Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I wrote in July that I planned to sell all of my shares in order to come up with a large down payment for the Condo I recently purchased, so this post will be an update on that process. In the last portfolio update I talked about the shares I sold on June 20, 2014. These shares were held in my Questrade account, but I was still left with some traditional DRIPs that I needed to either sell through the transfer agent, or transfer to my TD Direct Investing account and sell them there. One of the cons of traditional DRIPs is that it can take a while to sell certain shares because of the added transfer times. I thought this could take up to 2 months between my busy schedule and transfer times and it turns out this was about right.

Related articles: Portfolio Update: I’m Selling Everything! & I Bought A Condo – Excitement & Worries

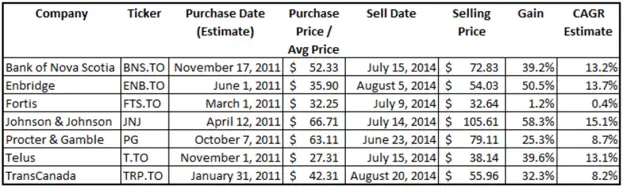

On June 23rd, and in July and August I sold the following shares and was left with a cash only portfolio:

- Bank of Nova Scotia [BNS Trend]

- Enbridge [ENB Trend]

- Fortis [FTS Trend]

- Johnson & Johnson [JNJ Trend]

- Procter & Gamble [PG Trend]

- Telus [T Trend]

- TransCanada [TRP Trend]

The results

All of these were dividend reinvestment plans, which meant I purchased additional shares over time (dollar cost averaging) and also had the dividends reinvested with each payment. This is different from my other investments where I typically purchased a larger amount of shares at once and used the dividend income to purchase shares of other companies. Because there isn’t one date in time where all the shares were purchased it makes calculating the compound annual growth rate (CAGR) a lot more difficult for DRIPs and requires a lot more time. Because of this I chose to pick a purchase date where the majority of the shares were purchased near to the time I first started investing in the DRIP. This has skewed my CAGR results down, so in reality my CAGR for the following investments are higher.

When I include the above sales with the shares I sold on June 20, 2014 this represents the entire liquidation of my portfolio and I estimate that my total portfolio CAGR was slightly above 20% which I’m very pleased with. I attribute this partly to luck. Markets are quite high so selling in this environment is partly good timing versus superior investing skills. Had I not bought the condo, I’d be holding on to the shares for the long term and collecting the increasing stream of dividend income. I started seriously investing in 2010 and markets have basically just gone up since then, so I’m not expecting +20% returns as the norm. In the long term I’d expect returns more in line with historic averages ranging from 6-10%. The important thing for me is that my investments grow their dividends at high sustainable rates for a very long time as I plan to use this dividend income to retire with.

I’ve updated my portfolio page. You’d expect an empty portfolio as I sold everything, but after I got possession of the condo I started investing again. I purchased shares of McDonald’s [MCD Trend] on August 28, 2014 for an average price of $93.96 in my taxable account and then again on September 5, 2014 with a small amount of money I had in my RRSP for an average price of $93.11. I’ll talk about this purchase shortly in the next post.

Photo credit: kevin dooley / Foter / Creative Commons Attribution 2.0 Generic (CC BY 2.0)

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!