Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

- 401(K) 2013 / Foter / CC BY-SA

I’ve been writing a lot of dividend stock analyses lately, so today I thought I’d take a break from them and write an article about diversification.

My fiancé and I are in the process of combining our finances, so I thought it would be important to look at my portfolio and re-examine risk. I have a higher risk tolerance than my fiancé so I thought I would start looking at our combined finances and ways to become more diversified.

Diversification is an easy way to help reduce risk. I’ve always known this, but I haven’t been utilizing it that much until more recently. When you are just starting out and don’t have a lot of money it can be harder to diversify when you buy individual stocks. With each new addition your portfolio changes quite drastically. For instance say you own 4 stocks of equal value and purchase a 5th, this is 20% of your portfolio. As time goes on and your portfolio grows you become more diversified naturally. It’s this reason that I wasn’t so worried about diversification in the early days.

Things have changed since then. Having all your eggs in one basket is risky because if something bad happens, you’re screwed. The idea behind diversification is to spread your eggs in different baskets to reduce risk.

I’m going to go over a few different ways I plan on diversifying. The first is asset allocation. Asset allocation attempts to balance risk and reward. This usually involves coming up with a mix of equities (stocks), fixed income (usually bonds), and cash that suits your risk tolerance. A common approach is the balanced method which is 60% equity and 40% bonds.

Another common approach is to have the percent of bonds match your age. For instance if you were 25 years old, you’d have 25% in bonds and 75% stocks. As you grew older and closer to retirement, say 65, your bond exposure would be 65% and stock exposure would be 35%. Bonds are considered less risky than stocks so as you grow older you reduce your risk with a larger percentage of bonds.

My portfolio is basically all stocks, so I’m not that diversified from an asset allocation perspective. I’m currently in the process of combining my finances with my fiancé and she has a large stock pile of cash. We’ve already been dealing with our finances together and we sorted of decided that she’d have more cash because I was mostly in stocks. From an individualistic perspective I am not diversified at all, but as a couple we are OK. Combined we have about 30% cash and 70% equity. We are both in our late 20’s, so I think this is reasonable. You may be wondering why we have such a large portion in cash. We have a lot of cash because we have an emergency fund, we are saving up for a wedding, and we were recently traveling the world and haven’t been working since March. I go back to work in September and my fiancé is going to be looking for work soon. Eventually when things settle down I expect cash to make up a smaller percentage of my portfolio and I’ll start investing in fixed income.

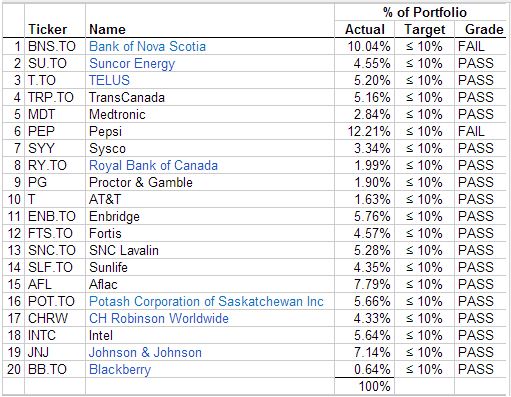

The second diversification method is individual stock allocation. I don’t want a single stock to represent more than 10% of my portfolio. This way if I loose all my money with one stock, my losses will be limited to 10% or less. I plan to use dividend income to support retirement, so if a company cuts its dividend then it also limits the loss in dividend income. Looking at my portfolio right now I have two companies out of 20 that are more than 10%.

Bank of Nova Scotia is 10.04% of my portfolio and Pepsi is 12.21%. I’m not as worried about Bank of Nova Scotia as it’s only 0.04% over. Pepsi is over 10% by 2.21%. Rather than selling some of these shares I plan on adding new positions to my portfolio. As I add new positions this will reduce the stock allocation of other stocks like Pepsi to below 10%.

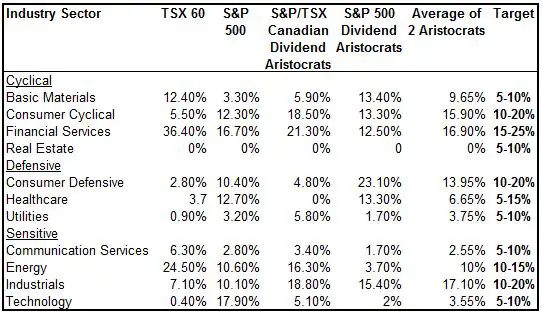

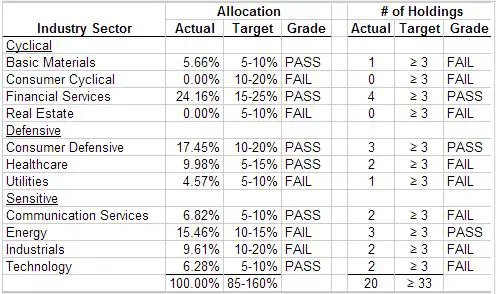

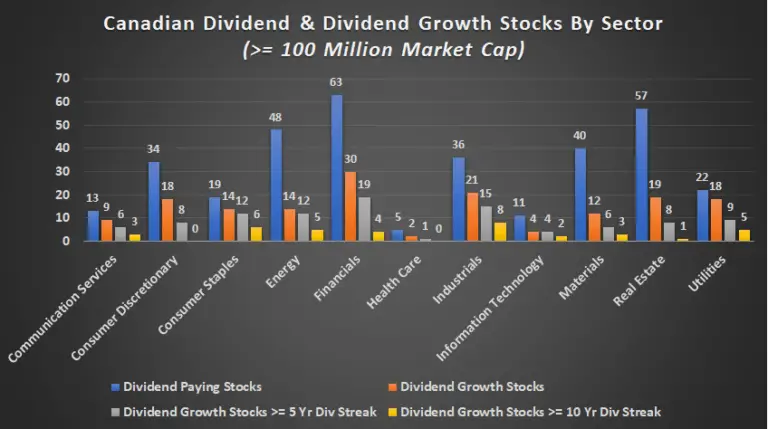

Another method of diversification is by industry sector. There are 11 common industry sectors: Basic Materials, Consumer Cyclical, Financial Services, Real Estate, Consumer Defensive, Healthcare, Utilities, Communication Services, Energy, Industrials, and Technology. I had a look at some common Canadian and US index’s to help me come up with a target allocation for each sector. I’m a dividend growth investor, so in the end I decided to come up with targets based on the Canadian and US dividend aristocrats. If you look at the targets below you’ll notice that they are mostly a range between the Canadian and US dividend aristocrats.

By having stocks in different sectors it helps reduce risk. If one sector is hit hard by negative news, you’ll still have other stocks in different sectors to rely on. As well as my target allocations, I want to have at least three stocks in each sector. This means that my portfolio should have at least 33 stocks in it. Currently I only have 20, so right away I can see a weakness in my portfolio. It will take me time to build up my portfolio to 33 stocks due to my conservative investing criteria and cash flow constraints, but eventual I should get there.

You can see from my current portfolio that my exposure to Consumer Cyclical and Real Estate is 0% which is a real weakness. There are some other areas that aren’t quite within my target range, but they are pretty close. I see the lack of stocks in real estate and consumer cyclical as significant weaknesses along with the fact that I don’t have three or more stocks in most industry sectors. Overtime I will be working to fix these weaknesses. A good example of this is my recent addition of Potash Corporation of Saskatchewan to my portfolio to increase my exposure to basic materials.

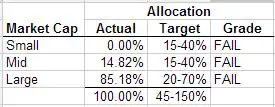

Another level of diversification is through small, mid, and large capitalization stocks. Small and mid cap stocks are generally considered to be riskier, but historically have performed better than large cap stocks. Part of a good portfolio is having a good mix of all three. I like to focus on dividend growth stocks with wide moats. It is difficult to find a company with a wide moat that is a small cap stock, which is why I have no exposure to small cap stocks currently. If you look at the table below you can see that my portfolio is mostly large cap stocks.

My target allocation for small, mid and large cap was set based on my personal preferences and my risk tolerance. I’m fairly young (27), so I should be investing in more small in mid cap stocks. In the long term this should benefit me. I have a hard time identifying good small cap stocks to invest in, so this will be a challenge.

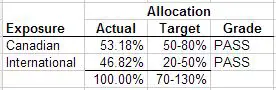

Yet another level of diversification is your international exposure to stocks. I live in Canada so I like to have the majority of my stocks in Canadian equities, with some exposure to international stocks.

Based on the table above, it looks like my exposure is fine. One weakness that isn’t shown is the fact that all of my international exposure is in US stocks.

By now you should be getting an understanding of all the different ways to diversify. There a lot of different ways to diversify and it can be a complicated process. A quick way to diversify your portfolio is by using ETF indexes. If you identify a weakness in your portfolio you can buy an index and get instant diversification. Indexes often represent a large number of companies in different industries and with varying market caps. If you stick with individual stocks it takes a bit more hands on work.

How’s your portfolio doing, are you properly diversified?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Hello DGI&R,

Great discussion about diversification and the many different “takes” available. Could you give some examples of Consumer Cyclical versus Consumer Defensive equities?

Many thanks!

Here is a list of all the consumer cyclical and defensive stocks in the July 31st Canadian Dividend All-Star List.

Consumer Cyclical

Thomson Reuters

CCL Industries Inc

Mcgraw-Hill Ryerson Limited

Transcontinental Inc

Tim Hortons Inc

Consumer Defensive:

Empire Company Ltd

Metro Inc

Saputo Inc.

Jean Coutu Group

Lassonde Industries Inc.

I also found a good explanation from http://research.scottrade.com/public/knowledgecenter/education/article.asp?docId=eaa91e6cda2548c08dbf780a648f07e2:

“Industries that greatly differ from each other in terms of business activity can react similarly to changes in the economy. For example, cyclical stocks, like retail and travel, are sensitive to the economic cycle because in tight economic periods, consumers are less likely to spend money on non-essential items.

On the other hand, defensive stocks represent necessary items, like food, gas and medicine, and tend to change very little with the economic cycle because consumers are likely to continue buying them even in tough economic times.

Investing in both cyclical and defensive stocks can potentially help hedge against the risk you face by selecting only industries that react similarly to changing market conditions.”

SMc

Hello DGI&G

When I look over your methodology, in my opinion the goal of seeking diversification should be low on your list. As you state diversification is utilized to reduce risk. Your stock selection method already accomplishes risk reduction by buying good companies when they are on sale. If by chance you happen to identify a company such as your potash purchase which provides some additional diversification in your portfolio great. In short, don’t let the tail wag the dog. Your suggestion of balanced etf’s for those starting out is good, I would also add those individuals who do not wish to put out the effort that you do.

By the way great blog.