Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Before I start the dividend stock analysis I want to mention to new readers that there is another article that you may want to read first. The other article better explains what I’m looking for in a company from a dividend growth perspective and why I analyze specific company components and ratios. The other article is meant more as an educational tool so that readers can better understand my dividend stock analyses. This dividend stock analysis will look at the company to identify if it is a good dividend growth candidate to invest in.

CH Robinson Worldwide Dividend Stock Analysis

I’ve been working on an article about companies with strong competitive advantages. Part of the research for this involved making a list of dividend growth stocks that have a wide moat rating from Morningstar. As part of the article I was planning on doing a brief summary of some companies that were close to a five star rating. During this process I stumbled across CH Robinson Worldwide. The more I looked into it, the more I liked the company, so I ended up just doing a full dividend stock analysis. Apparently I’m easily distracted. If you are interested in wide moat article, it should be up on the blog within a week.

Company Description

From Google Finance:

“C.H. Robinson Worldwide, Inc. (C.H. Robinson) is a third party logistics company. The Company provides freight transportation services and logistics solutions to companies of all sizes, in a range of industries. The Company operates through a network of 276 offices, which the Company calls branches, in North America, Europe, Asia, South America, and Australia. The Company has developed global transportation and distribution networks to provide transportation and supply chain services worldwide. In addition to transportation, the Company provides sourcing services (Sourcing). The Company’s Sourcing business is primarily the buying, selling, and marketing of fresh produce. The Company supplies fresh produce through its network of independent produce growers and suppliers. The Company’s customers include grocery retailers and restaurants, produce wholesalers, and foodservice distributors.”

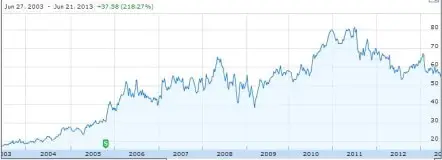

10 Year Stock Chart

There is a 10 year annual average return of 12.3%. If we include the dividend payments over the past 10 fiscal years (Total dividends paid of $7.26) then the total average annual return would be 13.7% with the average return from dividends representing 1.4%.

It’s been a bit of a choppy ride, but the overall trend and returns are good.

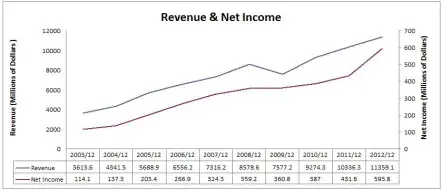

Revenue and Earnings

CH Robinson Worldwide has very consistent increasing earnings. In 2009 revenue dropped a bit, but other than that, it’s been all up. Overall it is an impressive chart.

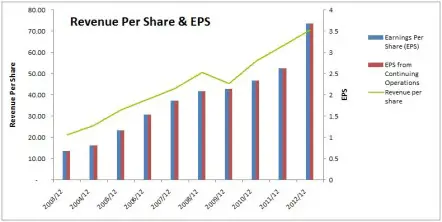

The same steady trend up emerges when revenue per share and EPS are examined.

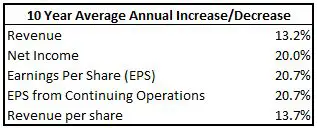

CH Robinson Worldwide has very impressive revenue charts and equally impressive 10 year annual average growth rates.

All growth rates are above the 8% I like to see.

Dividends

CH Robinson Worldwide has increased their dividend for 16 consecutive years in a row with their most recent increase occurring with the dividend recorded in January 2013 when they increased the quarterly dividend by 6.1% from $0.3300 to $0.3500.

The chart shows a steadily increasing dividend, exactly what I like to see from a dividend growth perspective.

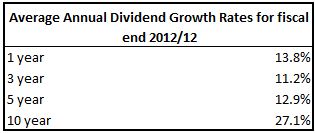

Dividend Growth

As you can see from the table below CH Robinson Worldwide shows good average annual dividend growth rates.

Dividend growth has been good, but with the most recent dividend increase of 6.1% it looks like dividend growth may be slowing.

Dividend Sustainability

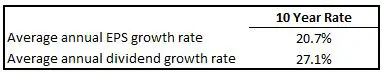

The 10 year average annual dividend growth has been a bit higher than EPS growth which suggests that dividend growth may slow down.

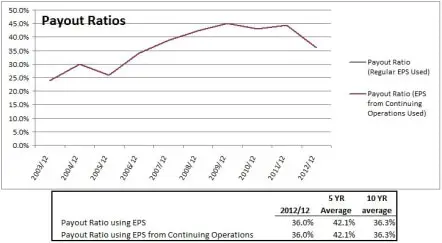

Let’s take a look at the payout ratio to see how much room for growth the dividend still has.

The company has been increasing dividends faster than earnings, but because they have a reasonable payout ratio the dividend is sustainable. It looks like more recently the payout ratio has been ranging from 35% to 45%. I expect the payout ratio to continue to be in this range.

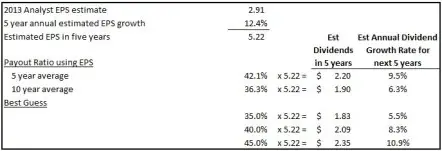

Estimated Future Dividend Growth

Analysts expect annual EPS growth to be 12.41% for the next 5 years. Accepting this EPS growth rate and using various payout ratios we can guess future dividend growth rates.

I expect a payout ratio between 35% to 45%. This would result in annual dividend growth ranging from 5.5% to 10.9%. This would be inline with the most recent dividend increase of 6.1%. Past dividend growth has been quite a bit better than this. I’ve said before that past dividend growth can be used to predict future dividend growth so I think dividend growth will be at the higher end of the 5.5% to 10.9% range, likely around 8%. The company also has high earnings growth targets which are another reason why I think dividend growth will be at the higher end of this range. I grabbed the following from CH Robinson Worldwide’s website.

“our long-term compounded annual growth target has been 15 percent for net revenues, income from operations, and earnings per share. Because our industry is so dynamic and volatile, we don’t predict or make forecasts about short-term expectations.”

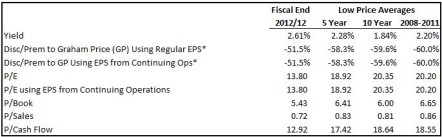

Competitive Advantage & Return on Equity (ROE)

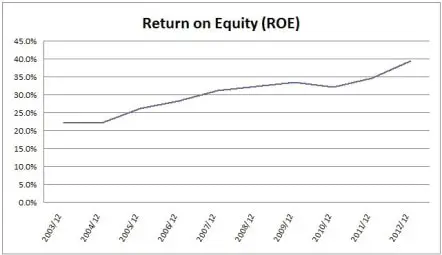

I would consider CH Robinson Worldwide to have a wide moat over the competition and the ROE chart would support this.

CH Robinson Worldwide has a very impressive chart with an upward trend and a ROE always above the 20% I like to see.

Looking at the table below, I can see that right now its ROE is well above the industry average for Air Delivery & Freight Services. Its competitors also seem to have higher than average ratios ranging from FedEx Corporation’s 11.1% to Expeditors International of Washington Inc’s 16.0%. CH Robinson Worldwide still blows the competition out of the water with a current ROE of 43.2%. This further supports a strong competitive advantage.

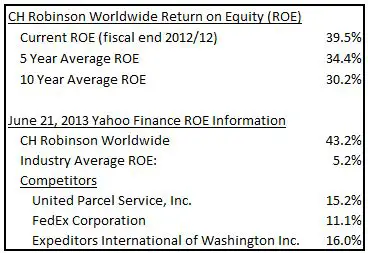

Debt & Liquidity

I want to invest in companies that are fiscally responsible, so it is important to look at debt levels and see that they are at reasonable levels.

In the past CH Robinson Worldwide has had no debt, but in 2012 they took some on. The debt to equity ratio is still very low, so I am not worried. Overall the company seems to be in good financial health.

Shares Outstanding

Shares outstanding have been steadily decreasing which is a good sign. I’d like to see this trend continue.

Valuation

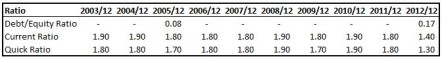

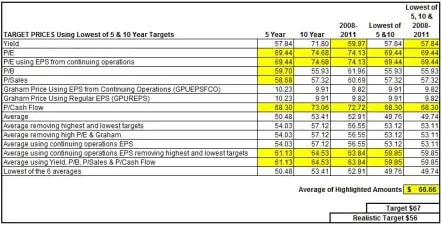

I use the low price averages for 6 main ratios to determine a fair price: Yield, Discount/Premium of the low price compared to the Graham Price, P/E, P/B, P/Sales and P/Cash flow. I like to look at both EPS and EPS from continuing operations so it ends up being a total of 8 ratios as the Graham Price an P/E both use EPS. You can read more about my valuation method here.

I get the following for CH Robinson Worldwide.

* The discount or premium to Graham Price hasn’t been calculated in the normal fashion. For the details read this article.

I use the averages from the previous table to determine my target price. Using these averages creates a lot of different target prices, so I back-test this strategy over the past 10 years. I identify which of the 8 valuation techniques would have given me a chance to buy the stock in two to three fiscal years in the past 10 fiscal years. It’s not always possible to test my strategy back 10 years, due to limited financial information, but I do my best. The results are highlighted below.

The average of the highlighted amount gives me a target price of $67. That would result in a dividend yield of 2.1%. I’m looking for an entry yield of at least 2.5%, so I lowered the realistic target to $56 which I think is a more reasonable target.

Morningstar currently rates CH Robinson Worldwide as a 4 star stock as it is currently priced under their estimated fair value of $73. For Morningstar to rate CH Robinson Worldwide as a 5 star undervalued stock the price would have to fall below their “consider buy price” of $51.10. The first calculated target of $67 is quite a bit higher than this, which is another reason I lowered the realistic target price to a more reasonable $56.

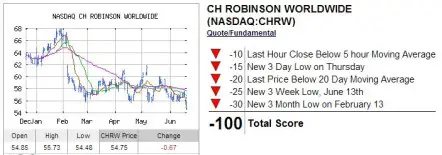

Trend Analysis

I also like to look at INO`s Free Trend Analysis prior to investing to see if I should hold off or not. Sometimes it is nice to see if the stock is trending down or up before buying it. For June 21, 2013 INO is showing a strong downtrend for CH Robinson Worldwide.

To see the most recent trend analysis for CH Robinson Worldwide click here. INO also has a list of the top 50 trending stocks and free trading seminars and videos.

From what I’ve seen so far CH Robinson Worldwide is the type of dividend growth stock I like to invest in. There may be a strong downtrend, but I’m happy to invest at current prices as it is below my $56 target.

Other Investment Options in the Same Industry

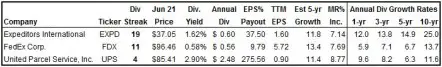

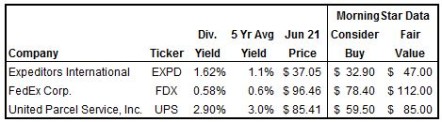

CH Robinson Worldwide shares the industry with Expeditors International, FedEx, and United Parcel Service. I updated the May 31, 2013 US Dividends Champions with the current prices and yield and added in information for United Parcel Service. I ended up with the following.

Expeditors International has the best dividend streak coming in at 19 years. It also has the best past annual dividend growth rates of the three. Its reasonable payout ratio of 38% and good estimated annual EPS growth of 11.8% all point to continued strong dividend growth. These are great dividend fundamentals, but the dividend yield is below the minimum 2.0-2.5% entry yield I like.

FedEx Corporation has OK dividend growth rates, but with the lowest payout ratio and highest estimated annual EPS growth it looks like dividend growth will be improving in the future. Like Expeditors International the minimum entry yield is too low for me to consider investing right now.

United Parcel Service has a dividend streak of 4 years, which is the lowest of the three. Its dividend growth rates are all around the 8% or higher that I like to see, but its payout ratio is well above a reasonable level. Its yield is above 2.5%, but because of its high payout ratio and low dividend streak I won’t be investing. I typically like to invest in US companies when they have a dividend streak around 10 years or more.

From a valuation perspective Expeditors International looks like the best alternate.

Expeditors International is the only company of the three that has a current dividend yield significantly above its 5 year average. It is also the closest of the three to Morningstar’s five star price of $32.90, with a current price roughly 13% higher. Using the current annual dividend of $0.60, the price would have to drop to $24 to get a dividend yield of 2.5%. This would require a significant price drop from current levels, so I won’t be investing in Expeditors International.

Right now I prefer CH Robinson Worldwide because it is closer to my target price and because of the larger dividend yield.

Conclusion

CH Robinson Worldwide has a strong competitive advantage and wide economic moat. It has consistent earnings growth and strong dividend growth fundamentals. I expect annual dividend growth to be around 8% going forward. At current prices, CH Robinson Worldwide comes in below my target price of $56, which is why I purchased shares at $54.25.

Disclaimer

I own shares of CH Robinson Worldwide. You can see my portfolio here. I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thank you for another very thorough analysis, from another diversification option. Do you have any concerns about this company’s loss in profit margin from last year? I read this mentioned in another analysis on this company, and this was the only area that has me a bit concerned.

I read about this too, and I think it is a valid concern for the short term. I think in the long run, this won’t be much of an issue as management should be able to improve margins back to higher levels.

There have been a number of downgrades for this stock recently and it missed analysts estimates by a small margin recently. I think this is what has triggered the drop in price recently. This will be a long term holding for me, so I’m not so much worried about the recent noise.