Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

For those new to the blog, I like to keep my readers up to date on portfolio changes. One of the reasons I started this blog was to educate others, but also to improve my own investing. By keeping an open book of my portfolio and changes to it, I hope to generate discussion so others can see how I put my investing philosophy into practice.

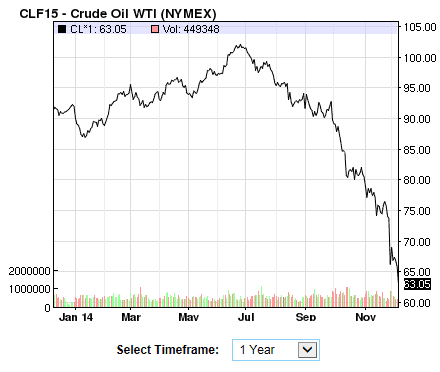

The price of oil has been diving recently and yesterday (December 8, 2014) it hit a new 5 year low. A quick look at the one year chart for WTI Oil and you can see that over the past six months the price of oil has dropped about 40%.

Not surprising we have seen the price of stocks in the Oil & Gas industry come crashing down too. With these significant price drops I’m starting to see some value in the industry. Currently there is a lot of uncertainty and speculation about where oil prices will go from here and I’m not here to add to that speculation. Rather than try and guess on where a commodity price is going in the short term I try and focus more on business fundamentals of the companies I want to invest in. With this in mind, I view the current decline in oil prices as an opportunity to pick up some good dividend growth stocks at depressed values.

Ensign Energy Services

I purchased Ensign Energy Services [ESI Trend] on November 27, 2014 at a price of $11.75. At the time I thought the price would drop further, but one can never be sure of these things. I hate missing opportunities to buy good companies below my target buy price, so I purchased half as much as I normally would. Sure enough prices fell some more and I purchased the other half on December 2, 2014 at a price of $10.44. The average price of these shares is $11.02. Since then the price of Ensign Energy Services has continued to drop and closed at $9.95 on December 9, 2014.

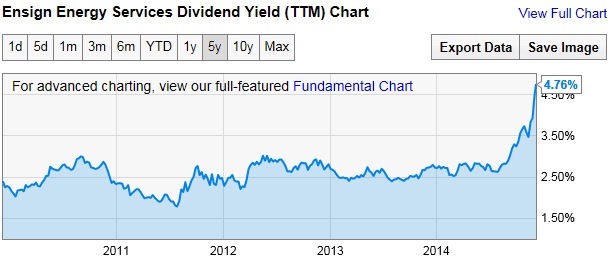

I first started getting interested in this stock around the $14/$15 mark, but it continued to drop which ultimately made my decision to buy easier. When the price started dropping below $14 I went back and forth on whether or not to invest in Ensign Energy Services. I ended up buying the first half of my shares at the 4% dividend yield mark and then again at the 4.5% yield mark. Part of the reason I had difficulty first investing in this stock is mostly because I consider this a good stock, but not a great stock. What ended up pushing me over the edge was the long dividend streak of 19 years. They recently announced a small 2% dividend increase which will take their dividend streak to an impressive two decades. This is tied for the 5th longest streak among Canadian companies. The two percent raise doesn’t sound very good, but considering the current climate, I’ll take it. I’ve noticed a lot of other articles popping up about which companies in the Oil & Gas industry will have to cut their dividend and which will can sustain their dividend. There aren’t many articles talking about companies raising dividends, so this is a good indication of a well-managed company.

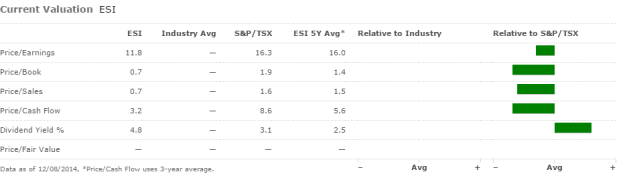

This is probably one of my more risky investments, but I think long term it will pay off. I can easily see oil prices dropping further and taking Ensign’s stock price with it, but long term I think this company will be making substantially more money and will have a higher dividend. Looking at the stats below you can see that the stock appears cheap using a variety of different valuation measures.

The company’s dividend yield is the highest it has been in over a decade. I didn’t look past 10 years, so it could potentially be the highest dividend yield it has ever seen. This is another good indication of a cheap stock.

Buying a company when it appears cheap with a variety of different valuation methods is a good sign, but in the short term I can see the price fluctuating a lot. The market seems a bit panicky right now and this is a mid cap stock in uncertain times. Long term I think this investment should work out well, but I expect it to be a bumpy ride.

I don’t plan on investing more in this stock for diversification reasons, so while the lower price today is tempting I chose to look at other players in the Oil & Gas industry… enter Suncor.

Suncor Energy

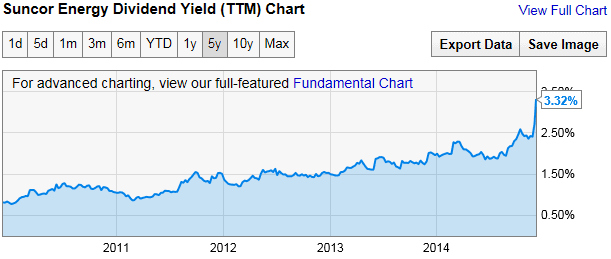

On December 8, 2014 I purchased shares of Suncor Energy [SU Trend] for $34. I wrote a dividend stock analysis for Suncor back in June 2013 and came up with a target buy price of $32. Since then they have increased their dividend substantially, so my revised target buy price is $34. If you look at the dividend yield chart below you can understand why I’m interested in this stock as the dividend yield is currently high for this stock.

With the uncertainty in the industry right now I wanted to invest in a high quality dividend growth stock that could make money even if oil prices dropped substantially further. Suncor gives me this. I looked at Canadian Natural Resources [CNQ Trend] too, but picked Suncor because of the higher dividend yield and because it dropped below my target buy price, whereas Canadian Natural Resources is still above theirs.

Final Thoughts

I really have no idea what is going to happen with oil prices, but if they keep dropping then I’ll look to scoop up more deals in the industry. I’ll be on the hunt for high quality stocks with long sustainable dividend streaks. On my shopping list I’ve been looking at Chevron [CVX Trend], Exxon Mobil [XOM Trend], Canadian Natural Resources [CNQ Trend] assuming they drop more in price. I only have 5 companies in my portfolio as I’m rebuilding, so I may have to curb my purchases in the Oil & Gas industry for diversifications sake. One last stock I’ve been looking at is Canadian Western Bank [CWB Trend]. It’s not in the Oil & Gas industry, but because a large portion of its income comes from Alberta customers who rely on the Oil & Gas industry its price has been coming down. I start getting interested in Canadian Western Bank at the 3% dividend mark, which currently is $28. I usually have to wait quite a while before prices drop low enough for me to consider them, but it looks like I might have a few opportunities especially with tax loss selling season coming up.

So far I’m happy with my purchases. What do you think of them? Has anyone else been buying stocks in the Oil & Gas industry or have a few companies they are interested in?

Photo credit Brendan Biele / Foter / CC BY-NC-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

I like Suncor and Canadian Natural Resources. I’ll buy more of both when the CAD starts to rise convincingly against the USD, at which time I will sell some assets currently in USD, convert the cash to CAD, then buy these two stocks.

At today’s prices these two stock should exceed considerably my personal goal of 10% YOC within ten years. I want to get the timing right, but not wait too long. We all would like to go back to 2008 and buy good stocks cheap; here is our chance with oil stocks.

i added more suncor to my portfolio and also bought ensign and canadian natural resources. I was encouraged by ensign raising their dividend, even though only 2%, in the face of huge drop in oil.

I already have SU and will be adding later this month.

ESI hit my target price as well when it got to 10$. The dividend growth streak is impressive. The company kept the streak going in the below 80$ environment of pre-2007 and weathered previous crude oil price fluctuations in 2008-2010.

I’m eyeing to buy more Suncor to existing position to average down our cost. The oil stock price is so depressed due to the crude price. This is a good chance to buy some cheap stocks.

Good read. I really appreciate your insight. Didn’t have ESI on my radar but now I definitely do. For sure I will be adding more SU shortly. If only I had more money available to invest as there are a lot of solid companies on sale. Melcor Developments (MRD) has my eye as they have raised their dividend the past 6 years and finally yield over 3 percent.

Hey Len, sun or is listed on the NYSE and the TSX no need to wait to change currency.

I bought Suncor when it was in the low $40 s…..:/

I will buy more to average down with it being so low

Duane: If I buy on the NYSE, do I get the favourable tax treatment accorded to “qualified” Canadian dividends?

Oil prices going down and suncor is going up :)…I recently bought some CPG on TSE. Mainly because its beaten too much and have a strong history of dividend payments.

Glad I found your site. I invested in US energy stocks recommended by Dr. Kent Moors, an energy adviser. Right afterward the House of Saud declared war on oil production. Of course my stocks all tanked. One MLP did rebound and I am up pennies. It is an expensive stock for me and I will be investigating switching that one stock for a Canadian brand. Thanks for the insight and the down-to-earth talk. I am a newbie to investing and have a hard time following the technical language.

I hope 2015 works for everyone.

What are your thoughts on ESI now?