Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

One of the reasons I started this blog was to educate others and to improve my own investing. This is why I like to keep my readers up to date on my portfolio changes. For the most up to date portfolio changes follow my twitter account as I will usually tweet first and then follow-up with a blog post.

By keeping an open book of my portfolio and changes to it, I hope to generate discussion so others can see how I put my investing philosophy into practice. With this post specifically I’m hoping to generate some serious discussion as I’m a little worried that I’ve gone yield chasing and diversified just for the sake of diversifying. I’ll let you be the judge…

Potash Corporation of Saskatchewan

I purchased Potash Corporation of Saskatchewan [TSE:POT Trend] twice in September. The first purchase was on September 25, 2015 for a price of $27.99 followed by another purchase on September 29, 2015 for $27.49.

Potash Corporation of Saskatchewan is the world’s largest fertilizer company measured by capacity. The company’s main focus is potash, where it is the global leader in installed capacity with a roughly 20% share. Potash is also a player in the nitrogen and phosphate industries, ranking third in global production of each nutrient. The company pays a quarterly dividend of $0.38 US, but it is converted to Canadian for shareholders resident in Canada using the exchange rate applicable on the dividend record date. Based on today’s exchange rate, Potash Corporation of Saskatchewan sports a dividend yield of 7.5%. While a high yield is appealing, this is very high for a basic materials company.

One of my worries with this purchase is that I have gone yield chasing and have not emphasized dividend growth enough. Potash Corporation of Saskatchewan has increased its dividend for 4 consecutive calendar years and has 5 and 10 year dividend growth rates of 60.0% and 37.4% respectively. These dividend growth rates are deceiving because the company has increased the dividend at the expense of its payout ratio. The company used to pay around 10% of its earnings out in dividends, but then in 2012 it started increasing its dividend at a higher pace than earnings. Currently the annual dividend is $1.52 and analysts are estimating EPS of $2.17 for 2015/12. This works out to a payout ratio of 70%. This is a huge jump and why I would not expect the same level of dividend growth going forward. In fact, I wouldn’t be surprised to see no dividend growth in the near to mid term.

So why, as a dividend growth investor, did I buy shares?

Three reasons…

First, the shares seem cheap. Morningstar currently has them as a 4 out of 5 star stock.

Second, I expect dividend growth in the long term. Yes the payout ratio is high at 70%, but the company has a healthy balance sheet and strong financial strength (ValueLine gives them an “A+” for financial strength). They are in the process of winding up some major capital intensive projects so they will have more cash on hand to pay the dividend. The company has a history of either keeping the dividend steady or increasing it and they have never cut the dividend since they first started paying the dividend in 1990. In 1999 they switched from a Canadian dollar dividend to a US dollar dividend and it looks like they cut, but when you factor in the exchange rate, they didn’t. I think that the company may be heading into a period of time where the dividend is held steady for a few years, but in the long term I expect this to be a dividend growth stock. In the meantime I’m collecting a pretty hefty dividend.

Third, I was looking to diversify into the basic materials sector with a wide moat stock. It is very difficult to find wide moat stocks in the basic materials sector because of the nature of basic material companies. Most of these companies are price takers and so earnings fluctuate based on the price of a commodity. I’m currently only aware of two wide moat basic materials companies that could be considered dividend growth stocks: Potash Corporation of Saskatchewan and Praxair [NYSE:PX Trend] (If you know of any others please let me know). I took this as an opportunity to diversify into a new sector as my current portfolio is pretty heavy in financials and energy right now. That said, I don’t think I want to allocate more than 5% of my portfolio to the basic materials sector as they typically don’t make great long term dividend growth stocks. Currently my Potash purchases make up roughly 2.8% of my portfolio.

Good or Bad Idea?

So what do you think of my Potash purchase? Do you think it is a good investment, or have I fallen for some classic traps like yield chasing and diversifying just for the sake of diversifying?

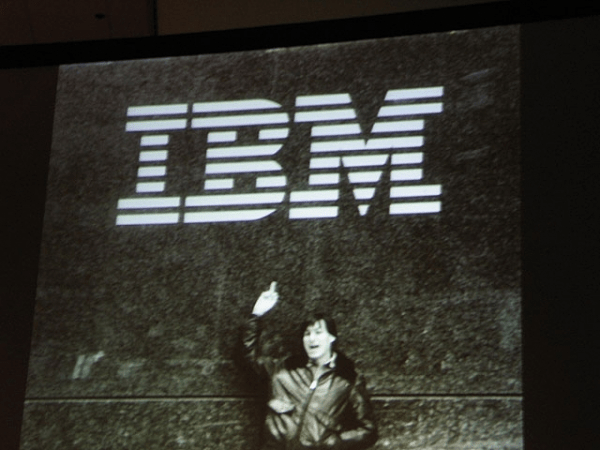

Photo credit: Rob Swatski / Foter.com / CC BY-NC

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

How did you get to this company ? interest post.

Not sure what you mean, can you clarify?

Good idea to me! 😉 I also like AGU. Did you look at it as well?

Mike

Didn’t really look at Agrium Inc. (AGU) in detail. It doesn’t have a wide moat and it is not as financially strong as Potash so I likely won’t be investing in it.

AGU credit ratings: BBB from S&P and Baa2 from Moody’s. Potash has A- from S&P and A3 from Moody’s.

I can’t argue with this one as I am tempted to make this my next purchase. Like DivGuy I also like AGU as well.

What’s your expectation for dividend growth from AGU?

It looks like things are pointing to double diget dividend growth once again as 2016 should be a good year for AGU.

Value Line is estimating dividend growth of 14% over the next 3-5 years.

What is the CAGR of your portfolio?

I’m not exactly sure to be honest.

I first started investing in ING Direct’s (Now Tangerine) Streetwise mutual funds (Think automated Couch Potato Strategy with 1% MER) and then started investing in DRIPs and individual stocks around 2010. I can’t remember when I sold the streetwise funds, but I didn’t have a lot of money with them as I was just starting out. My returns were positive, but I don’t think it was anything inspiring. When I sold the streetwise funds, the money would have gone into my dividend growth strategy.

In June, July & August of 2014 I sold off virtually all of my investments for a large downpayment on a condo and so I could setup the smith manoeuvre. I estimated that the portfolio CAGR was slightly above 20% for these stocks and DRIPs. You can read about those sales in two articles:

https://dividendgrowthinvestingandretirement.com/2014/07/portfolio-update-im-selling-everything/

https://dividendgrowthinvestingandretirement.com/2014/09/portfolio-update-selling-last-drips/

I attribute these 20%+ returns to luck. If you started investing seriously in 2010 and then sold in 2014 your returns were going to be good because of timing. In the long term I’d expect returns more in line with historic averages ranging from 6-10%.

I started investing again in August 2014 when I had the smith manoeuvre set up. Since then (August 2014) my CAGR has been -0.45% without dividends and assuming a 1.0 USD/CDN exchange rate. My portfolio dividend yield is currently around 4%, so I guess around 3.5% CAGR since August 2014 after dividends. More of my US holdings were purchased when the exchange rate was a lot better, so from a Canadian standpoint the CAGR is a little higher.

I don’t know what my CAGR would be from the start as I’ve never spent the time to calculate it. Do you know of any free portfolio tracking websites that track CAGR and will factor in dividend payments automatically?

CAGR is important, but my focus is on a sustainable growing stream of dividend income.

I try to be pretty open on this blog so you can see all of my portfolio updates here: https://dividendgrowthinvestingandretirement.com/category/portfolio-update/

My portfolio holdings are here: https://dividendgrowthinvestingandretirement.com/dividend-portfolio/

And if you are interested in my dividend income check this page out: https://dividendgrowthinvestingandretirement.com/dividend-income/

Cheers,

DGI&R

I bought it a couple of days ago as well thinking of holding it for a long time. The fundamentals look great and the business generates solid amount of free cash flows every quarter even in the most recent quarter. The industry will probably shaken next little while but the supply and demand will eventually balance out and that’s when we will see some boost.

Thanks for sharing

BSR

Potash has another good quality. It has become a basic human need. While there aren’t food shortages that has largely come about because of modern agriculture which is totally dependent on cheap sources of Potassium. Potash is the only cheap source and there are limited resources around the world. Potash Corp has some of the largest and most cost effective mines in the world and it is in close proximity to two very large potash customers. The downside is the fact that this is a cyclical stock and the price swings pretty wildly. I imagine the crazy high 7.5% dividend and the company’s ability to support it will act as a pretty solid floor.

Are you avg down on it ?

Since the purchases mentioned in this post I haven’t bought anymore Potash. If it drops further I’m not sure if I’ll buy more. I have to re-examine my sector allocation targets. I think i might have one more small purchase of Potash left in me, so I’d like to wait for a really low price.

Would you buy more POT at these prices? Do you think the dividend is still safe?

I think POT will be cutting its dividend soon.

I still like this company. Good fundamentals. I believe some long term projects for the company are completing this year which will reduce operating costs. There is always risk though… but this company is better positioned to handle cyclical downturns than most.

Unfortunately it appears POT will be cutting but that is fine. I am more interested in a company that is cautious with my capital than one that is reckless and this company has a long history of being prudent capital allocators (case in point: unwilling to sweeten the K+S deal.)

It looks like you were right. The cut the dividend by 34% so I sold my shares today @ $20.70.

Hi,

Traveling when dividend cut. Bought at $36.50 in registered account. Should have sold long time ago. And maybe bought back. Keep or dump? About 1% of portfolio.

New to this site and loving what I see. Bought POT in Sept @ 33.11 and will continue to hold. Div cut was not surprising but crops will always be grown and require fertilizers, so POT will eventually bounce back and I’m still collecting a 3% div allong the way.

Sadly Potash is a classic value trap, I blogged about it

http://my-investing-thoughts.blogspot.de/2016/03/potash-pot-classic-value-trap.html

I wrote a short blog post about this, Potash classic value trap

https://tr.im/OnojB