Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

57%* of dividend-paying firms across the world either cut (43%*) or eliminated their dividend (14%*) during the financial crisis of 2008-2009.

*Source: “Global Dividend-Paying Stocks: A Recent History,” A March 2013 DFA study covering 23 developed markets.

Scary stats if you plan to rely on dividend income in retirement, but it doesn’t need to be if; instead, you focus on the high-quality companies that were not only able to maintain their dividends during the global financial crisis, but increase them too.

Filter that list down to companies that were also able to increase their dividend through the 2020 COVID-19 pandemic and you’ll have a short-list of strong dividend growth candidates.

With the Canadian Dividend All-Star List you’ll be able to find these high-quality dividend growth companies quickly and use a ton of dividend and stock information to further your own research into finding the best Canadian dividend growth stocks.

Read on to find out:

- What the Canadian Dividend All-Star List is (Includes a sample file of the Canadian Dividend All-Star List),

- Understanding how a dividend growth streak is calculated,

- How to use the Canadian Dividend All-Star List to find high-quality dividend growth stocks,

- What the Canadian Dividend All-Star List is NOT, and

- Other useful resources.

What is the Canadian Dividend All-Star List (CDASL)?

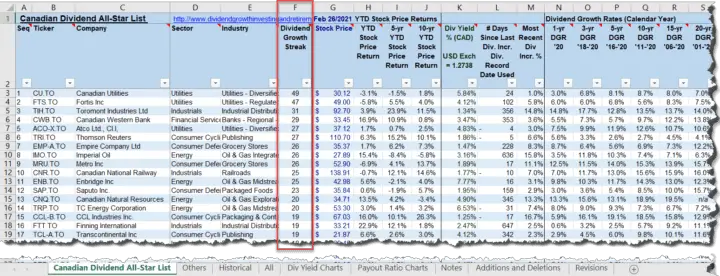

The Canadian Dividend All-Star List is an excel spreadsheet with a lot of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

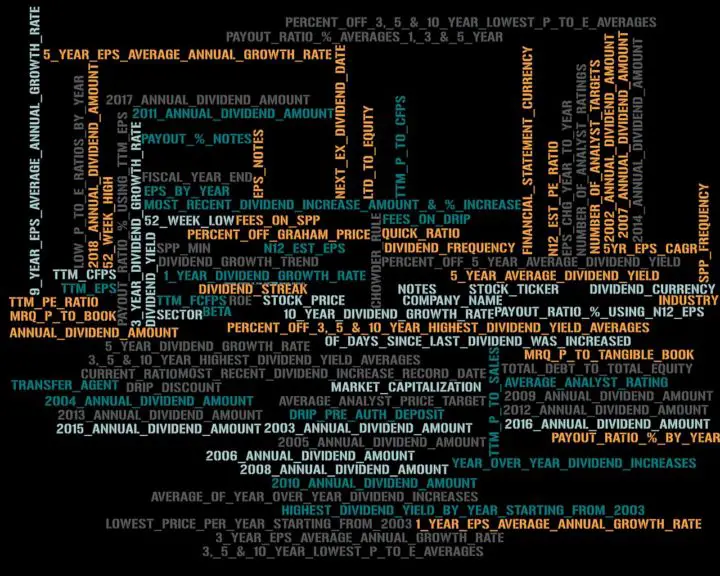

To give you a better sense of the type and just how much information is packed into the spreadsheet take a look at the word cloud below.

Or better yet, here is the February 28, 2021 file as an example:

February 28, 2021, Canadian Dividend All-Star List (CDASL) Spreadsheet [Free Download]

I’ve been updating the list monthly since early 2013, and at the beginning of each month email subscribers of Dividend Growth Investing & Retirement get sent the most recent copy. It is by far the most popular resource on my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

This valuable resource is typically used as a starting point to identify and screen Canadian dividend growth stocks.

To be able to use this resource effectively there are a few things you should understand first, starting with the dividend streak.

Understanding how a dividend growth streak is calculated

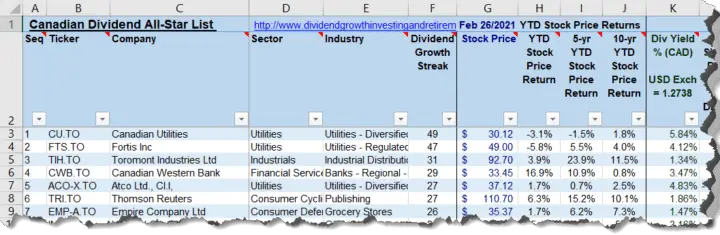

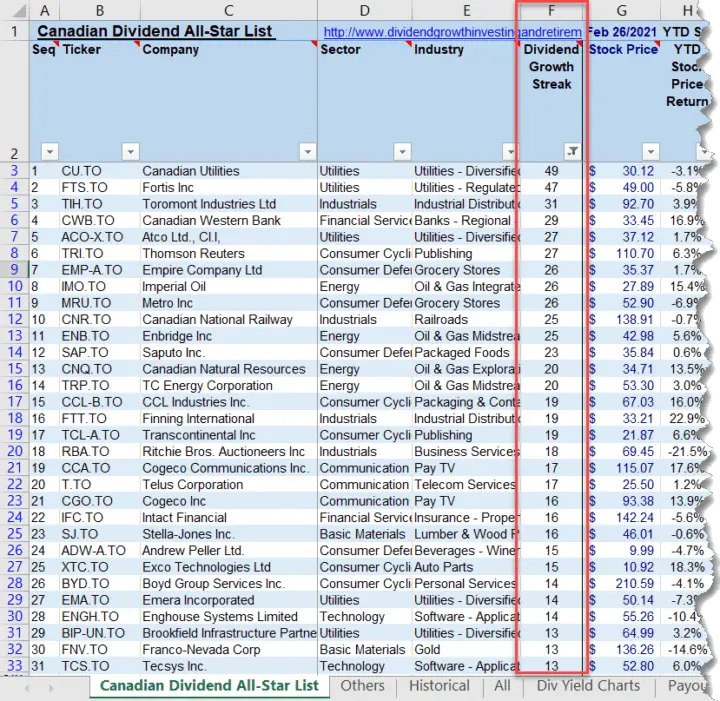

The Canadian Dividend All-Star List is sorted by the dividend growth streak length.

The dividend growth streak is the number of consecutive calendar years the company has increased its regular dividend.

Source: February 28, 2021, Canadian Dividend All-Star List

Looking at the above example we can see that in 2021, Canadian Utilities (TSE:CU) had the longest dividend streak with a very impressive 49 years of dividend growth. The second-longest streak belongs to Fortis (TSE:FTS; NYSE:FTS) with 47 years of consecutive dividend increases.

How a dividend growth streak is calculated

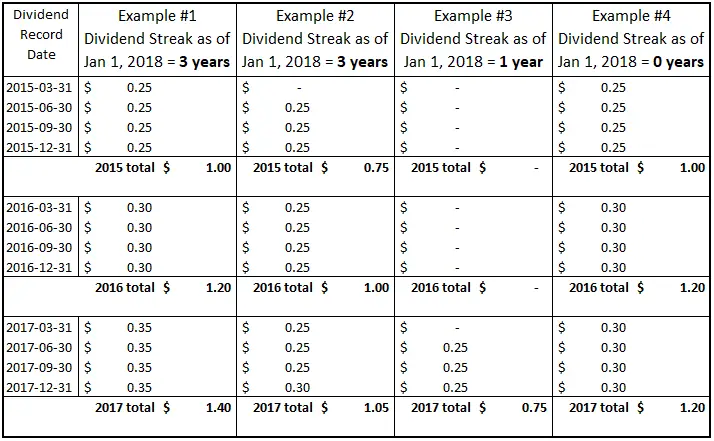

To understand how the streaks are calculated let’s look at a few examples.

- Example #1: The company increases the dividend each year at the beginning of the year so the dividend streak is 3 years. This is what most people think of when they think of a dividend streak.

- Example #2: The dividend streak is 3 years despite having only one dividend increase after initiating a dividend in the 1st year. If total regular dividends for the year are more than the previous year, the streak continues.

- Example #3: If the company initiates a dividend, I count that as year one in the dividend streak.

- Example #4: The 2017 total dividends of $1.20 are the same as the prior-year so the dividend streak is 0 years.

Remember, it’s only regular dividends that are used to determine dividend streaks, special one-time dividends are ignored.

There are four dividend dates:

- Dividend record date, (Canadian Dividend All-Star List uses this one)

- Dividend payable date,

- Dividend ex-date, and

- Dividend declared date.

The Canadian Dividend All-Star List uses the dividend record date based on a calendar year (January-December) to determine the streak length.

Dividend streaks are updated annually at the end of the calendar year.

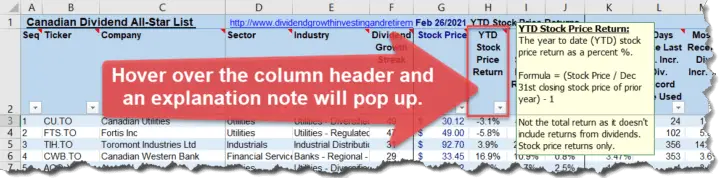

TIP: If you are struggling to understand any of the information in the Canadian Dividend All-Star List, hover over the column header and an explanatory note will pop up.

How to use the Canadian Dividend All-Star List to find high-quality dividend growth stocks

If you plan to rely on dividend income in retirement then a focus on high-quality dividend growth companies is important as it helps minimize the risk of dividend cuts or eliminations.

“Dividend growth stocks tend to be of higher quality than those of the broader market in terms of earnings quality and leverage. Quite simply, when a company is reliably able to boost its dividend for years or even decades, this may suggest it has a certain amount of financial strength and discipline.”

At the beginning of this article, I told you to focus not on the 57% of global firms that either cut or eliminated their dividend during the financial crisis of 2008-2009, but rather the ones that were able to increase their dividend.

With the Canadian Dividend All-Star List, it’s very simple to find these companies.

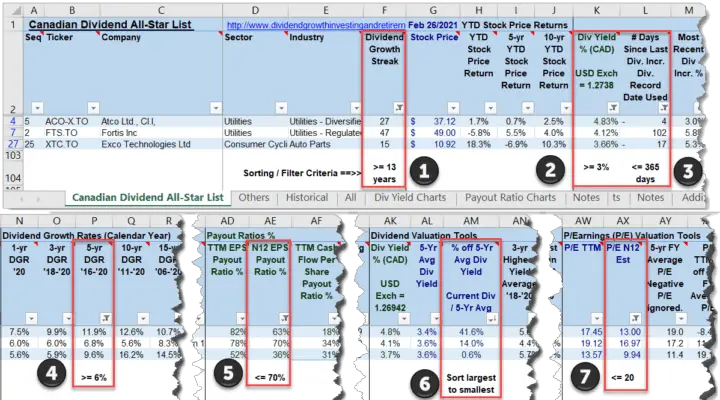

In early 2021, if you want companies with dividend streaks going back to 2008. This means a dividend growth streak of at least 13 years. Looking at the February 28, 2021, Canadian Dividend All-Star List that leaves you with 31 companies to continue your research with.

This is a very basic example of how you can use the Canadian Dividend All-Star List.

To find high-quality dividend growth companies you’ll need to look at more than just the dividend streak.

Let’s use a more robust example of how someone might use the Canadian Dividend All-Star List:

- Dividend streak = 13 years or more, to include the financial crisis years.

- Dividend yield = 3% or more, for a reasonable current dividend.

- Number of days since the most recent dividend increase = 365 days or less, to avoid stocks that haven’t recently increased their dividend.

- 5-year dividend growth rate = 6% or more, for reasonable dividend growth above inflation.

- Next 12 months (N12) EPS payout ratio = less than 60%, or less than 70% if it’s a utility company, for a sustainable dividend.

- % off of the 5-year highest yield average = sort largest to smallest, to get stocks with the current dividend yield higher than the 5-year highest yield average shown first.

- P/E Ration using N12 EPS = less than 20, to avoid expensive stocks.

From the 31 companies that had a dividend streak of at least 13 years, we’ve now got 3 companies to continue your research with.

It’s important to remember that this is just an example to illustrate how you could use the Canadian Dividend All-Star List. These are not recommendations.

Yes, the Canadian Dividend All-Star List is a great starting point to identify and screen Canadian dividend growth stocks, but you will have to do some further research on your own.

What the Canadian Dividend All-Star List is NOT

The Canadian Dividend All-Star List is NOT a list of stock recommendations.

The information is just that, information/data. Yes, it’s sorted by the dividend streak length, but that doesn’t mean I’m recommending these stocks.

Just because one stock is higher up the list than another, doesn’t mean it’s better.

Just because a stock is in the Canadian Dividend All-Star List, doesn’t mean it’s automatically a high-quality company. The only criteria to be listed on the Canadian Dividend All-Star List is that the company be listed on a Canadian stock exchange and have a 5-year dividend streak or longer.

The Canadian Dividend All-Star List is NOT always going to be 100% accurate. I have tried my best to provide accurate information, but I am subject to human error and this is a one-man operation. There is simply too much information in the file to make any sort of guarantees.

As with anything in the investment world, make sure you do your own due diligence.

The Bonus “Others” Tab

![]()

The stocks in the “Others” tab are not considered Canadian Dividend All-Stars because they don’t have a 5-year or longer dividend streak.

Companies in the “Others” tab pay a dividend, but there are no specific criteria to be included in the “Others” tab. It is just an assortment of stocks that people have asked to be included, or are thought of as dividend growth stocks.

TIP: Pay particular attention to the number of days since the last recorded dividend increase as some of these stocks have not increased their dividend for a number of years.

Other useful resources

If you are looking for a similar resource for US companies, take a look at the US Dividend Champions which was created by the late David Fish and is now being updated by Justin Law. Free download of the US Dividend Champions list is on The DRiP Investing Resource Center website, and you can read about the updates to the US list by following Justin Law on Seeking Alpha.

Dividend Radar also has a weekly update of US stocks that have raised their yearly dividend payouts for at least five years.

-

Eurozone & UK Dividend Champions

The Eurozone Dividend Champions List and UK Dividend Champions List are Excel spreadsheets with stock information on Eurozone and UK companies that have increased or maintained their dividend for 5 or more calendar years in a row. Both lists are updated and maintained by Christophe Soulet

In addition to sending out the Canadian Dividend All-Star List monthly updates to my email subscribers, I also write monthly articles that feature the Canadian Dividend All-Star List companies that increased their dividend in the prior month.

Mat Litalien writes weekly/monthly articles about Canadian Dividend All-Star List companies that he expects to increase their dividend soon along with an estimate of their future dividend growth.

Look for his articles, usually titled “Canadian Dividend All-Stars – Week of Month Day“, on Stocktrades.ca

Summary

During the global financial crisis of 2008-2009, when over half of the dividend-paying stocks around the world were cutting dividends, a select few high-quality companies were instead increasing their dividend.

With the Canadian Dividend All-Star List, you’ll be able to find these high-quality dividend growth companies quickly and use a ton of dividend and stock information to further your own research into finding the best Canadian dividend growth stocks.

The Canadian Dividend All-Star List is a list (spreadsheet) with a wealth of information on companies that are on a Canadian stock exchange and have a 5-year dividend streak or longer.

This valuable resource is a great starting point to identify and screen the best Canadian dividend growth stocks.

Subscribe to the Dividend Growth Investing & Retirement newsletter for free access to the most popular resource of the blog along with monthly updates to the Canadian Dividend All-Star List.

PS. If you find the Canadian Dividend All-Star List or other content on the blog useful, please donate. Creating and updating this file takes a lot of time and effort, so donations are always welcome! I do enjoy maintaining the blog, but since my son was born my priorities have shifted and I’m hoping this blog can help support my family in a more meaningful way.

Disclosure: I own shares of Atco Ltd (TSE:ACO.X), Brookfield Infrastructure Partners LP (TSE:BIP.UN), Canadian Utilities (TSE:CU), Canadian Western Bank (TSE:CWB), Emera Inc. (TSE:EMA), Enbridge Inc. (TSE:ENB), Fortis (TSE:FTS) and Telus (TSE:T). You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![How to estimate dividend growth and total returns using Josh Peters’ Dividend Drill Return Model [Example & Spreadsheet]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/10/How-to-estimate-dividend-growth-and-total-returns-using-Josh-Peters’-Dividend-Drill-Return-Model-Cover-768x575.png)

When I first looked at your list I was overwhelmed with the details it contains. I wasnt sure what to do with it. Thanks for this tutorial. It helps a lot. Looking forward to your emails.

i have used your list a few times… and bought shares that have given me very good dividends… good work.. thanks

First of, let me tell you how much I appreciate your list. I haven’t used it every month but when re balancing I had it open all the time, it’s very very valuable information!

I used your example today for the first time and wonder if you can comment, I have put the column letters next to individual suggestions but am not sure I found all of them. Please correct where I am wrong:

1. D = Dividend streak = 11 years or more, to include the financial crisis years.

2. ? = Dividend yield = 3% or more, for a reasonable current dividend.

3. K = 5-year dividend growth rate = 6% or more, for reasonable dividend growth above inflation.

4. Z= Number of days since the most recent dividend increase = 365 days or less, to avoid stocks that haven’t recently increased their dividend.

5. AF = Next 12 months (N12) EPS payout ratio = less than 60%, or less than 70% if it’s a utility company, for a sustainable dividend.

6. AJ= P/E Ratio using N12 EPS = less than 20, to avoid expensive stocks.

7. P= % off of the 5-year highest yield average = sort largest to smallest, to get stocks with the current dividend yield higher than the 5-year highest yield average shown first.

Below are the columns in the excel file that were used in the example.

1. Column D = Dividend streak = 11 years or more, to include the financial crisis years.

2. Column F = Dividend yield = 3% or more, for a reasonable current dividend.

3. Column K = 5-year dividend growth rate = 6% or more, for reasonable dividend growth above inflation.

4. Column Z= Number of days since the most recent dividend increase = 365 days or less, to avoid stocks that haven’t recently increased their dividend.

5. Column AF = Next 12 months (N12) EPS payout ratio = less than 60%, or less than 70% if it’s a utility company, for a sustainable dividend.

6. Column AJ= P/E Ratio using N12 EPS = less than 20, to avoid expensive stocks.

7. Column U= % off of the 5-year highest yield average = sort largest to smallest, to get stocks with the current dividend yield higher than the 5-year highest yield average shown first.

You were missing #2, and for #7, the column P was wrong, it should be column U. Column P is the percent (%) off of the 5-year average yield, whereas column U is the % off of the 5-year highest yield average.

Thank you!

Not a Face book user so I do not tweet, however each time I refer to your All-Star list, I send a silent thank you for all the work you do on my behalf.

Hi! I’m using LibreOffice Calc instead of Excel and I can’t sort the columns as you mention in your example. People using the Excel software can sort the columns, right? Thanks for sharing your research.

In excel there is a filter/sort option that I added to the Canadian Dividend All-Star List for this article. The file I share doesn’t have the filter option in the file.

I’m not familiar with LibreOffice Calc so I don’t know if you can add a filter or sort with Libre.

Thank you very much for your example and column explanations. I wonder if you could elaborate a little more on column U. I can’t figure out the significance between a positive and a negative %. What does this value tell you as a criteria for selecting a quality stock?

I just want to say that I appreciate so much what you do. Your All-Star spreadsheets are a great resource, and your articles contain very useful insights. I have introduced two friends so far to your site and tools, and in both cases there was amazement at what they saw. A big thank you!