Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I’m sorry to say, that it doesn’t look like dividend growth from Sun Life Financial is going to happen for a few years. Because of this I decided to sell my shares. My investing style is to buy quality dividend growth stocks at attractive prices and collect the increasing stream of dividend income in order to eventually support my retirement expenses. Most of the time I try and hold onto a stock for a long time, but there are some situations where I consider selling. One of these considerations is stalled dividend growth. I sold my shares of Sun Life Financial because I am a dividend growth investor, not a dividend investor (note the key word that’s missing: growth).

Related article: In What Conditions Would I Consider Selling A Stock?

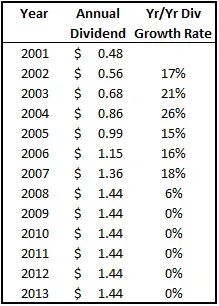

Dividend history

The last dividend increase from Sun Life Financial came with the dividend recorded in February 2008 when it increased the quarterly dividend from $0.34 to $0.36. Since then the dividend hasn’t changed.

If we look at the dividend history going back to 2001 we can see that Sun Life Financial had great dividend growth prior to 2008. Since then however it has been dismal. The only consolation is that there wasn’t a dividend cut like its competitor Manulife. In August 2009, Manulife announced that it was cutting its dividend by 50%. While I’m sure Sun Life Financial investors were happy that the dividend wasn’t cut, the fact is that the dividend hasn’t been increased for 6 years now. This is not very consoling to a dividend growth investor.

Using the past to predict the future

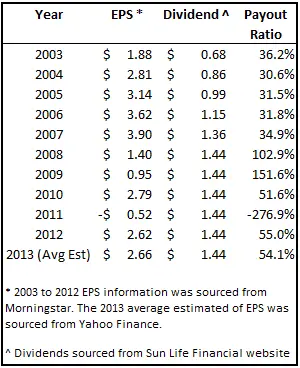

A lack of dividend growth in prior years is unsettling, but we still need to look at the other side of the picture: future dividend growth. To get an idea of the type of situations that need to exist for Sun Life Financial to increase its dividend I looked at the 2003 to 2007 period. During this period dividend growth was strong.

The average payout ratio for the 5 years from 2003 to 2007 is 33%. A look at the December 31, 2005 and December 31, 2006 Annual Information Forms filed on Sedar tells us that

“On February 9, 2006, the Board of Directors approved an increase in the target dividend payout ratio from a range of 25% to 35% to a range of 30% to 40%.”

In 2007 and early 2008 the target payout ratio of 30% to 40% was kept the same. After this period Sun Life Financial stopped providing guidance on its target payout ratio range. This tells me that before the chaos in 2008 and 2009 hit, the company was comfortable increasing its dividend so long as it was less than 40% of its earnings. If we assume that future dividend increases could be expected under a similar guideline we can estimate future dividend growth.

Related article: Can Past Dividend Growth Rates Be Relied Upon To Predict Future Rates?

A look to the future

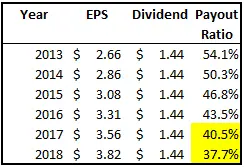

Right now Yahoo Finance is showing that analysts are estimating annual earnings growth of 7.53% for the next 5 years. Using the 2013 EPS average estimate of $2.66 and applying this growth rate I get the following.

In the table above I kept the annual dividend steady so that you can see when the payout ratio would get to a point where historically the company would consider a dividend increase (highlighted in yellow). Based on current growth estimates Sun Life Financial won’t get to a payout ratio of around 40% until 2017. If Sun Life Financial were to increase its dividend in 2018 to bring the payout ratio up to the 40% this would be an annual dividend of $1.53 ($3.82 x 40%) which is a 6.25% increase from current levels. A 6.25% increase 4 or 5 years down the road isn’t very good, especially when I’m trying for 8% annual dividend growth.

So am I estimating 6.25% dividend growth in 2018? No. Guessing specific information or what’s going to happen in five years in the stock market is near impossible. A better take away from this information would be to expect a steady dividend in the near term. I think Sun Life Financial could be in a position to increase its dividend again, but in the next few years the odds of this are low. Changes in interest rates which are expected to increase at some point (Again, I can’t predict the future), have a large impact on insurance companies like Sun Life Financial. With this added uncertainty it’s better to look at the overriding issue, rather than speculate on an exact dividend growth rate.

The bottom line

I don’t expect dividend growth in the next few years. This is why as a dividend growth investor I chose to sell my Sun Life Financial shares.

Photo credit: Eduardo Amorim / Foter.com / CC BY-NC-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![How to estimate dividend growth and total returns using Josh Peters’ Dividend Drill Return Model [Example & Spreadsheet]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/10/How-to-estimate-dividend-growth-and-total-returns-using-Josh-Peters’-Dividend-Drill-Return-Model-Cover-768x575.png)

I did the same with Power Financial (PWF-T). I held this stock patiently waiting for them to re-establish their dividend growth policy. I decided a year ago that if they didn’t raise by the end of 2013 I will sell. I sold in mid-December.

Interesting post. I came here in search of an answer to my question, what the hell has happened to dividend growth at PWF? In spite of being a full five years into a bull market, and in spite of PWF having every ability to increase the dividend even modestly, it,along with the others in the POW family, have held steady. SLF and MFC have similar profiles, although looking at the underlying earnings of IGM and GWO, I see some worrying signs–IGM grows along with the markets, not because of strong fund sales; a significant drop in markets thus could cause AUM to wither, and redemptions to soar. Then, at GWO, the recent quarter showed some growth at Irish Life, but also an inexplicable loss of $53 million at Putnam. The problems at Putnam seem never-ending. All three–SLF,MFC,PWF–require higher interest rates, but they aren’t expected to rise anytime soon, perhaps not for years; in fact, the trend seems to be further easing in Europe and even a possible cut in Canada. In conclusion, PWF, with six straight years of no dividend growth and a mere 4% yield, no longer seems attractive.