Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

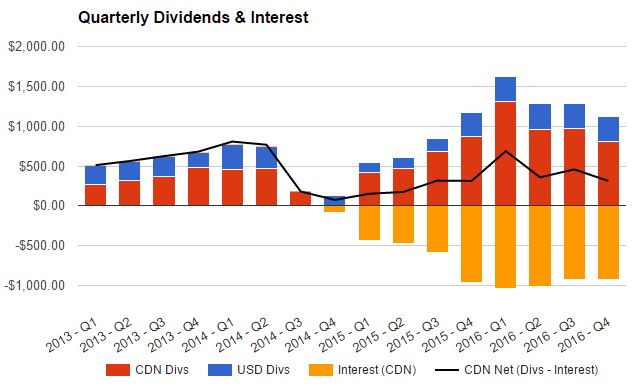

In 2016 I made $4,039.79 in Canadian dividends and $1,266.04 in US dividends for a Canadian equivalent total of $5,706.77. Canadian equivalent interest payments were $3,889.50 which resulted in net dividends of $1,817.23 which is almost double the $957.05 in net dividends I received in 2015.

*In 2014 I liquidated most of the portfolio to put a large down payment on a condo Ms. DGI&R and I bought and moved into. This is why dividend income drops off in the second half of 2014. Since then, I’ve been slowly building back the portfolio.

Why is there interest on my dividend income graph?

We purchased the condo with a re-advanceable mortgage, which is basically a traditional mortgage and a secured line of credit combined. As the mortgage portion is paid off, the credit limit on the line of credit portion increases. I’ve been paying off the mortgage aggressively and I use the line of credit to invest with when I find a reasonably cheap dividend growth stock to buy. That’s why you see the interest in yellow growing over time along with dividends. There is also some margin interest included here too as I currently get a 2.1% margin interest rate on my US purchases, whereas my line of credit interest rate is 2.7% Canadian. I’ve been keeping a small margin loan that will eventually be paid off with future USD dividends.

Borrowing to invest is a risky strategy and not one that I’d recommend for the average person, but so far it has been comforting to see the black line slowly creep up. The black line represents total dividend income in Canadian dollars (USD dividends have been converted to a Canadian equivalent) less the total interest paid in Canadian equivalent dollars.

I’ve noticed that because my investing criteria is fairly rigid I’m not able to buy stocks as fast as I pay off the mortgage. I’m usually only buying a few stocks in the year as the valuation I look for doesn’t come around a lot. For instance in 2016 I made 6 purchases – 4 of them in January 2016 when people were freaking out about China and a few other things. The other two were more recent in November and December when I purchased Novo Nordisk [NVO Trend] and CVS Health Corp. [CVS Trend].

Related articles: Portfolio Update – Novo Nordisk Purchased & Portfolio Update – CVS Health Corp. Purchased

Back to the dividends…

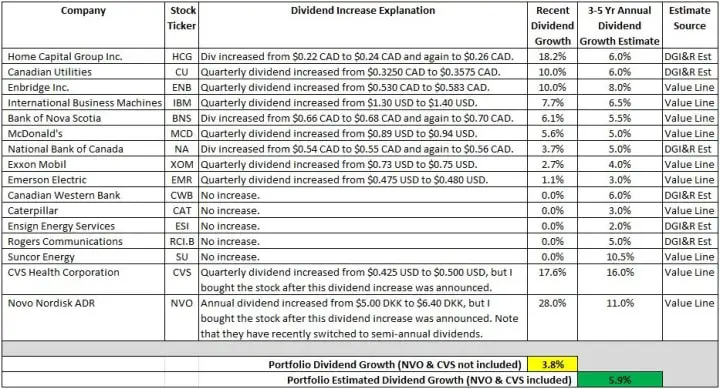

The dividend income almost doubling from 2015 to 2016 is mostly from new stock additions rather than dividend growth. In fact if I look at portfolio dividend growth in 2016 it is rather dismal coming in at around 3.8% (yellow below). This doesn’t even factor in the dividend cut from Potash Corporation of Saskatchewan [POT Trend] that my portfolio endured (I sold my Potash shares shortly after the dividend cut in January 2016).

Related article: January 2016 Portfolio Update – 3 Purchases & A Sale

Considering I’d like at least 8% annual dividend growth, 2016 wasn’t a good year for me at all.

To estimate future dividend growth I used ValueLine’s 3-5 year estimates and my own conservative quick and dirty (DGI&R Est) estimates for stocks that I couldn’t get ValueLine information for. I’m estimating about 6% (green above) future annual dividend growth which is still below my 8% target. This tells me that I need to add more high dividend growth stocks to the portfolio which I have been doing with my recent additions of CVS Health Corp. and Novo Nordisk.

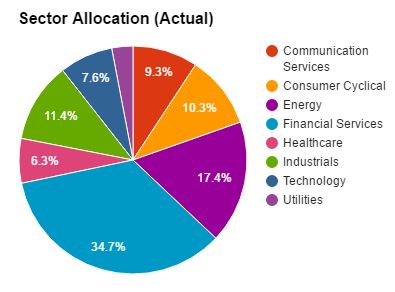

Weak Diversification

I’m still in the process of building my portfolio up so it is not diversified very much right now and that was reflected by low dividend growth in the energy sector which affected a number of my holdings. Of the five stocks that didn’t increase their dividend four were in some way affected by low oil prices in the energy sector. I expect some choppiness with dividend growth as I build the portfolio out, but in the future I expect a more consistent level of dividend growth as I become more diversified over the next few years. I’ve been noticing that different sectors become value priced at different times. For instance when oil prices were low I was able to pick up some energy stocks at low valuations, but I wasn’t really buying much else as other stocks appeared expensive. This has the short term effect of being overweight in the energy sector, but as I build out the portfolio into other sectors this problem will fix itself.

As you can see I have a lot of financials and energy stocks right now. As a consequence I don’t plan on adding any more money to these sectors. When I get my portfolio up to its target size in a few years financials will be around 20% and energy will be around 10%.

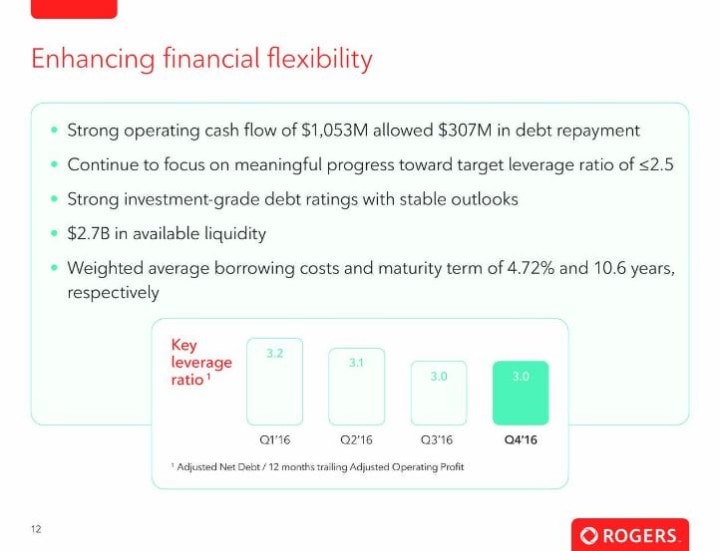

Debt Matters & Rogers Communications

The one stock that wasn’t affected by oil prices, but still didn’t increase their dividend was Rogers Communications [RCI.B Trend] which is a Canadian telecommunications company. They didn’t increase their dividend in 2016 and instead kept the quarterly dividend at $0.48 CAD. I was a little surprised when they didn’t increase their dividend in 2016 as they had a reasonable payout ratio and dividend streak of 11 years. They didn’t increase their dividend because their level of debt had increased over the years and they are now focusing on paying their debt down to a more manageable level. Specifically they are targeting a leverage ratio of 2.5. I’m not expecting a dividend increase in 2017, but I expect increases in 2018 and on.

Tony Staffieri the Chief Financial Officer had this to say on the January 26, 2017 conference call: “while we are seeing good trending in 2016, we still got work to do and want to continue to see it moving towards 2.5. We are in the middle of the CEO transition. So as most of you noted, it’s kind of a bit impractical for us to make a long-term decision on dividends during this time period. And so we sort of commonsense approach is to not do it right now and that’s what you see there. In terms of when we do it, don’t want to get too far ahead of ourselves, but I think the metrics to keep watching our cash flow growth and movement on the balance sheet as the key ones.”

So the lesson here is that debt matters, which is why I typically like to see a credit rating of BBB+ or higher before I invest. The exception is utility companies when I’m willing to go down to BBB or higher.

Summary

While 2016 was a disappointing year when it comes to dividend growth I expect a brighter future. My long term annual dividend growth goal of 8% is ambitious, but certainly achievable. I think I need to focus a bit more on high dividend growth stocks as I continue to build my portfolio into non-energy and non-financial sectors. My investing horizon is very long term, so I expect to have low dividend growth years like this from time to time. Much like stock prices I expect a certain amount of fluctuation, but as a long term investor I expect to reach my goals in the end. The ride may be bumpy, but if I stick with it I should be fine.

Disclosure: I own shares of Bank of Nova Scotia, Canadian Utilities, Canadian Western Bank, Caterpillar, CVS Health Corporation, Emerson Electric, Enbridge Inc., Ensign Energy Services, Exxon Mobil, Home Capital Group Inc., International Business Machines, McDonald’s, National Bank of Canada, Novo Nordisk ADR, Rogers Communications, and Suncor Energy. You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![How to estimate dividend growth and total returns using Josh Peters’ Dividend Drill Return Model [Example & Spreadsheet]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/10/How-to-estimate-dividend-growth-and-total-returns-using-Josh-Peters’-Dividend-Drill-Return-Model-Cover-768x575.png)

Well at least you have been n top of things. Overall you are doing well. Good on you.

XTC offers an attractive yield, low payout ratio and high dividend growth rate. I first discovered this stock thanks to your Div All-Star sheet!

nothing really startling in your increase…you have just had a reasonably safe and dull rreturn

Your portfolio doesnt really tell your audience anything

Hi all, I hope it is okay that I am posting here. I really enjoy dividend investing, and with my background in excel, I have created a very detailed and automated spreadsheet for dividend tracking and portfolio managing. I originally created this because I could not find any decent automated spreadsheets online. I now use this for all my personal investments. The nice part about it is that there is very little ongoing maintenance once you get started, all you really need to do is input your dividends! Even if you have been using the same spreadsheet for 10 years, it might be worth your time to see what this one can do. It is very useful for managing: Buys, Sells, Withdraws, DRIPs, Contribution Limits, Yield on Cost, Portfolio Net Worth, ROI, Annual Dividends etc. If this interests you, send me an email: [email protected]

Congrats on the condo purchase and also on the amazing dividend income received last year! I’m looking forward to more dividend updates.

Acadian Timber has treated me well so far…Fairly stable share price over the long term with low volume trades…but consistent and good dividend payout. It was in your list in the “Others” tab.

I am also located in BC (Fraser Valley)…moved out here from Ottawa a couple of years ago. Let me know if you are interested to get together and talk about investing strategies. Also I am pretty good with Excel and scripting and have some ideas I’d like to bounce of someone willing to listen. I’ve been doing my own investing for about a decade now and dabble into many areas. There is a lot of hype and fear in the markets but there is money to be made if one plays it smart. I believe there are more modern strategies to dividend investing and I would like to explore these.

I’m staying away from Acadian Timber. They cut their dividend in 2009-2010. They also had very high payout ratios some years; this year is over 80%. Not much revenue and free cash flow growth either…

Cheers