Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

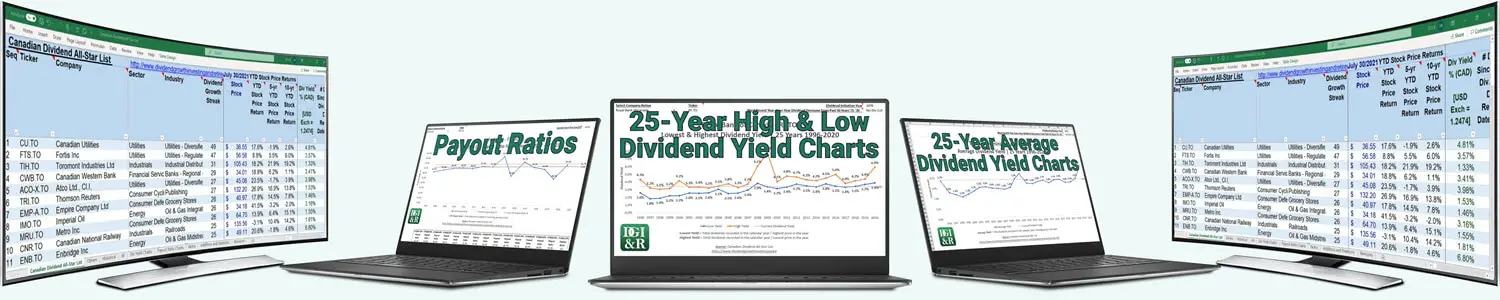

The Canadian Dividend All-Star List has been updated for July 31st. The Canadian Dividend All-Star List is a list/spreadsheet of Canadian companies that have increased their recorded dividends for five or more calendar years in a row. I added an “Others” tab to include some other companies that don’t have the five year dividend streak.

The list contains an array of stock information that includes over 10 years’ worth of dividend data, the highest dividend yield for each year, and a wealth of other stock information. The list can be useful when screening for Canadian dividend growth companies. Once a month I update the list and it can be downloaded free here.

In this month’s list one company was added to the All-Star List and there were a number of July dividend increases announced.

Chesswood Group Ltd. [TSE:CHW Trend] was added to the Canadian Dividend All-Star List as it has a dividend streak of 5 years. The company is a small cap stock in the industrials sector providing rental and leasing services in equipment financing, legal financing and automotive operations.

Chesswood Group Ltd.’s last dividend increase was the dividend recorded in November 2013 when the monthly dividend was increased 8.3% from $0.0600 to $0.0650. Chesswood Group Ltd. has increased its dividend for 5 consecutive calendar years and currently yields 6.5%. If the company doesn’t increase their dividend sometime in 2015 they will lose their dividend streak. They have a 5 year dividend growth rate of 18.8%. They have not been paying out a dividend long enough for a 10 year dividend growth rate.

I haven’t done a lot of research on the company, but for the time being I don’t plan to invest in the company.

Dividend Increases Announced in July

Imperial Oil

Imperial Oil [TSE:IMO Trend] announced a 7.7% dividend increase. The quarterly dividend will be increased from $0.1300 to $0.1400.

Imperial Oil has increased its dividend for 20 consecutive calendar years and currently yields 1.1%. They have 5 and 10 year dividend growth rates of 5.4% and 5.9% respectively. This is typically a low yielding dividend stock and the dividend growth hasn’t been that high so I likely won’t be investing. When a company has a low initial yield I want the dividend growth to be high to make up for the low yield. In Imperial Oil’s case the yield is low and dividend growth is moderate. I also currently own ExxonMobil [XOM Trend] which owns a large portion of Imperial Oil so I already have some exposure through ExxonMobil.

You can see my portfolio here.

Suncor Energy Inc.

Suncor Energy Inc. [TSE:SU Trend] announced a 3.6% dividend increase. The quarterly dividend will be increased from $0.2800 to $0.2900.

Suncor Energy Inc. has increased its dividend for 12 consecutive calendar years and currently yields 3.1%. They have 5 and 10 year dividend growth rates of 27.7% and 24.4% respectively.

As an owner of this stock I was happy to hear of the dividend increase. I bought shares at $34 plus the commission in December 2014. My valuation for the company has changed a bit, so now I start to get interested in investing around the $30 mark which is a dividend yield of 3.9% based on the new dividend.

Related articles: Portfolio Update: Ensign Energy Services and Suncor Energy Purchased & Suncor Energy: Dividend Stock Analysis

Accord Financial Corp.

Accord Financial Corp. [TSE:ACD Trend] announced a 5.9% dividend increase. The quarterly dividend will be increased from $0.0850 to $0.0900.

Accord Financial Corp. has increased its dividend for 9 consecutive calendar years and currently yields 3.3%. They have 5 and 10 year dividend growth rates of 4.9% and 6.2% respectively. The dividend growth is a little lower than I like to see, so I likely won’t be investing in this stock. That said, I don’t really know much about the stock so if you have any thoughts on the company please share.

I like to look at the highest dividend yield for each year of the past decade as a quick way to screen for dividend growth stocks. I’ll look for companies that have a current dividend yield higher or equal to the third highest dividend yield of the past decade. For Accord Financial Corp. the third highest yield is around a 5.0%. With the current yield at 3.3% I likely won’t look into this stock further for quite awhile as it’s not close to a dividend yield of 5%.

Tecsys Inc.

Tecsys Inc. [TSE:TCS Trend] announced an 11.1% dividend increase. The quarterly dividend will be increased from $0.0225 to $0.0250.

Tecsys Inc. has increased its dividend for 7 consecutive calendar years and currently yields 1.0%. They have a 5 year dividend growth rate of 19.0%. They have not been paying out a dividend long enough for a 10 year dividend growth rate.

I haven’t done very much research, but for the time being I don’t plan on investing in the company.

Alimentation Couche-Tard Inc.

Alimentation Couche-Tard Inc. [TSE:ATD.B Trend] announced a 22.2% dividend increase. The quarterly dividend will be increased from $0.0450 to $0.0550.

Alimentation Couche-Tard Inc. has increased its dividend for 5 consecutive calendar years and currently yields a very low 0.4%. They have a high 5 year annual average dividend growth rate of 28.4%. They have not been paying out a dividend long enough for a 10 year dividend growth rate.

I haven’t researched this stock in detail, but I’d start to get interested in investing or doing more research around my minimum dividend yield of 2.0% to 2.5%. It doesn’t look like they’ve reached a 2.0% level in the past decade so this likely means I won’t be investing in the stock for the foreseeable future.

That’s it for dividend increases this month; hopefully you’re seeing some dividend growth in your own portfolio.

Photo credit: marcodede / Foter / CC BY

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Hi

I have been reading your blog for about a year now and just wanted to say thanks for all the information. Have you done a post on the pros and cons of Canadians investing in American stock? I haven’t been able to find much for information on the subject. Thanks!

Glad you like the blog.

No I haven’t done an article on the topic. Some of the main benefits are diversification and more variety of high quality dividend growth stocks.

Cheers,

DGI&R

Thank you for the info!

As for not investing in lower yielding companies such as ATD.B I would add that sometimes, with companies in niche positions, lower yields are less important than growing dividends. Companies that are growing the dividend because of high and rising profits will see their share prices rise. My best performer, Stella Jones, first purchased at $7 pre split is now worth $45 after the 4 for one split. And it is still profitable and increase the dividend. Small growing companies such as the 2 I just mentioned are gold mines for investors as they offer increasing dividends and capital appreciation. Wish I could find more of that caliber.

Cheers

GF

IDK about IMO raising their dividend for 20 straight years. I own that stock and I don’t think they raised their dividend in 2004, 2006, 2009 and 2011.

The dividend streaks are based on the dividends recorded in each calendar year. I’ll use 2011 as an example of how the streak was maintained due an increase in the middle of 2010 even though the dividend wasn’t increased in 2011.

In 2010 recorded dividends totalled $0.43 ($0.10 + $0.11 + $0.11 + $0.11). They increased the quarterly dividend from $0.10 to $0.11 after the 1st quarter.

In 2011 recorded dividends totalled $0.44 ($0.11 + $0.11 + $0.11 $0.11). No dividend increase, but $0.44 is greater than 2010’s $0.43 so streak is maintained.

In 2012 they increased the quarterly dividend to $0.12 from $0.11 to keep the streak alive.

http://www.imperialoil.ca/Canada-English/about_investors_shareholder_historical.aspx

Hope that helps,

DGI&R

and 2014