Resources

A free source of knowledge for your investing journey.

Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Use the buttons below to filter the resource category you are interested in or check out my article on 7 Dividend Growth Investing Resources I Can’t Live Without.

Banks

EQ Bank

Hassle-Free High Interest Saving AccOunT (HISA)

I’ve been using EQ for a few years now, and if you are looking for a consistently high savings interest rate, EQ Bank is for you. Their interest rates are typically among the highest in Canada, and they stay that way. A lot of other banks will offer a high 3/6 month promo rate, and then drop rates drastically after the promo period ends. Then you are forced to transfer that money to another HISA. With EQ, you don’t have to play these games. CDIC insured.

Tangerine

No Fee Banking in Canada

I’ve been using Tangerine (formerly ING Direct) for over a decade now and it’s a good all-around no-fee bank. They’ll make you play games with interest rate promos on their savings account, but if you want a good no-fee bank account, it’s a good choice.

If you are looking for a brick-and-mortar bank with no fee banking, I usually recommend checking out a local credit union.

Blogs

Canadian Couch Potato

gREAT RESOURCE FOR A Low-Cost Index ETF STRATEGY

Dividend Growth Investing isn’t going to be for everyone, so if index investing is more your jam, check out Canadian Couch Potato.

There’s a lot of good content there, but I find their couch potato portfolio models the most useful.

Investing with low cost ETFs that track the market can be a good investment strategy too.

Yes, I’m a dividend growth investor, but that doesn’t necessarily mean you should be too. It’s more important to find a strategy that you can stick with long-term. That way when the market inevitably crashes you are able to resist the urge to sell and hang in there for the eventual recovery.

Dividend Growth .CA

Tom ConnolLy – Grandfather of DivideNd Growth Investing in Canada

Tom started his dividend growth investment newsletter, The Connolly Report, way back in 1981. He’s stopped sending the newsletter out now, but you’ll still find lots of great content from a Canadian Dividend Growth Investor that’s been using this strategy successfully for decades.

My Own Advisor

A Canadian PERSONAL FINANCE CLASSIC

Mark has been running My Own Advisor for quite some time and I enjoy reading about his plan to live off of dividends in retirement. He’s a much more consistent writer than I am, so you’ll always find new content there.

I recommend you check out his “Dividends” page and “Retirement” page for lots of good information. He’s also got some great links to retirement planning calculators and other tools on his “Helpful Sites” page.

Retire Happy

IT IS NOT JUST ABOUT THE MONEY

How much do you need to retire is an important question, but there are so many other things to consider in retirement too. Retire Happy does a good job of balancing money retirement topics with other factors like your mental readiness for retirement.

If you are close to retirement check out this article and the checklist that comes with it.

A great site with tons of content (+1,000 articles).

Tawcan

Canadian Dividend & #FiRE Blogger

Bob Lai is a fellow Canadian dividend investor who blogs at his website Tawcan.com. I enjoy reading his work as he delves more into his personal life than you typically see from other personal finance bloggers. Plus you can follow along in real-time as he works his way to F.I.R.E (Financial Independence, Retire Early).

Some popular posts at Tawcan are:

Books

The Single Best Investment: Creating Wealth with Dividend Growth

My Favourite investing book

“The Single Best Investment: Creating Wealth with Dividend Growth” by Lowell Miller provides an easy-to-understand roadmap to finding strong dividend growth stocks.

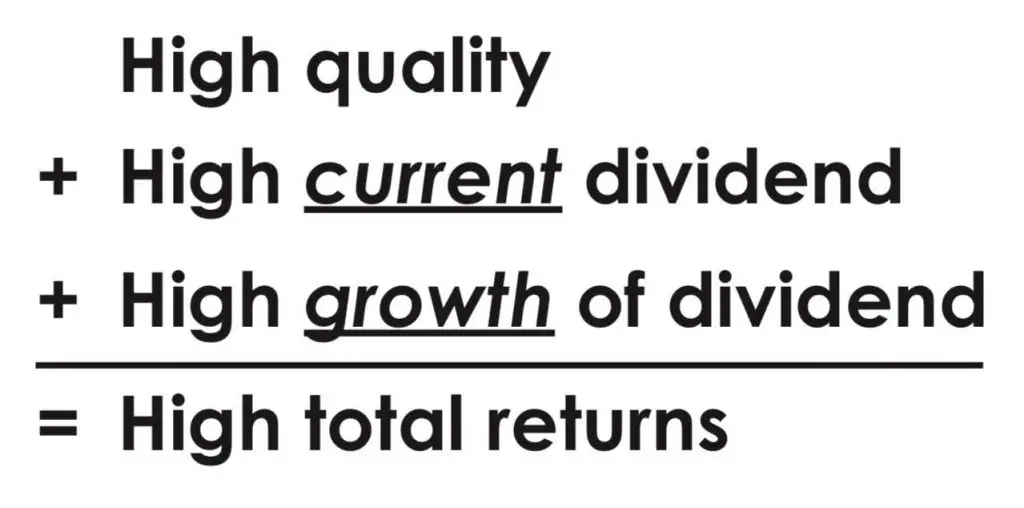

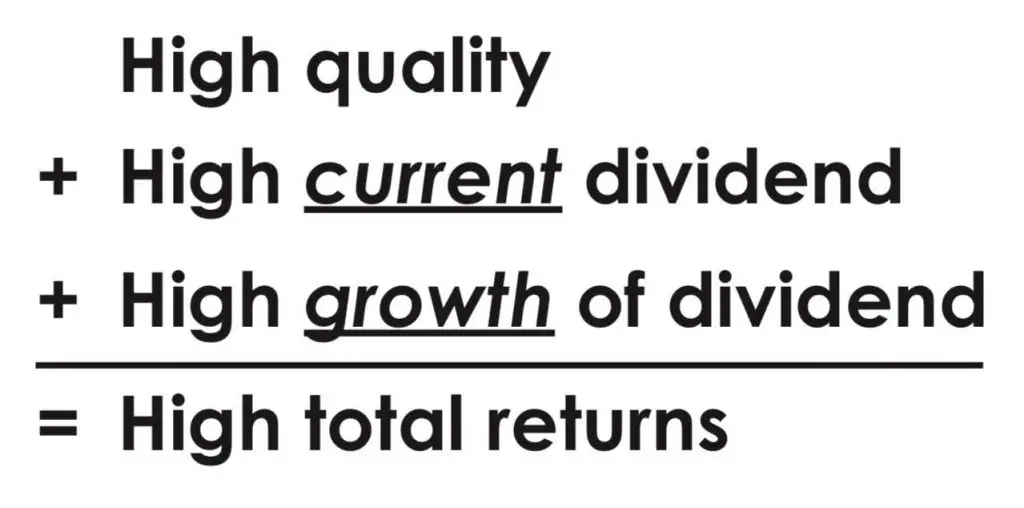

The author, Lowell Miller, uses a simple formula that is the core of his dividend growth investing strategy:

I own the hardcopy and find myself referring back to this highly-rated and practical book all the time.

How to get it free

I own the physical book, but Lowell Miller has a free PDF of The Single Best Investment: Creating Wealth with Dividend Growth on his Miller/Howard Investments website.

Brokers

Questrade

Best Low-Cost Broker in Canada

I’ve been using Questrade for over a decade and for someone looking for a good low-cost broker, you won’t find a better one. Over the years they’ve consistently ranked as either #1 or #2 broker in various comparisons. Best broker in Canada seems to mostly be a battle between Questrade and Qtrade.

Dividend Lists

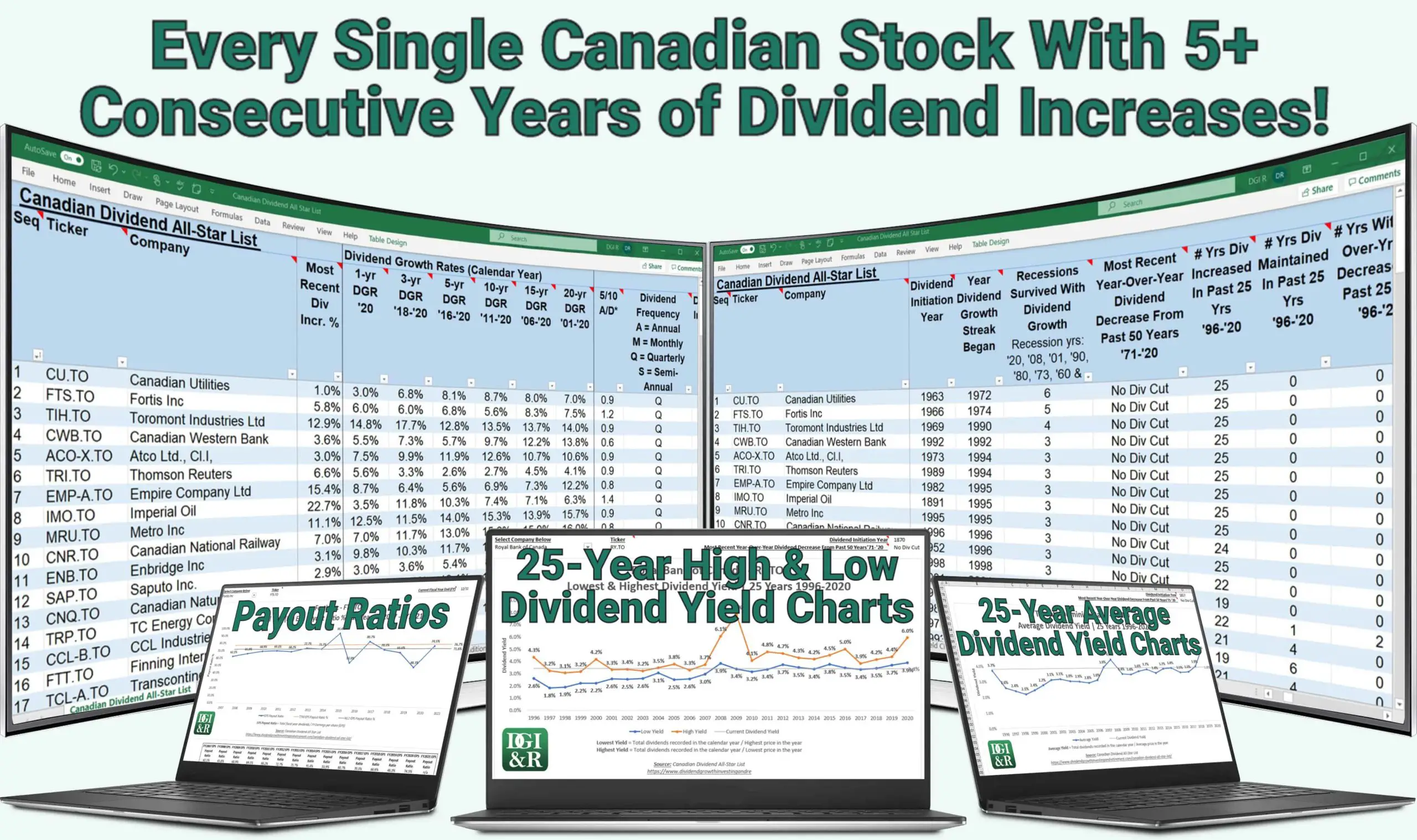

Canadian Dividend All-Star List

Canadian Dividend Stocks with 5+ YearS OF CONSECUTIVE Dividend INCREASES | EXCEL SPREADSHEET

I’m a bit biased here as I maintain this list, but the Canadian Dividend All-Star List is the perfect resource to quickly find strong Canadian dividend growth stocks with dependable dividend income. It’s one of my website’s most popular resources.

It is an excel spreadsheet with a huge amount of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

This valuable resource is emailed monthly to DGI&R subscribers and is typically used as a starting point to identify and screen Canadian dividend growth stocks.

US Dividend Champions List

US DIVIDEND STOCKS WITH 5+ YEARS OF CONSECUTIVE DIVIDEND INCREASES | EXCEL SPREADSHEET

The US Dividend Champions List is split into three categories:

- Dividend Champions are companies that have increased their dividend for 25+ years.

- Dividend Contenders have increased their dividend for 10-24 years.

- Dividend Challengers have increased their dividend for 5-9 years.

The idea for the spreadsheet was created in 2008 by Dave Fish (deceased in 2018) and is now available at either the Dividend Investing Resource Center or Dividend Radar. With the two links below you don’t need to give your email for the free spreadsheet download.

You can also sign up for a different version of the US Dividend Champions List maintained by Justin Law which also has a web-based screener. This excel spreadsheet and web screener are updated monthly and it’s free if you give your email address.

UK & Eurozone Dividend Champions Lists

EUROZONE DIVIDEND STOCKS MAINTAINing OR INCREASing DIVIDENDS FOR 5+ YEARS | UK DIVIDEND STOCKS Increasing Dividends For 5+ YEARS IN A Row | EXCEL SPREADSHEET

Christophe Soulet maintains these two dividend lists:

Eurozone Dividend Champions List is a spreadsheet with stock information on Eurozone companies that have increased or maintained their dividend for 5 or years in a row.

UK Dividend Champions List is a spreadsheet with stock information on dividend companies in the United Kingdom (UK) that have increased their dividend for 5+ years in a row.

Investing Tools

The Dividend Investing Resource Center

Dividend Lists | Forums | Tools

Be sure to check out the Tools page of this great website as this is where you’ll find download links for the US Dividend Champions, Canadian Dividend All-Star List, European Dividend Champions, UK Dividend Champions, and Global CCC List.

If you ever wanted to know anything about Dividend Re-Investment Plans (DRIPs), be sure to ask on the forum. You’ll get responses from investors that have been DRIPing for decades.

Value Line Investment Survey

Best One-Page Stock Research Reports

Value Line does many things well, but what I find most useful is their one-page company summaries, which include:

- 17 years’ worth of concise historical data.

- 3-5 year future growth rate estimates for Sales, Cash Flow, Earnings, Dividends, and Book Value.

- Rankings for Safety, Technicals, and Timeliness.

- A Financial Strength grade, and indexes of Price Stability, Price Growth Persistence, and Earnings Predictability.

- Total Return Projections

- The list goes on …

MorningStar

Moat Ratings | 5-Star Fair Value Estimates

Morningstar has a lot of stock information and resources, but I use it regularly for two reasons:

- Moat Ratings (Wide, Narrow, and No-moat), and

- 5-star Fair Value Estimates (5-star = undervalued, 3-star = fair value, 1-star = overvalued).

Here’s a screenshot of what a Morningstar report on Royal Bank of Canada (TSE:RY; NYSE:RY) looks like.

Source: February 24, 2021 Morningstar Report on Royal Bank of Canada (TSE:RY)

I want stocks with wide moats (strong sustainable competitive advantages) that are trading on the cheap.

With Morningstar’s economic moat ratings and fair value estimates I can identify these companies quickly. Plus, they’ll sometimes mention future dividend growth estimates in their analyst write-ups.

Morningstar also has nice 10-year financial summaries.

How to get it free

I access Morningstar through my broker for free.

You are unlikely to find Morningstar free at a Canadian library, but if you are in the US, you’ll have better luck. Check libraries in larger US cities. The Seattle Public Library for example provides free online Morningstar access.

Canadian Brokers That Have Morningstar

As far as I can tell these are all Canadian brokers that provide Morningstar as one of their free research tools:

As of August 2021

- BMO InvestorLine

- CIBC Investor’s Edge

- Desjardins Online Brokerage

- HSBC InvestDirect

- National Bank Direct Brokerage

- Qtrade Investor

- Questrade

- RBC Direct Investing

- TD Direct Investing

Canadian brokers that don’t provide free Morningstar research:

- Interactive Brokers Canada – $15 US / month for Morningstar.

- Laurentian Bank Discount Brokerage – No Morningstar access.

- Scotia iTrade – No Morningstar access.

- Virtual Brokers – No Morningstar access.

- Wealthsimple Trade – No Morningstar access.

Seeking Alpha

IN-DEPTH Investment Articles

A great site for in-depth stock research on US and Canadian investments.

Dividend Growth Investing Lessons by David Van Knapp

Best Free Dividend Growth Investing Lessons I Know Of

Dave Van Knapp is a longtime US dividend investor who has written 20 amazing dividend growth lessons. I highly recommend reading through them if you are just starting out. He lays everything out from start to finish in a very methodical and easy-to-understand approach.

20 Dividend Growth Investing Lessons by David Van Knapp

- What is a Dividend?

- Dividend Growth

- The 5-Year Rule

- The Power of Compounding

- The Power of Reinvesting Dividends

- Yield and Yield on Cost

- Dividends are Independent from the Market

- How to Build a High-Yielding Dividend Growth Portfolio

- My Top 14 Reasons Why Dividend Growth Investing Makes Sense

- Two Ways to Reinvest Your Dividends to Enhance Your Returns

- Valuation

- Run Your Investing Like a Business

- Specific Topics to Cover in Your Dividend Growth Investing Plan

- Grading Dividend Growth Stocks to Find the Best Ones for Your Portfolio

- Portfolio Management – How to Decide When to Sell Stocks

- Diversification

- Dividend Safety

- High Yield or Fast Growth?

- How to Increase Your Investor Returns

- My ‘Quality Snapshot’ Grading System

TMX Money

Lookup Dividend History GOING Back To 1987 & Screener

TMX Money is the official financial portal of the Toronto Stock Exchange and TSX Venture Exchange. TMX has lots of information on Canadian stocks, but I use it primarily for three things:

- They show the dividend history of Canadian stocks going back to 1987.

- TIP For the stock you are researching in TMX, go to “Key Data”, scroll down to “Dividend History” and you can use the left/right arrows to toggle dividend history all the way back to 1987.

- They list all the companies press releases in the “News” section.

- They have a screener for Canadian stocks that is alright.

SEDAR

ANnual REports & Company Filings

SEDAR (the System for Electronic Document Analysis and Retrieval) is not user-friendly at all, but if you need to find annual reports, annual information forms, press releases, etc. for all Canadian stocks going back to January 1, 1997, this is where you’ll find it.

Personal Finance

Personal Capital

US Networth Tracker

For US investors only. This is a free app for tracking and managing your money. They have some great financial tools/calculators like:

- A tool to determine your retirement readiness.

- Recession simulators to get perspective on today’s market.

- A fee analyze to find hidden fees in your retirement accounts.

Canadian Legal Wills

HighLY RATED ONLINE WILLS

If you need an will and you are considering an one online, check out Canadian Legal Wills.

I used them for my will and it was an easy & cheap process. A bonus with online wills is that depending on the plan you pick they’ll usually let you make unlimited changes over the years. When my 2nd child came along, I just logged in and updated the will.

Not all online will companies are created equal, so be careful who you choose. I liked that Canadian Legal Wills has been around for more than two decades, so their wills have been tested in the courts, etc.

EQ Bank

Hassle-Free High Interest Saving AccOunT (HISA)

I’ve been using EQ for a few years now, and if you are looking for a consistently high savings interest rate, EQ Bank is for you. Their interest rates are typically among the highest in Canada, and they stay that way. A lot of other banks will offer a high 3/6 month promo rate, and then drop rates drastically after the promo period ends. Then you are forced to transfer that money to another HISA. With EQ, you don’t have to play these games. CDIC insured.

Tangerine

No Fee Banking in Canada

I’ve been using Tangerine (formerly ING Direct) for over a decade now and it’s a good all-around no-fee bank. They’ll make you play games with interest rate promos on their savings account, but if you want a good no-fee bank account, it’s a good choice.

If you are looking for a brick-and-mortar bank with no fee banking, I usually recommend checking out a local credit union.

Canadian Couch Potato

gREAT RESOURCE FOR A Low-Cost Index ETF STRATEGY

Dividend Growth Investing isn’t going to be for everyone, so if index investing is more your jam, check out Canadian Couch Potato.

There’s a lot of good content there, but I find their couch potato portfolio models the most useful.

Investing with low cost ETFs that track the market can be a good investment strategy too.

Yes, I’m a dividend growth investor, but that doesn’t necessarily mean you should be too. It’s more important to find a strategy that you can stick with long-term. That way when the market inevitably crashes you are able to resist the urge to sell and hang in there for the eventual recovery.

Dividend Growth .CA

Tom ConnolLy – Grandfather of DivideNd Growth Investing in Canada

Tom started his dividend growth investment newsletter, The Connolly Report, way back in 1981. He’s stopped sending the newsletter out now, but you’ll still find lots of great content from a Canadian Dividend Growth Investor that’s been using this strategy successfully for decades.

My Own Advisor

A Canadian PERSONAL FINANCE CLASSIC

Mark has been running My Own Advisor for quite some time and I enjoy reading about his plan to live off of dividends in retirement. He’s a much more consistent writer than I am, so you’ll always find new content there.

I recommend you check out his “Dividends” page and “Retirement” page for lots of good information. He’s also got some great links to retirement planning calculators and other tools on his “Helpful Sites” page.

Retire Happy

IT IS NOT JUST ABOUT THE MONEY

How much do you need to retire is an important question, but there are so many other things to consider in retirement too. Retire Happy does a good job of balancing money retirement topics with other factors like your mental readiness for retirement.

If you are close to retirement check out this article and the checklist that comes with it.

A great site with tons of content (+1,000 articles).

Tawcan

Canadian Dividend & #FiRE Blogger

Bob Lai is a fellow Canadian dividend investor who blogs at his website Tawcan.com. I enjoy reading his work as he delves more into his personal life than you typically see from other personal finance bloggers. Plus you can follow along in real-time as he works his way to F.I.R.E (Financial Independence, Retire Early).

Some popular posts at Tawcan are:

The Single Best Investment: Creating Wealth with Dividend Growth

My Favourite investing book

“The Single Best Investment: Creating Wealth with Dividend Growth” by Lowell Miller provides an easy-to-understand roadmap to finding strong dividend growth stocks.

The author, Lowell Miller, uses a simple formula that is the core of his dividend growth investing strategy:

I own the hardcopy and find myself referring back to this highly-rated and practical book all the time.

How to get it free

I own the physical book, but Lowell Miller has a free PDF of The Single Best Investment: Creating Wealth with Dividend Growth on his Miller/Howard Investments website.

Questrade

Best Low-Cost Broker in Canada

I’ve been using Questrade for over a decade and for someone looking for a good low-cost broker, you won’t find a better one. Over the years they’ve consistently ranked as either #1 or #2 broker in various comparisons. Best broker in Canada seems to mostly be a battle between Questrade and Qtrade.

Canadian Dividend All-Star List

Canadian Dividend Stocks with 5+ YearS OF CONSECUTIVE Dividend INCREASES | EXCEL SPREADSHEET

I’m a bit biased here as I maintain this list, but the Canadian Dividend All-Star List is the perfect resource to quickly find strong Canadian dividend growth stocks with dependable dividend income. It’s one of my website’s most popular resources.

It is an excel spreadsheet with a huge amount of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

This valuable resource is emailed monthly to DGI&R subscribers and is typically used as a starting point to identify and screen Canadian dividend growth stocks.

US Dividend Champions List

US DIVIDEND STOCKS WITH 5+ YEARS OF CONSECUTIVE DIVIDEND INCREASES | EXCEL SPREADSHEET

The US Dividend Champions List is split into three categories:

- Dividend Champions are companies that have increased their dividend for 25+ years.

- Dividend Contenders have increased their dividend for 10-24 years.

- Dividend Challengers have increased their dividend for 5-9 years.

The idea for the spreadsheet was created in 2008 by Dave Fish (deceased in 2018) and is now available at either the Dividend Investing Resource Center or Dividend Radar. With the two links below you don’t need to give your email for the free spreadsheet download.

You can also sign up for a different version of the US Dividend Champions List maintained by Justin Law which also has a web-based screener. This excel spreadsheet and web screener are updated monthly and it’s free if you give your email address.

UK & Eurozone Dividend Champions Lists

EUROZONE DIVIDEND STOCKS MAINTAINing OR INCREASing DIVIDENDS FOR 5+ YEARS | UK DIVIDEND STOCKS Increasing Dividends For 5+ YEARS IN A Row | EXCEL SPREADSHEET

Christophe Soulet maintains these two dividend lists:

Eurozone Dividend Champions List is a spreadsheet with stock information on Eurozone companies that have increased or maintained their dividend for 5 or years in a row.

UK Dividend Champions List is a spreadsheet with stock information on dividend companies in the United Kingdom (UK) that have increased their dividend for 5+ years in a row.

The Dividend Investing Resource Center

Dividend Lists | Forums | Tools

Be sure to check out the Tools page of this great website as this is where you’ll find download links for the US Dividend Champions, Canadian Dividend All-Star List, European Dividend Champions, UK Dividend Champions, and Global CCC List.

If you ever wanted to know anything about Dividend Re-Investment Plans (DRIPs), be sure to ask on the forum. You’ll get responses from investors that have been DRIPing for decades.

Value Line Investment Survey

Best One-Page Stock Research Reports

Value Line does many things well, but what I find most useful is their one-page company summaries, which include:

- 17 years’ worth of concise historical data.

- 3-5 year future growth rate estimates for Sales, Cash Flow, Earnings, Dividends, and Book Value.

- Rankings for Safety, Technicals, and Timeliness.

- A Financial Strength grade, and indexes of Price Stability, Price Growth Persistence, and Earnings Predictability.

- Total Return Projections

- The list goes on …

MorningStar

Moat Ratings | 5-Star Fair Value Estimates

Morningstar has a lot of stock information and resources, but I use it regularly for two reasons:

- Moat Ratings (Wide, Narrow, and No-moat), and

- 5-star Fair Value Estimates (5-star = undervalued, 3-star = fair value, 1-star = overvalued).

Here’s a screenshot of what a Morningstar report on Royal Bank of Canada (TSE:RY; NYSE:RY) looks like.

Source: February 24, 2021 Morningstar Report on Royal Bank of Canada (TSE:RY)

I want stocks with wide moats (strong sustainable competitive advantages) that are trading on the cheap.

With Morningstar’s economic moat ratings and fair value estimates I can identify these companies quickly. Plus, they’ll sometimes mention future dividend growth estimates in their analyst write-ups.

Morningstar also has nice 10-year financial summaries.

How to get it free

I access Morningstar through my broker for free.

You are unlikely to find Morningstar free at a Canadian library, but if you are in the US, you’ll have better luck. Check libraries in larger US cities. The Seattle Public Library for example provides free online Morningstar access.

Canadian Brokers That Have Morningstar

As far as I can tell these are all Canadian brokers that provide Morningstar as one of their free research tools:

As of August 2021

- BMO InvestorLine

- CIBC Investor’s Edge

- Desjardins Online Brokerage

- HSBC InvestDirect

- National Bank Direct Brokerage

- Qtrade Investor

- Questrade

- RBC Direct Investing

- TD Direct Investing

Canadian brokers that don’t provide free Morningstar research:

- Interactive Brokers Canada – $15 US / month for Morningstar.

- Laurentian Bank Discount Brokerage – No Morningstar access.

- Scotia iTrade – No Morningstar access.

- Virtual Brokers – No Morningstar access.

- Wealthsimple Trade – No Morningstar access.

Seeking Alpha

IN-DEPTH Investment Articles

A great site for in-depth stock research on US and Canadian investments.

Dividend Growth Investing Lessons by David Van Knapp

Best Free Dividend Growth Investing Lessons I Know Of

Dave Van Knapp is a longtime US dividend investor who has written 20 amazing dividend growth lessons. I highly recommend reading through them if you are just starting out. He lays everything out from start to finish in a very methodical and easy-to-understand approach.

20 Dividend Growth Investing Lessons by David Van Knapp

- What is a Dividend?

- Dividend Growth

- The 5-Year Rule

- The Power of Compounding

- The Power of Reinvesting Dividends

- Yield and Yield on Cost

- Dividends are Independent from the Market

- How to Build a High-Yielding Dividend Growth Portfolio

- My Top 14 Reasons Why Dividend Growth Investing Makes Sense

- Two Ways to Reinvest Your Dividends to Enhance Your Returns

- Valuation

- Run Your Investing Like a Business

- Specific Topics to Cover in Your Dividend Growth Investing Plan

- Grading Dividend Growth Stocks to Find the Best Ones for Your Portfolio

- Portfolio Management – How to Decide When to Sell Stocks

- Diversification

- Dividend Safety

- High Yield or Fast Growth?

- How to Increase Your Investor Returns

- My ‘Quality Snapshot’ Grading System

TMX Money

Lookup Dividend History GOING Back To 1987 & Screener

TMX Money is the official financial portal of the Toronto Stock Exchange and TSX Venture Exchange. TMX has lots of information on Canadian stocks, but I use it primarily for three things:

- They show the dividend history of Canadian stocks going back to 1987.

- TIP For the stock you are researching in TMX, go to “Key Data”, scroll down to “Dividend History” and you can use the left/right arrows to toggle dividend history all the way back to 1987.

- They list all the companies press releases in the “News” section.

- They have a screener for Canadian stocks that is alright.

SEDAR

ANnual REports & Company Filings

SEDAR (the System for Electronic Document Analysis and Retrieval) is not user-friendly at all, but if you need to find annual reports, annual information forms, press releases, etc. for all Canadian stocks going back to January 1, 1997, this is where you’ll find it.

Personal Capital

US Networth Tracker

For US investors only. This is a free app for tracking and managing your money. They have some great financial tools/calculators like:

- A tool to determine your retirement readiness.

- Recession simulators to get perspective on today’s market.

- A fee analyze to find hidden fees in your retirement accounts.

Canadian Legal Wills

HighLY RATED ONLINE WILLS

If you need an will and you are considering an one online, check out Canadian Legal Wills.

I used them for my will and it was an easy & cheap process. A bonus with online wills is that depending on the plan you pick they’ll usually let you make unlimited changes over the years. When my 2nd child came along, I just logged in and updated the will.

Not all online will companies are created equal, so be careful who you choose. I liked that Canadian Legal Wills has been around for more than two decades, so their wills have been tested in the courts, etc.