Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I’d originally planned to review one of the companies on the Canadian Dividend All-Stars List (a list of Canadian companies that have increased their dividend for five or more consecutive years), but someone asked me about Johnson & Johnson (JNJ), so I decided to start with JNJ. Disclosure: I own this stock.

Johnson & Johnson (JNJ) Dividend Stock Analysis (DSA)

I’ve structured this article in an odd format on purpose. My DSAs can be quite long, so what I’ve done is put the conclusion (Summary) at the beginning and the end so readers can get an idea of what I’ve discovered in my analysis before having to sift through the entire in-depth analysis.

Summary

Johnson & Johnson has been considered a dividend growth star for a number of years now. Their dividend streak of 50 consecutive years with dividend increases is very impressive as only a handful of companies have been able to reach this milestone. While you would’ve had good dividend growth in the past I think these rates will drop. The company’s payout ratio has been increasing over the years and I don’t think they’ll want it to go much higher. If the 5 year estimated EPS growth rate of 6.4% is roughly accurate I think the dividend growth will be 4-6% per year going forward. I’m looking for a dividend growth rate of 8% or more, so this might keep me on the sidelines if there are better opportunities out there. The declining ROE is also a worry as it has dropped to the industry average. Slowing dividend growth and a declining competitive advantage are worries for me, but Johnson & Johnson is considered a core dividend growth holding and it has such an impressive dividend streak that I would still invest in the company. It’s probably not my first choice, but subject to the availability of my funds I’d invest in this company if the price came down to my target of $61.

In-Depth Analysis:

Company Description

Johnson & Johnson is a huge company that operates in three segments: Consumer, Pharmaceutical, and Medical Devices and Diagnostics. They are a well known dividend paying company having increased their dividend for 50 consecutive years. For a full company description check out their website here.

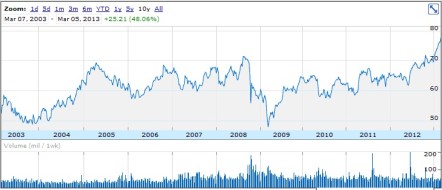

10 Year Stock Chart

Looking at the 10 year stock chart, there is a 10 year annual average return of 4.0%. If we include the dividend payments over the past 10 fiscal years, the total average annual return would be 6.1% with dividend payments representing 2.1%.

When I look at the 10 year stock chart I don’t really see a discernible trend. Mostly the stock has fluctuated between $50 and $70 over the past 10 years.

Revenue and Earnings

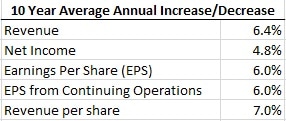

When I invest in dividend growth companies, I am looking for a sustainable dividend growth rate of 8% or more. For the dividend to be sustainable the company also needs to increase earnings by over 8%. I want to see Earnings Per Share (EPS) growth above 8%, but it’s also important to look at revenue per share growth. In cases where the EPS growth has increased more than revenue per share growth the company has become more efficient and found ways to save money or cut costs. While this is a good thing, a company can only become so efficient before it has to rely on genuine revenue growth. Companies can’t cut costs forever. For this reason I also like to see revenue per share growth around 8% or higher.

Next, I look at revenue and net income growth, so that I can get an idea of where the growth is coming from. I like to get an idea if growth on a per share basis is coming from genuine growth or because the company has been buying back shares. For example if a company has reduced the number of shares outstanding EPS growth will be higher than net income growth. I like growth rates on a per share basis and a total basis higher than 8% so I know the company has a good ability to grow.

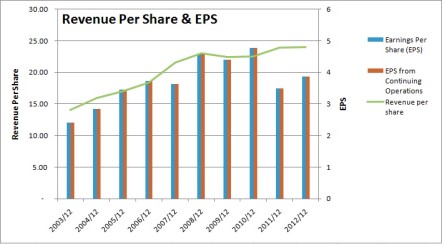

In the case of Johnson & Johnson I get the following growth rates based on the most recent fiscal period end (2012/12).

Johnson & Johnson hasn’t been able to reach my 8% growth targets, but they are close, so it warrants a further look.

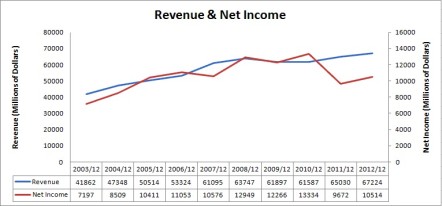

While the revenue and earnings growth rates might not be quite where I want them, the gradual trend upwards is encouraging. I like to invest in companies that have a history of increasing earnings year after year. I like to see revenue and net income steadily increasing over time. I will allow the odd blip, but I don’t like to see erratic earnings. I like companies that make more and more money over time, and do not have losses. I’d say Johnson & Johnson fits the bill.

When I look at the EPS trend below it’s a bit more erratic. The trend is good until we get to 2010 and then EPS drops. Johnson & Johnson has been having a bit of difficulty over the past few years and it shows. It looks like revenue increased over this period, so I’m hopeful that EPS will increase as they become more efficient.

Dividends

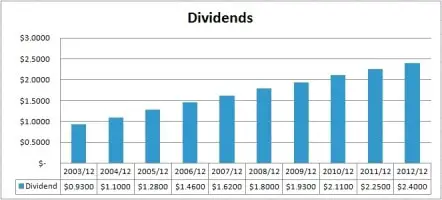

A quick look at the US Dividend Champions list tells me that Johnson & Johnson has increased their dividend for 50 consecutive calendar years in a row. This is a very impressive streak and also why Johnson & Johnson is considered a favorite stock among dividend growth investors. The dividends for the past 10 fiscal years are shown below.

The most recent quarterly dividend increase happened when the June 2012 dividend was paid. It increased by 7.0% from $0.57 to $0.61.

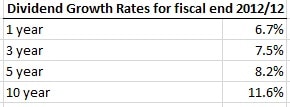

I am generally looking for growth rates of 8% or more. Past dividend growth rates cannot always be relied upon to estimate future dividend growth rates, but they are usually a good indicator. If a company has strong dividend growth history and earnings are growing, I generally expect dividend growth rates under 8% to remain around the same. Rates over 8% I expect to come down over time. Both the 5 and 10 year dividend growth rates are above 8%, but it looks like dividend growth rates have been declining in recent years.

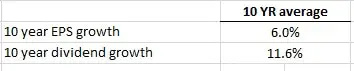

I like to compare the EPS growth over the past 10 years to the 10 year growth rate to see if dividends have been growing faster than earnings. If the dividend has been growing faster than earnings, I would expect dividend growth to slow in future years. A dividend growth rate consistently above EPS growth is unsustainable. If dividend growth is higher than earnings, I want to see a lower payout ratio so that the dividend is sustainable.

The ten year dividend growth rate is almost double that of the EPS growth. This is not a sustainable trend and I’d expect dividend growth to be lower than the 10 year dividend growth rate going forward.

Dividend Sustainability

When looking at the sustainability of dividends, I like to focus on two areas: the payout ratio and estimated future earnings.

1. Payout Ratio

The payout ratio is calculated as dividends per share divided by EPS. The idea is to have a company pay for its dividend with the earnings it brings in and still have some left over for growth. I like to see a payout ratio of less than 60% as this allows for some future dividend growth, while still allowing the company to use some of its earnings to fund company growth. For utilities and telecoms I’ll allow a slightly higher ratio.

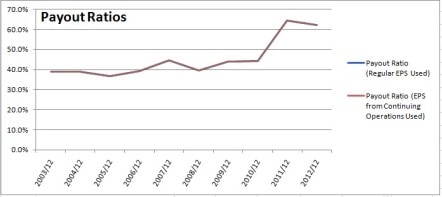

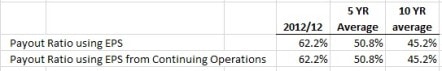

The payout ratio has been increasing over the past 10 years and this doesn’t surprise me as we saw that the dividend growth rate was almost double the EPS growth. The payout ratio is currently above the 5 and 10 year averages, which suggest future dividend growth will slow. So far everything I’ve seen points to slowing dividend growth.

2. Estimated Future Earnings

It’s important to look to the future as well as to the past. I’m generally looking for companies with an 8% dividend growth rate. In order for a company to sustain this level of dividend growth I want to see that their estimated earnings are above 8%. It’s best to take these estimates with a grain of salt as a lot can happen in 5 years, and the further away the estimate the less accurate it gets.

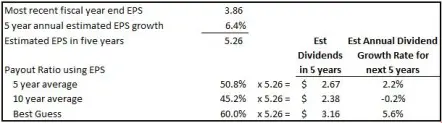

Another quick look at the US Dividend Champions List tells me that their estimated 5 year annual EPS growth is 6.4%. Using this growth rate I run the numbers to see if I can come up an estimated dividend growth rate.

As you can see, the 5 and 10 year payout ratio averages point to low dividend growth. In fact, using the 10 year payout ratio average leads to negative dividend growth. Johnson & Johnson has been paying out increasing dividends for 50 years, and I expect this trend to continue, so I don’t think a negative growth rate is a realistic. I don’t think Johnson & Johnson would consider a dividend cut unless its payout ratio was over 100%. I think a more realistic payout ratio for Johnson & Johnson going forward will be 60% and this would suggest a 5.6% annual dividend increase for the next five years.

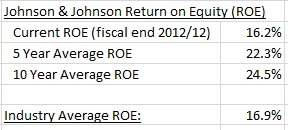

Competitive Advantage & Return on Equity (ROE)

I like to invest in companies with a sustainable competitive advantage. These companies can earn more money and generally do better than their competitors. I like to use ROE to help determine the competitive advantage of a company compared to its peers. ROE measures a company’s profitability by revealing how much profit a company generates with the money shareholders have invested. The ROE will vary widely from industry to industry, but by comparing a company’s ROE to the industry ROE you can get an idea if the company has a competitive advantage that allows it to perform more efficiently than its competitors.

Generally I’ll look at companies with a ROE higher than 12%, but I prefer it to be around 20% or higher. Depending on the industry I’ll occasionally stray beyond my guidelines. Rather than pick a specific ROE number to target, focus on a ROE higher than the industry average. It’s also important to see a stable ROE over time without any big spikes down. I like to see a stable or growing ROE that is above the industry average. This type of trend shows me the company has been able to consistently perform more efficiently than its competitors. This suggests a competitive advantage.

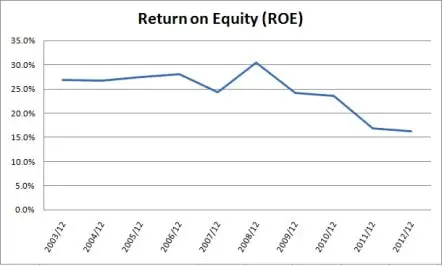

Return on Equity has been decreasing over the past few years and it’s not a trend I like to see. Johnson & Johnson has a number of well recognized brands under its belt (CLEAN & CLEAR, NEUTROGENA, RoC, LUBRIDERM, DABAO, VENDÔME, LISTERINE, REMBRANDT, REACH, BAND-AID, NEOSPORIN, CAREFREE, STAYFREE, SPLENDA, TYLENOL, SUDAFED, ZYRTEC) , which I would consider a competitive advantage. One thing to note is that most of their well known brands are in their consumer segment, but this is just one of three business segments. If we look at the industry average for ROE we can see that Johnson & Johnson has come down just below the industry average of 16.9%. (The industry average ROE is for the Drug Manufacturers – Major industry and was taken from Yahoo! Finance)

The 5 and 10 year averages are more compelling, but ROE has still been below 20% for the past two years, which is where I’d like to see it get back above.

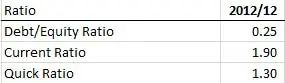

Debt & Liquidity

I want to invest in companies that are fiscally responsible, so it is important to look at debt levels and see that they are at reasonable levels.

I like to see a Debt/Equity ratio below 1, and a current ratio and quick ratio above 1. Johnson & Johnson’s debt levels look fine and these ratios are where I’d expect them to be.

Shares Outstanding

I don’t place too much importance on share buybacks in my analysis. Given the choice I’d rather have a company increase its dividend versus buying back shares, but often the companies I look at are doing both. A decreasing number of shares outstanding is a good thing, but I like to see smart share buyback programs. That is I like to see a company buying back its shares when they are priced low, rather than just buying back for the sake of buying back.

Looking at the chart, we can see that shares outstanding had generally been decreasing until 2012 when they jumped up.

Valuation

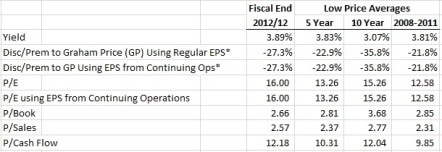

There is a misconception out there that dividend investors only care about the dividend and don’t worry about the stock price. I can’t speak for everyone, but this certainly isn’t the case for me. I believe it’s important to purchase stocks at a reasonable to cheap price. This helps preserve your capital and will generally result in better returns. Rather than rely on just one method I like to use a variety of different methods. Using this approach allows me better identify reasonable targets. I find that one measure could point to a cheap price, but another measure may not. For instance the P/E may point to a cheap price, but the P/Book may point to an expensive stock. By using a variety of different test you get a better idea if something is truly value priced.

I use the lowest price for the fiscal years to determine the 5 year, 10 year and 2008-2011 averages. Investors commonly use 5 and 10 year averages, but I like to include the fiscal 2008 to 2011 low price average, as I feel that the low prices during this era represent a reasonably low stock price. During 2008 and 2009 most companies experienced a really low price due to the Global Financial Crisis followed by increases in 2010 and 2011.

I use 6 main ratios to determine a fair price: Yield, Discount/Premium of the low price compared to the Graham Price, P/E, P/B, P/Sales and P/Cash flow. I like to look at both EPS and EPS from continuing operations so it ends up being a total of 8 ratios as the Graham Price an P/E both use EPS.

I get the following for Johnson & Johnson.

* Calculation Notes: I compare the low price to the calculated Graham Price (GP) to determine the discount or premium to GP. I calculate the GP using the square root of (22.5 x Book Value x EPS). For EPS in this formula I use the lesser of the 3 year EPS average or the current EPS. If the GP calculated is negative then I set the Discount/Premium to GP as -25%. The other ratios are calculated in the normal fashion.

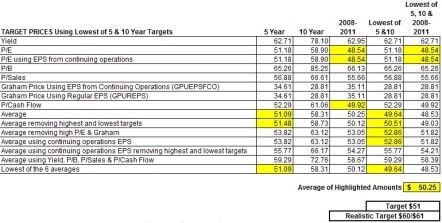

The majority of my valuation methods use historical averages, so it is important that you expect the company to continue to operate in a similar manner to its past. If you expect the company to change, these valuations become less useful.

Now that I have these different averages, I can use them to determine a target price. Using these averages will create a lot of different target prices, so I like to compare this strategy to previous years. Ideally what I’m looking for is a strategy that would have given me a chance to buy the stock in two to three fiscal years in the past 10 fiscal years. It’s not always possible to test my strategy back 10 years, due to limited financial information, but I do my best.

In the below table I was able to highlight the target prices from strategies that would have given you a target price above the low price in 2 – 3 of the past 10 fiscal years. I’ve used the average of these to determine the target price.

I would say that this strategy is quite conservative and as a result I don’t buy stocks very often. I’m usually waiting around for a few months before I’m able to buy something. This is fine by me as I’m young, so I’ve got the time and it pays to be patient. Sometimes my target price is too conservative, so much so, that occasionally I have to revise my target up. I like to use the yield as a way to gauge if my targets are realistic or not. For instance if my target price would result in a dividend yield that has never been paid by the company, then odds are the price isn’t going to come down that low. In these cases I adjust my target to a more realistic value. In rare instances I’ll adjust my target down further.

Johnson & Johnson’s current quarterly dividend is $0.61. Using the $51 target price this would result in a yield of 4.78%. In the past 10 fiscal years the highest yield has been roughly 4.2%. This suggests my target price is unreasonable, so I’ve adjusted it to a more realistic $61. This target price would result in a yield of 4.0%.

Before I buy a stock I like to look at Morningstar’s 5 star rating as a quick way of seeing what others think of the stock. If a stock has a 4 or 5 star rating then they consider the stock to be trading at discount to fair value. A 1 or 2 star rating indicates a premium to fair value and a 3 out of 5 rating suggests the price is close to fair value.

Morningstar currently rates JNJ 4 out of 5 stars.

Conclusion

Johnson & Johnson has been considered a dividend growth star for a number of years now. Their dividend streak of 50 consecutive years with dividend increases is very impressive as only a handful of companies have been able to reach this milestone. While you would’ve had good dividend growth in the past I think these rates will drop. The company’s payout ratio has been increasing over the years and I don’t think they’ll want it to go much higher. If the 5 year estimated EPS growth rate of 6.4% is roughly accurate I think the dividend growth will be around 6% per year going forward. I’m looking for a dividend growth rate of 8% or more, so this might keep me on the sidelines if there are better opportunities out there. The declining ROE is also a worry as it has dropped to the industry average.

Slowing dividend growth and a declining competitive advantage are worries for me, but Johnson & Johnson is considered a core dividend growth holding and it has such an impressive dividend streak that I would still invest in the company. It’s probably not my first choice, but subject to the availability of my funds I’d invest in this company if the price came down to my target of $61.

Disclaimer:

I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!