Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

“Dividends may not be the only path for an individual investor’s success, but if there’s a better one, I have yet to find it”

Josh Peters – The Ultimate Dividend Playbook: Income, Insight and Independence for Today’s Investor

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List along with a brief summary of these companies. This month there were 15 dividend increases, with the largest increase from Lassonde Industries Inc. (LAS-A.TO), which increased their dividend by a whopping 32.8%.

Before I go over the dividend increases in detail there are two questions that should be answered first:

Question 1: What is the Canadian Dividend All-Star List (CDASL)?

The Canadian Dividend All-Star List is an excel spreadsheet with a lot of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

It’s a valuable resource that is typically used as a starting point to identify and screen Canadian dividend growth stocks.

The list has been updated monthly since early 2013 and it has come to be one of the most popular parts of the Dividend Growth Investing & Retirement website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

Question 2: Why are dividend increases good?

A dividend increase is a sign from management that they feel good about the future prospects of the company. There is a theory; Dividend Signaling, that suggests that dividend increases generally indicate the stock will perform well in the future. Conversely, the same theory suggests that if the dividend is cut or decreased it is signal that stock won’t perform well.

The Dividend Signaling Theory is a bit controversial but testing of the theory suggest that generally, dividend signaling does occur.

Dividend signaling also makes sense from a common-sense perspective:

- It is common knowledge that companies that cut or decrease their dividend are typically punished quite severely in the stock market. Companies know this, so they try to avoid increasing the dividend if it isn’t sustainable or thinks it might have to be decreased in the near future. To try and avoid a dividend cut or decrease, the company will typically only increase the dividend to a sustainable level based on their outlook for the company.

- Future dividend payments are typically paid for with future cash flows. By increasing the dividend, management is signaling that they think future cash flows will be enough to pay for the increased dividend.

Beyond dividend signaling, there is another reason that dividend increases are good. Dividend growth stocks typically outperform the market.

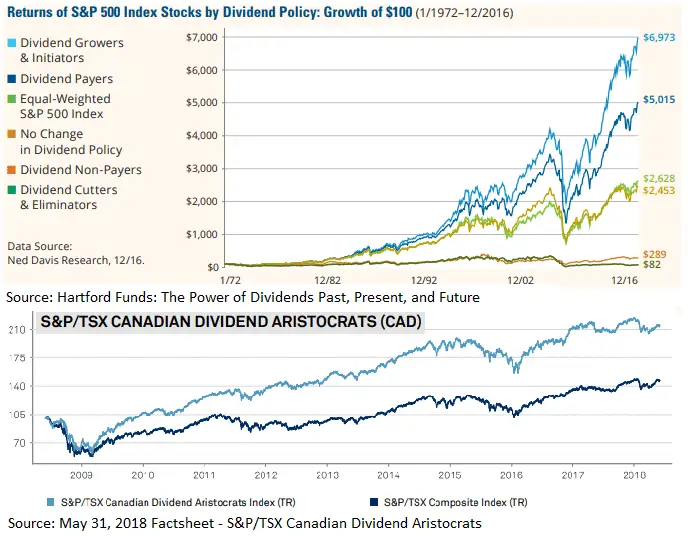

Companies that regularly increase their dividend typically do better than those that don’t and will typically do so with less volatility. You can see this from the two charts below.

The first chart was from a study done on US stocks in the S&P 500 index and the second chart is of the Canadian dividend aristocrats (Companies that have a history of increasing their dividend each year) vs. a Canadian benchmark index.

Related article: The Number One Reason to be a Dividend Growth Investor (And it’s not what you were expecting)

OK, now on to the dividend increases…

15 Dividend Increases in the May Canadian Dividend All-Star List

In total there were 15 dividend increases from companies in the Canadian Dividend All-Star List during the month of May 2018. They are listed below, starting with the largest dividend increase and ending with the lowest.

1. Lassonde Industries Inc. (LAS-A.TO) – 32.8% Dividend Increase

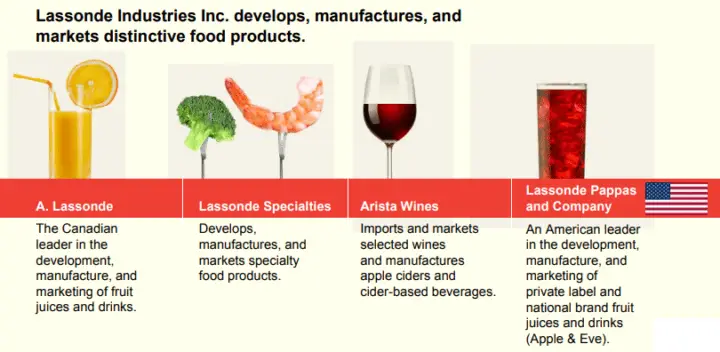

Lassonde is a North American leader in the development, manufacture, and sale of fruit and vegetable juices and beverages.

Source: Lassonde Industries Inc. Presentation – May 11, 2018, Annual General Meeting

Lassonde Industries Inc. which has a dividend streak of 10 years recently increased their quarterly dividend 32.8% from $0.6100 CAD to $0.8100 CAD. This dividend increase comes into effect with the dividend recorded on May 22, 2018. The dividend yield as of May 31, 2018, was 1.1%, and they have 5 and 10-year average annual dividend growth rates of 13.7% and 16.0% respectively.

This low yielding, but high dividend growth stock hasn’t been on my radar because of the low yield. I plan to investigate further if it gets up to a 2.0% dividend yield which could be awhile. Last time Lassonde got close to 2.0% yield was in 2013 and during the financial crisis (2009) it only managed to get up to around 3.0%.

2. Onex Corp (ONEX.TO) – 16.7% Dividend Increase

Onex is a private equity firm. They make their money by investing their own capital and collecting management fees from their investors. Their investors include public and private pension funds, sovereign wealth funds, banks, insurance companies and family offices) they collect management fees.

Onex Corp which has a dividend streak of 5 years recently increased their quarterly dividend 16.7% from $0.0750 CAD to $0.0875 CAD. This dividend increase comes into effect with the dividend recorded on Jul 10, 2018. The dividend yield as of May 31, 2018, was 0.4%, and they have 5 and 10-year average annual dividend growth rates of 21.2% and 10.1% respectively.

3. Open Text Corporation (OTEX.TO) – 15.0% Dividend Increase

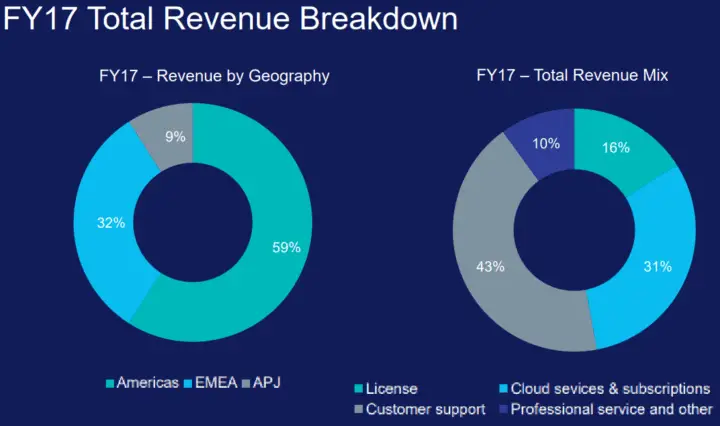

Open Text operates in the Enterprise Information Management (EIM) market and develops enterprise software for digital transformation. At its core, EIM is about helping organizations get the most out of information. Open Text’s EIM offerings include Content Services, Business Process Management, Customer Experience Management, Discovery, Business Network, and Analytics.

Source: August 3, 2017 Investor Presentation

Open Text Corporation which has a dividend streak of 5 years recently increased their quarterly dividend 15.0% from $0.1320 USD to $0.1518 USD. This dividend increase comes into effect with the dividend recorded on Jun 08, 2018. The dividend yield as of May 31, 2018, was 1.7%.

I’m not too familiar with this company and was initially attracted to its high growth rates, but it has a short dividend history having only started paying dividends in 2013. Also, Moody’s has assigned them a low credit rating of Ba1.

4. Algonquin Power & Utilities Corp. (AQN.TO) – 10.0% Dividend Increase

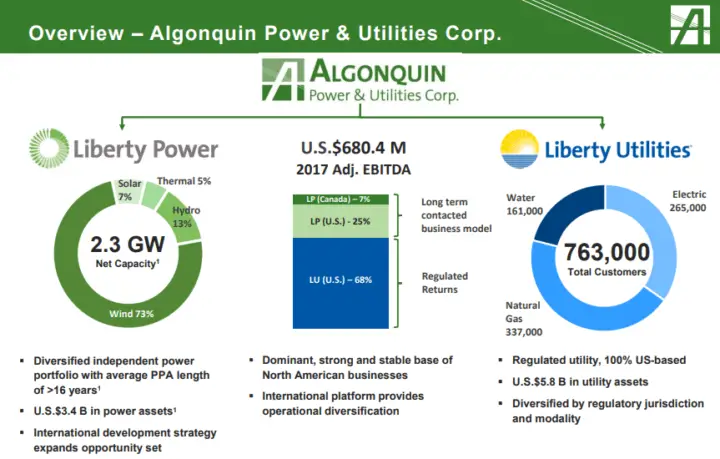

Algonquin Power & Utilities Corp. is North American renewable energy and regulated utility company that operates green and clean energy assets including hydroelectric, wind, thermal, and solar power facilities, as well as sustainable utility distribution businesses (water, electricity and natural gas) through its two operating subsidiaries: Liberty Power and Liberty Utilities.

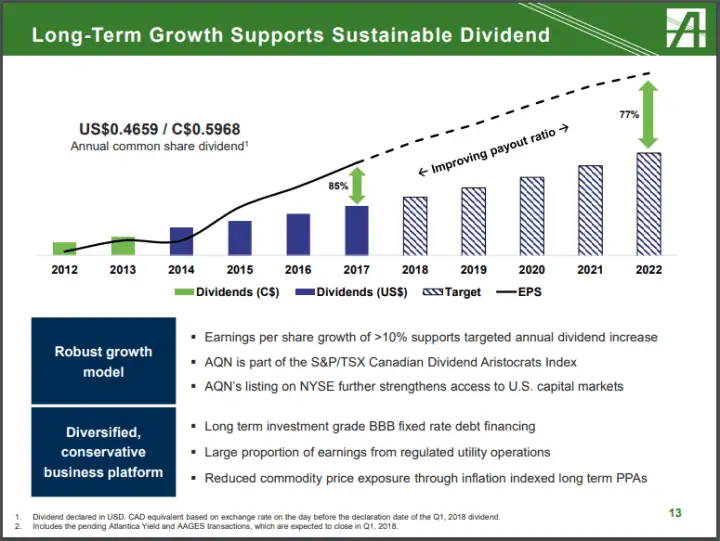

Source: May 30, 2018 TD Securities Power & Utilities Conference Investor Presentation

Algonquin Power & Utilities Corp. which has a dividend streak of 7 years recently increased their quarterly dividend 10.0% from $0.1165 USD to $0.1282 USD. This dividend increase comes into effect with the dividend recorded on Jun 29, 2018. The dividend yield as of May 31, 2018, was 5.3%, and they have 5 and 10-year average annual dividend growth rates of 9.6% and -6.6% respectively.

The negative 10-year average annual dividend growth was caused by a dividend cut in Algonquin’s history that was partially caused by the conversion of an income trust to a corporation.

Algonquin Power & Utilities Corp. Dividend Policy

They have a dividend policy in place that calls for an impressive 10% annual dividend growth until 2022, just be wary of the high payout ratio.

Source: March 2018 Investor Presentation

S&P rates Algonquin BBB and DBRS rates them BBB (low), so the average of the two is somewhere between BBB and BBB-. This is a little too low for me and I’d wait for a better credit rating before investing. If Algonquin is able to achieve their goals then it is likely fine, but a high payout ratio and a lower credit rating make it a riskier bet for long-term high dividend growth. Should the credit rating and payout ratio improve then I think Algonquin is worth your consideration.

5. Loblaw Companies Limited (L.TO) – 9.3% Dividend Increase

Loblaw Companies Limited provides grocery, pharmacy, health and beauty, apparel, general merchandise, banking, and wireless mobile products and services. They have the largest network of grocery stores and pharmacies in Canada including Loblaws, Zehrs, Superstore, No Frills, Shoppers Drug Mart, and others. They have several private-label food brands like President’s Choice and No Name. In addition, they have an apparel brand Joe Fresh, provide financial services through PC Financial and are the majority unitholder of Choice Properties Real Estate Investment Trust.

Loblaw Companies Limited which has a dividend streak of 6 years recently increased their quarterly dividend 9.3% from $0.2700 CAD to $0.2950 CAD. This dividend increase comes into effect with the dividend recorded on Jun 15, 2018. The dividend yield as of May 31, 2018, was 1.8%, and they have 5 and 10-year average annual dividend growth rates of 4.7% and 2.4% respectively.

6. George Weston Ltd (WN.TO) – 7.7% Dividend Increase

George Weston Ltd owns almost half (47%) of Loblaw Companies Limited (L.TO); which has the largest network of grocery stores and pharmacies in Canada. Their investment in Loblaws contributes to the vast majority of their sales, but they also have a Weston Foods division. This division produces a variety of fresh, frozen and specialty bakery products including bread, rolls, bagels, tortillas, donuts, cakes, pies, cookies, crackers and other baked goods in North America.

George Weston Ltd which has a dividend streak of 6 years recently increased their quarterly dividend 7.7% from $0.4550 CAD to $0.4900 CAD. This dividend increase comes into effect with the dividend recorded on Jun 15, 2018. The dividend yield as of May 31, 2018, was 1.9%, and they have 5 and 10-year average annual dividend growth rates of 4.3% and 2.3% respectively.

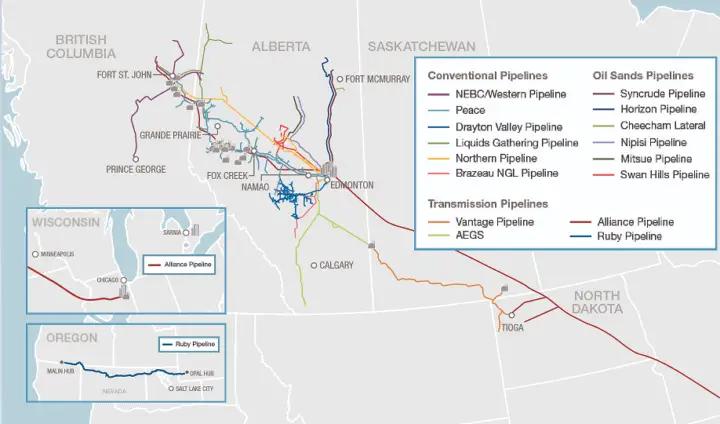

7. Pembina Pipeline (PPL.TO) – 5.6% Dividend Increase

Based in Calgary, Alberta, Pembina Pipeline Corporation is an energy infrastructure company that owns an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products produced primarily in western Canada. They also own gas gathering and processing facilities and an oil and natural gas liquids infrastructure and logistics business.

Pembina Pipeline which has a dividend streak of 6 years recently increased their monthly dividend 5.6% from $0.1800 CAD to $0.1900 CAD. This dividend increase comes into effect with the dividend recorded on May 25, 2018. The dividend yield as of May 31, 2018, was 5.1%, and they have 5 and 10-year average annual dividend growth rates of 4.9% and 4.1% respectively.

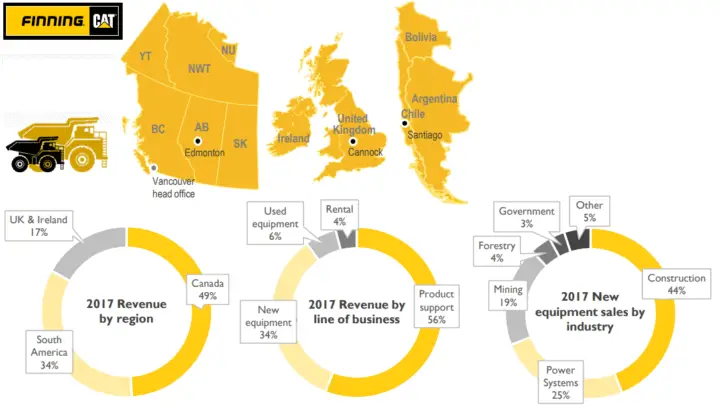

8. Finning International (FTT.TO) – 5.3% Dividend Increase

Finning International is the world’s largest Caterpillar equipment (Heavy-duty machinery and parts) dealer, operating in Canada, South America, and the British Isles. The Company sells, rents, and provides parts and service for equipment and engines to customers in various industries, including mining, construction, petroleum, forestry, and a wide range of power systems applications.

Finning International which has a dividend streak of 16 years recently increased their quarterly dividend 5.3% from $0.1900 CAD to $0.2000 CAD. This dividend increase comes into effect with the dividend recorded on May 25, 2018. The dividend yield as of May 31, 2018, was 2.5%, and they have 5 and 10-year average annual dividend growth rates of 6.3% and 7.5% respectively.

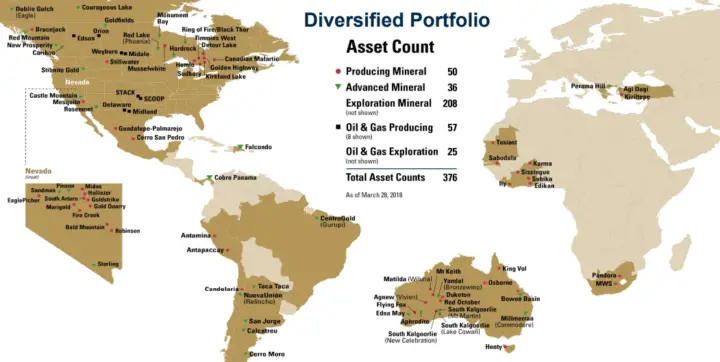

9. Franco-Nevada Corp (FNV.TO) – 4.3% Dividend Increase

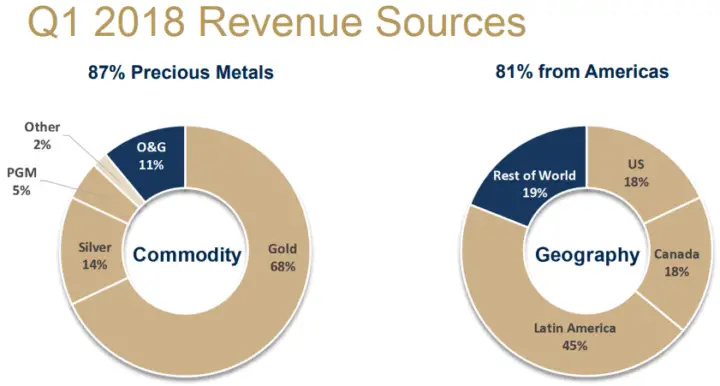

Franco-Nevada is a gold-focused royalty, stream and investment company. They have the largest and most diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project. The portfolio is actively managed with the aim to maintain over 80% of revenue from precious metals: gold, silver & PGM (Platinum). Franco-Nevada does not operate mines, develop projects or conduct exploration. Instead, they focus on managing and growing their portfolio of royalties and streams.

Source: May 2018 Presentation – Annual and Special Meeting of Shareholders

Source: May 10, 2018 Presentation – Q1 2018 Results Conference Call

Franco-Nevada Corp which has a dividend streak of 10 years recently increased their quarterly dividend 4.3% from $0.2300 USD to $0.2400 USD. This dividend increase comes into effect with the dividend recorded on Jun 14, 2018. The dividend yield as of May 31, 2018, was 1.4%, and they have a 5-year average annual dividend growth rate of 11.0%.

10. Telus Corporation (T.TO) – 4.0% Dividend Increase

Telus provides phone, internet, and television services and is one of the three largest telecom companies in Canada.

Telus Corporation which has a dividend streak of 14 years recently increased their quarterly dividend 4.0% from $0.5050 CAD to $0.5250 CAD. This dividend increase comes into effect with the dividend recorded on Jun 08, 2018. The dividend yield as of May 31, 2018, was 4.6%, and they have 5 and 10-year average annual dividend growth rates of 10.1% and 9.6% respectively.

Telus Corporation’s Dividend Policy

Telus typically raises their dividend twice a year and is targeting annual dividend increases in the range of 7 to 10% from 2017 through to the end of 2019. Their long-term dividend payout ratio guideline is 65 to 75 percent of prospective net earnings.

11. Canadian Apartment Properties Real Estate Investment Trust (CAR-UN.TO) – 3.9% Dividend Increase

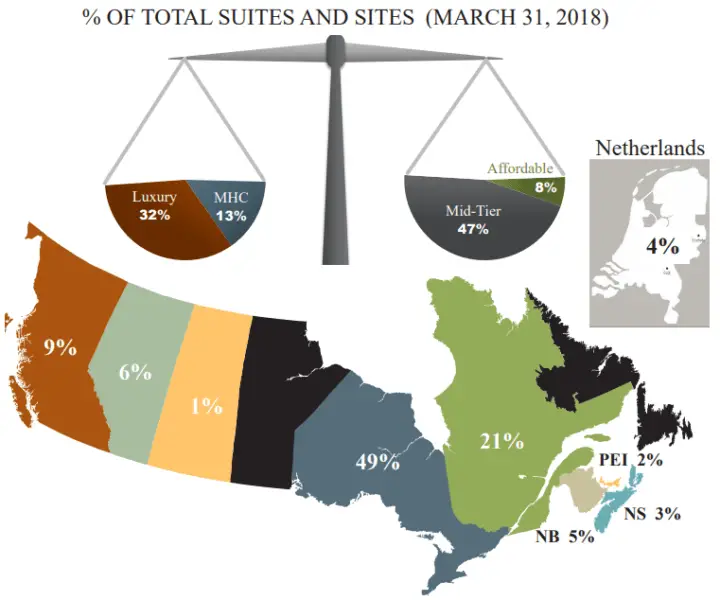

Canadian Apartment Properties Real Estate Investment Trust owns and rents out multi-unit residential complexes, including apartment buildings, townhomes and manufactured home communities (“MHCs”), principally located in or near major urban centers across Canada.

Source: May 9, 2018 Presentation – First Quarter 2018 Conference Call

Canadian Apartment Properties Real Estate Investment Trust which has a dividend streak of 6 years recently increased their monthly dividend 3.9% from $0.1067 CAD to $0.1108 CAD. This dividend increase comes into effect with the dividend recorded on May 31, 2018. The dividend yield as of May 31, 2018, was 3.3%, and they have 5 and 10-year average annual dividend growth rates of 3.1% and 1.7% respectively.

12. Equitable Group Inc (EQB.TO) – 3.8% Dividend Increase

Equitable Group Inc operates through its subsidiary Equitable Bank which is a branchless Canadian bank that offers residential lending, commercial lending, and savings solutions. Their residential mortgages are to customers who have the financial resources to achieve real estate ownership but don’t qualify for a mortgage in the prime market. This includes self-employed borrowers, new Canadians, and the credit challenged.

Equitable Group Inc which has a dividend streak of 7 years recently increased their quarterly dividend 3.8% from $0.2600 CAD to $0.2700 CAD. This dividend increase comes into effect with the dividend recorded on Jun 15, 2018. The dividend yield as of May 31, 2018, was 2.0%, and they have 5 and 10-year average annual dividend growth rates of 12.8% and 9.0% respectively.

In the past few years, Equitable Group has been increasing their quarterly dividend multiple times each year. This most recent increase was the fourth quarterly increase in a row.

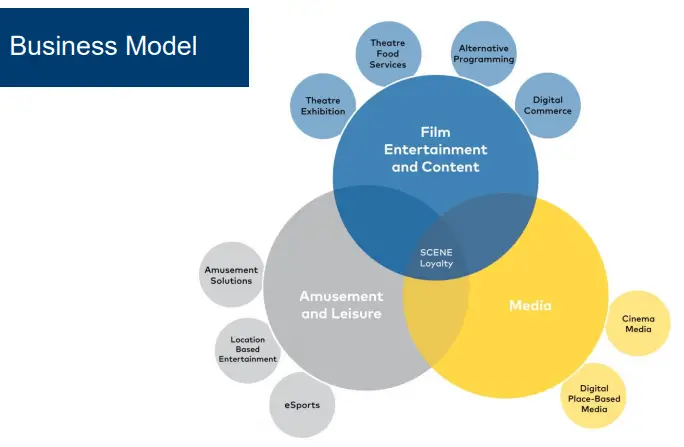

13. Cineplex Inc. (CGX.TO) – 3.6% Dividend Increase

Cineplex is the largest movie theatre operator in Canada. They primarily make their money by selling movie tickets and food in their theatres. They also have a few other revenue sources as you can see from their business model below.

Source: Cineplex Presentation – 2017 Fourth Quarter and Full Year As at December 31, 2017

Cineplex Inc. which has a dividend streak of 7 years recently increased their monthly dividend 3.6% from $0.1400 CAD to $0.1450 CAD. This dividend increase comes into effect with the dividend recorded on May 31, 2018. The dividend yield as of May 31, 2018, was 6.1%, and they have 5 and 10-year average annual dividend growth rates of 4.5% and 3.4% respectively.

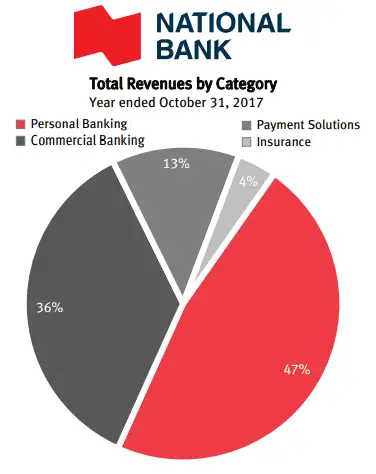

14. National Bank (NA.TO) – 3.3% Dividend Increase

Usually, when investors think of Canadian banks they think of the “Big 5”, but with a history dating back to 1860, the #6 bank in Canada is worth your consideration too. National Bank is the leading bank in Quebec and has branches in almost every province in Canada as well as numerous representative offices, subsidiaries and partnerships, through which it can serve clients in the United States, Europe and other parts of the world. They provide a range of financial services that include: banking and investment solutions for individuals and businesses as well as securities brokerage, insurance and wealth management services.

Source: 2017 Annual Report

National Bank which has a dividend streak of 8 years recently increased their quarterly dividend 3.3% from $0.6000 CAD to $0.6200 CAD. This dividend increase comes into effect with the dividend recorded on Jun 26, 2018. The dividend yield as of May 31, 2018, was 4.0%, and they have 5 and 10-year average annual dividend growth rates of 8.0% and 7.0% respectively.

In recent years National Bank has been increasing their dividend twice a year and this recent increase was no exception.

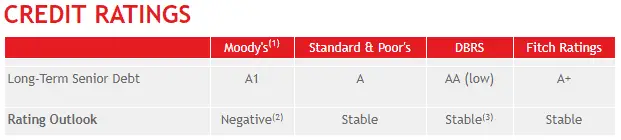

Source: National Bank Investor Relations website – Capital and Debt Information

National Bank Dividend Policy

National Bank has a medium-term payout ratio target of 40-50%.

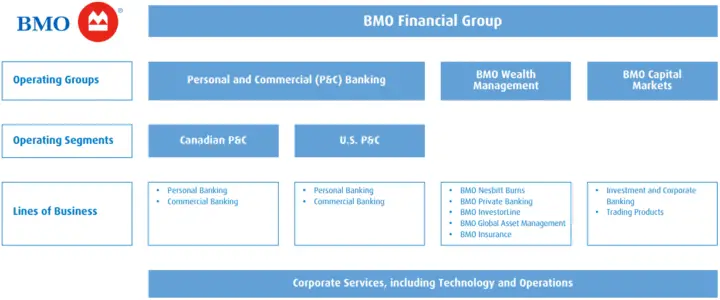

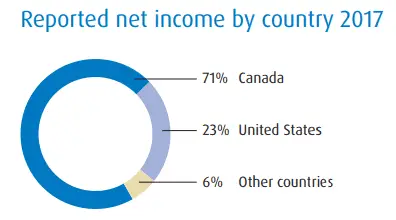

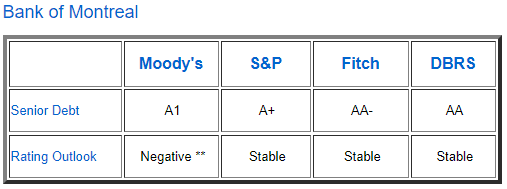

15. Bank of Montreal (BMO.TO) – 3.2% Dividend Increase

Bank of Montreal is one of the “Big 5” Canadian banks and is Canada’s oldest bank having been established in 1817. In 1829 BMO started paying dividends and hasn’t stopped since, giving it the longest-running dividend payout record of any company in Canada.

BMO is a diversified financial services provider based in North America (Canada and the United States with a focus on six U.S. Midwest states – Illinois, Indiana, Wisconsin, Minnesota, Missouri and Kansas) which also operates in select global markets in Europe, Asia, the Middle East and South America. They provide a broad range of personal and commercial banking, wealth management and investment banking products and services.

Source: 2017 Annual Report

Bank of Montreal which has a dividend streak of 6 years recently increased their quarterly dividend 3.2% from $0.9300 CAD to $0.9600 CAD. This dividend increase comes into effect with the dividend recorded on Aug 01, 2018. The dividend yield as of May 31, 2018, was 3.8%, and they have 5 and 10-year average annual dividend growth rates of 4.8% and 2.8% respectively.

BMO has been increasing their dividend twice a year and this recent increase was right on schedule.

Source: Bank of Montreal Investor Relations website – Fixed Income Investors

BMO Dividend Policy

BMO’s policy is to pay out 40% to 50% of its earnings in dividends to shareholders over time.

Summary

Monitoring dividend increases is a good idea because it is a sign from management that they feel good about the future prospects of the company.

Dividend Signalling; while a slightly controversial theory, suggests that dividend increases generally indicate the stock will perform well in the future. Conversely, the same theory suggests that if the dividend is cut or decreased it is signal that stock won’t perform well.

Dividend growth stocks typically outperform the market. Companies that regularly increase their dividend typically do better than those that don’t and will do so with less volatility.

There were 15 May dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Lassonde Industries Inc. – 32.8% Dividend Increase

- Onex Corp – 16.7% Dividend Increase

- Open Text Corporation – 15.0% Dividend Increase

- Algonquin Power & Utilities Corp. – 10.0% Dividend Increase

- Loblaw Companies Limited – 9.3% Dividend Increase

- George Weston Ltd – 7.7% Dividend Increase

- Pembina Pipeline – 5.6% Dividend Increase

- Finning International – 5.3% Dividend Increase

- Franco-Nevada Corp – 4.3% Dividend Increase

- Telus Corporation – 4.0% Dividend Increase

- Canadian Apartment Properties REIT – 3.9% Dividend Increase

- Equitable Group Inc – 3.8% Dividend Increase

- Cineplex Inc. – 3.6% Dividend Increase

- National Bank of Canada – 3.3% Dividend Increase

- Bank of Montreal – 3.2% Dividend Increase

Disclosure: I own shares of National Bank of Canada (NA.TO). You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![Screening the Canadian Market for Dividend Growth Consumer Staples [Spreadsheet included]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/03/Saputo.png)

It would be great if you would also post updates to your (wonderful) All-Stars lists in the Facebook group called “Canadian Dividend Investing:.