Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

“In business, I look for economic castles protected by unbreachable ‘moats’.”

Warren Buffett

A key component of dividend growth investing is finding high-quality companies that can pay increasing dividends over long periods of time.

The search for high-quality starts with wide-moat stocks.

That is why it’s important to understand what a moat is, and what separates the best (wide-moat stocks) from the rest (narrow and no-moat stocks).

To illustrate, I’ll use Canadian wide-moat stock examples to explain what a moat is, and the 5 sources of a moat.

What is a Moat?

A moat is made up of a company’s sustainable competitive advantages.

How sustainable those advantages are, determines how wide or narrow the moat is.

If a company has an advantage over its competitors that they can maintain for decades, they have a wide moat.

A no-moat company has no sustainable competitive advantages and a narrow-moat company that has some advantages that are expected to erode over the next 10 plus years or so.

This investing term “moat” was made popular by famous investors Warren Buffett and Charlie Munger.

“The most important thing [is] trying to find a business with a wide and long-lasting moat around it … protecting a terrific economic castle with an honest lord in charge of the castle”

Warren Buffett

As you can see, the quest for high-quality stocks should start with identifying these wide-moat companies.

I use Morningstar to quickly identify wide-moat companies, so here is their moat definition and a short (1 min 33 secs) video that sums up their Economic Moat Rating well.

“Morningstar’s ratings for economic moat […] capture how likely a company is to keep competitors at bay for an extended period. One of the keys to finding superior long-term investments is buying companies that will be able to stay one step ahead of their competitors, and it’s this characteristic that Morningstar is trying to capture with the economic moat rating, which will be either wide, narrow, or none”

Source: https://youtu.be/qWnqPCc2wPY

The 5 Sources of a Moat with Canadian Examples

As we saw in the video, there are five sources of economic moats:

- Switching costs,

- Intangible assets,

- Network effect,

- Cost advantage, and

- Efficient scale.

Source: https://www.vaneck.com/five-sources-of-moats/

Wide-moat stocks will often have more than one of these five sources of economic moats.

For example, Canadian National Railway Co (TSE:CNR; NYSE:CNI) has a wide moat from its cost advantage and its efficient scale. You’ll see this trend in the examples below too.

Switching Costs

If it’s too expensive or too much of a nuisance to switch to a competitor then a company maintains its competitive advantage with high switching costs.

Royal Bank of Canada (TSE:RY; NYSE:RY) – Switching Cost Wide Moat Example

Royal Bank is Canada’s biggest bank and it operates in a favourable oligopolistic Canadian banking market.

Morningstar sees “switching costs in the Canadian system being driven by a tightly regulated oligopolistic market structure, which limits excess competition, therefore stabilizing product pricing and giving customers less incentive to switch banks.” … “Royal Bank of Canada has a wide moat because it has superior market share in the advantageous Canadian banking environment, superior operating efficiency, and exposure to more moaty nonbank businesses.”

Other Canadian Wide Moat Switching Cost Companies

- The Toronto-Dominion Bank (TSE:TD; NYSE:TD)

FYI – The four other “Big 6” Canadian banks have narrow moats.

Intangible Assets

Think of companies with strong brands or companies with patents or licenses that force others to use only their product or severely limit the competition.

Waste Connections Inc (TSE:WCN; NYSE:WCN) – Intangible Assets Wide Moat Example

These guys get paid to pick up your garbage.

Or, in more formal terms:

Waste Connections is a waste management company that provides non-hazardous waste collection, transfer, disposal and recycling services in the U.S. and Canada. They were primarily based in the US until they merged with the Canadian company Progressive Waste in 2016.

Morningstar explains that “the firm’s overall portfolio of traditional solid waste business enjoys sustainable competitive advantages rooted in intangible assets (regulatory permits) and cost advantage (route density).

In terms of intangible assets, regulatory permits create immense structural barriers to entry for the firm’s disposal operations. Developing and operating a landfill requires facility permits, various licenses, and a host of federal and local government approvals associated with zoning and environmental protection, and such approvals are costly and a challenge to secure. On top of that, “not in my backyard” opposition is no small barrier to constructing a new landfill.”

Other Canadian Wide Moat Intangible Assets Companies

- None

As there are not currently any other Canadian wide moat intangible asset examples other than Waste Connections Inc, I thought I’d share some US names:

- Coca-Cola Co (NYSE:KO)

- McDonald’s Corp (NYSE:MCD)

- Starbucks Corp (NASDAQ:SBUX)

Network Effect

Network effect moats come from companies that are able to provide more value to their customers/users as their customer base grows. This can lead to stronger and stronger moats with each added customer.

It’s a bit easier to explain with an example, but there aren’t any wide moat network effect companies in Canada.

Instead, I’ll use a Canadian narrow moat example: Ritchie Bros Auctioneers Inc (TSE:RBA; NYSE:RBA).

Ritchie Bros Auctioneers Inc (TSE:RBA; NYSE:RBA) – Network Effect Narrow Moat Example

Ritchie Bros is the world’s largest industrial auctioneer.

Before we get to the specifics of Ritchie Bros network effect moat, it will help to understand what a successful auction needs. You need two things:

- Something to sell that people want, and

- A way to attract lots of buyers/bidders.

Buyers won’t bid or attend an auction unless there are interesting things to bid on, but sellers won’t sell unless they know they’ll be lots of buyers so they can get a good price for what they are selling.

The more buyers you attract to the auction, the more confidence the sellers have. This leads to more sellers and more interesting things to sell at the auction. Now there are more things that buyers want, and this leads to more buyers.

More buyers lead to more sellers, more sellers leads to more buyers. And on and on and on … This cycle is how a network effect moat grows.

With each added buyer/seller the moat grows stronger as more value is provided to everyone. Buyers get more options, and sellers get a larger market to sell their products.

In the case of Ritchie Bros, it’s grown to become the world’s largest industrial auctioneer so it’s network effect moat is quite strong.

Morningstar put it this way:

“Like most businesses that generate a moat via a network effect, Ritchie Bros. provides compelling value for all of its customers. For buyers, Ritchie’s ability to draw seller’s equipment into multi-day auctions that have been promoted for days in advance provides assurance that the event will offer many lots of equipment that will cater to virtually all of their equipment needs.” […]

“Sellers also get compelling value.” […] “With the ability to draw some of the largest auction audiences in the industry, sellers can be confident that they are likely to sell their equipment in the most liquid and advantageous environment possible.” […]

“The company’s massive scale and the value it creates for buyers and sellers creates a virtuous cycle, spurring more buyers and sellers to join Ritchie’s ecosystem.”

Other Canadian Wide Moat Network Effect Companies

- None

As there are not currently any Canadian wide moat network effect companies I thought I’d share some US names instead:

- Alphabet Inc (NASDAQ:GOOG) – They own Google.

- Facebook Inc (NASDAQ:FB)

- Mastercard Inc (NYSE:MA)

- Microsoft Corp (NASDAQ:MSFT)

- Visa Inc (NYSE:V)

Cost Advantage

Who can make it the cheapest? – That is cost advantage.

If you can make a product or provide a service cheaper than the competition in a way that is difficult for others to copy, it gives you two good options:

- You can undercut the competition by charging less which reduces your competition’s profitability and potentially forces them out of your industry. It also de-incentivizes new competition. OR

- You can charge prices that are the same or close to your competition, but because you are able to make the product cheaper your profits will be more.

The really strong cost advantage moats come from companies that find a way to keep cutting costs as they grow. This allows them to continually lower prices and can lead to a continual cycle of large growth.

Canadian National Railway Co (TSE:CNR; NYSE:CNI) – Cost Advantage Wide Moat Example

I first thought of Walmart Inc (NYSE:WMT) as a good cost advantage moat example, but we’re looking for Canadian examples so instead, let’s look at Canadian National Railway Co.

A railway might surprise you as a cost advantage example, but when you start to think about the cheapest way to transport goods across land, you realize that they are the cheapest option by a mile.

Morningstar puts it this way (emphasis added):

“Cost advantage is a key driver of CN’s wide economic moat. While barges, ocean liners, aircraft, and trucks also haul freight, railroads are by far the low-cost option where no waterway connects the origin and destination, especially for freight with low value-per-unit weight (bulk commodities). Along those lines, railroads enjoy roughly quadruple the fuel efficiency of trucking (per ton-mile of freight), and through greater railcar capacity and train length, rails make more effective use of locomotive assets and manpower despite the need for train yard personnel. Rails can also carry significantly more freight at once. Even for freight that can be shipped by truck, we estimate railroads enjoy a 10%-30% discount on a similar lane (on average). Even for intermodal container freight, which is largely made up of consumer-related products, rail has historically been cheaper than its key competitor truckload shipping on average over the cycle thanks to the rails’ aforementioned fuel efficiency and more economical use of labor.”

You take these cost advantages and add it to CN Rail’s other source of a moat, which comes from its efficient scale, and it’s easy to understand why they have a wide moat.

Other Canadian Wide Moat Cost Advantage Companies

- Canadian Pacific Railway Ltd (TSE:CP; NYSE:CP)

- Royal Bank of Canada (TSE:RY; NYSE:RY)

- The Toronto-Dominion Bank (TSE:TD; NYSE:TD)

- Waste Connections Inc (TSE:WCN; NYSE:WCN)

Efficient Scale

Think utility companies, airports, telecommunications, railroads, and pipelines. These types of companies typically operate in a market that is only designed for one or a few companies. When the demand for a market is fulfilled by one or just a few companies it disincentivizes competition coming into the market as it is very difficult for new entrants to make money.

Enbridge Inc (TSE:ENB; NYSE:ENB) – Efficient Scale wide moat example

Enbridge Inc is a pipeline company that has a wide network of pipelines across North America. They have already built or bought these pipelines, so there is little incentive for competitors to enter their markets. This, along with the high-quality nature of their assets and their ability to negotiate 20-25 year contracts are why Enbridge has a wide moat.

Morningstar put it this way: “Midstream companies process, transport, and store natural gas, natural gas liquids, crude oil, and refined products. There are multiple ways for midstream companies to build moats, but efficient scale is the dominant source.” […] “Once a transport route is established, there’s usually little need to build a competing route. Doing so would drive returns for both routes below the cost of capital. Thus, pipelines are generally moaty because they efficiently serve markets of limited size.”

Other Canadian Wide Moat Efficient Scale Companies

- Canadian National Railway Co (TSE:CNR; NYSE:CNI)

- Canadian Pacific Railway Ltd (TSE:CP; NYSE:CP)

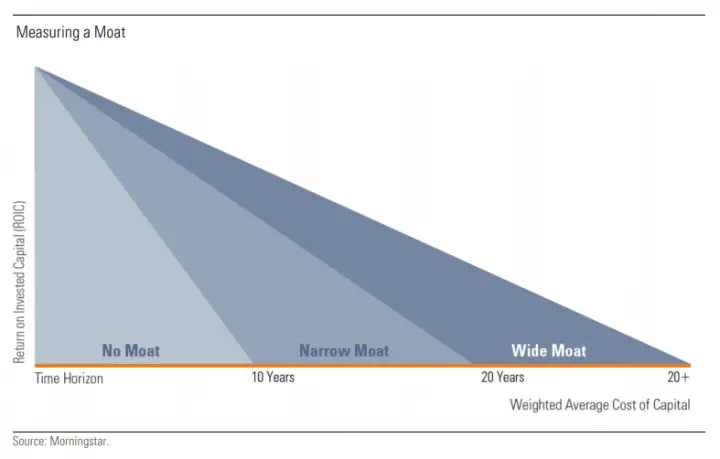

The Difference Between A Wide, Narrow & No-moat Rating

A company’s moat is its competitive advantage. The wide, narrow and no-moat ratings reflect how sustainable a competitive advantage is.

In other words, how long will this competitive advantage last?

Here’s the short version…

Wide moat = +20 years

Narrow moat = 10-19 years

No moat = 0-9 years

“A company whose competitive advantages we expect to last more than 20 years has a wide moat; one that can fend off their rivals for 10 years has a narrow moat; while a firm with either no advantage or one that we think will quickly dissipate has no moat.”

Source: The Morningstar Economic Moat Rating

Source: Morningstar Equity Research Methodology

Summary

The search for high-quality dividend growth stocks starts with finding wide-moat stocks that will be able to pay increasing dividends over very long periods of time.

That’s why it’s important to be able to answer these two questions:

Q1. What is a moat?

A1. A company’s sustainable competitive advantages.

To better illustrate, Canadian examples were used to explain the 5 sources of a moat:

- Switching Costs – Wide-moat example: Royal Bank of Canada

- Intangible Assets – Wide-moat example: Waste Connections Inc

- Network Effect – Narrow-moat example: Ritchie Bros Auctioneers Inc

- Cost Advantage – Wide-moat example: Canadian National Railway Co

- Efficient Scale – Wide-moat example: Enbridge Inc

Q2. What separates the best (wide-moat stocks) from the rest (narrow and no-moat stocks)?

A2. It comes down to how long the competitive advantage will last:

Wide moat = +20 years

Narrow moat = 10-19 years

No moat = 0-9 years

Hopefully, the article helped you understand what a moat is and what a company needs to have a wide moat.

After all… A focus on high-quality stocks, like wide-moat companies, is so important when building a portfolio designed to pay you ever-increasing dividends.

PS. Don’t forget to check out the rest of the wide moat articles in this series.

- What is a Moat? With 5 Canadian Wide Moat Examples (This is the article you just read)

- Why Invest in Wide Moat Stocks?

- 3 Ways to Find Wide Moat Stocks

- Each & Every Wide Moat Stock in Canada

- Every Wide Moat Stock in the USA

- International Wide Moat Stocks – Every Single One Listed

- 8 Canadian Dividend Growth Wide Moat Stocks

- 76 US Wide Moat Dividend Growth Stocks

- 23 International Wide Moat Dividend Growth Stocks

- 100 Canadian Narrow Moat Stocks

- 44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/08/Free-Online-Value-Line-Investment-Survey-Access-in-Canada-Map.-768x526.png)

Excellent.

Thanks Vijay!

Hi DGI&R,

This is a good article explaining the moat concept. The one thing that struck me is how companies like CN or CP may have good moats, but they are still vulnerable to broad economic conditions. For example, if a lengthy recession led to reduced demand for rail cargo, wouldn’t the companies potentially suffer in two ways: 1) lower share price and, 2) if the recession were really protracted, possible dividend cuts?

The same could be true for different reasons in the banking a retail sectors.

So if one were trying to come up with a recession-proof dividend grower, wouldn’t moat be one factor in the consideration but also the sector the company operates in would be important as well.

What comes to mind here is the utilities sector. Are they good examples of moats there that might also be somewhat more resilient to recessions (e.g., FTS, AQN, etc.).

Thanks for your post.

Michael

Hi Michael,

You are absolutely right. Just because a company has a wide moat doesn’t mean it’s recession proof and having a moat is just one factor of many to look at.

The sector or industry the company operates in will make a difference.

It’s funny you mention Utilities because I’m writing a series of articles on wide moat stocks. This post is the 1st and and I’m currently working on the 4th article: “Every Wide Moat Stock in Canada”. The article won’t come out until sometime next month.

When I did my research for the “Every Wide Moat Stock in Canada” post I was surprised to see that Canadian utility companies (FTS, CU, EMA, etc.) are generally considered narrow moat vs. wide moat stocks.

Just because they have narrow moats doesn’t mean they don’t hold up better in recessions to most other stocks though. Utilities usually have predictable earnings and cash flows due to their regulated nature which helps them in recessions.

The narrow-moat comes from regulated operations in service territory monopolies and efficient scale advantages.

Like telecoms, it’s regulation for the public good that typically prevents them from reaching a wide moat rating, but at the same time these regulations also help maintain a narrow-moat.

Government regulation for the public good is good for us consumers, not so good for a company’s bottom line. It’s the cap placed on a regulated utility’s return on equity (ROE) that typically prevents them achieving the wide moat rating.

Hope that made sense.

Cheers,

DGI&R

Excellent article and timing… Forwarded to my siblings.

Thanks Stu!

That makes total sense. Thank you for your excellent explanation. I look forward to your upcoming moat articles. Great topic.

Excellent article. Many thanks.

Thanks Brenda!

DGI&R,

Thank you for the time you spent on this site and writing articles which impact-fully benefits so many. What is a return on your side beyond measure…..

With gratitude,

Angela

Thanks Angela.

I wasn’t sure what you meant by: “What is a return on your side beyond measure…..”

If it’s a compliment, thank you 🙂

If it’s a question, please clarify and I’ll do my best to answer.

Excellent explanation for the moat illiterate!

Thanks Bonnie!

Excellent Article. Thanks for explanation. I had that question in

my mind many years and I never found any better explanation than what you have provided. Again thanks for taking time. Excited to see your future article about wide moat companies as you have mentioned in one of the reply.

Thanks Alkesh!

Next wide moat article comes out on Sept 29th and it’ll be called “Why invest in wide moat stocks?”

After that comes “3 ways to find wide moat stocks” and then there will be a number of articles covering Canadian, US and international wide moat stocks, etc.

Cheers,

DGI&R

Thank you so much for your article and explanations. It does make sense and will help with my decisions going forward. I appreciate your time and efforts to put this article together.

Warm Regards,

Pamela

Thanks Pamela! It’s always nice to hear when my work is appreciated.

Cheers,

DGI&R

Very nice explanation of most concept in investing! Awaiting your upcoming posts.

Regards

Abraham

Thanks!

Hello DGI&R,

Thank you for resending these articles. I did not come across these excellent articles earlier. Thank you again.

Also, the article and the comments section mentions follow up articles, so where can I get hold of the rest of the articles?

Much appreciate your time and attention.

Naresh

Here are the links to the full series:

What is a Moat? With 5 Canadian Wide Moat Examples (This is the article you just read)

Why Invest in Wide Moat Stocks?

3 Ways to Find Wide Moat Stocks

Each & Every Wide Moat Stock in Canada

Every Wide Moat Stock in the USA

International Wide Moat Stocks – Every Single One Listed

8 Canadian Dividend Growth Wide Moat Stocks

76 US Wide Moat Dividend Growth Stocks

23 International Wide Moat Dividend Growth Stocks

100 Canadian Narrow Moat Stocks

44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Cheers,

DGI&R