Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

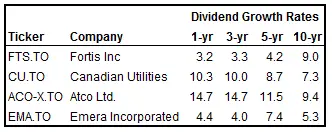

As a dividend growth investor there are four Canadian utility stocks that I’d consider investing in: Canadian Utilities Ltd. [TSE:CU Trend], Fortis Inc. [TSE:FTS Trend], Atco Ltd. [TSE:ACO.X Trend], and Emera Inc. [TSE:EMA Trend]. Atco Ltd. owns Canadian Utilities Ltd. and has some other activities, so you could say there are really only 3 ½ companies I’m interested in. Canadian Utilities Ltd, Fortis Inc. and Atco Ltd. have been able to increase dividends in each calendar year for over two decades, while Emera Inc. has a dividend streak of 8 years. These are impressive streaks, but what has me worried with some of these utility stocks is their long term dividend growth rates.

Typically I try and target annual dividend growth of 8% or higher, but for utility companies this may not be realistic due to the regulated nature of their industry. Regulated utilities allow for a more reliable income stream, but it can be difficult to get consistent high dividend growth from these companies over the long term. A good example would be Fortis Inc. which has a 5 year average annual dividend growth rate of 4.2%. Its 10 year dividend growth rate is better at 9.0%, but I prefer consistently high dividend growth and Fortis Inc. hasn’t been able to deliver that in the past 5 years. It can be difficult for utility companies to find growth opportunities so this can stifle dividend growth for periods of time.

Lower dividend growth doesn’t automatically mean that I won’t invest in the company. Fortis Inc. has one of the longest dividend streaks in Canada at 41 years, so clearly the company is doing something right. In a case where the dividend streak is quite long I might consider bending the rules a bit. While I might not be able to get the 8% dividend growth or higher that I like, I can always set a higher minimum dividend yield for Fortis Inc. to make up for the lack of high dividend growth.

Typically a dividend growth investor will have a mix of three categories of dividend investments:

- Low yield, high dividend growth – think 2.5% yield or less, but dividend growth over 10%.

- Moderate yield, moderate dividend growth – think 3-4% yield and dividend growth of 6-10%.

- High yield, low dividend growth – think above 5% yield and dividend growth of 4% or less.

For some utility stocks I’d consider adding them to my portfolio under the assumption that they will act like a high yield, low dividend growth investment.

There are of course exceptions to consider. For instance you can see from the dividend growth tables below, that Atco Ltd. and Canadian Utilities Ltd. have had good consistent dividend growth over the past decade.

Dividend growth utility stocks seem to have low to moderate dividend growth

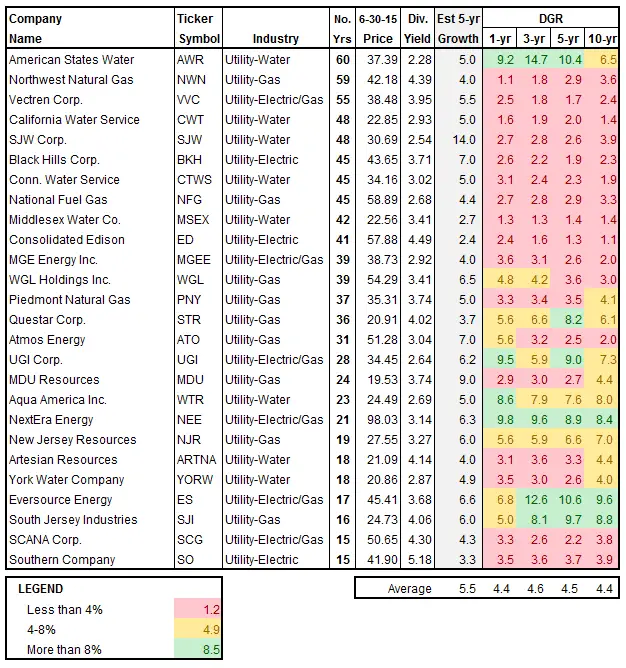

There aren’t a lot of utility companies in Canada with long dividend streaks so I went to the US to help prove my point. If you look at the dividend growth rates for utility stocks in the US Dividend Champions list with a dividend streak of 15 or more years you can see that most of the stocks have low dividend growth of less than 4% (highlighted in red).

You’ll also notice that the estimated 5 year earnings growth rates (grey column) are mostly moderate to low and average out to 5.5%. Keep in mind these are based on analyst estimates which don’t have the best long term track record, but you get the idea. This means that in the future I’d expect dividend growth to be moderate to low if the dividend is to be sustainable. For a dividend to be sustainable long term you would expect it to be in line with earnings growth as the company has to pay for an increasing dividend with increasing earnings.

Final thoughts

Like most things in life it is best to assess things on a case by case basis. While I think utility dividend growth stocks typically have low to moderate dividend growth, that doesn’t mean certain individual companies don’t have good dividend growth. I think a good example of this is Atco Ltd. and to a lesser extent Canadian Utilities Ltd. which both have had good to strong dividend growth. I’d consider investing in Atco Ltd. around the 2.9% dividend yield mark and I’d consider investing in Canadian Utilities Ltd. around a dividend yield of 3.9%. For Fortis Inc. and Emera Inc. I equate these to more of a higher yield slower dividend growth investment and would consider investing in Fortis Inc. at a dividend yield of 4.7% and for Emera Inc. a yield of 5.1%. For my next post I’ll go into a bit more detail on how I came up with these valuations and talk a bit more about the dividend fundamentals of each company.

PS. Did I miss any Canadian dividend growth utility stocks and why not consider Brookfield Infrastructure Partners LP?

Brookfield Infrastructure Partners LP [TSE:BIP.UN Trend] is a company that is of some interest too, because it has a dividend streak of 7 years and has provided dividend growth guidance of 5% to 9% annual distribution growth. I don’t really know how to value the company properly or the best way to evaluate it because of its corporate structure. I have an idea of what I should be doing, but I’m not quite there yet. I know other dividend growth investors like the company so I thought it was worth mentioning.

A good rule of thumb when investing is if you don’t understand it, don’t invest in it. So for the time being I’ll be staying away, but if you have some thoughts on the company please share as I’d like to learn more about the company.

Let me know if I missed any other companies in the comments section too.

Photo credit: marumeganechan / Foter / CC BY-NC-ND

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![How to estimate dividend growth and total returns using Josh Peters’ Dividend Drill Return Model [Example & Spreadsheet]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/10/How-to-estimate-dividend-growth-and-total-returns-using-Josh-Peters’-Dividend-Drill-Return-Model-Cover-768x575.png)

DGI&R,

I don’t own any of the four you’re considering but I have owned BIP.UN since 2011 and have CU & BEP.UN on my watch list. BIP.UN has been my highest performer of the 32 stocks currently held in my RRSP. The dividend growth has also been stellar. You might find the two Seeking Alpha articles linked below to be of interest to you.

http://seekingalpha.com/article/3255225-brookfield-infrastructure-superior-results-decoupled-from-market-volatility

http://seekingalpha.com/article/3283105-brookfield-infrastructure-partners-world-class-infrastructure-assets-and-undervalued-with-solid-growth-prospects

Thanks Bernie. I had a read and they helped.

DGI&R

I was waiting for this blog from quite a time now. Perfect timing and great article as always.

Utility companies for some people are like a sure shot investment. They are safe and with FTS its all about DRIP

Fortis was one of my first DRIPs when I first started investing.

These are just thoughts off the “top of my head”, not with the aid if any deep research.

First, ATCO doesn’t strike me as being a utility stock. But this is a minor point.

Second, utilities take a beating when interest rates rise. This is perhaps because their potential capital gains are limited by so much regulation that it is only the dividends themselves that attract many investors. So, a dividend that is attractive today might not be so attractive when rates rise and more-conservative assets like bonds start being seen as competitors. Yield-chasing investors then sell utility stocks and you have a potential capital loss on your hands.

But if you don’t care about price fluctuations, because you intend to hold the utility stock for ever, and if the projected yield on cost meets your target yield, go ahead and buy.

Hey Len,

Atco does a variety of things, so it might not be a pure play utility, but I’d still call it a utility. When I went looking for Canadian dividend growth utility stocks I used the Canadian All-Star List and screened for stocks with a sector classification of “Utilities” and Atco showed up. For industry they are classified as “Utilities – Diversified”.

I can’t remember the post, but last year I think I wrote that I wouldn’t be surprised if interest rates increased in 2015. They have decreased twice since then, lol. The problem is trying to guess when that will happen and the level of raises. Do they rise soon?, Will interest rates rise and keep increasing, or have a small raise and be steady? You get the idea. I think that when interest rates rise utilities might drop in price, but over the long term it could be a different story. I invest for the long term, so rather than time the market I try an purchase good companies at reasonably cheap valuations.

Over the long term you want to invest in companies that can navigate these changes and make more money over time. If the company is making more and more money over time then that should reduce the likelihood of capital losses, assuming you didn’t initially invest when they were over-valued.

Cheers,

DGI&R

This US table is very handy. I’ve been strongly considering NJR at current levels, valuation looks attractive at present and this table validates their position and record against their peers. Must say though that I’m being swayed against utilities with talk that interest rates might rise.

I don’t really know much about NJR. There seem to be a lot of people worried about how higher interest rates will affect the stock prices of utilities. I look at it as more of a buying opportunity if they continue to drop in price.

I own both of Atco and CU. I recently averaged down Atco. Such a great company that are still on discount. I just can’t believe I picked it up at awesome price 🙂 I am interested in BIP.UN but it seems quite expensive at this time and as you said, I don’t understand them very well.

I’d be interested in both Atco and CU, but I’m waiting for another 20% to 25% drop.

Please post your thoughts on Trans Alta (TA). The current yield is 7.56 and the Stock price is at historic low ..

I did a quick look at the company, but wasn’t that impressed with them. They cut their dividend in 2014. EPS is sporadic and they have lost money in two years of the past decade. In fiscal 2005 they made EPS of $1.01. In fiscal 2014 they made EPS of $0.52. I like companies that make more and more money over time. If earnings are sporadic because of the nature of the business that is fine, but I don’t want the company to be losing money which Transalta has in the past.

I’m a dividend growth investor and I like to see earnings and dividend growth so Transalta isn’t for me.