Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“you donʼt have to be a professor of finance to know that if a company increases its dividend, management is saying good things about the future. It would be foolish indeed to raise the dividend if the company couldnʼt afford it, perhaps sufficiently foolish to open the company and management to shareholder lawsuits.”

Source: The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (AL. I personally own and highly recommend this book.)

This month there were 14 dividend increases with the largest coming from Onex Corp (TSE:ONEX) at 14.3%.

May 2019 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Onex Corp (TSE:ONEX) – 14.3% Dividend Increase

- Algonquin Power & Utilities Corp. (TSE:AQN) – 10.0% Dividend Increase

- Industrial Alliance (TSE:IAG) – 8.4% Dividend Increase (2nd increase in the past year)

- Pembina Pipeline (TSE:PPL) – 5.3% Dividend Increase

- National Bank of Canada (TSE:NA) – 4.6% Dividend Increase (2nd increase in the past year)

- Domtar (TSE:UFS) – 4.6% Dividend Increase

- Franco-Nevada Corp (TSE:FNV) – 4.2% Dividend Increase

- Cineplex Inc. (TSE:CGX) – 3.4% Dividend Increase

- Equitable Group Inc (TSE:EQB) – 3.3% Dividend Increase (3rd increase in the past year)

- TELUS Corp. (TSE:T) – 3.2% Dividend Increase (2nd increase in the past year)

- Bank of Montreal (TSE:BMO) – 3.0% Dividend Increase (2nd increase in the past year)

- Finning International (TSE:FTT) – 2.5% Dividend Increase

- George Weston Ltd (TSE:WN) – 1.9% Dividend Increase (2nd increase in the past year)

- Laurentian Bank of Canada (TSE:LB) – 1.5% Dividend Increase (2nd increase in the past year)

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it is the most popular resource of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

1. Onex Corp (TSE:ONEX) – 14.3% Dividend Increase

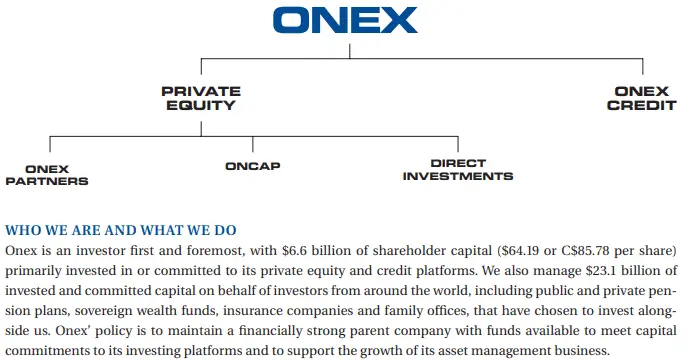

Onex is a private equity firm with offices in Toronto, New York, New Jersey and London. They make their money by investing their own capital and collecting management fees from their investors. Their investors include public and private pension funds, sovereign wealth funds, banks, insurance companies and family offices.

Onex has been on a bit of a buying streak recently. In March 2019, Onex entered into an agreement to acquire Gluskin Sheff for $445 million, and then in May, they announced that they were planning to buy WestJet for approximately $5 billion including assumed debt.

Source: ONEX Q1 2019 Interim Report

Onex Dividends

Onex Corp which has a dividend streak of 6 years recently increased their quarterly dividend 14.3% from $0.0875 CAD to $0.1000 CAD. This dividend increase comes into effect with the dividend recorded on July 10, 2019.

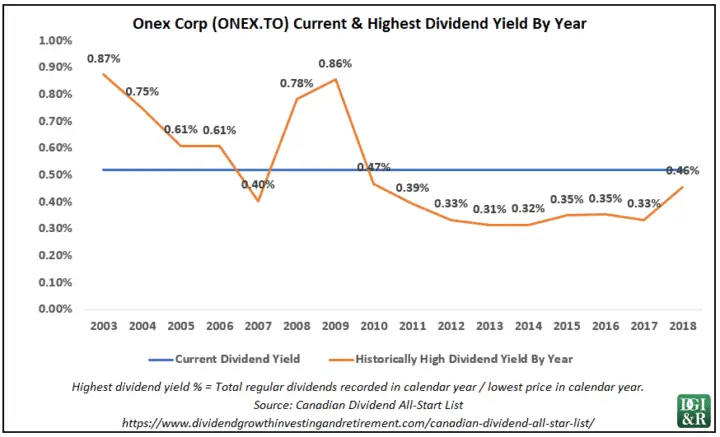

The dividend yield as of May 31, 2019, was 0.5%, and they have 5 and 10-year average annual dividend growth rates of 20.1% and 11.4% respectively.

Onex Highest Dividend Yield By Year

Onex typically has a very low dividend yield (<1%) which is why the company isn’t really on my radar.

Onex Final Thoughts

The Westjet acquisition by Onex has everyone talking right now, but ultimately the dividend yield is just too low to get me excited.

Yes, they have strong dividend growth, but when you are starting with a yield of less than 1% it’s not worth it. I’m typically looking for a company that has a yield of around 4% or more, so Onex isn’t even close.

Yes, I’ll make exceptions, but it will be very rare that I’ll go below 2.5% yield. My dividend growth strategy involves a decent starting yield with good dividend growth that over time compounds into meaningful returns.

[Back to Table of Contents] [Jump to Summary]

2. Algonquin Power & Utilities Corp. (TSE:AQN; NYSE:AQN) – 10.0% Dividend Increase

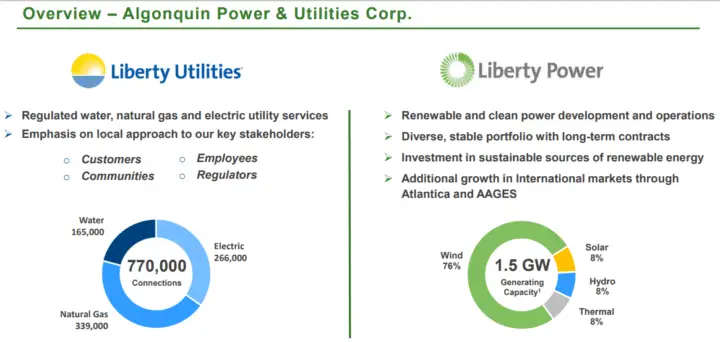

Algonquin Power & Utilities Corp. is a North American renewable energy and regulated utility company that operates green and clean energy assets including hydroelectric, wind, thermal, and solar power facilities, as well as sustainable utility distribution businesses (water, electricity and natural gas) through its two operating subsidiaries: Liberty Power and Liberty Utilities.

Source: May 2019 Investor Presentation

Algonquin Power & Utilities Corp. Dividends

Algonquin Power & Utilities Corp. which has a dividend streak of 8 years recently increased their quarterly dividend 10.0% from $0.1282 USD to $0.1410 USD. This dividend increase comes into effect with the dividend recorded on Jun 28, 2019.

The dividend yield as of May 31, 2019, was 4.8%, and they have 5 and 10-year average annual dividend growth rates of 8.5% and -3.9% respectively.

The negative 10-year average annual dividend growth was caused by a dividend cut in Algonquin’s history that was partially caused by the conversion from an income trust to a corporation.

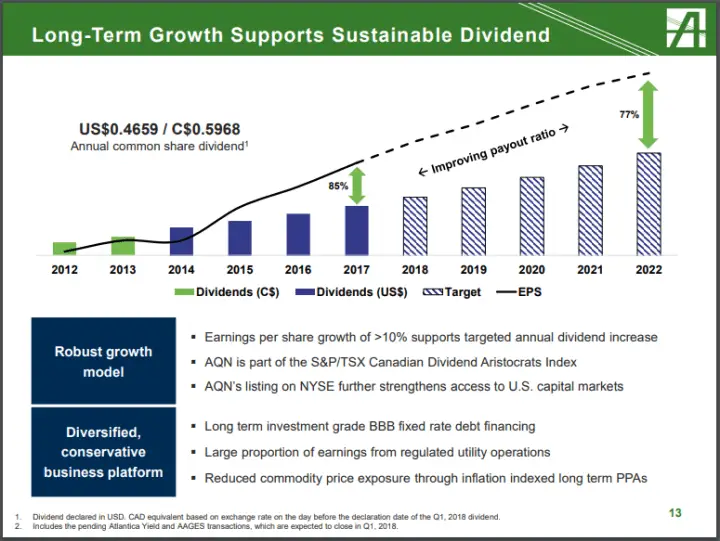

Algonquin Power & Utilities Corp. Dividend Policy

They have a dividend policy in place that calls for an impressive 10% annual dividend growth until 2022, just be wary of the high payout ratio. The slide below is a little more than a year old, but you can see that the strategy is to grow the dividend by 10% and grow earnings by more than 10% to reduce the high payout ratio.

Source: March 2018 Investor Presentation

For the fiscal year 2019 analysts are estimating EPS of $0.627 USD. With the dividends for 2019 expected to be $0.5512 USD (0.1282 + 0.1410 + 0.1410 + 0.1410) the payout ratio is around 88% which is high even for a utility.

Normally I like to see a payout ratio of less than 60%, but for utilities, I’m OK with 70% or less.

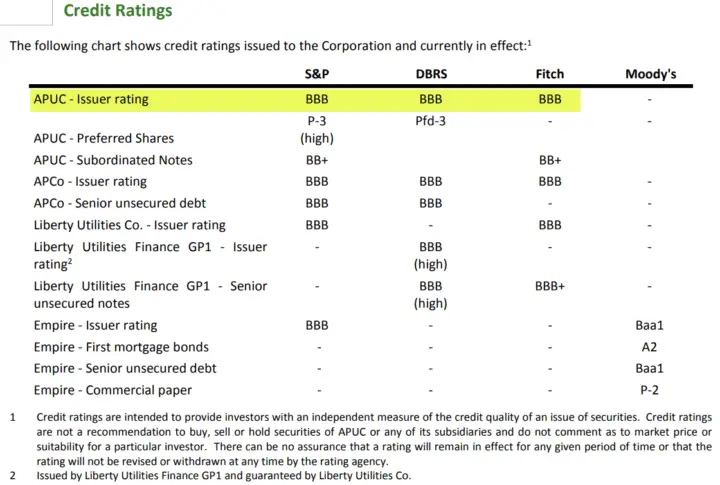

Algonquin Power & Utilities Corp. Financial Strength

Algonquin’s financial strength is OK as S&P, Fitch, and DBRS all a give credit rating of BBB to Algonquin. For a utility company, this is the lowest I’ll go. For non-utilities, I typically look for BBB+ or higher.

Source: 2018 Annual Information Form

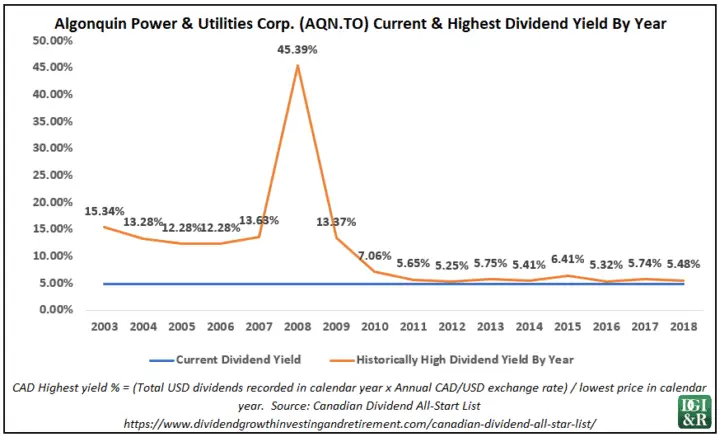

Algonquin Power & Utilities Corp. Historically High Dividend Yields

The current yield of 4.8% is below historic highs, so if you are interested in the stock it might be worth waiting for a better entry point, say around the 5.5% level.

The really high dividend yield in 2008 is skewed by a dividend cut in the year that was partially caused by the conversion from an income trust to a corporation.

Total dividends of $0.7494 ($0.0766 x 9 + $0.02 x 3) were recorded in the year, but near the end of the year, they cut the monthly dividend 74% from $0.0766 to $0.02.

When you re-calculate the dividend yield based on the cut dividend of $0.02 per month, the high yield for 2008 is actually around 13.6% ($0.02 monthly dividend x 12 / $1.76 2018 low stock price).

Algonquin Power & Utilities Corp. Final Thoughts

If Algonquin is able to achieve its goal of >10% earnings growth then it is likely fine, but a high payout ratio makes it a riskier bet for long-term high dividend growth. Either the payout ratio based on earnings needs to improve or some more work looking into the cash flow payout ratio and free cash flow situation should be done to make sure you are OK with the higher payout.

[Back to Table of Contents] [Jump to Summary]

3. iA Financial Group (formerly Industrial Alliance) (TSE:IAG) – 8.4% Dividend Increase (2nd increase in the past year)

iA Financial Group, formerly Industrial Alliance, is a life and health insurance company.

Source: 2018 Annual Report

iA Financial Group Dividends

iA Financial Group which has a dividend streak of 5 years recently increased their quarterly dividend 8.4% from $0.4150 CAD to $0.4500 CAD. This dividend increase comes into effect with the dividend recorded on May 24, 2019.

This was the 2nd increase in a year. Between the two dividend increases, it would have been an 18.4% increase ($0.38 quarterly dividend to $0.4150 and then most recently to $0.4500).

The dividend yield as of May 31, 2019, was 3.5%, and they have 5 and 10-year average annual dividend growth rates of 10.2% and 5.4% respectively.

iA Financial Group Dividend Policy & Target Payout Ratio

“According to the Corporation’s dividend policy, the dividend payout rate to common shareholders is between 25% and 35% of sustainable recurring profits, i.e., profits arising from the Corporation’s regular operations. Profits arising from regular operations exclude, among other things, substantial gains or losses realized on the acquisition or disposition of blocks of business, or relating to other events that management considers unlikely to occur regularly.”

Source: 2018 Annual Information Form

For the fiscal year 2019, analysts are estimating EPS of roughly $6. This puts the current payout ratio around the midpoint of their 25% to 35% target. This is a healthy, if not low payout ratio.

Source: 2018 Annual Report

If they meet their 10% or more earnings growth goals then I’d expect dividend growth to be similar to earnings growth as their current payout ratio of around 30% is at the midpoint of their target ratio and also generally fairly low.

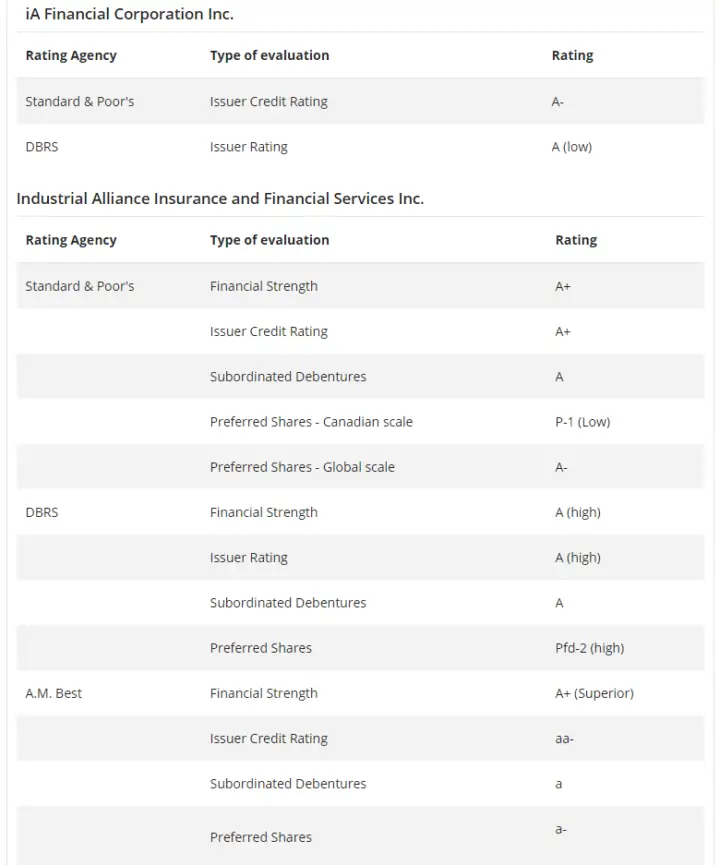

iA Financial Group Financial Strength

iA’s financial strength is good with A- and A (low) credit ratings from S&P and DBRS.

Source: Investor Relations Website

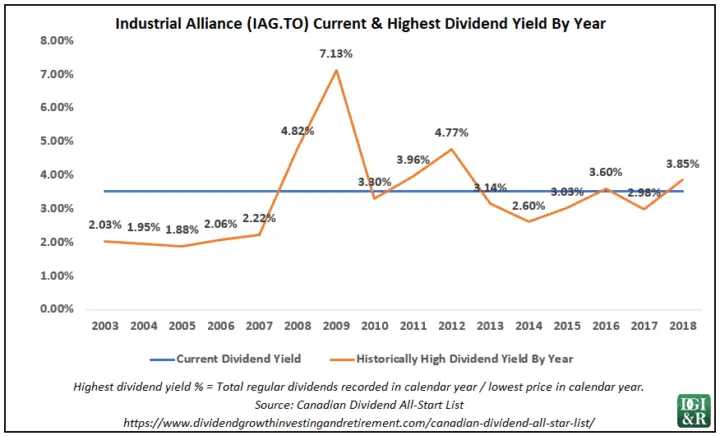

iA Financial Group Historically High Dividend Yields

The current dividend yield of 3.5% seems reasonably high looking at the past 15 years. Yes, it was higher during the global financial crisis (2008/2009), but this is the case with most companies. 3.5% or higher seems like a reasonably high yield for the company.

iA Financial Group Final Thoughts

iA Financial Group has good credit ratings, a low payout ratio, and good recent dividend growth. If iA can meet their ambitious +10% earnings growth, I’d expect similar strong dividend growth of around 10% per year for the medium term.

The dividend streak at 5 years is on the low side, but they didn’t cut their dividend during the financial crisis.

The dividend yield is OK at 3.5%, but I typically like to try for 4% or above. When you consider that you can usually find some good Canadian financials (ie. The big Canadian banks) with dividend yields above 4% with decent dividend growth prospects this might not be people’s first choice in the financial industry, but it seems decent enough.

Overall, I think the company warrants some more research as it isn’t one that has really been on my radar. What’s your take on the company?

[Back to Table of Contents] [Jump to Summary]

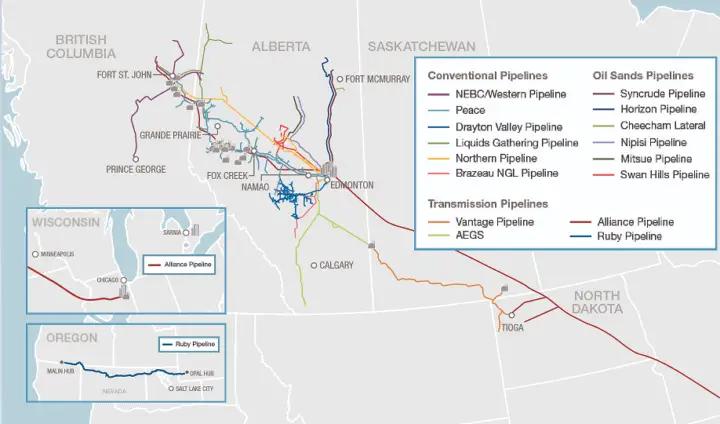

4. Pembina Pipeline (TSE:PPL; NYSE:PBA) – 5.3% Dividend Increase

Based in Calgary, Alberta, Pembina Pipeline Corporation is an energy infrastructure company that owns an integrated system of pipelines that transport various hydrocarbon liquids and natural gas products produced primarily in western Canada. They also own gas gathering and processing facilities and an oil and natural gas liquids infrastructure and logistics business.

Pembina Pipeline Dividends

Pembina Pipeline which has a dividend streak of 7 years recently increased their monthly dividend 5.3% from $0.1900 CAD to $0.2000 CAD. This dividend increase comes into effect with the dividend recorded on May 24, 2019.

The dividend yield as of May 31, 2019, was 5.0%, and they have 5 and 10-year average annual dividend growth rates of 6.4% and 4.2% respectively.

The payout ratio based on earnings is high. Analysts are expecting EPS of $2.44 over the next 12 months with dividends of $2.40 (12 x the new monthly dividend of $0.20). This means that almost all (98%) earnings are being paid out in dividends.

Normally I like a company to have a 60% EPS payout ratio or lower, for utilities I’ll go up to 70%.

You could make the argument that Pembina acts similar to a utility as most of their earnings are fairly reliable, but they still have a high payout ratio.

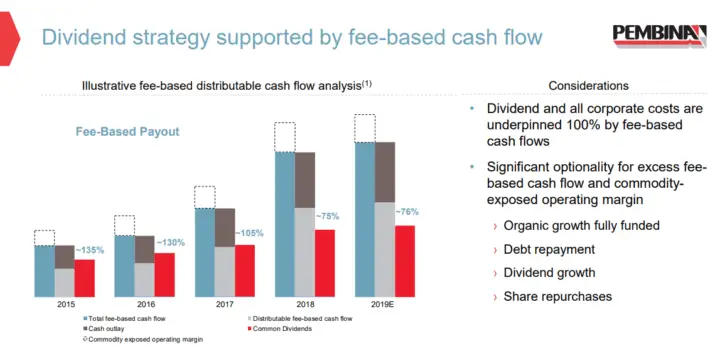

Instead of a payout ratio based on earnings, Pembina’s use what they call fee-based distributable cash flow. In 2019 they are expecting the dividend to be ~76% of fee-based distributable cash flow.

Source: Pembina Pipeline May 2019 Corporate Update Presentation

By using fee-based distributable cash flow they are using a less conservative method than EPS which is why I think this is a high payout ratio.

You can still have a high payout ratio and have dividend growth, but it’s a riskier investment. In these high payout ratio scenarios, I want to see strong financial strength before investing.

Overall, I’m still expecting Pembina to continue increasing their dividend, but I just consider it riskier dividend growth.

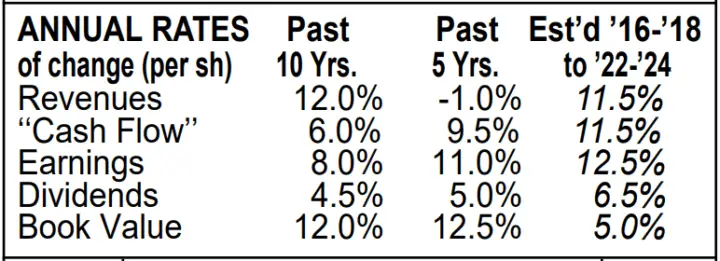

Value Line is estimating 6.5% annual dividend growth over the next 3-5 years and 12.5% earnings growth.

Source: May 31, 2019 Value Line Report

Pembina Pipeline Financial Strength & Valuation

Value Line gives Pembina a “B++” rating for financial strength and they have BBB credit ratings from DBRS and S&P which are below the BBB+ or equivalent I typically like to see.

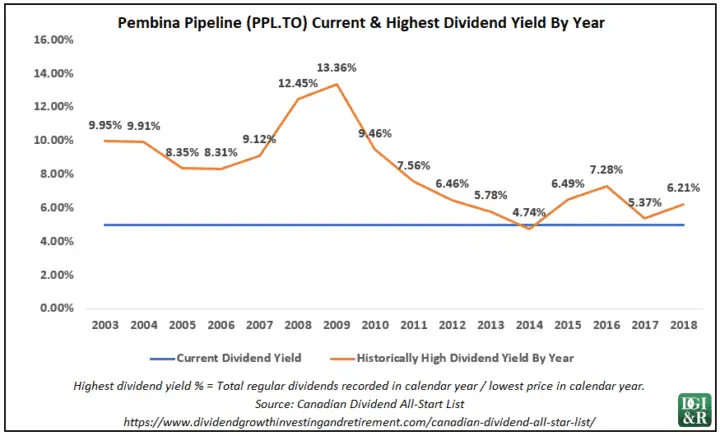

Normally I’d consider Pembina’s current dividend yield of 5% moderately high for a company, but looking over the past 15 years it looks like there were a lot of opportunities to get in at a higher yield than current levels.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around the fair value estimate of $45 CAD. Morningstar’s five-star price for Pembina Pipeline is $28.20.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Pembina Pipeline Final Thoughts

Pembina is not a company I’m currently interested in for two main reasons:

- They have a high payout ratio, and

- Their credit ratings are one notch below the BBB+ I typically like to see.

[Back to Table of Contents] [Jump to Summary]

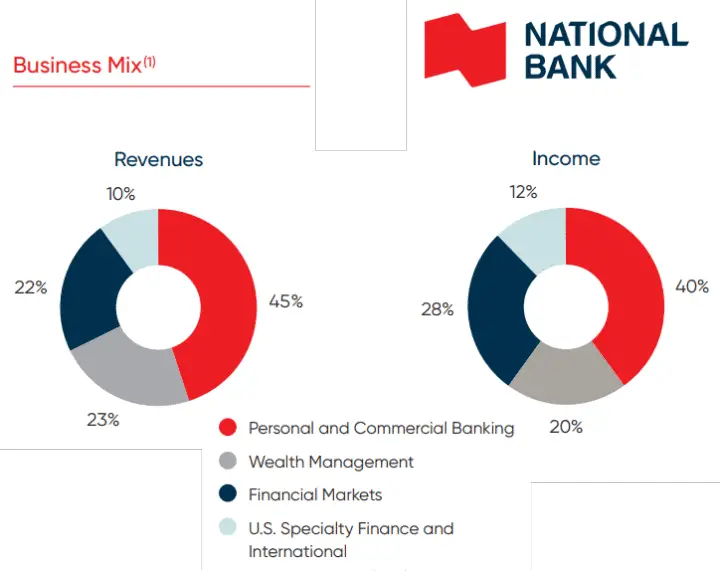

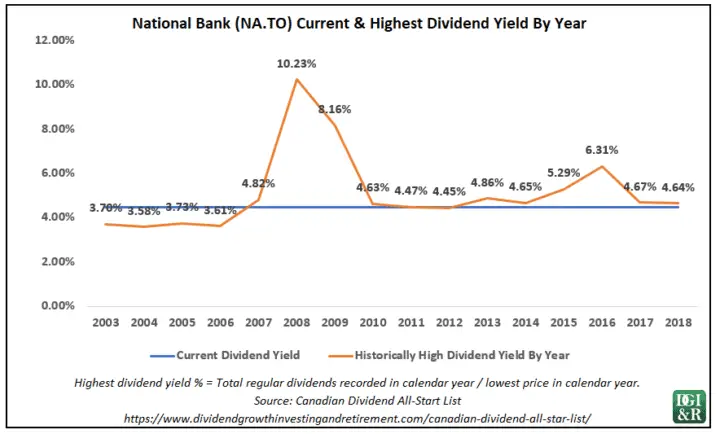

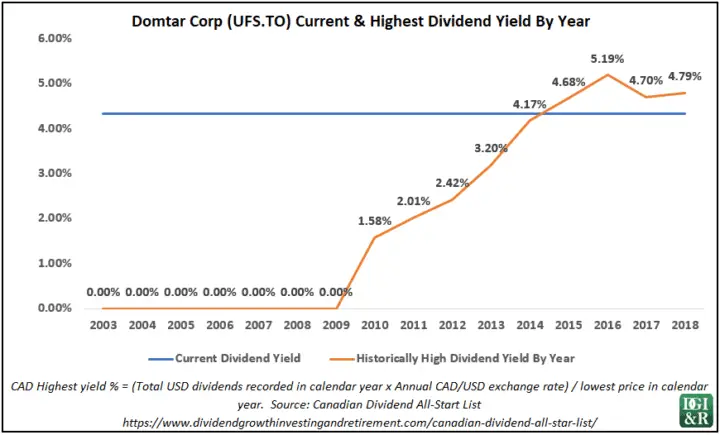

5. National Bank of Canada (TSE:NA) – 4.6% Dividend Increase (2nd increase in the past year)

Usually, when investors think of Canadian banks they think of the “Big 5”, but with a history dating back to 1860, the #6 bank in Canada is worth your consideration too.

National Bank is the leading bank in Quebec and has branches in almost every province in Canada as well as numerous representative offices, subsidiaries and partnerships, through which it can serve clients in the United States, Europe and other parts of the world.

They provide a range of financial services that include: banking and investment solutions for individuals and businesses as well as securities brokerage, insurance and wealth management services.

Source: 2019 Q2 Investor Fact Sheet

National Bank of Canada Dividends

National Bank which has a dividend streak of 9 years recently increased its quarterly dividend 4.6% from $0.6500 CAD to $0.6800 CAD. This dividend increase comes into effect with the dividend recorded on Jun 25, 2019.

National Bank of Canada has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 9.7% ($0.62 quarterly dividend to $0.65 and then most recently to $0.68).

The dividend yield as of May 31, 2019, was 4.5%, and they have 5 and 10-year average annual dividend growth rates of 7.4% and 7.2% respectively.

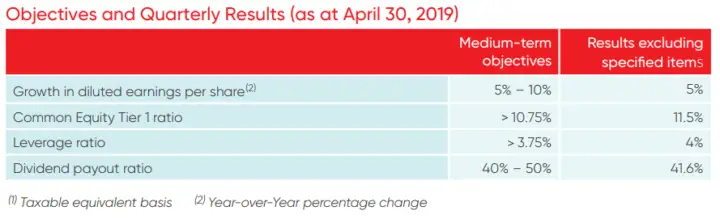

National Bank Dividend Policy & Future Dividend Growth

National Bank has a medium-term payout ratio target of 40-50%. As of 2019 Q2, they were near the bottom of the range at 41.6%.

Source: 2019 Q2 Investor Fact Sheet

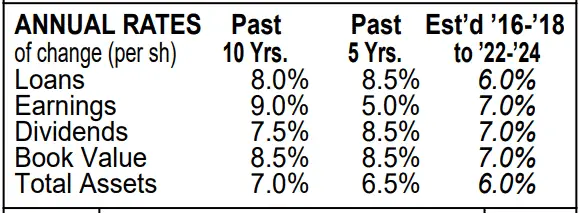

If they meet their EPS growth target of 5% to 10% then I’d expect dividend growth around the same. Value Line is estimating 7.0% annual dividend growth over the next 3-5 years with 7.0% earnings growth.

Source: May 10, 2019 Value Line National Bank of Canada Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

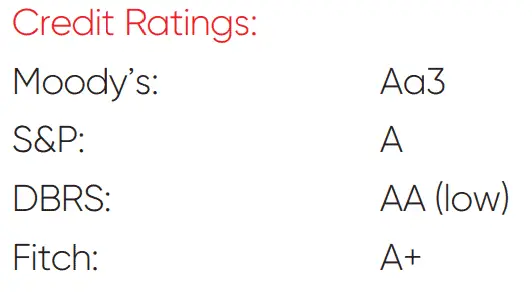

National Bank of Canada Financial Strength & Valuation

Value Line gives National Bank of Canada a “B++” rating for financial strength, and the 4 rating agencies give the bank A or higher credit ratings. The company appears to have good financial strength.

Source: 2019 Q2 Investor Fact Sheet

Using the dividend yield as a valuation tool suggests that they are reasonably priced. If you were looking for better value, you might wait for a higher yield, say a bit closer to 5%.

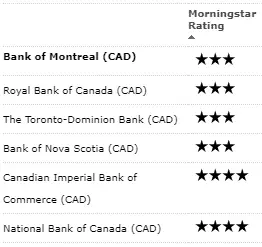

Morningstar rates them a narrow moat stock with a four-star valuation as they are currently trading below their fair value estimate of $70 CAD.

Tip – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research. (I’ve been using Questrade (AL) for years and I consider them the best low-cost broker in Canada)

National Bank Final Thoughts

National Bank has been increasing its dividend twice a year, so the annual dividend increase is actually 9.7%, instead of this most recent 4.6%. Compared to the other big banks, this dividend growth is better than most.

Considering that National Bank’s payout ratio is one of the lowest (low 40%s) among the large Canadian banks, it looks like National Bank is in a good position to keep up this strong dividend growth.

National Bank of Canada offers a good mix of higher yield than some of the other Big Banks and also higher dividend growth. A tempting mix.

That’s not to say the other Big 5 aren’t worth considering, as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects and strong financial strength.

National Bank of Canada yields 4.5%, but you can get a higher starting dividend yield with other narrow moat banks: Bank of Nova Scotia (BNS.TO) 5.1% yield or CIBC (CM.TO) 5.5% yield. Bank of Montreal (BMO.TO); another narrow moat stock, offers a 4.2% yield.

If you want a wide moat stock look at Royal Bank of Canada (RY.TO) 4.0% yield or Toronto Dominion Bank (TD.TO) 4.0% yield.

It all comes down to picking the one or more that suit you best.

Disclosure: I own shares of National Bank of Canada (TSE:NA) and Bank of Nova Scotia (TSE:BNS).

[Back to Table of Contents] [Jump to Summary]

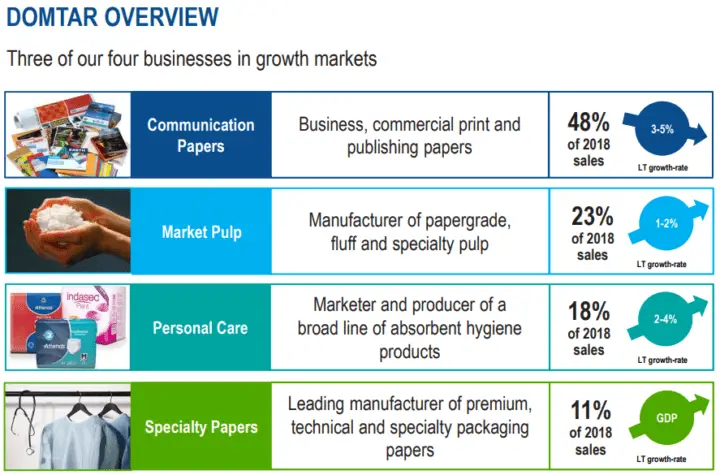

6. Domtar (TSE:UFS; NYSE:UFS) – 4.6% Dividend Increase

Domtar designs, manufactures, markets and distributes a wide variety of pulp, paper and personal care products from copy paper to baby diapers through their two divisions:

- Pulp and Paper Division

Domtar is the largest integrated manufacturer and marketer of uncoated freesheet paper in North America, and one of the largest manufacturers of pulp in the world.

They have 13 pulp and paper mills and 10 paper converting facilities for a total of 3 million tons of papermaking capacity and 1.8 million air-dried metric tons (ADMT) of market pulp capacity annually.

- Personal Care Division

Domtar is a leading manufacturer of high-quality and innovative absorbent hygiene products (diapers, training and youth pants, adult incontinence products including absorbent briefs, protective underwear, pads, washcloths, etc.) with six manufacturing plants that serve customers primarily in North America and Europe.

Source: Bank of America Merrill Lynch Agriculture & Materials Conference Fort Lauderdale, February 27, 2019

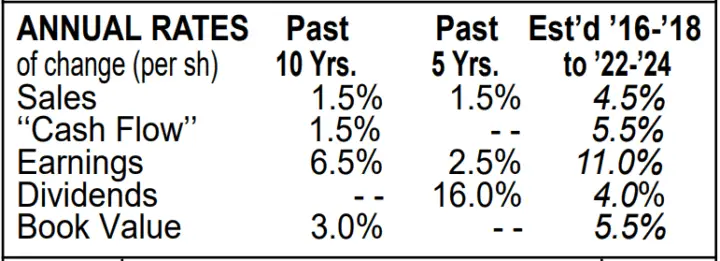

Domtar Dividends

Domtar Corp which has a dividend streak of 9 years recently increased their quarterly dividend 4.6% from $0.4350 USD to $0.4550 USD. This dividend increase comes into effect with the dividend recorded on Jul 02, 2019.

The dividend yield as of May 31, 2019, was 4.3%, and they have a 5-year average annual dividend growth rate of 10.4%.

Value Line is estimating 4% annual dividend growth over the next 3-5 years and 11% earnings growth. Please note that the Value Line report is for the US NYSE listed Domtar, not the Toronto Stock Exchange Domtar.

Source: Domtar (NYSE:UFS) March 22, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Domtar Financial Strength

Value Line gives Domtar a “B++” rating for financial strength and they have a BBB- credit rating from S&P and a Baa3 credit rating from Moody’s. The credit ratings are below the BBB+ or equivalent I typically like to see.

Domtar Historically High Dividend Yields

Domtar first started paying a dividend in 2010. The current yield of 4.3% is below the more recent dividend highs of around 4.7% or higher.

Domtar Final Thoughts

This isn’t a company I’m interested in largely because of the industry they are in. To give you some perspective here are three disturbing quotes from the “OUR COMPETITION” and “RISK FACTORS” sections of Domtar’s 2018 annual report:

-

“The markets in which our businesses operate are highly competitive with well-established domestic and foreign manufacturers. In the paper business, our paper production does not rely on proprietary processes or formulas, except in highly specialized papers or customized products.”

-

“The pulp and paper industry is highly cyclical. Fluctuations in the prices of and the demand for the Company’s pulp and paper products could result in lower sales volumes and smaller profit margins.”

-

“Most of the Company’s paper products are commodities that are widely available from other producers. Because commodity products have few distinguishing qualities from producer to producer, competition for these products is based primarily on price, which is determined by supply relative to demand.”

Source: 2018 Annual Report

It’s hard to have a sustainable advantage in the paper & paper products industry, so it’s not a company that can be relied on for consistent long-term earnings and dividend growth. Yes, by keeping their dividend payout low, companies like Domtar can maintain dividend streaks, but in general companies in the basic materials sector don’t make great long-term dividend growth stocks.

Add to that their credit ratings are below the BBB+ I like to see and Value Line is only estimating 4% dividend growth in the future.

[Back to Table of Contents] [Jump to Summary]

7. Franco-Nevada Corp (TSE:FNV; NYSE:FNV) – 4.2% Dividend Increase

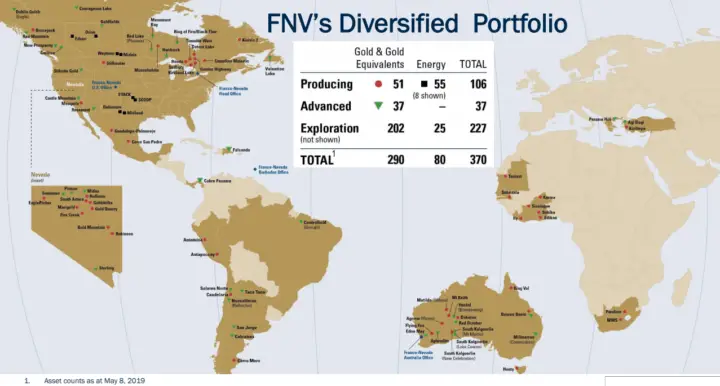

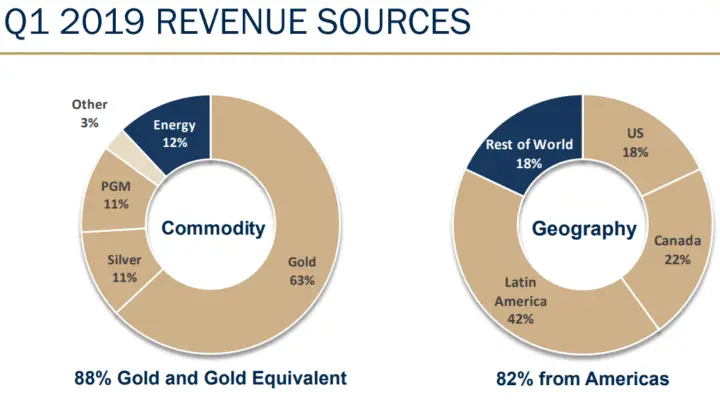

Franco-Nevada is a gold-focused royalty, stream and investment company. They have the largest and most diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project. The portfolio is actively managed with the aim to maintain over 80% of revenue from precious metals: gold, silver & PGM (Platinum). Franco-Nevada does not operate mines, develop projects or conduct exploration. Instead, they focus on managing and growing their portfolio of royalties and streams.

Source: May 2019 Corporate Presentation

Source: May 9, 2019 Q1 2019 Results Conference Call Presentation

Franco-Nevada Dividends

Franco-Nevada Corp which has a dividend streak of 11 years recently increased their quarterly dividend 4.2% from $0.2400 USD to $0.2500 USD. This dividend increase comes into effect with the dividend recorded on Jun 13, 2019.

The dividend yield as of May 31, 2019, was 1.3%, and they have 5 and 10-year average annual dividend growth rates of 5.7% and 14.7% respectively.

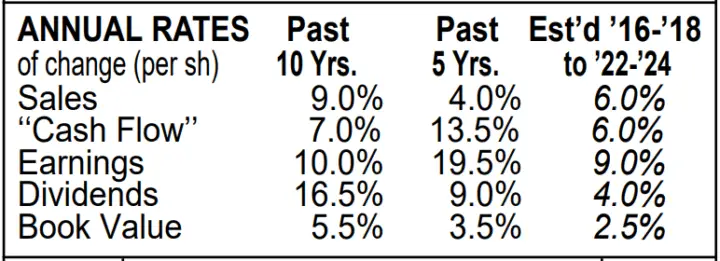

Value Line is estimating 4% annual dividend growth over the next 3-5 years and 9% earnings growth. Please note that the Value Line report is for the US NYSE listed FNV, not the Toronto Stock Exchange FNV.

Source: Franco-Nevada (NYSE:FNV) April 9, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Franco-Nevada Financial Strength

Value Line gives Franco-Nevada an “A” rating for financial strength which is good.

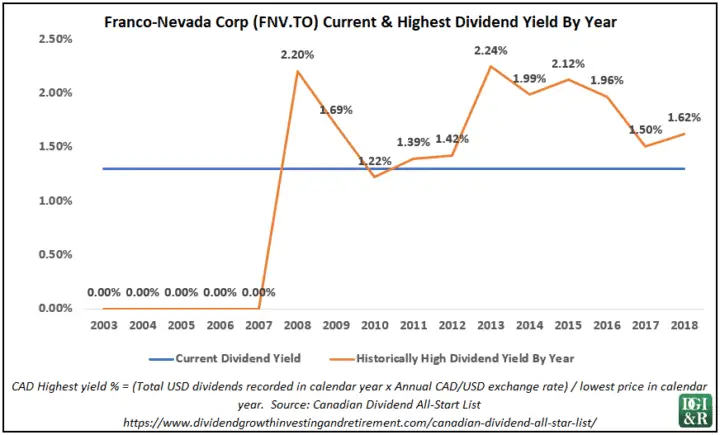

Franco-Nevada Historically High Dividend Yields

Franco-Nevada started paying a dividend in 2008 and since that time the yield has been low. The current yield of 1.3% is below most previous highs, and even if the current yield were closer to its all-time high of around 2.25% it would still be too low for me.

Franco-Nevada Final Thoughts

The yield of 1.3% is just to low for me, so it’s not a stock I’m currently interested in.

To get me interested in low yield companies I need to be enticed by high dividend growth, but Franco-Nevada is not showing that with this recent dividend increase of just 4.2%. Also, Value Line is estimating only 4% future dividend growth.

[Back to Table of Contents] [Jump to Summary]

8. Cineplex Inc. (TSE:CGX) – 3.4% Dividend Increase

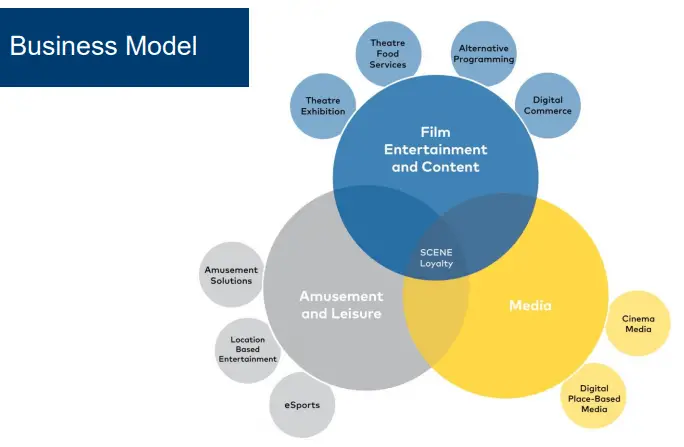

Cineplex is the largest movie theatre operator in Canada. They primarily make their money by selling movie tickets and food in their theatres. They also have a few other revenue sources as you can see from their business model below.

Source: Cineplex Presentation – 2017 Fourth Quarter and Full Year As at December 31, 2017

Cineplex Dividends

Cineplex Inc. which has a dividend streak of 8 years recently increased their monthly dividend 3.4% from $0.1450 CAD to $0.1500 CAD. This dividend increase comes into effect with the dividend recorded on May 31, 2019.

The dividend yield as of May 31, 2019, was 7.7%, and they have 5 and 10-year average annual dividend growth rates of 4.1% and 3.2% respectively.

Cineplex Payout Ratio

With a high dividend yield like Cineplex’s 7.7% a good question to ask is, “Is the dividend safe?”.

The answer … I’m not sure.

The payout ratio based on analyst EPS estimates for the next 12 months is over 200%. Such a high payout ratio coupled with a high yield is a warning sign.

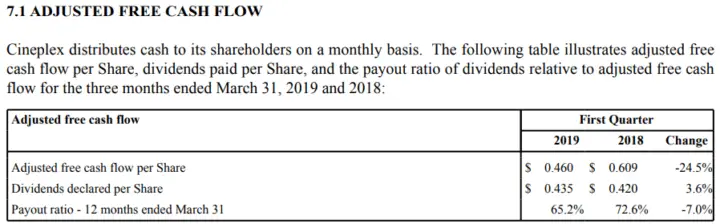

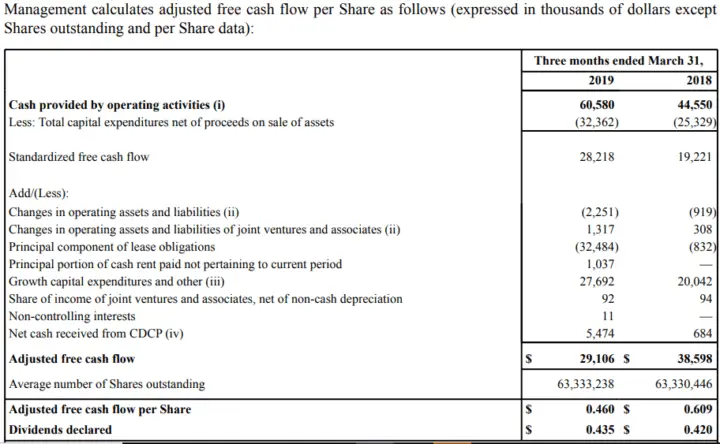

That said, Cineplex has its own target payout ratio of 60% to 85% of what they call adjusted free cash flow per share.

“Cineplex will pay a monthly dividend, subject to the discretion of the Board, at an annualized rate in the range between 60% and 85% of adjusted free cash flow per Share.”

Source: March 29, 2019 Annual Information Form

According to Cineplex, they are currently around 65% of adjusted free cash flow, but this is based on the 12 months ended March 31st and not a forward-looking adjusted free cash flow figure.

Source: Management’s Discussion and Analysis – May 8, 2019

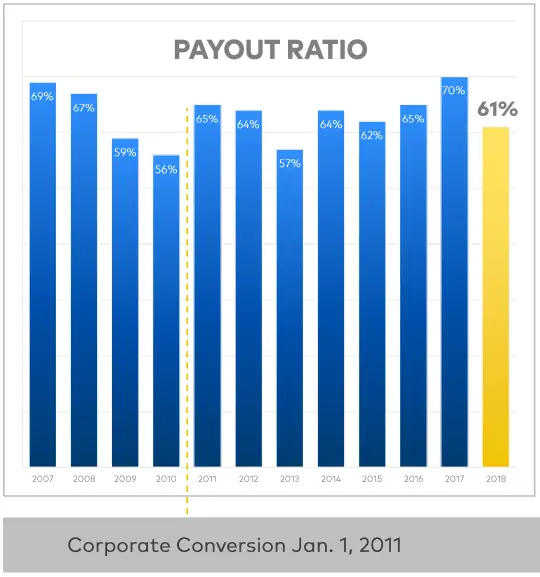

Here is Cineplex’s payout ratio using adjusted free cash flow going back to 2007. Overall the 65% looks to be in-line with prior rates.

Source: 2018 Fourth Quarter and Full Year Presentation

What bugs me is that it is quite difficult to estimate future adjusted free cash flow, let alone calculate it in the first place.

Source: Management’s Discussion and Analysis May 8, 2019

If you look at the most recent quarter ending March 31, 2019, the payout ratio using their adjusted free cash flow for just the quarter is 95%.

Because the quarterly payout is 95% vs the annual payout of 65% it would be nice to figure out an estimate of future adjusted free cash flow to see if this is just a quarterly blip, or if the dividend is in danger. I know Avengers will likely have a positive impact on the next quarter, but to what overall extent, I’m not sure.

I can’t easily figure it out and if I don’t know, then that means I don’t invest.

Ultimately, I consider the payout ratio high, so I won’t be investing in Cineplex.

If you can figure it out, or have some insights on Cineplex’s dividend safety please leave a comment, because it’s bugging me.

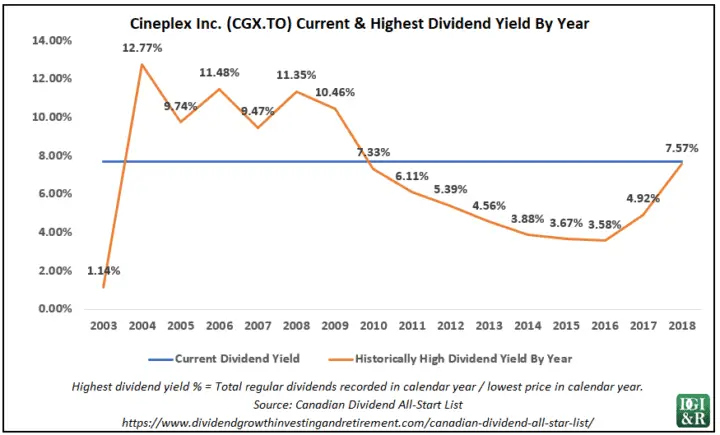

Cineplex Historically High Dividend Yields

The yield looks historically high when compared to recent years.

Cineplex Final Thoughts

Is Cineplex a yield trap? I don’t know… and it’s bugging me. If you know the answer please leave a comment.

Cineplex’s dividend growth is typically low, but the high yield makes it tempting.

As the payout ratio based on EPS is very high, the dividend could be in danger. Cineplex has a target payout ratio of 60 to 85% of adjusted free cash flow, but as I can’t easily project adjusted free cash flow, I’m having a hard time determining the dividend safety going forward.

As I can’t figure it out easily, I don’t plan on investing. If I don’t understand something then I don’t invest.

[Back to Table of Contents] [Jump to Summary]

9. Equitable Group Inc (TSE:EQB) – 3.3% Dividend Increase (3rd increase in the past year)

Equitable Group Inc operates through its subsidiary Equitable Bank which is a branchless Canadian bank that offers residential lending, commercial lending and savings solutions. Their residential mortgages are to customers who have the financial resources to achieve real estate ownership but don’t qualify for a mortgage in the prime market. This includes self-employed borrowers, new Canadians, and the credit challenged.

Equitable Group Inc Dividends

Equitable Group Inc which has a dividend streak of 8 years recently increased their quarterly dividend 3.3% from $0.3000 CAD to $0.3100 CAD. This dividend increase comes into effect with the dividend recorded on Jun 14, 2019.

The dividend yield as of May 31, 2019, was 1.8%, and they have 5 and 10-year average annual dividend growth rates of 12.5% and 10.4% respectively.

In the past few years, Equitable Group has been increasing its quarterly dividend multiple times each year. A year ago, the dividend was $0.27, then they increased it 3 times over the next four dividends with this most recent increase resulting in a $0.31 quarterly dividend.

If you factor in the three increases, then the annual increase was 14.8% ($0.27 to $0.28, then to $0.30, and with this latest announcement to $0.31).

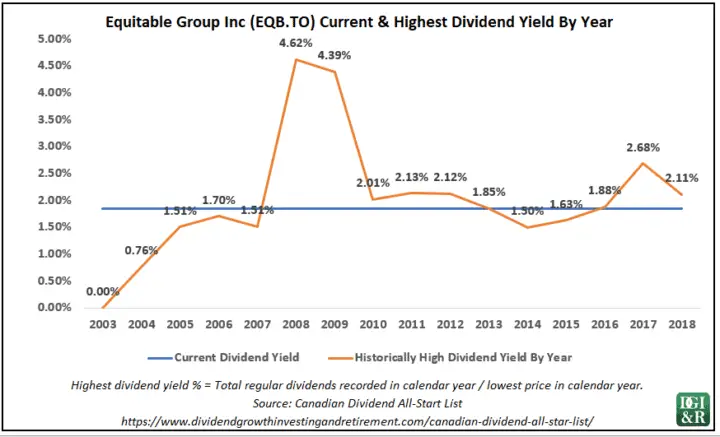

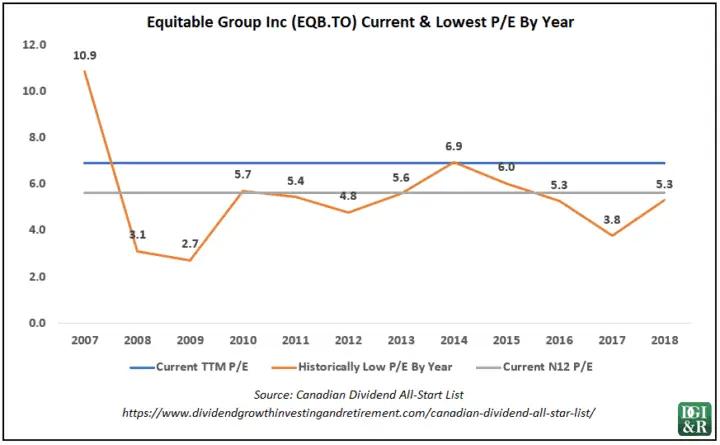

Equitable Group Financial Strength, Historically High Dividend Yields & Historically Low P/Es

DBRS gives the company a credit rating of BBB (low) which is two notches below the BBB+ or equivalent I typically like to see.

The current dividend yield of 1.8% is low compared to some of its historical highs.

Equitable Group has a forward P/E ratio of around 6. Normally this would be considered a low P/E and the stock would be considered cheap. However, when you at their history it’s not that cheap for them.

They got as low as 2.7 in 2009, and they’ve even had some 3, 4 and 5s. So maybe it’s not as cheap after all.

Equitable Group Inc Final Thoughts

This is not a stock I’m interested in as the credit rating is too low at BBB (low). On top of that my portfolio already has enough financials.

Yes, the dividend growth has been strong recently, but the yield is low.

If you are looking to add Canadian financials, start with the Big 6 banks. I feel like the big banks give you a better mix of high dividend yield and decent dividend growth prospects, plus they are in a much better financial position (Higher credit ratings) than Equitable Group.

Disclosure: I don’t own the stock Equitable Group Inc, but I do bank with EQ Bank.

[Back to Table of Contents] [Jump to Summary]

10. TELUS Corp. (TSE:T; NYSE:TU) – 3.2% Dividend Increase (2nd increase in the past year)

Telus is the largest telecom in Western Canada and one of the Big 3 in Canada. They provide phone, internet, and television services.

Telus Dividends

Telus Corporation which has a dividend streak of 15 years recently increased its quarterly dividend 3.2% from $0.5450 CAD to $0.5625 CAD. This dividend increase comes into effect with the dividend recorded on Jun 10, 2019.

The dividend yield as of May 31, 2019, was 4.5%, and they have 5 and 10-year average annual dividend growth rates of 9.1% and 8.7% respectively.

Telus has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 7.1% ($0.5250 quarterly dividend to $0.5450 and then most recently to $0.5625).

Telus Dividend Policy

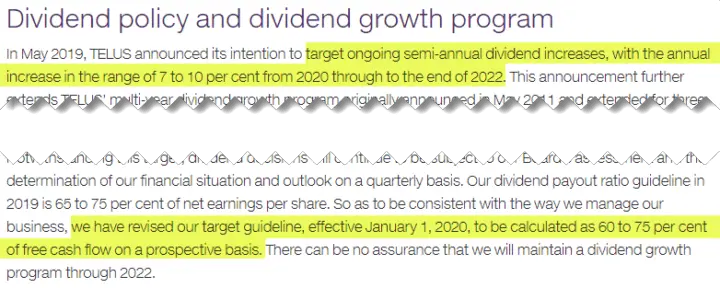

Telus typically raises their dividend twice a year and is targeting annual dividend increases in the range of 7 to 10% from 2020 through to the end of 2022. Starting in 2020 their payout ratio guideline is 60 to 75 percent of prospective free cash flow.

Source: Telus Dividend Information Website

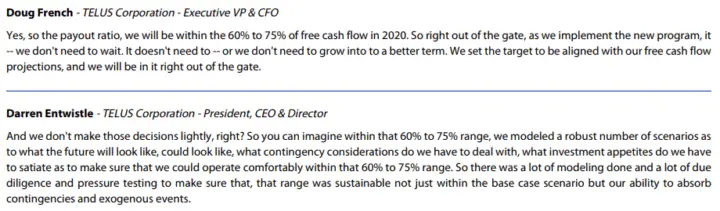

Telus management feels like they’ll be within their 60-75% of free cash flow range starting 2020.

Source: May 9, 2019 / 5:30PM, Q1 2019 Telus Corp Earnings Call Transcript

Telus Future Dividend Growth

Analysts are estimating around $3 per share in earnings over the next 12 months which would put their payout ratio around 75% which is in-line but on the high side of their 2019 guideline of 65 to 75 percent of prospective net earnings.

The 2019 payout ratio guideline is a bit on the high side in general. Typically, I like to see 60% or less payout ratio, but will go up to 70% for utilities where the cash flow is a bit more predictable.

You could make the argument that telecoms have a similar level of predictability as a utility, so I’d be OK with 70% so long as they have good financial strength.

Starting January 1, 2020, they are switching to a payout ratio target of 60-75% of prospective free cash flows (FCF). I don’t have estimates for future FCF, so I’m not sure how they compare to this target. I know when you look at FCF per share in prior years the dividend has historically been higher than FCF.

Source: Morningstar Telus Key Metrics

Telus management stated in the May 9, 2019 earnings call that they’ll be within their 60-75% of free cash flow range starting in 2020, which would be a change from the past.

Given the strong CEO comments in the May 9, 2019 earnings call and the fact that Telus has been providing dividend guidance since 2011 and they’ve always met their stated dividend growth goals, I’m inclined to believe them. I expect Telus to meet their 7-10% annual dividend growth goals.

It will come down to whether or not you are comfortable with a higher payout ratio than in the past while they deliver the 7-10% dividend growth.

I think I’d be OK with this, but I might want a bit higher of yield, say +5%.

Morningstar is forecasting Telus to “increase its dividend 7% annually over the next five years.”

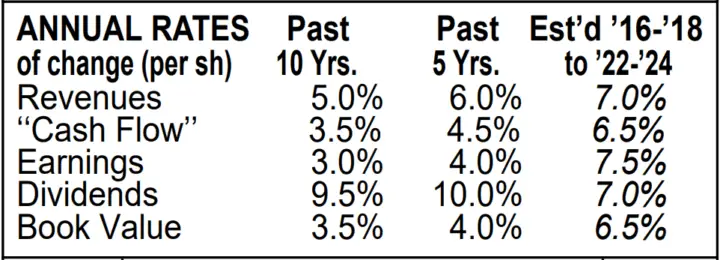

Value Line is estimating future dividend growth of 7% over the next 3-5 years.

Source: March 15, 2019 Telus Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

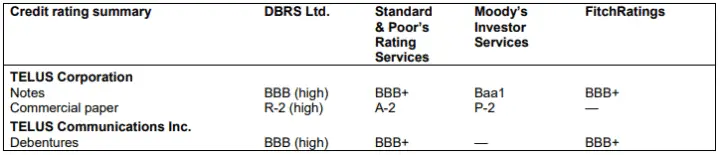

Telus Financial Strength & Valuation

Telus has a financial strength rating from Value Line of B++ and credit ratings of BBB+ or equivalent from the rating agencies. I typically look for a B+ rating or higher from Value Line and from the credit rating agencies a BBB+/BBB (high)/Baa1 rating or higher. Telus meets all of these requirements.

Source: 2018 Annual Information Form

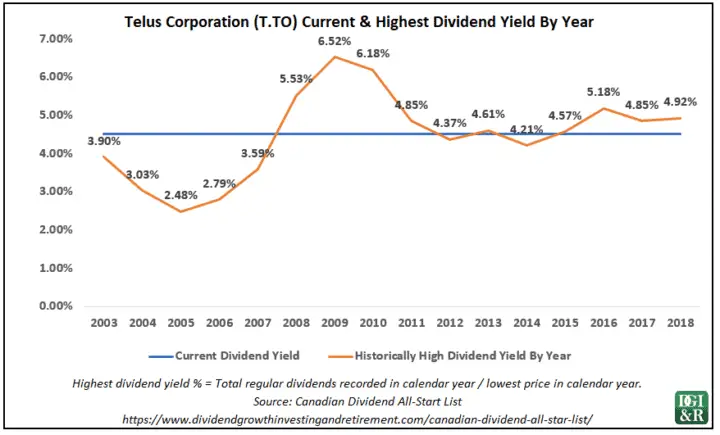

Based on dividend yield the stock looks moderately attractive as the current yield is around its recent historic highs. You could’ve done a bit better in 2008 and 2009, but this can be said for most companies.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around their fair value estimate of $50.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Telus Final Thoughts

Telus has been on my radar for a while now as they have consistently posted the largest dividend increases compared to the other Canadian telecom companies. Somehow, I never pulled the trigger. I have some cash sitting on the sidelines that I’d like to have invested and I’m currently strongly considering Telus as I only own Rogers (TSE:RCI.B; NYSE:RCI) in this sector.

Telus hits most of my requirements, but I’m hoping to see the price come down a bit more. In a perfect world, I’d be looking for a +5% dividend yield. Since this isn’t a perfect world, I might just bite the bullet and buy them as they have a yield around 4.5%, good financial strength, are fairly valued and are expecting 7-10% dividend growth until 2022.

Because they have a high payout ratio based on earnings (Around 75%), you may want to look at their cash flow situation more in-depth before investing.

What’s your take on Telus?

Disclosure: I own shares of Rogers Communications (TSE:RCI.B, NYSE:RCI) I may initiate a position in Telus (TSE:T) in the next few days.

[Back to Table of Contents] [Jump to Summary]

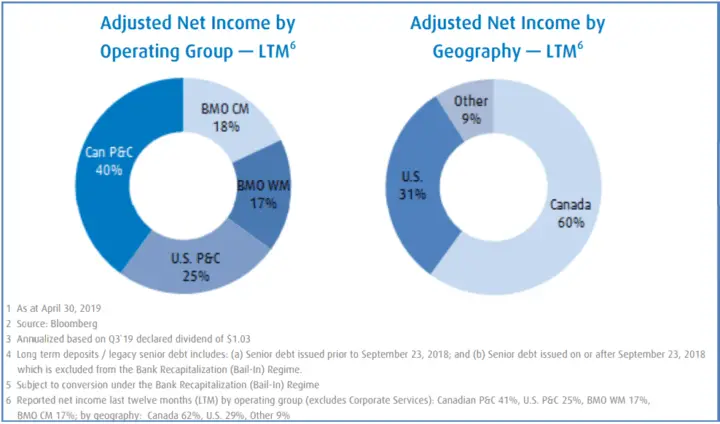

11. Bank of Montreal (TSE:BMO; NYSE:BMO) – 3.0% Dividend Increase (2nd increase in the past year)

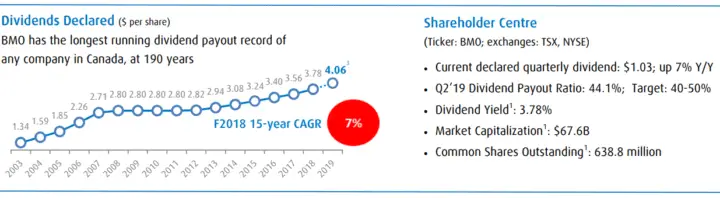

Bank of Montreal is one of the “Big 5” Canadian banks and Canada’s oldest bank (Established in 1817). In 1829 BMO started paying dividends and hasn’t stopped since, giving it the longest-running dividend payout record of any company in Canada.

BMO is a diversified financial services provider based in North America (Canada and the United States with a focus on six U.S. Midwest states – Illinois, Indiana, Wisconsin, Minnesota, Missouri and Kansas) which also operates in select global markets in Europe, Asia, the Middle East and South America.

They provide a broad range of personal and commercial banking, wealth management and investment banking products and services.

Source: 2017 Annual Report

Source: Bank of Montreal Q2 Investor Fact Sheet

Bank of Montreal Dividends

Bank of Montreal which has a dividend streak of 7 years recently increased their quarterly dividend 3.0% from $1.0000 CAD to $1.0300 CAD. This dividend increase comes into effect with the dividend recorded on Aug 01, 2019.

BMO has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 7.3% ($0.96 quarterly dividend to $1.00 and then most recently to $1.03).

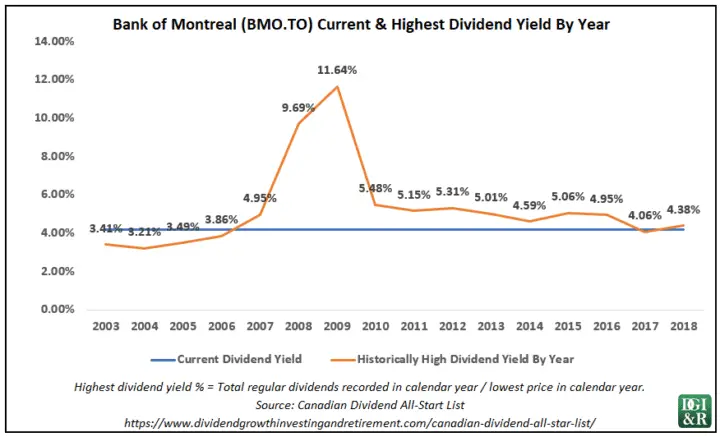

The dividend yield as of May 31, 2019, was 4.2%, and they have 5 and 10-year average annual dividend growth rates of 5.2% and 3.0% respectively.

Source: Bank of Montreal Q2 Investor Fact Sheet

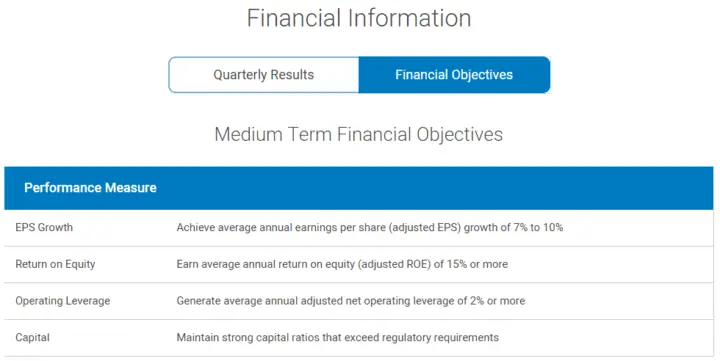

BMO Dividend Policy & Future Dividend Growth

BMO’s policy is to pay out 40% to 50% of its earnings in dividends to shareholders over time. Currently, the payout ratio is in that range. In 2019 Q2 it was 44.1%.

Source: https://www.bmo.com/main/about-bmo/banking/investor-relations/financial-information#2019

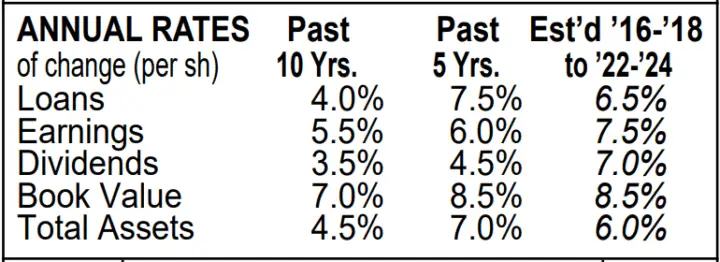

If they meet their adjusted EPS growth target of 7% to 10% then I’d expect dividend growth around the same. Value Line is estimating 7.0% annual dividend growth over the next 3-5 years with 7.5% earnings growth.

Source: May 10, 2019 Value Line BMO Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Bank of Montreal Financial Strength & Valuation

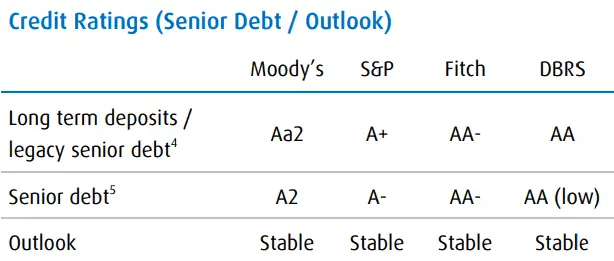

Value Line gives Bank of Montreal a “B++” rating for financial strength, and the 4 rating agencies give the bank A+ or higher credit ratings. The company appears to have strong financial strength.

Source: Bank of Montreal Q2 Investor Fact Sheet

Using the dividend yield as a valuation tool suggests that they are reasonably priced, but not any sort of steal. If you were looking for better value, you might wait for a yield of closer to 5% or more.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around their fair value estimate of $104 CAD.

Out of the big Canadian banks, it is only CIBC and National Bank that Morningstar currently rates as under-valued as both have four-stars.

Source: Morningstar May 31, 2019

Tip – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research. (I’ve been using Questrade (AL) for years and I consider them the best low-cost broker in Canada)

Bank of Montreal Final Thoughts

Bank of Montreal is a good bank, but I think you can get a better mix of high dividend yield, strong dividend growth, and better valuations with some of the other Big 6 banks right now.

Bank of Montreal yields 4.2%, but you can get a higher starting dividend yield with other narrow moat banks: National Bank of Canada (TSE:NA) 4.5% yield, Bank of Nova Scotia (TSE:BNS) 5.1% yield, or CIBC (TSE:CM) 5.5% yield. If you want a wide moat stock look at Royal Bank of Canada (TSE:RY) 4.0% yield or Toronto Dominion Bank (TSE:TD) 4.0% yield.

It all comes down to picking the one or more that suits you best.

Disclosure: I own shares of Bank of Nova Scotia (TSE:BNS), and National Bank (TSE:NA)

[Back to Table of Contents] [Jump to Summary]

12. Finning International (TSE:FTT) – 2.5% Dividend Increase

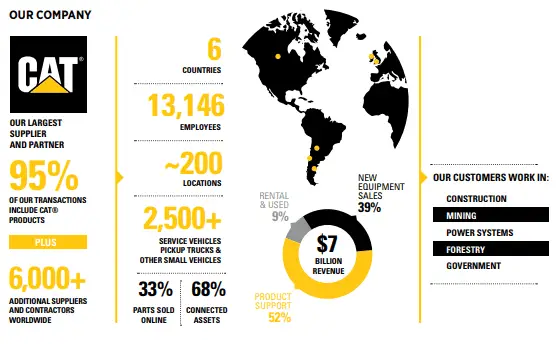

Finning International is the world’s largest Caterpillar equipment (Heavy-duty machinery and parts) dealer, operating in Canada, South America, and the British Isles. The Company sells, rents, and provides parts and service for equipment and engines to customers in various industries, including mining, construction, petroleum, forestry, and a wide range of power systems applications.

Source: Finning 2018 Sustainability Report

Finning International Dividends

Finning International which has a dividend streak of 17 years recently increased their quarterly dividend 2.5% from $0.2000 CAD to $0.2050 CAD. This dividend increase comes into effect with the dividend recorded on May 23, 2019.

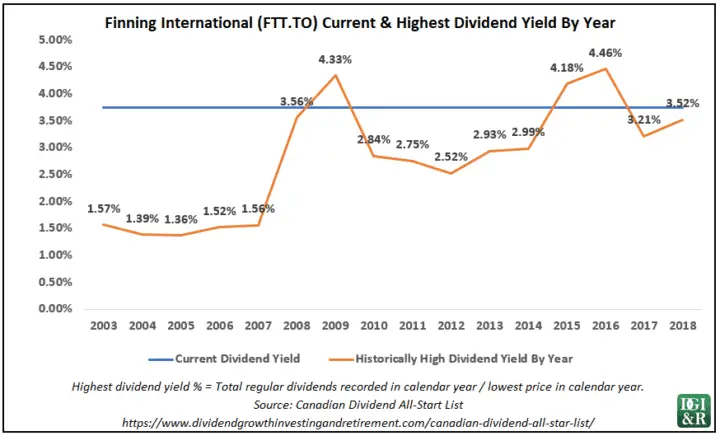

The dividend yield as of May 31, 2019, was 3.7%, and they have 5 and 10-year average annual dividend growth rates of 5.7% and 6.3% respectively.

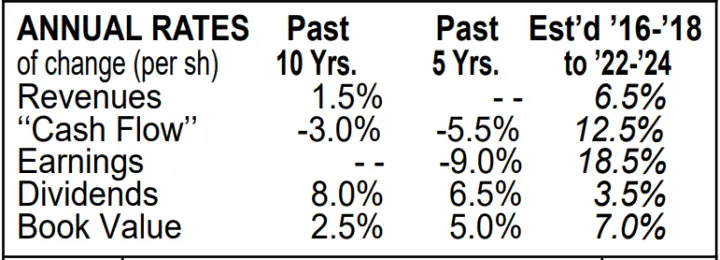

Value Line is estimating 3.5% annual dividend growth over the next 3-5 years and 18.5% earnings growth.

Source: Finning International Value Line May 17, 2019 Annual Rates Table

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Finning International Financial Strength & Valuation

Value Line gives Finning International a “B++” rating for financial strength and they have a BBB+ credit rating from S&P and a BBB (high) credit rating from DBRS. The credit ratings meet the BBB+ or equivalent I typically like to see.

Finning has a decent dividend yield of 3.7% right now, which is historically on the high side for them. This suggests the stock could be under-valued a bit. That said, it might be prudent to try and wait for a +4% dividend yield.

Finning International Final Thoughts

Finning has a good dividend streak, OK dividend growth rates and decent financial strength, but the recent low dividend increase of just 2.5% coupled with Value Line’s low future dividend growth estimate of 3.5% makes me pause.

Finning operates in a cyclical industry so expect some ups and downs when it comes to the stock price and earnings. I also get a little nervous when the business is so tied to another company like Finning is tied to Caterpillar.

If the dividend growth starts to improve and yield went above 4% and I didn’t already own Caterpillar, then I’d start considering Finning, but I’m not 100% sold on them just yet.

Disclosure: I own shares of Caterpillar (NYSE:CAT)

[Back to Table of Contents] [Jump to Summary]

13. George Weston Ltd (TSE:WN) – 1.9% Dividend Increase (2nd increase in the past year)

George Weston Ltd owns almost half (47%) of Loblaw Companies Limited (L.TO); which has the largest network of grocery stores and pharmacies in Canada. Their investment in Loblaws contributes to the vast majority of their sales, but they also have a Weston Foods division. This division produces a variety of fresh, frozen and specialty bakery products including breads, rolls, bagels, tortillas, donuts, cakes, pies, cookies, crackers and other baked goods in North America.

George Weston Dividends

George Weston Ltd which has a dividend streak of 7 years recently increased their quarterly dividend 1.9% from $0.5150 CAD to $0.5250 CAD. This dividend increase comes into effect with the dividend recorded on Jun 15, 2019.

This was the 2nd increase in the past year. If you factor in both increases then the annual increase was 7.1% ($0.4900 quarterly dividend to $0.5150 and then most recently to $0.5250).

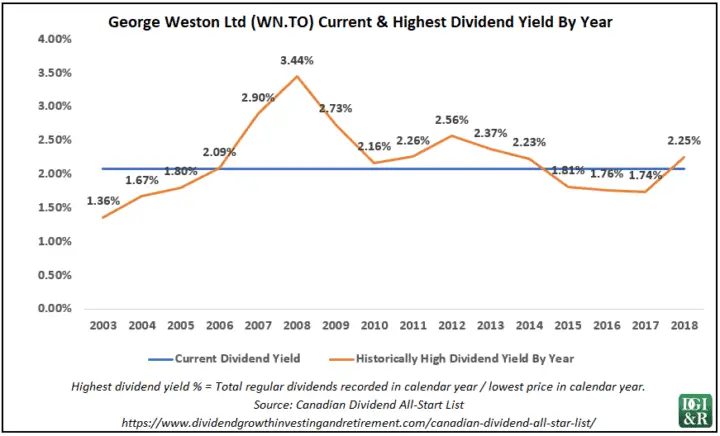

The dividend yield as of May 31, 2019, was 2.1%, and they have 5 and 10-year average annual dividend growth rates of 3.7% and 3.1% respectively.

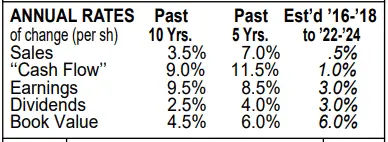

While the company has had two dividend increases in the past year, Value Line is estimating low future dividend growth of 3% over the next 3-5 years which is more in-line with its 5 and 10-year dividend growth rates.

Source: George Weston Value Line Report October 19, 2018

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

George Weston Financial Strength & Valuation

George Weston has a financial strength rating from Value Line of B++ and credit ratings of BBB from S&P and DBRS. This is a little too low for me.

FYI – I typically look for a B+ rating or higher from Value Line and from the credit rating agencies a BBB+/BBB (high)/Baa1 rating or higher.

Based on dividend yield the stock around fair value or moderately attractive as the current yield is a bit higher than it has been in recent years, but still under the 2007 to 2014 highs.

Morningstar rates them a no-moat stock with a four-star valuation as they are currently trading under their fair value estimate of $122.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

George Weston Final Thoughts

Despite the 2nd dividend increase in a year, I’m not interested.

The company doesn’t have a moat, the dividend streak is less than 10 years and the credit ratings are a bit too low (BBB when I want BBB+ or higher).

The dividend yield is low at 2.1% and Value Line is estimating low future dividend growth of only 3%.

[Back to Table of Contents] [Jump to Summary]

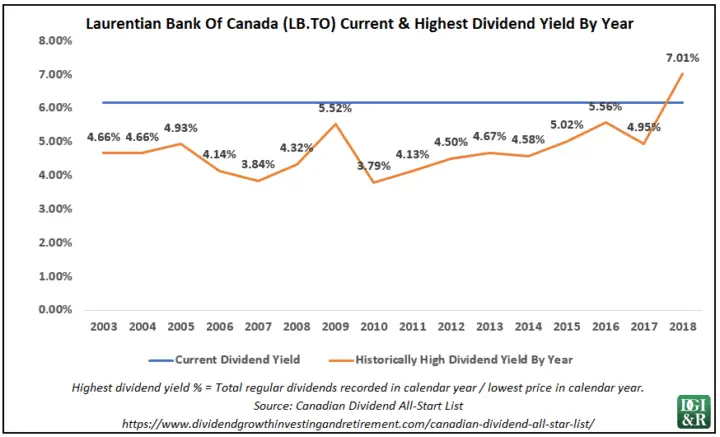

14. Laurentian Bank of Canada (TSE:LB) – 1.5% Dividend Increase (2nd increase in the past year)

Laurentian Bank is a Canadian bank primarily based in the province of Quebec. The bank was founded in 1846 and has been paying uninterrupted dividends since 1871.

They provide diversified financial services including a range of advice-based solutions and services to its customers through its businesses: Retail Services, Business Services, B2B Bank and Capital Markets.

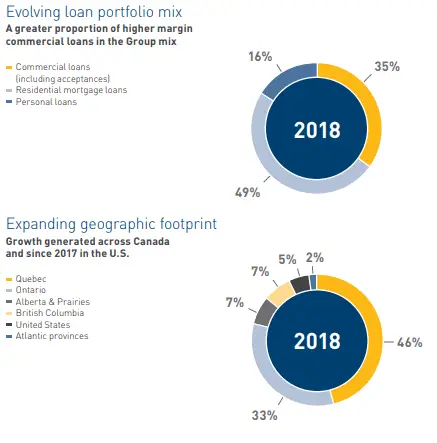

Source: 2018 Annual Report

Laurentian Bank Dividends

Laurentian Bank Of Canada which has a dividend streak of 11 years recently increased their quarterly dividend 1.5% from $0.6500 CAD to $0.6600 CAD. This dividend increase comes into effect with the dividend recorded on Jul 02, 2019.

The dividend yield as of May 31, 2019, was 6.2%, and they have 5 and 10-year average annual dividend growth rates of 5.1% and 6.9% respectively.

While this recent dividend increase may appear low at only 1.5% the bank has been increasing their dividend twice a year. If you factor in both increases; both were one cent increases, then the annual increase was 3.1% (Quarterly dividend of $0.64 to $0.66 over the year). Granted, still low, but better than nothing.

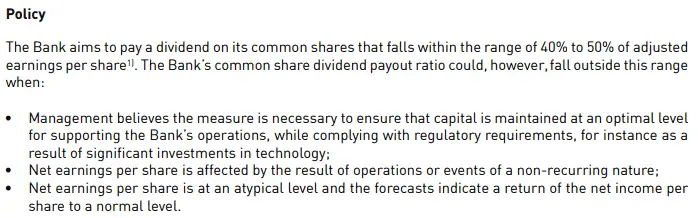

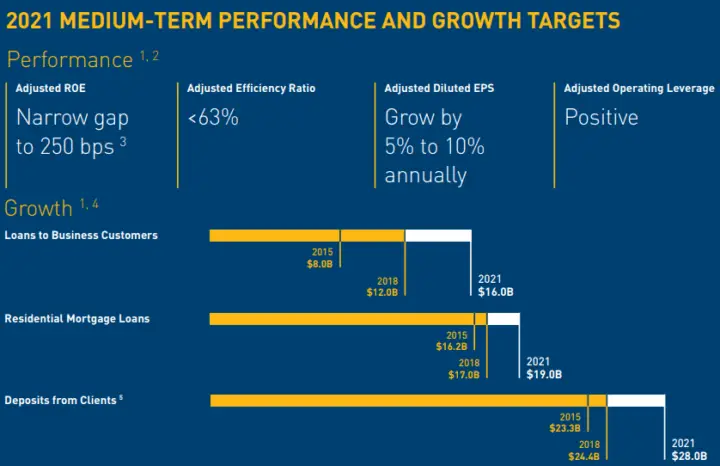

Laurentian Bank of Canada Dividend Policy

The bank’s target payout ratio is 40% to 50% of adjusted earnings per share.

Source: Annual Information Form December 8, 2018

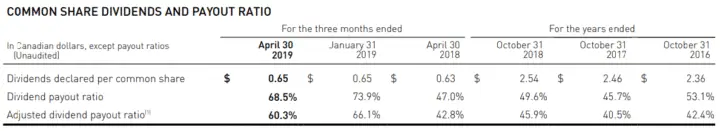

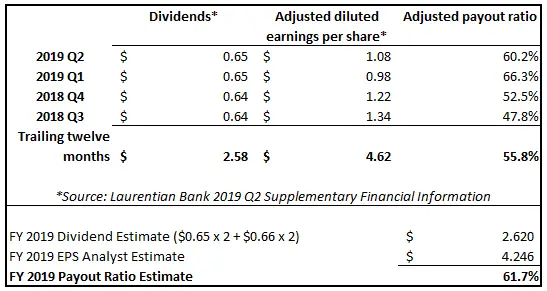

For the most recent quarter, Laurentian’s payout ratio of 60.3% was above their target range of 40-50%.

Source: 2019 Q2 Results

Whether you look at the quarter, the trailing twelve months or the FY 2019 estimates the payout ratio in all cases is above their target range of 40-50%.

Generally, I like to see a payout ratio of 60% or less.

Source: 2018 Annual Report

Even if they meet their adjusted EPS growth target of 5% to 10%, I still don’t expect that great of dividend growth because their payout ratio is above their target range. I think Laurentian will continue to have low dividend over the medium term.

Laurentian Bank Financial Strength & Valuation

DBRS has given them an A (low) credit rating with a stable outlook which is OK, but S&P has given them a BBB rating with a negative outlook. S&P is below the BBB+ level I like to see.

If you are looking for Canadian banks with better credit ratings focus on the “Big 5” and you can get a much better credit rating and financial strength profile.

Using the dividend yield as a valuation tool suggests that they are quite undervalued as the yield is historically high for the bank.

Laurentian Bank Final Thoughts

I can understand why some investors might be tempted by Laurentian Bank’s long history of paying dividends and its historically high dividend yield of around 6%, but the BBB credit rating from S&P makes the company a pass for me. That and the low expectations for future dividend growth.

In 2018 they had some mortgage issues, so if you are considering investing, you’ll want to look more into this too.

They’ve been increasing the dividend by one cent every other quarter going back to 2016. If they can break out of this trend with a higher dividend increase then I’d take this as a positive.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the future prospects of the company.

In May 2019 there were 14 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Onex Corp (TSE:ONEX) – 14.3% Dividend Increase

- Algonquin Power & Utilities Corp. (TSE:AQN) – 10.0% Dividend Increase

- iA Financial Group (formerly Industrial Alliance) (TSE:IAG) – 8.4% Dividend Increase (2nd increase in the past year)

- Pembina Pipeline (TSE:PPL) – 5.3% Dividend Increase

- National Bank of Canada (TSE:NA) – 4.6% Dividend Increase (2nd increase in the past year)

- Domtar (TSE:UFS) – 4.6% Dividend Increase

- Franco-Nevada Corp (TSE:FNV) – 4.2% Dividend Increase

- Cineplex Inc. (TSE:CGX) – 3.4% Dividend Increase

- Equitable Group Inc (TSE:EQB) – 3.3% Dividend Increase (3rd increase in the past year)

- TELUS Corp. (TSE:T) – 3.2% Dividend Increase (2nd increase in the past year)

- Bank of Montreal (TSE:BMO) – 3.0% Dividend Increase (2nd increase in the past year)

- Finning International (TSE:FTT) – 2.5% Dividend Increase

- George Weston Ltd (TSE:WN) – 1.9% Dividend Increase (2nd increase in the past year)

- Laurentian Bank of Canada (TSE:LB) – 1.5% Dividend Increase (2nd increase in the past year)

Of these 14 companies, National Bank of Canada, Telus, and iA Financial Group (formerly Industrial Alliance) are the three that warrant some extra attention.

National Bank and Telus both have a high yield of around 4.5% and high dividend growth. National Bank has a lower payout ratio though so I prefer National Bank between the two. I already own National Bank so I’m strongly considering Telus. What is holding me back is the valuation, but I might still buy it.

I consider Telus fairly valued, but in a perfect world, I’d be able to buy it under-valued a bit and maybe closer to the 5% yield mark.

iA Financial Group (formerly Industrial Alliance) has a short dividend streak of 5 years, but they’ve had strong dividend growth recently coupled with a low payout ratio. This stock wasn’t really on my radar before, so I want to dig into it a bit more as I don’t own any insurance companies in my portfolio.

Other dividend growth favourites like Algonquin Power & Utilities Corp. and Bank of Montreal also increased their dividend this month. Algonquin Power & Utilities Corp. has a high payout ratio though and you have some better options than BMO when it comes to Canadian banks right now.

Out of the 14 stocks, Cineplex had the highest dividend yield, but is it safe?

Please share your thoughts on any of these 14 companies.

I’d be especially grateful to hear what others think of Telus and also Cineplex’s dividend safety.

Disclosure: I own shares of Bank of Nova Scotia (TSE:BNS), National Bank of Canada (TSE:NA), and Caterpillar (NYSE:CAT). You can see my portfolio here. I may initiate a position in Telus (TSE:T) in the next few days.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

I’ve hold IAG for some time but sold it as I already own MFC, SLF and IFC. It disappointed and I tend to agree with Bruce Campbell on BNN who said it’s cheap for a reason, will probably stay cheap because it’s smaller.

An excellent piece of work, thank you. I sold my Telus holdings a while back when it was revealed that the company is deeply committed to Huawei products. Not that I am squeamish about Chinese products necessarily, but the Huawei issue has several important facets including extradition, suspected spyware embedded in electronic gear, and strong links to Chinese government. Telus took a strong defensive stand on their use of Huawei, which led me to pull the trigger. Otherwise I would buy back. I stick with BCE.

Have you considered covering TCL.A seems like a stock you’d appreciate right now