Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

The investment landscape can be broken down into 11 different sectors:

- Consumer Discretionary,

- Consumer Staples (Also known as Consumer Defensive),

- Energy,

- Financials,

- Health Care,

- Industrials,

- Information Technology,

- Materials,

- Real Estate,

- Telecommunication Services, and

- Utilities

Wouldn’t it be nice to know which of these sectors offer the best mix of dividend growth and a long history of increasing their dividend each year (A long dividend streak)?

I reviewed Canadian and US dividend growth stocks and discovered that there were 3 clear winners when it came to dividend streak length:

- Consumer Staples (AKA Consumer Defensive),

- Utilities, and

- Telecommunication Services.

A long dividend streak is important, but it’s only half of the picture. The other half is strong dividend growth.

Before I tell you which of these 3 sectors offers the best of both worlds; A long dividend streak with high dividend growth, it is important to understand the answer to a more fundamental question.

Why is a long dividend streak important?

For dividend growth investing to work, you need a long-term mindset. The goal is to create a portfolio of high-quality companies that can increase their dividend on a regular basis. Over time you benefit from this increasing stream of dividend income.

Many rely on the dividend income to wholly or partially fund retirement. If this is the case or the goal, then you want to make sure that the dividends are coming from reliable companies that can fund your retirement years.

You want companies that will be around for a few decades and making materially more money so that they can easily fund the growing dividend and you can continue to rely on this dividend income. These are the companies that will have long dividend streaks and why a long streak is important.

When you start thinking in terms of decades, you soon realize that a cyclical company that increases its dividend for 5 years in a row, only to cut it in year 6 is not the type of investment you are looking for. Longevity is what you want.

Stephen Jarislowsky, a famous Canadian investor with a long-term mindset, tries to only invest in non-cyclical growth stocks for this very reason.

“my rule is to invest only in top-quality, largely non-cyclical growth stocks that have a predictable high rate of earnings and, hopefully, dividend growth.”

Source: The Investment Zoo: Taming the Bulls and the Bears by Stephen A. Jarislowsky (Affiliate link, but recommended for primarily Canadian investors)

Common Sense & the Top 3

There are some sectors that offer a better chance of a long dividend streak than others and it comes down to common sense.

What sectors are more likely to survive long-term, even during the tough times (Recession, wars, etc.)?

The answer is companies that provide necessities of life, companies that sell goods or services that you need and aren’t willing to go without. Sectors like our top 3:

- Consumer Staples (AKA Consumer Defensive),

- Utilities, and

- Telecommunication Services.

When you look at the top 3, it is no wonder that these sectors typically have the longest dividend streaks as they all provide necessities and are better equipped to survive long-term.

Lowell Miller put it better than I can so I’m going to borrow two quotes from his book The Single Best Investment: Creating Wealth with Dividend Growth (Affiliate link, but I personally own and highly recommend this book.)

On consumer staples…

“As long as people are going to reach for a Hershey Bar, or have a can of soup for lunch, or brush their teeth, or wipe their bottoms, or take an antibiotic, these companies will be making money.”

On utilities and telecommunication services…

“Most of all, individuals have been drawn to the “common sense” of utilities, to the fact that the utility services are the necessities of life without which we cannot even survive in the civilized mode of living to which weʼve become accustomed. You can put off buying a new car or computer or a new dress, but you canʼt put off turning on the lights. Youʼve got to have a telephone, youʼve got to heat and cook. Youʼve got to drink and wash with water.”

As you can see, a lot of this is common sense, but let’s dive into the data to see which sector offers the best mix of dividend growth and a long dividend streak.

The Data

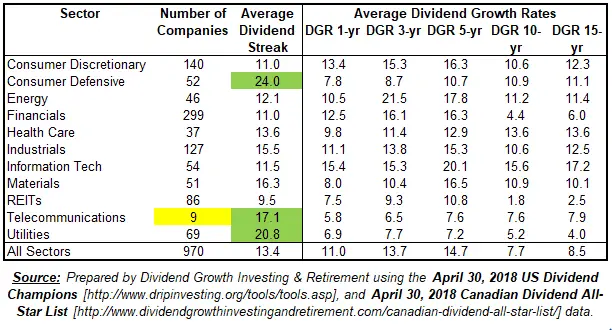

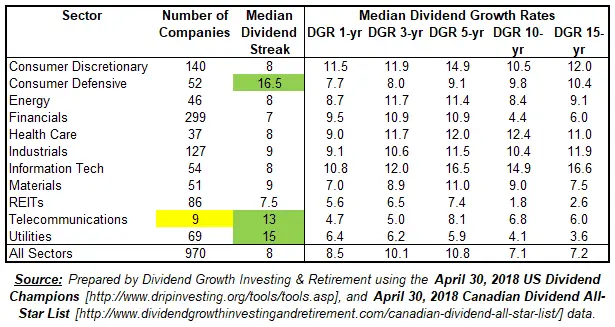

I calculated the median and average dividend growth rates and dividend streaks for all US and Canadian publicly listed companies that increased their dividend for 5 or more years in a row (Dividend streak of 5 or more years) by combining data from the US Dividend Champions list and the Canadian Dividend All-Star List.

Average Dividend Streak Length and Dividend Growth Rates by Sector

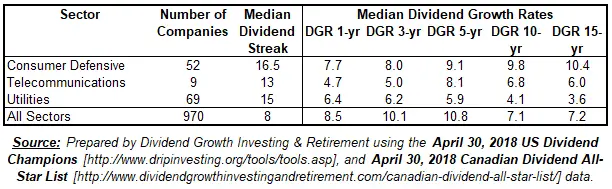

Median Dividend Streak Length and Dividend Growth Rates by Sector

The longest three dividend streaks are highlighted in green and whether you use the average or median, the results are the same. Consumer Staples (AKA Consumer Defensive) has the longest streak, Utilities has the 2nd longest streak, and Telecommunication Services has the 3rd longest streak.

When you look at the dividend growth rates you soon realize that there is a clear winner.

The Winner: Consumer Staples

Consumer staples offer the best mix of a long dividend streak and high dividend growth.

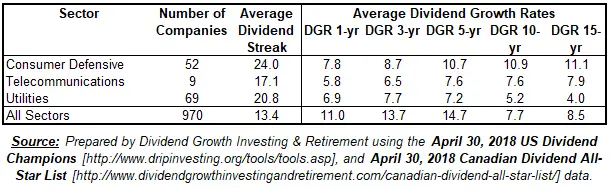

Top 3 – Average Dividend Streak Length and Dividend Growth Rates

Top 3 – Median Dividend Streak Length and Dividend Growth Rates

The dividend growth stocks in the consumer staples sector have median and average 5, 10 and 15-year dividend growth rates ranging around 9-11%, whereas with utilities it ranges from around 4-7%, and telecommunications it ranges from 6-8%. This makes the consumer staples sector the clear winner.

The consumer staples sector has the highest median and average dividend streak length out of all sectors and it also offers high dividend growth rates.

If you are a Canadian investor, you are likely aware that finding high-quality dividend growth stocks in the consumer staples sector with a sustainable and high dividend is quite challenging. This is why I look to the US for most of my consumer staples.

Data Notes

- There were only 9 companies in the Telecommunications sector which is quite low compared to the other sectors. Keep this in mind as averages can be more easily skewed.

- It is important to remember that I didn’t review all stocks in all sectors, I reviewed only companies that have increased their dividend for 5 years or more.

- I was originally going to review the Canadian listed stocks separately, but there are only 100 companies in the April 30, 2018 Canadian Dividend All-Star List which is too small of a sample size, so I combined the US and Canadian data to create a larger sample.

- There were 100 companies in the April 30, 2018 Canadian Dividend All-Star List and 882 companies in the April 30, 2018 US Dividend Champions list. Some companies were listed on both US and Canadian stock exchanges, so the duplicate companies were removed and 970 companies remained.

Summary

A long dividend streak is important as a long-term investor as you want companies that will be around in a few decades and making materially more money so that they can easily fund the growing dividend and you can continue to rely on this dividend income in retirement.

Among Canadian and US dividend growth stocks the 3 sectors that have the longest dividend streak are:

- Consumer Staples,

- Utilities, and

- Telecommunication Services.

It makes sense why these three sectors have the longest dividend streaks as they all provide necessities of life and are equipped to survive and thrive long-term.

Of these three sectors, consumer staples offer the best mix of dividend growth and a long dividend streak. The consumer staples sector had the highest median and average dividend streak length out of all sectors and it also offered high dividend growth rates.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Interesting that the Financial sector is not in the top three. The sector is neck and neck with the leaders until the ten-year mark, when it sinks because financials were hard hit by the Great Recession. But if you accept the majority view that that Recession was a once in a lifetime event, then you could include the Canadian banks as contenders for your dividend-growth candidates.