Popular Posts

Subscribe Now!

Recent Posts

Why You Should Use Dividend Yield As A Valuation Tool For Stocks

“The concept of identifying undervalued and overvalued stock prices according to historic patterns of dividend yield can be applied to any stock with a reasonably long dividend history. However, investors who make the decision to include only high-quality, blue-chip stocks in their considerations will probably never regret it.” Source: Dividends Don’t Lie – Geraldine Weiss/Janet…

Yield + Dividend Growth: A Simple Formula To Estimate Future Total Returns

“Dividend Yield + Dividend Growth = Prospective Return” Josh Peters, The Ultimate Dividend Playbook Yield + Dividend Growth = Total Return Estimate. Such a simple formula, but you’ll see from US and Canadian examples that it’s also been surprisingly accurate. That said, it has some pitfalls to be aware of too. Yield + Dividend Growth Estimate…

Chowder Number / Chowder Rule – The Perfect Mix of Dividend Yield and Dividend Growth

The Chowder Number/ Chowder Rule is all about finding the right mix between dividend yield and dividend growth. In a perfect world, we’d all be investing in high-yield, high-dividend growth stocks. The reality is that many high-yield stocks have lower dividend growth rates than lower-yielding stocks. So how do you find the right balance between…

Double Your Dividend Income With Dividend Growth & Triple It With Dividend Reinvestment

Want to double your dividend income in 10 years? Invest in dividend growth stocks that average +7% dividend growth per year. Want to triple your dividend income in 10 years? Add in dividend reinvestment with a reasonably high starting dividend yield. A portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income…

3 Reasons to Invest in Stocks with 10+ Year Dividend Growth Streaks

During the Global Financial Crisis, no Canadian stock with a 10+ year dividend growth streak cut its dividend. Looking for peace of mind high-quality investments that can weather recessions and continue to pay dividends you can rely on in retirement? Well, start by investing in companies with at least 10 years of consecutive dividend increases….

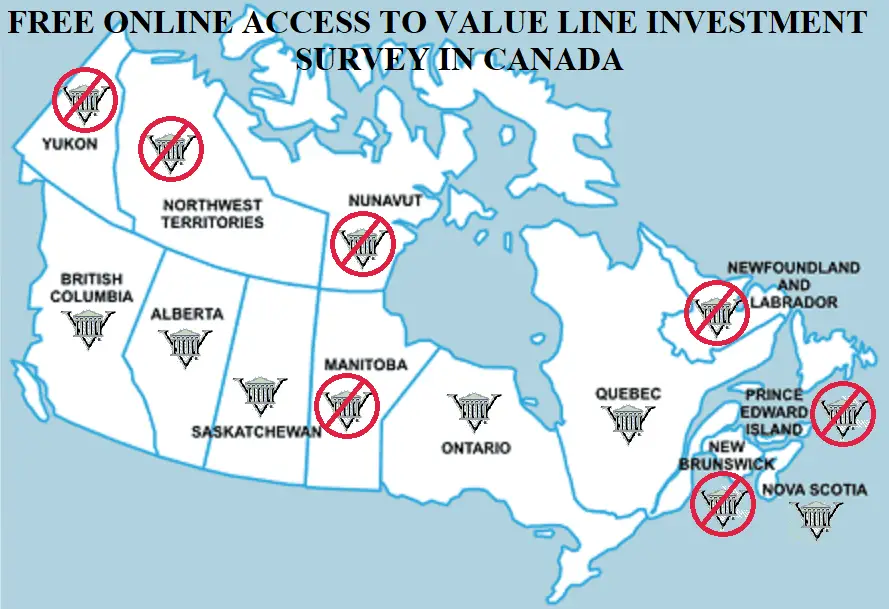

7 Dividend Growth Investing Resources I Can’t Live Without

Before I invest a cent of my hard-earned money into a dividend growth stock, I use these 7 dividend growth investing resources for every new investment. I wanted this list to be valuable, so to make it onto the list: It had to be a resource that I always use when researching or investing in…

44 Canadian Wide & Narrow Moat Dividend Growth Stocks

In Canada there are 9 wide moat stocks and 100 narrow moat stocks, but which of these companies with strong sustainable competitive advantages make good dividend growth investments? To answer this question, I did three things: I researched all Canadian wide and narrow moat companies to identify 44 stocks with a 5+ year dividend growth…

100 Canadian Narrow Moat Stocks

With only 9 wide moat stocks in Canada, narrow moat stocks are a necessary concession for anyone looking to build a diversified portfolio. Now a narrow moat might not be as good as a wide moat, but narrow moat companies are still expected to maintain their competitive advantages for 10-20 years. Not as long as…

23 International Wide Moat Dividend Growth Stocks

As dividend growth investors, we know that wide moat stocks make a good starting point, but it is just one of many considerations on our hunt for high-quality dividend growth stocks. Which of these international companies with strong sustainable competitive advantages make good dividend growth investments? To help answer this question, I have separate articles…

Why Invest in Wide Moat Stocks?

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products and services that have wide, sustainable moats around them are the ones that…