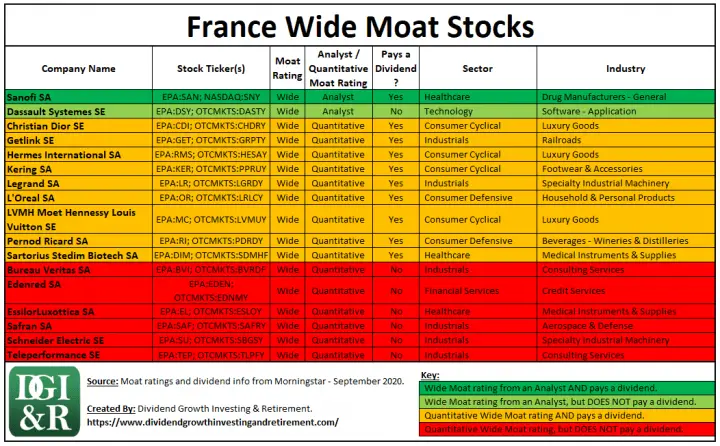

France

[Back to List of All Countries] [Back to Table of Contents]

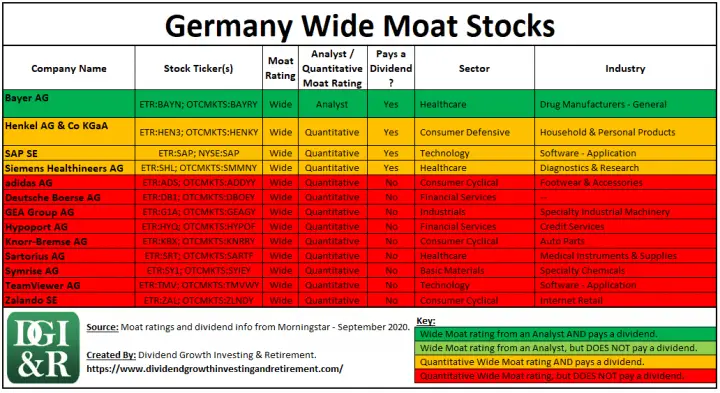

Germany

[Back to List of All Countries] [Back to Table of Contents]

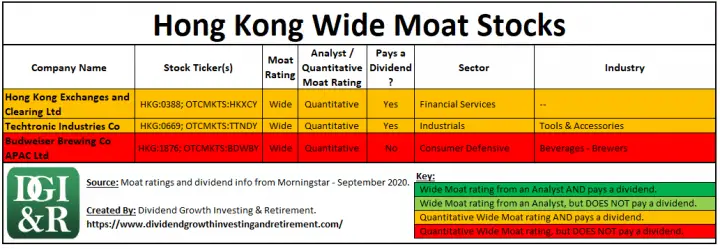

Hong Kong

[Jump to China] [Back to List of All Countries] [Back to Table of Contents]

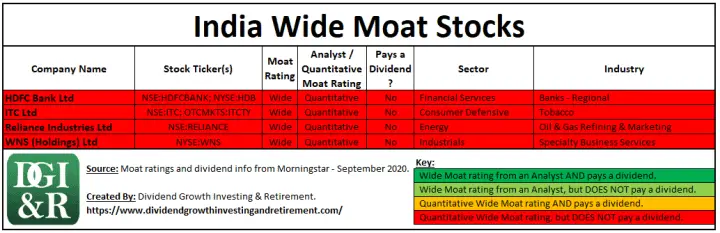

India

[Back to List of All Countries] [Back to Table of Contents]

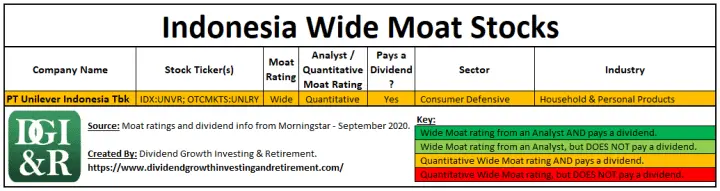

Indonesia

[Back to List of All Countries] [Back to Table of Contents]

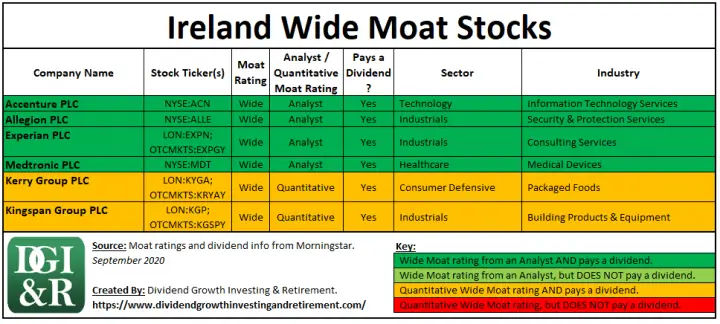

Ireland

[Back to List of All Countries] [Back to Table of Contents]

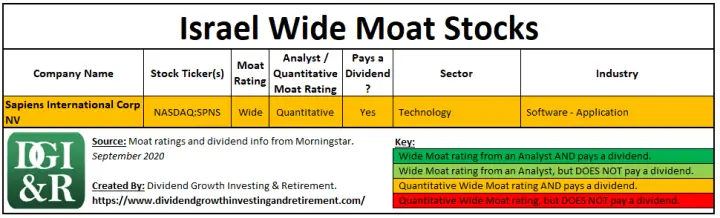

Israel

[Back to List of All Countries] [Back to Table of Contents]

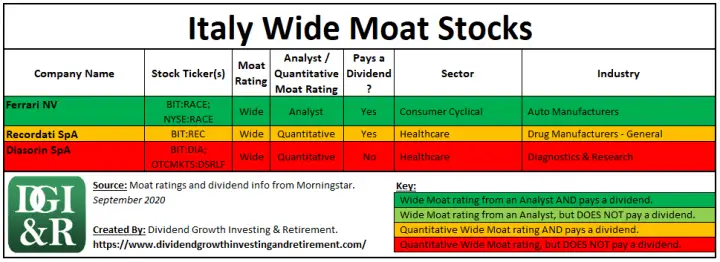

Italy

[Back to List of All Countries] [Back to Table of Contents]

Japan

[Back to List of All Countries] [Back to Table of Contents]

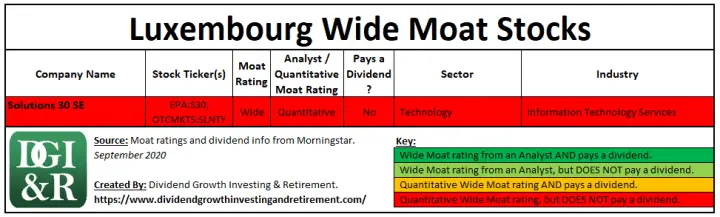

Luxembourg

[Back to List of All Countries] [Back to Table of Contents]

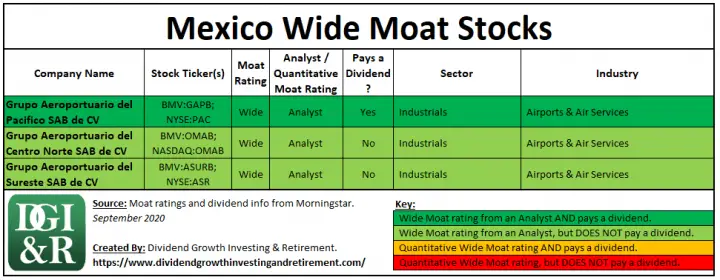

Mexico

[Back to List of All Countries] [Back to Table of Contents]

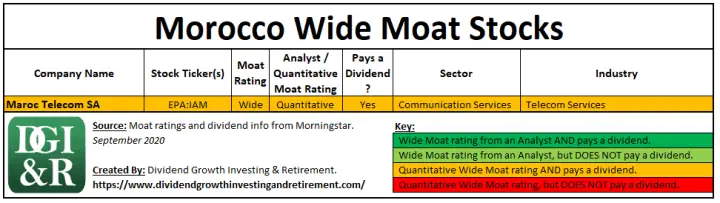

Morocco

[Back to List of All Countries] [Back to Table of Contents]

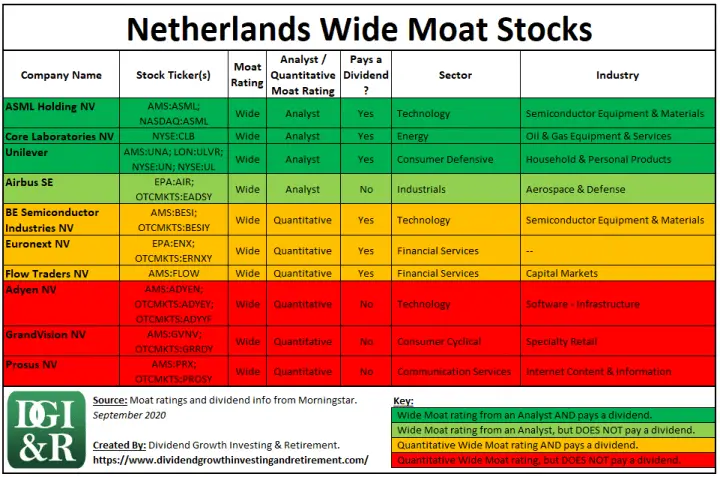

Netherlands

[Back to List of All Countries] [Back to Table of Contents]

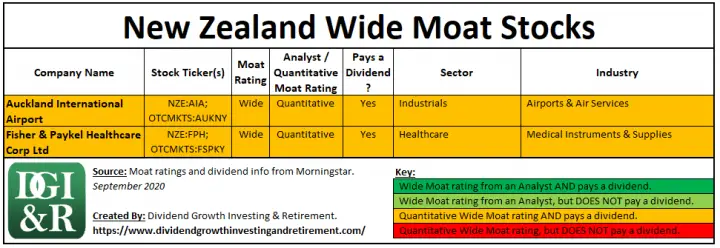

New Zealand

[Back to List of All Countries] [Back to Table of Contents]

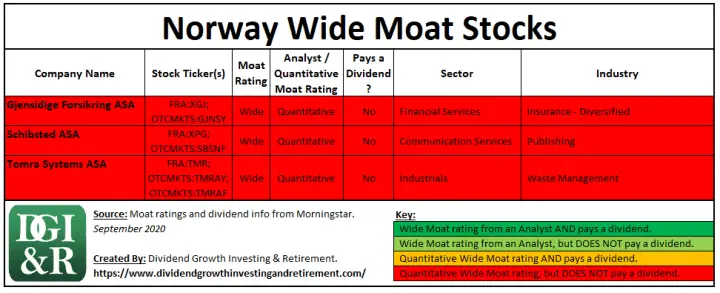

Norway

[Back to List of All Countries] [Back to Table of Contents]

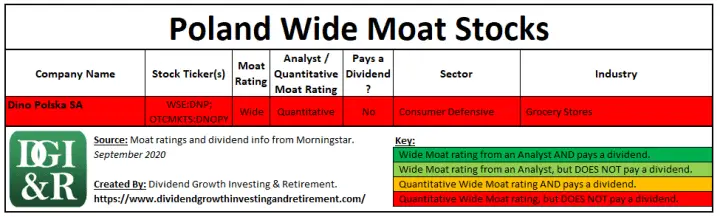

Poland

[Back to List of All Countries] [Back to Table of Contents]

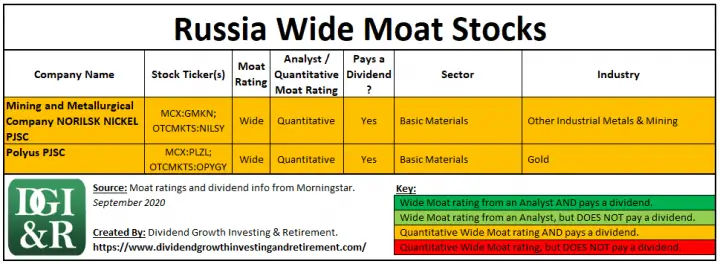

Russia

[Back to List of All Countries] [Back to Table of Contents]

South Africa

[Back to List of All Countries] [Back to Table of Contents]

South Korea

[Back to List of All Countries] [Back to Table of Contents]

Spain

[Back to List of All Countries] [Back to Table of Contents]

Sweden

[Back to List of All Countries] [Back to Table of Contents]

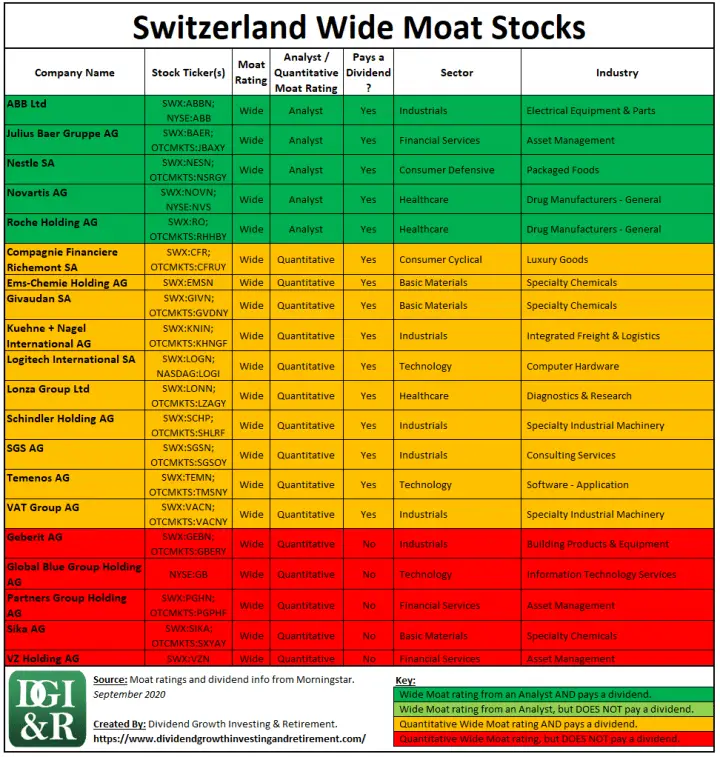

Switzerland

[Back to List of All Countries] [Back to Table of Contents]

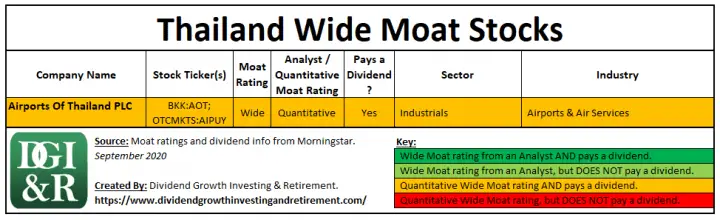

Thailand

[Back to List of All Countries] [Back to Table of Contents]

United Kingdom

[Back to List of All Countries] [Back to Table of Contents]

4 Additional Resources

Besides the other articles in my wide moat series, here are four additional resources you might find helpful.

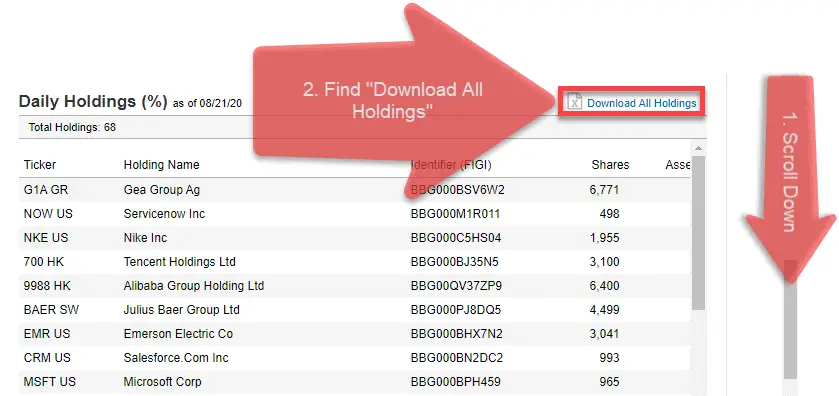

1. Morningstar Wide Moat ETFs

VanEck has ETFs that track two Morningstar indexes that contain undervalued International wide moat stocks.

Check out the holdings of these ETFs to find undervalued wide moat stocks.

- GOAT – Morningstar Global Wide Moat ETF Holdings – Global (including Canada and US) undervalued wide moat stocks

- MOTI – Morningstar International Moat ETF Holdings – Global (excludes US, includes Canada) undervalued wide moat stocks

The links above are geared towards US investors. After you click the link they may ask you which country you are from. If they do, select US. If you don’t select US, the links might not work.

Look for the “Download All Holdings” link to get a spreadsheet of all the current holdings.

2. UK Dividend Champions List

The UK Dividend Champions List is a free excel spreadsheet with stock information on UK companies that have either increased OR maintained their dividend for 5+ years in a row.

Christophe Soulet updates the list every month.

3. Eurozone Dividend Champions List

Similar to the UK list, the Eurozone Dividend Champions List is a free excel spreadsheet with stock information on Eurozone (19 countries), Swiss, Danish and Swedish companies that have either increased OR maintained their dividend for 5+ years in a row.

Christophe Soulet updates the list every month.

4. Morningstar

I used Morningstar’s moat ratings for this article, so check your online broker for Morningstar access. Most Canadian brokers provide it free.

For a list of Canadian brokers that provide Morningstar access as well as some other ways to get Morningstar free, check out the details in my upcoming article: 3 Ways to Find Wide Moat Stocks – Coming December 1, 2020.

Summary

I used Morningstar to find all International wide moat stocks. There were a total of 190 companies from 30 different countries.

Morningstar has two types of moat ratings:

- Analyst (real person) ratings, and

- Quantitative ratings (a computer formula figures it out instead of a person).

The quantitative ratings are less reliable than the analyst ratings.

Starting with ABB Ltd and ending with Westpac Banking Corp I listed off all 37 wide moat companies from Morningstar analyst ratings.

There were an additional 153 companies with wide moat quantitative ratings.

Don’t forget to check out the rest of the wide moat articles in this series.

- What is a Moat? With 5 Canadian Wide Moat Examples

- Why Invest in Wide Moat Stocks?

- 3 Ways to Find Wide Moat Stocks

- Each & Every Wide Moat Stock in Canada

- Every Wide Moat Stock in the USA

- International Wide Moat Stocks – Every Single One Listed (This is the article you just read)

- 8 Canadian Dividend Growth Wide Moat Stocks

- 76 US Wide Moat Dividend Growth Stocks

- 23 International Wide Moat Dividend Growth Stocks

- 100 Canadian Narrow Moat Stocks

- 44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!