Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

For those new to the blog, I like to keep my readers up to date on portfolio changes. One of the reasons I started this blog was to educate others, but also to improve my own investing. By keeping an open book of my portfolio and changes to it, I hope to generate discussion so others can see how I put my investing philosophy into practice. For the most up to date portfolio changes follow my twitter account as I will usually tweet first and then follow-up with a blog post.

Canadian financials have been struggling of late and I took this as an opportunity to add to two of my existing holdings and add a new one.

Canadian Western Bank

On July 23, 2015 I purchased shares of Canadian Western Bank [TSE:CWB Trend] for $24 a share plus the commission. This bank has a large exposure to Alberta, so with oil prices low and Canadian banks coming down in value I was able to average down again. This was third purchase of Canadian Western Bank. My average cost basis for all three purchases is $27.21. I first purchased shares at an average price of $29.33 in December 2014 and bought more in February 2015 at an average price of $26.93.

Canadian Western Bank has the longest current dividend streak of the Canadian banks having increased its dividend for 23 consecutive calendar years. At $24 the stock yields 3.67% which is quite high for the stock so I was happy to pick up more shares in what I consider a quality dividend growth company. They have a history of strong dividend growth with 5 and 10 year dividend growth rates of 12.7% and 17.6% respectively. They also have a history of consistently high earnings growth as they have been able to increase EPS each year in 9 of the 10 years from 2005 to 2014.

I’ve written quite a bit about Canadian Western Bank so check out the following articles if you want to learn more.

- Canadian Western Bank Dividend Stock Analysis & Portfolio Update

- Portfolio Update: Canadian Western Bank Purchased … Again

- 14 Canadian Dividend Growth Companies With Consistently High Earnings Growth

Home Capital Group Inc.

On July 27, 2015 I purchased shares of Home Capital Group Inc. [TSE:HCG Trend] for $28.35 plus the commission. At $28.35 the dividend yield is 3.1% which is high for this stock. The highest it has reached in the past decade was in 2009 when it got up to 3.8%. This was my fourth purchase of the stock. My average cost is $34.95 and my yield on cost is currently 2.5%.

It’s been a wild ride with this stock for the month of July. The stock starting plummeting on an early release of Q2 news that mortgage originations had dropped. Later in the month a board member resigned for personal reasons. All this was happening during a blackout period so very little information was being provided by the company. This led to a lot of speculation in a highly shorted and volatile stock. Then during the end of the month the company released news that the drop in originations were from suspending its relationship with approximately 45 individual mortgage brokers as they had uncovered falsified income information on some of their mortgage applications received from the brokers. “The Company concluded that it is unlikely that this matter will lead to credit losses.” You can read the full release here. This release was followed by the earnings release for Q2 and the conference call. The explanation and conference call from management seem to have reassured investors a bit as the stock shot up about 14% on this news.

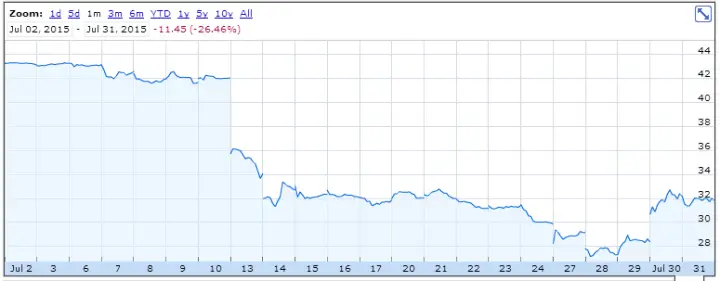

Here’s the stock chart for July. You can see it’s been a bumpy ride.

I think in the short term this stock could continue to be volatile. This like all my investments is a long term holding for me so I’ll stick it out. I originally purchased this stock as a low dividend yield high growth stock so I’m hoping they get back to growing earnings and dividend at high rates. You can see from its dividend growth rates that it has had high dividend growth as it has 5 and 10 year average annual dividend growth rates of 19.3% and 27.8% respectively and has increased its dividend for 16 years in a row. You can read about my other purchases and the dividend stock analysis here:

- Home Capital Group Dividend Stock Analysis

- Bird Poop & Portfolio Update: Home Capital Group Inc. Purchased

- Portfolio Update – Home Capital Group Inc. Purchased Again

Bank of Nova Scotia

On July 27, 2015 I purchased shares of Bank of Nova Scotia [TSE:BNS Trend] for $62 plus the commission. Bank of Nova Scotia is one of the big 6 Canadian Banks and has a wide moat according to Morningstar. They have a long and rich history of increasing dividends having increased dividends in 43 of the last 45 years. Bank of Nova Scotia has 5 and 10 year dividend growth rates of 5.5% and 8.8% respectively and have increased its dividend for 4 years in a row.

This stock has been toying with me as it has barely missed my limit orders a few times in the past 6 months or so. The stock finally came down in price enough and I feel like I got in at a reasonably cheap price of $62.

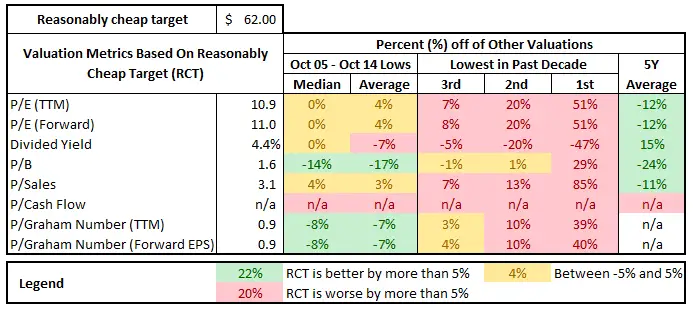

Bank of Nova Scotia Valuation

I wrote a dividend stock analysis in the past, but that article is about 2 years old so I decided I talk a bit about its current valuation.

Related article: The Great Canadian Banking Series: Bank of Nova Scotia Dividend Stock Analysis (Part 2 of 10)

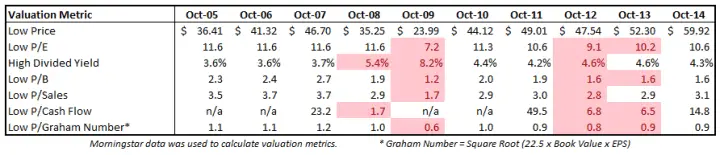

There are a lot of different ways to value of company some of them better than others. Rather than focus solely on one method I like to use a variety of methods and compare the results to find a reasonably cheap price range to buy at. To start with I like to look at the past decade and calculate the lowest price and valuations for each year to get an idea of what was considered cheap in the past.

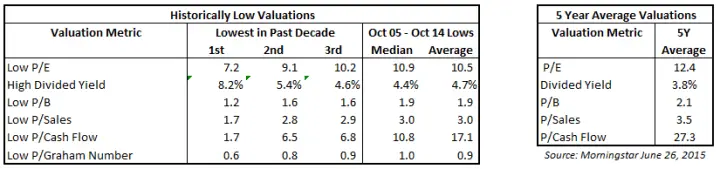

From here I like to focus on the lowest 3 valuations from the past decade (highlighted in red above). This is typically the range I like to target as reasonably cheap. For comparison’s sake I also include the median and average of the lowest valuation methods for the decade, and also the 5 year average valuations.

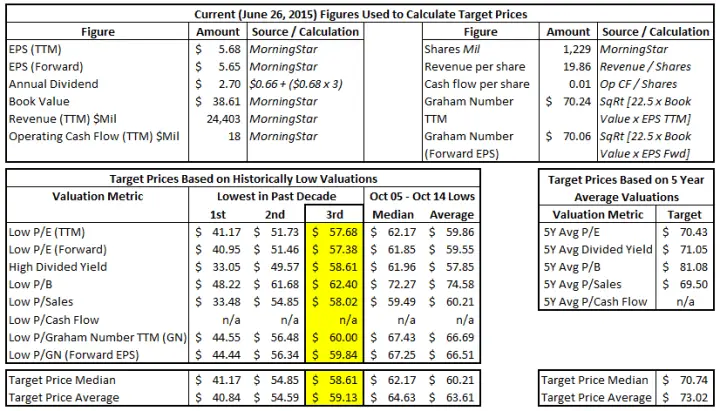

Now that a picture is starting form of what valuation ranges are historically cheap we can use these same figures to reverse calculate target prices using today’s figures. For a reasonably cheap price I typically focus on target prices that are comparable to the 3rd lowest in the past decade (highlighted in yellow below).

I came up with $62 as a reasonably cheap price. You can see from the table below that this cheap from a P/B perspective as it is comparable to the 3rd lowest P/B of the past decade. At $62 it is also within a few percentage points from the 3rd lowest P/Graham Number.

Based on the above valuation metrics I took this as a good opportunity to scoop some shares up at a reasonably cheap price of $62.

All-in-all it was a busier week than I was expecting on the stock purchasing front. What do you think of my three purchases?

Photo credit: Jordon / Foter / CC BY-NC-SA

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Hey DGI&R,

These buys are looking good!

My small portfolio already has 20% Financials, so I’m not looking to add more at this time.

However, the Canadian banks are an excellent opportunity for me to diversify my holdings, as I currently own USA stocks only.

Congratulations on your buy!

Best wishes, DfS

Great call on Canadian banks. In July I went heavy on Canadian financials. Bought BNS, TD, and RBC. I just sold BAC in my TFSA and I’m thinking about buying CIBC.

Would be happy again to buy more BNS, especially if it goes back to $60.75 like it briefly did last week. Solid company!

That is funny cause I wrote an article on the five big Canadian banks recently (http://seekingalpha.com/article/3287425-which-is-the-best-canadian-bank) and Scotia Bank was my number 3! Still a nice pick, but I think there are better options currently.

Cheers,

Mike

Hello,

I enjoy reading your blog for it’s insight and your methodology, so thank-you for that! Not a fan of Home Capital Group, seems like a house of cards. Take this comment with a grain of salt, coming from someone who owns more Crescent Point Energy than I would like!

Keep up the informative work!

Nice! I’ve been trying to pick up more BNS, TD and RY too. With the markets taking a bit of a downturn the prices are becoming even more attractive. Now all we need is lots of fresh capital to deploy 🙂

What are your thoughts on BNS, TD and CWB…Where you are avg down

I averaged down on BNS at $55.04 on Aug 24th. I get interested in TD around $47, but I own three banks now (bought National Bank of Canada recently) so I likely won’t be buying TD. I’ll consider averaging down on CWB at $21 again, but I’m not sure if I’ll pull the trigger. I have a lot of exposure to the financial industry right now and I’d prefer to add some new positions in other industries to get more diversified as I build the portfolio.

Where do I see your current portfolio?

https://dividendgrowthinvestingandretirement.com/dividend-portfolio/