Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products and services that have wide, sustainable moats around them are the ones that deliver rewards to investors.”

– Warren Buffett

Why invest in wide moat stocks?

Well, wide moat stocks are high-quality companies that can maintain competitive advantages for decades. If you are looking for a first-rate company to invest in, wide moat stocks are a natural starting point.

After all …

A good investment strategy requires a long-term mindset, a long-term mindset needs high-quality companies, and high-quality companies are wide-moat stocks.

Wide Moat = High-Quality

A wide moat company is expected to maintain its competitive advantage(s) for more than two decades (20+ years).

Any company that can fend off the competition and grow earnings for that long is worth looking into as they’ll have the potential to be a great long-term investment.

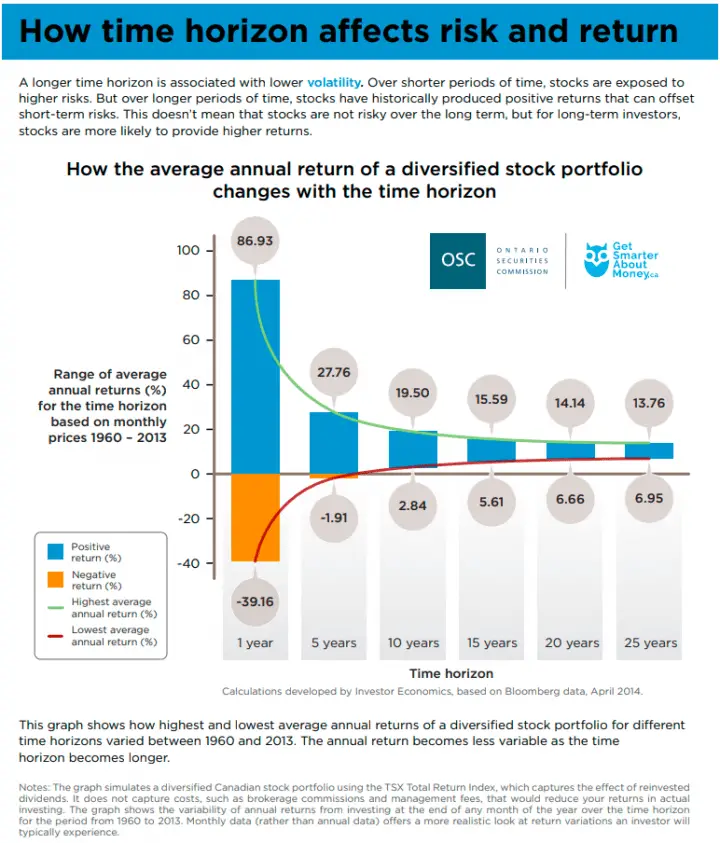

Lower Risk Comes From Long Time Horizons

Most successful investment strategies have a long-term view because a longer time horizon reduces risk.

A natural consequence of a long-term focus is to look for high-quality companies that are more likely to survive and thrive.

It’s not surprising then, to see lots of successful investment strategies with quality criteria built into their investment selection process.

Quality First

Warren Buffet prefers a “wonderful” vs. “fair” company

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

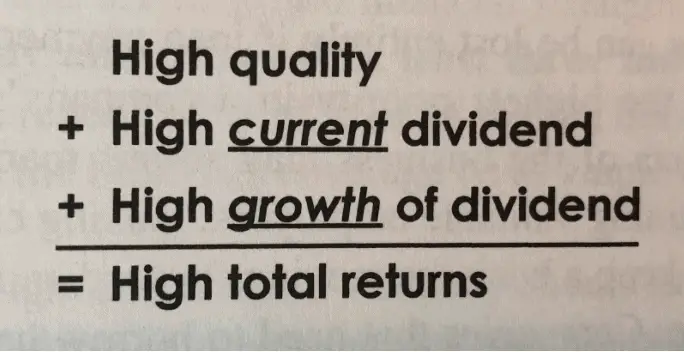

And Lowell Miller, an author I respect, has quality at the top of his dividend growth investing formula:

Source: The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (Affiliate link, but I personally own and highly recommend this book.)

As a dividend growth investor, my strategy mimics the one laid out in Lowell Miller’s book:

I try to invest in high-quality companies that are financially strong, have a reasonably high dividend yield, and a history of increasing dividends that I expect to continue.

This strategy only works if my investments are able to grow their earnings consistently over the long term in order to pay for an ever-increasing dividend.

Naturally, this starts with a focus on quality companies, like wide-moat stocks.

Wide moat companies are better able to fend off the competition and grow earnings over a long period of time.

Undervalued Wide Moat Stocks = Outperformance

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.”

– Warren Buffett

It’s important to remember that a wide moat stock on its own doesn’t necessarily make a good investment.

The price you pay for a stock matters.

For example…

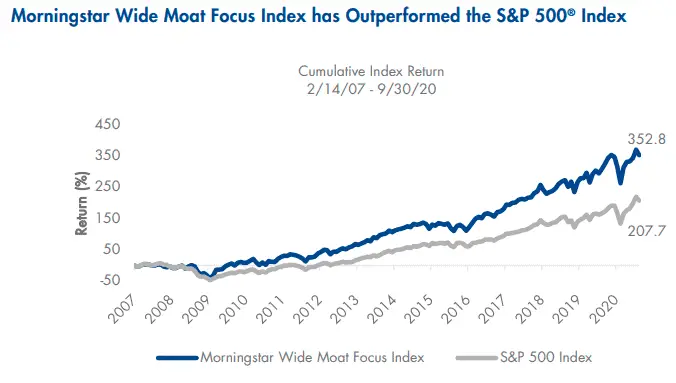

A nice by-product of focusing on undervalued wide-moat stocks is that they also tend to outperform the market.

VanEck has an ETF (MOAT) that tracks the Morningstar Wide Moat Focus Index. The index is made up of the most undervalued US wide-moat stocks according to Morningstar.

You can see below that this US index outperforms the S&P 500.

Source: VanEck – Wide Moat Investing: A History of Outperformance

Reminder: The index focuses on the most undervalued wide-moat stocks. So…

Just like any other stock, try to buy wide-moat stocks when they are undervalued.

Summary

So why invest in wide-moat stocks?

A good investment strategy requires a long-term mindset, a long-term mindset needs high-quality companies, and high-quality companies can come from wide-moat stocks.

Oh and try to buy wide-moat stocks when they are under-valued for a better chance at outperforming the market.

PS. Don’t forget to check out the rest of the wide moat articles in this series.

- What is a Moat? With 5 Canadian Wide Moat Examples

- Why Invest in Wide Moat Stocks? (This is the article you just read)

- 3 Ways to Find Wide Moat Stocks

- Each & Every Wide Moat Stock in Canada

- Every Wide Moat Stock in the USA

- International Wide Moat Stocks – Every Single One Listed

- 8 Canadian Dividend Growth Wide Moat Stocks

- 76 US Wide Moat Dividend Growth Stocks

- 23 International Wide Moat Dividend Growth Stocks

- 100 Canadian Narrow Moat Stocks

- 44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Quoting Buffet ad nauseam is silly and an epic waste of time. You’re not Warren Buffet.

Fair enough. Can’t win them all I guess?

He did popularize the “wide moat” term so I do think it’s relevant to the topic.

That said, there are three quotes from Warren Buffett in the article, so I take your point.

Hopefully you like my other articles better!

PS. Thanks for a bit of a chuckle this morning. It was “epic waste of time” that got me. It’s not that I don’t take your point, it’s just my comments aren’t usually so blunt. ????

Love wide moat stocks, to be honest. It is a great precursor for a strong, reliable dividend, right?

Excellent article.

Bert

Very true!

Glad you liked the article.

Cheers,

DGI&R

Your articles are helpful and well-written. I recently purchased shares of a VanEck ETF (PFXF) so your mention of MOAT caught my eye for further study. Could you please print future articles in a larger font?

Out of all the research that is available on the World Wide Web, I am always looking forward to yours. Thank you so much for the education.

Trevor

Wow, very kind words. Thank you Trevor!