“The concept of identifying undervalued and overvalued stock prices according to historic patterns of dividend yield can be applied to any stock with a reasonably long dividend history. However, investors who make the decision to include only high-quality, blue-chip stocks in their considerations will probably never regret it.”

Source: Dividends Don’t Lie – Geraldine Weiss/Janet Lowe

Want 25-year charts of the low, average and high dividend yields for 100 Canadian dividend growth stocks?

You’ve come to the right place ….

In this massive resource that you’ll keep coming back to, I include charts like the two below for every Canadian listed stock that has increased its dividend for 5 or more years in a row.

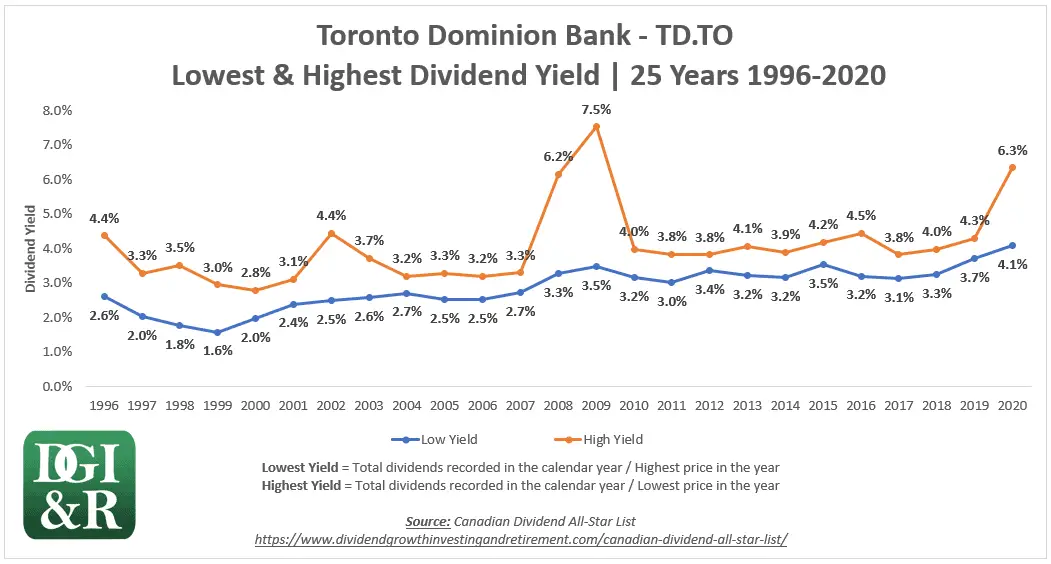

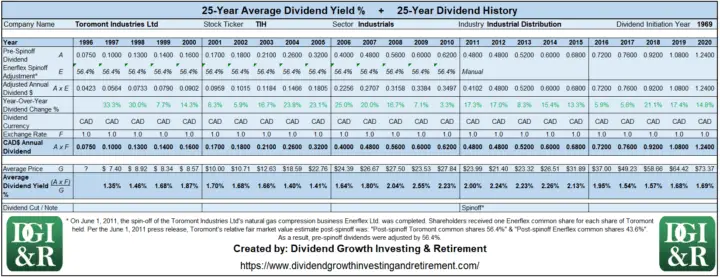

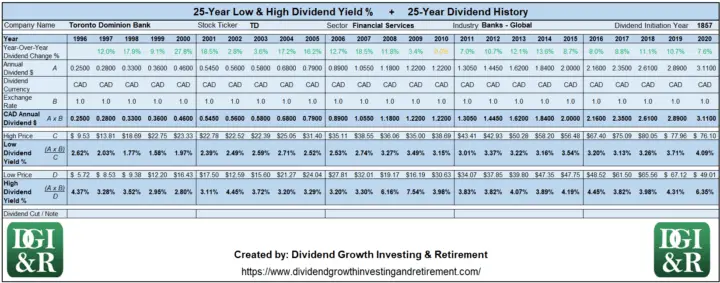

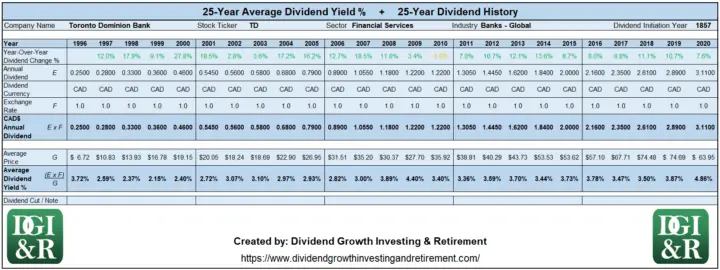

Low & High Dividend Yield, 25-Year Chart Example – Toronto Dominion Bank (TSE:TD)

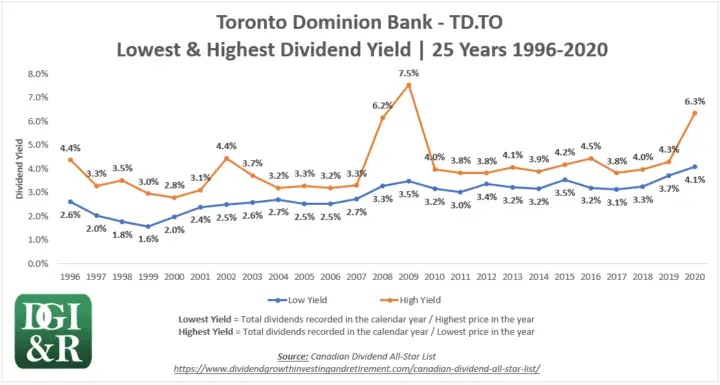

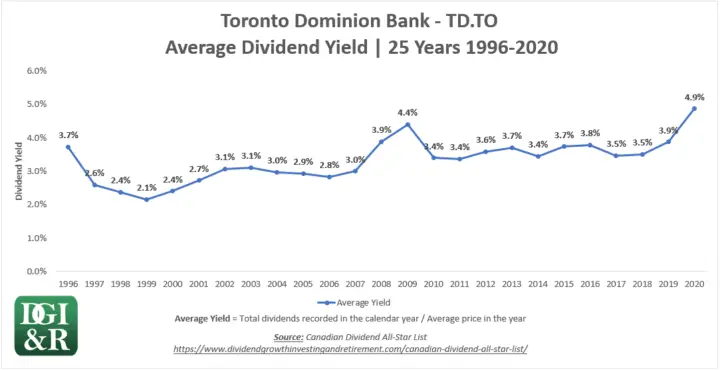

Average Dividend Yield, 25-Year Chart Example – Toronto Dominion Bank (TSE:TD)

I hope this resource makes it easier for you to use dividend yield as a valuation tool.

Before we get to the yield charts it’s important to understand how to use these charts.

How To Use 25-Year Dividend Yield Charts

High Yield = Undervalued, Low Yield = Overvalued

High Yield = Undervalued

Use the high yield to figure out when the stock is undervalued.

Look for historically high dividend yield points as this can give you a sense of an upper limit on yield.

When the yield starts getting close to this level it’s an indication the stock is undervalued.

You’ll typically find these high yield points when the company is perceived to be going through a hard time or when the market is in a bear market (20% drop or more).

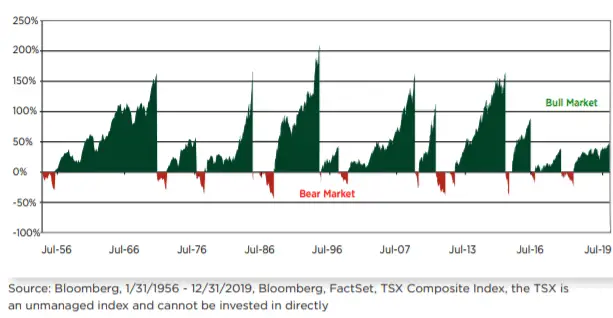

Bear markets (red drops in the chart below) in Canada on average, come along every three years.

Source: Edward Jones – Don’t Fear the Bear

These are interesting times to review as it gives you a sense how the company did in a falling market.

There are a lot of red blips in the chart above, so I like to focus on the big events.

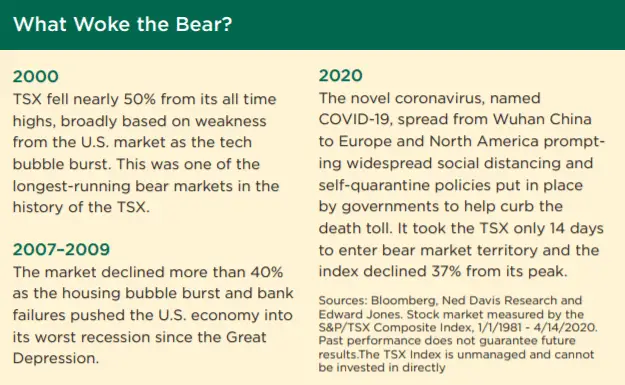

Over the 25 years from 1996 to 2020 the three big stock market crashes in Canada were:

- 2000 – The dot-com bubble burst

- 2008 & 2009 – Global Financial Crisis

- 2020 – COVID-19 Global Pandemic

Source: Edward Jones – Don’t Fear the Bear

If the stock you are reviewing has:

- paid dividends for 25 years, and

- Has not cut their dividend during this time,

Then these 3 market crashes (2000, 2009 & 2020) will usually give you a good sense of what the upper limit on dividend yield is going to be. It’s not an exact science, but nothing is when it comes to predicting the future.

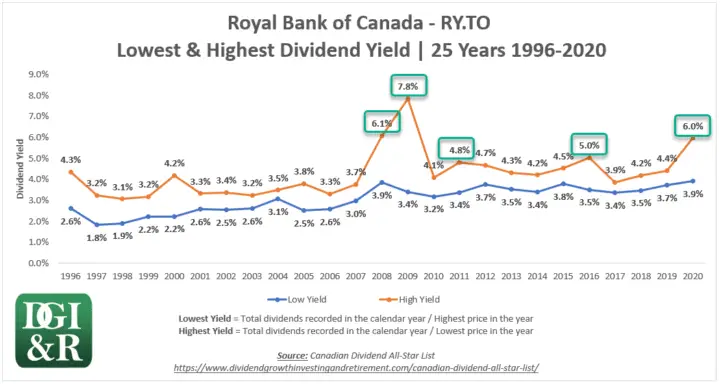

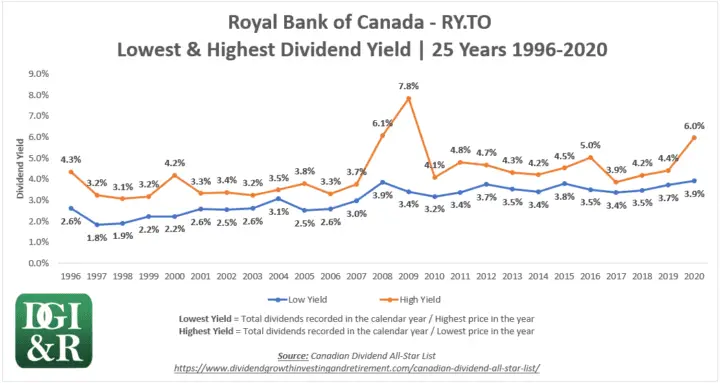

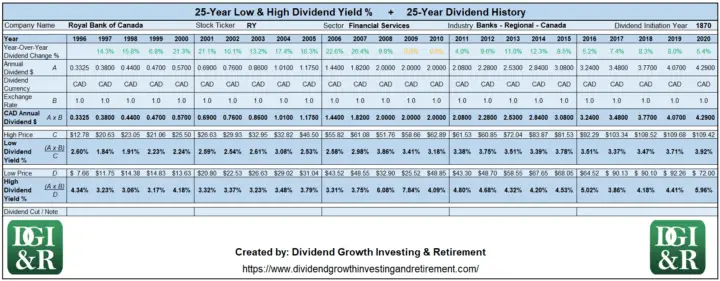

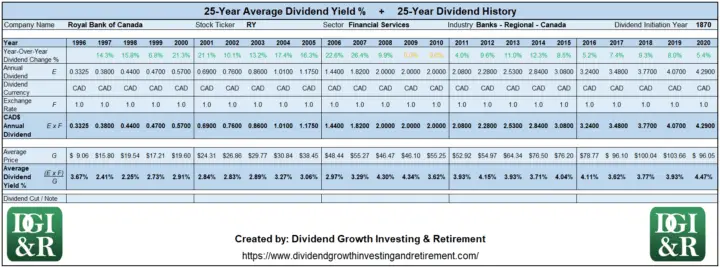

Let’s look at Royal Bank as an example.

Royal Bank of Canada (TSE:RY) 25-Year Low & High Yield Chart Example

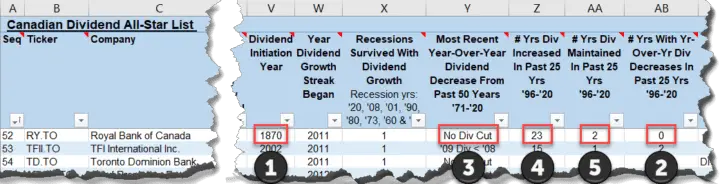

Checking the Canadian Dividend All-Star List (CDASL) I can see that Royal Bank of Canada:

- Initiated their dividend in 1870, so they have been paying dividends for well over 25 years. (#1 below)

- Had no dividend cuts in the 25 years from 1996 to 2020. (#2 below)

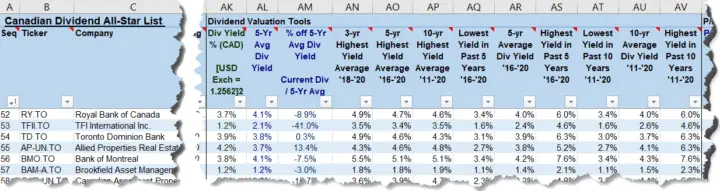

Source: March 31, 2021 Canadian Dividend All-Star List

In fact, they had no dividend cuts in the past 50 years (#3 above), and they’ve increased the dividend in 23 of the 25 years from 1996 to 2020 (#4 above). The other 2 years the dividend was maintained (#5 above).

If you want the latest free copy of the Canadian Dividend All-Star List, which contains this information on all Canadian stocks with 5 or years of consecutive dividend increases, sign up below. It’s the most popular resource of this website, so you won’t regret it!

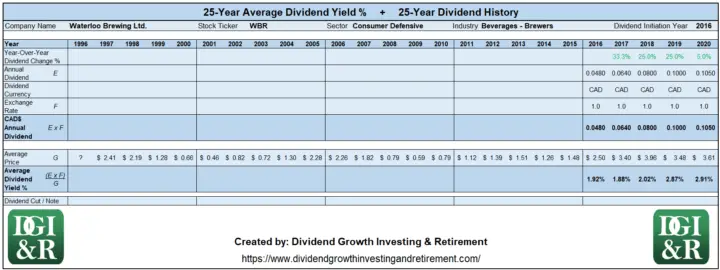

You’ll also find the same 25-year yield charts covered in this article in the “Div Yield Charts” tab of the Canadian Dividend All-Star List.

Looking at the 25-year yield chart of Royal Bank, I can see that the 5 highest yields (circled in green below) occurred in

- 2009: 7.8%

- 2008: 6.1%

- 2020: 6.0%

- 2016: 5.0%

- 2011: 4.8%

I’m not surprised to see the large jump up in 2008 & 2009 as the global financial crisis hit the banks very hard. We also see the jump up in 2020 for the COVID-19 market crash.

Interestingly, you can see a jump up to 4.2% in 2000 when the dot-com bubble burst, but it still wasn’t high enough to break the top 5 highest yields.

Like we saw with the year 2000, the high yield points aren’t necessarily always going to happen when the whole stock market is crashing.

A good practice is to look at the 3-5 highest yielding years in the past 25 and then go investigate what caused the yield to spike up in those years.

After you do this exercise, you’ll have a better sense of what the upper limit yield is, aka the undervalued high dividend yield limit.

Let’s go back to our 5 highest yields for Royal Bank from 1996 to 2020

- 2009: 7.8%

- 2008: 6.1%

- 2020: 6.0%

- 2016: 5.0%

- 2011: 4.8%

- Average of the top 5: 5.94%

Looking at these top 5 yields and the yield chart above, you might decide that:

- Anything in the high-4%s is a reasonably high yield if you want to invest sooner and don’t want to wait for the next market crash.

- If you were more conservative then you could use high-5%s or 6.0% as the undervalued high yield to target.

- You could also take the average of the top 5 which is 5.94% as your high yield undervalue target.

Another strategy comes from the book Dividends Don’t Lie:

“The historic high and low dividend-yield points – or “turning points” – can be seen on the stock’s chart. It will become apparent that the stock in question turns in the vicinity of the same dividend yield each cycle. By averaging the turning points, the boundaries of bottom and top are defined.” … “the dividend-yield theory considers prices to be undervalued or overvalued when they are within the ten percent range of their historic levels of high or low dividend yield.”

Source: Dividends Don’t Lie – Geraldine Weiss/Janet Lowe

If we applied this “Dividends Don’t Lie” concept to our Royal Bank example then the undervalued high yield would be 5.35% (5.94% average x 90%). This assumes that our top 5 highest yields which averaged 5.94% were the “turning points”.

As you can see there are a lot of different ways to interpret these yield charts. Ultimately it is going to be up to you, to decide how you want to utilize them.

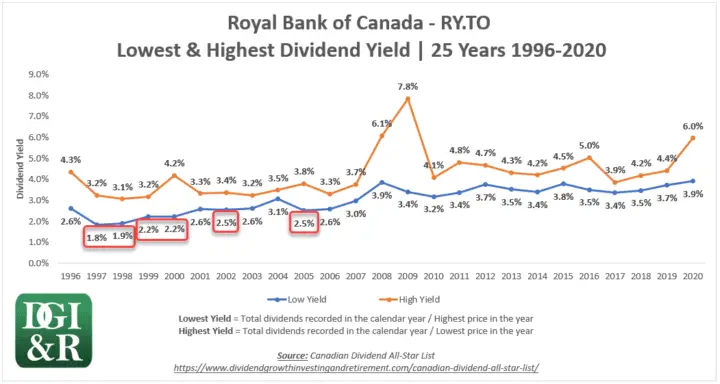

Low Yield = Overvalued

You can also do the opposite and look at the 3-5 lowest yielding years in the past 25. Investigate those years and you’ll now have a better sense of the lower limit yield or overvalued dividend yield.

Continuing on with our Royal Bank 25-year yield chart example you can see that the 5 lowest yields (circled in red below) occurred in

- 1997: 1.8%

- 1998: 1.9%

- 1999: 2.2%

- 2000: 2.2%

- 2002 & 2005: 2.5%

- Lowest 5 average 2.12%

Basically, the really low yields all led up to the 2000 dot-com bubble burstIng. It may sound odd, but this is actually good to see. It means our valuation tool, dividend yield, is doing its job.

Leading up to a bubble bursting you’d expect valuations to be stretched and the market to be overvalued. These low yields before the bubble bursts were a signal that the stock was overvalued. You want your valuation method to tell you when something looks overvalued before a bubble bursts, so it was nice to see this with Royal Bank.

Hindsight is always 20-20 so it’s not going to be this obvious to you in the moment. Nonetheless, I took this as a sign that using dividend yield as a valuation tool for Royal Bank seems to work.

As far as coming up with an overvalued dividend yield for Royal Bank I think something in the mid to high 2%s, say 2.5% to 2.7% is reasonable.

The yield got much lower (down to 1.8%) in the late 1990s, but leading up to the global financial crisis in 2007 the low yield was 3.0% and before the COVID-19 crash, the low yield in the years leading up were all in the mid-3%s. When you factor this in I thought a more reasonable low yield overvalue target was 2.5% to 2.7%.

Putting it all together

“Years of stock market research have shown that stocks generally fluctuate between repetitive extremes of high dividend yield and low dividend yield. These recurring extremes of yield can be used to establish a channel of undervalued and overvalued price levels.”

Source: Dividends Don’t Lie – Geraldine Weiss/Janet Lowe

Put it all together for our Royal Bank example, and I’d say:

- The undervalued high dividend yield was somewhere in the mid-5%s,

- and the overvalued low dividend yield was somewhere in the mid-2%s.

Figuring this all out can take a bit of time, but hopefully, with the yield charts I share for over 100 stocks later in this article it won’t take you too long.

Some More Tips

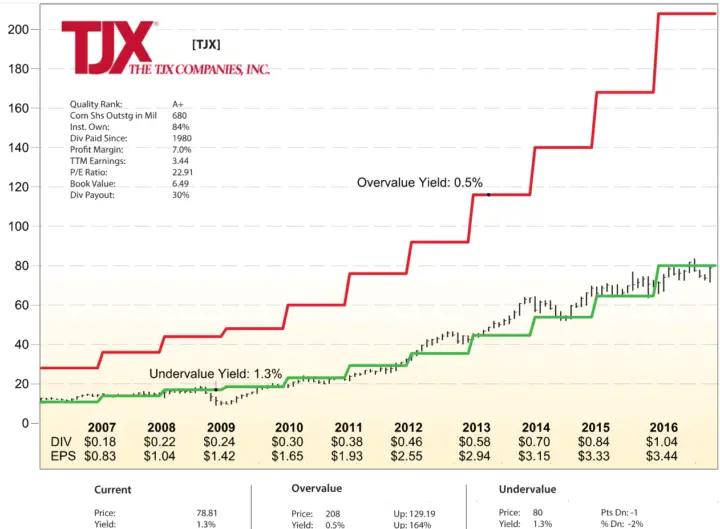

You can also chart the undervalue and overvalue dividend yield lines over the stock chart to give you a sense of how the current price compares. Here’s an old example from Investment Quality Trends:

Source: IQT – About the Charts

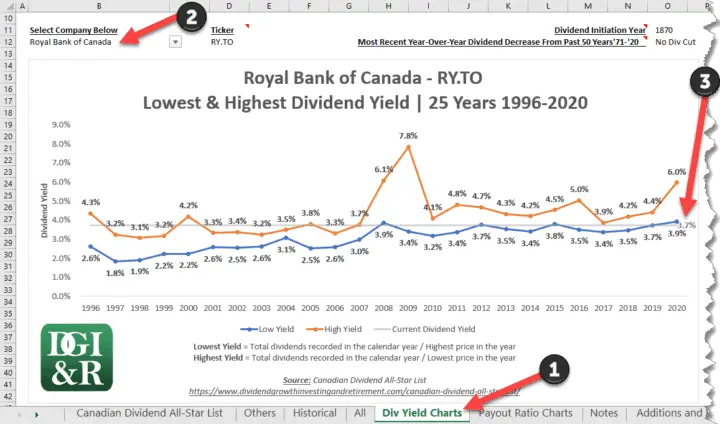

If you use the Yield Charts in the Canadian Dividend All-Star List, I also add the current dividend yield (grey line shown below, see #3) so that it’s easier to compare.

Source: March 31, 2021 Canadian Dividend All-Star List

On March 31, 2021, Royal Bank had a 3.7% dividend yield which is the grey line above. This gives you a quick sense of how the stock compares to the historic dividend yields.

TIP: If you use the Canadian Dividend All-Star List you’d get to this chart by:

- #1 clicking the “Div Yield Charts” tab, and

- #2 Selecting Royal Bank of Canada from the drop-down menu.

Sometimes you just want a quick sense of where the current dividend yield is in relation to its historic highs and lows.

You can use these yield charts for that, but I also share the 10-year lowest, average and high yield range in the Canadian Dividend All-Star List.

Looks like this:

Source: March 31, 2021 Canadian Dividend All-Star List

When you are trying to narrow a large list of potential stocks down to a few, I find it’s nice to get a quick sense of how the current yield compares to various historical dividend yield information.

With the Canadian Dividend All-Star List, you can quickly compare the current dividend yield (column AK above) to

- The 5 and 10-year averages (columns AL, AR & AU in the screenshot above),

- The lowest or highest yields in the past 5 & 10 years (columns AQ, AS, AT & AV in screenshot above), and

- The 3, 5, and 10-year averages of the highest dividend yield. (columns AN, AO & AP in screenshot above)

For free access to the most recent version of the Canadian Dividend All-Star List subscribe below.

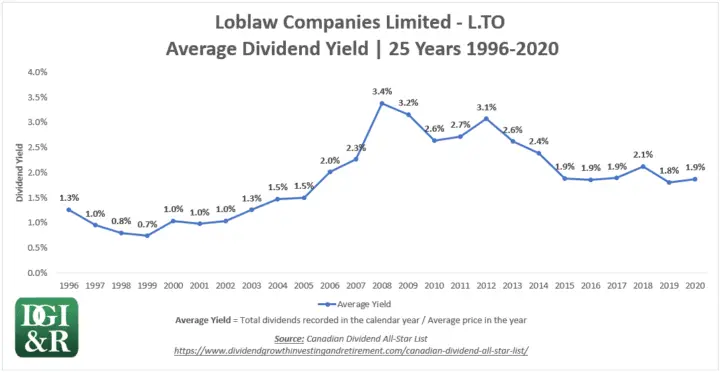

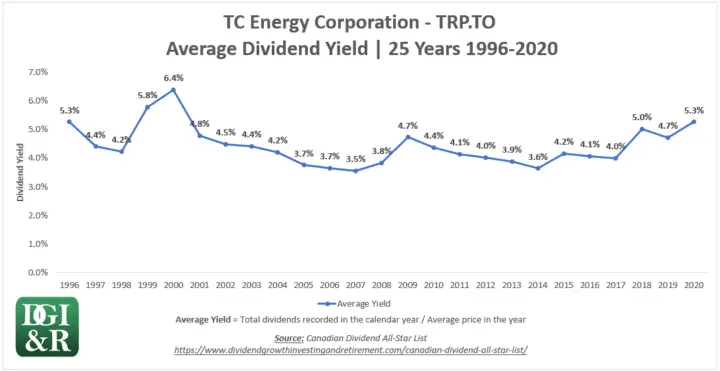

Average Yield = Fair Value

If high yield indicates undervaluation and low yield overvaluation, then the average yield suggests fair value.

You can use these 25-year average yield charts to come up with an estimate of fair-value.

Let’s jump right in, with our Royal Bank example…

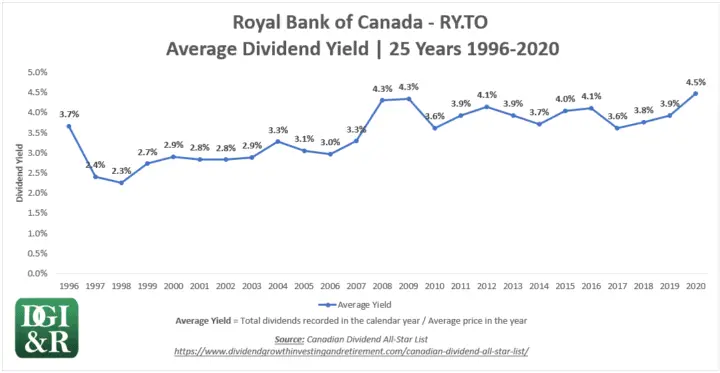

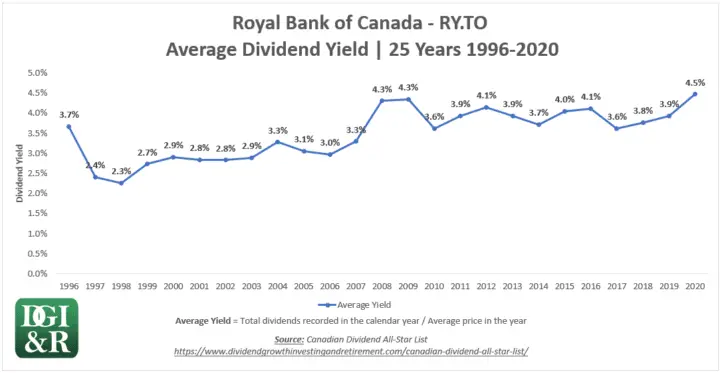

Royal Bank of Canada (TSE:RY) 25-Year Average Yield Chart Example

In addition to the 25-year high & low dividend yield charts, I’ll also be sharing 25-year average yield charts for over 100 Canadian stocks. They’ll look like the one below:

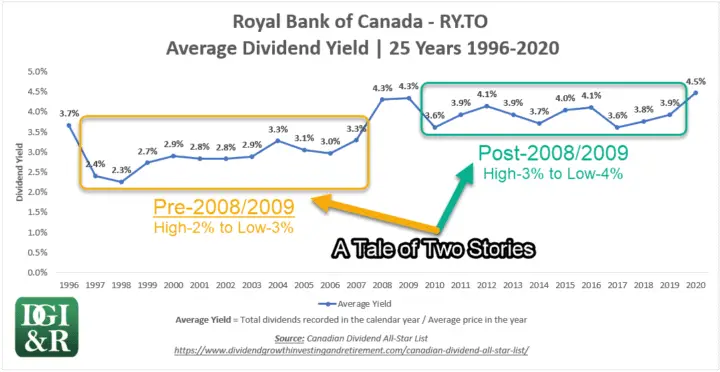

Looking at the 25-years from 1996 to 2020 for Royal Bank of Canada, I see two stories: the time before the 2008/2009 global financial crisis and the time after.

Before the global financial crisis: In the late 1990s and early 2000s, the average dividend yield was either high 2%s or low 3%s.

After the global financial crisis: From 2010 and on, the average dividend yield was generally high 3%s or low 4%s.

I’m not too surprised by this as the global financial crisis had a large impact on how investors perceive the safety of banks overall. With the global financial crisis eroding some confidence in the global banking system in general, it’s not surprising to see investors demand a higher yield on average.

So what is the fair value yield for Royal Bank?

We have the pre-2008/2009 financial crisis saying it’s high-2% to low-3%. And the post-2008/2009 crisis saying high-3% or low-4%.

I’d go with the more conservative of the two, and say the fair value for Royal Bank is around a dividend yield of high-3% to low-4%.

Different investors are going to have different opinions on how to interpret these 25-year average yield charts, so it’s not really about whether you agree with my fair value assessment of Royal Bank.

It’s more about showcasing how these tools can be used and deciding for yourself on something that works for you.

Video: How to Find the 25-Year History of Low, Average & High Dividend Yields with the Canadian Dividend All-Star List

If you already subscribe to the Dividend Growth Investing & Retirement newsletter, you’ll find these same yield charts in the Canadian Dividend All-Star List (CDASL) spreadsheet that is emailed out at the start of every month. Here is a short video on how to find these charts with the CDASL.

Not everyone has Excel, so I’m also sharing these 25-year yield charts for over 100 Canadian stocks at the end of this article too.

If you want the latest version of the Canadian Dividend All-Star List (CDASL) spreadsheet sign up below.

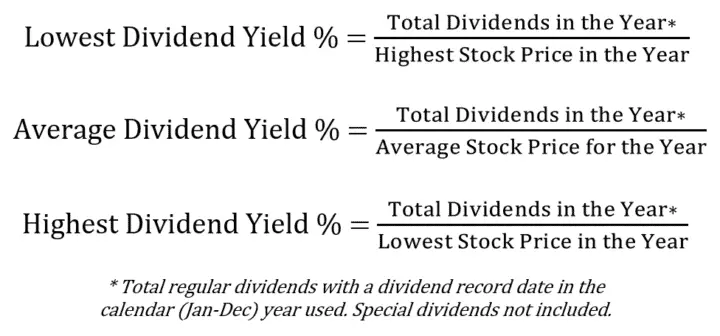

Good enough, but not perfect: How I calculate low, average, and high yields

Over 100 stocks, 25 years, ~252 trading days in a year, the low yield, the average yield, and the high yield. It’s a lot of information.

Over 1,890,000 data points (100 x 25 x 252 x 3) if you wanted to do it correctly.

I’m not a computer programmer so I haven’t done it the right way.

To save time, I’ve taken a “good enough” approach to these charts.

What’s good enough for me, might not be good enough for you.

That’s why I strongly recommend you read how I calculate the yields and the problems with these methods.

You have been warned!

How I calculate the lowest, average, and highest yields. I call these my “good enough” calculations.

4 Problems with my “good enough” method

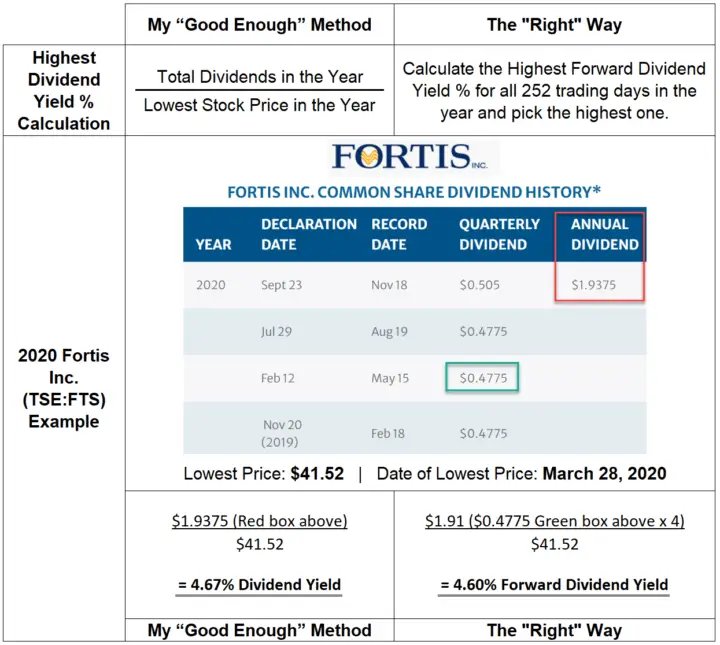

Problem #1 Total Dividends In The Year vs. The Daily Forward Dividend Can Skew Yields Lower or Higher

Rather than take the forward dividend amount on the day of the lowest price in the year, I use the total annual dividends for the whole year divided by the lowest price in the year.

This can result in the correct, slightly lower or slightly higher yield.

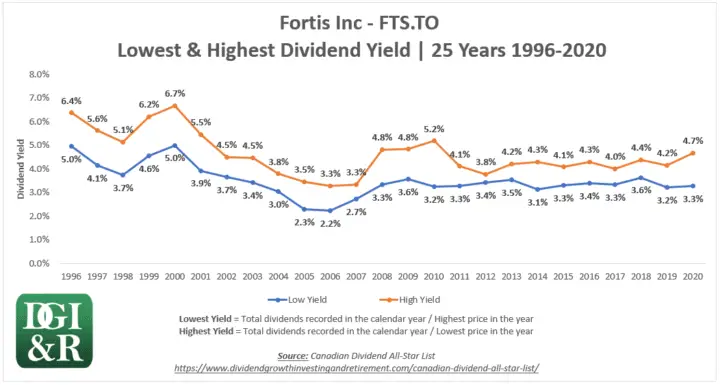

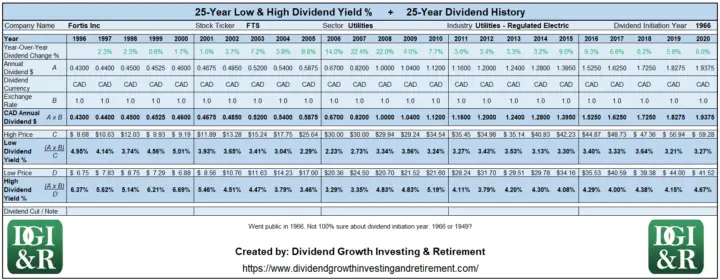

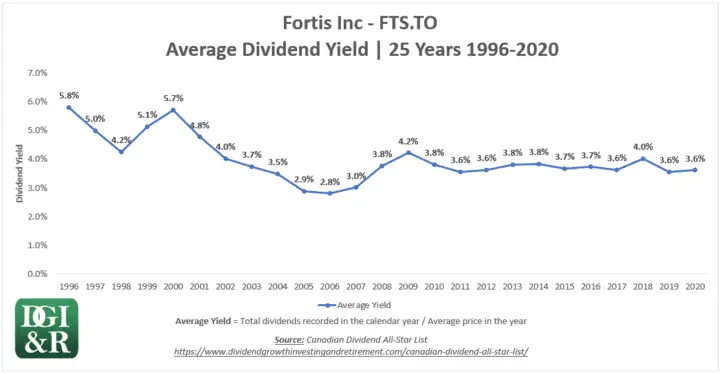

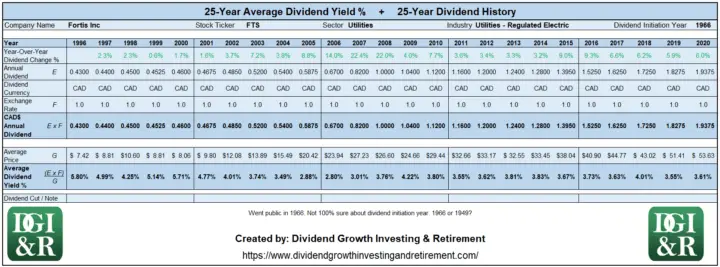

Fortis (TSE:FTS) Example where my “good enough” method skews the yield higher

As you can see from above, my “good enough” method shows 4.67% as the highest yield for Fortis Inc (TSE:FTS) in 2020. In reality, it only ever got up to 4.60%. So my “good enough” method has a slightly higher yield of 4.67% vs. the correct 4.60%.

Not perfect, but “good enough” for me.

Key takeaway: If there is a dividend increase or dividend cut in the year my “good enough” method is going to be wrong. If the dividend was maintained at the same level throughout the whole year, without any dividend increase/cut announcements, it’ll be correct.

Why is this happening?

Let’s go back to our 2020 Fortis example.

The total dividends in 2020 include the increased quarterly dividend announced near the end of the year on September 23rd.

But you’ll remember that the lowest price occurred on March 23rd well before the 2020 dividend increase announcement.

On March 23rd the regular quarterly dividend was $0.4775, so the yield would’ve been based on the $0.4775 quarterly dividend at the time.

The correct yield on March 23rd would’ve been the forward dividend yield of 4.60% ($0.4775 x 4 / $41.52).

Using my “good enough” method I’ve inflated the high dividend yield in 2020 to 4.67% vs. the correct yield of 4.6%.

What I should be doing is calculating the dividend yield for each of the 252 trading days in the year and picking the highest from that list.

Do this for ~252 trading days/year for 25 years for over 100 stocks, and then repeat for the lowest, average, and highest yield when you aren’t a computer programmer. You quickly realize why I’ve gone with my ”good enough” method.

Now let’s look at how it can also skew the yield lower.

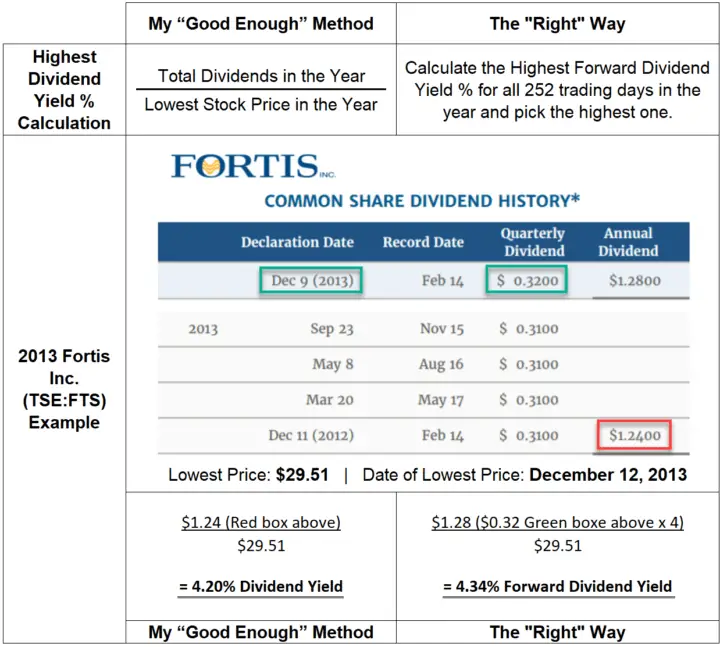

Fortis Example where my “good enough” method skews the yield lower

We will stick with Fortis, but let’s look at 2013 instead of 2020 this time.

For Fortis Inc. (TSE:FTS) the lowest stock price in 2013 was $29.51 and it occurred on December 12, 2013.

2013 annual dividends total $1.24 (red box above), and forward annual dividends on December 12th were $1.28 ($0.32 green box above x 4) as they announced a $0.31 to $0.32 or 3.2% dividend increase to the quarterly dividend on December 9, 2013.

Using my “good enough” method results in a slightly lower yield of 4.20% ($1.24 / $29.51) when it should actually be 4.34% ($1.28 / $29.51).

By moving the lowest price date to a time after a dividend increase was announced my “good enough” method will be lower than the correct high yield.

Again, not perfect, but “good enough” for me.

Conversely, if the lowest price date is before a dividend increase announcement then the “good enough” calculation will be higher than the correct high yield. We saw this with the prior 2020 Fortis example.

So far my “good enough” method has been pretty close, but where it won’t be remotely close is in the year of a dividend cut.

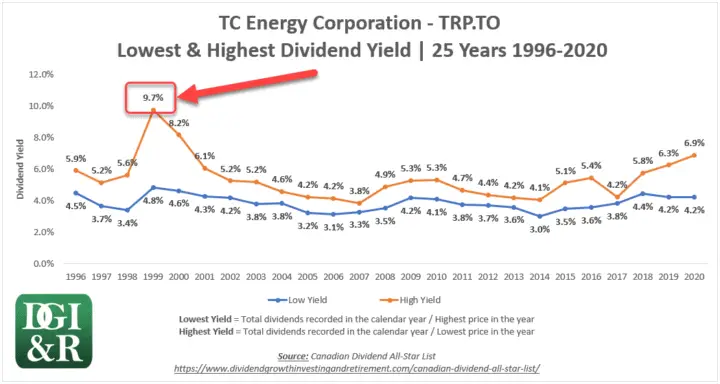

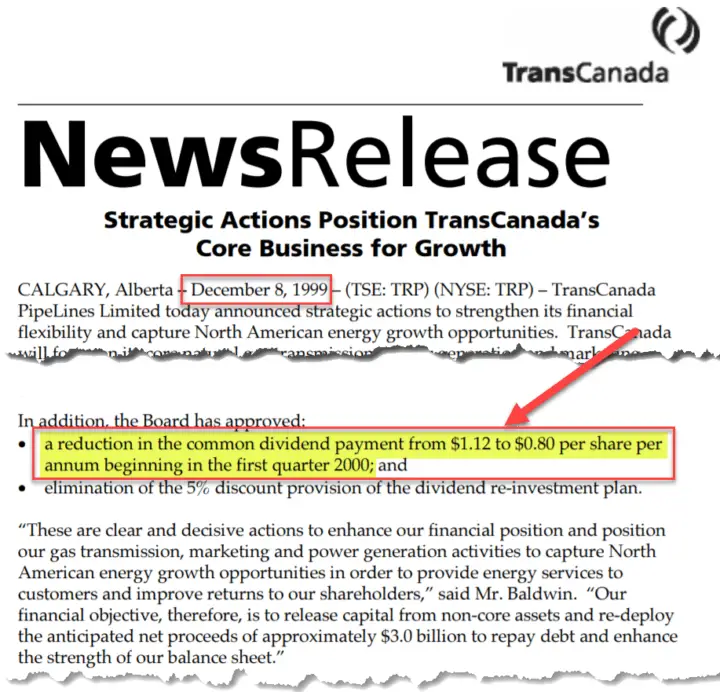

Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

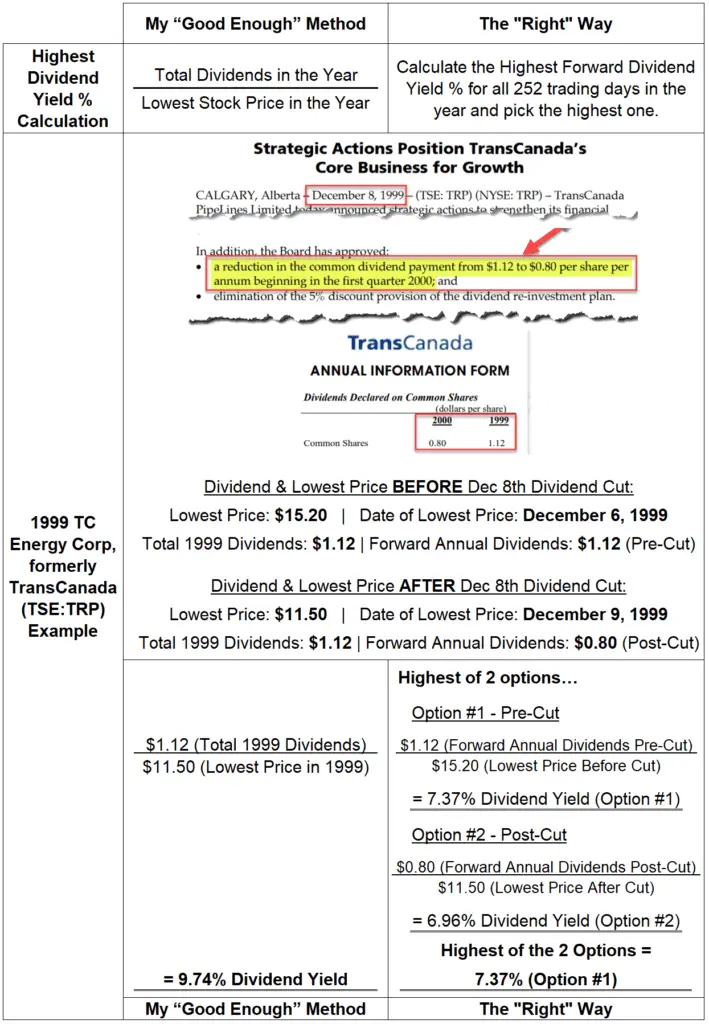

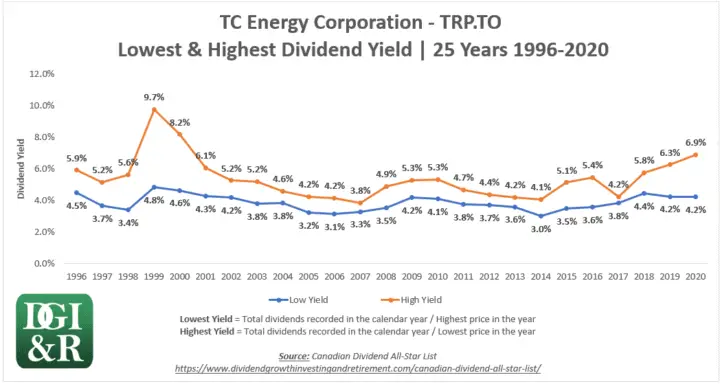

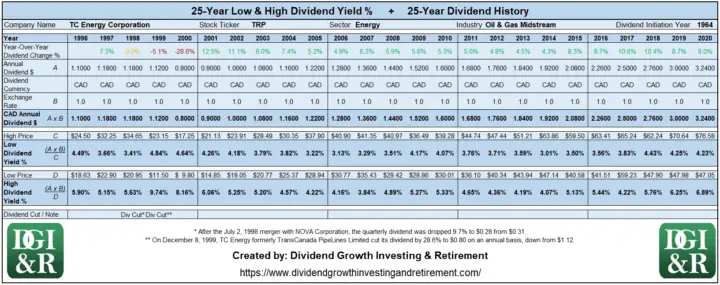

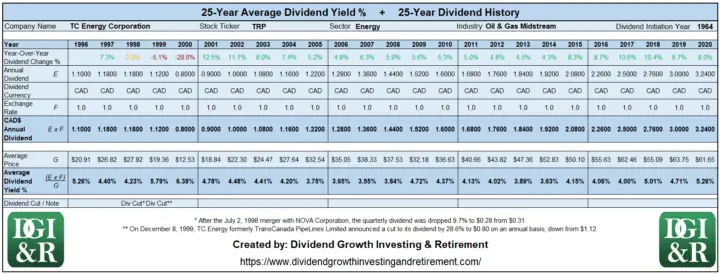

I’m going to use TC Energy Corp (TSE:TRP) as an example.

TC Energy Corp (TSE:TRP), Formerly TransCanada, 1999 Dividend Cut Example

This is TC Energy’s high & low dividend yield, 1996-2020, 25-year chart:

1999 sticks out like a sore thumb.

Did the yield really get up to 9.7% in 1999?

No, it actually only got up to 7.37%.

This is a big difference, so when you look at these yield charts watch out for dividend cut years as the yield can be off by a lot in these years.

If you aren’t sure of dividend cut years, I’ve made sure to add a dividend cut history section under each stock’s yield charts.

Getting back to our example…

On December 8, 1999, TC Energy (formerly TransCanada) announced a dividend cut, dropping the annual $1.12 dividend down to $0.80.

Source: TransCanada PipeLines Limited December 8, 1999 Press Release

As with most stocks that announce a dividend cut, the stock price dropped and a new low for the 1999 year was established the following day on December 9, 1999, at $11.50.

With a reduced forward-looking annual dividend of $0.80 on December 9, 1999, the yield was 6.96% ($0.80 / $11.50).

Initially, I thought this was the correct highest yield for 1999, but I was wrong.

The lowest price before the December 8th dividend cut was $15.20 on December 6th. Calculate the forward dividend on December 6th and it turns out to be higher at 7.37% ($1.12 / $15.20). Because the dividend cut wasn’t announced or known about on December 6th, the higher forward annual dividends of $1.12 would’ve been used at the time.

The infographic below explains it well…

Because total dividends in 1999 were $1.12, my “good enough” method of calculating the highest dividend yield for the year turns out to be substantially higher at 9.74% ($1.12 / $11.50) vs. the correct highest dividend yield of 7.37% for 1999.

Bottom line: Watch out for dividend cut years in the charts below as the yields for those years will be off by quite a bit.

Problem #3 Dividend Initiation Year Can Result In A Lower Yield

My formula to calculate the yield takes the total dividends in the year and divides it by the lowest, average, or highest price.

If dividends were initiated later in the year, say Q4, then the total dividends in the year will be low as a full year of dividends haven’t been paid. This causes problems for my “good enough” method.

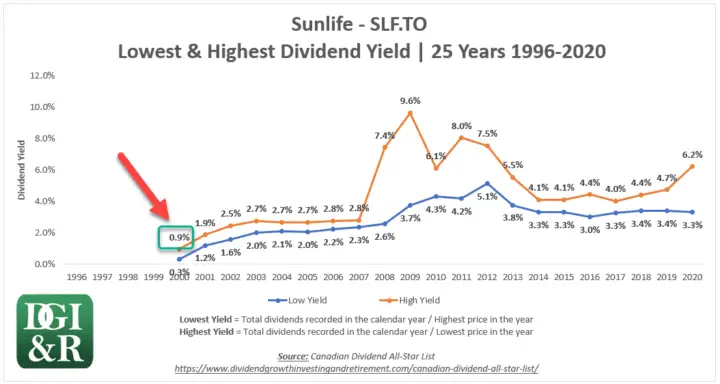

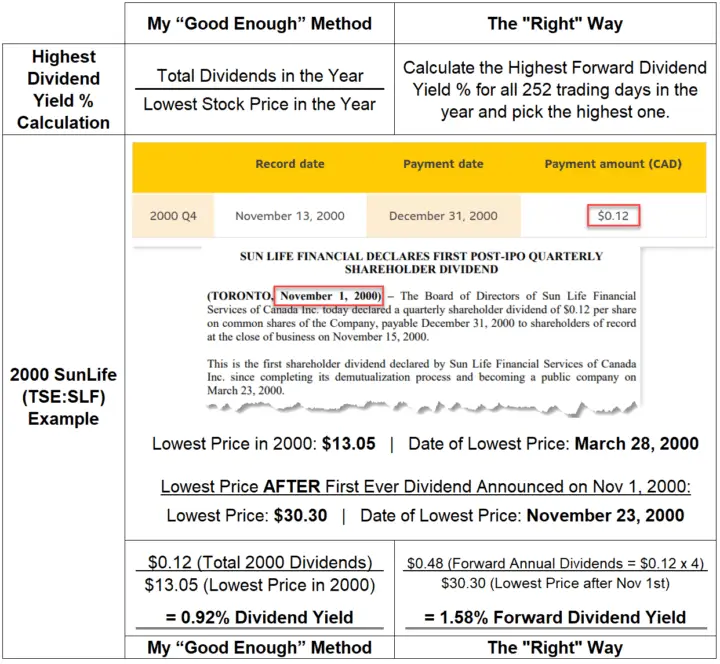

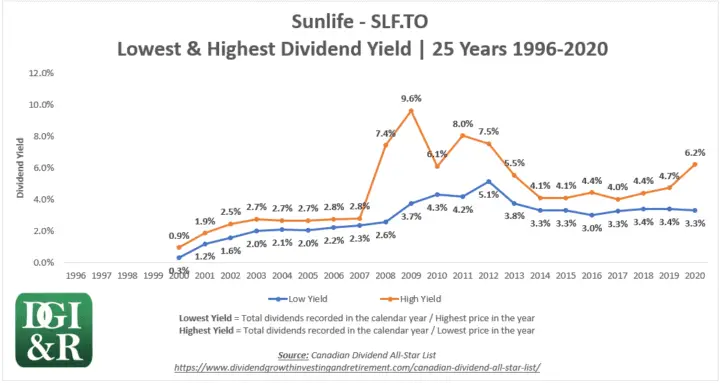

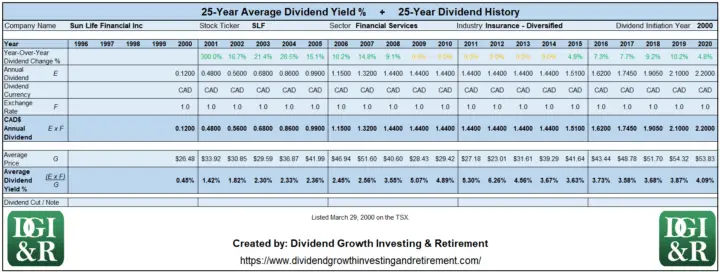

SunLife (TSE:SLF) Highest Dividend Yield in 2000 Example

Here’s the yield chart for Sunlife (TSE:SLF)

In 2000, when the dividend was initiated, was the correct high dividend yield really 0.9%?

No, the correct highest yield was actually 1.58% in 2000.

They initiated a quarterly dividend of $0.12 in Q4 of 2000.

This means total dividends in 2000 were only $0.12, because the quarterly dividend was initiated in the last quarter of the year.

Whereas forward annual dividends in late 2000 would be $0.48 (4 x $0.12), which is 4 times higher.

It shouldn’t be surprising then, that my “good enough” method is going to be wrong in dividend initiation years.

Take a look at this infographic to better understand what I’m talking about…

Because SunLife initiated their dividend late in the year, only one quarterly dividend of $0.12 was recorded in 2000, instead of the standard four.

Using my “good enough” method to calculate the highest dividend yield for the year results in a yield of 0.92% ($0.12 / $13.05) when it should actually be 1.58% ($0.12 x 4 / $30.30).

Bottom line: For companies that initiated a dividend in the past 25 years and initiated the dividend in Q2, Q3, or Q4, my “good enough” method is likely going to calculate the dividend yield as too low.

Not sure when a stock first started paying a dividend?

Not to worry, I’ve made sure to add the dividend initiation year under each stock’s yield charts.

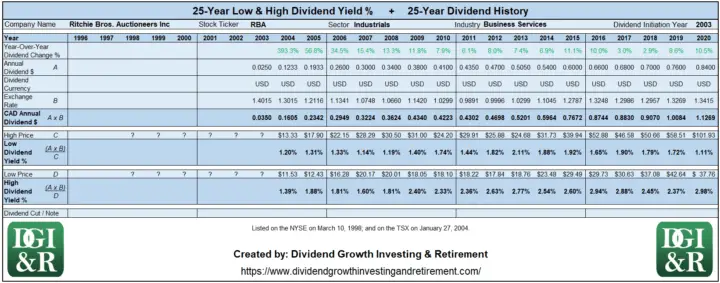

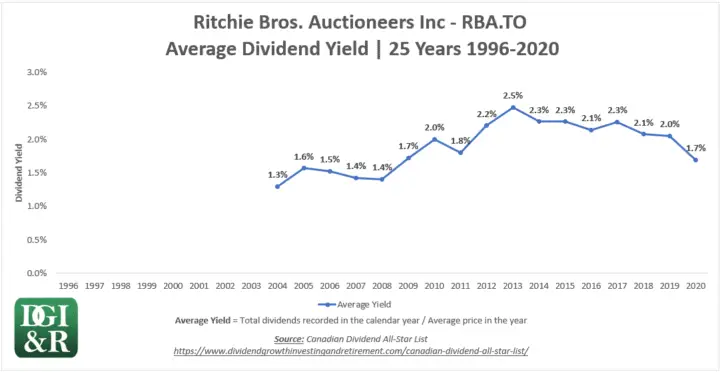

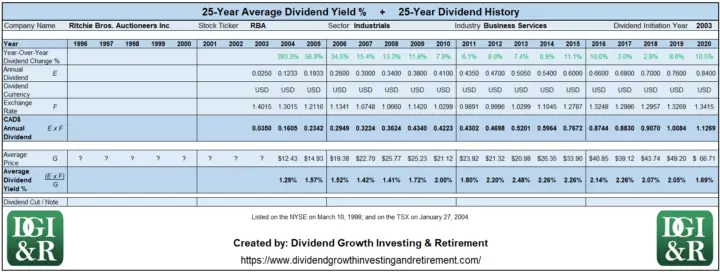

Problem #4 Canadian Stocks Paying USD Dividends

There are a number of Canadian listed stocks that pay dividends in US dollars (USD). To calculate the correct dividend yield, the USD dividend needs to be converted to Canadian dollars (CAD) before it’s divided by the CAD$ stock price.

Instead of calculating the yield for each of the 252 trading days in a year and using the USD to CAD exchange rate on each of these 252 days, I just used the average annual exchange rate for the year.

I’ve used the average annual exchange rate for the year to convert the total dividends in the year back to a Canadian amount.

Depending on currency swings throughout the year the yield could actually be lower or higher.

To help compensate for this problem, I’ll show you how I calculate the dividend yield under each of the dividend yield charts. That way you’ll see the dividend currency and exchange rate used each year.

25-Year Dividend Yield Charts | Low, Average & High Yields

Dividend Yield Charts for 100 Canadian Stocks

Use the links below to find the 25-year low, average, and high yield dividend yield chats. You’ll also find a 25-year summary of the stock’s dividend history.

Company Name Table of Contents

You can use the company name or stock ticker below to jump to the stock you are most interested in. (Listed alphabetically)

- Agnico Eagle Mines Limited – AEM,

- Algonquin Power & Utilities Corp – AQN,

- Alimentation Couche-Tard Inc – ATD.B,

- Allied Properties REIT – AP.UN,

- Andrew Peller Ltd – ADW.A,

- Atco Ltd – ACO.X,

- Badger Daylighting Ltd – BAD,

- Bank of Montreal – BMO,

- Bank of Nova Scotia – BNS,

- BCE Inc – BCE,

- Boyd Group Services Inc -BYD,

- Brookfield Asset Management Inc – BAM.A,

- Brookfield Infrastructure Partners LP – BIP.UN,

- Brookfield Property Partners – BPY.UN,

- Brookfield Renewable Energy Partners LP – BEP.UN,

- Canadian Apartment Properties REIT – CAR.UN,

- Canadian General Investments, Limited – CGI,

- Canadian Imperial Bank of Commerce (CIBC) – CM,

- Canadian National Railway – CNR,

- Canadian Natural Resources – CNQ,

- Canadian Pacific Railway Ltd – CP,

- Canadian Tire Corp Ltd – CTC.A,

- Canadian Utilities – CU,

- Canadian Western Bank – CWB,

- Capital Power Corporation – CPX,

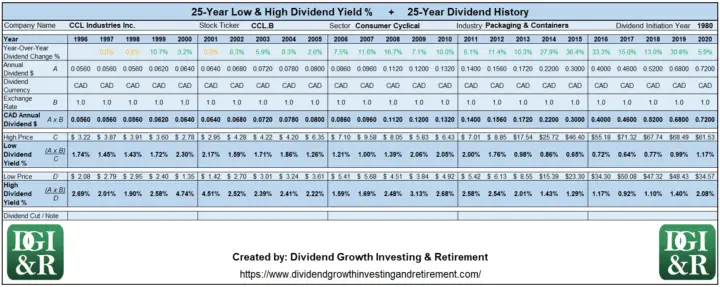

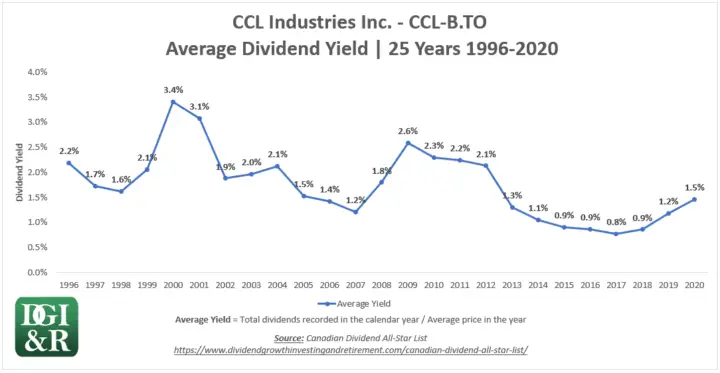

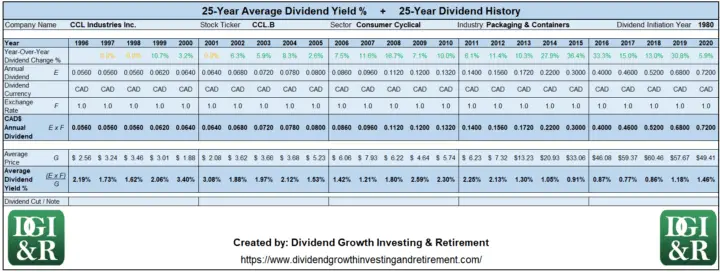

- CCL Industries Inc – CCL.B,

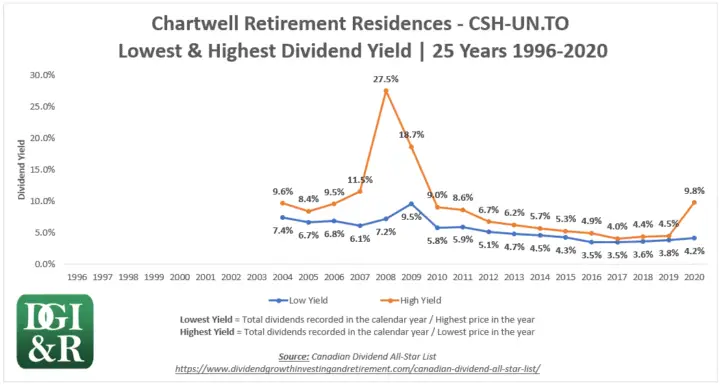

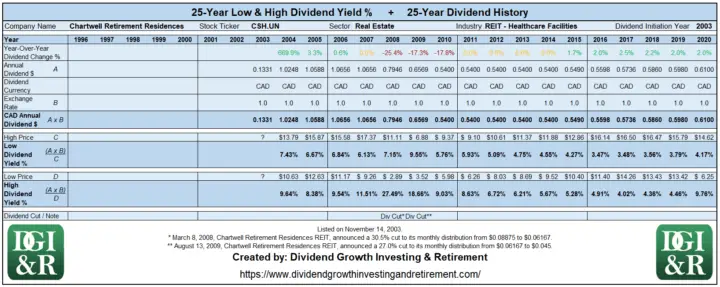

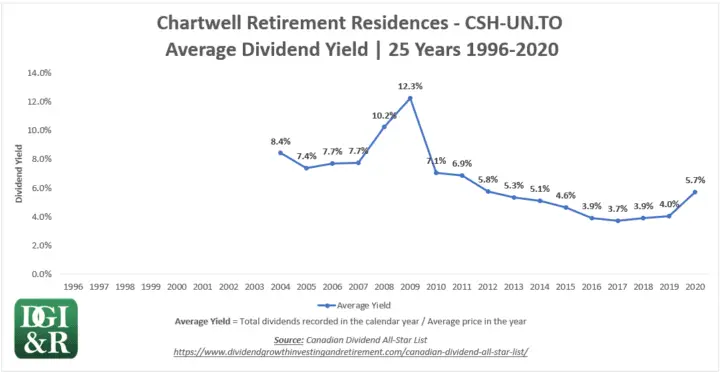

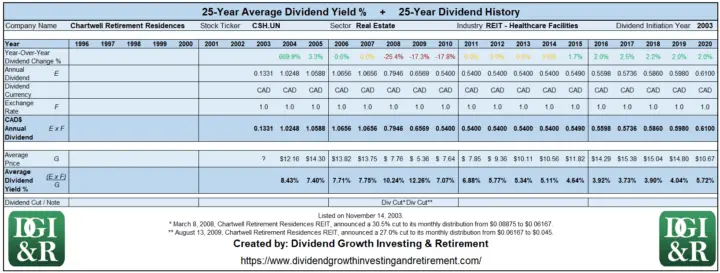

- Chartwell Retirement Residences – CSH.UN,

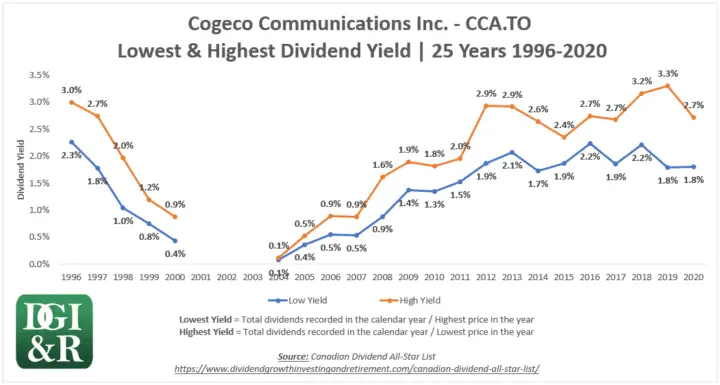

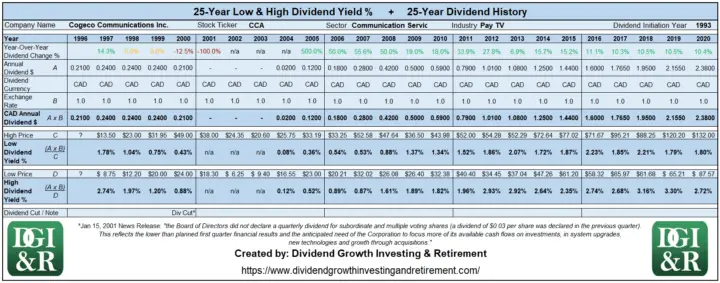

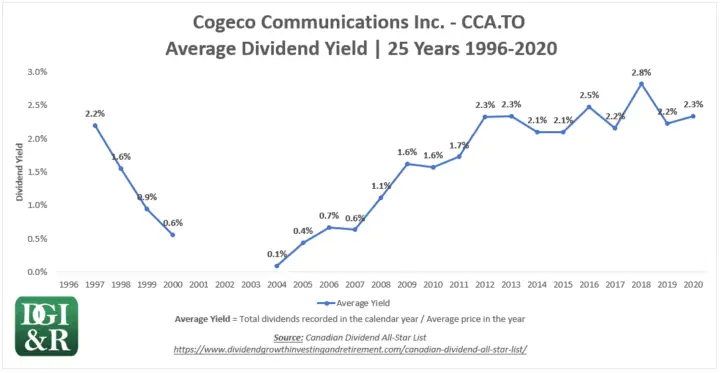

- Cogeco Communications Inc – CCA,

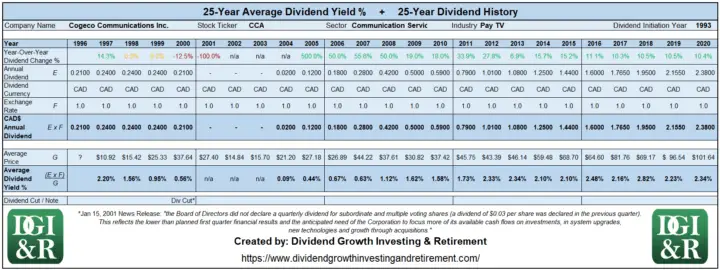

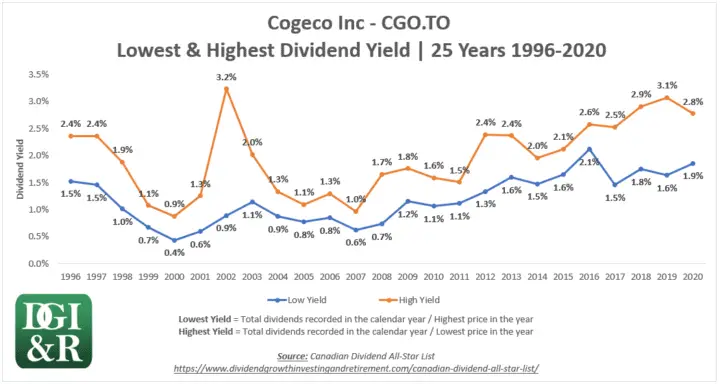

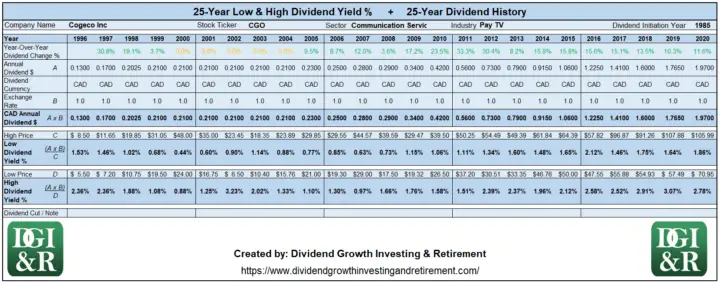

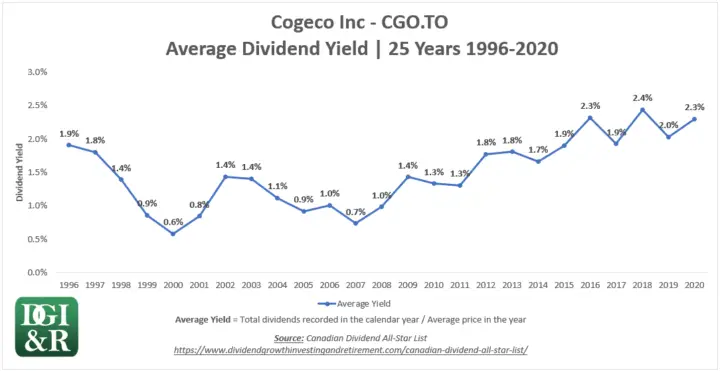

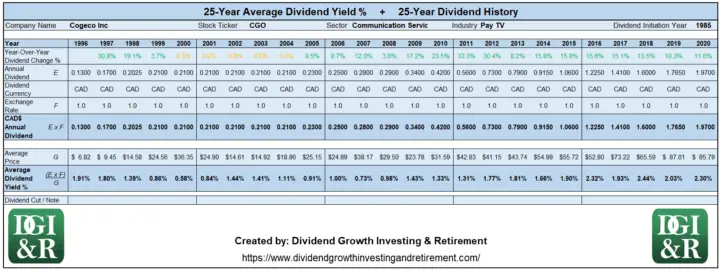

- Cogeco Inc – CGO,

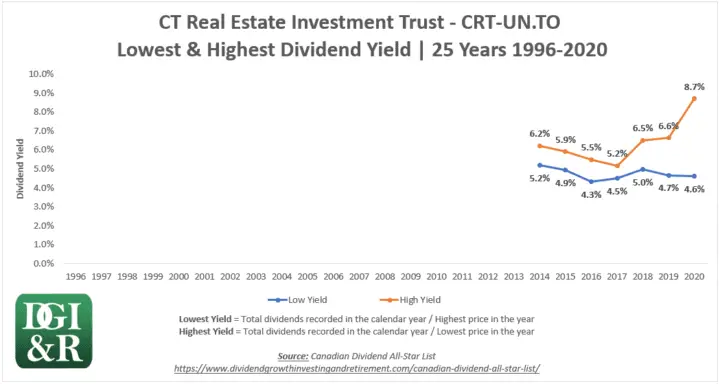

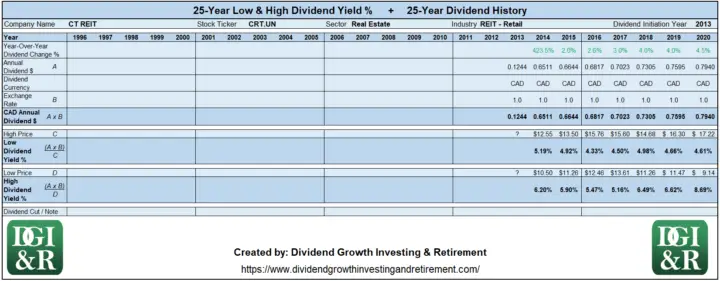

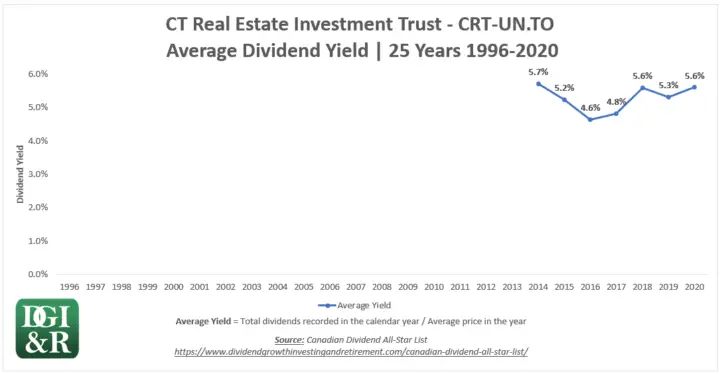

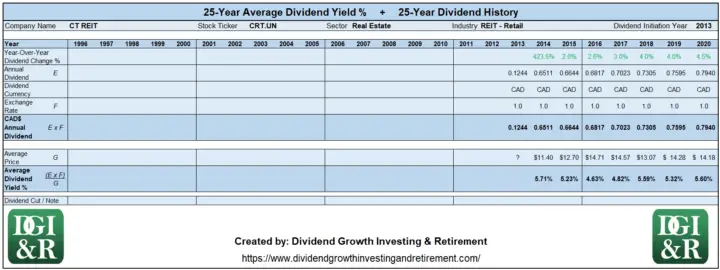

- CT REIT – CRT.UN,

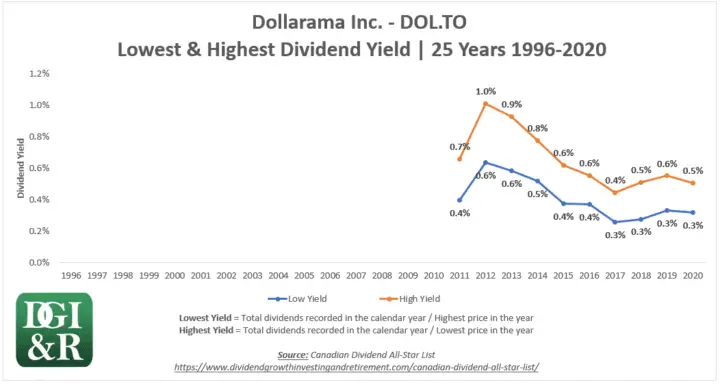

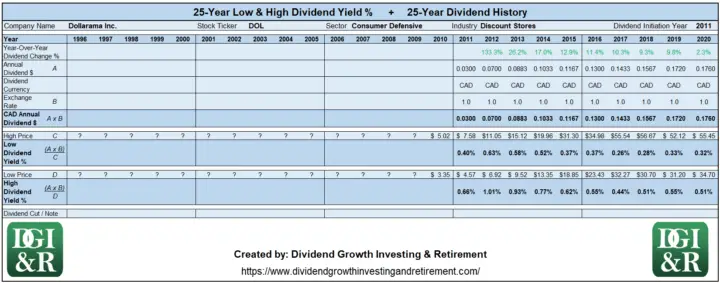

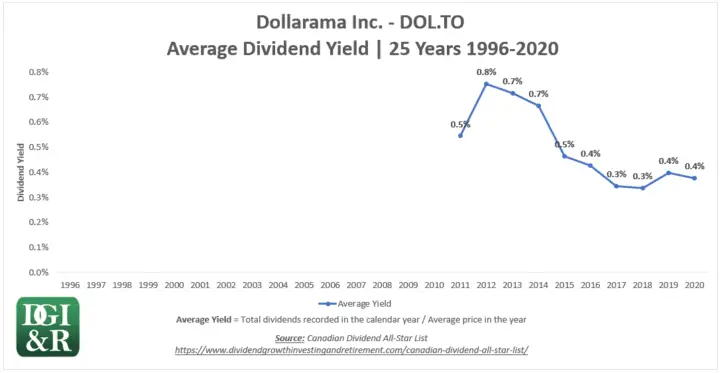

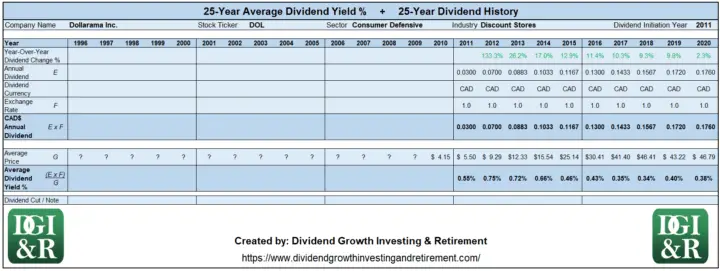

- Dollarama Inc – DOL,

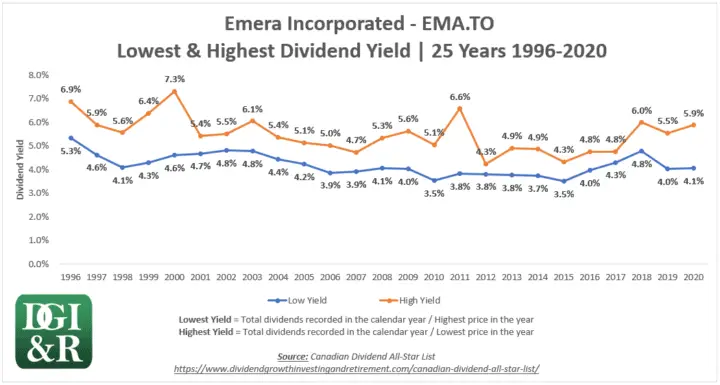

- Emera Incorporated – EMA,

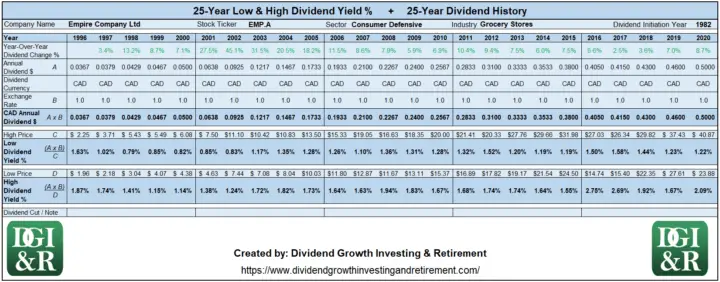

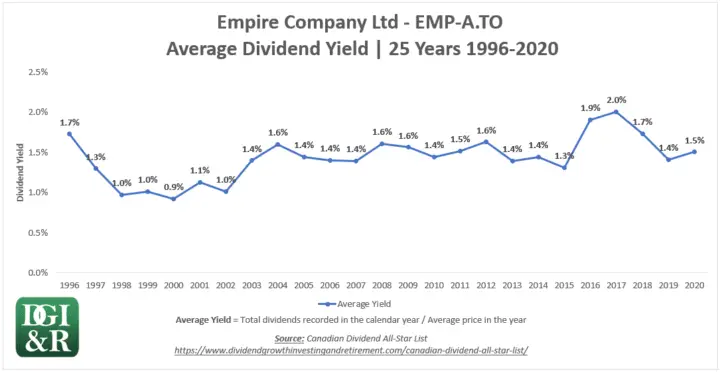

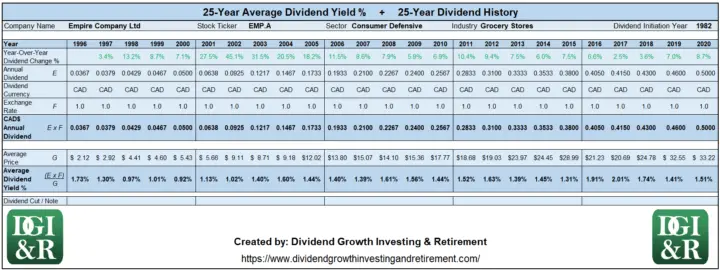

- Empire Company Ltd – EMP.A,

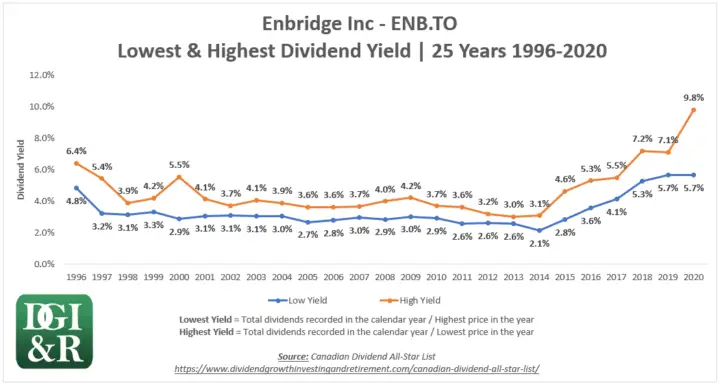

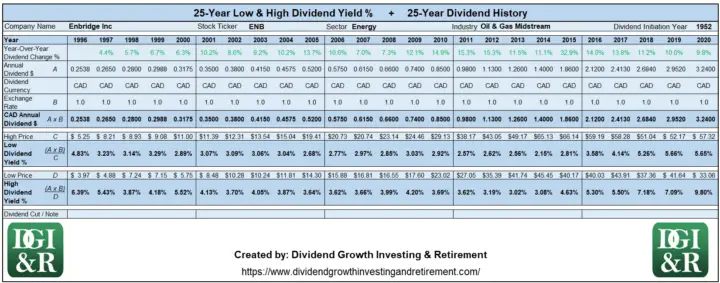

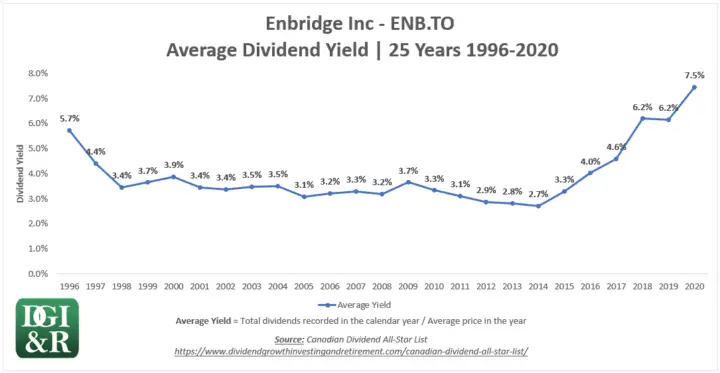

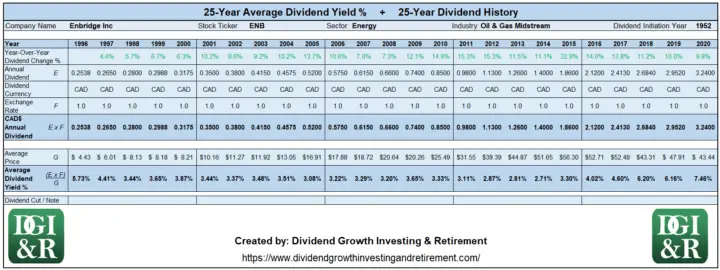

- Enbridge Inc – ENB,

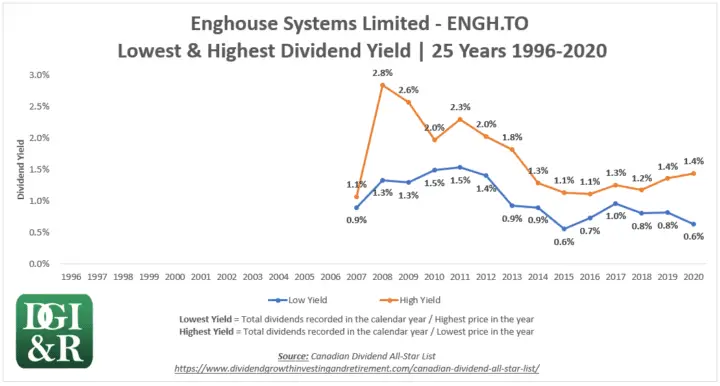

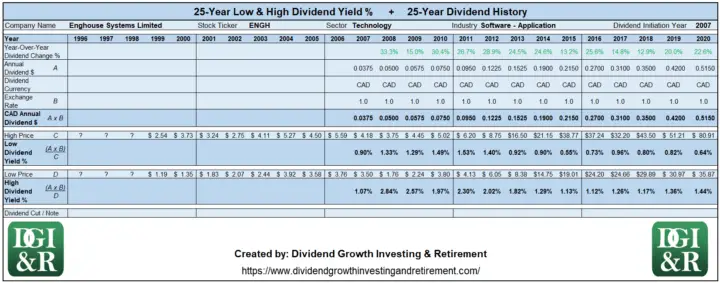

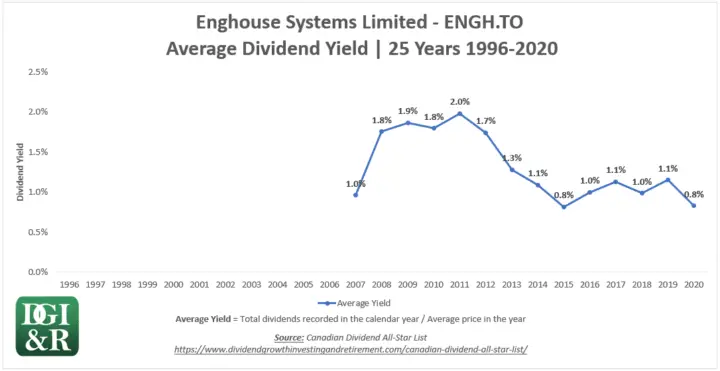

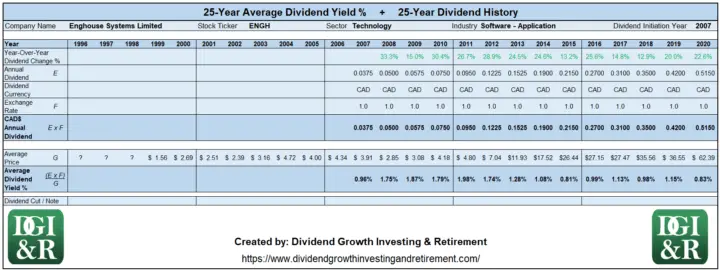

- Enghouse Systems Limited – ENGH,

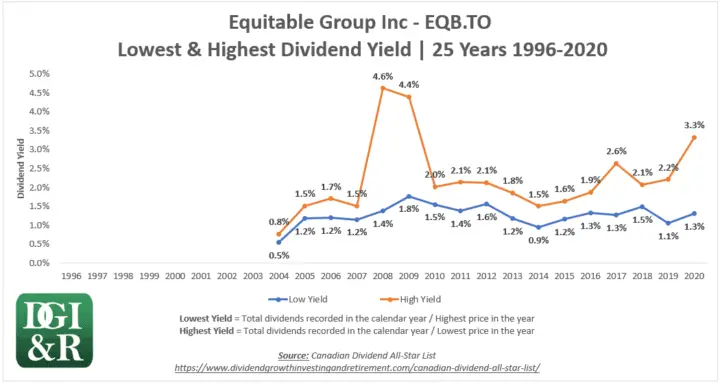

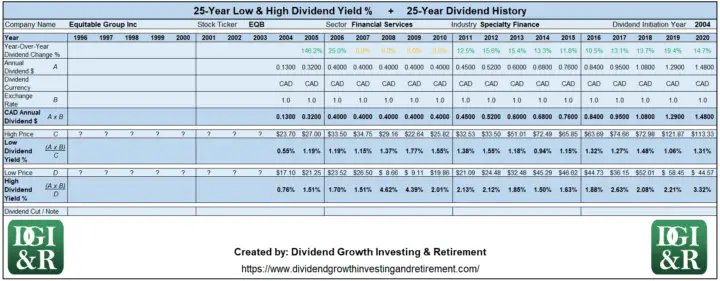

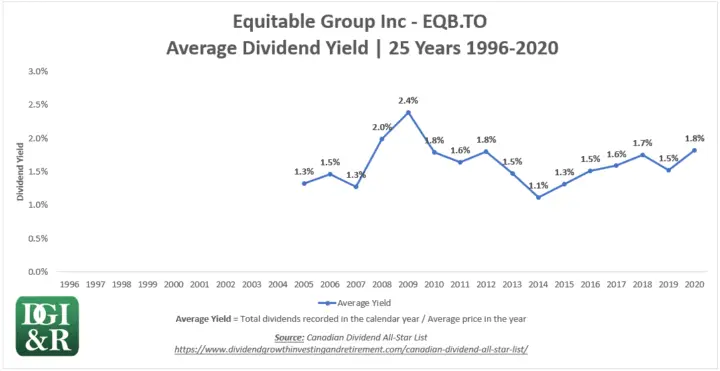

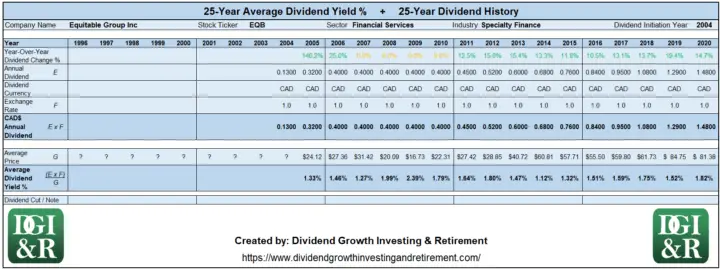

- Equitable Group Inc – EQB,

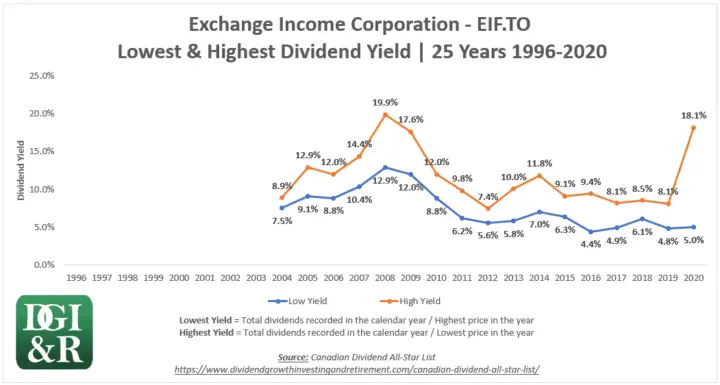

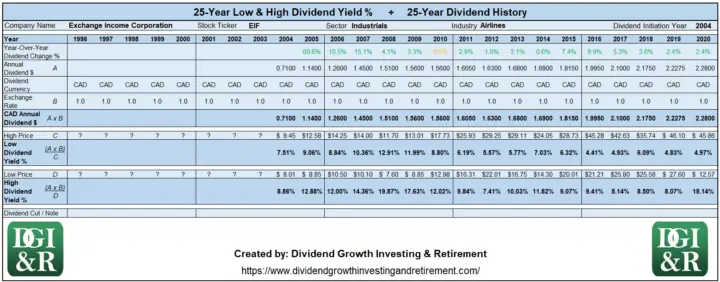

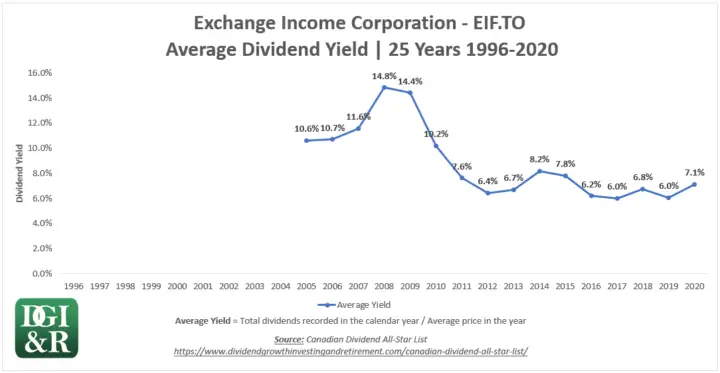

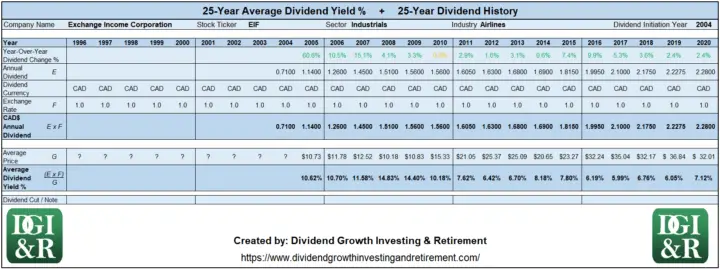

- Exchange Income Corporation – EIF,

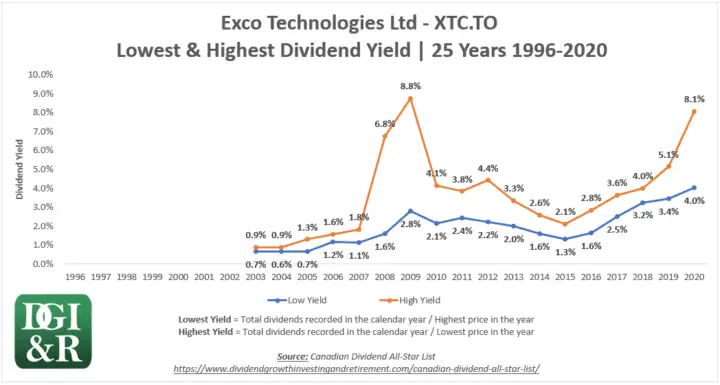

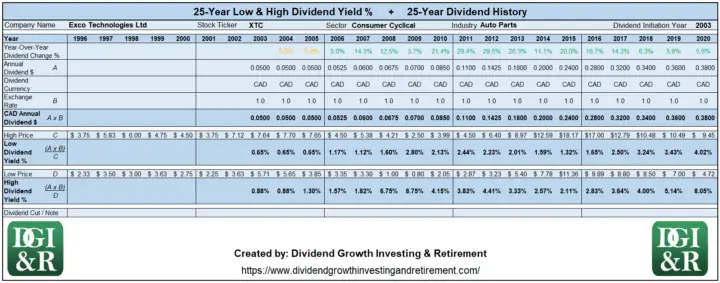

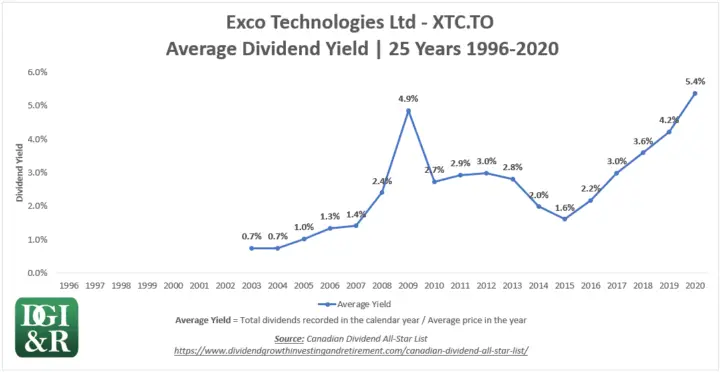

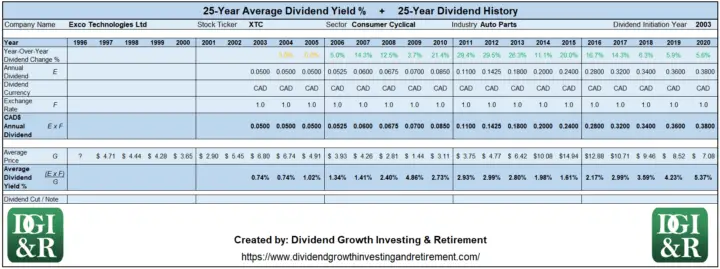

- Exco Technologies Ltd – XTC,

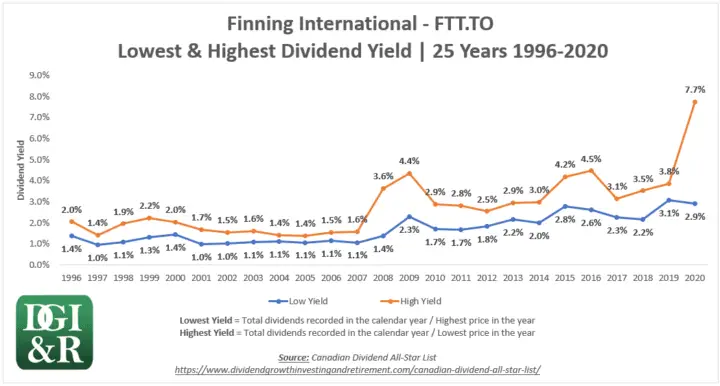

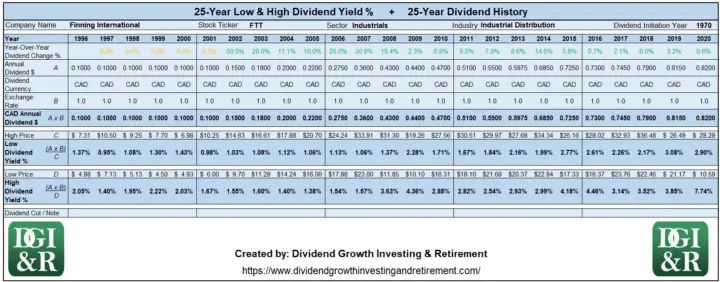

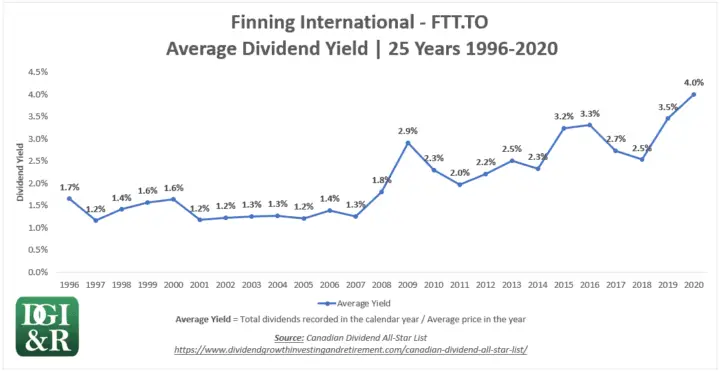

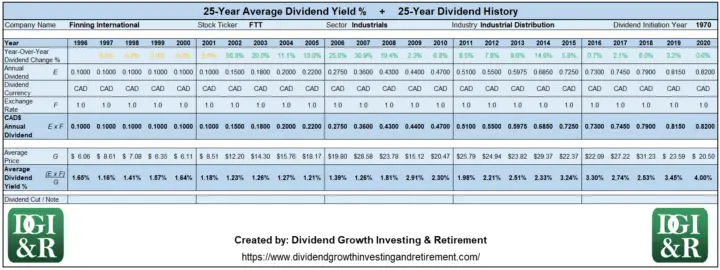

- Finning International – FTT,

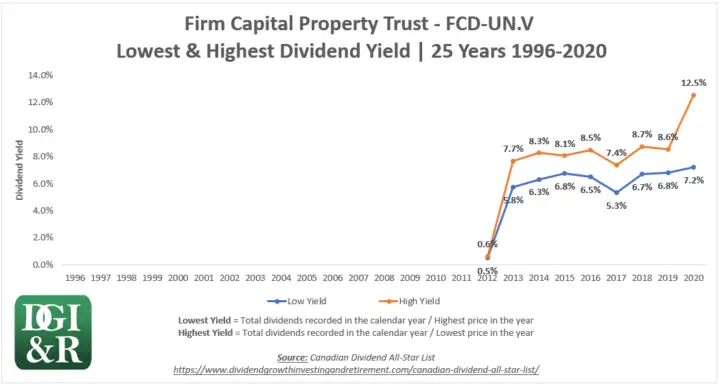

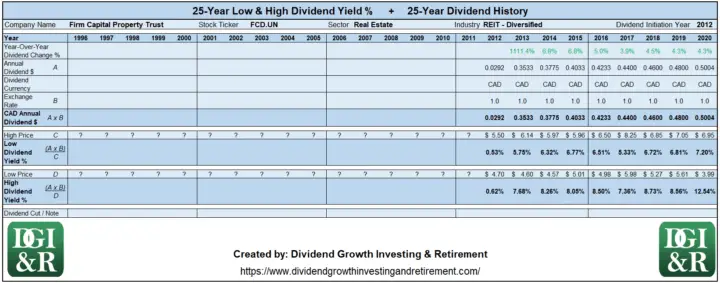

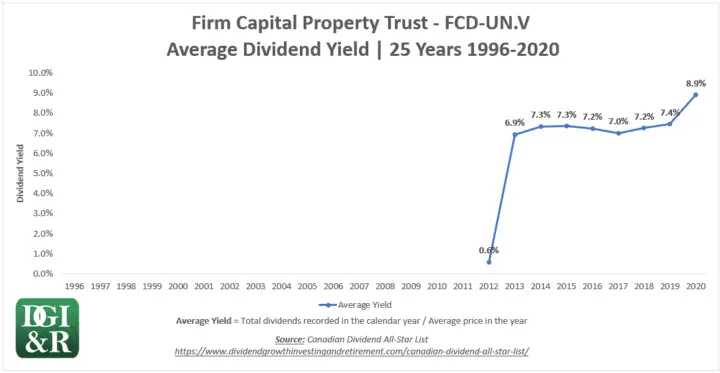

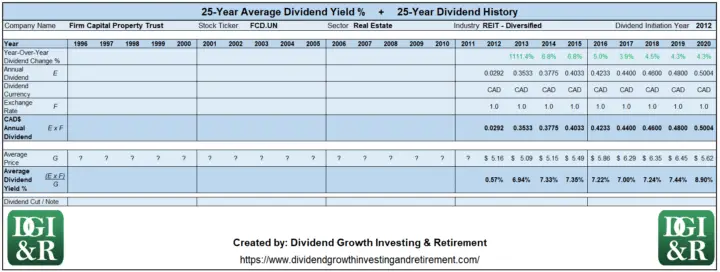

- Firm Capital Property Trust – FCD.UN,

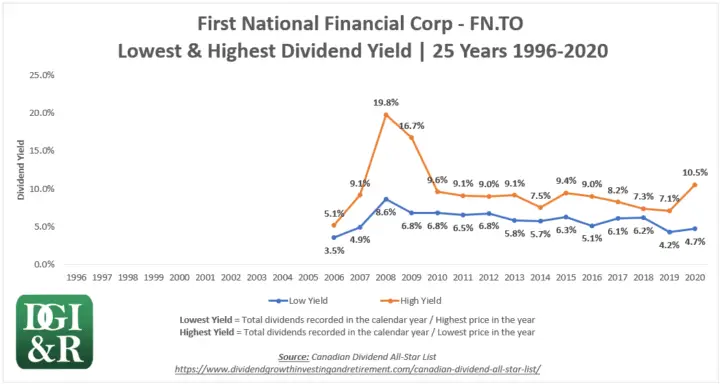

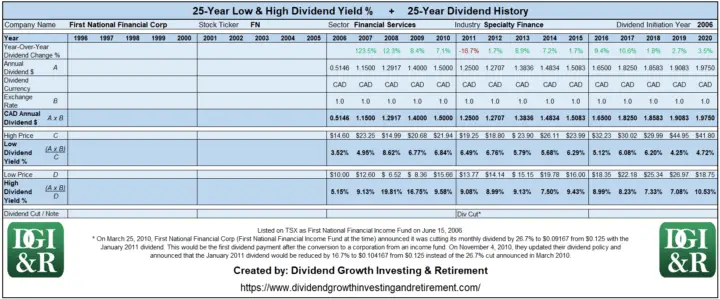

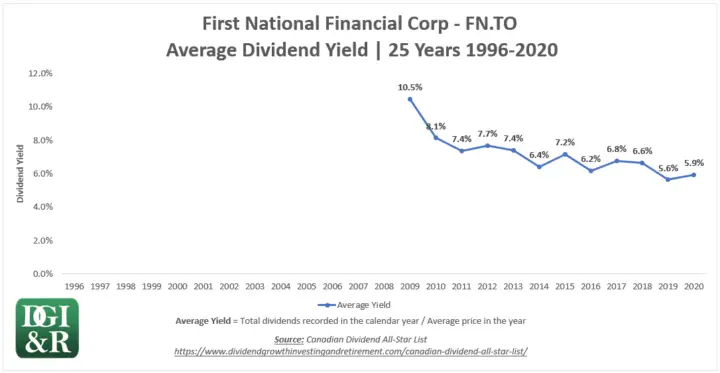

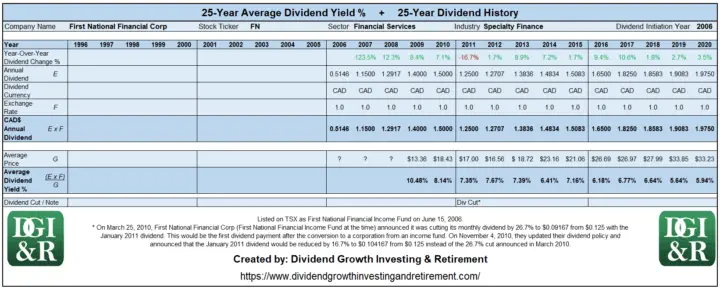

- First National Financial Corp – FN,

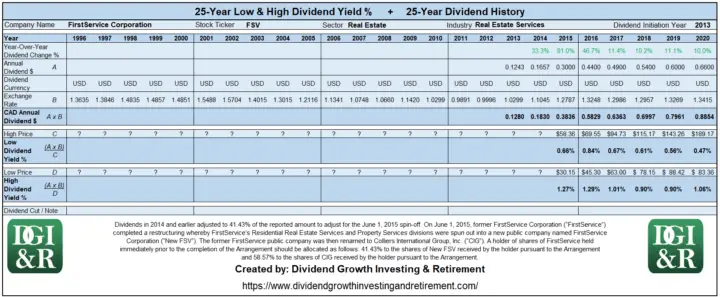

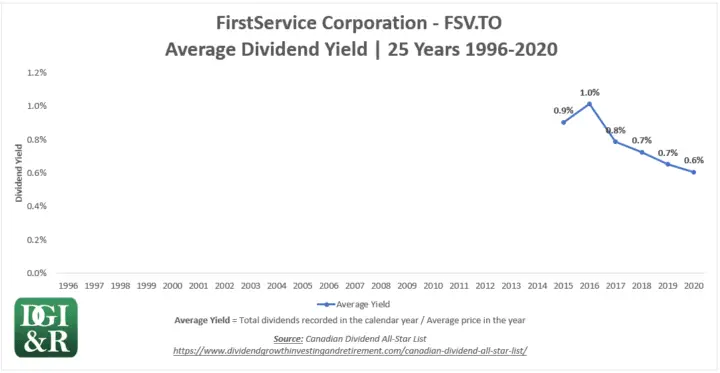

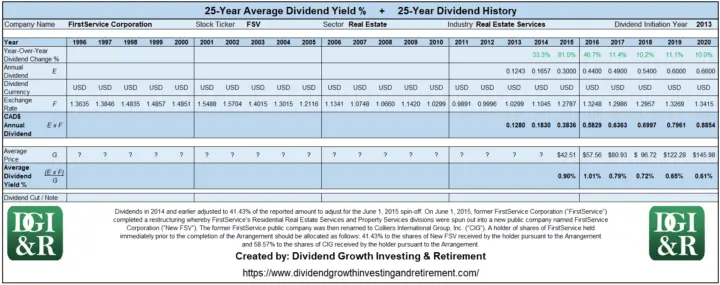

- FirstService Corporation – FSV,

- Fortis Inc – FTS,

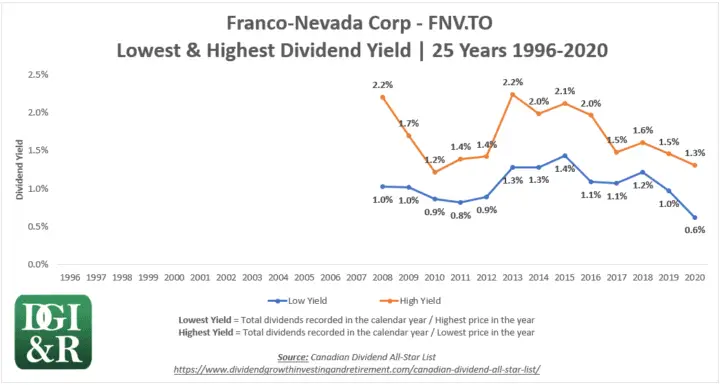

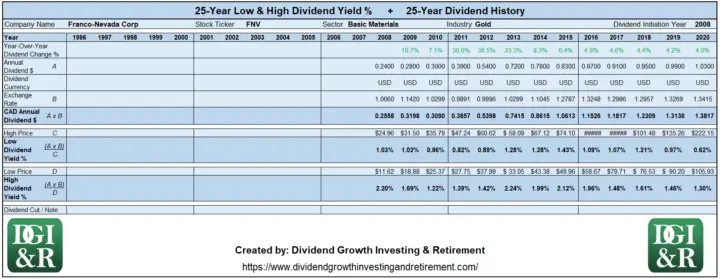

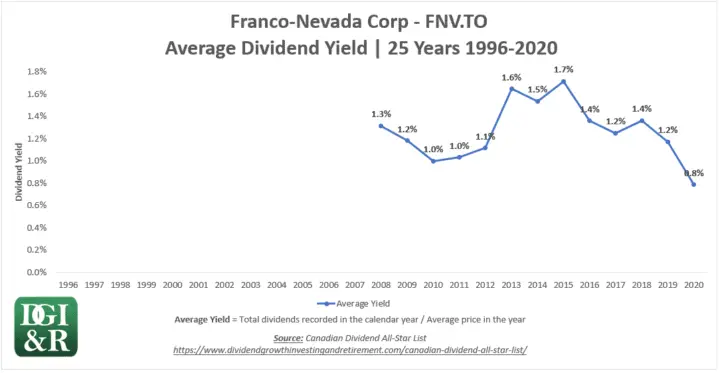

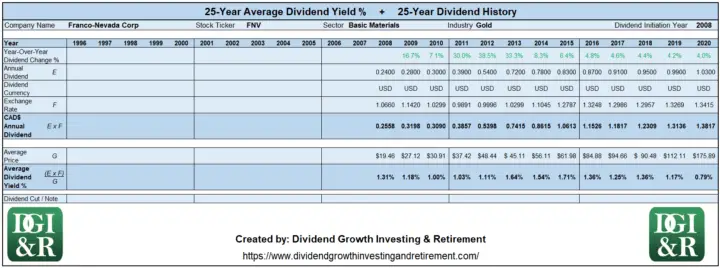

- Franco-Nevada Corp – FNV,

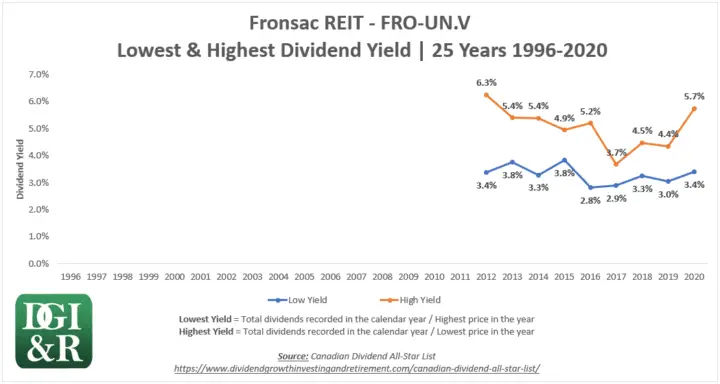

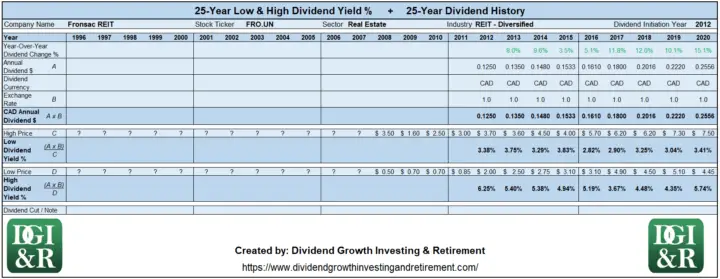

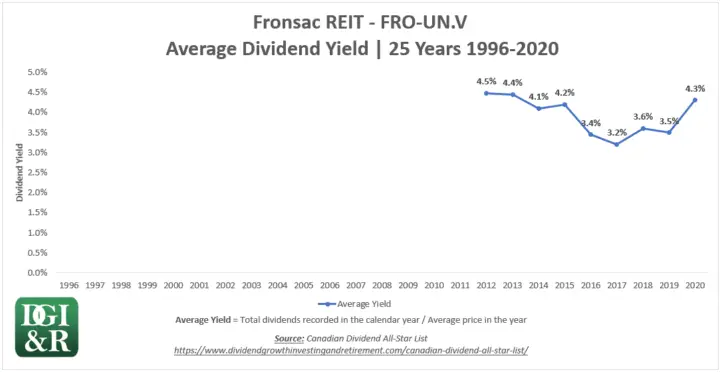

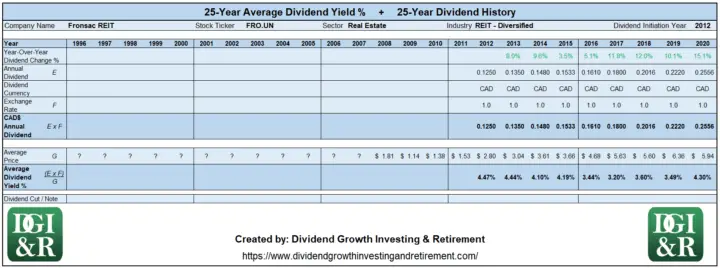

- Fronsac REIT – FRO.UN,

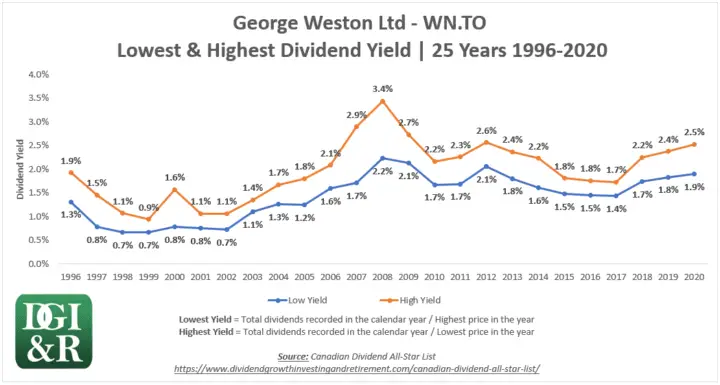

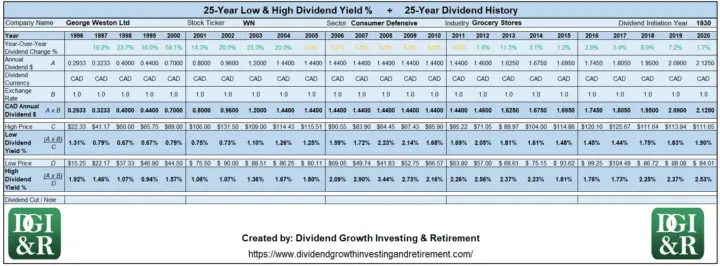

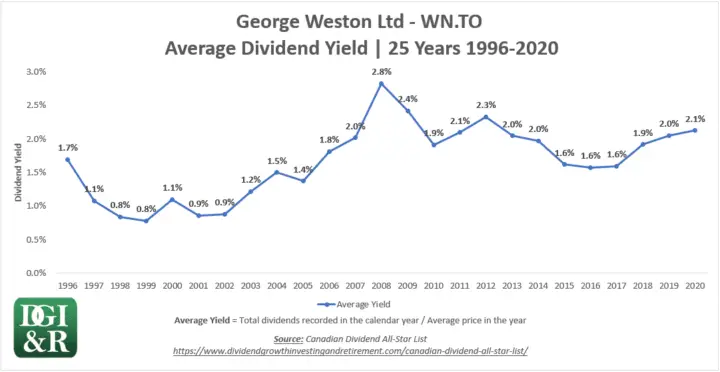

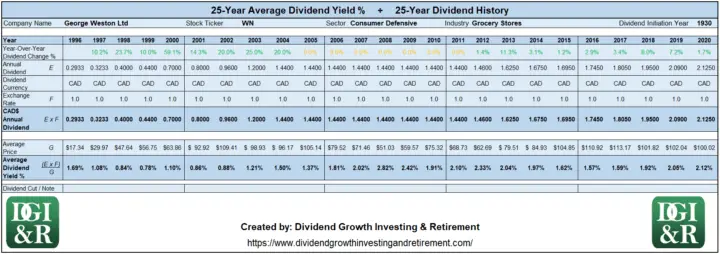

- George Weston Ltd – WN,

- Global Water Resources Inc – GWR,

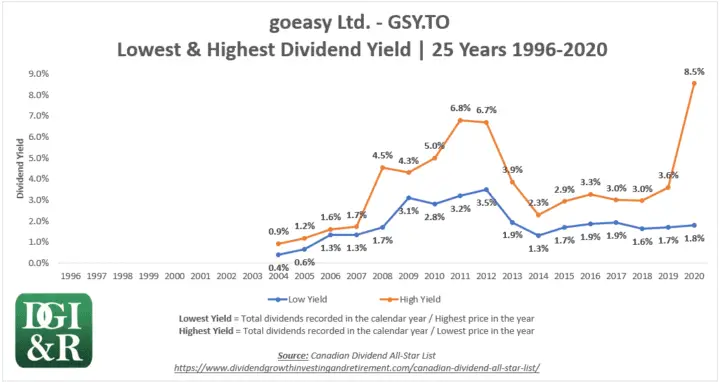

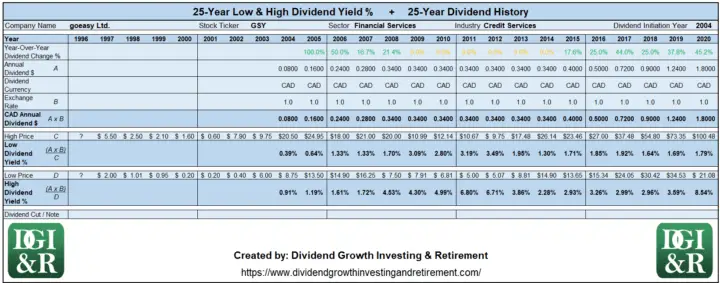

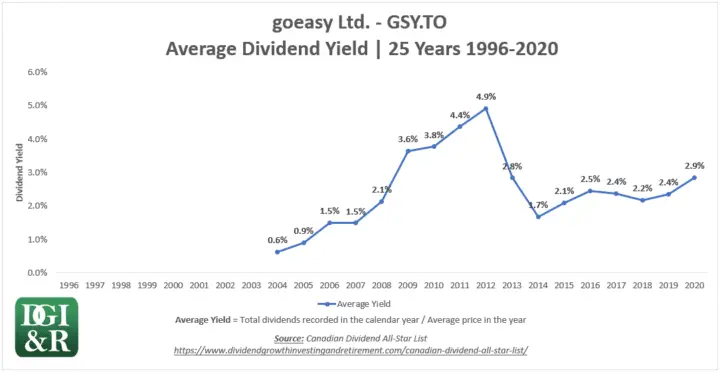

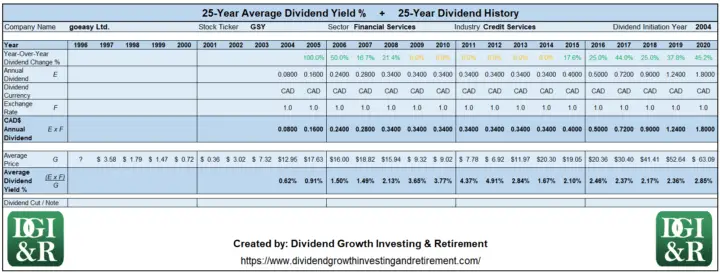

- goeasy Ltd – GSY,

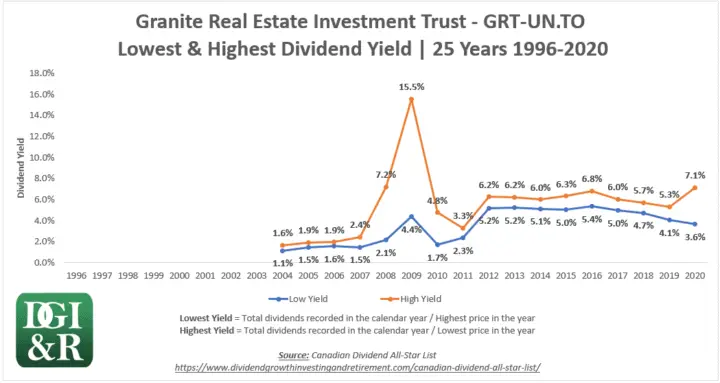

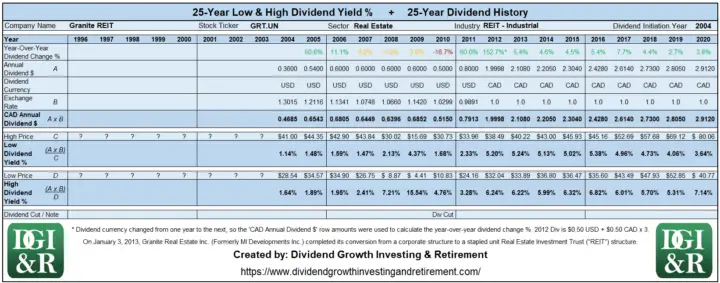

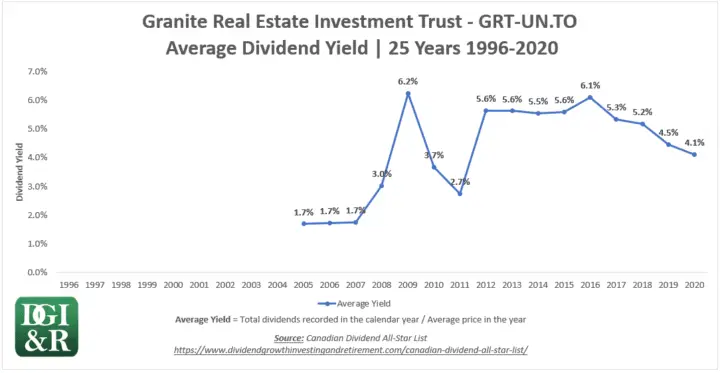

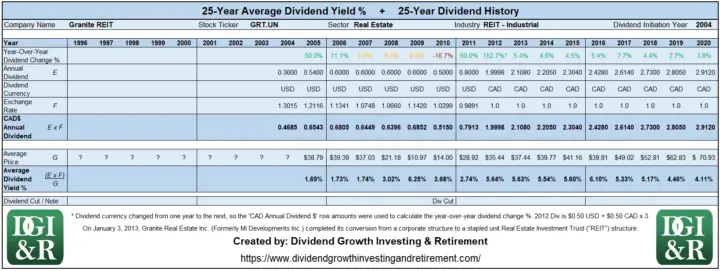

- Granite REIT – GRT.UN,

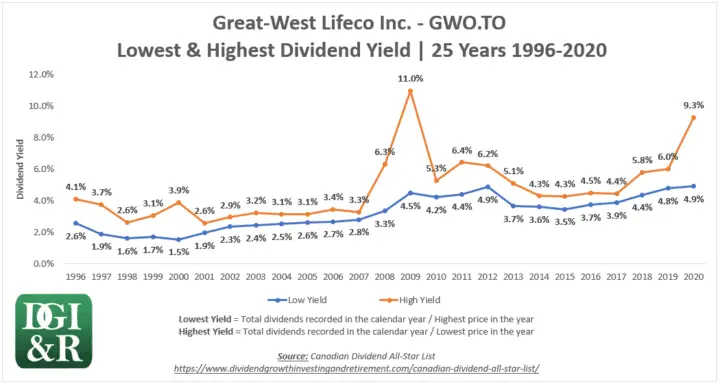

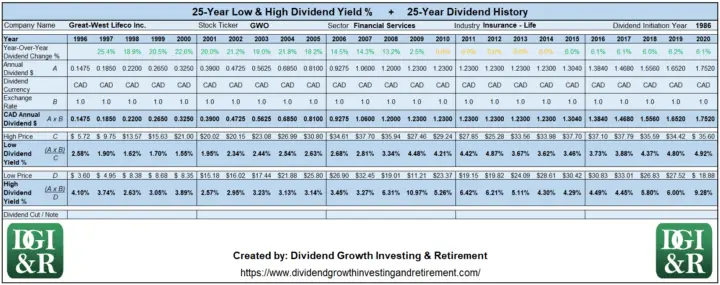

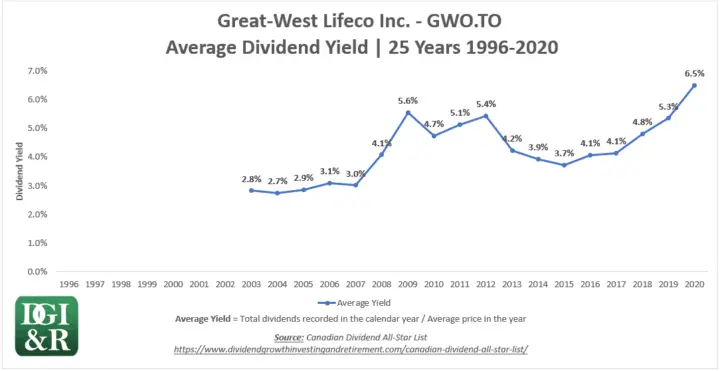

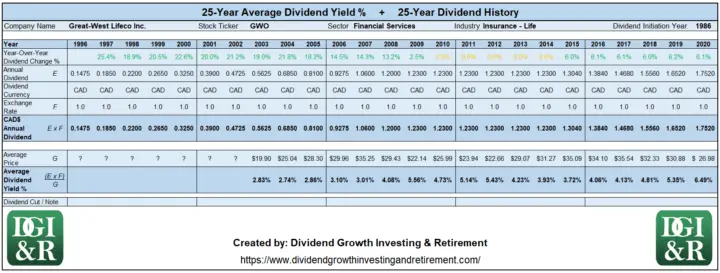

- Great-West Lifeco Inc – GWO,

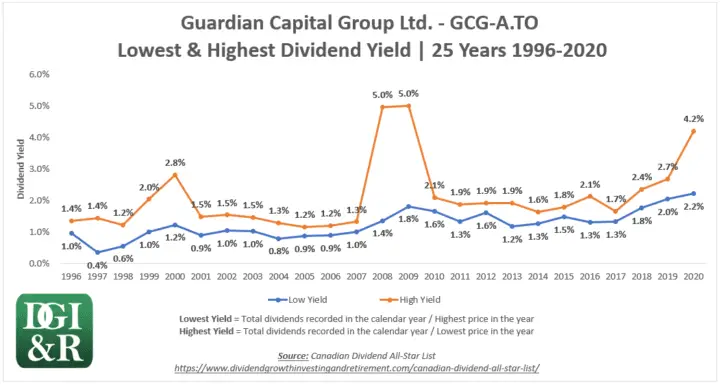

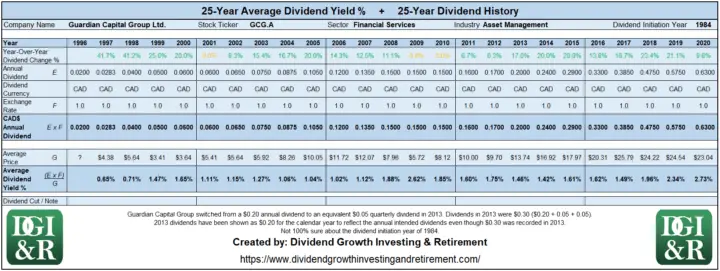

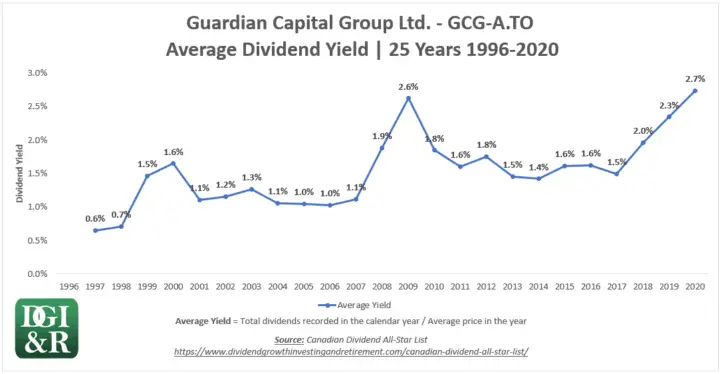

- Guardian Capital Group Ltd – GCG.A,

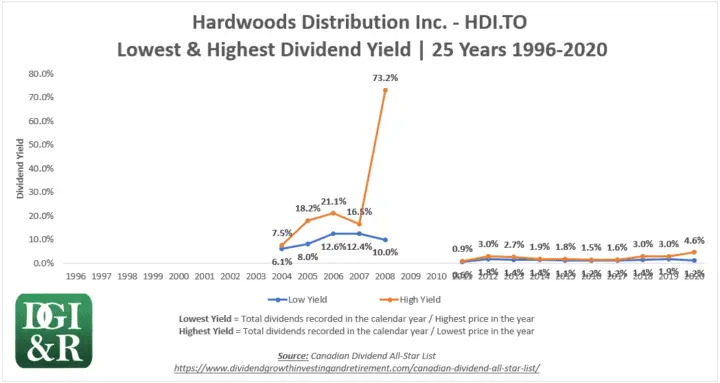

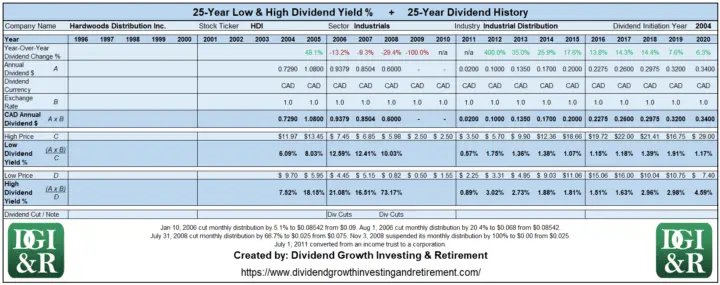

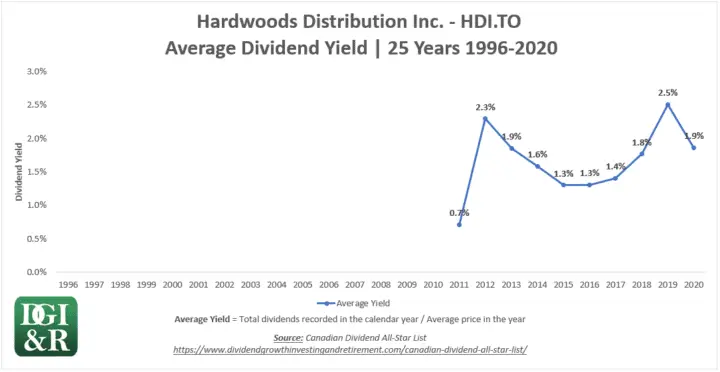

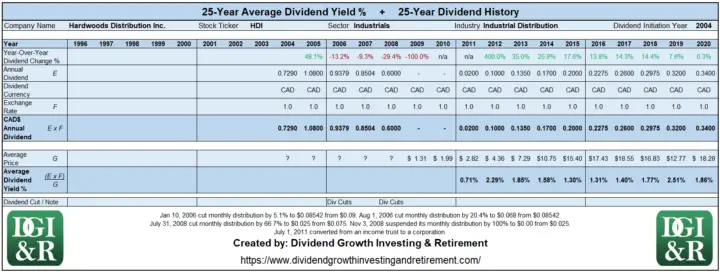

- Hardwoods Distribution Inc – HDI

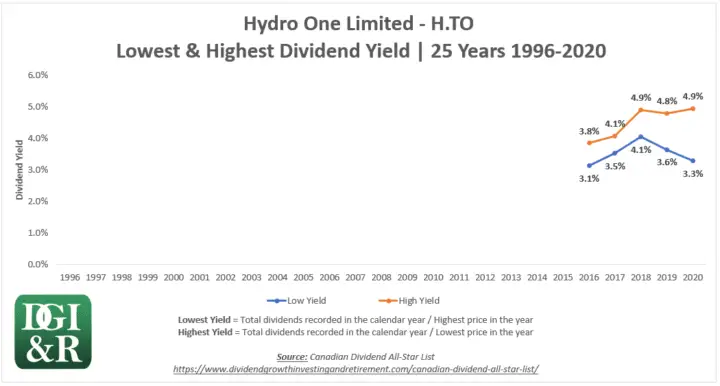

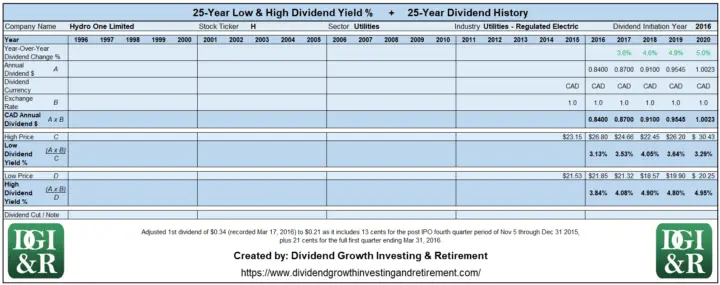

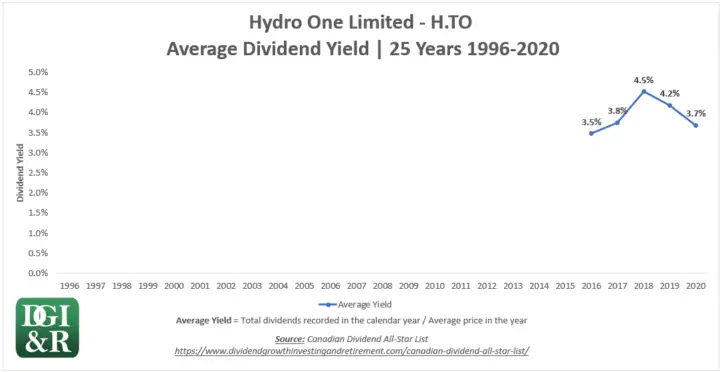

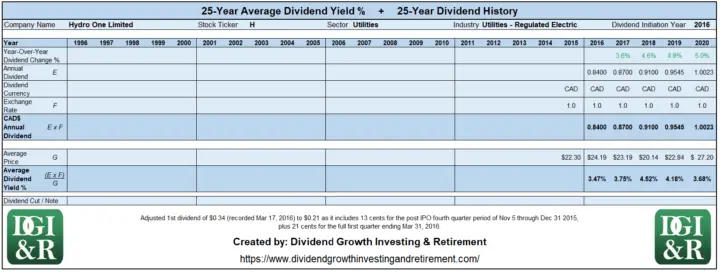

- Hydro One Limited – H,

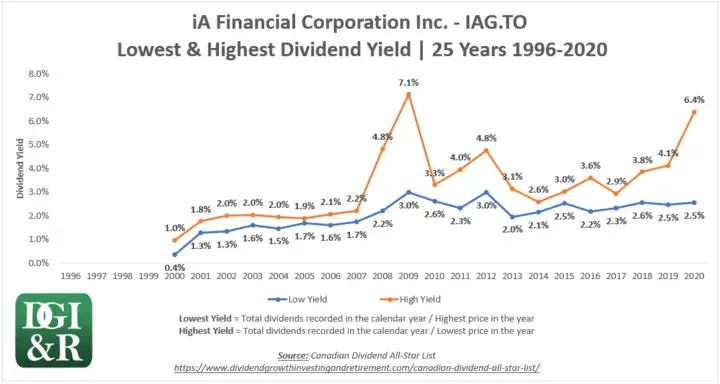

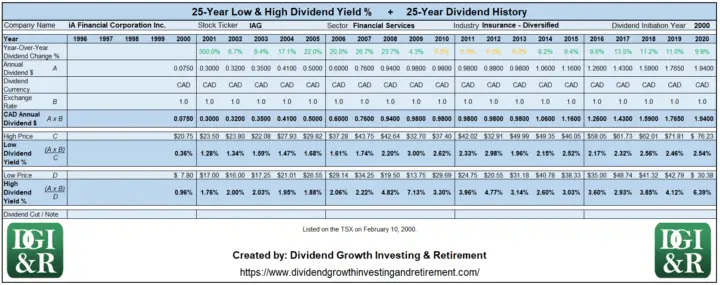

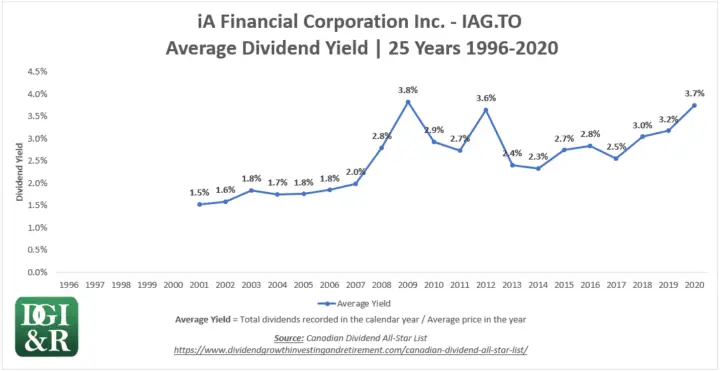

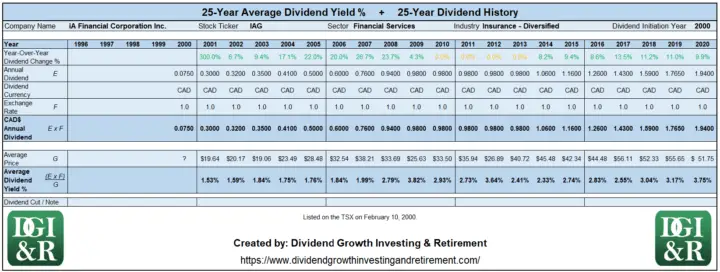

- iA Financial Corporation Inc – IAG,

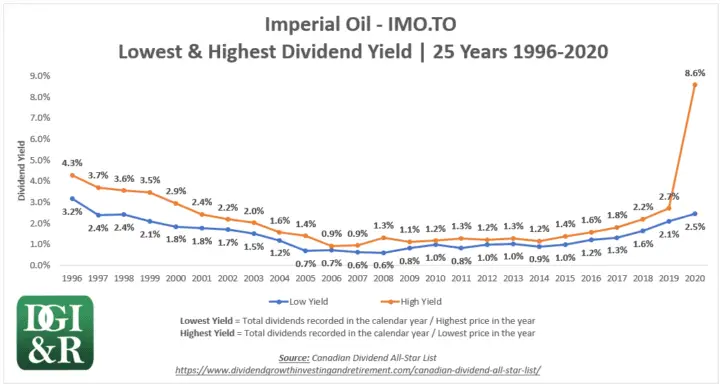

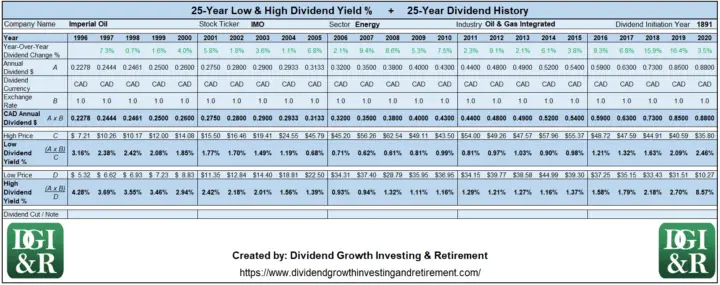

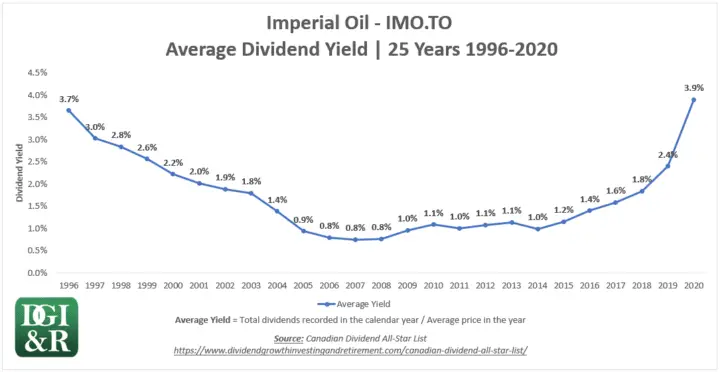

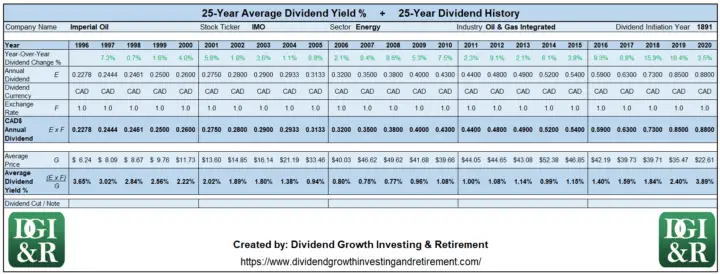

- Imperial Oil – IMO,

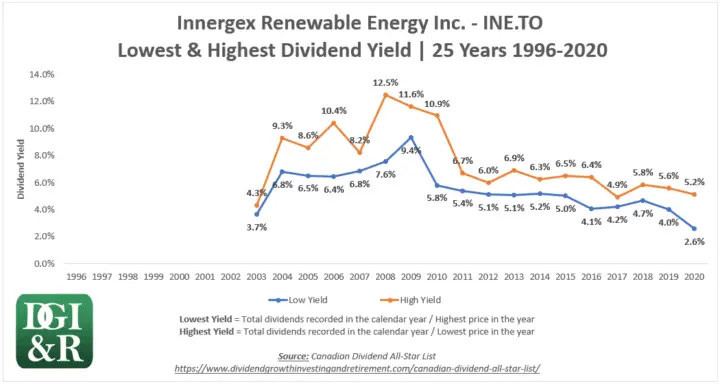

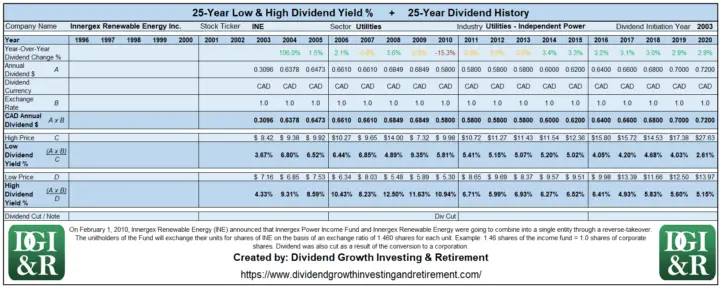

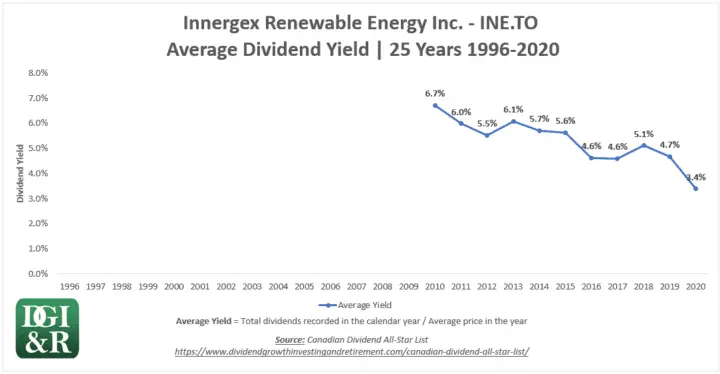

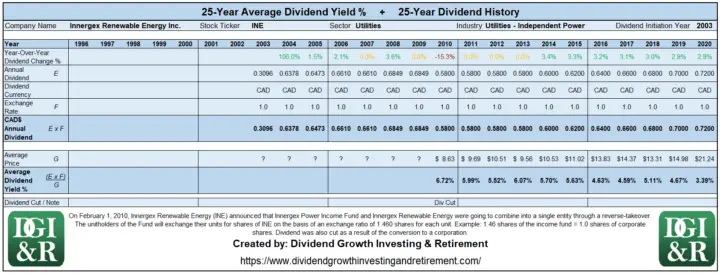

- Innergex Renewable Energy Inc – INE,

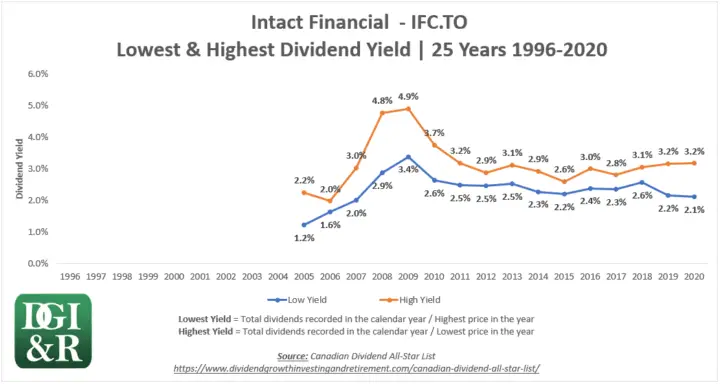

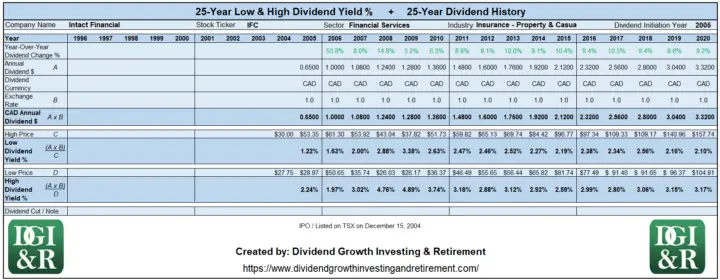

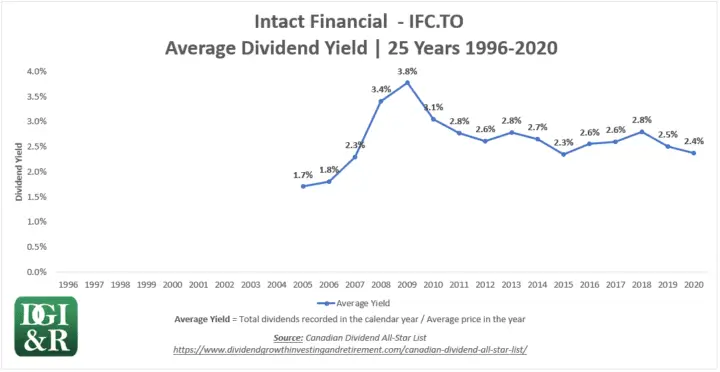

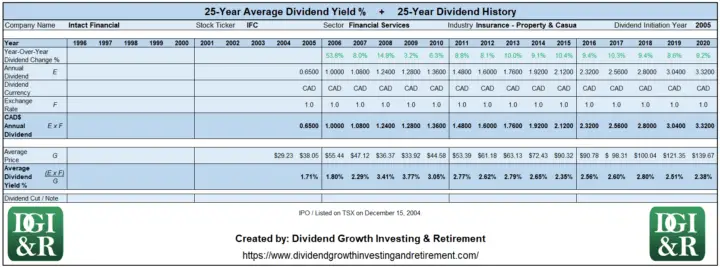

- Intact Financial – IFC,

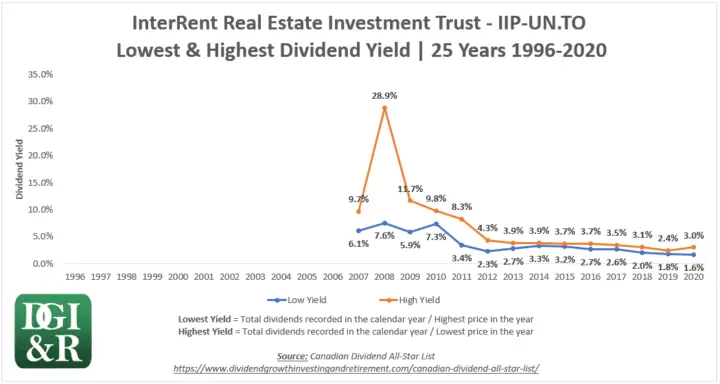

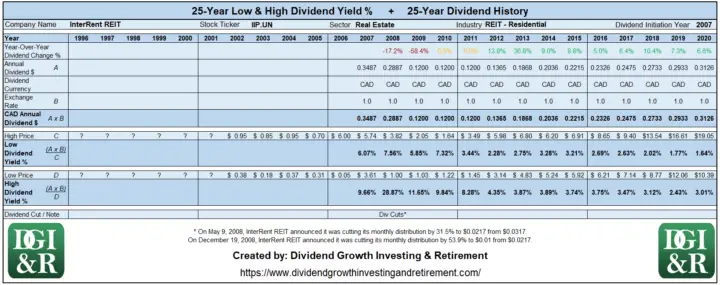

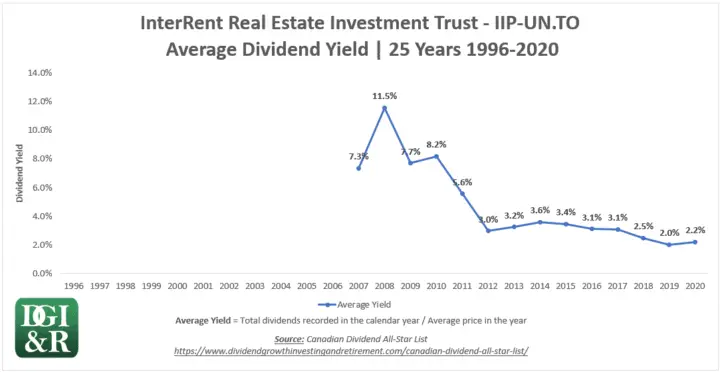

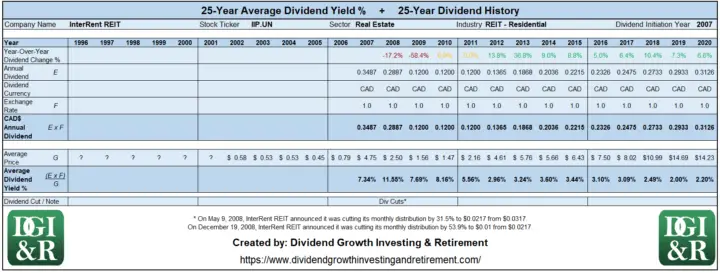

- InterRent REIT – IIP.UN,

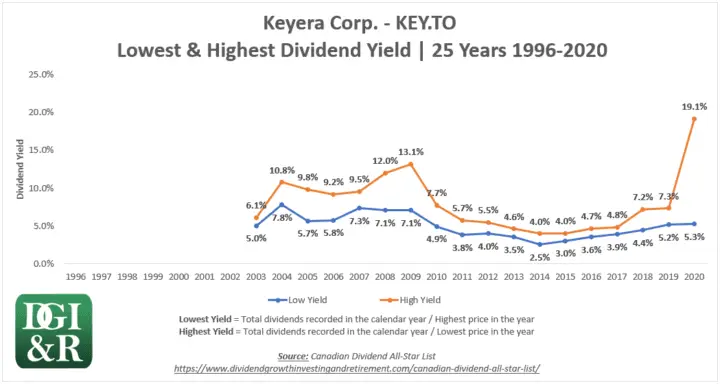

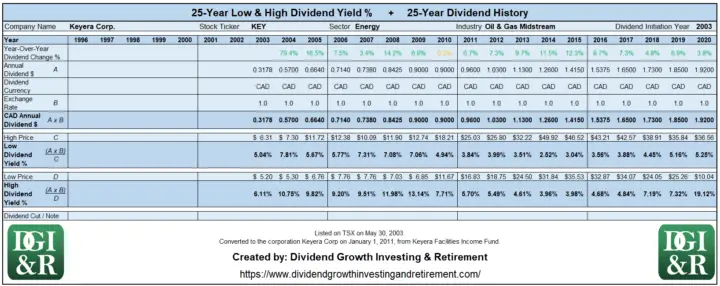

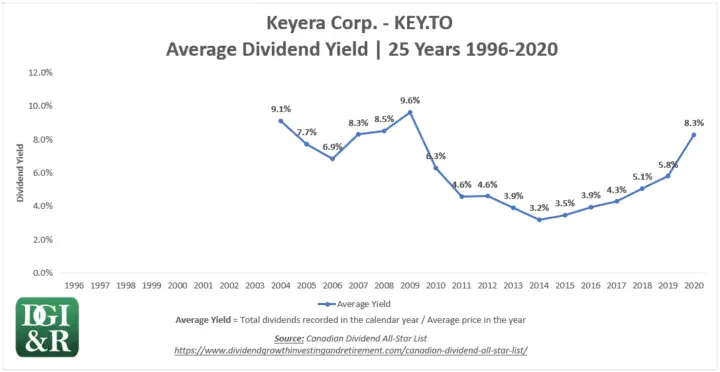

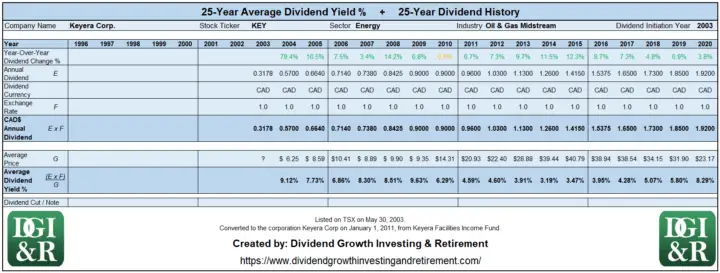

- Keyera Corp – KEY,

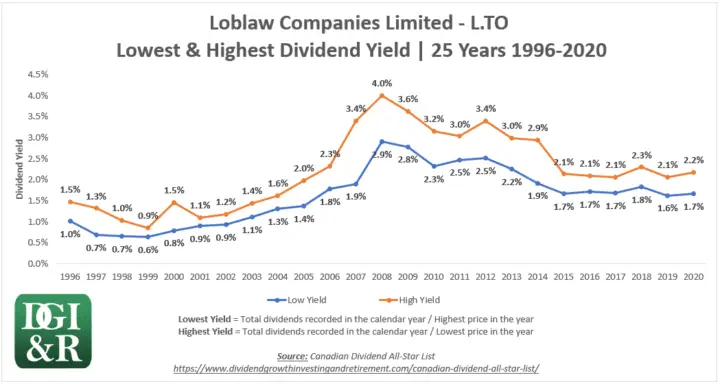

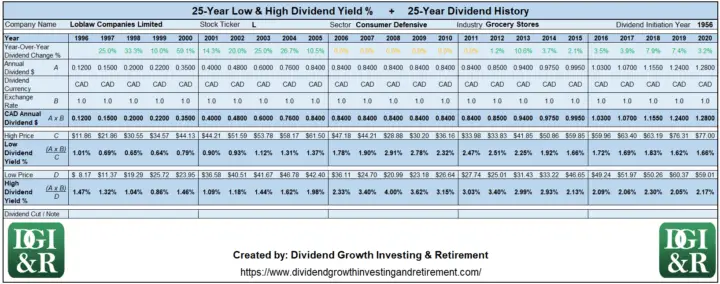

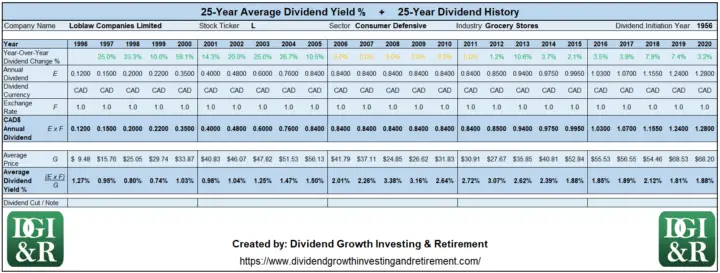

- Loblaw Companies Limited – L,

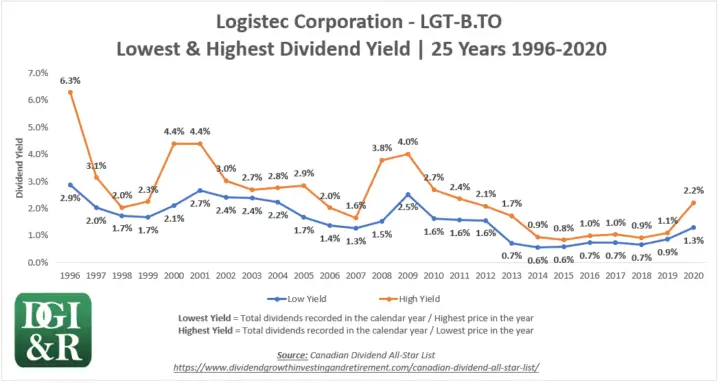

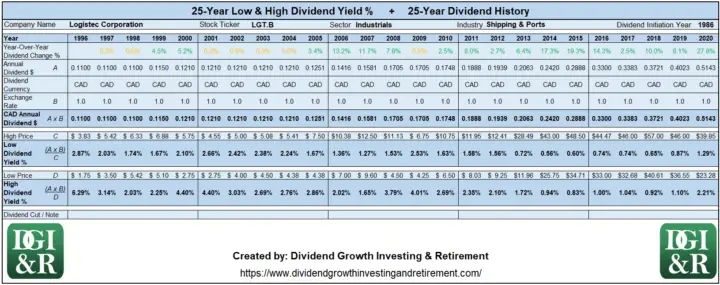

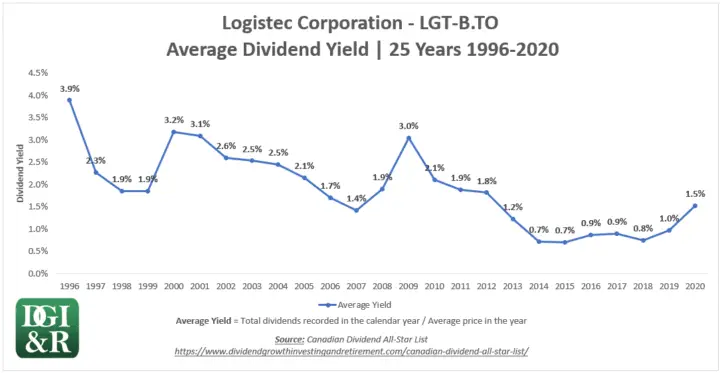

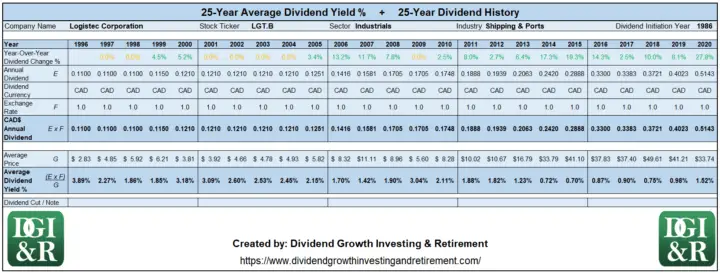

- Logistec Corporation – LGT.B,

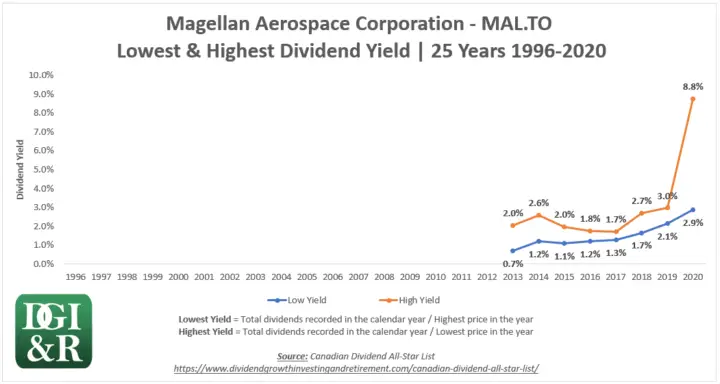

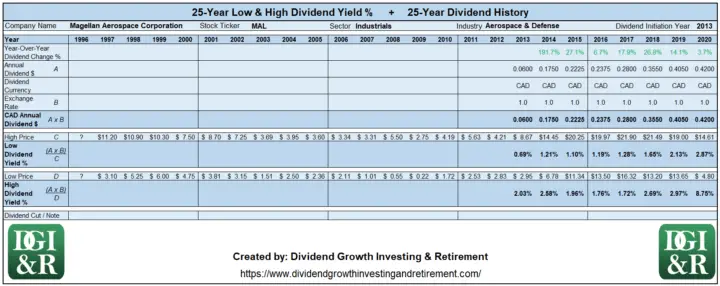

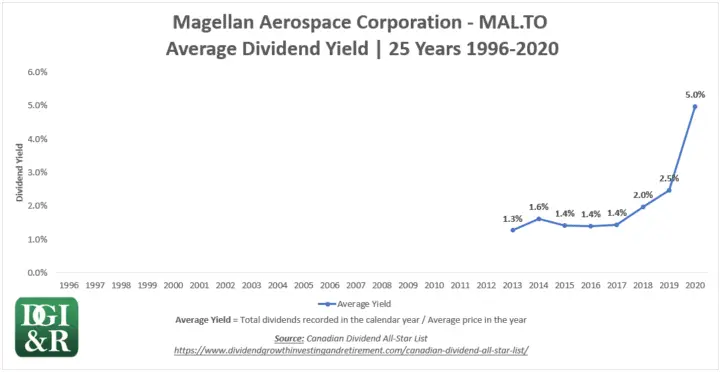

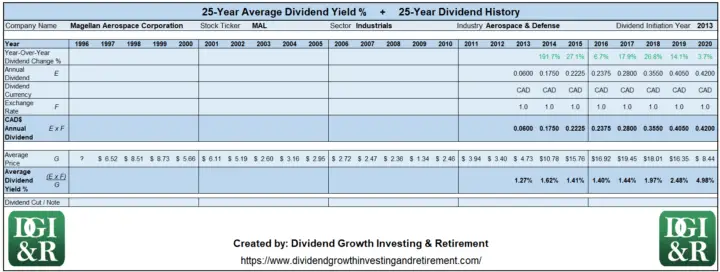

- Magellan Aerospace Corporation – MAL,

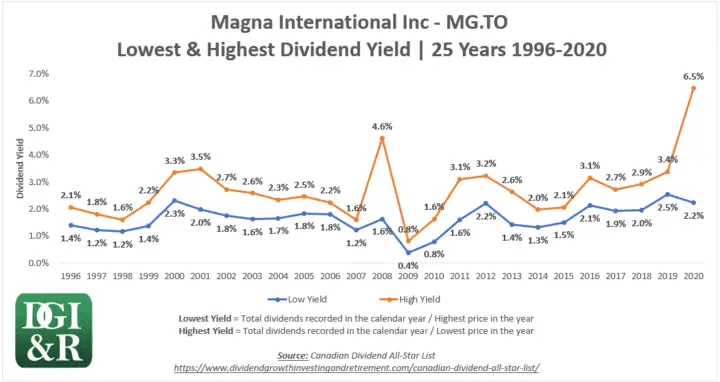

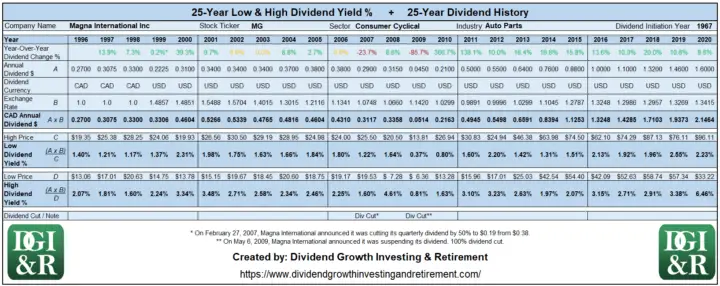

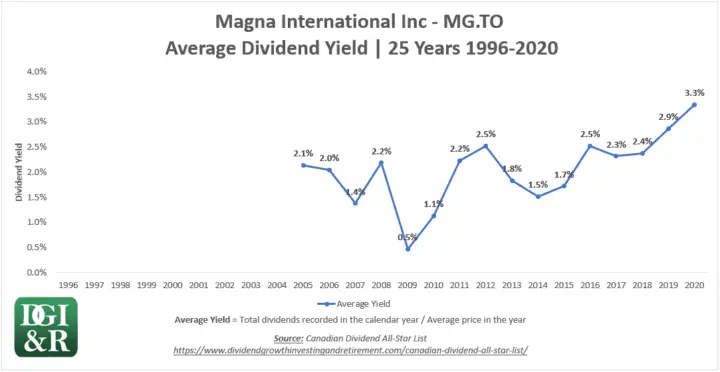

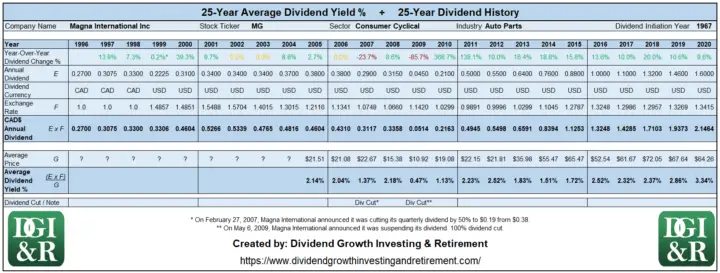

- Magna International Inc – MG,

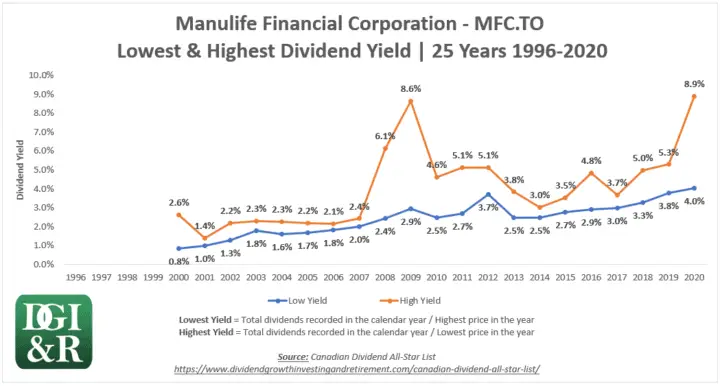

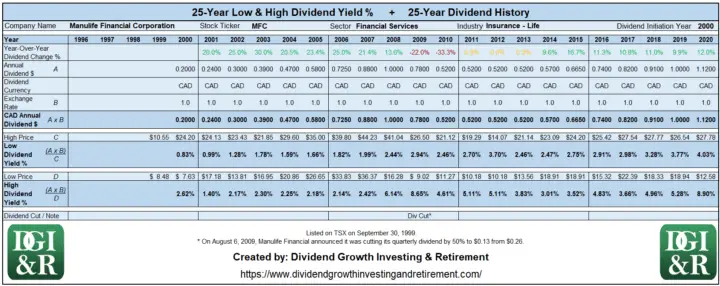

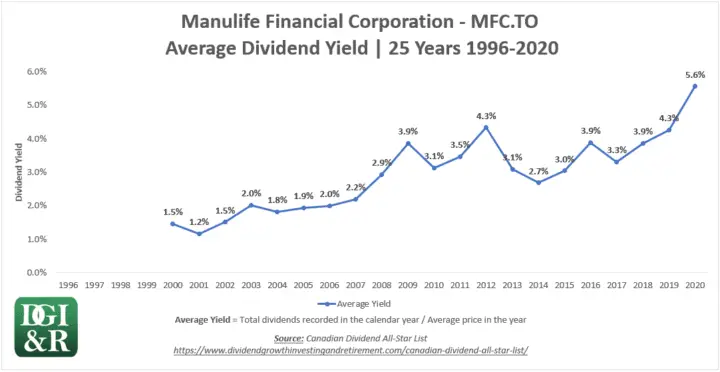

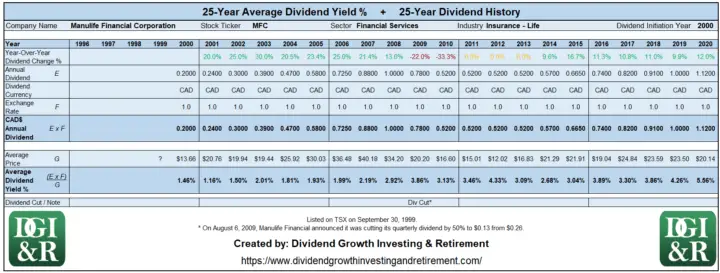

- Manulife Financial Corporation – MFC,

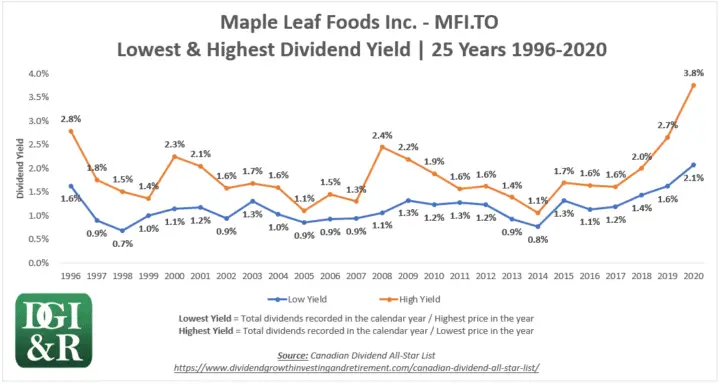

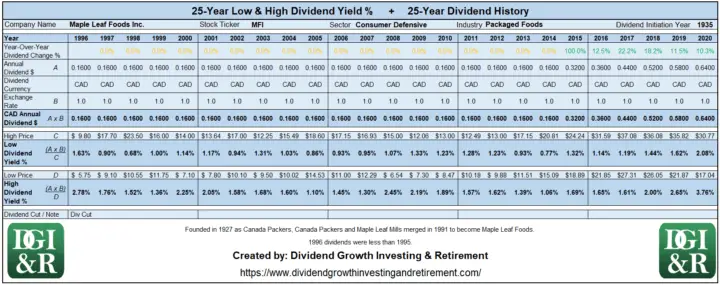

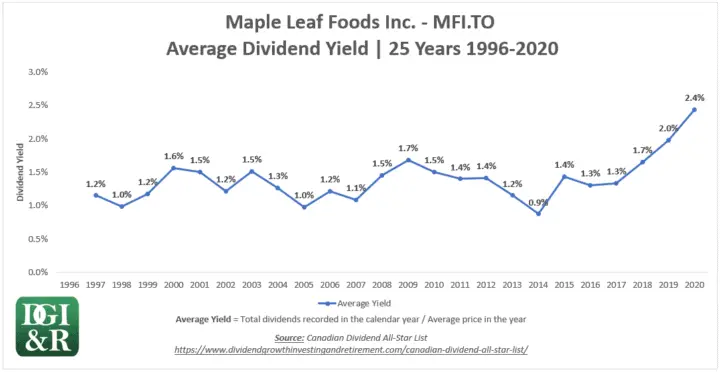

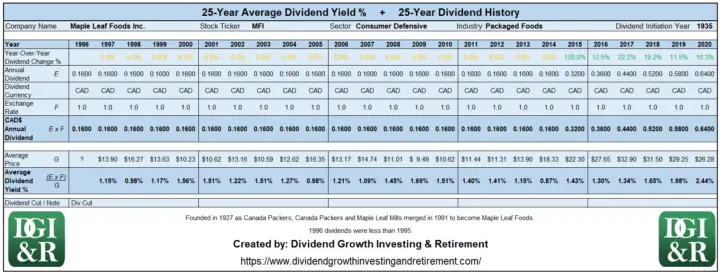

- Maple Leaf Foods Inc – MFI,

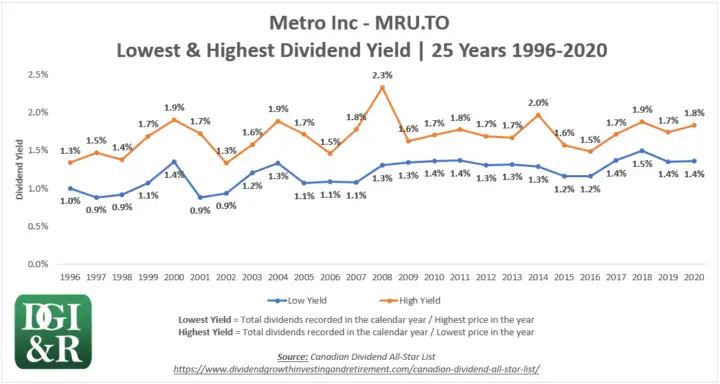

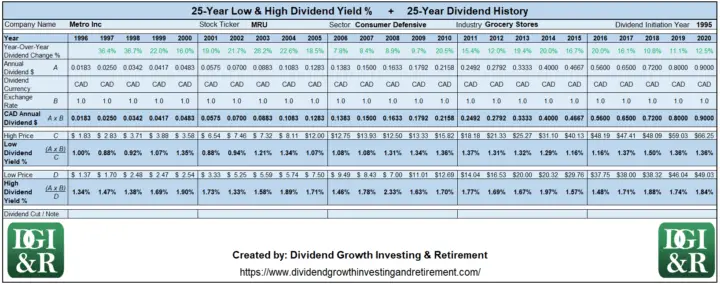

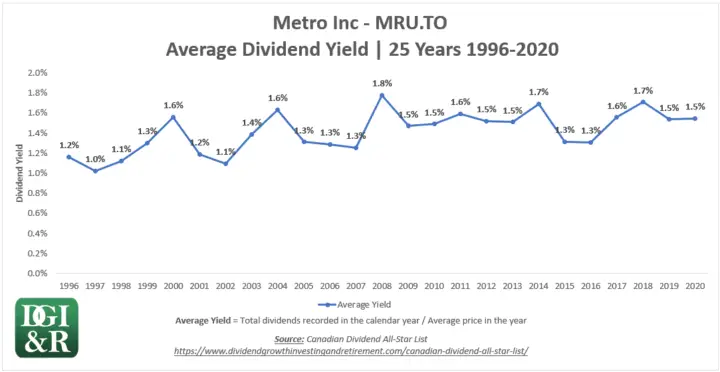

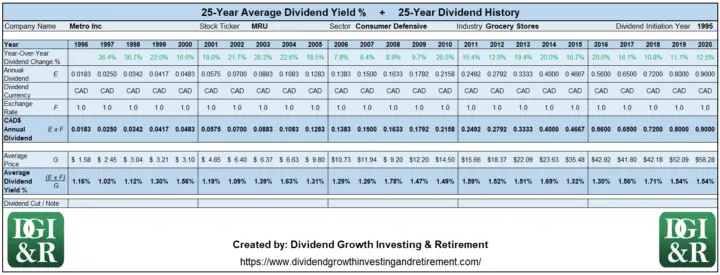

- Metro Inc – MRU,

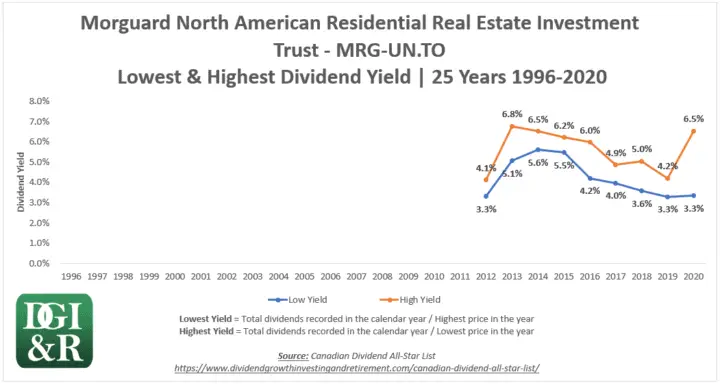

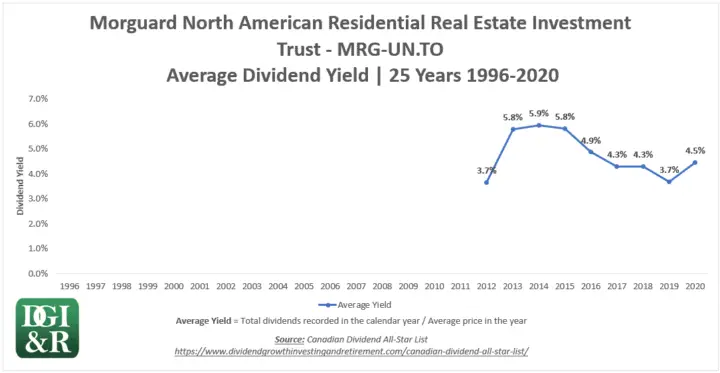

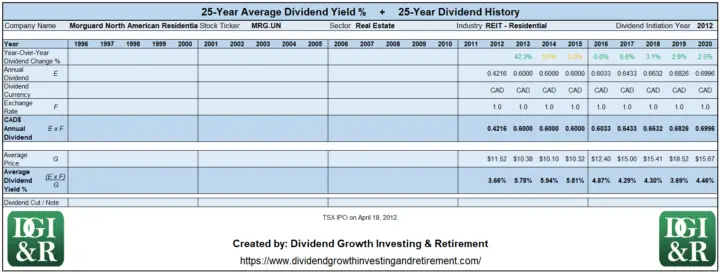

- Morguard North American Residential REIT – MRG.UN,

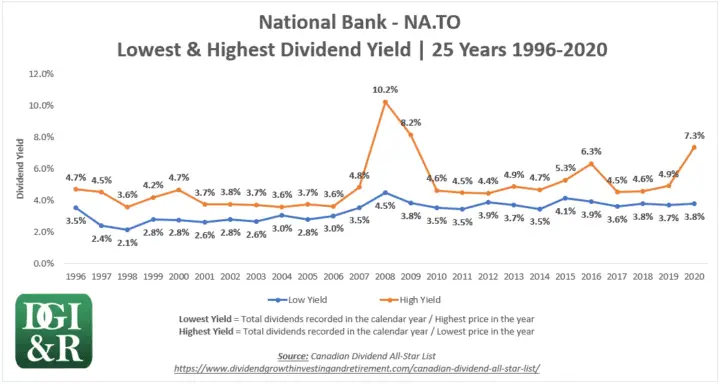

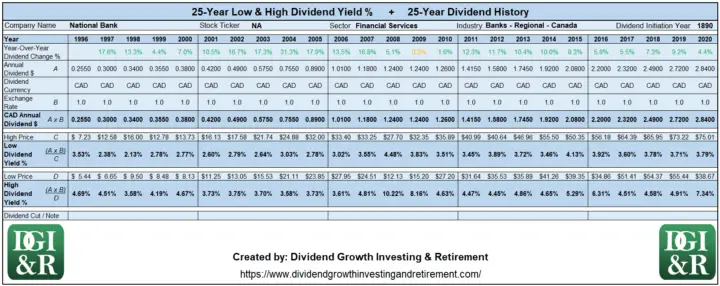

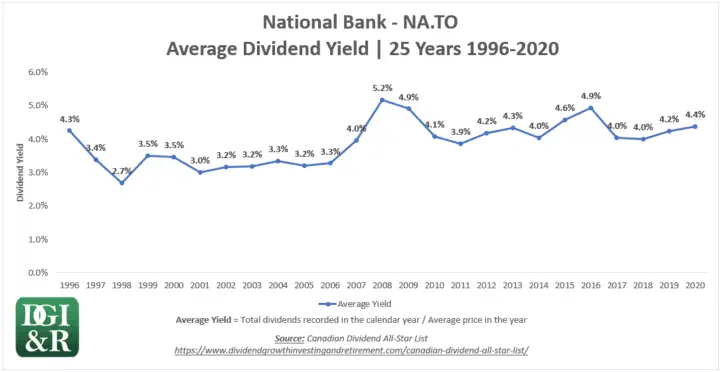

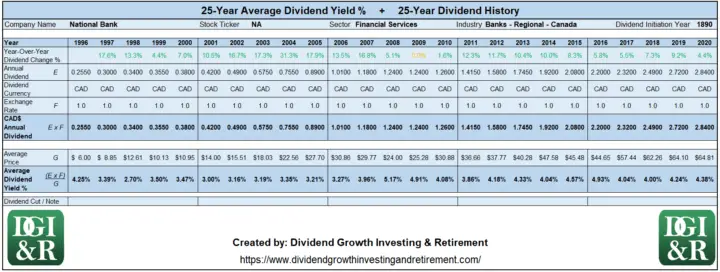

- National Bank – NA,

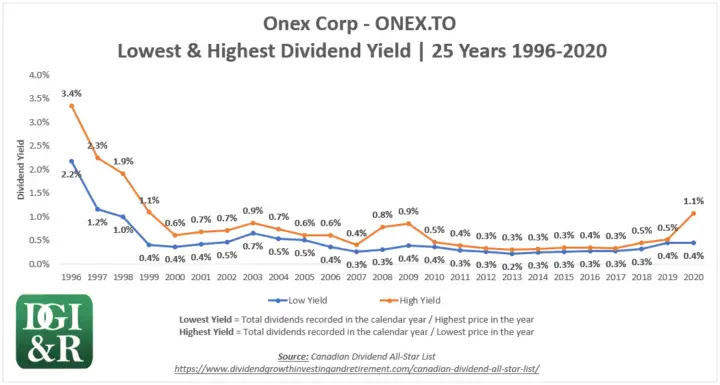

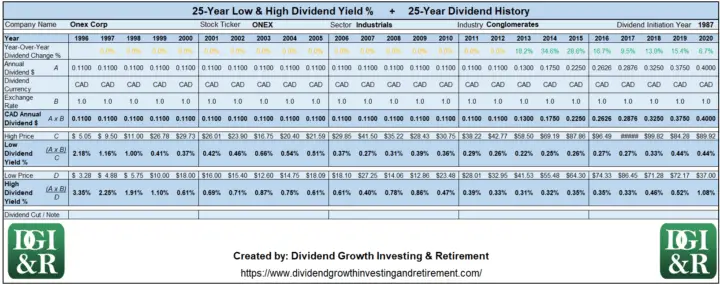

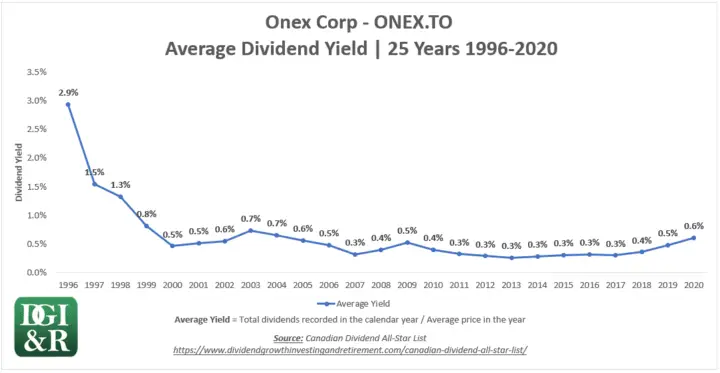

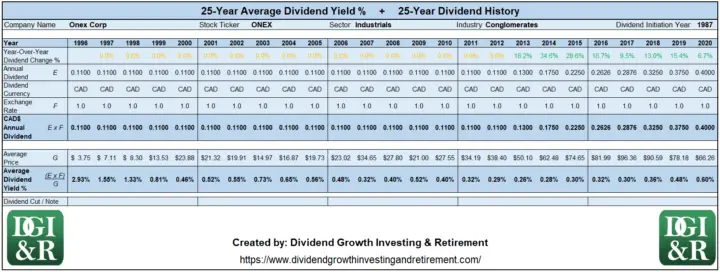

- Onex Corp – ONEX,

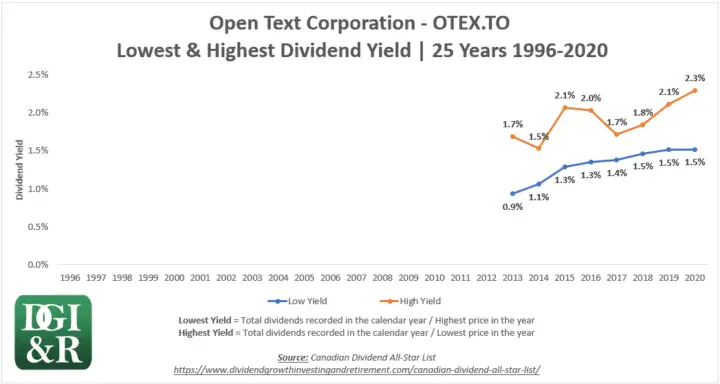

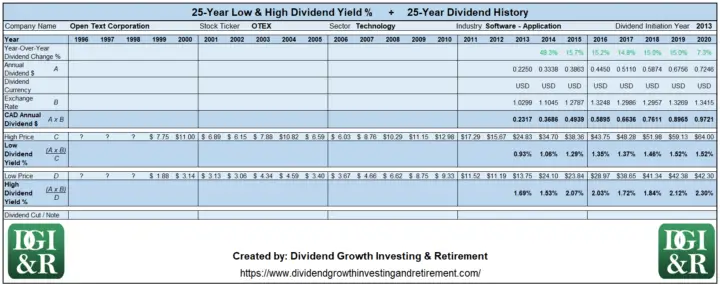

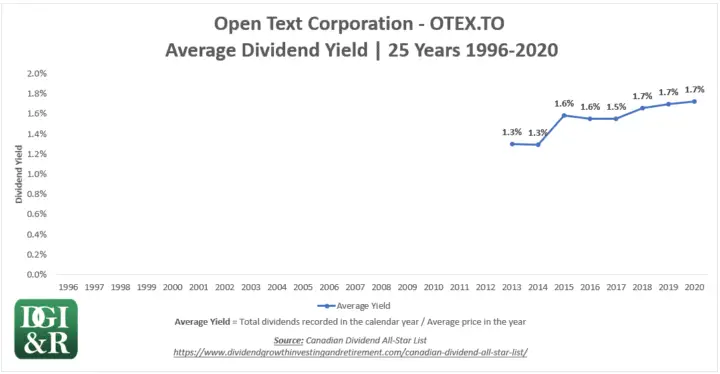

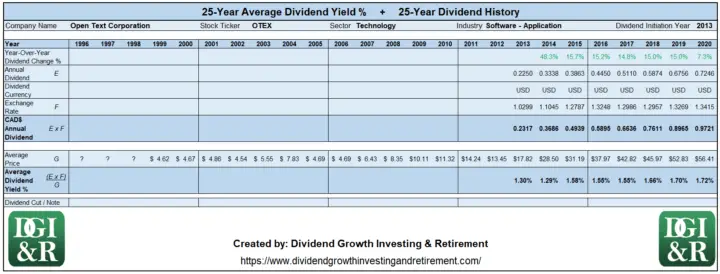

- Open Text Corporation – OTEX,

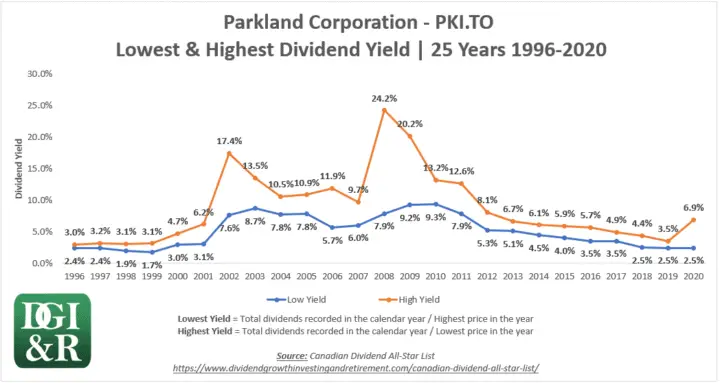

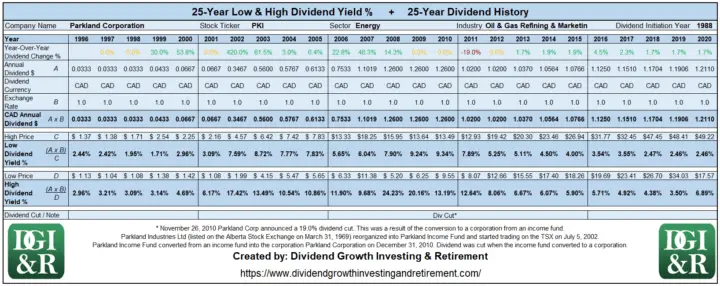

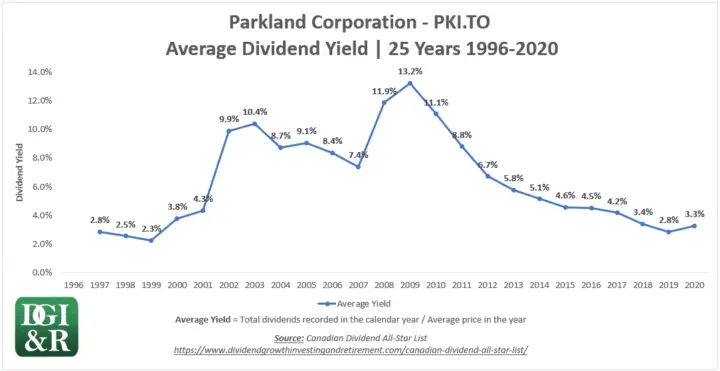

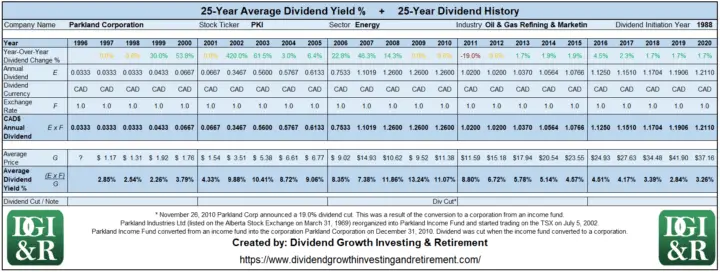

- Parkland Corporation – PKI,

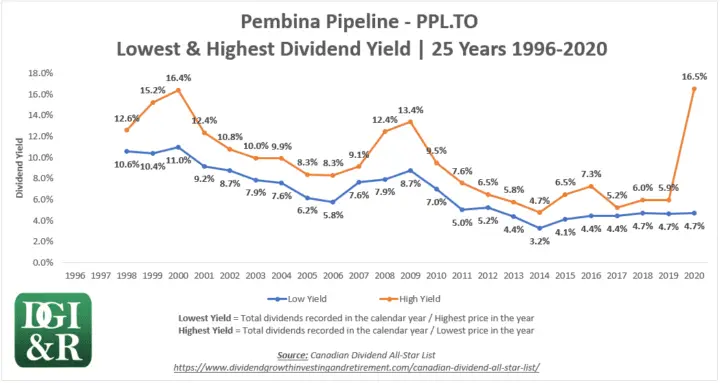

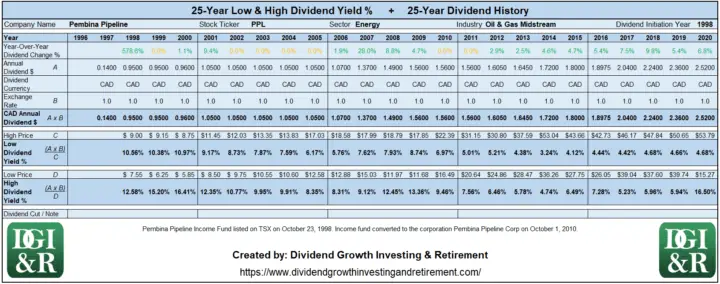

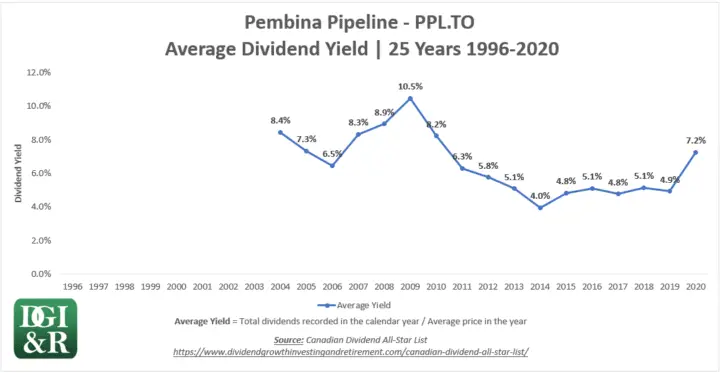

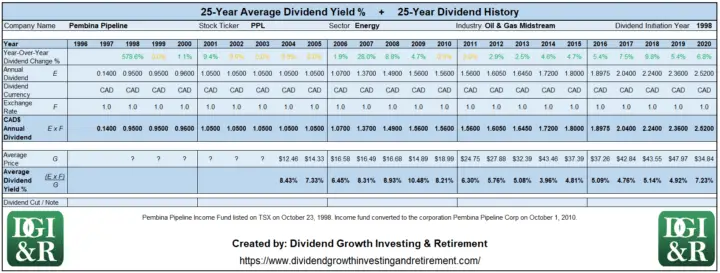

- Pembina Pipeline – PPL

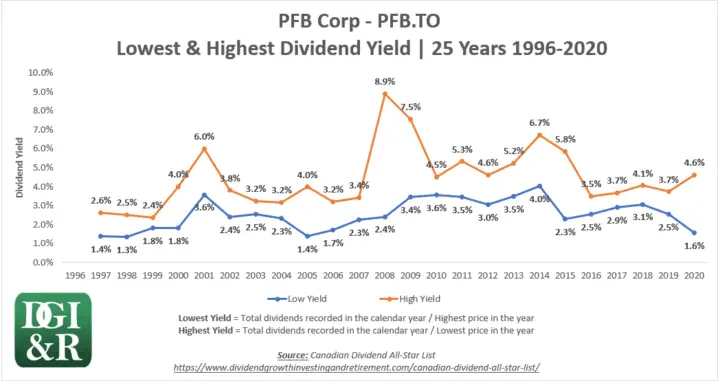

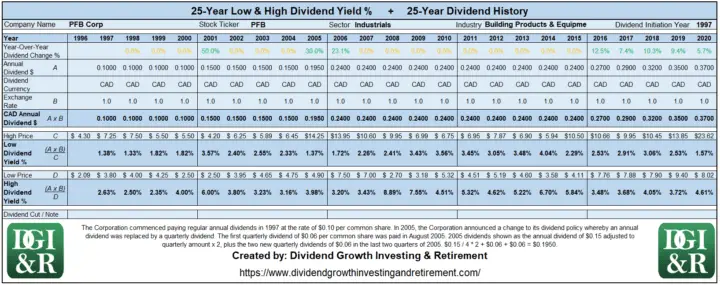

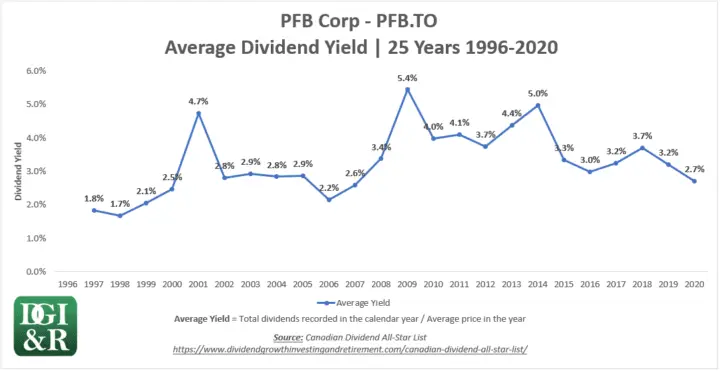

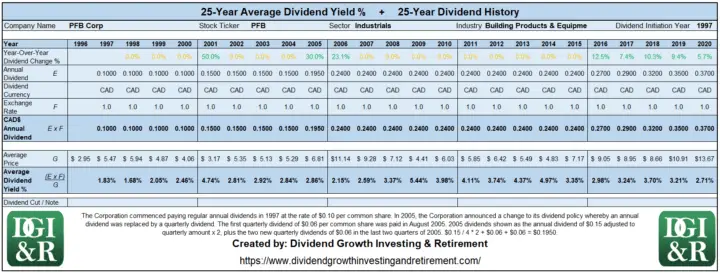

- PFB Corp – PFB,

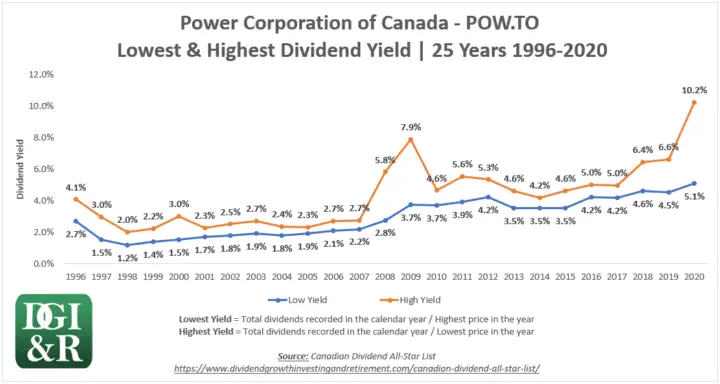

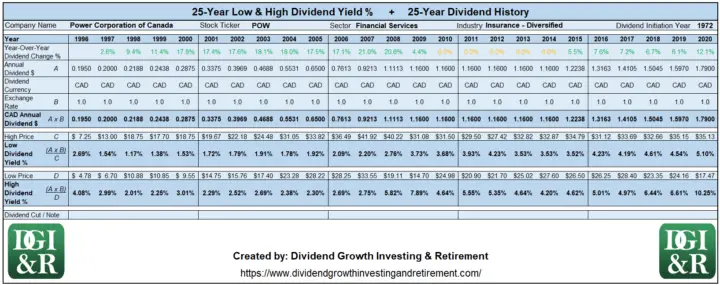

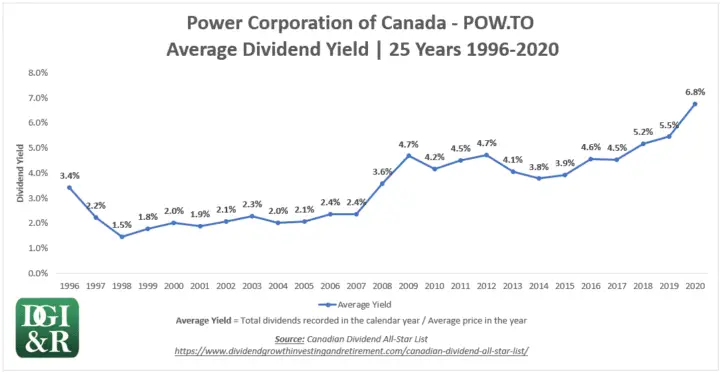

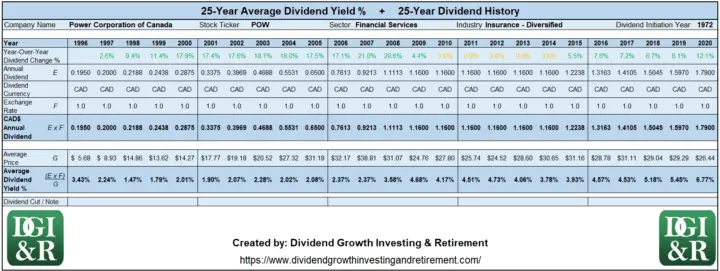

- Power Corporation of Canada – POW,

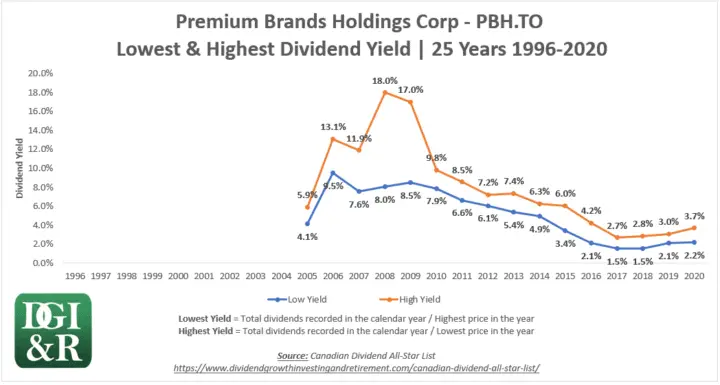

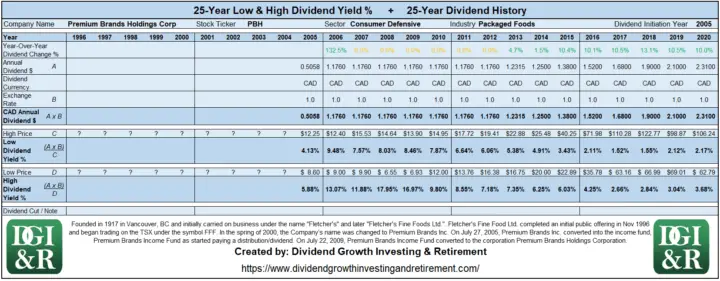

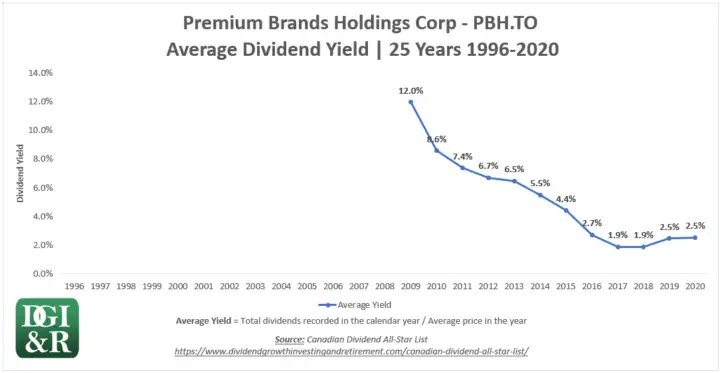

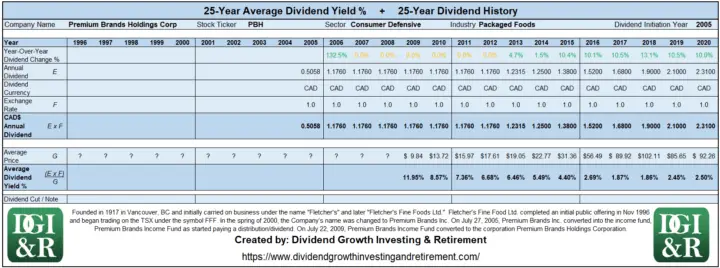

- Premium Brands Holdings Corp – PBH,

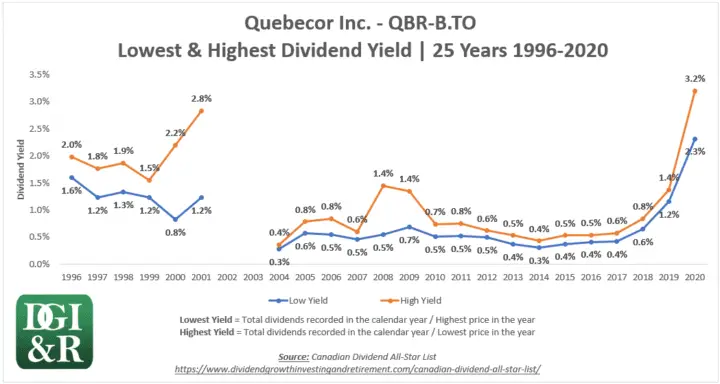

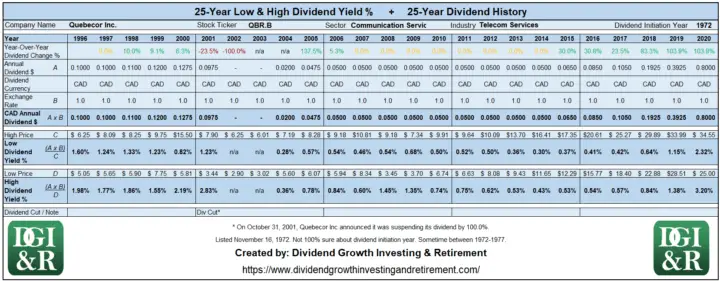

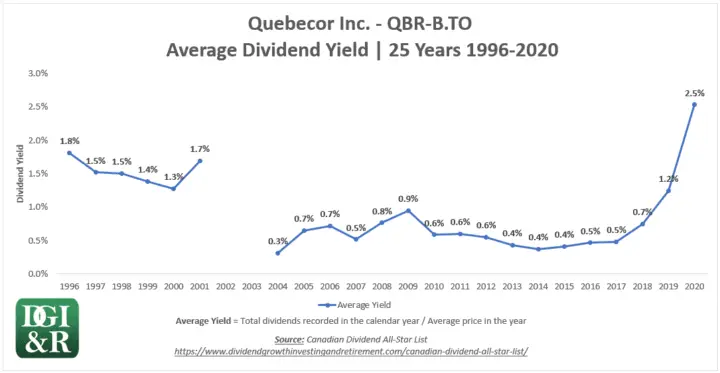

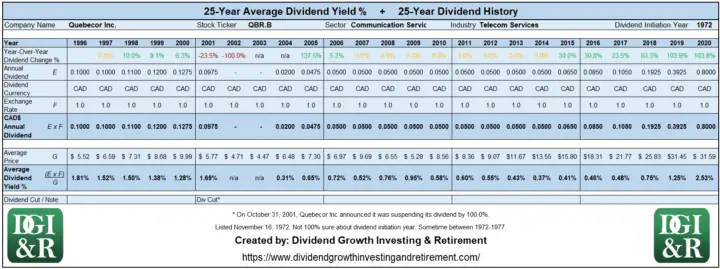

- Quebecor Inc – QBR.B,

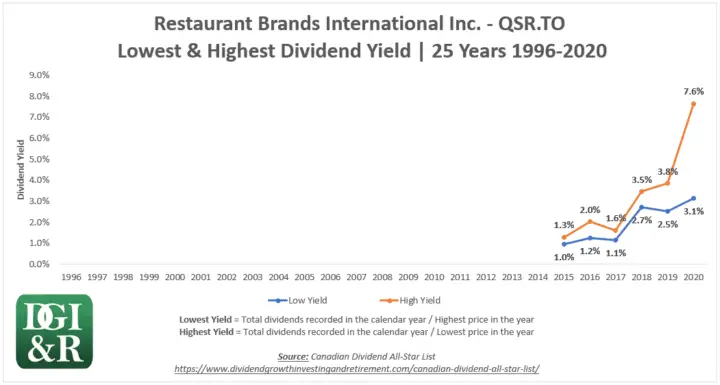

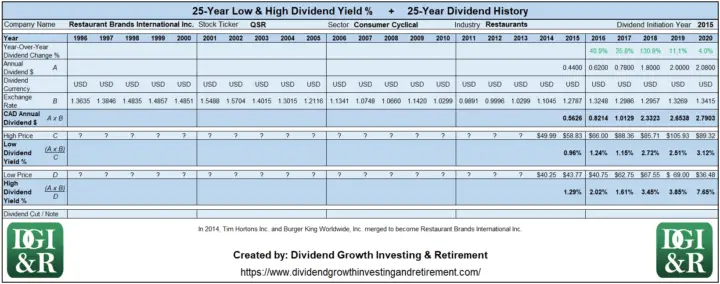

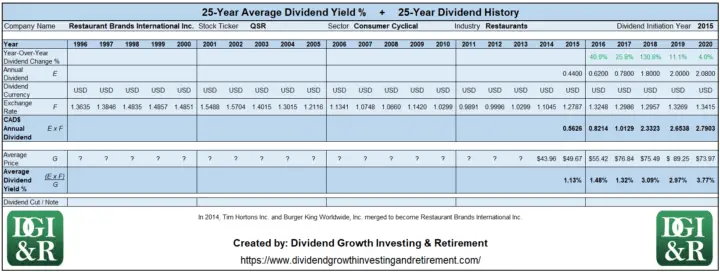

- Restaurant Brands International Inc – QSR,

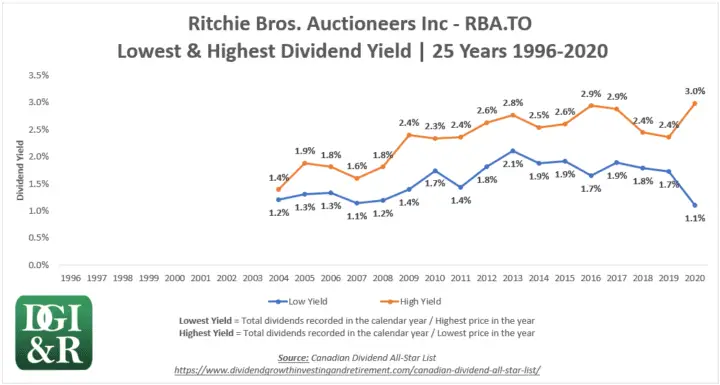

- Ritchie Bros. Auctioneers Inc – RBA,

- Royal Bank of Canada – RY,

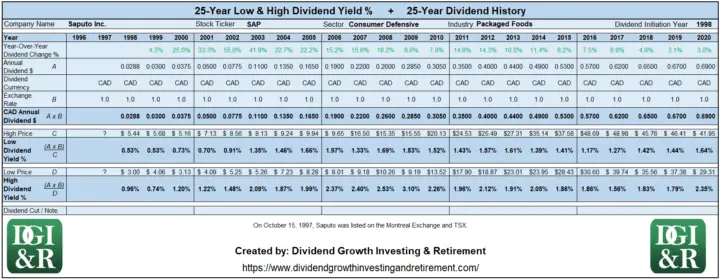

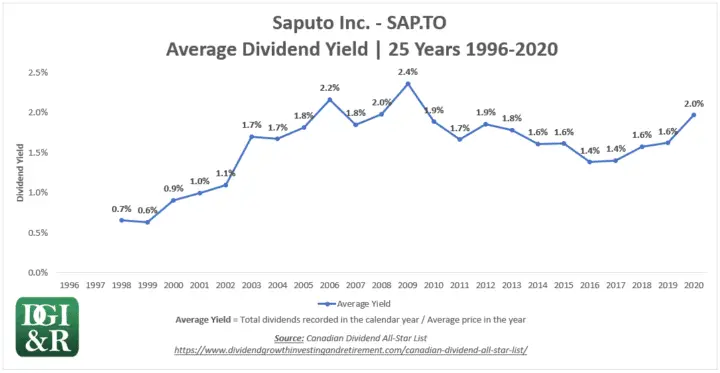

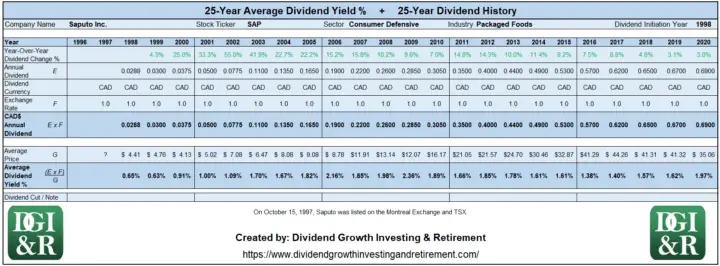

- Saputo Inc – SAP,

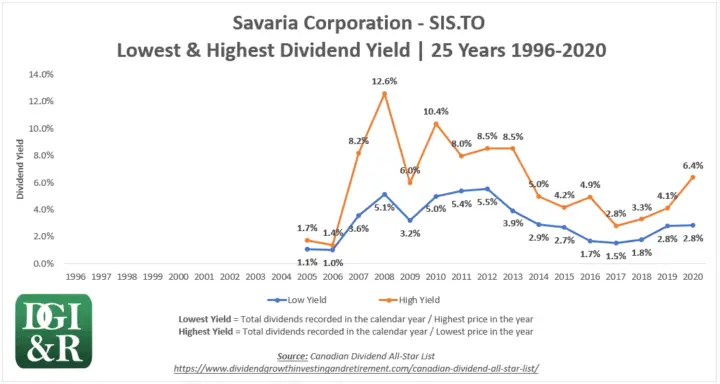

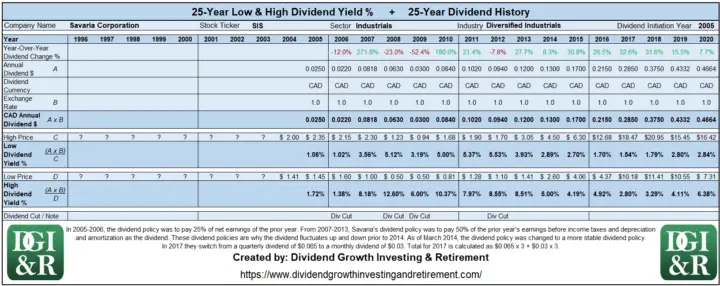

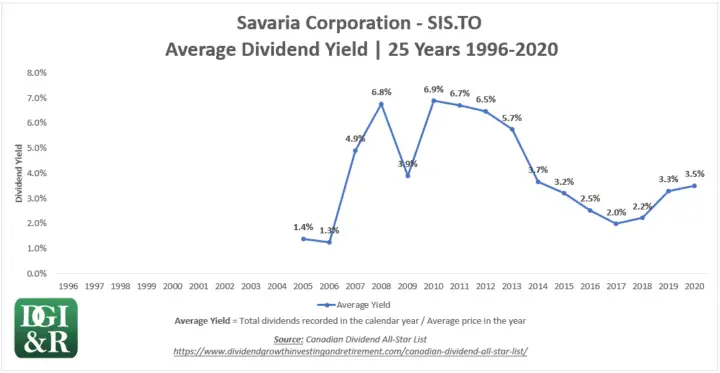

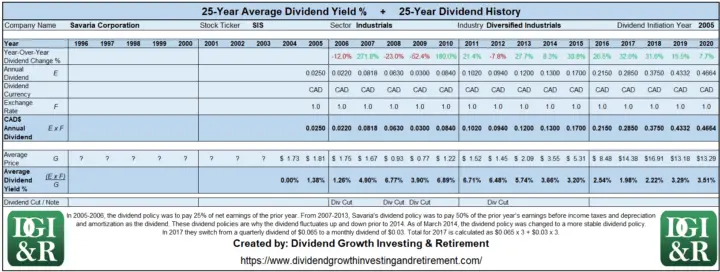

- Savaria Corporation – SIS,

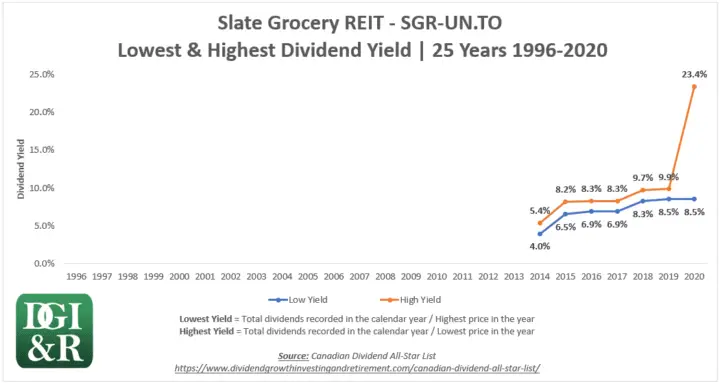

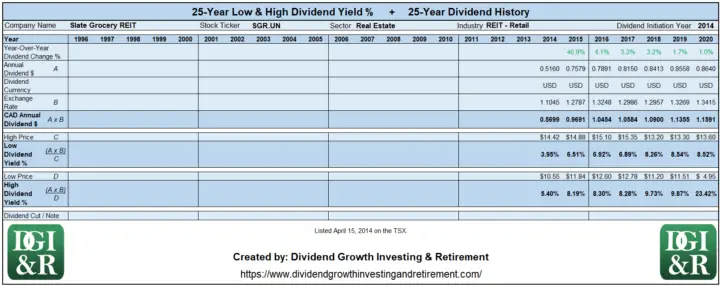

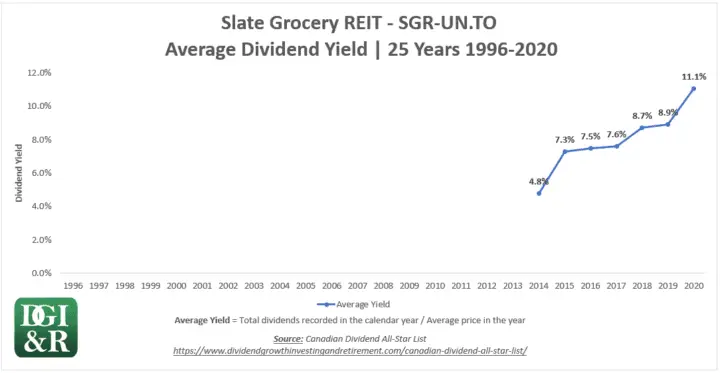

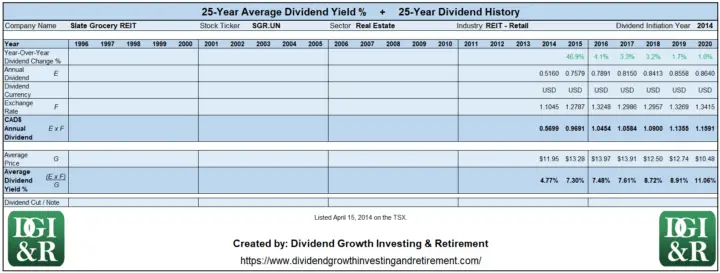

- Slate Grocery REIT – SGR.UN,

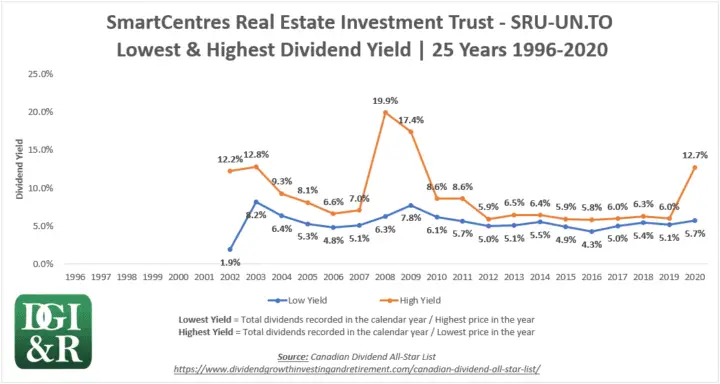

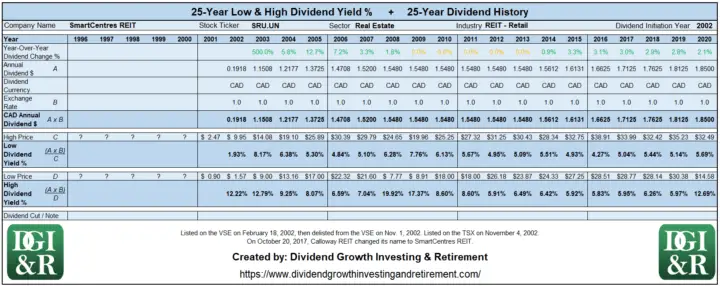

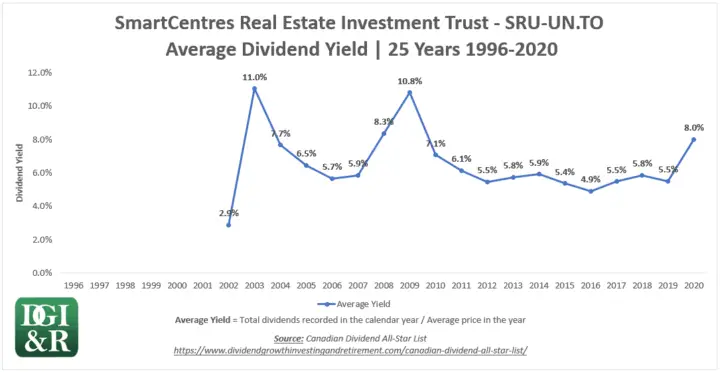

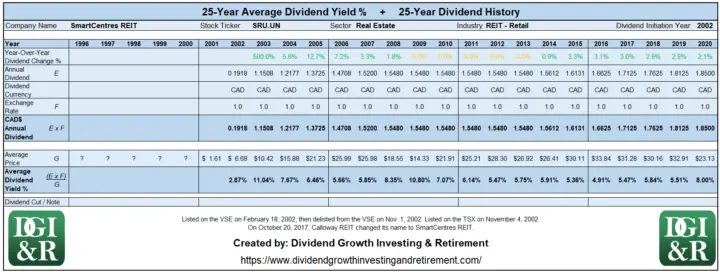

- SmartCentres REIT – SRU.UN,

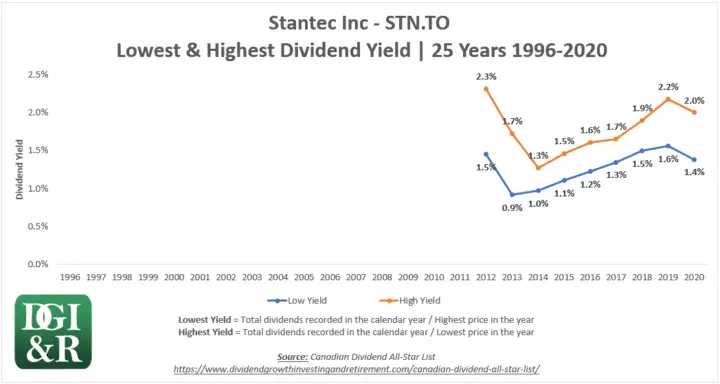

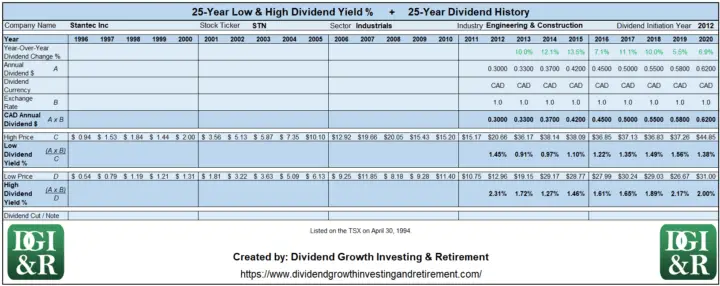

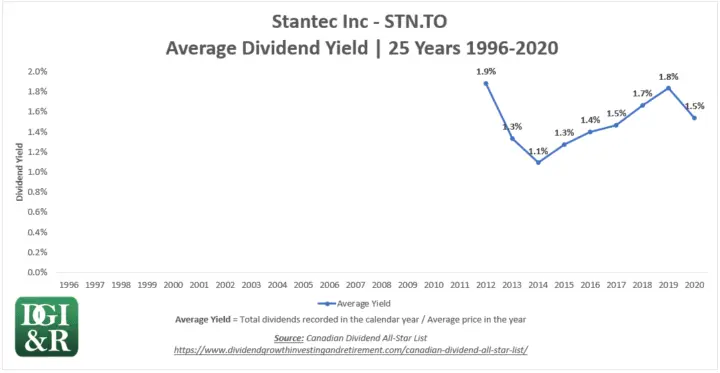

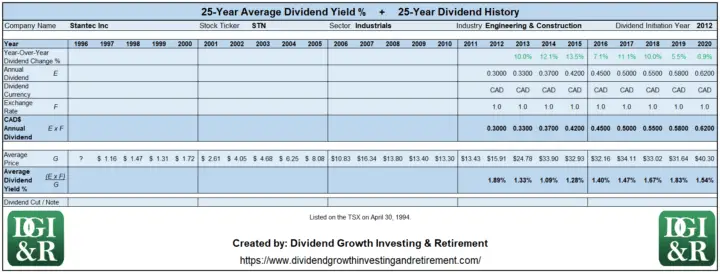

- Stantec Inc – STN,

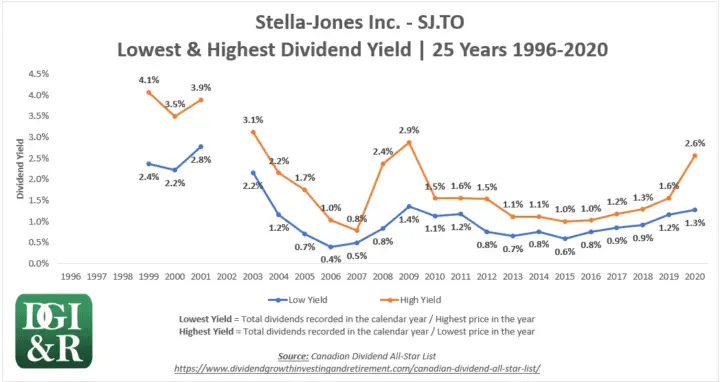

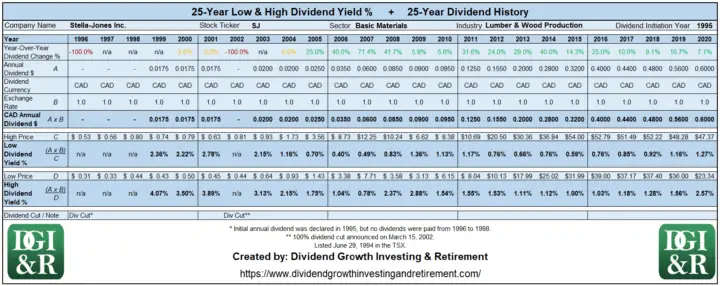

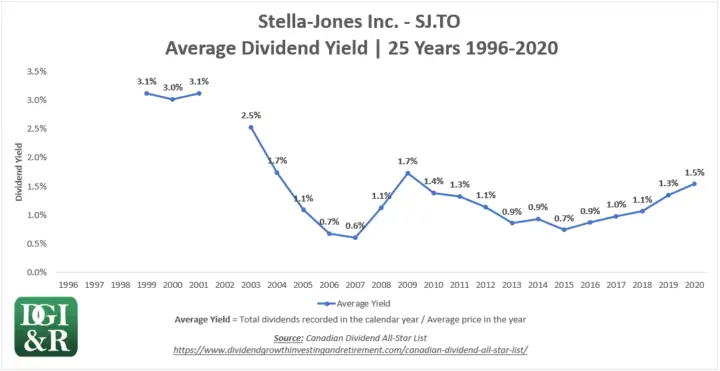

- Stella-Jones Inc – SJ

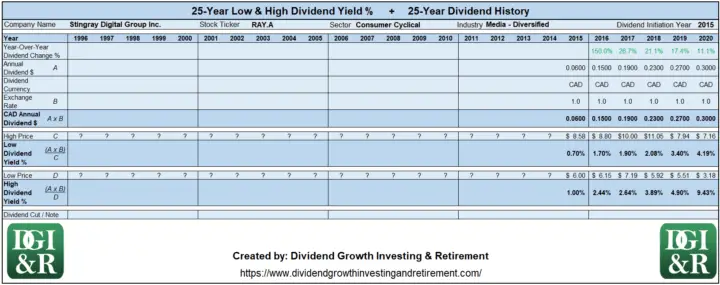

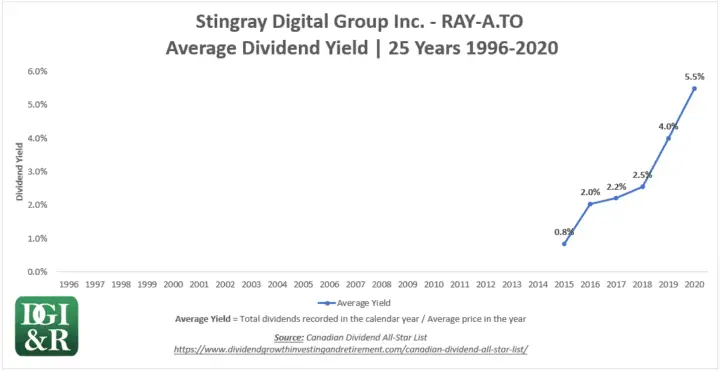

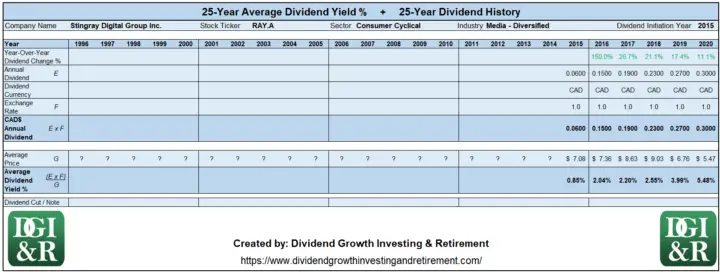

- Stingray Digital Group Inc – RAY.A

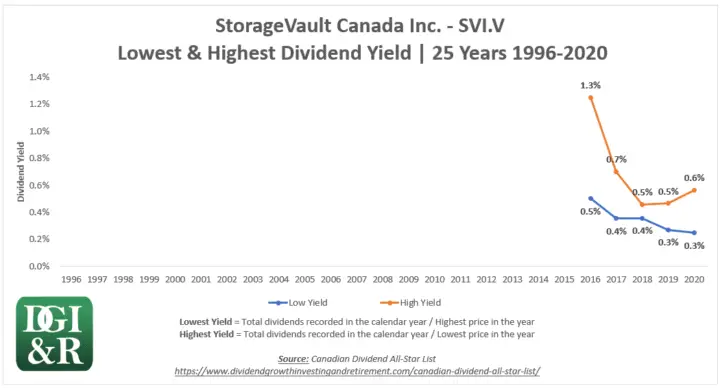

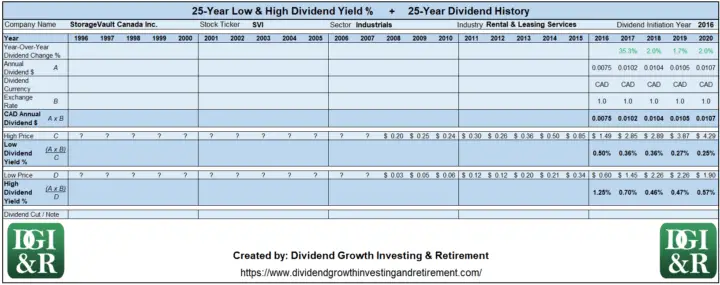

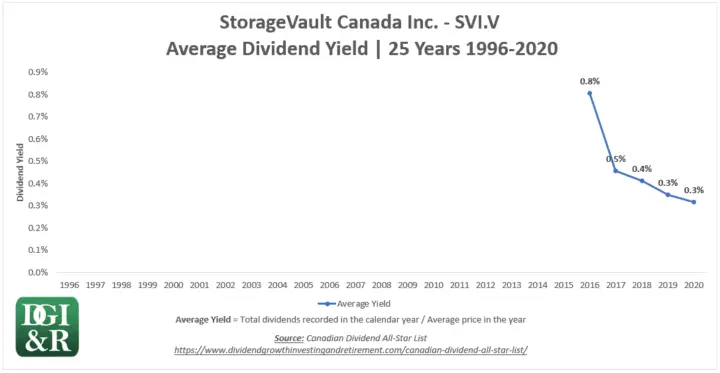

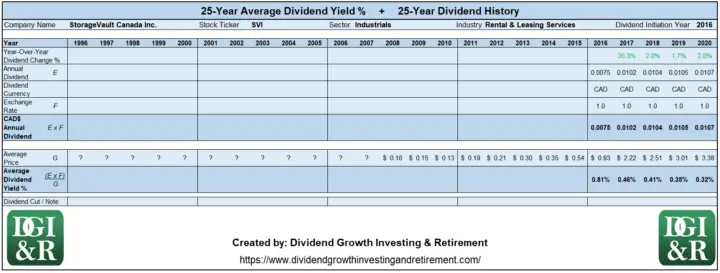

- StorageVault Canada Inc – SVI,

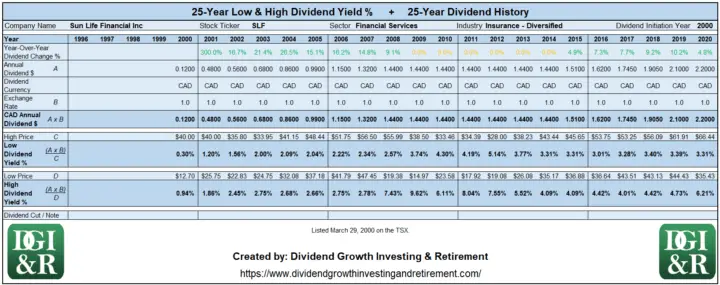

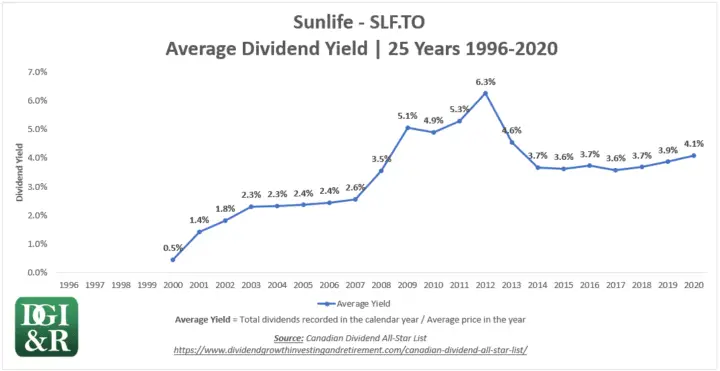

- Sun Life Financial Inc – SLF,

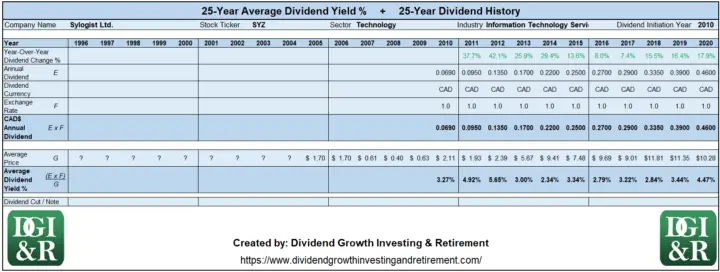

- Sylogist Ltd – SYZ,

- TC Energy Corporation – TRP,

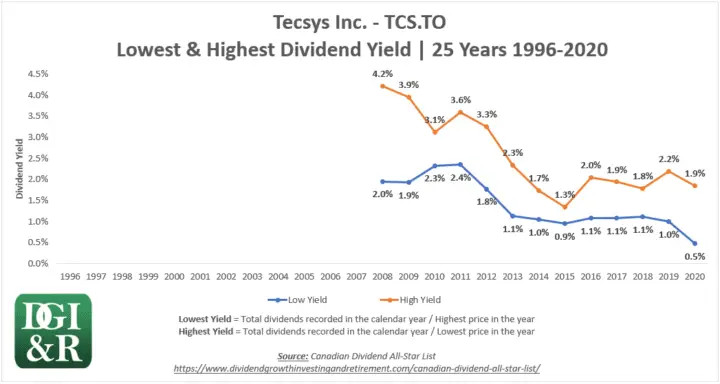

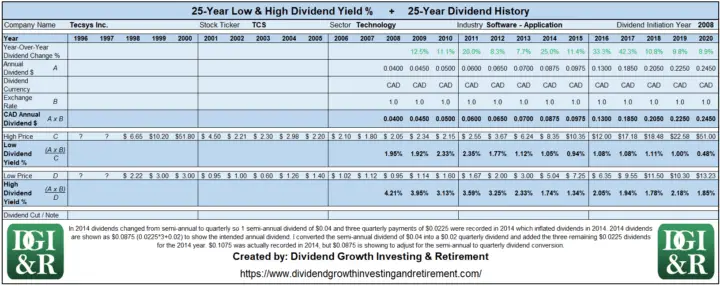

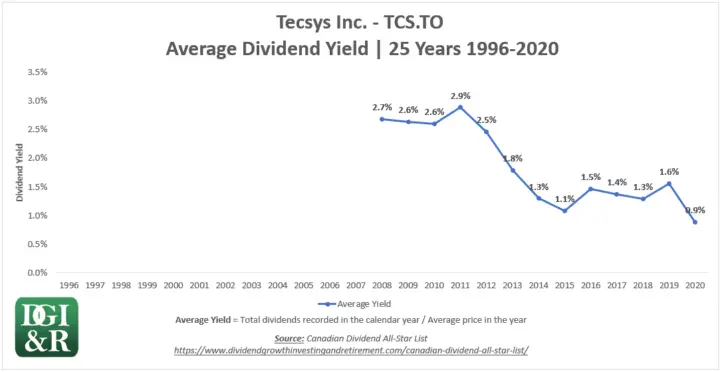

- Tecsys Inc – TCS,

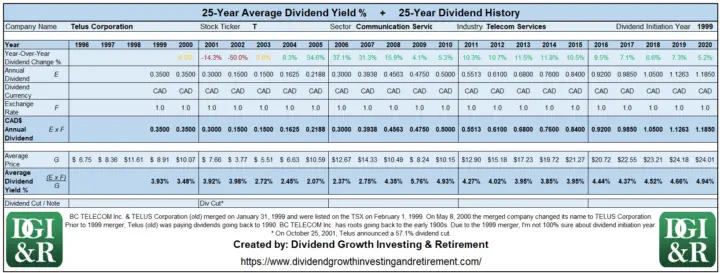

- Telus Corporation – T,

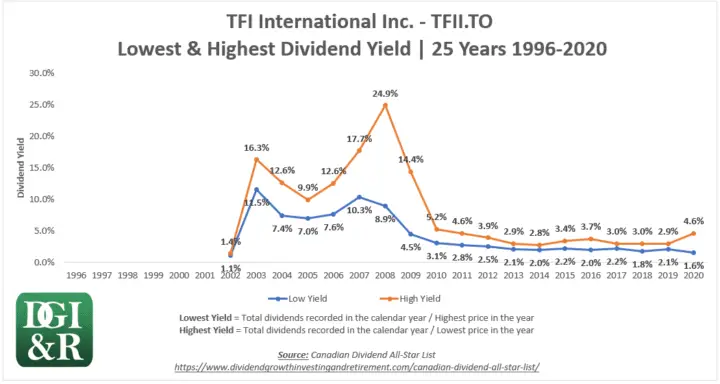

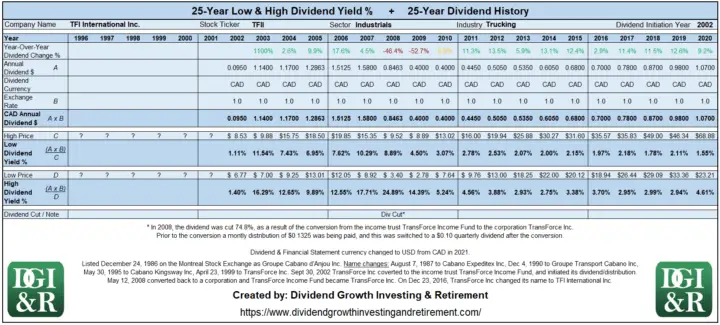

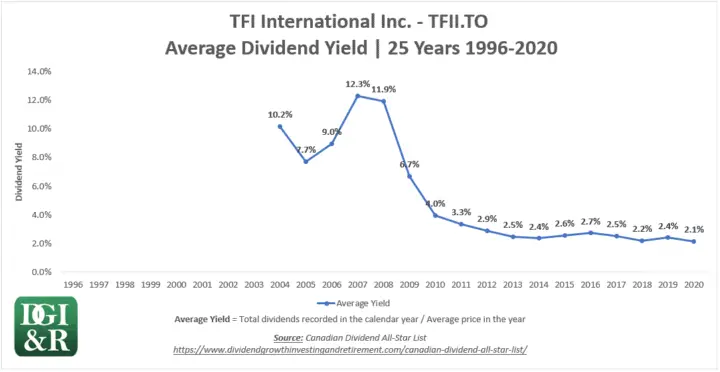

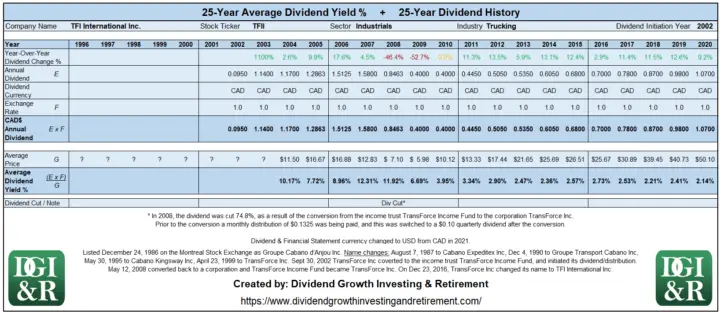

- TFI International Inc – TFII,

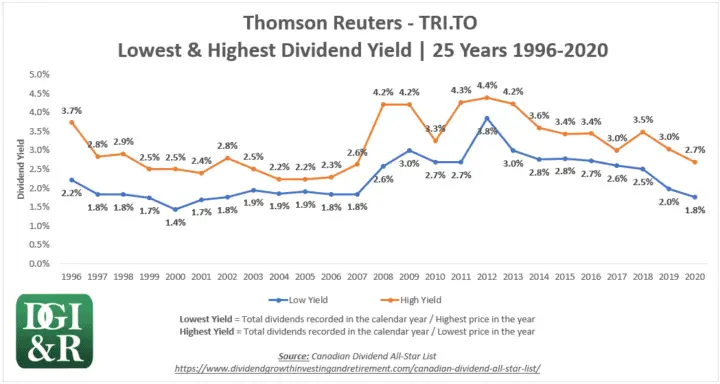

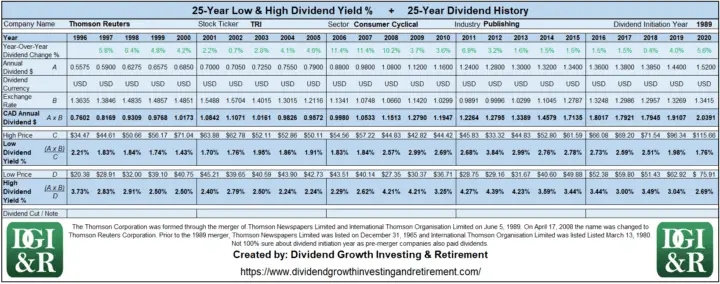

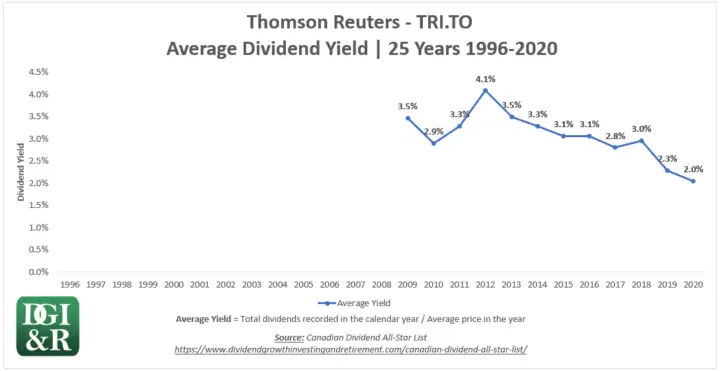

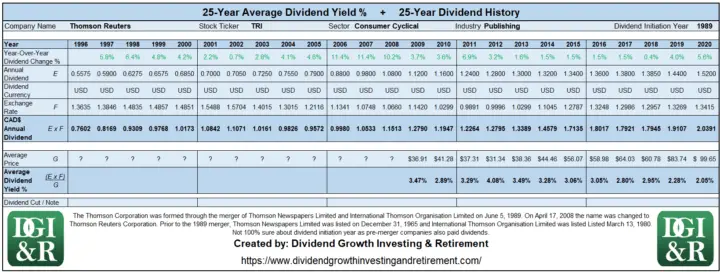

- Thomson Reuters – TRI,

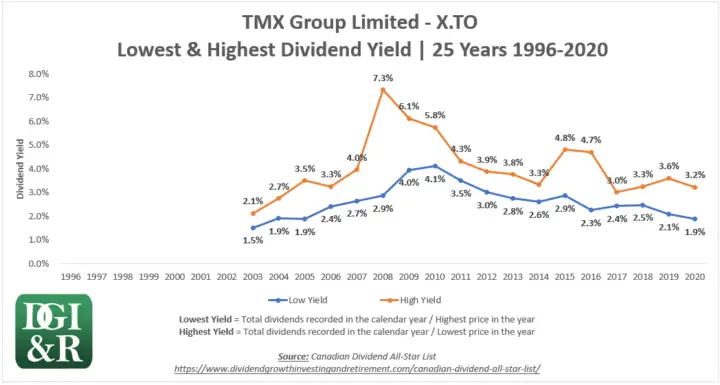

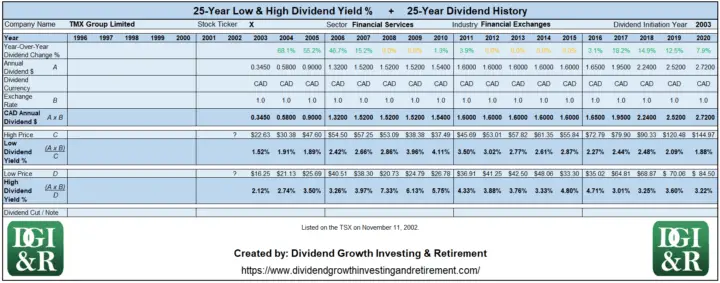

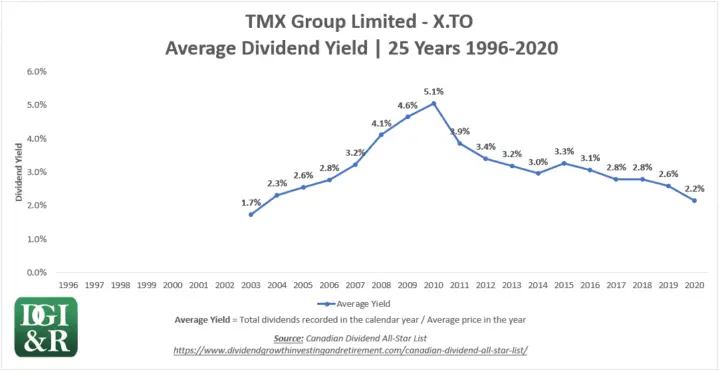

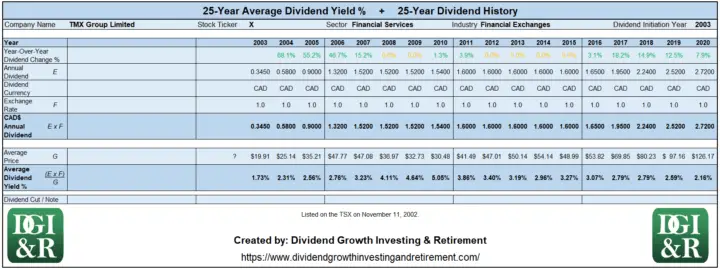

- TMX Group Limited – X,

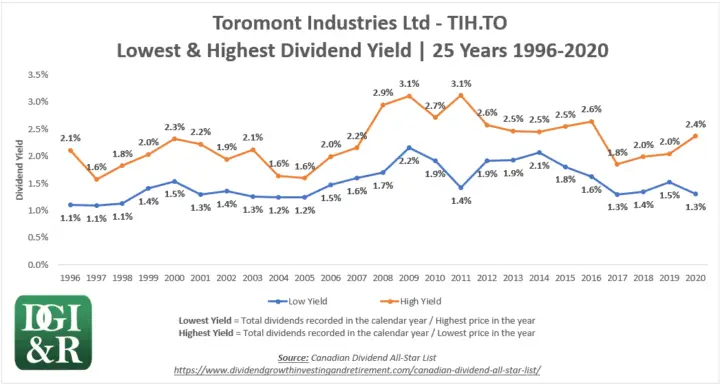

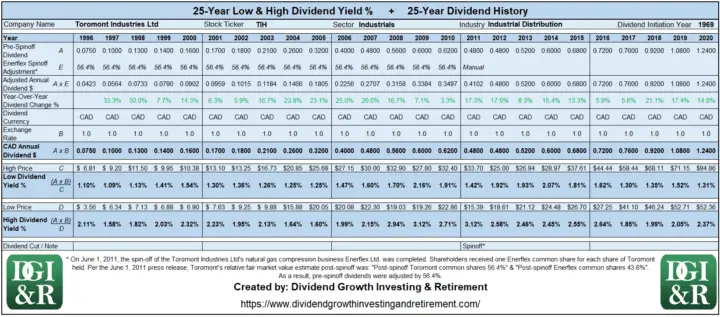

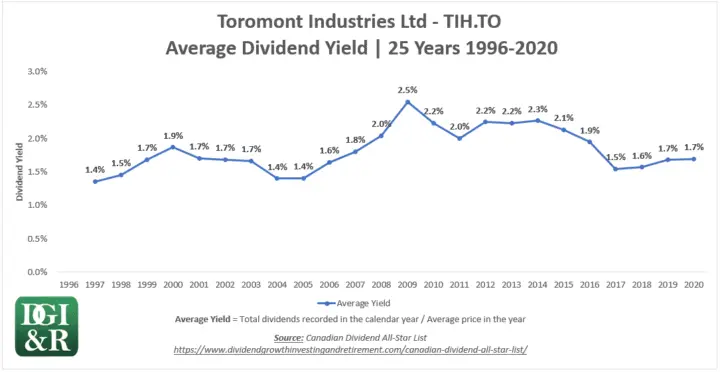

- Toromont Industries Ltd – TIH,

- Toronto Dominion Bank – TD

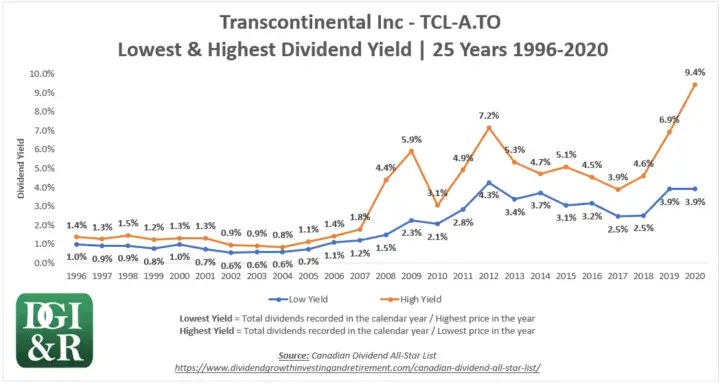

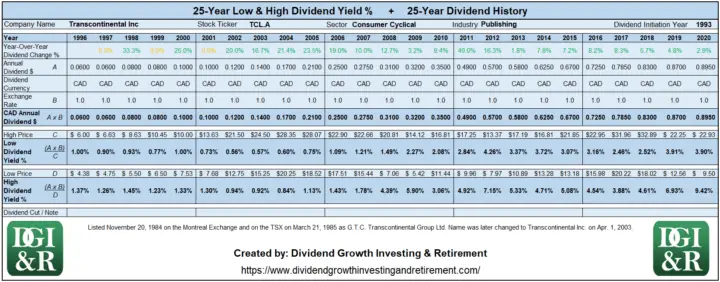

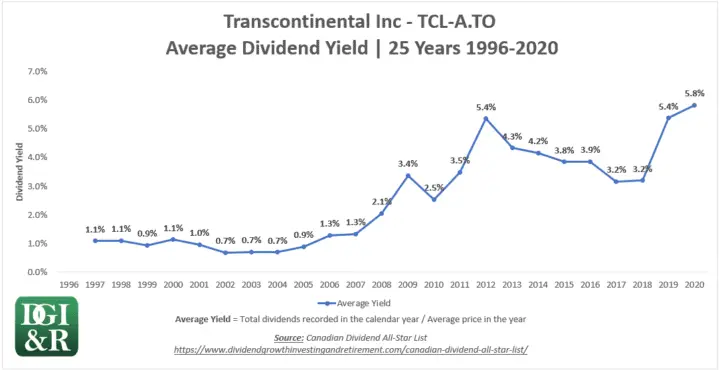

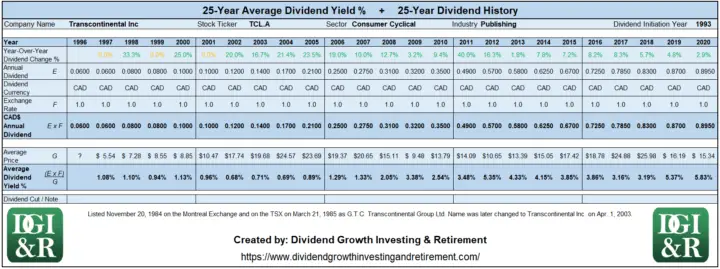

- Transcontinental Inc – TCL.A,

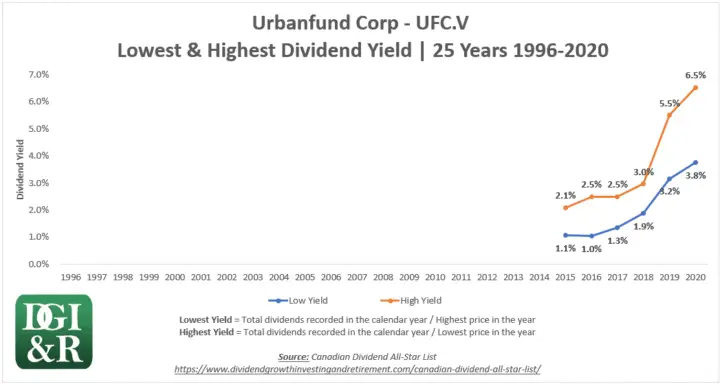

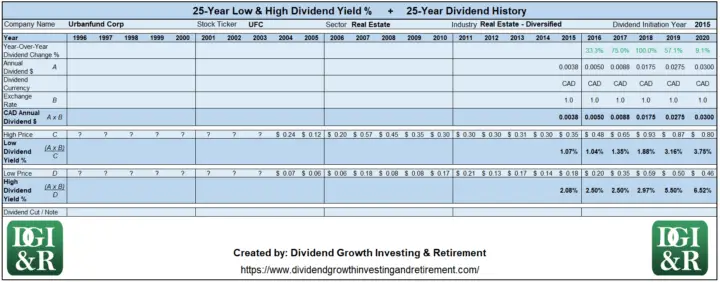

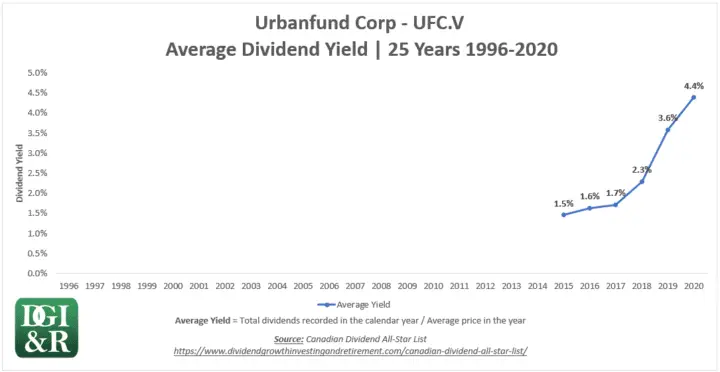

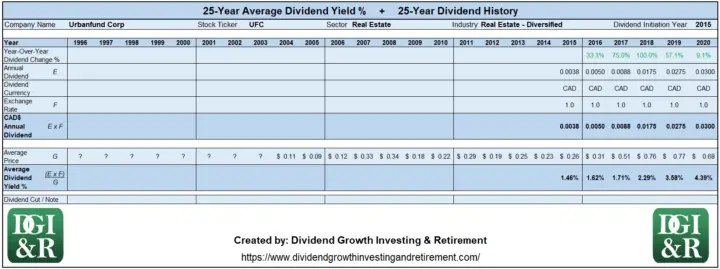

- Urbanfund Corp – UFC,

- Waste Connections Inc – WCN, and

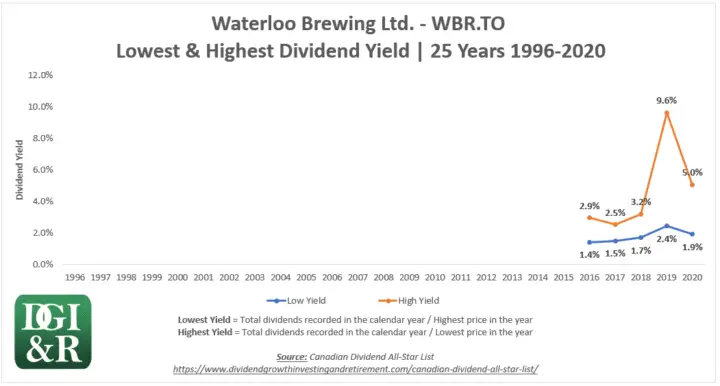

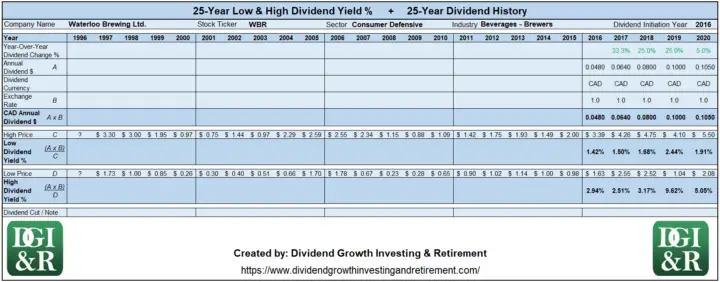

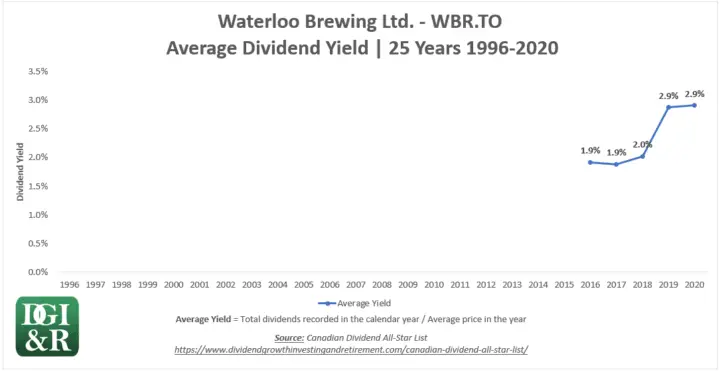

- Waterloo Brewing Ltd – WBR.

Stock Ticker Table of Contents

You can use the stock ticker below to jump to the stock you are most interested in. (Listed alphabetically)

ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

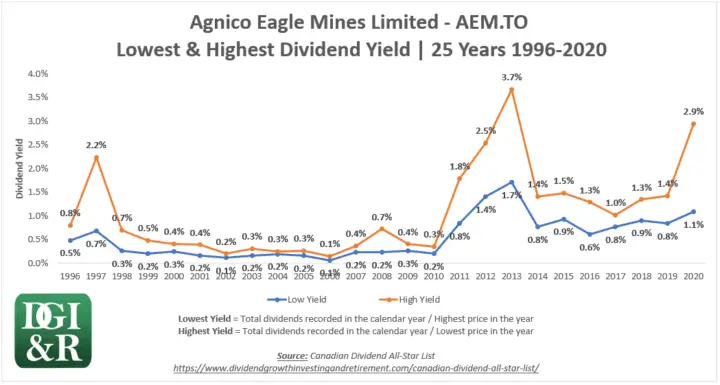

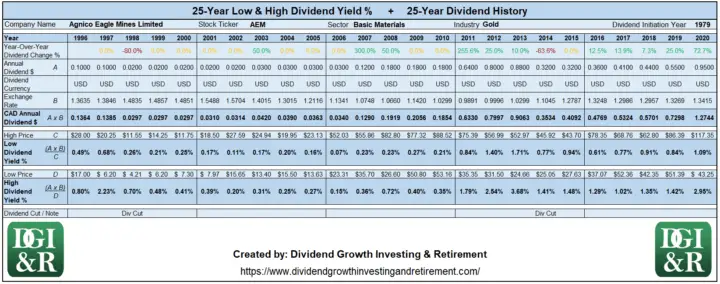

Agnico Eagle Mines Limited – AEM

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

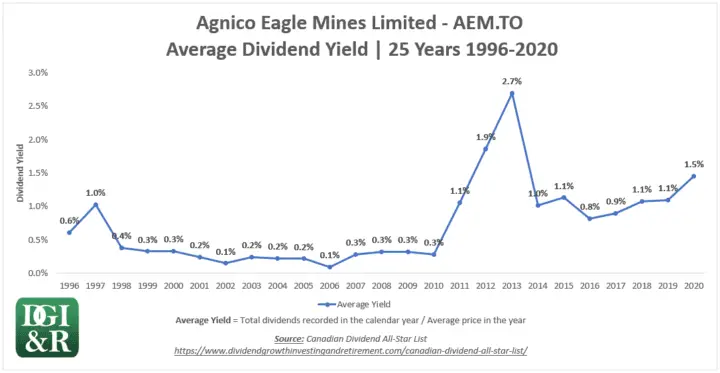

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1979

Dividend Cut History:

- On February 13, 2014, Agnico Eagle Mines Ltd announced a cut to its quarterly dividend by 64% from $0.22 to $0.08. News Release here.

- On December 18, 1997, Agnico Eagle Mines Ltd announced a cut to its annual dividend by 80% from $0.10 to $0.02. News Release here.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

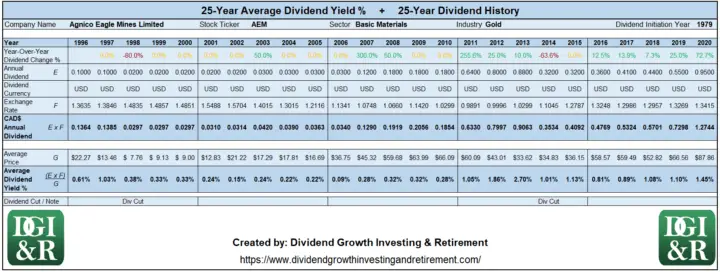

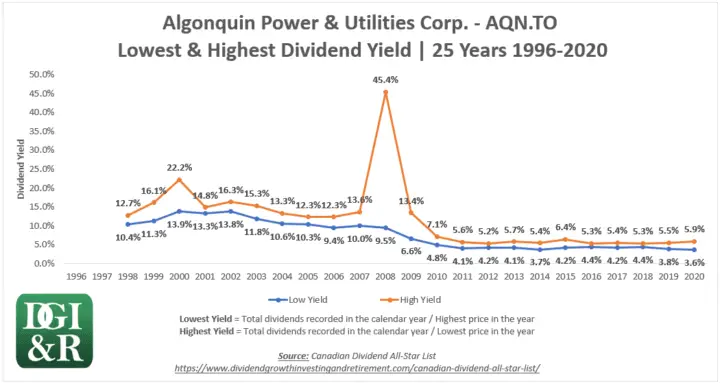

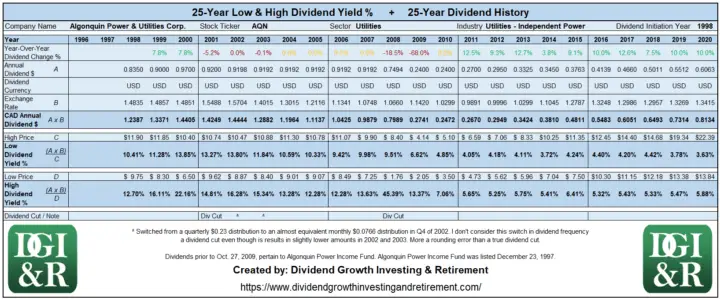

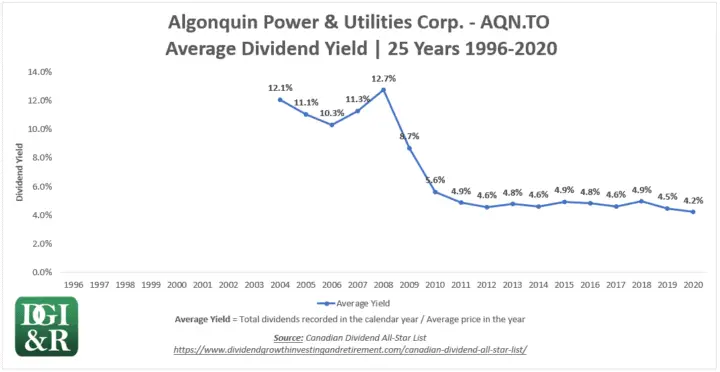

Algonquin Power & Utilities Corp. – AQN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1998

Dividend Cut History:

- On October 20, 2008, Algonquin Power Income Fund announced a cut to its monthly distribution by 73.9% from $0.0766 to $0.02. News Release here.

- On March 20, 2001, Algonquin Power Income Fund announced a $0.23 quarterly distribution which was a 5.2% cut from the prior quarterly distribution of $0.2425. News Release here.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- On September 27, 2002, they announced a switched to a monthly distribution from the prior quarterly distribution. News Release here.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

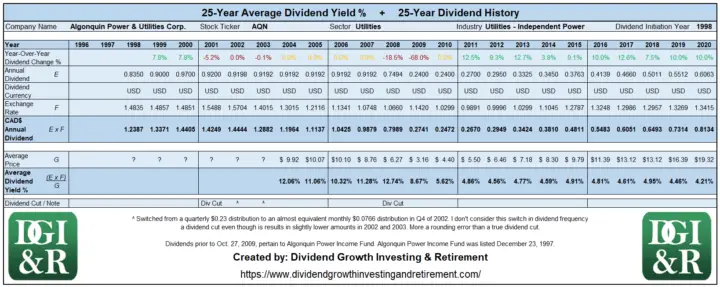

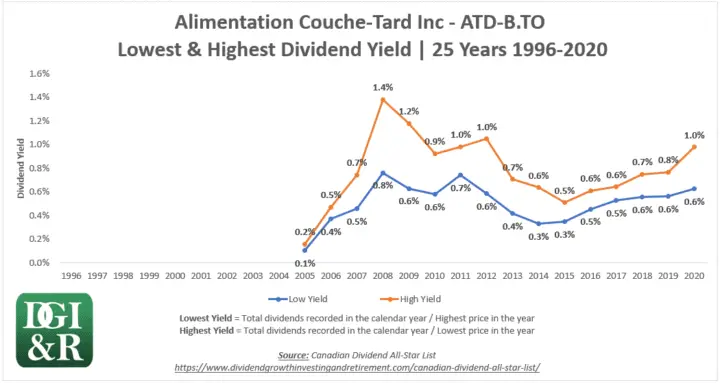

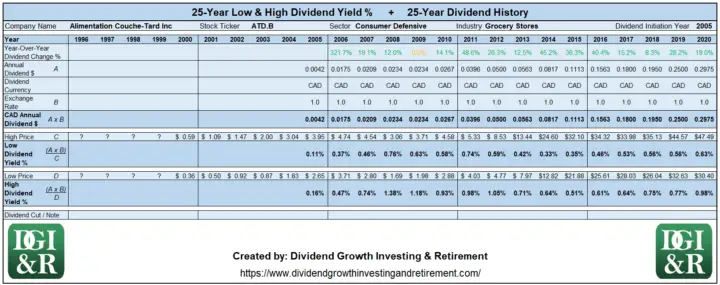

Alimentation Couche-Tard Inc – ATD.B

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

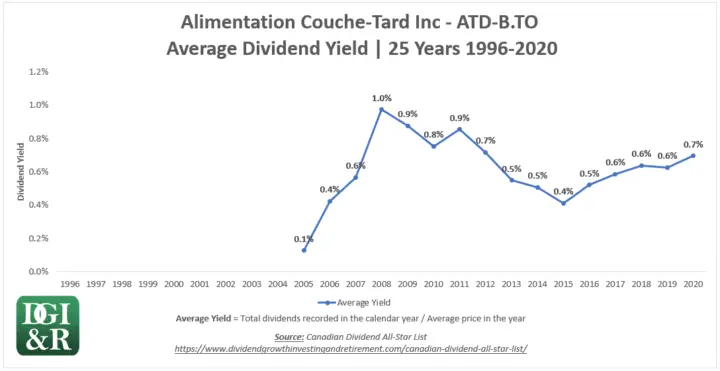

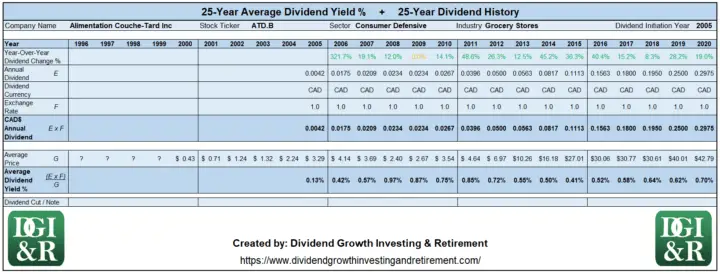

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2005

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

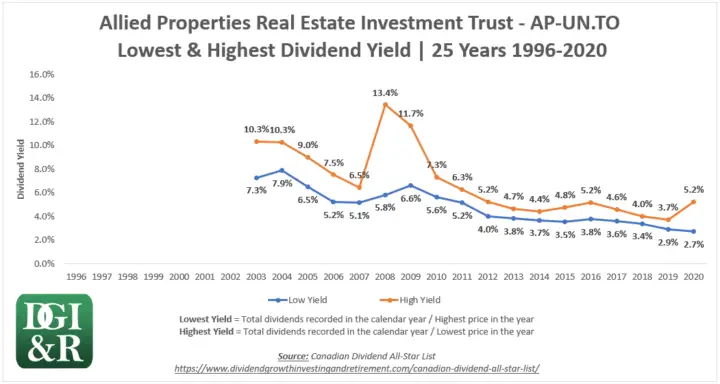

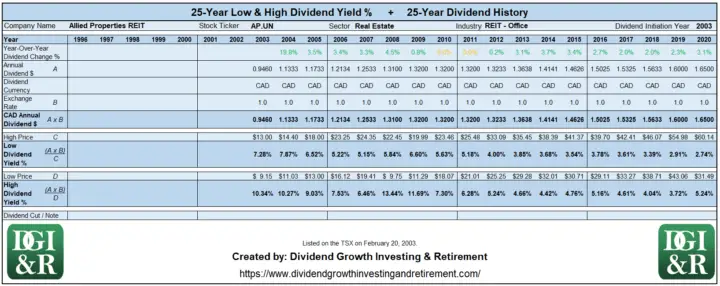

Allied Properties REIT – AP.UN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

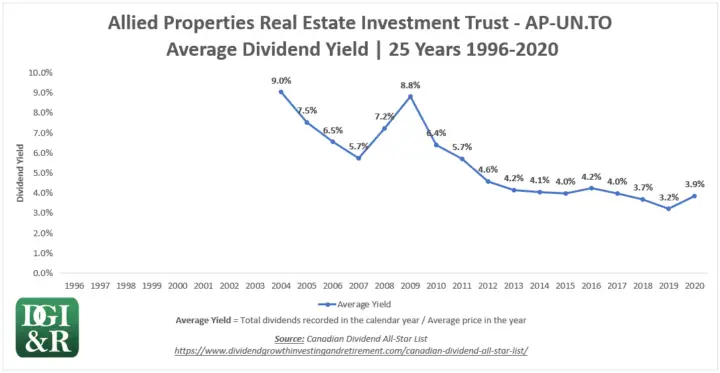

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2003

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

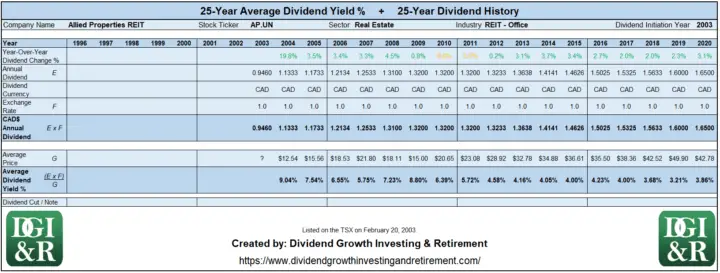

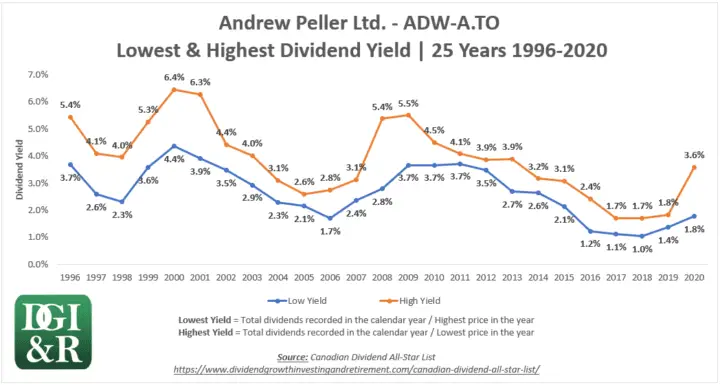

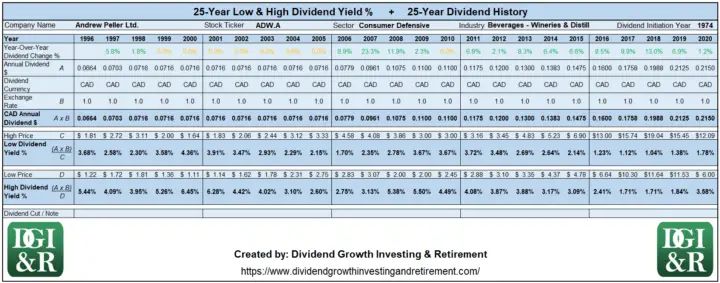

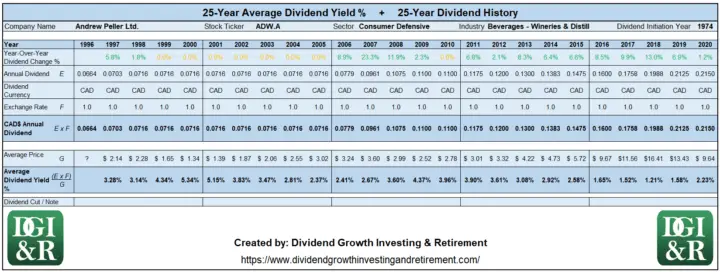

Andrew Peller Ltd. – ADW.A

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

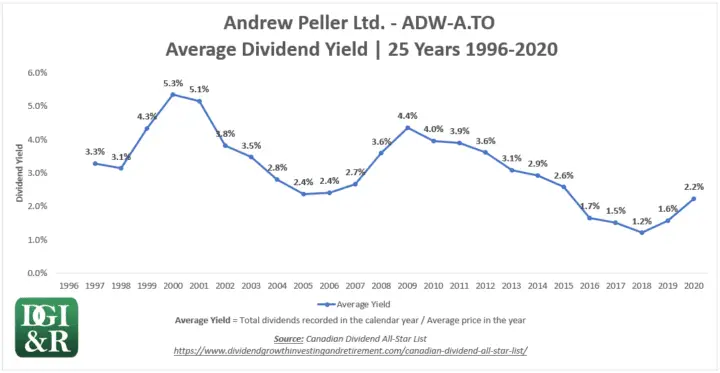

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1974

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

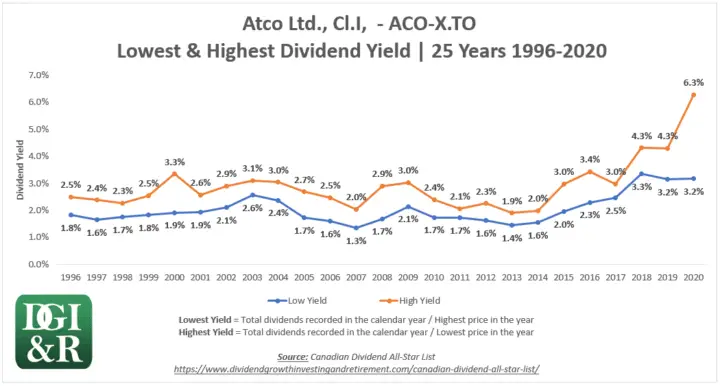

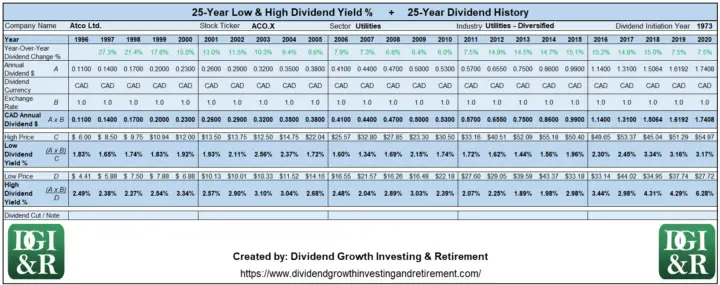

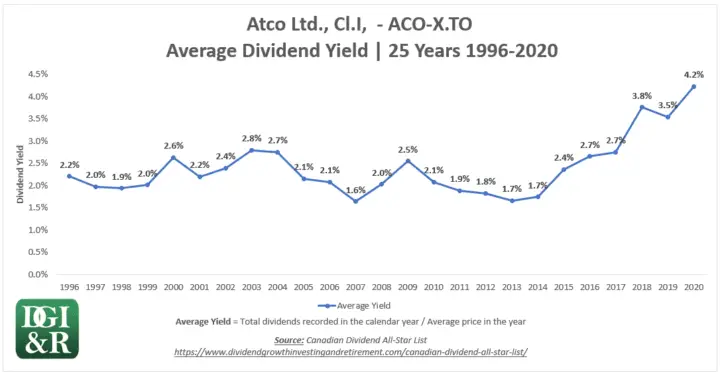

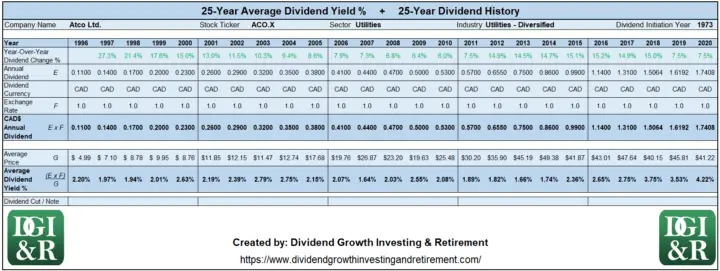

Atco Ltd. – ACO.X

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1973

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

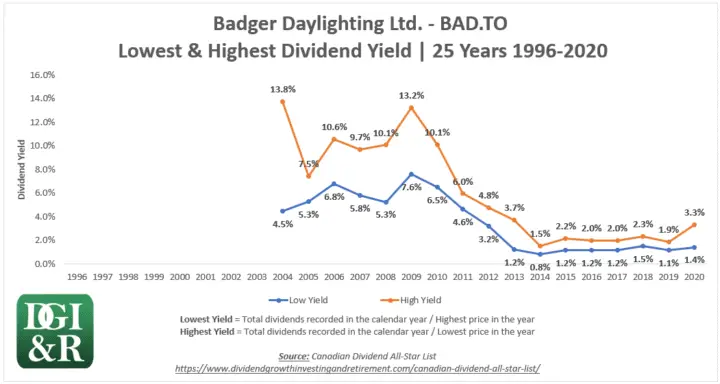

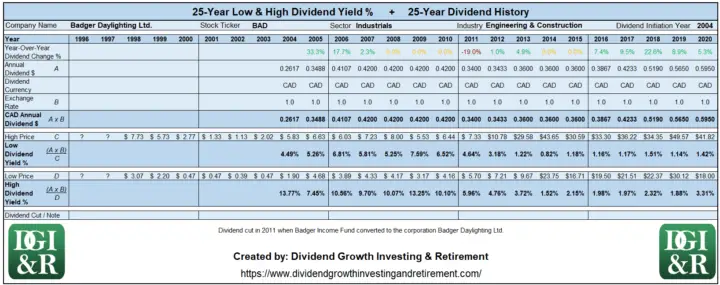

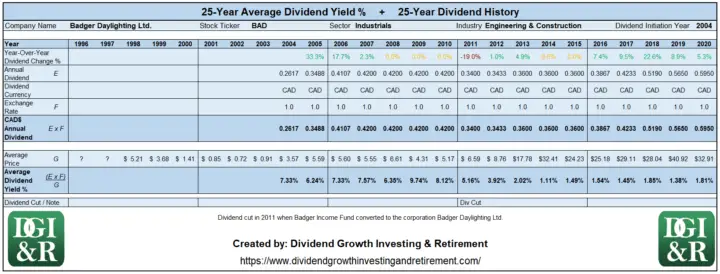

Badger Daylighting Ltd. – BAD

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

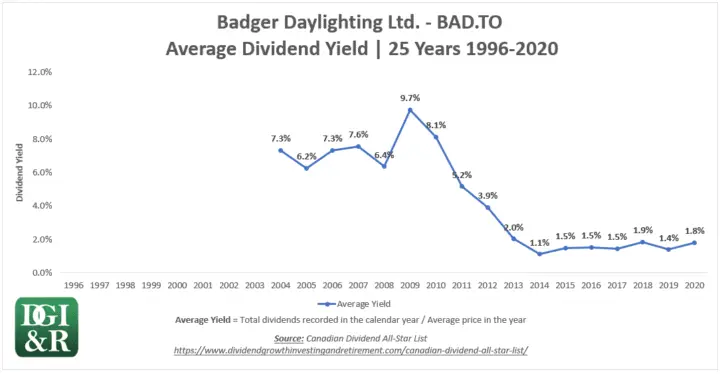

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2004

Dividend Cut History:

- On November 10, 2010, they announced that following the conversion from an Income Fund to a corporation, “Badger as a corporation will remit a dividend between 75 percent and 100 percent of the current level of the Fund’s annual distribution ($1.26 per unit)”. News Release here.

- On December 13, 2010, they officially announced a 19.0% cut to its monthly dividend from $0.105 to $0.085. News Release here.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Dividend cut in 2011 when Badger Income Fund converted to the corporation Badger Daylighting Ltd.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

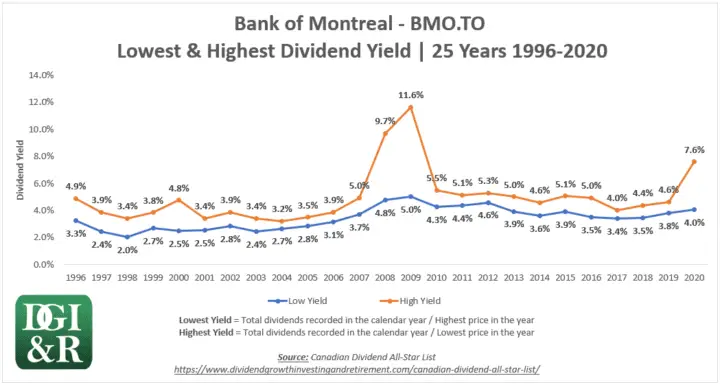

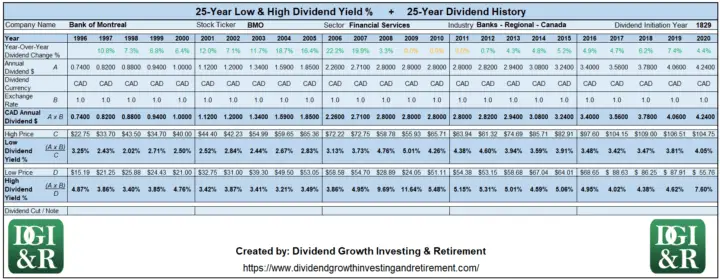

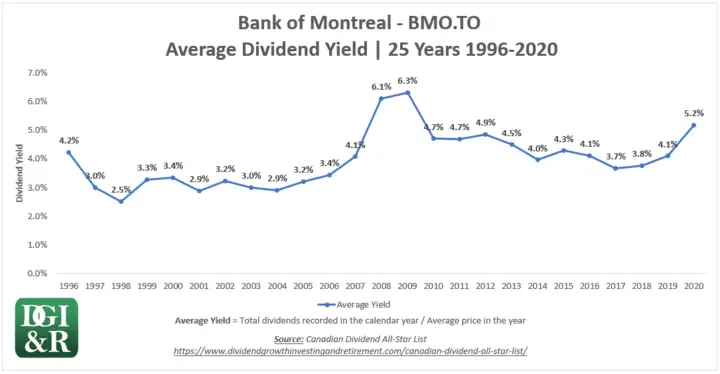

Bank of Montreal – BMO

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1829

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Longest dividend-paying stock in Canada.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

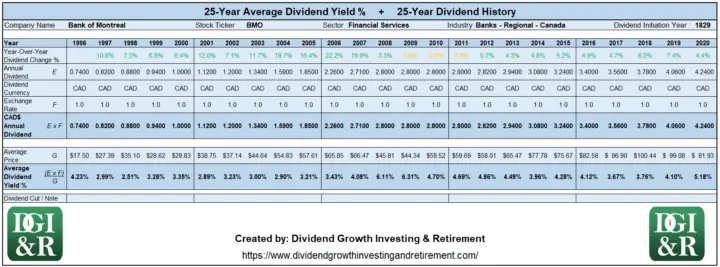

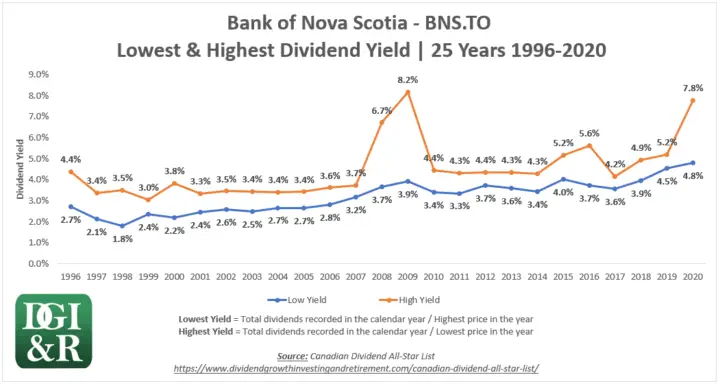

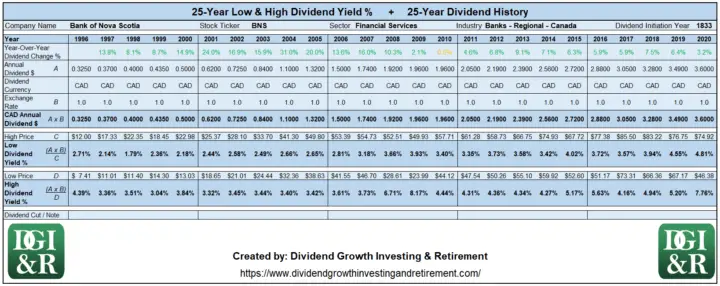

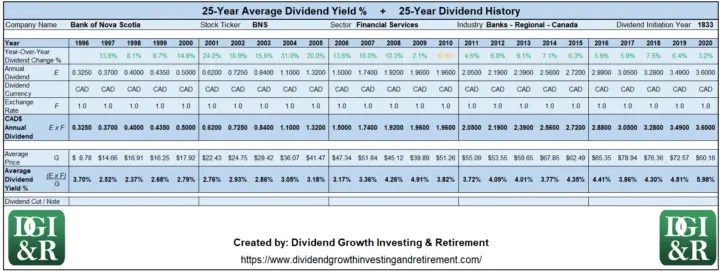

Bank of Nova Scotia – BNS

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

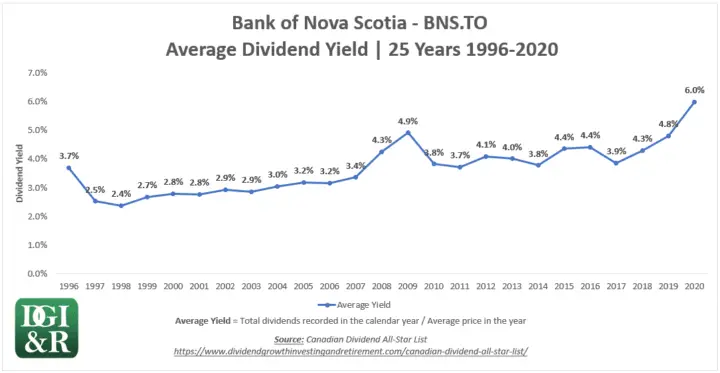

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1833

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

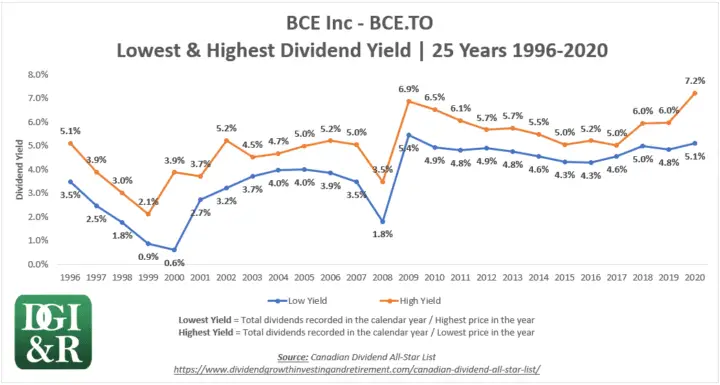

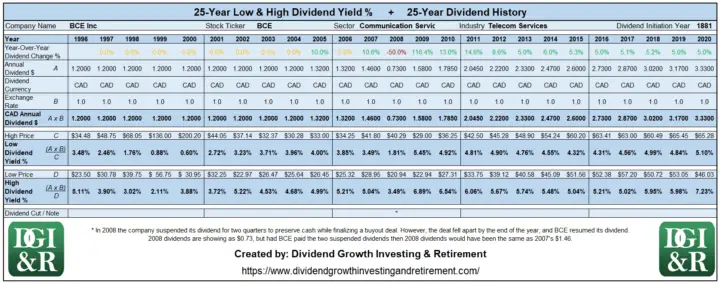

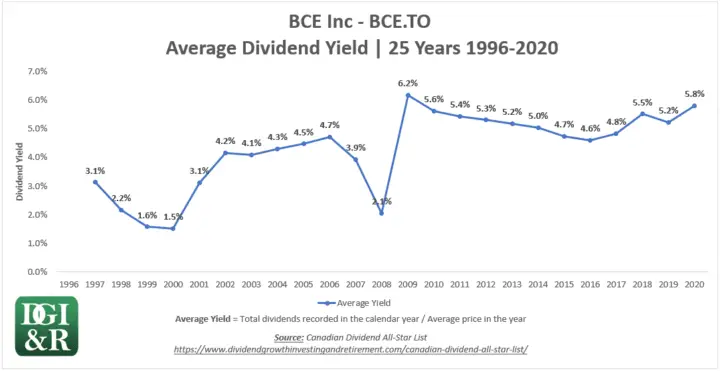

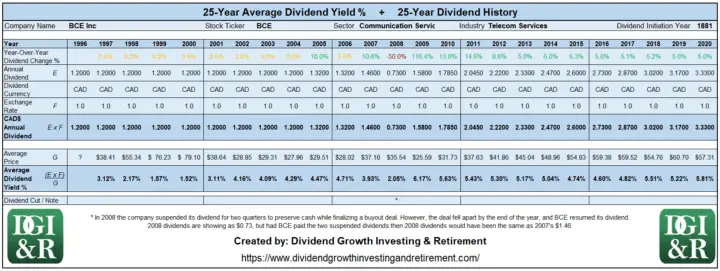

BCE Inc – BCE

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1881

Dividend Cut History:

- In 2008 the company suspended its dividend for two quarters to preserve cash while finalizing a buyout deal. However, the deal fell apart by the end of the year, and BCE resumed its dividend. 2008 dividends are showing as $0.73 but had BCE paid the two suspended dividends then 2008 dividends would have been the same as 2007’s $1.46.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- In 2008 the company suspended its dividend for two quarters to preserve cash while finalizing a buyout deal. However, the deal fell apart by the end of the year, and BCE resumed its dividend. 2008 dividends are showing as $0.73 but had BCE paid the two suspended dividends then 2008 dividends would have been the same as 2007’s $1.46.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

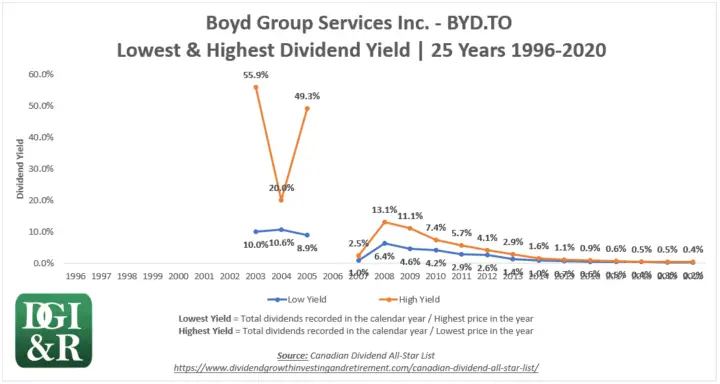

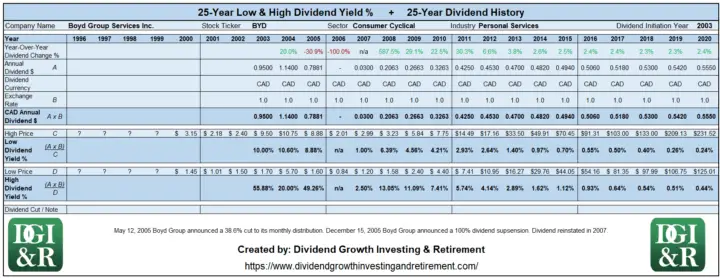

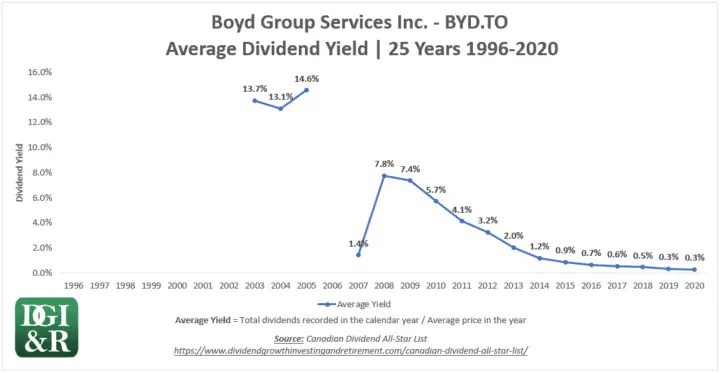

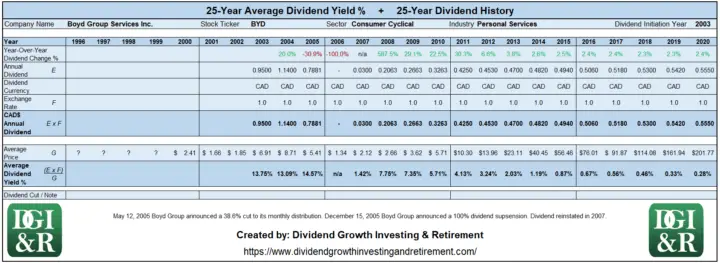

Boyd Group Services Inc. – BYD

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2003

Dividend Cut History:

- On May 12, 2005, Boyd Group Income Fund (now Boyd Group Services Inc.) announced a 38.6% cut to its monthly distribution from $0.095 to $0.0583. News Release here.

- On December 15, 2005, Boyd Group Income Fund (now Boyd Group Services Inc.) announced a 100% dividend suspension. News Release here.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

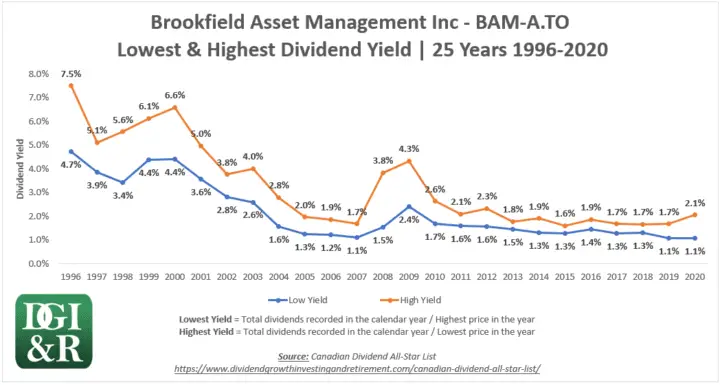

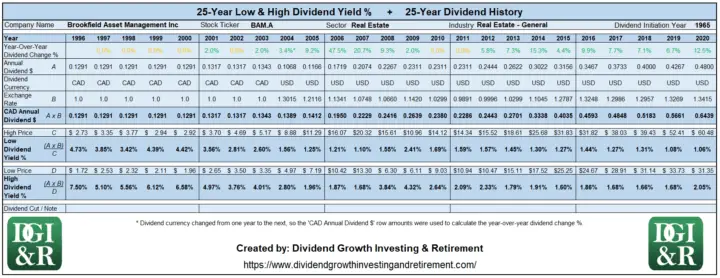

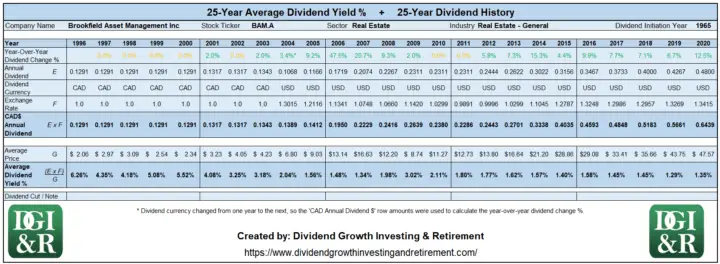

Brookfield Asset Management Inc – BAM.A

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

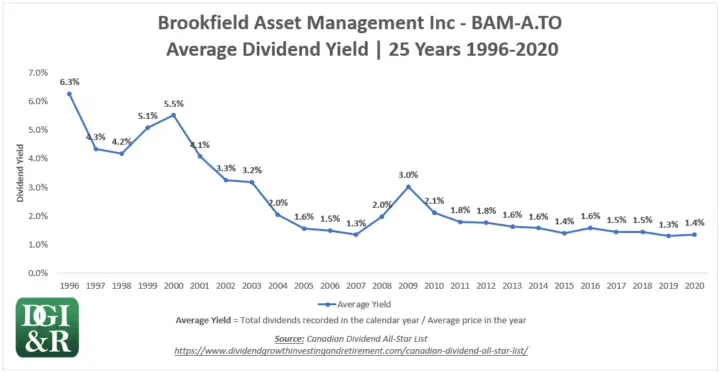

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1965

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

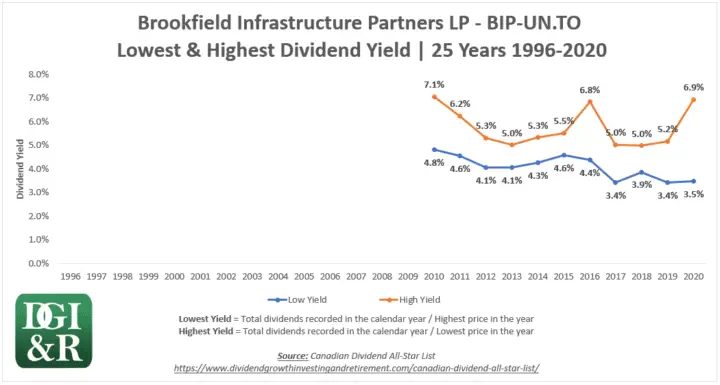

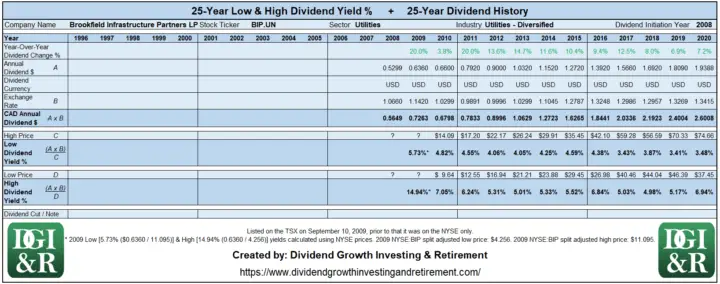

Brookfield Infrastructure Partners LP – BIP.UN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

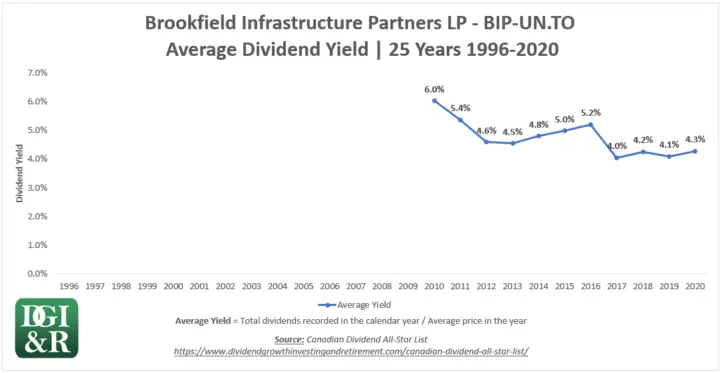

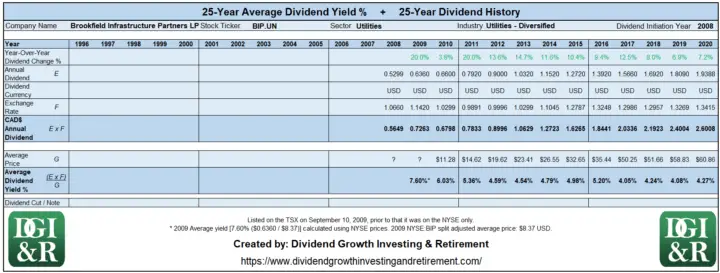

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2008

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Listed on the TSX on September 10, 2009, prior to that it was on the NYSE only.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

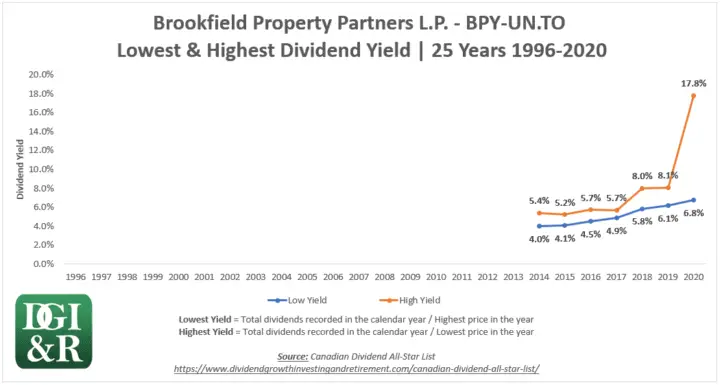

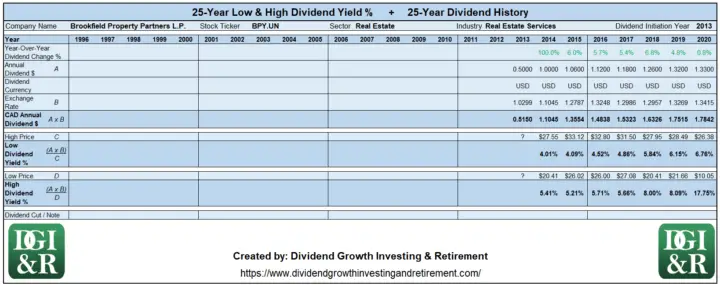

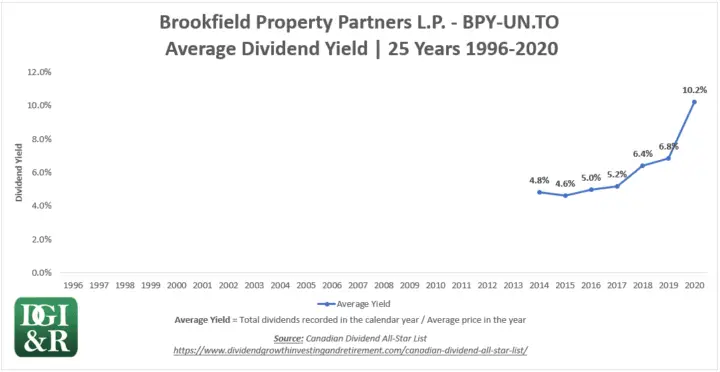

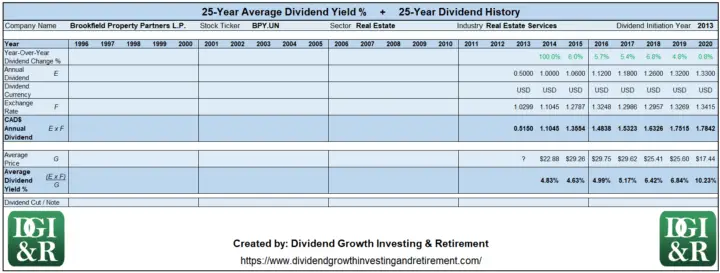

Brookfield Property Partners L.P. – BPY.UN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2013

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

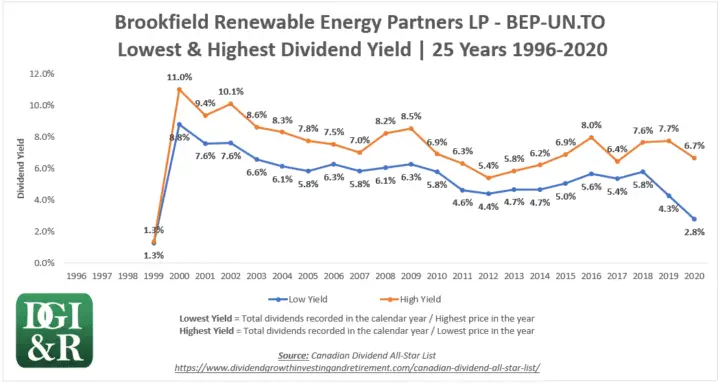

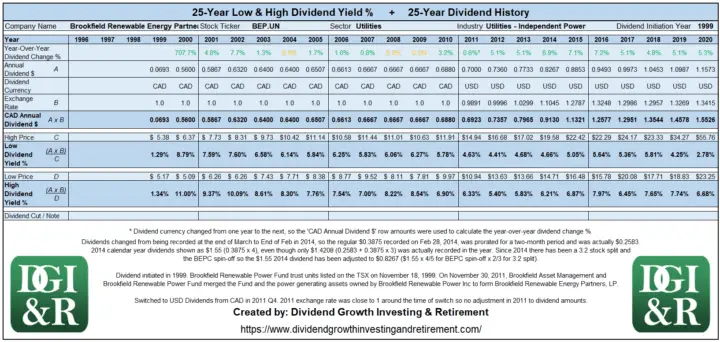

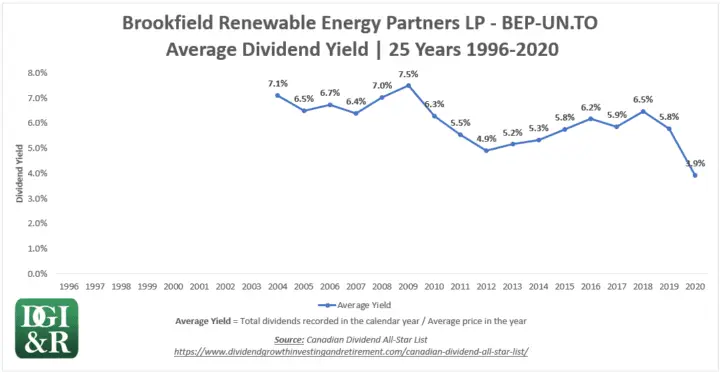

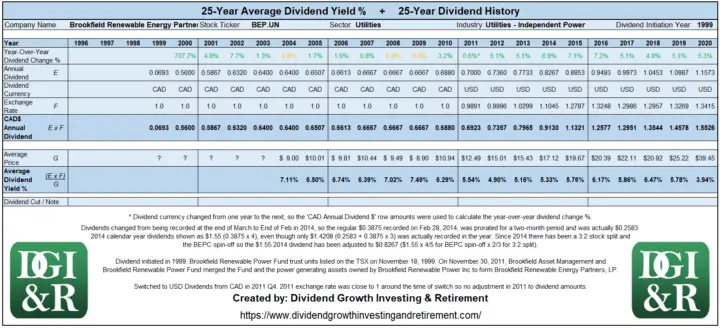

Brookfield Renewable Energy Partners LP – BEP.UN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1999. Brookfield Renewable Power Fund (formerly Great Lakes Hydro Income Fund) trust units listed on the TSX on November 18, 1999. On November 30, 2011, Brookfield Asset Management and Brookfield Renewable Power Fund merged the Fund and the power generating assets owned by Brookfield Renewable Power Inc to form Brookfield Renewable Energy Partners, LP.

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Dividends changed from being recorded at the end of March to End of Feb in 2014, so the regular $0.3875 recorded on Feb 28, 2014, was prorated for a two-month period and was actually $0.2583. The dividend streak remains intact. 2014 calendar year dividends shown as $1.55 (0.3875 x 4), even though only $1.4208 (0.2583 + 0.3875 x 3) was actually recorded in the year. Since 2014 there has been a 3:2 stock split and the BEPC spin-off so the $1.55 2014 dividend has been adjusted to $0.8267 ($1.55 x 4/5 for BEPC spin-off x 2/3 for 3:2 split).

- Dividend initiated in 1999. Brookfield Renewable Power Fund trust units listed on the TSX on November 18, 1999. On November 30, 2011, Brookfield Asset Management and Brookfield Renewable Power Fund merged the Fund and the power generating assets owned by Brookfield Renewable Power Inc to form Brookfield Renewable Energy Partners, LP.

- Switched to USD Dividends from CAD in 2011 Q4. 2011 exchange rate was close to 1 around the time of switch so no adjustment in 2011 to dividend amounts.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

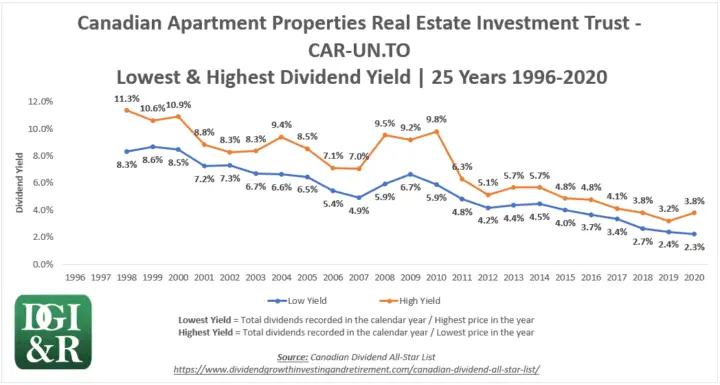

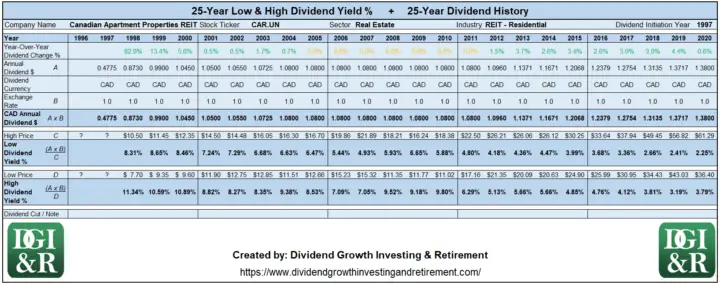

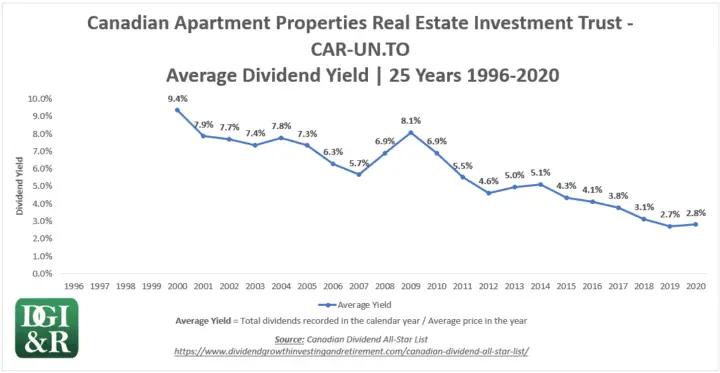

Canadian Apartment Properties REIT – CAR.UN

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1997

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

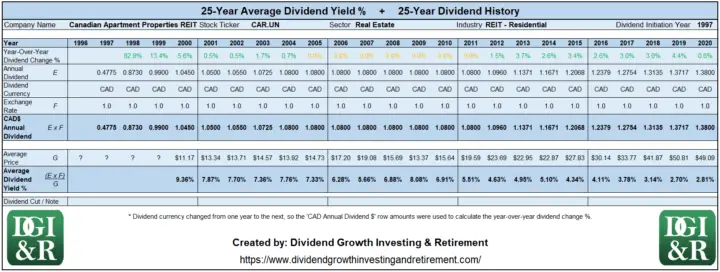

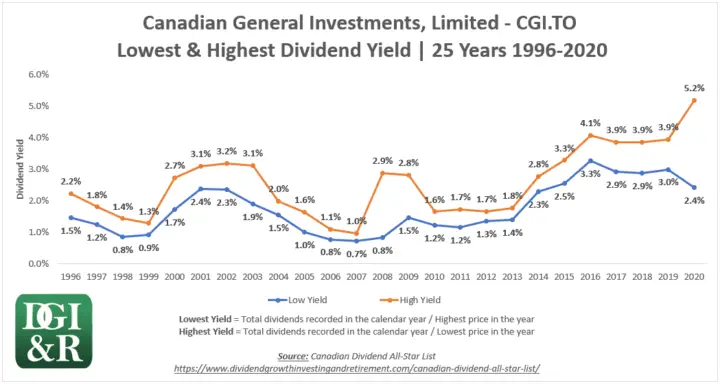

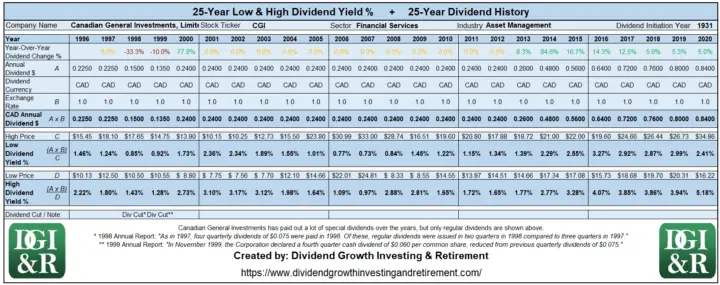

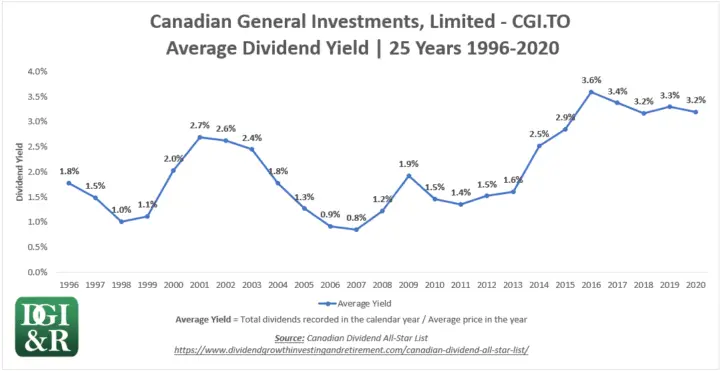

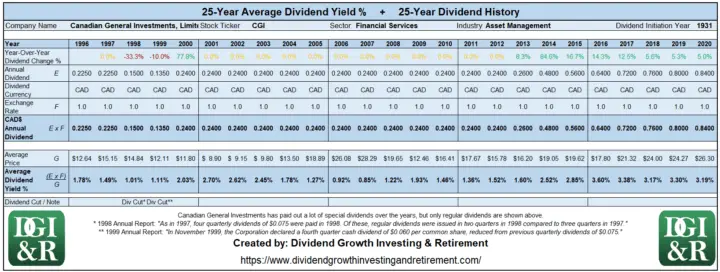

Canadian General Investments, Limited – CGI

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1931

Dividend Cut History:

- “As in 1997, four quarterly dividends of $0.075 were paid in 1998. Of these, regular dividends were issued in two quarters in 1998 compared to three quarters in 1997.” Source: 1998 Annual Report, page 4-5.

- “In November 1999, the Corporation declared a fourth quarter cash dividend of $0.060 per common share, reduced from previous quarterly dividends of $0.075. The Board intends to maintain a regular quarterly dividend payable in cash at the $0.06 per share level subject to periodic review based on any future increases in common share capital and general market considerations.” Source: 1999 Annual Report, page 5. November 17, 1999, News Release here.

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Canadian General Investments has paid out a lot of special dividends over the years, but only regular dividends are shown.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

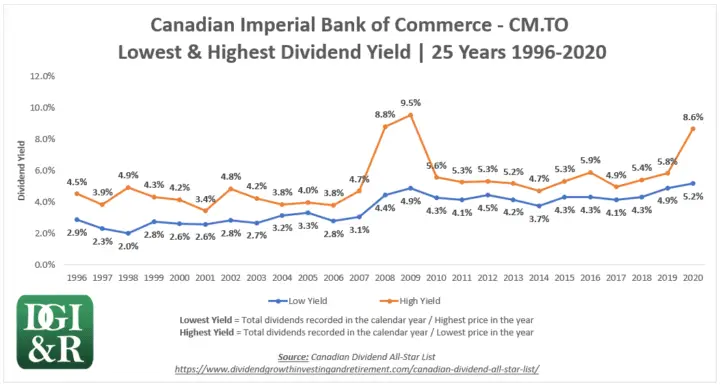

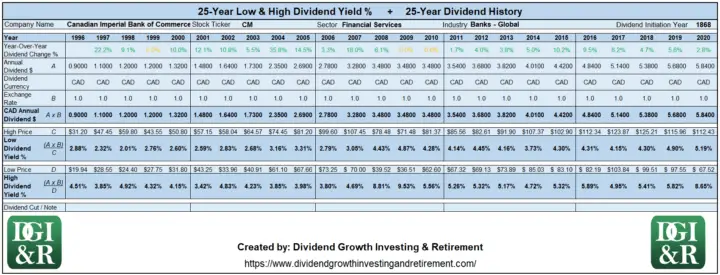

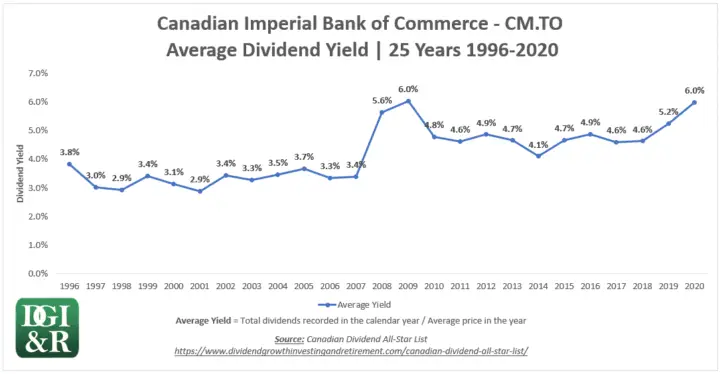

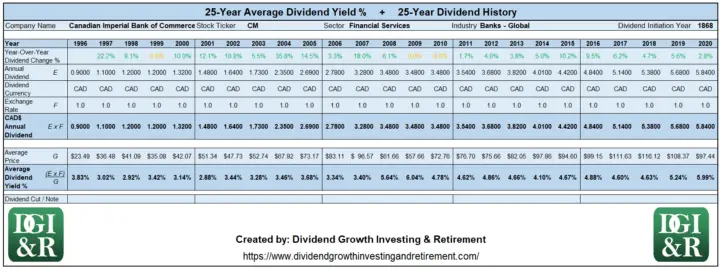

Canadian Imperial Bank of Commerce – CM

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1868

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- CIBC hasn’t missed a regular dividend since its first dividend payment in 1868.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

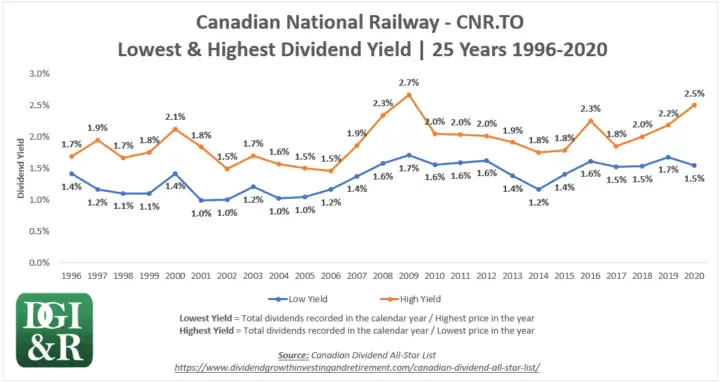

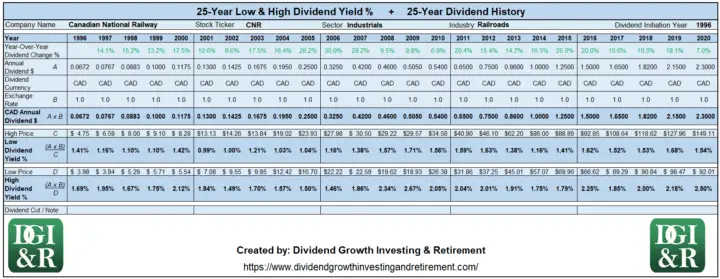

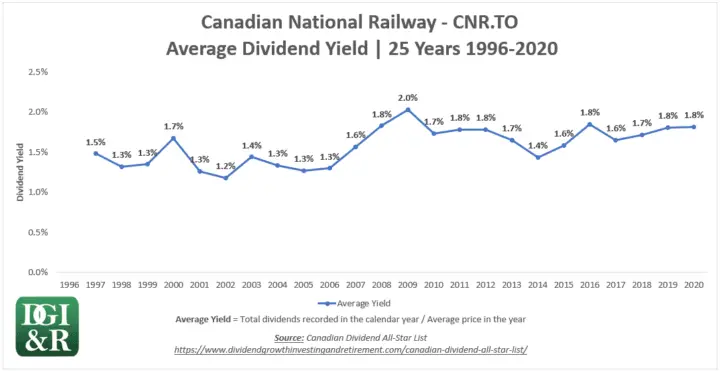

Canadian National Railway – CNR

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1996

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

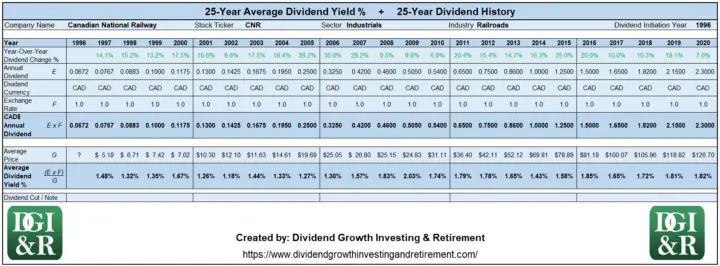

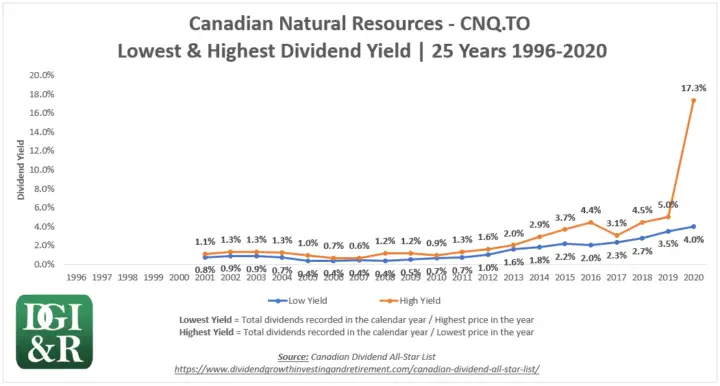

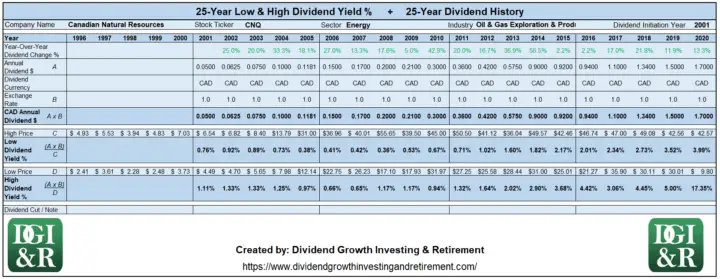

Canadian Natural Resources – CNQ

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

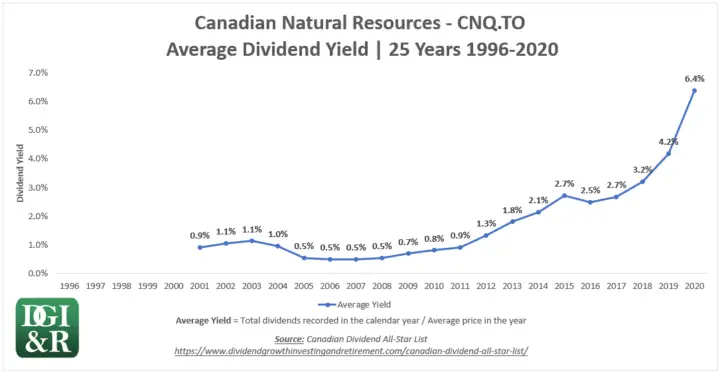

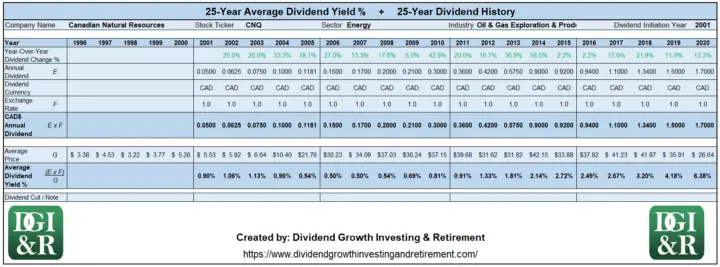

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2001

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- None

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

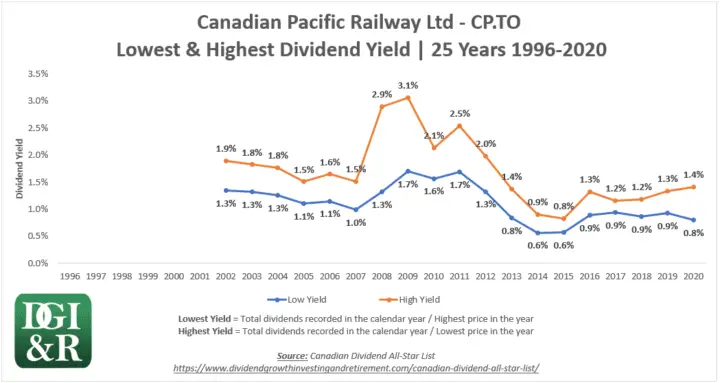

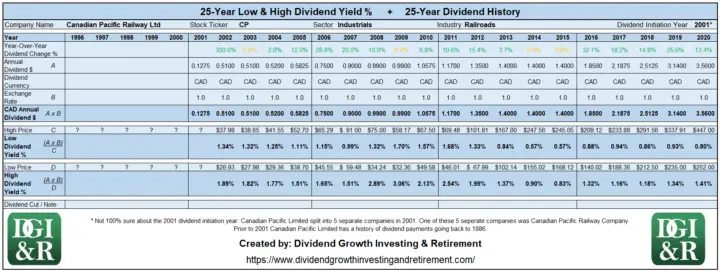

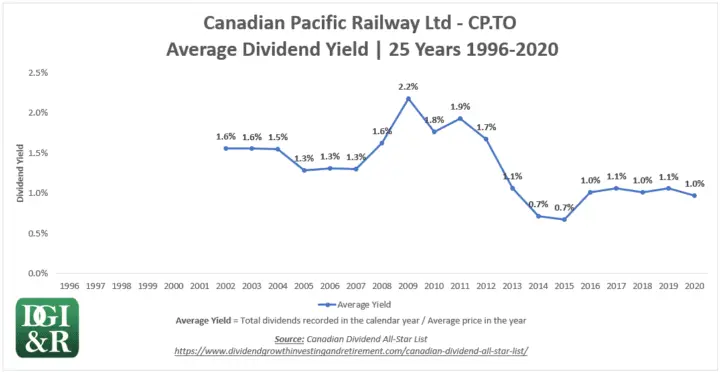

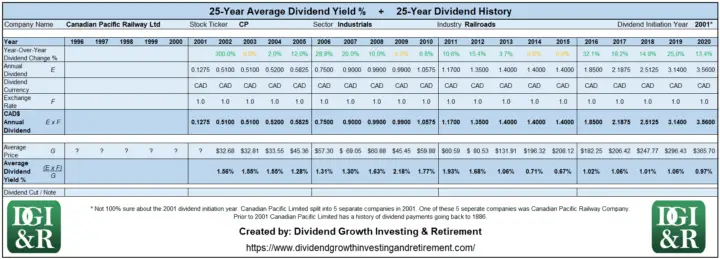

Canadian Pacific Railway Ltd – CP

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 2001. Not 100% sure about the dividend initiation year. Canadian Pacific Limited split into 5 separate companies in 2001. One of these 5 separate companies was Canadian Pacific Railway Company. Prior to 2001 Canadian Pacific Limited has a history of dividend payments going back to 1886.

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Not 100% sure about dividend initiation year. Canadian Pacific Limited split into 5 separate companies in 2001. One of these 5 seperate companies was Canadian Pacific Railway Company. Prior to 2001 Canadian Pacific Limited has a history of dividend payments going back to 1886.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

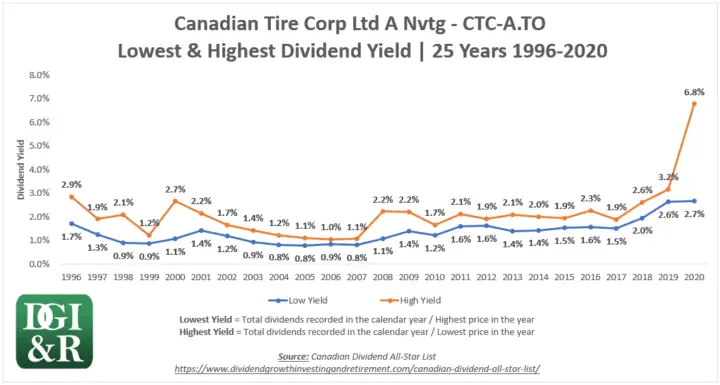

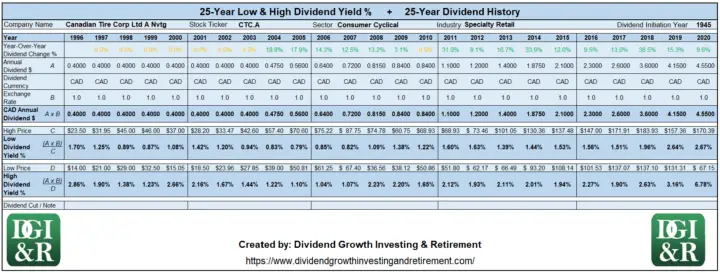

Canadian Tire Corp Ltd – CTC.A

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

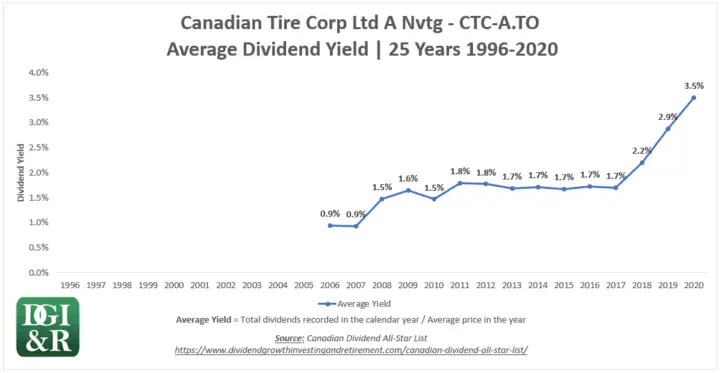

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1945

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Listed January 2, 1945.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

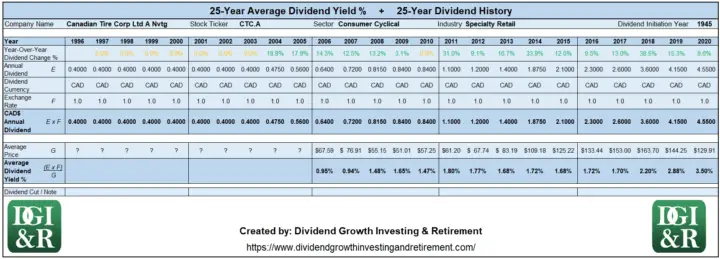

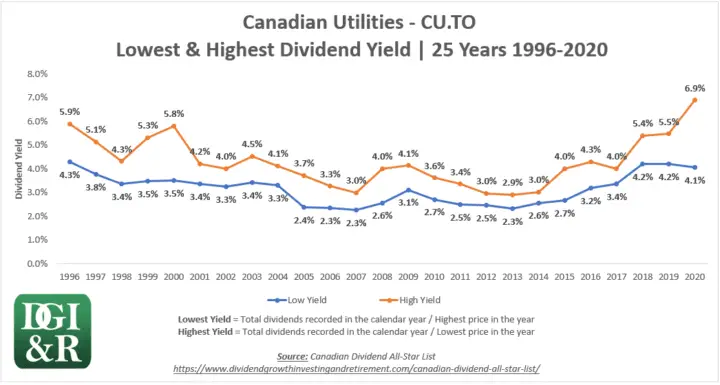

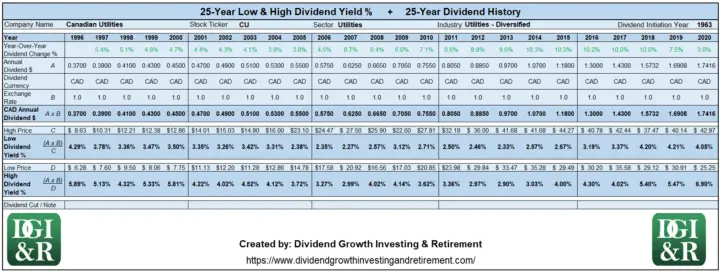

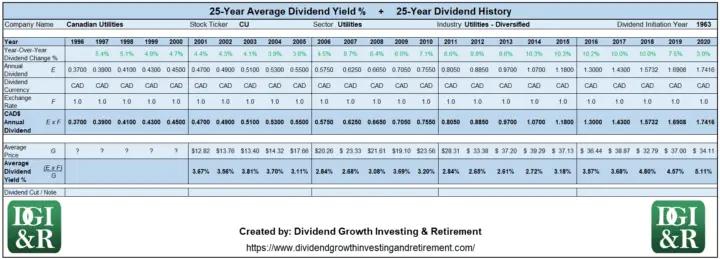

Canadian Utilities – CU

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

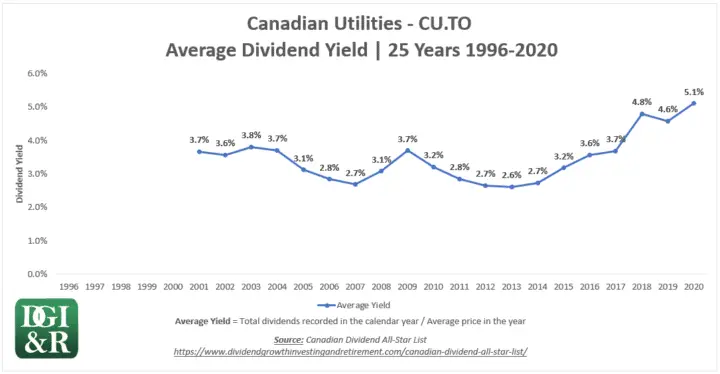

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1963

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- Longest dividend growth streak in Canada.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

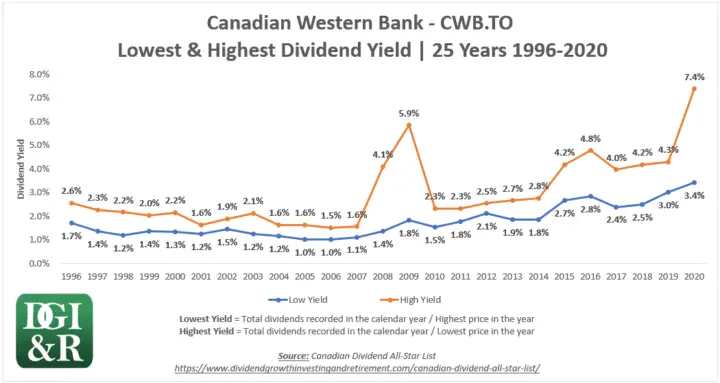

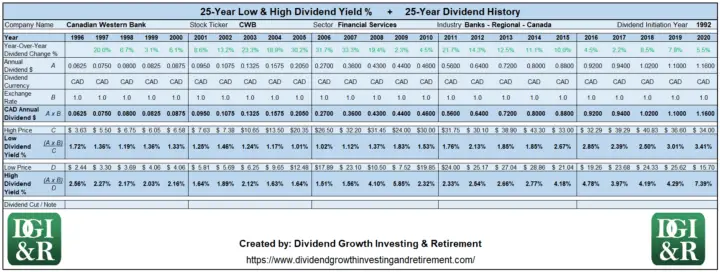

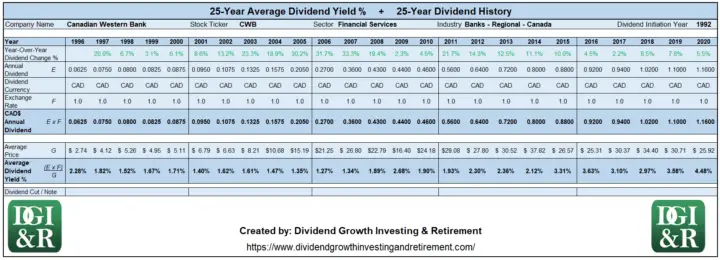

Canadian Western Bank – CWB

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

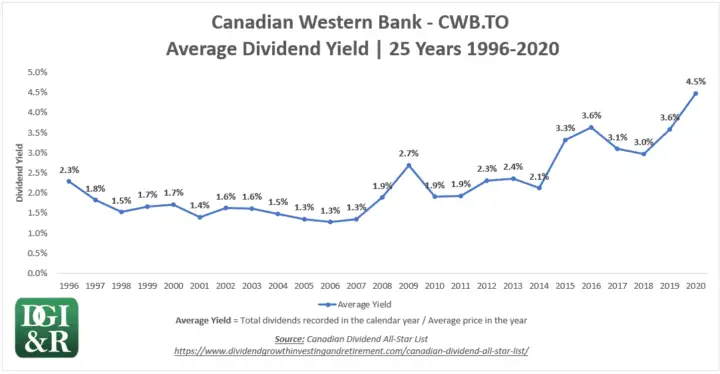

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.

Dividend Initiation Year & Dividend Cut History

Dividend Initiation Year:

- 1992

Dividend Cut History:

- None

Important reminder: Because I use a “good enough” calculation for the dividend yields shown in the charts, dividend cut years can show a significantly inflated/higher dividend yield than the correct yield.

Jump back to the explanation here: Problem #2 Dividend Cuts Can Inflate The Dividend Yield Shown For That Year

Dividend Notes

- The dividend policy was amended to be semi-annual instead of annual during the third quarter of fiscal 1999. The dividend rate for fiscal 1999 appears unusually high on the annual report as it includes the last annual dividend of $0.32 per share paid in the first quarter and the first semi-annual dividend of $0.16 paid in the third quarter.

Click a Stock Ticker to Jump to Other Dividend Yield Charts: ACO.X, ADW.A, AEM, AP.UN, AQN, ATD.B, BAD, BAM.A, BCE, BEP.UN, BIP.UN, BMO, BNS, BPY.UN, BYD, CAR.UN, CCA, CCL.B, CGI, CGO, CM, CNQ, CNR, CP, CPX, CRT.UN, CSH.UN, CTC.A, CU, CWB, DOL, EIF, EMA, EMP.A, ENB, ENGH, EQB, FCD.UN, FN, FNV, FRO.UN, FSV, FTS, FTT, GCG.A, GRT.UN, GSY, GWO, GWR, H, HDI, IAG, IFC, IIP.UN, IMO, INE, KEY, L, LGT.B, MAL, MFC, MFI, MG, MIC, MRG.UN, MRU, NA, ONEX, OTEX, PBH, PFB, PKI, POW, PPL, QBR.B, QSR, RAY.A, RBA, RY, SAP, SGR.UN, SIS, SJ, SLF, SRU.UN, STN, SVI, SYZ, T, TCL.A, TCS, TD, TFII, TIH, TRI, TRP, UFC, WBR, WCN, WN, X, and XTC.

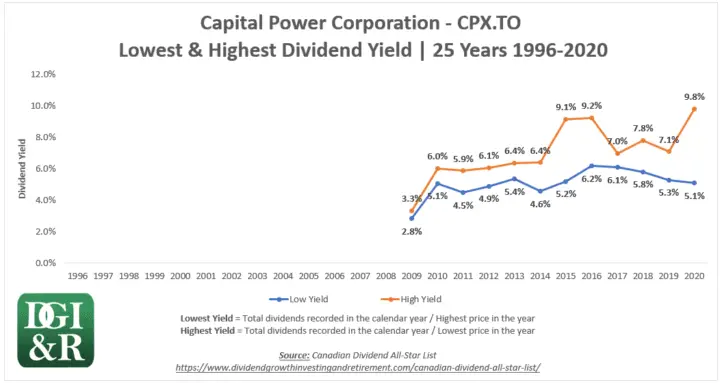

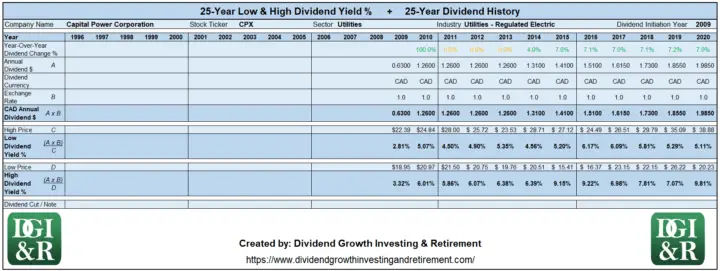

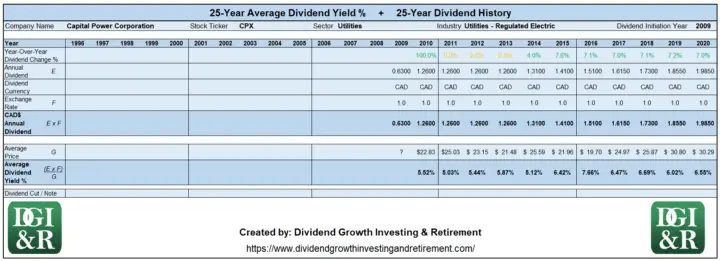

Capital Power Corporation – CPX

High & Low Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This High & Low Dividend Yield Chart

Low & High Dividend Yield Calculations

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Read more here about problems with my “good enough” calculation method.

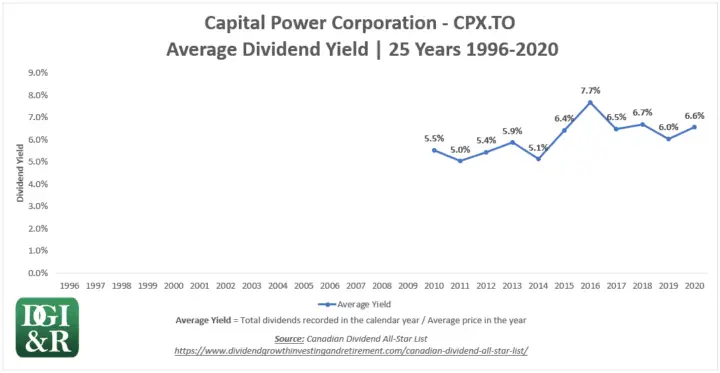

Average Dividend Yield Chart

Source: Canadian Dividend All-Star List

Need help? Jump back to: How To Use This Average Dividend Yield Chart

Average Dividend Yield Calculations

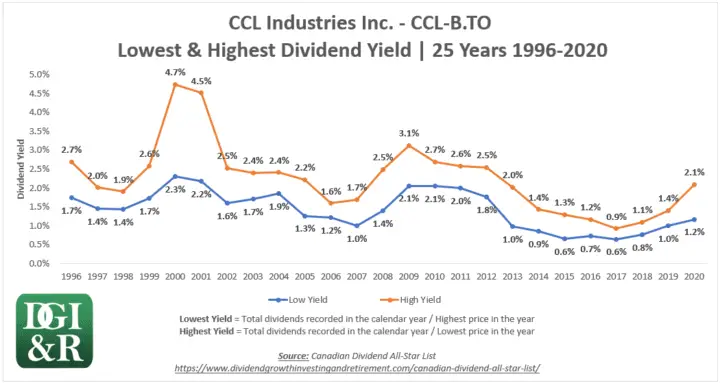

Important reminder: I use a “good enough” calculation for the dividend yields shown above. Jump back to read about problems with my “good enough” calculation method.