Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I’ve updated the Canadian Dividend All-Star List for the month. You can download the latest version here. Each month I go through the list of companies and see if any of them have increased their dividend. The Canadian Dividend All-Star List uses the record date to determine the dividend streak. Often the dividend increase is announced before the record date, so some of my announcements may be old news. Because of the number of companies I track it’s not practical to comment on each increase when it happens, so instead I like to do a monthly summary.

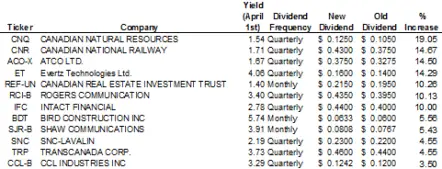

Companies that have increased their dividend in the Canadian Dividend All-Star List and have their record date in March are shown in the table below. I’ve sorted them by the highest % increase.

12 companies from the Canadian Dividend All-Star List managed to increase their dividend. I don’t know exactly what inflation is, but it’s usually around 2% or 3%, so I was happy to see that all of these dividend increases were above inflation. I find that most dividend growth investors are looking for regular dividend increases that are at least above inflation. For me personally I’m generally looking for 8% or more.

If I look at this month I can see that 7 of the 12 increases were above the 8% mark, but most of these are below my 2.5% minimum dividend yield threshold. It’s hard to find high dividend growth (greater than 8%) with a respectable yield (above 2.5%). In March’s increases there are only 3 companies that meet this criteria: Evertz Technologies Ltd, Rogers Communication, and Intact Financial. Among other things I look for a reasonable payout ratio and a cheap valuation. When I take into account these other criteria my list of potential investments quickly shrink. That’s why I like to have a list of companies that I’d like to own and a target price. When the price drops below my target price I buy shares. In Canada I’d say there are around 20 or 30 good dividend growth companies. I wait around for a reasonably cheap valuation before buying one of these 20-30 companies, which is why I don’t purchase shares very often.

I’ve started a dividend growth watch-list that I update every time I do a dividend growth stock analysis. Currently there is only one company in the list, but it will grow over time. I have my own personal target list that has a lot more companies, but I didn’t want to share it before a full dividend stock analysis was completed. Often I’ll do a quick and dirty valuation test to come up with a target. Later if the company gets closer to my target price I do the complete analysis. I was worried that by sharing my quick and dirty target prices I would mislead my readers. Sometimes when the complete analysis is done I decide not to invest in the company, so I didn’t want these included in a public target list.

How do you decided which stocks to buy?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!