Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

They say the hardest lessons in life are learned through experience. Well let’s just say a 38.6% loss in about a month is a lot of “experience”.

On November 6, 2015, and December 1, 2015, I purchased shares of a stock that was yielding 8-9% and was guiding annual dividend growth of 6-10% for the next few years. The company had a wide moat and a long dividend streak.

Unlike other companies that typically increase their dividend once a year, they’d started increasing dividends every quarter. I got in after the 7th consecutive quarterly dividend increase.

Sounds like every dividend growth investor’s dream, right?

Not so fast …

A week after my 2nd purchase they cut the dividend 75% and I sold the stock; Kinder Morgan Inc. (NYSE:KMI), for a 38.6% loss.

Source: https://ir.kindermorgan.com/dividend-history

Here is the 5th lesson I learned in the third part of this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” …

You can check out the other lessons here:

- Lesson 1 & 2: Maintaining an “Investment Grade” Credit Rating Matters & Financial Strength Should Never Be Overlooked

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

- Lesson 8: Know Yourself, Make A Plan and Be Patient

A high dividend yield is a warning sign

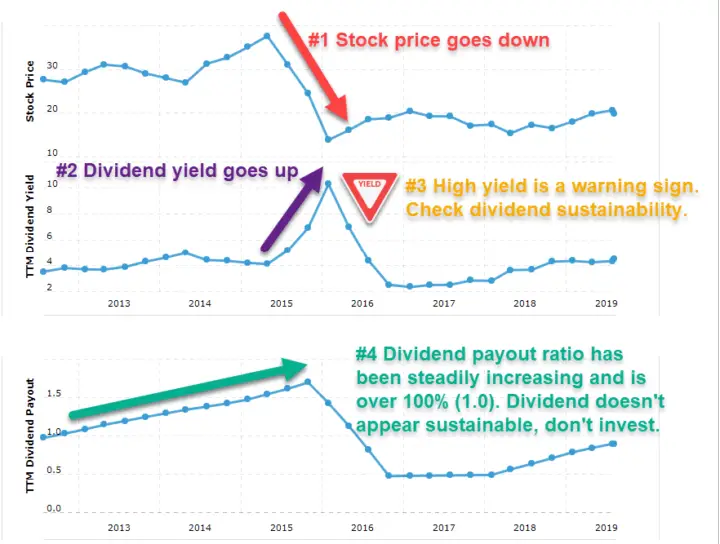

In the years leading up to the December 8, 2015 dividend cut, the trailing twelve-month (TTM) dividend yield was mostly in the 3-5% range.

Then the stock started to drop and the dividend yield went way up.

I bought shares at the 8-9% dividend yield level. You can see this was way above normal for Kinder Morgan, and also very high on an absolute basis for a dividend growth investor.

Source: Zacks Dividend Yield (TTM) Chart for Kinder Morgan

Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

For the dividend yield to get so high, the stock price has to drop. If the stock has dropped significantly, it’s because investors are worried about something.

You need to figure out what that something is, and if their worries are justified.

In Kinder Morgan’s case, they were justified as they cut the dividend 75% on December 8, 2015.

Here’s what I should have done…

Source: Macrotrends Kinder Morgan Dividend Yield History. Comments from Dividend Growth Investing & Retirement

Having a high yield isn’t going to cause a dividend cut, but it’s a warning sign to check dividend sustainability.

“Is the dividend in jeopardy? This is basically the payout ratio question.”

Source: The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (AL)

In #4 above, the payout ratio was above 100% which means the company is paying out more in dividends than it earns … not a good sign.

There were other problems too that aren’t in the chart.

Kinder Morgan had a high payout ratio based on what they call distributable cash flow which was close to 100%, they had a lot of debt, and their BBB- credit rating was at the lowest level of the investment-grade ratings.

Had I paid attention to Kinder Morgan’s high yield warning sign and properly checked dividend sustainability, I could have avoided a 38.6% loss and the 75% dividend cut.

I went yield chasing towards an enticing 8-9% dividend yield and hoped management would come through on their promise of 6-10% annual dividend growth guidance. Instead, they cut the dividend 75%. By hoping, I ignored obvious red flags like:

- A very high dividend yield,

- Earnings and cash flow payout ratios which were close to or above 100%,

- High debt levels, and

- A BBB- credit rating (the lowest of the investment-grade ratings).

Don’t be like me and ignore the warning signs of a high yield.

Summary

The 5th lesson I learned in this 5-part series covering the “8 Lessons I Learned from One of My Worst Dividend Growth Investments” was …

Lesson 5: When the Dividend Yield Gets Really High, It’s A Warning Sign That A Dividend Cut May Be Coming.

For the dividend yield to get high, the stock price has to drop. This means investors are worried about something. This is a warning sign and you need to figure out what that something is if their worries are justified and if the dividend is sustainable.

I ignored Kinder Morgan’s high yield warning sign and went yield chasing. I hoped management would come through on their promise of 6-10% annual dividend growth guidance. Instead, they cut the dividend 75%. By hoping, I ignored obvious red flags like:

- A very high dividend yield,

- Earnings and cash flow payout ratios which were close to or above 100%,

- High debt levels, and

- A BBB- credit rating (the lowest of the investment-grade ratings).

Don’t be like me and ignore the warning signs of a high yield.

The Other Lessons

They say the hardest lessons in life are learned through experience. A 38.6% loss in about a month is a lot of “experience”, and that means a lot of lessons.

In fact, too many for just one article, so you’ll have to check out the other 4 articles in this 5-part series for the rest of the lessons.

- Lesson 1 & 2: Maintaining an “Investment Grade” Credit Rating Matters & Financial Strength Should Never Be Overlooked

- Lesson 3 & 4: Don’t Trust Management If the Numbers Don’t Make Sense & Never Ignore the Payout Ratio

- Lesson 6 & 7: Diversification & Asset Allocation Matter & Don’t Forget Income Allocation Too!

- Lesson 8: Know Yourself, Make A Plan and Be Patient

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!