Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Before buying your first share so that you can enrol in a dividend reinvestment plan (DRIP) there are a number of considerations you should go over first. The easiest way in my opinion to become a shareholder in a company so that you can enrol in the company’s DRIP and SPP is to enrol through the Direct Share Purchase Plan (DSPP). An important first step is checking to see if a DSPP exists for the company you are interested in. If a DSPP exists then you don’t have to go through the hassle of buying a single share, you can simply start investing in the company directly through the transfer agent.

Related article: Pros & Cons of a Traditional Dividend Reinvestment Plan (DRIP/DRP) with a Share Purchase Plan (SPP)

Most Canadian companies do not offer a DSPP, but a number of US companies do. A notable Canadian exception is Fortis, but it only offers a DSPP through their transfer agent Computershare to residents of NL/Labrador & PEI. Here are some resources if you are trying to find US companies that offer a DSPP through their transfer agent.

- Comutershare’s list of DSPP companies.

- Wells Fargo’s list of DSPP companies. Once there, click on Direct Purchase Plan (DPP) Companies.

If there isn’t a DSPP, which a lot of the time there won’t be, then you will have to buy a starter share. I recommend buying a share off of the DRIP Investing Resource Center’s share exchange. This website has information on DRIP investing, but functions mainly as a forum for Canadian and US dividend investors. It is an invaluable resource, especially if you are just starting out.

Related article: What Is A Dividend Reinvestment Plan (DRIP/DRP)?

The first thing to find out is if the company you are interested in offers a DRIP. You can do this by looking at the investor relations section of the company website. It is usually not worth enrolling in a traditional DRIP if they don’t have a share purchase plan (SPP) as well. The SPP will allow you to buy additional shares via an optional cash purchase (OCP) while avoiding fees (in most cases). To get a list of Canadian companies that offer a DRIP and SPP, check out Drip Primer. For a list of US DRIPs that have no fees, check out this site.

Once you have found the DRIP you want to invest in, it is important to do some research into the plan details. If you are investing in Canadian DRIPs Drip Primer offers an easy to read spreadsheet that lists Canadian companies offering DRIPs and SPPs, their plan details, whether they have fees and additional notes.

For US DRIPs you can check the investor relations section of the company’s website. It should have some details about the plan. It may just give you the name of the transfer agent. If this is the case go to the transfer agent’s website and search the plan details there. I find a lot of the time the transfer agent’s website has better information, but you need to go to the company website first to find out who their transfer agent is. In some cases they won’t have a transfer agent and will administer the plan themselves (This is rare).

This article is quite long, so I’ve summarized the main points first and then followed up with an in depth explanation of the DRIP and SPP considerations.

A summary of things to consider before buying your starter share

- Does the company offer a DRIP?

- How often do they pay dividends? (Quarterly, monthly, semi-annual, etc)

- Can I enrol in the plan? (This can be an issue for international investors)

- How many shares do I need to enrol? (Most of time you only need one share, but occasionally it will be more)

- What kind of DRIP do you want to enrol in? Most people just want an account in their name, but you can also have joint accounts, accounts for children, trusts, etc.

- Does the DRIP offer a discount? (More common for Canadian DRIPs)

- Who is the transfer agent?

- Are there any fees?

- Does the company offer a SPP?

- On what frequency can I purchase shares? (Weekly, Monthly, Quarterly, etc)

- SPP min: What is the minimum amount I have to invest for each optional cash purchase (OCP)?

- SPP max: What is the maximum I can invest? (This is usually an annual limit that is quite high)

- What’s the OCP deadline? When does the transfer agent need the money by to buy more shares?

- When will the shares actually be purchased? Once the transfer agent receives your OCP money, on what date will the shares actually be purchased?

- What method of payment does the SPP accept? (Usually they accept a check/cheque. In some cases you can setup a pre-authorized debit that takes the money directly from your bank account. In rare instances they may require a certified cheque/check.)

- Does the SPP offer a discount? (This is rare)

- Are there SPP fees?

- Is your bank account in the correct country? (This can be an issue for international investors)

- Did you pick a good dividend stock? Investing in DRIPs is a long term investment style, so it’s important you select a good company to start with. If you are trying to identify good candidates a good place to start is the Canadian Dividend All-Star List and the US Dividend Champions list. These lists have companies that have a history of increasing their dividend for consecutive years in a row. These are just a few questions you could consider when picking a company.

- Does the company have a viable business that will allow it to grow earnings and pay out dividends in a sustainable and hopefully growing manner?

- What’s the company dividend history?

- Do they have a history of increasing dividends?

- Have there been any recent dividend cuts?

- Do you understand the business?

An in-depth look

Enrolment options to consider

- How can you enrol in the DRIP? Does the company offer an online enrolment option that lets you buy shares initially, or do you have to be a shareholder already and use this information to enrol?

- How many shares do you have to own to enrol in the DRIP? Most of the time you need a single starter share, but in some cases they might require 10 or 100 shares before you can enrol in the DRIP.

- What are the deadlines to enrol? Usually each company requires that you enrol before a set date so that they have time to process the dividend reinvestment for the dividend that is paid. This isn’t a huge issue, but it can delay things quite a bit. If you miss the deadline the first dividend will be paid to you in cash and you’ll be enrolled for the next dividend payment. Where this can be frustrating is if you are also trying to buy additional shares through the SPP for the first time. If it is a SPP that only allows quarterly optional cash purchases (OCP) and you miss the deadline you end up waiting months until the first purchase of shares goes through.

DRIP considerations

- Can I enrol in the DRIP?

- Some Canadian companies only allow Canadian residents to enrol in the DRIP and vice versa for US DRIPs. I’ve found that most of the well-known DRIPs allow for US or Canadian citizens and some other international countries.

- Do you have a bank account in the right country? For instance if you want to invest in US DRIPs, but are from another country you will have to setup a bank account in the USA. To buy more shares requires a USD bank account. For Canadians this can be done a variety of different ways, but it gets more difficult if you are from another country.

- What kind of DRIP do you want to open?

- The most common is a DRIP in the investor’s name, but if you want a joint account with a partner, or you want to setup an account for a child then you have to make sure the share is registered in the correct manner.

- Say you want to invest with your partner then your shares would be registered as a joint account. There are different types of joint accounts, so you should go over your options with a lawyer. I’ve shown the two most common types that I’ve seen. For example say Bob and Jane want to have a joint account, then they would have their shares registered as either

- Bob and Jane JTWROS, or

- Bob and Jane JTTEN

- JTTEN stands for Joint Tenancy and JTWROS stands for Joint Tenants with Right of Survivorship. From what I understand both of these mean that either person can make changes to the account and if one person dies ownership of the shares will go to the other partner.

- Say you want to setup a DRIP for your child then you have two options, a custodian account or trust account. I’ve found that most parents use the trust option because they have a bit more control of when the shares will be passed onto the child. If you setup a custodian account then the shares will fall into the kid’s hands when they are of legal age. With a trust account the parent can decide when they want the shares to be given to the child. I’ve found some parents are more comfortable handing over a large number of shares to a 25 year old compared to an 18 year old. An example of how you would register a trust account would be:

- Dad/Mom held in trust for Child.

- There are additional tax and legal implications to consider, so I’d recommend talking to a lawyer and accountant if setting up this type of account.

- Dad/Mom held in trust for Child.

DRIP/SPP discount considerations

- Is there a DRIP discount? Some DRIPs offer a discount ranging from 1-5%. This means that the price used to determine how many shares you get from your reinvested dividends will be discounted by 1-5%. You see this in some Canadian companies.

- Is there a SPP discount? A SPP lets you buy additional shares at a discounted price. The discount usually ranges from 1-5%. You see this in rare instances with some Canadian DRIPs.

- While a discount is a nice added perk, don’t simply invest in a company because it has a discount. There are more important factors to consider first like the business fundamentals, the strength of its dividend, etc.

SPP considerations

- What’s the minimum amount you can invest at a time? These range from $0 to $1,000 depending on the plan. Most plan minimums are around $25 to $100.

- What’s the maximum amount you can invest at a time? These limitations are usually an annual amount and vary widely. For instance Pengrowth Energy (PGF Trend Analysis) will allow $1,000 per month, but Johnson & Johnson (JNJ Trend Analysis) will allow $50,000 per calendar year. Most of the time the limitations are quite high (>$20,000 per year) and shouldn’t impact the average person that much. My guess is that in Pengrowth Energy’s case it has a low maximum because they offer a 5% discount on the DRIP and SPP (As of January 29, 2014).

- How frequently can you buy additional shares? I’ve found most companies offer a monthly SPP, but it still varies a lot. Some companies only offer quarterly SPPs, so it’s important you pay attention. If you miss the deadline your next opportunity isn’t until 3 months later. Other plans offer weekly or bi-monthly plans. They all differ, so check the plan for details.

- What are the deadlines to send in an optional cash purchase? Each plan has a different deadline for when the transfer agent has to receive the money for the optional cash purchase. If you miss it, then the money won’t be invested until the next optional cash purchase date.

- If you are making an optional cash purchase, what type of payment will the transfer agent accept?

- Do you have to mail in a cheque/check, or can you make a pre-authorized debit (PAD)? Being able to setup a PAD with the transfer agent is a lot simpler than mailing in a cheque/check. Most US DRIPs offer PADs, and some Canadian companies that have Computershare as their transfer agent offer PADs. Most Canadian companies that use Canadian Stock Transfer (formerly CIBC Mellon) don’t offer PADs.

- Does the cheque/check have to be a certified cheque/check? In most case a regular cheque/check is fine, but in rare cases they require a certified cheque/check. For example Altagas (ALA Trend Analysis) needs a certified cheque/check if you want to buy more shares in their SPP.

- Are you able to enrol in automatic investments? For example can you have a set amount taken from your bank each month?

Transfer considerations

- Are there black-out periods? Sometimes the transfer agent won’t process requests between the dividend record date and the payable date. For some companies this period is about a month long. This means that if you submitted a request to transfer shares then it could be delayed. If you are concerned, call the transfer agent. Transfers from a transfer agent to a broker typically take quite a while and if you are transferring shares to a broker because you want to put them in a tax sheltered account by a deadline then you should start this process early.

Fee considerations

- Is there a fee to reinvest dividends? Most of the time there won’t be, but some plans do. You see this with US companies more.

- Is there a fee to buy more shares? Most of the time there won’t be, but some plans do. You see this with US companies more. Depending on how you buy shares there may be fees.

- If you buy shares as a one-time transaction (mail cheque/check in, or setup a bank debit) is there a fee?

- If you are setup for automatic investments at a set interval is there a processing fee?

- For example Johnson & Johnson (JNJ Trend Analysis) will charge you a $1 processing fee for automatic monthly bank debits, but won’t charge you for one-time bank debits even if you make a one-time bank debit each month.

- If you can enrol in the plan online through the transfer agent, what is the cost?

- If you want to sell shares through the transfer agent what are the costs?

- Selling fees can broke into two components; a cost per share sold as well as a set fee to process the request. These vary widely from one company to the next. If selling fees are high, consider transferring the shares to your broker and selling them there.

Conclusion

Investing in DRIPs can be a great strategy, but it is not for everyone. It’s important to do the research and consider all all the variables before investing this way.

Related articles:

- What Is A Dividend Reinvestment Plan (DRIP/DRP)?

- Pros & Cons of a Traditional Dividend Reinvestment Plan (DRIP/DRP) with a Share Purchase Plan (SPP)

Photo credit: Marco Bellucci / Foter / CC BY

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

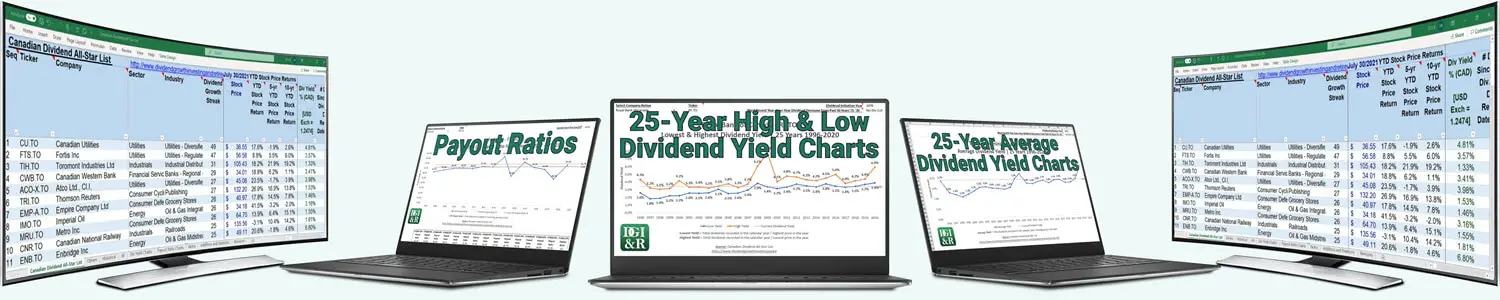

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thought you’d mention Connolly’s Rule: “If a company doesn’t pay a dividend, don’t buy it. If a company doesn’t grow it’s dividend don’t buy it either!”

Clearly all drip companies pay a dividend, but it’s the second part that’s the key item to consider with drips.