Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

When scanning the Canadian market for dividend growth stocks there are two common places that investors start:

- The S&P/TSX Canadian Dividend Aristocrats

- To be included in the list the company must be common stock or income trust listed on the TSX and in the S&P Canada Broad Market Index (BMI).

- They must have increased ordinary cash dividends every year for 5 years, but can maintain the same dividend for a maximum of 5 consecutive years within that 5-year period.

- The company must have a minimum C$ 300 million float-adjusted market cap.

- Canadian Dividend Achievers™ Index

- “Constituents must be incorporated in Canada, trade on a major exchange in Canada and must have paid increasing regular cash dividends for five or more consecutive years. The average daily cash volume must exceed CD$500k in CAD$ in the November and December prior to reconstitution.”

These two lists are a great starting point and when I started creating the Canadian Dividend All-Star List this is where I started. The Canadian Dividend All-Star List is a Microsoft Excel list that I have created that aims to show all the Canadian companies that have increased their dividend for five or more years in row. When creating the Canadian Dividend All-Star List part of the problem I had, is that the two lists screen out companies if their volume is less than $500,000 or the market cap is less than $300 million. To solve this problem I went to TMX Money and used their free stock screener to screen for a positive 5 year dividend growth rate and a market cap of less than $500,000. This gave me a list of about 40 stocks. From there I used Google Finance to quickly see if they had a history of increasing dividends. For those that did, I looked into their dividend history more carefully and added them to my Canadian Dividend All-Star List.

The results

I ended up finding 7 lesser known companies. I’m not recommending any of these companies, as I haven’t looked into them further yet, but it’s still an interesting list.

- Enghouse Systems Limited

- Glentel Inc.

- McGraw-Hill Ryerson Limited

- Calian Technologies Ltd.

- Lassonde Industries Inc.

- MCAN Mortgage Corporation

- Accord Financial Corp.

The full list of the Canadian Dividend All-Star List can be downloaded for free here.

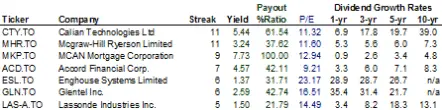

Over the next while I plan on reviewing this list for good dividend growth stocks. Every investor has their own preference, but I like to see a payout ratio of less than 60%, a yield of at least 2.5%, 10 year dividend growth rate above 8%, and rising earnings to sustain dividend growth.

If I take a quick look at some of the information in the Canadian Dividend All-Star list I get the following:

MCAN Mortgage Corporation has too high of a payout ratio for my liking, and I’m naturally skeptical of dividend yields above 6%. Mortgage corporations usually have a higher payout ratio and higher yields, so this is to be expected to a certain point, but I’m generally looking for dividend growth above 8% and from what I can see their dividend growth has been decreasing over the past few years.

While I’m interested in looking at Enghouse Systems and Glentel Inc in more detail, I generally try and avoid investing in Canadian companies with a P/E above 15.

Lassonde Industries (LAS-A.TO) and Enghouse Systems both have a dividend yield below my 2.5% minimum. Occasionally I’ll go as low as a 2% yield if the dividend growth is very high, but these two are still below that.

That leaves me with Calian Technologies , Mcgraw-Hill Ryerson , and Accord Financial . From a dividend growth perspective, I start by looking into these companies further.

One thing to keep in mind with the 7 stocks listed above is that they are smaller cap stocks with lower trading volume, so they’d be considered higher risk stocks.

Any thoughts on my list of lesser known dividend stocks?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![Screening the Canadian Market for Dividend Growth Consumer Staples [Spreadsheet included]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/03/Saputo.png)

Nice bloq. Thank you. CTY looks good. Do you own it?

Thanks for stopping by. No I don’t own CTY. To see what’s in my portfolio check out this page: https://dividendgrowthinvestingandretirement.com/dividend-portfolio/