Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Before I start the dividend stock analysis I want to mention to new readers that there is another article that you may want to read first. The other article better explains what I’m looking for in a company from a dividend growth perspective and why I analyze specific company components and ratios. The other article is meant more as an educational tool so that readers can better understand my dividend stock analyses. This dividend stock analysis will look at the company to identify if it is a good dividend growth candidate to invest in.

TELUS Dividend Stock Analysis

Canadian Telecom stocks have been dropping in price ever since Verizon Communications announced that they plan to buy WIND Mobile. Rogers Communications and TELUS have been hit the hardest because a larger portion of their income is from wireless communications, which Verizon would compete for. With this recent drop, Rogers Communications is close to my target price, so I thought it would be a good time to review TELUS.

Company Description

From Google Finance:

“TELUS Corporation (TELUS), incorporated on October 26, 1998, is a telecommunications companies, providing a range of telecommunications products and services products including wireless, data, Internet protocol, voice and television. The Company’s operates in two segments: wireless and wireline. The Wireless segment includes voice, data and equipment sales. The Wireline segment includes data (which includes: television; Internet, enhanced data and hosting services; and managed and legacy data services), voice local, voice long distance, and other telecommunications services excluding wireless. TELUS earns revenue from access to, and the usage of, the Company’s telecommunications infrastructure, or from providing products and services that facilitate access to and usage of this infrastructure. As of December 31, 2012, the Company’s owned 100% of TELUS Communications Inc. (TCI). In 2012, the Company acquired Wolf Medical Systems.”

10 Year Stock Chart

There is a 10 year annual average return of 10.0%. If we include the dividend payments over the past 10 fiscal years (Total dividends paid of $15.27) then the total average annual return would be 14.5% with the average return from dividends representing 4.5%.

The overall returns are good, but had you invested in 2007 you wouldn’t be very happy.

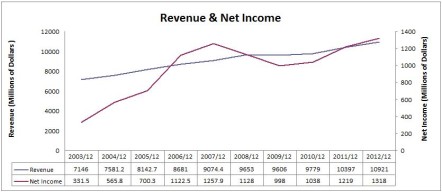

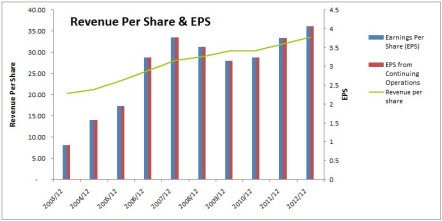

Revenue and Earnings

TELUS has a good overall revenue trend, but net income from 2008 and on has been mostly flat.

Revenue per share has been steadily increasing, but EPS was only recently (2012) able to get higher than 2007 levels.

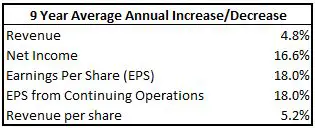

TELUS has OK revenue charts, and the same can be said for the 9 year average annual growth rates for various earnings figures. I used 9 years instead of 10 years because in 2002 the company had losses.

Net income and EPS growth rates are great, but revenue growth rates are around 5%. I typically like to see rates above 8%, but it doesn’t look like TELUS is targeting revenue growth above the 8%. In 2012 they targeted revenue growth of 3-6%, and for 2013 they have a target of 4-6%. Their 2013 basic EPS growth target is 3-14%.

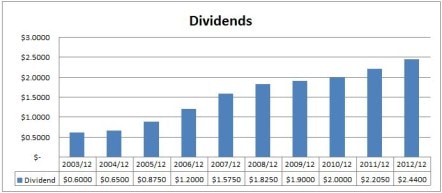

Dividends

A quick look at the Canadian Dividend All-Star List tells me that TELUS has increased their dividend for 9 consecutive years in a row. The most recent increase happened with the dividend recorded earlier this month (June 2013) when they increased the quarterly dividend by 6.3% from $0.3200 to $0.3400. There was a recent 2:1 stock split so the previous dividend of $0.32 was actually $0.64, but I adjusted it to $0.32 for the 2:1 stock split. The dividend table below has not been adjusted for the 2:1 stock split in 2013.

The chart shows a steadily increasing dividend, exactly what I like to see from a dividend growth perspective.

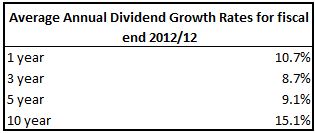

Dividend Growth

As you can see from the table below TELUS shows good average annual dividend growth rates.

Dividend growth rates are all above the 8% I like to see.

Dividend Sustainability

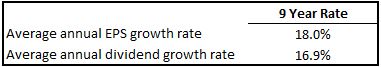

The 9 year average annual dividend growth has been a bit lower than EPS growth which suggests that dividend growth has been sustainable.

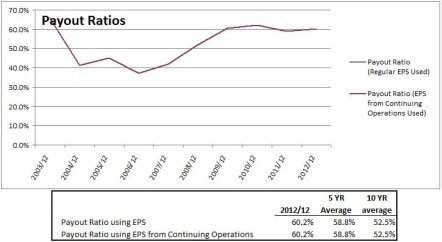

Let’s take a look at the payout ratio to see how much room for growth the dividend still has.

In the past few years the payout ratio has been right around 60%. The company recently announced that they will be increasing their payout ratio target to 65% to 75%. This is up 10% from their previous target of 55% to 65%.

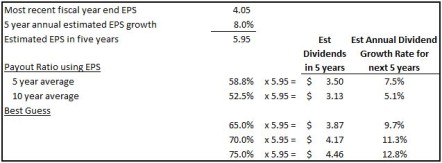

Estimated Future Dividend Growth

Analysts expect annual EPS growth to be 8.0% for the next 5 years. Accepting this EPS growth rate and using various payout ratios we can guess future dividend growth rates.

I expect a payout ratio of 65% to 75%, just like the company announced. This would result in annual dividend growth ranging from 9.7% to 12.8%. The company recently announced that it plans to increase its dividend twice a year for 3 years with an average annual growth rate around 10%. This is in-line with my range of 9.7% to 12.8%, so my guess is that it will be around 10%. One thing to point out is that the analyst’s estimate of 8% annual EPS growth rate for the next five years likely hasn’t been adjusted for the Verizon entry. This rate might drop a bit in the future once analysts make adjustments for Verizon. In the short term I don’t think it will affect EPS much, if at all. In the long term Verizon may have a negative impact.

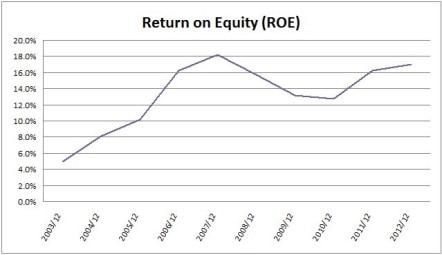

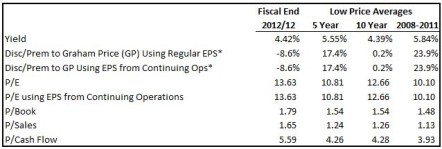

Competitive Advantage & Return on Equity (ROE)

I’m typically looking for 12% or above, but 20% is better. Overall I’d say that TELUS has an OK return on equity. I’d like to see it stabilize and trend up.

Looking at the table below, I can see that right now its ROE is well above the Wireless Communications industry average of 11.9%, but when compared to its Canadian competitors it falls a little short. I threw in Verizon Communications out of curiosity, but right now I wouldn’t consider it a major competitor in Canada.

I would consider TELUS to have a narrow economic moat. There are only a few key players in the industry, but the industry is highly competitive. While it may be difficult to enter the industry, the current competition is strong enough to take away a significant competitive advantage.

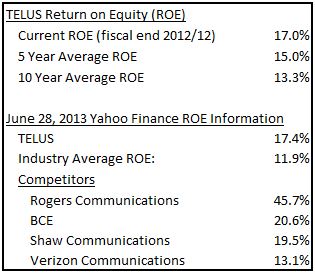

Debt & Liquidity

I want to invest in companies that are fiscally responsible, so it is important to look at debt levels and see that they are at reasonable levels.

I’d like to see the current and quick ratios above 1.0, but it looks like they’ve been able to operate below these levels for a number of years. Overall the company seems to be in OK financial health.

Shares Outstanding

While a little choppy, the overall trend for shares outstanding is downward, which is a good sign. I’d like to see this trend continue.

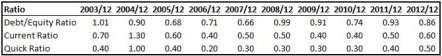

Valuation

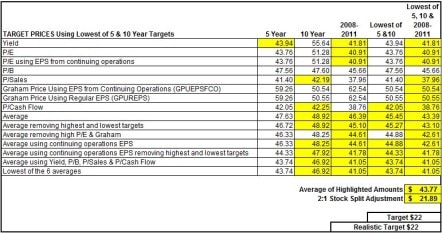

I use the low price averages for 6 main ratios to determine a fair price: Yield, Discount/Premium of the low price compared to the Graham Price, P/E, P/B, P/Sales and P/Cash flow. I like to look at both EPS and EPS from continuing operations so it ends up being a total of 8 ratios as the Graham Price an P/E both use EPS. You can read more about my valuation method here.

I get the following for TELUS.

* The discount or premium to Graham Price hasn’t been calculated in the normal fashion. For the details read this article.

I use the averages from the previous table to determine my target price. Using these averages creates a lot of different target prices, so I back-test this strategy over the past 10 years. I identify which of the 8 valuation techniques would have given me a chance to buy the stock in two to three fiscal years in the past 10 fiscal years. It’s not always possible to test my strategy back 10 years, due to limited financial information, but I do my best. The results are highlighted below.

The average of the highlighted amount gives me a target price of $44, but because of the recent 2:1 stock split I adjusted it to $22. This would result in a dividend yield of 6.18%. This is definitely a higher yield for TELUS, but you could’ve got to these levels in 2009 and 2010. I kept my realistic target the same as the calculated $22 for this reason.

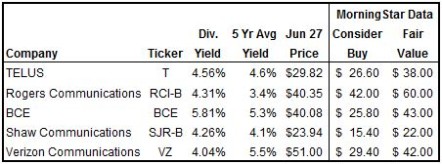

Morningstar currently rates TELUS as a 4 star stock as it is currently priced under their estimated fair value of $38. For Morningstar to rate TELUS as a 5 star undervalued stock the price would have to fall below their “consider buy price” of $26.60. Morningstar’s target is 21% higher than mine, so mine might be too conservative, but I’m OK with that.

Trend Analysis

I also like to look at INO`s Free Trend Analysis prior to investing to see if I should hold off or not. Sometimes it is nice to see if the stock is trending down or up before buying it. For June 28, 2013 INO is showing a strong downtrend for TELUS.

To see the most recent trend analysis for Telus or to sign up for free trend analysis’s click here. INO also has a list of the top 50 trending stocks and free trading seminars and videos.

This downtrend is going to have to continue for sometime if I’m going to hit my target price of $22.

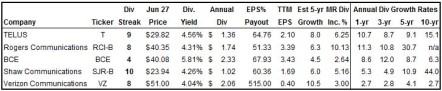

Other Investment Options in the Same Industry

TELUS shares the industry with Rogers Communications, Shaw Communications and BCE. Because of the recent news that Verizon may be entering the industry I included it in the chart as well.

Rogers Communications has the lowest payout ratio and an OK estimated EPS growth rate of 6.3%, which should translate into good dividend growth. Their past dividend growth rates have been good with them all above 10%, including the most recent increase. No dividends were paid in 2002, so the 10 year dividend growth rate couldn’t be calculated. The 9 year average annual dividend growth rate is an impressive 46.8% though. I completed a dividend stock analysis of Rogers Communications in May 2013, and my estimate for dividend growth was 4.2% to 8.0%. Analysts have since increased their estimated growth rate for Rogers, so I expect dividend growth around 8-10% annually. With the potential for new competition from Verizon I’m comforted by their low payout ratio compared to the others.

BCE offers the highest yield, but has low dividend growth prospects. BCE’s payout ratio is fairly high at 67.93%. This does not allow for much dividend growth beyond its EPS growth rate. Currently analysts expect EPS to grow 4.5% annually for the next 5 years, which suggests limited future dividend growth. My guess is that it will be around 4% or 5% annually. BCE has the lowest dividend streak, and the limited dividend growth potential will keep me on the sidelines for now. BCE doesn’t have as much of its income coming from wireless sources so the Verizon entry wouldn’t affect it as much as Rogers Communications or TELUS.

Shaw Communications has a good dividend streak, a reasonable payout ratio, and an OK estimated EPS growth rate of 6.0%, but the recent dividend increases have been around 5%. This is 3% lower than the 8% I like to target. I recently completed a dividend stock analysis of Shaw Communications where I estimated annual dividend growth of 5.2% to 8.5%. The company recently stated that they plan to target dividend increases of 5% to 10% over the next two years due to an improvement in free cash flow. It is hard to say if dividend growth will meet my 8% target, but I would consider investing in it. I still prefer TELUS and Rogers Communications over Shaw Communications however. Shaw Communications doesn’t have any of its income coming from wireless sources so the Verizon entry shouldn’t affect it.

Verizon Communications has an OK dividend streak of 8 years, but its dividend growth is not very impressive as it has generally been around 3% or 4%. Its payout ratio is really high when compared to the EPS from the last twelve months. I looked into this a bit further and analysts expect EPS for 2013 to be $2.80 which would result in a more reasonable, but still high payout ratio of 73.57%. The annual EPS estimated growth rate of 10.5% is good, but because of its high payout ratio I think dividend growth will be lower than EPS growth. I don’t plan on investing in Verizon.

From a valuation perspective Rogers Communications looks to be the best option right now.

Rogers Communications is the only company that is currently rated a 5 star stock by Morningstar. Its current yield is the highest above its five year average coming in 27% higher. It is currently a little above my $38 target price, but it is still the closest to my target compared to my other target prices of $22 for TELUS and $20 for Shaw Communications. Right now Rogers Communications looks more appealing than TELUS.

Conclusion

TELUS has seen some recent price drops due to the announcement from Verizon, but it still needs to come down a lot more for it to reach my target price of $22. I expect dividend growth around 10% going forward. While 10% annual dividend growth is appealing I think you can get similar rates from Rogers Communications with a better overall valuation at current levels. Overall TELUS is a well run company and I’d be happy to invest more, but its valuation is currently too rich for me.

Disclaimer

I own shares of TELUS. I also own a small portion of BCE shares leftover from my DRIP selling days. You can see my portfolio here. I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Guess what! I bought a good amount of TELUS stock at $7 each. It is $41 now!!! No complaints at all. I will stick with it. No Rogers for me.