Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

They say the hardest lessons in life are learned through experience. Well let’s just say a 38.6% loss in about a month is a lot of “experience”.

On November 6, 2015, and December 1, 2015, I purchased shares of a stock that was yielding 8-9% and was guiding annual dividend growth of 6-10% for the next few years. The company had a wide moat and a long dividend streak.

Unlike other companies that typically increase their dividend once a year, they’d started increasing dividends every quarter. I got in after the 7th consecutive quarterly dividend increase.

Sounds like every dividend growth investor’s dream, right?

Not so fast …

A week after my 2nd purchase they cut the dividend 75% and I sold the stock; Kinder Morgan Inc. (NYSE:KMI), for a 38.6% loss.

Source: https://ir.kindermorgan.com/dividend-history

Here are the first 2 lessons I learned in the first part of this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” …

You can check out the other lessons here:

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

- Lesson 8: Know Yourself, Make A Plan and Be Patient

Financial Strength & Maintaining an “Investment Grade” Credit Rating Matter

Kinder Morgan is a pipeline company and when they want to build a new pipeline or some other growth project, they can fund a project in one of three ways:

- Use cash on hand or free cash flow, or

- Raise capital (sell shares), or

- Use debt.

Back in 2015, Kinder Morgan didn’t have a huge amount of cash on hand, its free cash flow was mostly going to dividend payments, and selling more shares when oil prices had dragged the industry and Kinder Morgan’s stock price down didn’t make sense.

Typically, a company wants to try and issue shares when its stock price is high and buyback shares when the price is low.

Also, they were paying an 8-9% dividend yield, so issuing more shares would cost them at least 8-9% annually, even more, if the dividend kept growing.

Interest rates in 2015 were very low (well under 8-9%), so using debt to finance growth projects seemed like the only option at the time.

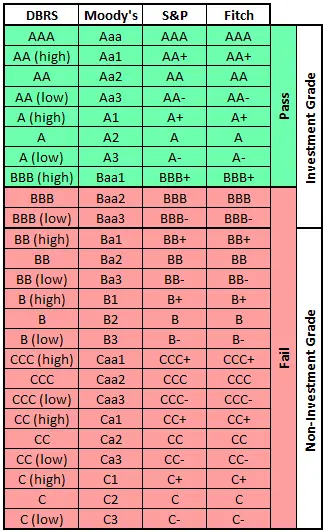

This is where credit ratings come into play. The better your credit rating the better interest rate you’ll get. If a company relies on debt, which Kinder Morgan does, then maintaining an investment-grade credit rating (BBB- or higher) is important to them.

Kinder Morgan had a lot of debt, but they still had a stable investment-grade credit rating of BBB- or equivalent. That was until November 30th when they announced that they were increasing their ownership in Natural Gas Pipeline Company of America LLC (NGPL) which would add about $1.5 billion to their debt.

The next day, Moody’s (one of the credit rating agencies) changed its outlook to negative. They were worried that the Kinder Morgan’s leverage which would now be around 5.9x adjusted debt to EBITDA was too high for an investment-grade rating and had this to say:

“The negative outlook could be restored to stable if KMI appears likely to have consistent Moody’s adjusted debt to EBITDA of 5.8x or below.

The ratings could be downgraded if it appears that Moody’s adjusted debt to EBITDA will not be consistently 5.8x or below, distribution coverage appears likely to fall below 1x, business risk increases or if the company undertakes an acquisition that increases leverage or does other debt financed activities where the company is highly reliant on equity markets to bring down leverage. The rating could be upgraded if Moody’s adjusted debt to EBITDA appears to be sustainable below 5.0x.”

Source: December 1, 2015, Moody’s changes Kinder Morgan’s outlook to negative

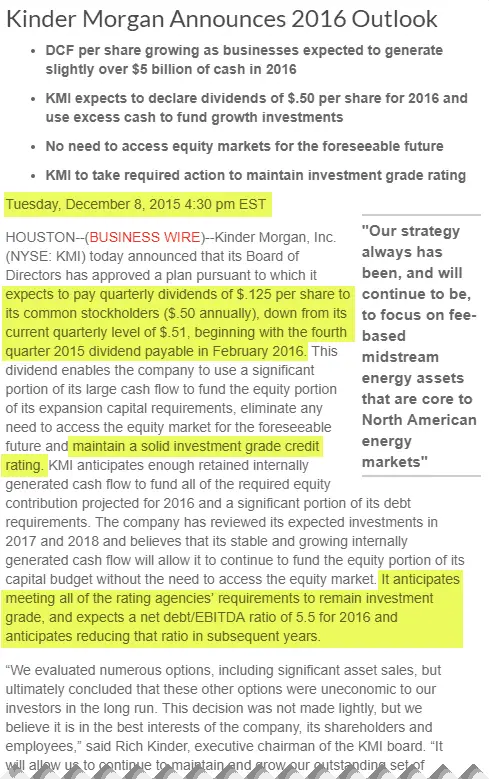

A week later, in an effort to maintain its investment-grade credit rating, Kinder Morgan announced a 75% dividend cut.

Source: https://ir.kindermorgan.com/press-release/kinder-morgan-announces-2016-outlook

The dividend cut would allow for more cash to pay down debt to around a net debt/EBITA ratio of 5.5 which was under the 5.8 threshold Moody’s had set.

Later that same day, Moody’s changed the outlook back to stable citing the “the very significant change Kinder Morgan […] made to its dividend policy, slashing its 2016 dividend by 75% and thereby eliminating its 2016 reliance on debt and equity markets access.”

Source: https://www.moodys.com/research/Moodys-changes-Kinder-Morgans-outlook-to-stable–PR_340835

Lesson 1: Maintaining an “Investment-Grade” Credit Rating Matters

Investment-grade credit ratings are BBB- or higher. BB+ or lower is considered non-investment-grade but is also commonly known as a “junk” rating.

What company wants to be considered junk? … Not many.

As a result,

Companies will do a lot to avoid a “junk” credit rating of BB+ or lower. As we saw with Kinder Morgan, this includes cutting the dividend.

Avoid companies that are close to a “junk” rating by focusing on BBB+ or equivalent or higher credit ratings.

If you are worried about a credit rating cut, take a look at what the credit rating companies have to say about the company you are interested in or its competitors. They’ll usually mention debt ratios that you can compare to the investment you are considering.

For example, with Kinder Morgan we saw that Moody’s wanted an adjusted debt to EBITDA of 5.8x or below to maintain the Baa3 rating (same as BBB-) and consistently above 5.8x would result in a downgrade to Ba1 (same as BB+).

Three of the four main credit rating agencies; DBRS, Moody’s, and S&P, offer free online access to current credit ratings and various other information once you register a free account with them. Fitch is the fourth main credit rating agency.

Lesson 2: Financial Strength Should Never Be Overlooked

Lowell Miller said it best in his book The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (AL):

“thereʼs no point in going up to the borderline of financial quality, no point in stretching the boundaries so that a particular pet name can fit in the cut. Weʼll use only the highest rated segment of the corporate world. For our purposes, in the Standard and Poorʼs ranking system, a stock must have a minimum credit rating of BBB+ to qualify.”

My investment strategy relies on collecting a growing stream of dividends over a very long period of time. For this strategy to work, I should only be investing in companies that can survive long term and continue to increase the dividend. This starts with a financially strong company.

Listen to the advice of Mr. Miller and target companies that have a BBB+ or equivalent credit rating or higher (BBB or higher is OK for utilities).

Had I listened; I could have avoided a 38.6% loss.

Instead, I went yield chasing towards an enticing 8-9% dividend yield and 6-10% dividend growth guidance and hoped that it would be OK.

Hope is not a good investment strategy!

Summary

The first two lessons I learned in this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” were …

Lesson 1: Maintaining an “Investment Grade” Credit Rating Matters

Companies will do a lot to avoid a “junk” credit rating of BB+ or lower. As we saw with Kinder Morgan, this includes cutting the dividend.

Give yourself a buffer and avoid companies that are close to a “junk” rating by focusing on BBB+ or higher credit ratings.

Lesson 2: Financial Strength Should Never Be Overlooked

For an investment strategy that relies on collecting a growing stream of dividends over a very long period of time, financial strength is crucial.

After all, you want to invest in companies that can survive long term and continue to increase the dividend. This starts with a financially strong company.

The Other Lessons

They say the hardest lessons in life are learned through experience. A 38.6% loss in about a month is a lot of “experience”, and that means a lot of lessons.

In fact, too many for just one article, so you’ll have to check out the other 4 articles in this 5-part series for the rest of the lessons.

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

- Lesson 8: Know Yourself, Make A Plan and Be Patient

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thanks for the reminder. I deviated from this very plan and have been ‘paying’ the price ever since.

DGI&R,

Good article! Have you given any thought to including the Company Credit Rating in your CDAS Lists?

Agree with Bernie, that would be an excellent addition.

I think this would be a great addition. After reading this article I went to look up some company credit ratings and it was harder than I expected.

I agree it would be nice to have, but it is too much manual entry for me so I don’t think it’s going to happen, sorry.

DGI&R

Excellent article! Should be read by every investor. Reminds me a little of my Ensign Energy 🙁

Thanks. This was a good reminder. Sometimes it’s easy to get focused on a stock for the wrong reasons.