Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

I hope everyone is enjoying the Holidays so far. I’ve got about a week off from work and I’m really looking forward to some relaxing time with the family over the Holidays. On the theme of relaxing I thought I would write a cop-out article on my most popular posts in 2016 ;). This is an annual tradition for most bloggers, lol. So without further ado here they are…

Most Popular Page

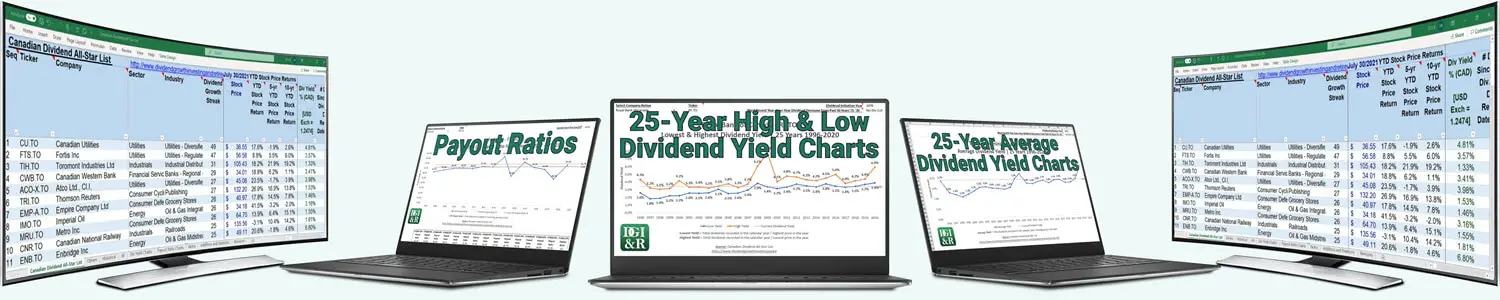

Canadian Dividend All-Star List

The Canadian Dividend All-Star List is a free excel spreadsheet of Canadian companies that have recorded 5 or more years of consecutive dividend increases. The list is updated monthly, contains an abundance of stock information and is used by most as a screening tool for Canadian dividend growth stocks. This page gets more page views than my home page and continues to be the most popular part of my blog. When I first started this blog I thought about what I could do that would add real value to my readers and this was one of the ideas I had. At the time I used (and continue to use) David Fish’s US Dividend Champions list and found it really useful, so I created a similar Canadian spin on David’s list and the Canadian Dividend All-Star List was born.

Over time the list has continued to grow as I added more information. The big updates typically come at the end of the year so if you have suggestions now is the time to speak up 🙂. There is also an extra tab where other dividend paying stocks without the 5 year dividend streak can be added. There isn’t a set criteria for the Others tab, but generally I want the stock to be considered a dividend growth stock. I’d expect the company to have some dividend growth in its past and they shouldn’t have any recent dividend cuts. If you want any companies added to this “Others” tab reply to this post and I’ll consider it when I do my big annual update near the beginning of next year. Please submit your suggestions before December 31st.

2 Most Popular 2016 Articles

Financially Strong Canadian Dividend Growth Stocks & Their Credit Ratings

I went through all the stocks (89 in all) of the May 31, 2016 Canadian Dividend All-Star list + Bank of Montreal [TSE:BMO Trend] and found their lowest credit/debt rating from the four major rating agencies. If they weren’t rated by any of the ratings agencies I used financial strength ratios to determine their financial strength. Using this information I went through and identified stocks that were financially strong, which I consider to be a BBB+ or higher rating. Of the 89 stocks 47 passed.

8 Canadian Dividend Growth Stocks With No Long Term Debt

After doing the research for the “Financially Strong Canadian Dividend Growth Stocks & Their Credit Ratings” article I discovered that there were 8 stocks without long term debt from the original list of 89, so I profiled each of these 8 stocks.

4 Most Popular Oldies, But Goodies (Not written in 2016)

Pros & Cons of a Traditional Dividend Reinvestment Plan (DRIP/DRP) with a Share Purchase Plan (SPP)

In this 2014 article I talk about the advantages (Pros) and disadvantages (Cons) of a traditional DRIP with a SPP. I wanted it to be useful as a starting point for people getting interested in DRIPs, so I tried to include a lot of detail. This resulted in a very long post (over 5,000 words), but because you can jump between the summary and explanations readers still seem to find it useful.

14 Canadian Dividend Growth Companies with Consistently High Earnings Growth

The title says it best. In this 2015 article I went through the Canadian Dividend All-Star list and graded the companies based on high earnings growth and consistency. The results were 14 companies with consistently high earnings growth.

Wide Moat Stocks In The US Dividend Champions List

I wrote this article in 2013, but it’s still useful if you are looking for some US ideas. I used the US Dividend Champions list and Morningstar to identify US companies with a dividend streak of 5 or more years that also had a wide moat (sustainable competitive advantage) rating.

Things to consider before buying a share and enrolling in a dividend reinvestment plan (DRIP)

I started my investing journey into dividend growth stocks with dividend reinvestment plans (DRIPs). In this 2014 article I go over some things that investors should consider before enrolling. DRIPs were a great starting point for me, but they aren’t for everyone, especially now that DIY trading costs for the average Joe have dropped substantially from 2014.

Happy Holidays

I still owe you an article on my $79.41 December 21, 2016 purchase of CVS Health Corporation [CVS: Trend], but that might not get posted until the New Year, so if I don’t talk to until then… Happy Holidays and Happy New Year!

See you in 2017,

DGI&R.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Re: suggestions for the Canadian Dividend All-Star List

It would be nice if you included a column for the “Chowder Rule” number similar to David Fish’s CCC List.

Chowder Rule has now been added.

Marry Christmas to you all from me.

Author: I am unable to post a second comment to a post. I tend to forget this, compose a response, then cannot post it. Don’t know why.

Hmm, I’ll try and look into this. Not sure why it’s doing this.

My son and I are huge fans of your Canadian Divided All-Star list and we love to scour it regularly. The one think that we would find very helpful would be a 5 year (and possibly 10 year) average payout ratio for a company so we could see which way the PO ratio is trending. I have only ever seen a 5 year average on one other site (ca.dividendinvestor.com) and I found it very useful.

Keep up the good work and Happy Holidays.

Payout ratios for the past 10 years were added if the company had a December 31st year end. 1, 3, and 5 year average payout ratios were also added. To calculate this numbers you need EPS, so I left the 10 years of EPS info in the list too. The December 31, 2016 version has this information.

My son and I are big fans of your Canadian Dividend All-Star List and we really appreciate all the work you put into it. I do have one suggestion for your next update……could you add a 5-year (and possibly 10-year) Paid Out Ratio average to help us track the PO ratio trend? I have only seen a 5-year PO average on one other site (ca.dividendinvestor.com) and I have found it very helpful.

Wishing you a happy and healthy Holiday season,

Mike

Keep up the great work. I love to scan your database for potential new purchases or additions to my current holdings