Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Welcome to part two of The Great Canadian Banking Series. In this 10 part series I examine the Canadian Banking Sector to identify good dividend growth candidates. Today I’ll be looking into Bank of Nova Scotia.

Before I start the dividend stock analysis I want to mention to new readers that there is another article that you may want to read first. The other article better explains what I’m looking for in a company from a dividend growth perspective and why I analyze specific company components and ratios. The other article is meant more as an educational tool so that readers can better understand my dividend stock analyses. This dividend stock analysis will look at the company to identify if it is a good dividend growth candidate to invest in.

Bank of Nova Scotia Dividend Stock Analysis

I chose Bank of Nova Scotia (Click for a FREE trend analysis of TSE:BNS) as the first bank to review, because it is the largest bank holding in my portfolio. It was also one of the first companies I invested in.

Company Description

From Google Finance:

“The Bank of Nova Scotia (the Bank) is a diversified financial institution. As of October 31, 2011, the Bank offered a range of products and services, including retail, commercial, corporate and investment banking to more than 18.6 million customers in more than 50 countries around the world. The Bank has four business lines: Canadian Banking, International Banking, Scotia Capital and Global Wealth Management. In January 2012, the Company closed its acquisition of 51% of Banco Colpatria. In April 2012, the Company through Scotia Capital Inc. acquired Howard Weil Incorporated. In April 2013, Bank of Nova Scotia acquired a 50% interest in Administradora de Fondos de Pensiones Horizonte SA.”

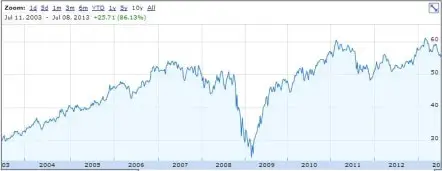

10 Year Stock Chart

There is a 10 year annual average return of 6.4%. If we include the dividend payments over the past 10 fiscal years (Total dividends paid of $16.58) then the total average annual return would be 9.2% with the average return from dividends representing 2.8%.

The Canadian banks overall have had good returns over the past decade. Bank of Nova Scotia’s average annual return of 9.2% is good, but TD Bank, Royal Bank, and National Bank all have better 10 year returns.

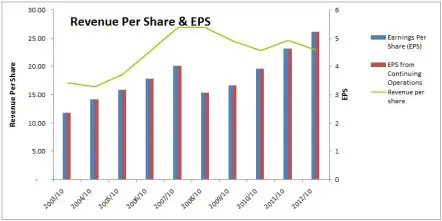

Revenue and Earnings

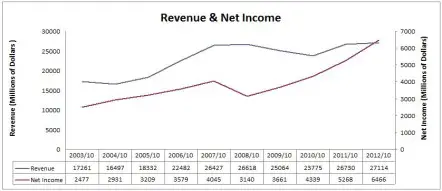

Bank of Nova Scotia has a good overall net income trend, but its revenue has been mostly flat since 2007.

You can see the affects of the global financial crisis on both revenue per share and EPS. EPS dropped in 2008, and didn’t get back above 2007 levels until 2011. Revenue per share still hasn’t fully recovered.

Bank of Nova Scotia has OK revenue charts, but I’d like to see an improvement in revenue and revenue per share.

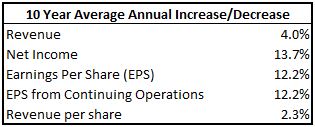

Net income and EPS growth rates are great, but the revenue figures are low. I typically like to see rates above 8%. For the year end 2013 Bank of Nova Scotia is targeting EPS growth of 5-10%.

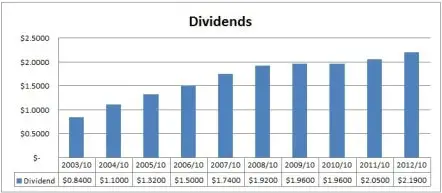

Dividends

Bank of Nova Scotia has increased their dividend for 2 consecutive years in a row, which doesn’t sound very impressive, but a look at their website informed me that they had dividend increases in 42 of the last 45 years. This is very impressive.

The most recent dividend increase happened with the dividend recorded in April 2013 when they increased the quarterly dividend by 5.3% from $0.5700 to $0.6000. Recently they have been increasing their dividend twice a year, so the most recent annual dividend increase would be from $0.55 to $0.60 which is a 9.1% increase.

In the chart you can see where dividend growth slowed around 2008-2010. The overall trend is good, but dividend growth has been slow since 2008.

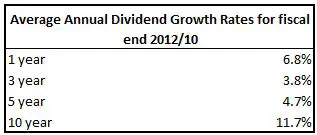

Dividend Growth

As you can see from the table below Bank of Nova Scotia shows a good 10 year average annual dividend growth rate, but leaves me wanting more with the other rates.

Only the 10 year average rate is above the 8% I like to see, but it looks like dividend growth might be improving with the more recent dividend increases showing improved growth.

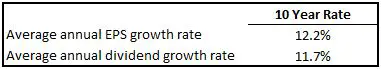

Dividend Sustainability

The 10 year average annual EPS growth rate is roughly in line with dividend growth which suggests sustainable dividend growth.

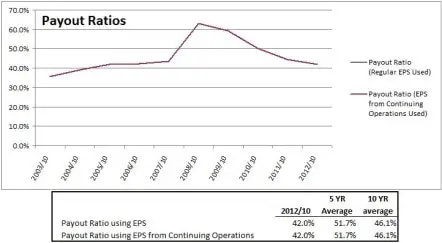

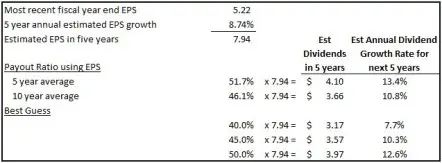

Let’s take a look at the payout ratio to see how much room for growth the dividend still has.

In the past few years the payout ratio has been around 40-50%, which is what I think Bank of Nova Scotia will target in the future. Other banks like CIBC (Click for a FREE trend analysis of TSE:CM) and Bank of Montreal (Click for a FREE trend analysis of TSE:BMO) have stated that they are targeting a payout ratio of 40-50%, and looking at Bank of Nova Scotia’s payout ratio it looks like they are targeting a similar payout ratio.

Estimated Future Dividend Growth

Analysts expect annual EPS growth to be 8.74% for the next 5 years. Accepting this EPS growth rate and using various payout ratios we can guess future dividend growth rates.

I expect a payout ratio of 40% to 50%. This would result in annual dividend growth ranging from 7.7% to 12.6%. The company’s most recent annual dividend increase of 9.1% leads me to think that future dividend growth will be around 8-10%.

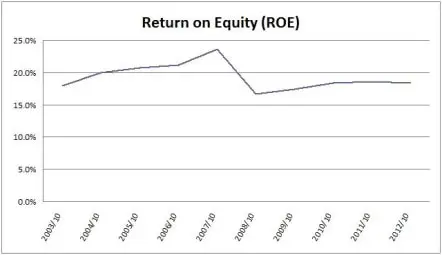

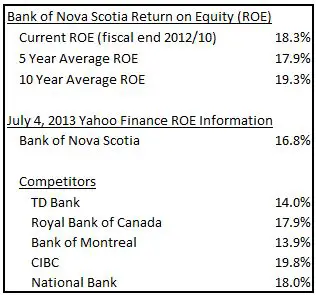

Competitive Advantage & Return on Equity (ROE)

For the past 10 fiscal years I get a ROE that ranged between 16.7% and 23.6%. Their 2013 target is 15-18%.

Looking at the table below, I can see that right now its ROE is in-line with the competition.

The Canadian banking industry is dominated by the big six banks. The big six are all very competitive so while there are not a lot of big players in the Canadian market, it is still very competitive. Bank of Nova Scotia is known as a more international bank compared to the other Canadian banks, so it is also competing with international banks.

Morningstar rates Bank of Nova Scotia as having a narrow economic moat. I would agree with this rating.

Debt & Liquidity

I want to invest in companies that are fiscally responsible, so it is important to look at debt levels and see that they are at reasonable levels.

Based on what the different rating agencies say, the company seems to be in good financial health.

Shares Outstanding

Shares outstanding have been mostly level with a slight increase in shares more recently. I’d like to see this trend reverse.

Valuation

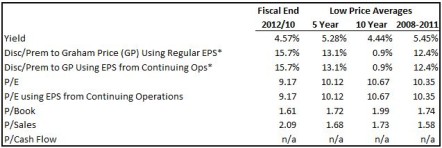

I use the low price averages for 6 main ratios to determine a fair price: Yield, Discount/Premium of the low price compared to the Graham Price, P/E, P/B, P/Sales and P/Cash flow. I like to look at both EPS and EPS from continuing operations so it ends up being a total of 8 ratios as the Graham Price an P/E both use EPS. I was unable to get all the P/Cash flow information I needed, so it wasn’t used. You can read more about my valuation method here.

I get the following for Bank of Nova Scotia.

* The discount or premium to Graham Price hasn’t been calculated in the normal fashion. For the details read this article.

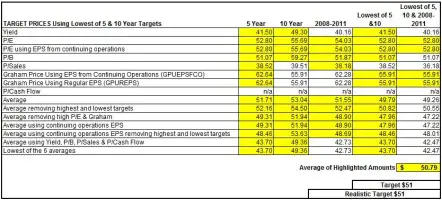

I use the averages from the previous table to determine my target price. Using these averages creates a lot of different target prices, so I back-test this strategy over the past 10 years. I identify which of the 8 valuation techniques would have given me a chance to buy the stock in two to three fiscal years in the past 10 fiscal years. It’s not always possible to test my strategy back 10 years, due to limited financial information, but I do my best. The results are highlighted below.

The average of the highlighted amount gives me a target price of $51. This would result in a dividend yield of 4.7% with the current annual dividend of $2.40. I think this a reasonable target, so I left the realistic target at $51.

Morningstar currently rates Bank of Nova Scotia as a 3 star stock as it is currently priced close to their estimated fair value of $62. For Morningstar to rate Bank of Nova Scotia as a 5 star undervalued stock the price would have to fall below their “consider buy price” of $37.20.

My target price of $51 is 37% higher than Morningstar’s 5 star target. This is quite a difference, so I was worried that my target price wasn’t conservative enough. Whenever I need a tie breaker for valuation I like to use dividend yield. The 5 star price would result in a dividend yield of 6.5%, and my target price a yield of 4.7%. When I look at the past 10 fiscal years it looks like a yield of 4.7% is still conservative compared to past dividend yields.

Morningstar’s 5 star price is very conservative, and it looks like the only opportunity to buy at a 6.5% yield would’ve been in 2009 in the height of the global financial crisis. Having looked at historic high dividend yields, I’m content to keep my target price at $51. You can see all of my target prices here.

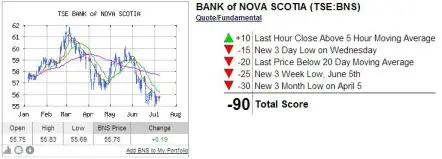

Trend Analysis

I also like to look at INO`s Free Trend Analysis prior to investing to see if I should hold off or not. Sometimes it is nice to see if the stock is trending down or up before buying it. For July 9, 2013 INO is showing a strong downtrend for Bank of Nova Scotia.

To see the most recent trend analysis for Bank of Nova Scotia or to sign up for free trend analysis’s click here. INO also has a list of the top 50 trending stocks and free trading seminars and videos.

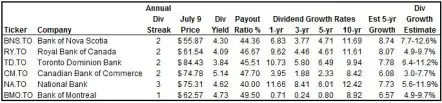

Other Investment Options in the Same Industry

Bank of Nova Scotia is one of six banks that make up the majority of the Canadian market. They share the industry with: TD Bank (Click for a FREE trend analysis of TSE:TD), Royal Bank, CIBC, Bank of Montreal, and National Bank.

All the banks offer a good entry dividend yield with rates ranging between Toronto-Dominion Bank’s 3.84% to CIBC’s 5.14%. With the exception of CIBC and Bank of Montreal, the banks show a similar trend in their dividend growth rates. The 10 year rates are good, but due to the global financial crisis the 3 and 5 year rates are low, and the 1 year rate shows an improvement. CIBC and Bank of Montreal haven’t shown the recent improvement in dividend growth rates that the others have. The dividend growth rates shown in the table are based on the dividends recorded in each calendar year from 2003 to 2012.

They all offer reasonable payout ratios with rates ranging from National Bank’s 40.00% to Bank of Montreal’s 49.50%. Looking at the various payout ratio history’s of all the banks and reading their annual reports it looks like the standard payout ratio target for the big six banks is 40-50% with the exception being National Bank. Based on past payout ratios National Bank looks like it is targeting a payout ratio of 30-40%. Using these payout ratio targets, the current EPS and the analyst’s 5 year annual EPS growth estimates I calculated an annual dividend growth estimate for each of the banks.

Royal Bank of Canada has increased its dividend twice in the past year which has led to an annual dividend increase of 10.5%. It looks like dividend growth has been improving and will likely be at the higher end of my estimated range of 4.9-9.7%.

Like most of the big six banks Toronto-Dominion Bank has increased its dividend twice in the past year. This led to an annual dividend increase of 12.5%. My guess is that future dividend growth will be at the higher end of my estimated range of 6.4-11.2%.

CIBC recently increased their quarterly dividend from $0.90 to $0.94 with the dividend recorded in September 2012 and then again from $0.94 to $0.96 with the dividend recorded in June 2013. The annual increase from $0.90 to $0.96 is 6.7%. This would suggest that dividend growth will be at the higher end of my estimate of 3.0-7.7%, but still below the 8% I typically like to see. CIBC has stated that their target payout ratio is 40-50% so I feel like my estimate should be fairly close.

In the past year National Bank increased its quarterly dividend from $0.79 to $0.83 and then again to $0.87. This is a 10.1% annual increase. I expect annual dividend growth at the higher end of my estimated range of 5.6-11.9%. National Bank has the lowest payout ratio of all the banks which also suggests that it has the best ability to grow its dividend. That said National Bank typically likes to keep its payout ratio lower than the other 5 banks. There are a number of good dividend growth candidates among the Canadian banks, but overall I like National Bank’s dividend growth prospects the best.

Bank of Montreal’s target payout ratio of 40-50% is shown on their website, so I feel fairly confident in my dividend growth estimate of 4.9-9.7%. In the past year Bank of Montreal increased their quarterly dividend from $0.70 to $0.72 and then again to $0.74. This is an annual increase of 5.7%. Prior to these two increases the dividend was held steady for a number of years with the previous increase recorded with the November 2007 dividend when it was increased from $0.68 to $0.70. Bank of Montreal was the slowest of the big six banks to recover from the financial crisis and begin dividend increases again. While the dividend increases appear to have started again, it is not at the 8% or above rate I like to see. With its most recent increases it looks like the dividend increases will be in the middle of my dividend growth estimates.

From a dividend growth perspective National Bank, Bank of Nova Scotia and TD Bank show the most promise. I think Royal Bank offers appealing fundamentals too, but prefer the previous three banks just mentioned. I think CIBC and Bank of Montreal will offer lower annual dividend growth below my target of 8% or more, so for the time being I don’t think I’d invest in CIBC or Bank of Montreal. Now that I’ve reviewed the dividend fundamentals lets take a look at valuation.

All the banks seem to be trading fairly close to their 5 year yield averages, which normally suggests a fair value. The 5 year period includes a time when bank stock prices were very low due to the global financial crisis, so the 5 year average yield could also indicate a slight undervaluation. If we look at the current price compared to Morningstar’s fair value it looks like most of the banks are undervalued by around 10%, with the exception of Royal Bank of Canada and Bank of Montreal. Bank of Montreal appears to be fairly valued and Royal Bank of Canada looks a little overvalued.

Bank prices have come down a bit recently, but I’d need prices to drop another 10-20% before they fell below my target prices. I’d be interested in investing in Bank of Nova Scotia, Royal Bank of Canada, Toronto-Dominion Bank and National Bank should they fall below my target price. Bank of Montreal and CIBC don’t offer the dividend growth I’m looking for so I don’t plan on investing in these banks for the time being.

Conclusion

Like all banks, Bank of Nova Scotia was hit hard by the global financial crisis, but it looks to be getting back to its old self. This is good news for dividend growth investors. Right now Bank of Nova Scotia is a little above my target price, but should it come down to $51 I’d consider investing more into Bank of Nova Scotia. I expect future dividend growth of 8 to 10%. This coupled with a good entry yield above 4% makes it an enticing investment option. There are other banks that offer similarly enticing dividend fundamentals so it might just be a matter of waiting for the first one to fall below my target price. Should this happen I’d consider investing in National Bank, Bank of Nova Scotia, Toronto-Dominion Bank, or Royal Bank of Canada.

In part 3 of the Great Canadian Banking Series I’ll be reviewing Toronoto-Dominion Bank.

Disclaimer

I own shares of Bank of Nova Scotia and Royal Bank of Canada. You can see my portfolio here. I also own a small amount of shares of Bank of Montreal, and Canadian Imperial Bank of Canada that were left over from my DRIP selling days. I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Geez, great details. How long did this post take you? 🙂

Well done.

Mark

It took me a few days, working on it here and there. Definitely one of my loner posts.

DGI&R

How did you get EPS=7.30? 5.22*(1.0874)^5=7.94

Thanks for pointing that out. I used the wrong template, which was calculating the EPS in 4 years, not 5. I’ve changed the post and revised my estimates with the correct figures. Thanks so much for catching that.

DGI&R

You indicated “The most recent dividend increase happened with the dividend recorded in April 2013 when they increased the quarterly dividend by 5.3% from $0.5700 to $0.6000. Recently they have been increasing their dividend twice a year, so the most recent annual dividend increase would be from $0.55 to $0.60 which is a 9.1% increase.”

Confusing here as you indicated dividend increased from 57 cents to 60 cents then 55 cents to 60 cents??.

I agree it’s a little confusing. Basically what I meant to say is that in the year they increased the dividend twice. The first increase was from $0.55 to $0.57 and then from $0.57 to $0.60. I wrote this article awhile ago, so since then Bank of Nova Scotia has increased their quarterly dividend again to $0.62.

Im interested in 1 stock first, then use the DPP to get additional stocks. Does someone knows where can i get it?

Try the share exchange on the DRIP Investing Resource Center. Read this article for the full details on how to buy a starter share on the share exchange.