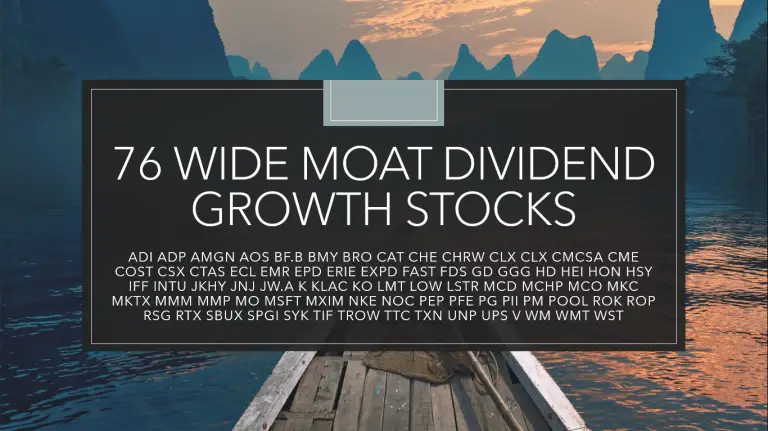

76 US Wide Moat Dividend Growth Stocks

As dividend growth investors, we know that wide moat stocks make a good starting point, but it is just one of many considerations on our hunt for high-quality dividend growth stocks. Which of these companies with strong sustainable competitive advantages make good dividend growth investments? To help answer this question, I’ve identified all the US…

![How to estimate dividend growth and total returns using Josh Peters’ Dividend Drill Return Model [Example & Spreadsheet]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/10/How-to-estimate-dividend-growth-and-total-returns-using-Josh-Peters’-Dividend-Drill-Return-Model-Cover-768x575.png)

![How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/08/Free-Online-Value-Line-Investment-Survey-Access-in-Canada-Map.-768x526.png)