Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

A dividend reinvestment plan (DRIP) is a plan for shareholders of a company that allows them to reinvest their cash payment from dividends with the purchase of more shares in the same company. There are two types of DRIPs, a synthetic DRIP and a traditional DRIP. A synthetic DRIP is a plan that is provided by your broker and administered by them. A traditional DRIP is a plan offered by the company and administered by a transfer agent.

Related article: What Is A Dividend Reinvestment Plan (DRIP/DRP)?

A share purchase plan (SPP) allows investors enrolled in a traditional DRIP to buy more shares of the company through the transfer agent. Most investors don’t setup a traditional DRIP unless the company also offers a SPP as they want to be able to buy more shares as well as reinvest their dividends.

In this article I’m going to talk about the advantages (Pros) and disadvantages (Cons) of a traditional DRIP with a SPP. The article is very long (over 5,000 words) so I’ve summarized the pros and cons here. You can jump between the summary and explanations as you see fit.

Pros (Advantages)

Pro #1: You can invest small amounts in a cost efficient way [Back to top]

DRIPs aren’t for everyone, but they can be great for investors who don’t have a lot of money to invest. If you don’t have a lot of money broker commissions and costs can be prohibitive. With a DRIP you usually only need one share to enrol. Once enrolled investors wanting to contribute a small amount of money can utilize the low costs of DRIPs to slowly build up their portfolio. Say you wanted to buy $10 worth of shares, you could and there would likely be no fees. DRIPs have advantages for those looking to invest larger amounts of money too, but the greatest benefits are for the investor with not a lot of money.

Pro #2: They have low or no fees [Back to top]

Once a DRIP is setup there are usually no or very low fees. This means that you can buy shares and reinvest your dividends without having to pay a commission or fee to your broker. This is one of the biggest advantages of a DRIP & SPP. Depending on the plan you have you will either have to mail in a cheque/check or setup a pre-authorized debit from your bank account to buy more shares. If you have to mail in a cheque/check then the cost to buy more shares is the price of a stamp. If it’s a pre-authorized debit it should be free. All-in-all, pretty low fees.

I’ve found that most US DRIPs offer electronic options, so most of the time you won’t have to mail a cheque/check in, and you can enrol in the DRIP online. US DRIPs are mostly fee free, but some companies do charge fees to buy more shares or reinvest dividends. The fees are usually low, but I don’t invest in DRIPs with fees. There are enough no fee options out there that this shouldn’t’ really be a big problem.

In Canada there are two main transfer agents Computershare and Canadian Stock Transfer (formerly CIBC Mellon). If you’re DRIP is administered by Canadian Stock Transfer you’ll be doing everything by mail in most cases, so again it will cost you the price of a stamp. Computershare is more computer friendly and they offer some DRIPs with pre-authorized debits, so depending on the DRIP it will either be free or the price of a stamp. The vast majority of Canadian DRIPs don’t have fees to reinvest dividends or purchase additional shares, with the notable exception of Tim Horton’s (THI Trend Analysis).

In most cases to setup a traditional DRIP you will have to pay a one-time fee initially. These fees usually range from $10 to $300. If you are smart about it, you shouldn’t really be paying more than $10 to $25 and in most cases it should be closer to $10. Most brokers will charge you around $5 to $30 every time you buy shares. Compare this to paying a one-time fee of around $10 to be able to buy shares for free every time after that is pretty good.

For investors who don’t have a lot of money and want to accumulate shares slowly by investing a set amount on a regular basis (for example $100 per month) DRIPs and SPPs offer a great way to accumulate shares in a low cost manner. Investing $100 at a time with a broker means you lose a large portion of your investment initially to broker commissions which typically range from $5 to $30 per buy. In most cases once a traditional DRIP and SPP are setup the fee to buy more shares should either be nothing or the cost of a stamp.

Pro #3: It’s an automatic savings method [Back to top]

Normally when a company pays a dividend the shareholder receives it in cash. When you setup a DRIP the dividend is reinvested automatically and more shares are purchased. This in a sense is an automatic saving plan. Slowly the DRIP builds up your position in the company and in theory your net worth.

Pro #4: Some DRIPs & SPPs have discounts [Back to top]

It’s not very common in the USA, but in Canada there are a number of DRIPs that offer a DRIP discount. A DRIP discount ranging from 1% to 5% is offered on select DRIPs. This means that when the dividends are used to buy more shares they will buy additional shares using a share price that is 1% to 5% lower than normal. While this may not be a huge amount, it gives you a bit more bang for your buck. Most brokers will not match this DRIP discount in their synthetic DRIP. For Canadian investors, a notable exception is RBC Direct Investing which will match the DRIP discount. As far as I know no other brokers will match the discount in Canada. To see a list of Canadian companies that offer a DRIP discount check out dripprimer.ca. DRIP plans can change on a semi-regular basis, but here are a few examples of better known Canadian companies that offered a DRIP discount on January 29, 2014:

- 5% – Emera (EMA Trend Analysis)

- 4% – Canadian REIT (REF.UN Trend Analysis)

- 4% – Dundee REIT (D.UN Trend Analysis)

- 3.1% – Riocan REIT (REI.UN Trend Analysis)

- 3% – H&R REIT (HR.UN Trend Analysis)

- 2% – Bank of Nova Scotia (BNS Trend Analysis)

- 2% – Enbridge (ENB Trend Analysis)

- 2% – Fortis (FTS Trend Analysis)

- 2% – Manulife (MFC Trend Analysis)

The DRIP discount is great, but in a few rare instances companies will even offer a SPP discount. This means that you are able to buy shares at a discount ranging from 1% to 5% off of the regular price. I haven’t encountered these in US DRIPs, and as far as I can see there are only two companies that offer a SPP discount in Canada right now (January 29, 2014); Pengrowth Energy (PGF Trend Analysis) with a 5% SPP discount and TransAlta (TA Trend Analysis) with a 3% SPP discount.

Pro #5: Partial shares can be purchased [Back to top]

Dividends that are reinvested to buy more shares can be used to buy partial shares. This means all of your money is being put to work. This is best illustrated with an example. Say you received $125 as a dividend payment, and the share price is $100. With a synthetic DRIP the $100 would be used to reinvest and buy one share, and the remaining $25 would be deposited as cash in your account. If you had a traditional DRIP that allowed fractional shares then 1.25 shares would be purchased.

As you can see from the example the traditional DRIP offers the advantage of being able to buy fractional shares. This can be a significant advantage if your dividend is regularly lower than the share price making it impossible to participate in a synthetic DRIP.

SPPs also let you buy fractional shares. For instance if you were enrolled in Bank of Montreal’s (BMO Trend Analysis) DRIP and SPP through their transfer agent Comutershare you could send in $7 and it would be used to buy about a tenth ($7/$70 = 1/10) of a share. (BMO’s price as of January 29, 2014 was around $70).

Pro #6: They are a good learning tool [Back to top]

Every investor makes mistakes. For investors just starting out it is likely that they will make more mistakes early on, and as they learn more these mistakes will become less frequent. A key part of any good portfolio is minimizing these mistakes and the overall effect they have on your portfolio returns. Why I like traditional DRIPs is that they teach some valuable lessons early on. Because setting up a traditional DRIP can be quite time consuming it gives beginners a bit more time to figure everything out. To setup a broker account and start trading can be done in a matter of days. Typically to setup a traditional DRIP if you buy your share on the DRIP Investing Resource Centre’s Share Exchange it can take a month or two. While you are waiting for your share and to enrol in the DRIP you get a bit more time to learn about investing and dividend stocks. When I first setup my online broker account at Questrade I was excited to go and buy some shares and make a fortune. In reality, I would have been better served reading more and waiting for my initial excitement to wear off, before I started investing.

One of the disadvantages of a traditional DRIP is that it you have less control over the timing of the purchase and the share price used to buy or sell the stock. While this is a disadvantage, it also means that more thought goes into selecting a good long term investment that isn’t likely to cut its dividend. This thought process of trying to find a company that will continue paying or increasing its dividend over the long term is something that DRIPers think about from the get go. Investing with this frame of mind is an advantage because it gets beginners thinking about investing for the long term in viable growing companies. This mindset is a good one in my opinion.

With a SPP you are usually given the opportunity to buy shares on a monthly or quarterly basis. This is limiting, but it also means that as a beginner you focus more on company fundamentals rather than the news of the day. You are going to be less concerned with a small drop in price because of some short term news event and more worried about the long term fundamentals of the company. Because you lose control over the short term prices, beginners learn early on to ignore the noise from the media and focus on long term prospects and fundamentals.

Cons (Disadvantages)

Con #1: You cannot DRIP in a tax sheltered account [Back to top]

One of the biggest complaints I hear about the traditional DRIP and SPP is that they cannot be setup in a tax sheltered account. There are a few exceptions with US DRIPs, but these typically have fees. This means that investors looking to invest in a tax sheltered account usually just invest with their broker.

Another option is to use the traditional DRIP and SPP to accumulate shares. When a meaningful amount of shares have been accumulated they can be transferred to a taxable broker account, and from there they are transferred to a tax sheltered account setup with your broker. This method can be time consuming, but transferring shares from your DRIP account with the transfer agent to your broker doesn’t usually involve any fees. Shares from a traditional DRIP can’t be transferred directly into a tax sheltered account, which is why you have to transfer them to a taxable account with your broker first and then move them into the tax sheltered account from there.

For a low cost way to invest small amounts in a tax sheltered account investors should consider index investing. My broker Questrade offers no fee ETF purchases. This means I can buy index ETFs with low management expense ratios (MER%) in small quantities and slowly build up a portfolio without incurring fees. This, like DRIPs, is another effective low cost way of building up a portfolio without needing a lot of money upfront. I won’t go into more detail here because it is an entirely different strategy and it deserves its own article. If you’d like to learn more, read the related article below.

Related article: Index Investing: The Couch Potato Strategy

Con #2: You have less control over the timing of the purchase and the share price [Back to top]

With a broker you can pick the price you want to buy or sell shares by setting a limit order. You can also buy or sell shares most of the year during business hours. With a DRIP and SPP you lose some control of these factors.

A SPP will buy shares at a pre-defined date, usually at the average price for that day, or the average price for a few days leading up to that date. This is best illustrated with an example.

Johnson & Johnson SPP example

Say I am enrolled in Johnson & Johnson’s (JNJ Trend Analysis) DRIP and SPP. I want to buy $100 worth of shares. To buy more shares I can either mail in a check, or authorize a one-time online bank debit from a US bank account. I look at their DRIP and SPP and find out that

“cash payments will be invested once a month beginning on the 7th day of each month in which no dividend is payable. In the months in which dividends are ordinarily paid, additional cash payments and dividends will be invested concurrently beginning on the dividend payment date. Dividends are customarily paid on or about the first or second Tuesday of March, June, September and December.”

Let’s assume I want to invest in February, so the $100 will be used to buy shares on the 7th. I have to make sure they receive the money before then so they have time to process the request. This means I might mail in the check or initiate the bank debit 2 weeks prior to February 7th. Regardless of what happens to the share price in the two weeks, I will be buying $100 worth of shares on February 7th. This example highlights the control you lose with a SPP compared to a broker. With a broker you could decide on February 7th if you want to invest after knowing the stock price. With a SPP you don’t know the price before hand and the order will go through. In this case the SPP is a monthly plan, so you only get 12 opportunities to buy shares in the year. A broker lets you buy shares anytime during business hours throughout the year. Monthly SPPs are probably the most common, but you can get quarterly, weekly and other intervals too.

Con #3: Lots of mail [Back to top]

After you’ve setup a few DRIPs, you will be bombarded by mail. You’ll receive quarterly or monthly account statements, annual reports, quarterly reports, proxies, etc. Say you setup 5-10 DRIPs then this turns into a lot of mail. An easy way to deal with this is to sign up for electronic online statements. Not all DRIPs offer this option, but a lot do. You can also opt out of the quarterly or annual statements. If you need the information later you can usually get this information from the company’s investor relations website. You can also get a company’s filings (annual reports, quarterly reports and others) from SEDAR for Canadian companies and EDGAR for US companies.

You’ll need to keep the account statements for tax time. If you get monthly statements, this can be overwhelming. A trick is to just keep the last statement of the year because it shows all of the transactions for the year. This means you won’t need the first 11 statements from the year.

Lots of mail isn’t a huge disadvantage, I’d say it’s more of a nuisance.

Con #4: It complicates your taxes [Back to top]

Having a bunch of DRIPs setup can make it more confusing come tax time. If you receive international dividends then there are foreign tax credits that are involved on top of the regular reporting of your dividend income. In cases where you have a capital gain (selling shares or transferring shares into a tax sheltered account can trigger capital gains) it can be complicated to determine the correct amount to report, especially if the dividends have been reinvesting for a long time. Every time a dividend is reinvested or additional shares are purchased the cost base of your shares will change. You have to track your cost for each DRIP which results in a lot of record keeping. I don’t talk about taxes on this blog, so I recommend talking to an accountant to learn more about this.

Con #5: All DRIPs are different [Back to top]

Each company DRIP has a different plan. This can make it very confusing for investors new to DRIPs. You’ll see from the list below that there are a lot of different variables to consider and I haven’t even gone into the decisions you should make before picking a company to DRIP. These are just different elements that each DRIP or SPP has. As you can see from the extensive list below, enrolling in a DRIP can be overwhelming.

- Enrolment options to consider

- How can you enrol in the DRIP? Does the company offer an online enrolment option that lets you buy shares initially, or do you have to be a shareholder already and use this information to enrol?

- How many shares do you have to own to enrol in the DRIP? Most of the time you need a single starter share, but in some cases they might require 10 or 100 shares before you can enrol in the DRIP.

- What are the deadlines to enrol? Usually each company requires that you enrol before a set date so that they have time to process the dividend reinvestment for the dividend that is paid. This isn’t a huge issue, but it can delay things quite a bit. If you miss the deadline the first dividend will be paid to you in cash and you’ll be enrolled for the next dividend payment. Where this can be frustrating is if you are also trying to buy additional shares through the SPP for the first time. If it is a SPP that only allows quarterly optional cash purchases (OCP) and you miss the deadline you end up waiting months until the first purchase of shares goes through.

- DRIP considerations

- Can I enrol in the DRIP?

- Some Canadian companies only allow Canadian residents to enrol in the DRIP and vice versa for US DRIPs. I’ve found that most of the well-known DRIPs allow for US or Canadian citizens and some other international countries.

- Do you have a bank account in the right country? For instance if you want to invest in US DRIPs, but are from another country you will have to setup a bank account in the USA. To buy more shares requires a USD bank account. For Canadians this can be done a variety of different ways, but it gets more difficult if you are from another country.

- What kind of DRIP do you want to open?

- The most common is a DRIP in the investor’s name, but if you want a joint account with a partner, or you want to setup an account for a child then you have to make sure the share is registered in the correct manner.

- Say you want to invest with your partner then your shares would be registered as a joint account. There are different types of joint accounts, so you should go over your options with a lawyer. I’ve shown the two most common types that I’ve seen. For example say Bob and Jane want to have a joint account, then they would have their shares registered as either

- Bob and Jane JTWROS, or

- Bob and Jane JTTEN

- JTTEN stands for Joint Tenancy and JTWROS stands for Joint Tenants with Right of Survivorship. From what I understand both of these mean that either person can make changes to the account and if one person dies ownership of the shares will go to the other partner.

- Say you want to setup a DRIP for your child then you have two options, a custodian account or trust account. I’ve found that most parents use the trust option because they have a bit more control of when the shares will be passed onto the child. If you setup a custodian account then the shares will fall into the kid’s hands when they are of legal age. With a trust account the parent can decide when they want the shares to be given to the child. I’ve found some parents are more comfortable handing over a large number of shares to a 25 year old compared to an 18 year old. An example of how you would register a trust account would be:

- Dad/Mom held in trust for Child.

- There are additional tax and legal implications to consider, so I’d recommend talking to a lawyer and accountant if setting up this type of account.

- Dad/Mom held in trust for Child.

- Can I enrol in the DRIP?

- DRIP/SPP discount considerations

- Is there a DRIP discount? Some DRIPs offer a discount ranging from 1-5%. This means that the price used to determine how many shares you get from your reinvested dividends will be discounted by 1-5%. You see this in some Canadian companies.

- Is there a SPP discount? A SPP lets you buy additional shares at a discounted price. The discount usually ranges from 1-5%. You see this in rare instances with some Canadian DRIPs.

- While a discount is a nice added perk, don’t simply invest in a company because it has a discount. There are more important factors to consider first like the business fundamentals, the strength of its dividend, etc.

- SPP considerations

- What’s the minimum amount you can invest at a time? These range from $0 to $1,000 depending on the plan. Most plan minimums are around $25 to $100.

- What’s the maximum amount you can invest at a time? These limitations are usually an annual amount and vary widely. For instance Pengrowth Energy (PGF Trend Analysis) will allow $1,000 per month, but Johnson & Johnson (JNJ Trend Analysis) will allow $50,000 per calendar year. Most of the time the limitations are quite high (>$20,000 per year) and shouldn’t impact the average person that much. My guess is that in Pengrowth Energy’s case it has a low maximum because they offer a 5% discount on the DRIP and SPP (As of January 29, 2014).

- How frequently can you buy additional shares? I’ve found most companies offer a monthly SPP, but it still varies a lot. Some companies only offer quarterly SPPs, so it’s important you pay attention. If you miss the deadline your next opportunity isn’t until 3 months later. Other plans offer weekly or bi-monthly plans. They all differ, so check the plan for details.

- What are the deadlines to send in an optional cash purchase? Each plan has a different deadline for when the transfer agent has to receive the money for the optional cash purchase. If you miss it, then the money won’t be invested until the next optional cash purchase date.

- If you are making an optional cash purchase, what type of payment will the transfer agent accept?

- Do you have to mail in a cheque/check, or can you make a pre-authorized debit (PAD)? Being able to setup a PAD with the transfer agent is a lot simpler than mailing in a cheque/check. Most US DRIPs offer PADs, and some Canadian companies that have Computershare as their transfer agent offer PADs. Most Canadian companies that use Canadian Stock Transfer (formerly CIBC Mellon) don’t offer PADs.

- Does the cheque/check have to be a certified cheque/check? In most case a regular cheque/check is fine, but in rare cases they require a certified cheque/check. For example Altagas (ALA Trend Analysis) needs a certified cheque/check if you want to buy more shares in their SPP.

- Are you able to enrol in automatic investments? For example can you have a set amount taken from your bank each month?

- Transfer considerations

- Are there black-out periods? Sometimes the transfer agent won’t process requests between the dividend record date and the payable date. For some companies this period is about a month long. This means that if you submitted a request to transfer shares then it could be delayed. If you are concerned, call the transfer agent. Transfers from a transfer agent to a broker typically take quite a while and if you are transferring shares to a broker because you want to put them in a tax sheltered account by a deadline then you should start this process early.

- Fee considerations

- Is there a fee to reinvest dividends? Most of the time there won’t be, but some plans do. You see this with US companies more.

- Is there a fee to buy more shares? Most of the time there won’t be, but some plans do. You see this with US companies more. Depending on how you buy shares there may be fees.

- If you buy shares as a one-time transaction (mail cheque/check in, or setup a bank debit) is there a fee?

- If you are setup for automatic investments at a set interval is there a processing fee?

- For example Johnson & Johnson (JNJ Trend Analysis) will charge you a $1 processing fee for automatic monthly bank debits, but won’t charge you for one-time bank debits even if you make a one-time bank debit each month.

- If you can enrol in the plan online through the transfer agent, what is the cost?

- If you want to sell shares through the transfer agent what are the costs?

- Selling fees can broke into two components; a cost per share sold as well as a set fee to process the request. These vary widely from one company to the next. If selling fees are high, consider transferring the shares to your broker and selling them there.

Con #6: Time consuming to setup [Back to top]

To enrol in a DRIP you usually have to be a shareholder of the company. This usually means having a single share registered in your name. The process of acquiring this share is very time consuming. When you buy a share through a broker the shares are in the broker’s name held on your behalf, so simply buying a single share through a broker is not enough. You need a share certificate or DRS Account Statement in your name in order to enrol in a DRIP. There a variety of different ways to get the starter share:

- Buy the share from another shareholder and have them register the share in your name when they transfer it from their DRIP to you. This involves buying a share off the Share Exchange at the DRIP Investing Resource Center. This will typically cost the share price plus $10 and take anywhere from a few weeks to a few months. This option is usually the cheapest and is a great way to buy starter shares for Canadian DRIPs, but it can be more difficult to find US starter shares on the Share Exchange. If you don’t have any luck buying a US share on the exchange try the other options. This how I purchased started shares and it’s the one I recommend the most.

- Have a fellow DRIPer transfer you a share. If you don’t know anyone try finding an investment club in your area. This is the same transfer process, but some people like to see the person before they are comfortable paying upfront or something that won’t show up for a few weeks. This will typically cost the share price plus $10 and take anywhere from a few weeks to a few months. If it’s a friend they might waive the $10.

- Buy the share with your broker and have them issue you a share certificate in your name. This is an expensive way of doing it as you have to pay the broker commission to buy the share and then they will charge you anywhere from $50 to $300 depending on the broker. It will depend on your broker how quick the process is. Questrade will charge you $300 to issue a share certificate in your name. Other brokers typically charge around $50 to $100.

- Do a group buy. A group buy is similar to the previous broker option, but instead of buying just one share you buy 10 shares and have the certificate issued in your name. When you receive the certificate for 10 shares you mail it to the transfer agent with a transfer form that has been stamped with a medallion guarantee stamp and have them transfer the other 9 shares to the other members of the group. The price is the same as the previous broker option, but now you split the costs with 9 others so you are only paying a tenth of the original costs. This can take quite a while to complete (a month or longer). If you are interested in this method here’s an article on how to coordinate a group buy.

- Use Temper of the Times to buy your US DRIPs. This company will charge you $30 to $60 plus the cost of the share and they will enrol you in the DRIP. Depending on when you buy from them it will usually take a month or so. The offer discounts on certain DRIPs, so you get the $30 price if you are smart about it.

The time consuming part of enrolling is getting the starter share in your name, but once you have the share certificate or DRS Account Statement, you will still need to mail in DRIP and SPP enrolment forms to the transfer agent. Sometimes you can enrol online through the transfer agent and this saves some time. It takes a bit of time for the transfer agent to process the enrolment forms. After all this you are finally setup for a DRIP, but don’t be surprised if it took a month or two.

The easiest way to avoid these time delays is if the company offers online enrollment through the transfer agent. This is known as a direct share purchase plan (DSPP). Usually you have to pay a one-time fee initially and commit to a minimum investment amount ($100 to $1,000). The advantage with this method is that you are buying the share directly from the company so it’s issued in your name from the start. The one-time fee is usually around $10 or $15 which is one of the cheaper options and it is by far the quickest. Not all companies offer a DSPP, mostly you see this with some US DRIPs. If the company offers a DSPP I’d use it over the other methods unless the cost is prohibitive.

Con #7: DRIPs are not diversified [Back to top]

With a DRIP you are investing in one company, which means whatever happens good or bad you have to live with the consequences. If you didn’t do a lot of research at the beginning when you selected the company’s DRIP then you might end up investing in a company that doesn’t have great long term prospects. DRIP investing is a long term investment style, so it is crucial that you select companies with viable long term business models that have a sustainable and preferably growing dividend. Being invested in a single company is risky. You can diversify more by setting up other DRIPs too, but you aren’t ever going to get the instant diversification you could get from buying an index ETF of an entire market.

Your portfolio may become over-concentrated in one holding if dividends have been reinvesting for a long time. I try and keep my individual holdings to 10% or less, but closer to 5% is better.

Con #8: You miss out on other opportunities [Back to top]

If your dividends are reinvesting in the same company and the company is overvalued then you miss out on putting that money to better use in a different company that could be undervalued. This risk can be mitigated by turning off the reinvestment feature of the DRIP and collecting the cash to invest in other opportunities. Later on, the reinvestment feature can be turned back on, by sending in a form to the transfer agent.

Conclusion

As you can see there are a lot of different variables to consider when deciding to invest with DRIPs and SPPs. In my opinion the main advantages are the low costs or no fees that DRIPs and SPP offer to investors looking to invest small amounts at a time. DRIPs allow the little guy to start accumulating shares and build a portfolio in a cost efficient manner.

If you’ve still got questions then feel free to contact me or leave a comment, but I’d be remiss if I didn’t mention the DRIP Investing Resource Center as valuable resource as well. For those new to DRIPs I highly recommend signing up to the forum and posting questions there as well. They have a collaboration of seasoned DRIPers who have been investing this way for a very long time and are happy to help.

Related articles:

- What Is A Dividend Reinvestment Plan (DRIP/DRP)?

- Things to consider before buying a share and enrolling in a dividend reinvestment plan (DRIP)

- How to buy a share on the DRIP Investing Resource Center’s share exchange

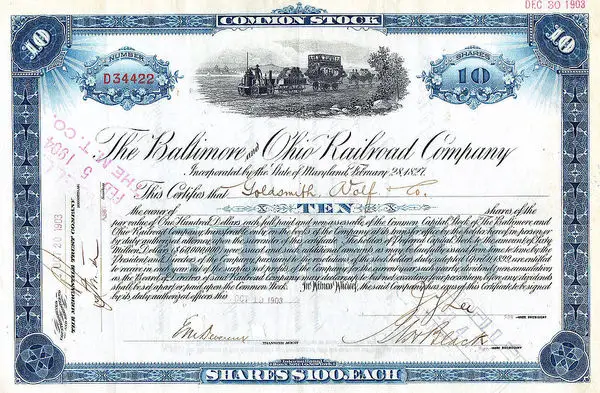

Photo credit nickwheeleroz / Foter / CC BY-NC-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Great DRIP summary!!

I would add to the Pro’s: It’s the easiest way for people with limited funds to invest and obtain the best long term return on their investment. Buy one good stock and begin regular dollar investments to buy more shares and re-invest all the dividends. This is the best option for investing for kids.

Many of the companies with Computershare now allow Direct Bank Debits to make the investing process even easier.

The only time #8 of the Con’s might be considered is when the amount of dividends becomes fairly large. When the amounts are small (under $500) than re-invest to dollar cost average and get every $ working to compound your returns. Maybe for non-drip accounts you may wish to hold back on the dividend re-investment, but I prefer to re-invest all.

Many investors don’t consider that a fee of $5 or $10 or ETF annual fees of 0.50% will have a major effect to their long term investment returns. I do and suggest one avoid fees whenever possible.

you don`t explain the best way to sell. i`ve been using drip for 50 years. i`m retired now an want to sell & use my saving to enjoy the few years i have left. I`m 81, it`s time for us to travel an profit from our planing an saving. i`ve done well (safely) in drip