Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

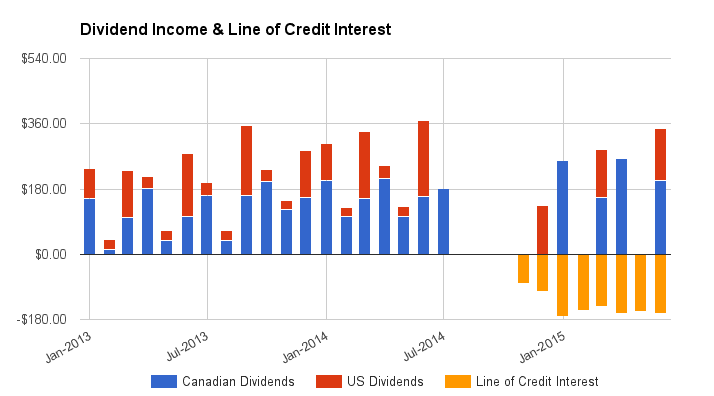

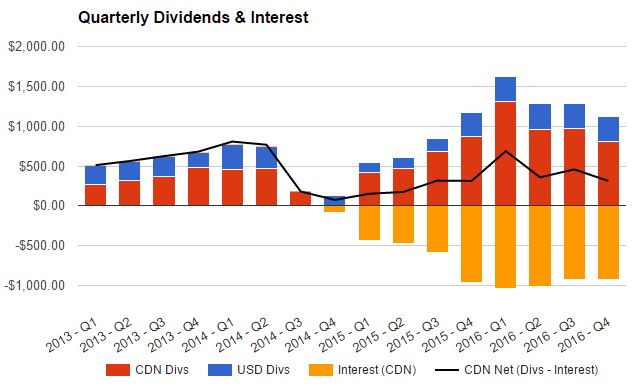

As a way of tracking my progress towards financial freedom I total up the dividends I receive each month. The end goal is to have my dividends cover my expenses. This is a long term goal, so I have a lot of years to go, but I find it encouraging to see my dividend income steadily rise over time. This reminds me that I’m on the right track and to stick with it. Here are the results for May, June, July and August.

My dividend income for May 2014:

May Canadian Dividend Income

- Altagas [ALA Trend Analysis] – $33.41

- Potash [POT Trend Analysis] – $53.47

- Royal Bank [RY Trend Analysis] – $17.04

Total May Canadian Dividend Income – $103.92

May US Dividend Income

- AT&T [T Trend Analysis] – $17.02

- Proctor & Gamble [PG Trend Analysis] – $10.31

Total May US Dividend Income – $27.33

My dividend income for June 2014:

June Canadian Dividend Income

- Altagas [ALA Trend Analysis] – $38.65

- Enbridge [ENB Trend Analysis] – $36.71

- Fortis [FTS Trend Analysis] – $37.59

- Suncor Energy [SU Trend Analysis] – $23.00

- SNC Lavalin [SNC Trend Analysis] – $24.00

Total June Canadian Dividend Income – $159.95

June US Dividend Income

- Aflac [AFL Trend Analysis] – $37.00

- CH Robinson Worldwide [CHRW Trend Analysis]- $17.85

- Johnson & Johnson [JNJ Trend Analysis]- $37.85

- Intel [INTC Trend Analysis]- $38.25

- Pepsi [PEP Trend Analysis] – $77.29

Total June US Dividend Income – $208.24

My dividend income for July 2014:

July Canadian Dividend Income

- Bank of Nova Scotia [BNS Trend Analysis] – $87.55

- Telus [T Trend Analysis]- $49.93

- TransCanada [TRP Trend Analysis] – $43.01

Total July Canadian Dividend Income – $180.49

Total July US Dividend Income – $0.00

My dividend income for August 2014:

Total August Canadian Dividend Income – $0.00

Total August US Dividend Income – $0.00

You’ll notice that in July I had no USD dividend income and in August I had no dividend income at all! This is because I bought a condo recently and liquidated all of my shares in order to make a large down payment. As a result I am effectively starting over. Now that I’ve moved in, I’ve started investing again, but it will take some time to build back my dividend income to the level it was before.

Related articles: I Bought A Condo – Excitement & Worries & Portfolio Update: I’m Selling Everything!

The dividend income chart has been updated on the dividend income page, check it out here: Dividend Income Page. To see a list of the companies currently in my portfolio check out my portfolio page.

Photo credit: Chaval Brasil / Foter / Creative Commons Attribution-NonCommercial-NoDerivs 2.0 Generic (CC BY-NC-ND 2.0)

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

I guess that saves you from deciding to sell CHRW or not. 🙂 This is a big decision I’m considering, but will probably wait for the next dividend announcement before selling. The yield does not warrant holding unless there is significant DGR.

I guess so. I think we have a similar mindset when it comes to CHRW. Generally if a company doesn’t increase it’s dividend I think giving it two years to see if they start increasing the dividend again is fair. Had I held onto this investment I’d be waiting to hear if they declare an increased dividend in December and then go from there.

I’m a US based reader and of course not being Canadian run into the issues of non-residence tax on dividend income and the depending on how you look at it, the precipitous drop in the Canadian dollar or its reversion to the mean. I own, BCE, Telus, Loblaw, and TD equities as well as some significant investments in rate reset preferred shares. With RBC’s recent projection that the Loonie could drop to as low as 85 cents to the US dollar within a year, beyond being a safe haven for Americans who have no faith in the total corruption and incompetence of the US government and the Federal Reserve how do you see a long term, income seeking American investor managing this situation? Is it time to put new investments in Canada on hold, pull existing money out? With someone like Stephen Poloz in a position of authority there seems to be little hope of rational policy decisions coming out of Canada for some time.

When it comes to currency rates I’m not the best guy to ask as I don’t follow the currency exchange that much and don’t know much about it. Sorry.

I also have a few hundred thousand sitting on the sidelines in CAd and US cash.

I am very interested when and how you will be investing back into the market.

Can you provide some additional guidance on how you will be investing?

Will you be providing monthly updates with what you have invested in and why?

thanks,

I try and provide updates on when I buy and sell shares as they happen, or close to it. Sometimes I’ll tweet about the purchase or sale before I get a chance to write about it, so twitter might be your best bet for the most up to date actions, but usually within a few days I’ll write about it on the blog and you can find out the decision making process I went through to buy/sell the stock then.

As for how I will be investing… I am basically starting all over again, so I’ll be investing in high quality Canadian and US dividend growth stocks as their price becomes reasonably cheap. The markets are pretty hot right now, so I don’t see a huge amount of value out there right now which means this will likely be a slow process for me. I’m using the smith maneuver which means I am borrowing to invest so my investment choices will be skewed towards a higher yield to help cover the interest payments. My minimum starting dividend yield is 2.5%, but I’ll likely be trying for a higher yield to offset the interest. My current interest rate on the line of credit is 3.25%. As I’m investing with borrowed money it’s important that I focus on companies with a good chance of sustainable dividend increases for the long term and that are financially strong.