Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

If you look at my retirement goals you’ll see that I want to have a growing stream of dividend income to support me in retirement. In order to meet my goals I’m looking for a dividend growth rate (DGR) of 8%. This is an ambitious rate in my opinion. Don’t get me wrong, I think it is entirely possible, but it is not an easy thing to achieve. My early retirement dreams are tied to dividend growth, so being able to predict future dividend growth is very important to me.

I use a lot of historical averages in my analysis of dividend stocks, so I was excited to discover an article on Seeking Aplha: Dividend Growth Rates: Using The Past To Estimate The Future by Dividend Growth Machine that studied the correlation between past dividend growth rates and future rates.

The study looked at the 10 year DGR of US companies from 1991-2001 and compared them to the 10 year DGR from 2001-2011. The study only looked at companies that continued to increase their dividend for the entire period. One of the limitations from this study that the author points out is that “It excluded all companies that froze or cut their dividends during either time period.” This is a pretty big limitation in my mind because it is only looking at companies that had a dividend streak of at least 20 years by the end of 2011. If I use this study’s findings and apply it to Canadian companies it will be flawed data simply because Canada has very few companies that have been able to maintain a dividend streak of 20 years or more. If I take a look at the Canadian Dividend All-Stars List I can see that there are currently 3 Canadian companies (Fortis, Canadian Utilities, and Canadian Western Bank) with a dividend streak of 20 years or more, and 28 with 10 years or more.

While the study has limitations for my purposes, I haven’t been able to find any other studies that test the predictability of future dividend growth compared to past dividend growth. There are not a lot of Canadian investing studies related to dividend growth because of the limited number of dividend growth companies in Canada, so I’m stuck using US studies and hoping that Canadian dividend growth companies mimic the trends of US dividend growth companies. I think that there would be similarities between Canadian and US dividend growth companies, but I have no data to support this, it is just my opinion.

So now that we are aware of some of the study’s limitations, let’s see what the results were. The study concluded that

“past DGRs were modestly predictive of future DGRs, but with the important caveat that companies with high past DGRs tended to have reduced (but still relatively high) future DGRs. Companies with low past DGRs tended to either maintain or slightly increase their DGRs in the future.”

So what does this mean and how do I use this information to become a better investor? Well, I’m looking for dividend growth rates of 8% to support my retirement goal, so generally I should be looking for companies with past dividend growth rates greater than 8%. It is important to note that the study was only “modestly predictive” so I will continue to analyse the dividend sustainability in my dividend stock analyses, but it is still helpful to know that “For stocks with relatively low past DGRs (< 8%), the past DGR is probably a reasonable value to use”. For rates above 8% the author of the study came up with the following formula:

“Future DGR = 3.90 + 0.54 * Past DGR”

Final Thoughts

Being Canadian I have a preference to buy Canadian Dividend Growth Stocks because of the more favorable tax treatment, but I am limited to about 20 to 30 companies that meet my dividend investing criteria. Of these 20 or 30 companies I often find that they are above my target price, so I frequently look to USA for its larger landscape of dividend growth stocks and diversification.

I feel more comfortable using the study’s findings when analyzing US companies. That said, I will still use these findings when looking at Canadian companies, but I am more aware of the limitations of the study. I think it is a fair assumption to say that most people understand that you can’t predict the future, but it is nice to have a best guess.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

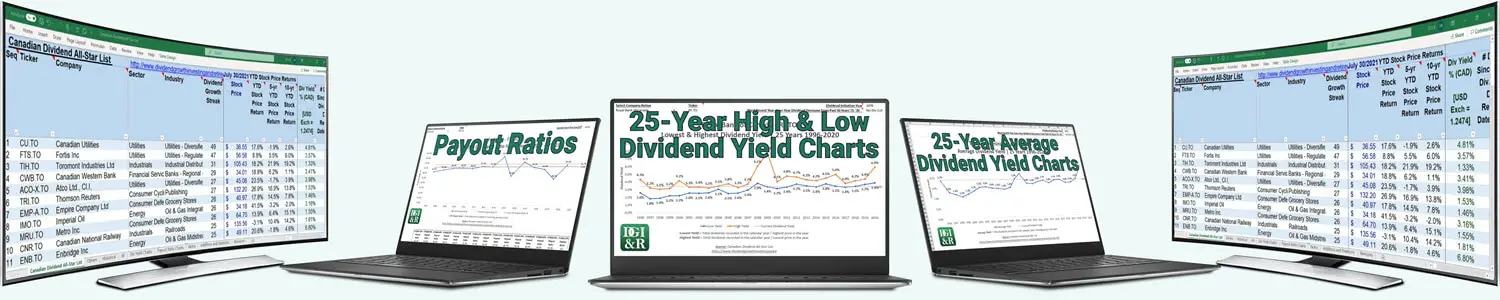

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![Screening the Canadian Market for Dividend Growth Consumer Staples [Spreadsheet included]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/03/Saputo.png)

Excellent analysis. I use your database extensively, but like you I find the array of Canadian dividend-growth stocks to be limited.

Finding quality Canadian dividend growth companies with long dividend streaks and then waiting for a reasonably cheap entry point can have you waiting a long time sometimes.