Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

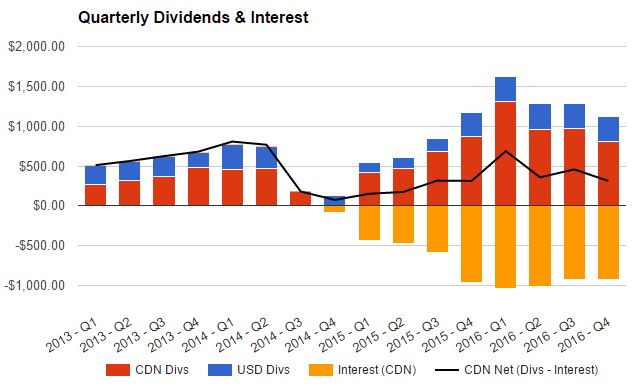

As a way of tracking my progress towards financial freedom I total up the dividends paid to me each month. The end goal is to have my dividends cover my expenses. This is a long term goal, so I have a lot of years to go, but I find it encouraging to see my dividend income steadily grow over time. This reminds me that I’m on the right track and to stick with it.

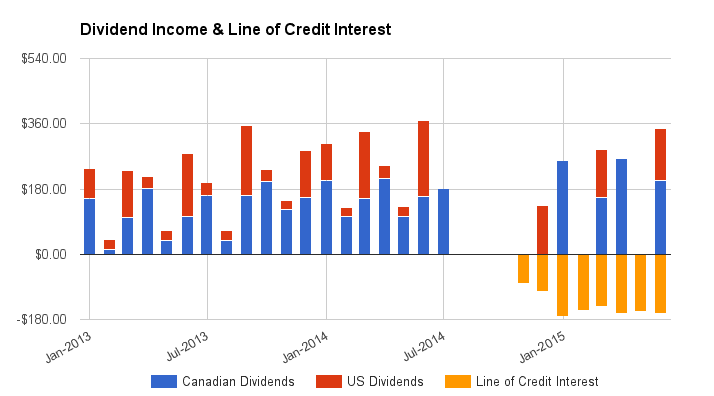

My dividend income for August 2013:

Canadian Dividend Income

- Royal Bank – $15.12

- SNC Lavalin – $23.00

Total Canadian Dividend Income – $38.12

US Dividend Income

- AT&T – $16.65

- Proctor & Gamble – $9.46

Total US Dividend Income – $26.11

I didn’t earn a lot of income in August, but this was expected. This month of the quarter is always the lowest one. With my purchase of Potash Corporation of Saskatchewan I expect dividend income to increase. Potash pays out one of its quarterly dividends in August, but I purchased it to late, so I won’t start receiving the dividend until November. With my purchase of Potash (Click for a FREE trend analysis of TSE:POT) I’ll add $46 per quarter in dividends to my dividend income.

Potash was my only purchase in August. I had my eye on Rogers Communications, but it didn’t quite make it to my $38 target. With the news that Verizon Communications is not coming to Canada, Canadian telecoms have bounced back up in price, making it unlikely that I’ll be able to buy Rogers below my target price.

To see a full list of the companies currently in my portfolio check out my portfolio page. To see dividend income earned from previous months see my dividend income page.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Nice work. Great seeing the money come in 🙂

Congratulations on a good month. By the way, I read a piece in the global mail that profiled you. Nice work!

Nice job brother! Are the numbers you’ll be posting AFTER TAX / withholding taxes etc? Im thinking about doing something like this, it is nice to watch them grow! 🙂

The numbers are the dividends that were actually paid to me, so yes after tax amounts.

I’ll admit I’m not very familiar with dividend investing. What are the potential risks/rewards when compared to index mutual fund investments (which I’m much more familiar with)?