Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Before I invest a cent of my hard-earned money into a dividend growth stock, I use these 7 dividend growth investing resources for every new investment.

I wanted this list to be valuable, so to make it onto the list:

- It had to be a resource that I always use when researching or investing in dividend growth stocks, and

- If there is a way to access the resource for free, I share it. As a result, I show you how to access all 7 dividend growth investing resources for free.

#1 – Value Line – The Best One-Page Reports Out There

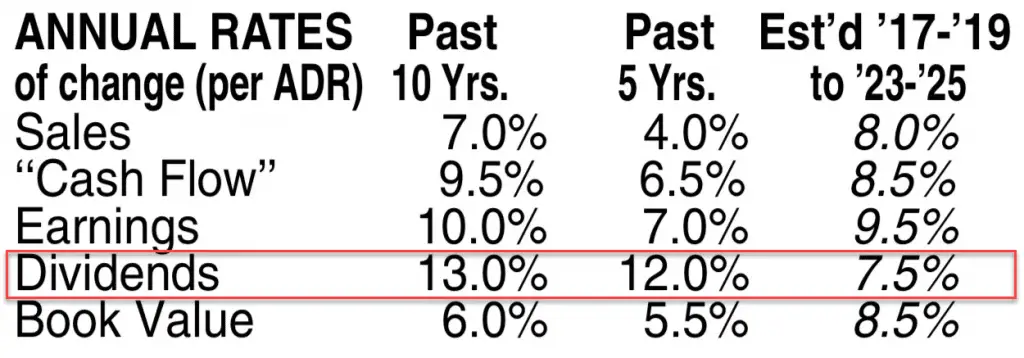

Value Line does many things well, but what I find most useful is their one-page company summaries, which include:

- 17 years worth of concise historical data.

- 3-5 year future growth rate estimates for Sales, Cash Flow, Earnings, Dividends, and Book Value.

- Rankings for Safety, Technicals, and Timeliness.

- A Financial Strength grade, and indexes of Price Stability, Price Growth Persistence, and Earnings Predictability.

- Total Return Projections

- The list goes on …

Here’s a Value Line sample report that also contains explanations of all the different sections in the report.

Download the August 2013 Johnson & Johnson (NYSE:JNJ) sample PDF report here.

I review the whole report, but there are two areas I always look at:

- Dividend growth estimates, and

- Financial Strength.

Dividend Growth Estimates

There are very few resources that provide a long term estimate of dividend growth, so I always see what Value Line is estimating for future dividend growth.

Financial Strength Grades

Before I invest in a stock I want to make sure the company is financially strong. With Value Line I want a Financial Strength of at least B+, but most of my investments end up with higher grades.

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

How to get it free

Hint: it’s the next resource …

#2 – The Library

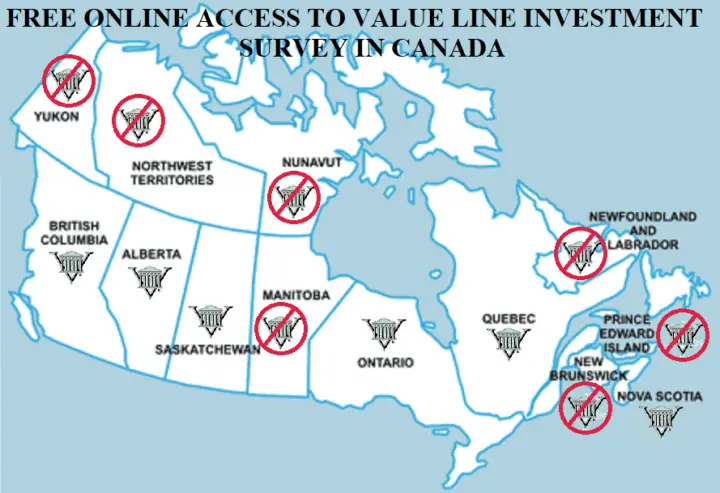

The 2nd of my 7 dividend growth investing resources might surprise you, but this is how I access Value Line for free.

The Value Line investment research services that I get through my library would normally cost me over $500 USD/year. Instead, it’s free, and all I have to do is log in through my library for online access.

For a list of all the libraries in Canada that provide free online access to Value Line, read this article: How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Libraries in larger city centers and business libraries at universities are more likely to have free online access to Value Line. If the library doesn’t have it available online, check to see if they have the paper/print version. Some libraries will keep the paper version of Value Line available for in-library use only.

Libraries aren’t just about getting that book you want to read anymore.

Check the online resources/databases section of your local library and you’ll usually find at least a few business/investment resources.

And of course, I still use the library to borrow books too.

How to get it free

Walk into your local library and ask for a library card!

Or check their website as some allow for online applications where they’ll either mail you a library card or a code to confirm you live locally.

This isn’t really investment-related, but if you have a smartphone and listen to audiobooks or read ebooks, get the free Libby app to use in conjunction with your library account. I’ve been using this app for years and recommend it to all my friends and family.

#3 – Morningstar

Morningstar has a lot of stock information and resources, but I use it regularly for two reasons:

- Moat Ratings (Wide, Narrow, and No-moat), and

- 5-star Fair Value Estimates (5-star = undervalued, 3-star = fair value, 1-star = overvalued).

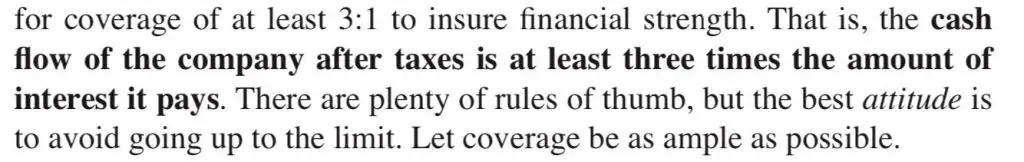

Here’s a screenshot of what a Morningstar report on Royal Bank of Canada (TSE:RY; NYSE:RY) looks like.

Source: February 24, 2021 Morningstar Report on Royal Bank of Canada (TSE:RY)

I want stocks with wide moats (strong sustainable competitive advantages) that are trading on the cheap.

Related article: What is a moat? With 5 Canadian Wide Moat Examples

With Morningstar’s economic moat ratings and fair value estimates I can identify these companies quickly. Plus, they’ll sometimes mention future dividend growth estimates in their analyst write-ups.

Morningstar also has nice 10-year financial summaries (example shown below), that everyone can access on their public website.

Source: http://financials.morningstar.com/ratios/r.html?t=ry®ion=can&culture=en-US

Morningstar seems to try and make these 10-year summaries hard to find, so I usually just adjust the stock ticker in the link address to go to the stock I’m looking for. In the example above we have Royal Bank of Canada which has the “RY” stock ticker (highlighted below). Link would be:

http://financials.morningstar.com/ratios/r.html?t=RY®ion=can&culture=en-US

Say you wanted to look for Atco Ltd which has the ticker “ACO.X” the link would be:

http://financials.morningstar.com/ratios/r.html?t=ACO.X®ion=can&culture=en-US

Or Granite REIT which has a ticker of “GRT.UN” the link would be:

http://financials.morningstar.com/ratios/r.html?t=GRT.UN®ion=can&culture=en-US

You get the idea.

How to get it free

I access Morningstar through my broker for free.

You are unlikely to find Morningstar free at a Canadian library, but if you are in the US, you’ll have better luck. Check libraries in larger US cities. The Seattle Public Library for example provides free online Morningstar access.

For the list of all Canadian brokers that have Morningstar free, read about the next dividend growth investing resource I can’t live without …

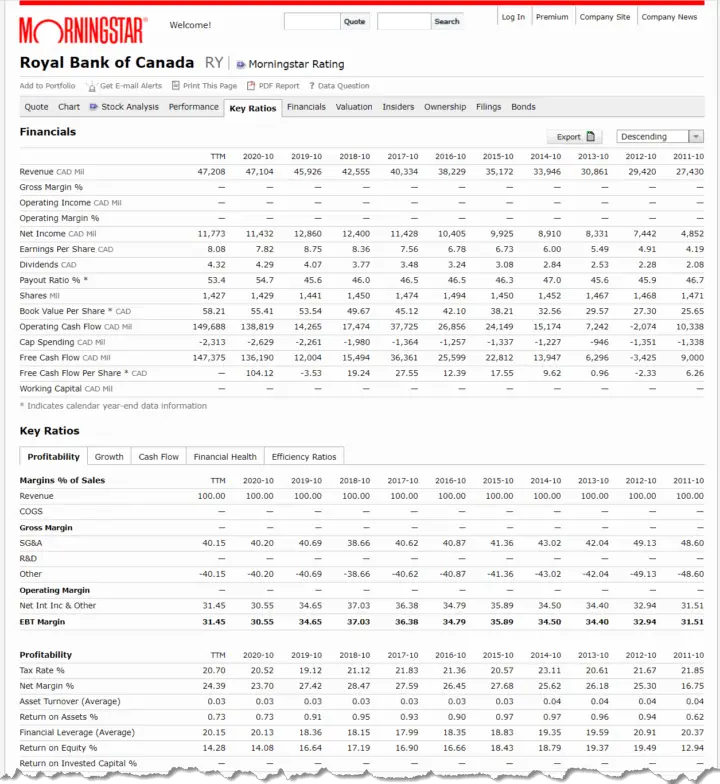

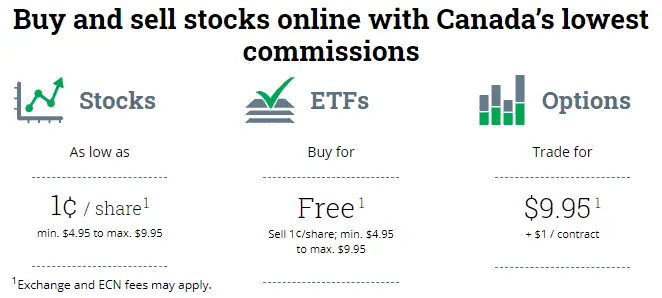

#4 – Questrade – My Broker

I originally chose Questrade because I’m cheap, and I consider them the best low-cost broker in Canada.

Brokers are more than just a cheap way to buy and sell stocks though. The research tools a broker provides are important too.

Questrade used to provide free access to a Morningstar screener that I’d use to find Morningstar 4 & 5 star under-valued stocks. Much to my disappointment, they announced in late December 2020 that they were planning to drop Morningstar. The Morningstar screener is gone now, but you can still access some Morningstar reports.

Login to Questrade >> Go to “Trading” >> Search for the stock you are interested in (RY.TO Royal Bank of Canada example below) >> Scroll down and click on “Reports”. FYI – My Morningstar reports aren’t sorted by date properly so you may have to scroll down to find the more recent reports.

Luckily, my broker, along with many others, provides free access to Morningstar.

Canadian Brokers That Have Morningstar

As far as I can tell these are all Canadian brokers that provide Morningstar as one of their free research tools:

As of March 2021

- BMO InvestorLine

- CIBC Investor’s Edge

- Desjardins Online Brokerage

- HSBC InvestDirect

- National Bank Direct Brokerage

- Qtrade Investor

- Questrade

- RBC Direct Investing

- TD Direct Investing

Canadian brokers that don’t provide free Morningstar research:

- Interactive Brokers Canada – $15 US / month for Morningstar.

- Laurentian Bank Discount Brokerage – No Morningstar access.

- Scotia iTrade – No Morningstar access.

- Virtual Brokers – No Morningstar access.

- Wealthsimple Trade – No Morningstar access.

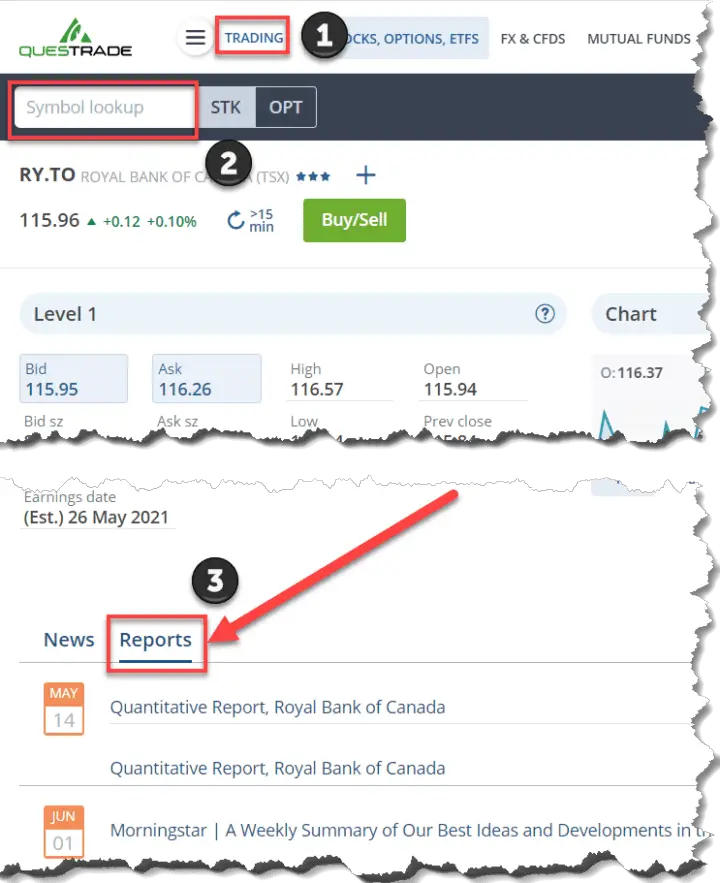

How to get it free

Use this link to open an account for free and start with $50 in free trades.

All brokers with Morningstar research in Canada have trading fees, but with Questrade, you get some of the lowest transaction fees in Canada.

As of March 2021, Questrade still has Morningstar reports, despite announcing in late December 2020 that they were dropping Morningstar. When Questrade finishes upgrading their new research platform, I’m worried that Morningstar might be dropped completely. It’s not clear when the new research platform is coming out, but I’ll update this article when it happens.

With the uncertainty around Morningstar & Questrade, it may be a better idea to try another Canadian broker if you are looking for Morningstar access.

TD Direct Investing seems to always to score well in the research tools section of broker comparisons. Qtrade and Questrade seem to battle each other for the #1 or #2 best overall spot in the broker comparisons I’ve seen.

If Morningstar isn’t important to you, then consider Questrade as it’s one of the cheapest.

#5 – Dividend Lists

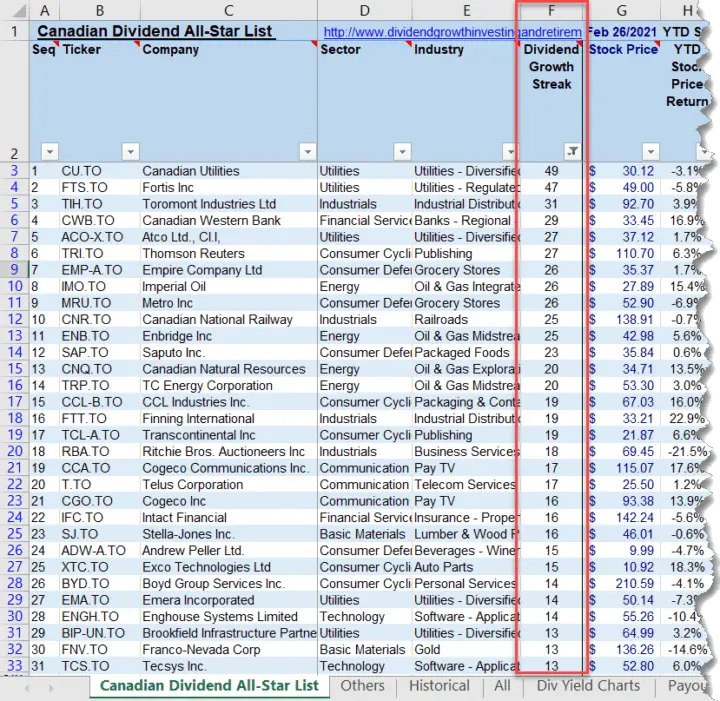

Before I invest I want to know how many years in a row the company has increased its dividend. This is known as the dividend growth streak.

Source: February 28, 2021, Canadian Dividend All-Star List

The minimum dividend growth streak I want is 10 years. I get this information and a lot more from the

- Canadian Dividend All-Star List,

- US Dividend Champions List,

- UK Dividend Champions List, and

- Eurozone Dividend Champions List.

These spreadsheets/lists are a great screening tool for dividend growth stocks because they contain a lot of stock information on companies that have increased their dividend for 5+ years in a row.

How to get it free

I maintain the Canadian Dividend All-Star List (CDASL) which is emailed to my subscribers at the beginning of each month. For free access subscribe below.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

Related article: Canadian Dividend All-Star List: Best Resource to Find High-Quality Canadian Dividend Growth Stocks

Use these links for free spreadsheet downloads of the US Dividend Champions List, UK Dividend Champions List, and Eurozone Dividend Champions List.

#6 – Credit Rating Agencies

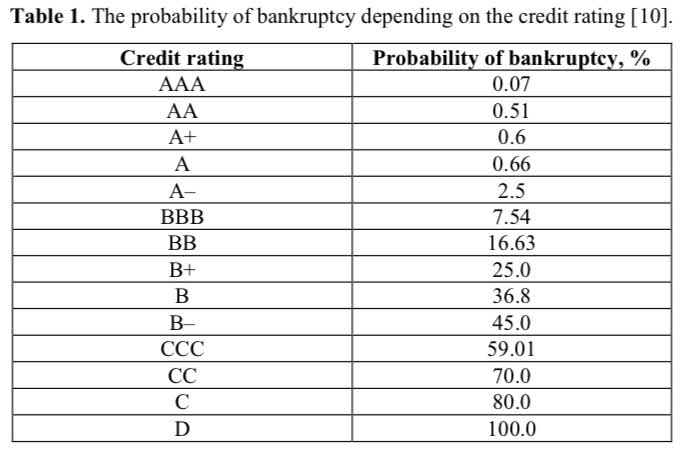

I use credit ratings as a quick way to assess the financial strength of a company.

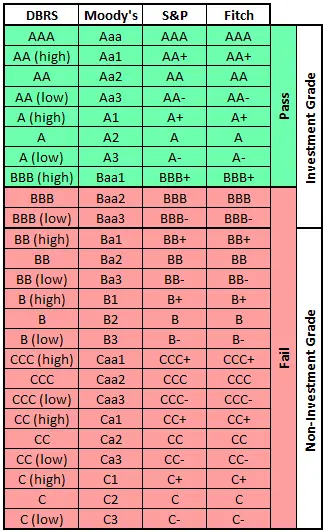

The 4 major rating agencies I use are:

Companies with higher credit ratings make better long-term investments because they are less likely to go bankrupt.

Here are the odds of a company going bankrupt over a 30-year period based on its credit rating:

Source: The algorithms for the environmental finance based on adjusted present value models by Oksana Pirogova, Evgeny Gorin, and Vladimir Plotnikov & A. Zadorozhnaya, Finance and Credit 7, 34-44 (2015)

I need a BBB+ or equivalent rating before I’ll consider investing. The one exception is utility stocks. For utilities, I’ll accept BBB or higher.

How to get it free

If you register/sign-up for a free account with DBRS, Moody’s, and Standard & Poors (S&P) you can access credit ratings for the companies they cover.

With Fitch you don’t need an account, just use their website’s search bar to find the company’s credit rating.

Sometimes you’ll also find credit ratings:

- On the company’s investor relations website under a credit ratings, debt, or bond holders section.

- In the Annual Information Form (AIF) for Canadian listed stocks. AIFs will be on SEDAR and sometimes the company’s website.

- In the Annual Report (AR). Typically you’ll have better luck with the AIF vs. AR for credit ratings.

Most companies are covered by one or more of these rating agencies, but in some cases if the company is small, or if they have very little to no debt they won’t be covered.

#7 – My Favourite Dividend Growth Investing (DGI) Book

My favourite book is The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller

This book is my roadmap to finding strong dividend growth stocks. I have the hardback sitting on my bookshelf and refer back to it often.

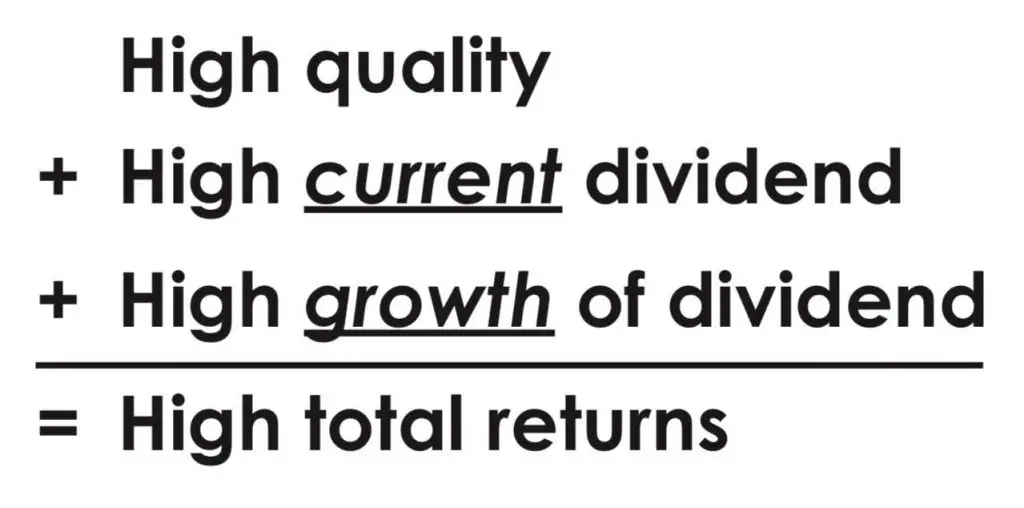

Lowell Miller’s DGI rules, simple to understand formula,

Source: Chapter 4, The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller

and various investment parameters for different industries make it a book that I keep coming back to.

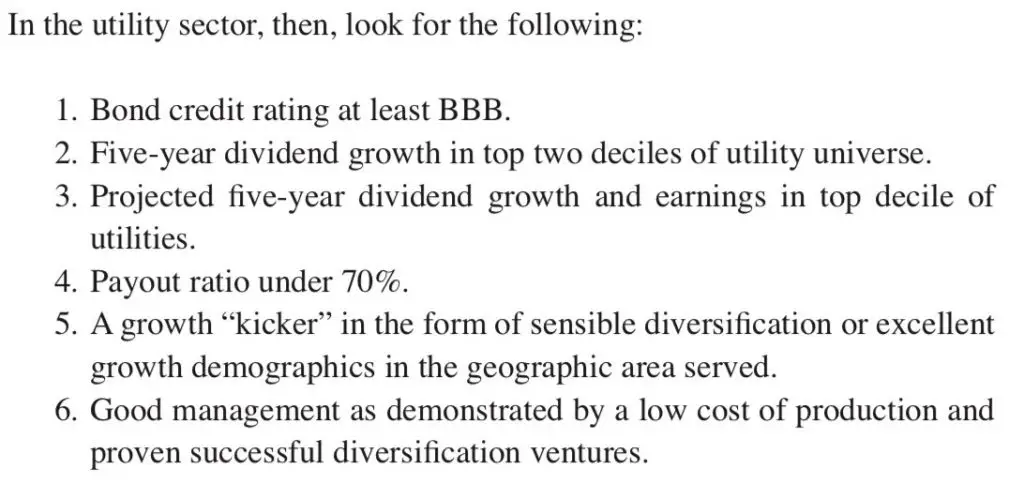

For instance, say I was looking at a utility stock. I just flip to his sector parameters for a refresher.

Source: Appendix B, The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller

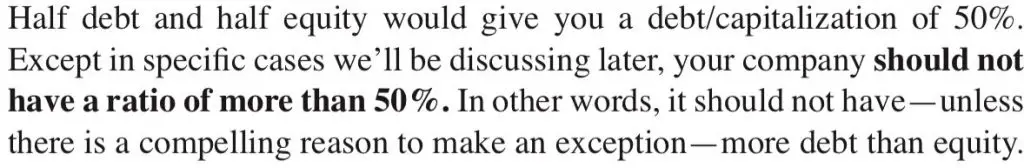

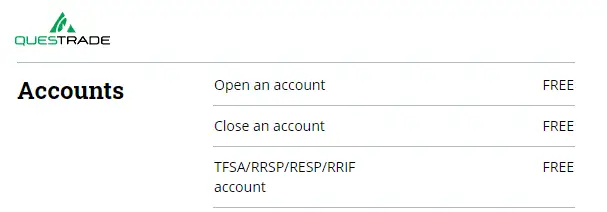

Or say there is a company I want to invest in, but I’m struggling with their financial strength. Value Line and the credit rating agencies don’t cover the stock, so I dig into the financials.

I check the book for a reminder that I want a debt-to-capital ratio of 0.5 or less and a 3:1 or higher coverage ratio.

Source: Chapter 4, The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller

How to get it free

I own the physical book, but Lowell Miller has a free PDF of The Single Best Investment: Creating Wealth with Dividend Growth on his Miller/Howard Investments website.

Summary

Before I invest in a dividend growth stock, I always use these 7 resources:

- Value Line – The Best One-Page Reports Out There

- The Library

- Morningstar

- Questrade – My Broker

- Dividend Lists

- Credit Rating Agencies

- My Favourite Book – The Single Best Investment: Creating Wealth with Dividend Growth

I tried to make this list as useful as possible by only including resources I always use when researching or investing in a dividend growth stock.

In addition, if there was a way to access the resource for free, I shared it. As a result, you should now know how to access all 7 resources for free.

I hope you found my list of must-have dividend growth investing resources useful.

What are the investing resources you can’t live without?

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Wow! You are wonderfully kind with your helpful ideas.

Thanks Bruce!

A real abundance of financial info. Thank you so much.

Thanks Hal!

What a pleasure to have the generous advice. Thank you!

Thanks Ludek!

I’m a recent subscriber and very impressed with the quality information you share for free; really appreciate all of the great tips and advice. I’ve spent a couple of days studying your Canadian Dividend All-Star List. And thanks to you, I just downloaded Miller’s book for free. It’s 285 pages long and the content looks great.

Thanks for the kind words Tony and welcome to DGI&R!

I really try to focus on quality over quantity when I write, so it’s nice to hear it’s working.

Lowell Miller’s book is my favourite investing book so I think you’ll enjoy it. It’s written from a US perspective, but the concepts still apply to Canadians and it’s easy to read unlike some other investing books.

Cheers,

DGI&R

Excellent!. Thank you very much. Please and keep posting.

i like your work so much that i actually like to donate $$ to you annually for doing same.-I think all subscribers should (hint year end not such a bad time to donate!)

Especially like the tip about the library

Thanks so much Glen!

I find all your articles VERY informative, the amount of information and knowledge I have learned about DGI has truely opened my eyes.

Please!!! keep sharing your wisdom.

Thank you

Thanks Patrick!

Thank You for providing excellent, free investing ideas and a great variety of resources!

Thanks for the kind words Mary!

thank you for all your helpful ideas and info, much appreciated!

Thanks Glen!

Great post!

Thanks ????

Looks like Questrade doesn’t support morning star anymore. Which brokerage will you use next? I would hate to have minimum amount at another brokerage just to be able to use the morningstar 😀

Yeah I was disappointed to find this out and also bad timing with my article.

It looks like as of December 18, 2020 they have dropped their Market Intelligence research which is where you got Morningstar access. They are replacing it with something else, but that won’t be released until January 2021. I plan to wait and see what the replacement looks like and then go from there.

QTrade consistently scores high in the broker comparisons and I think TD also always scores high for rea search, but it’s been awhile since I looked at all the Canadian brokers in-depth. I’ll take a more serious look in January/February.

Any recommendations?

Cheers,

DGI&R

Thank you for your great articles. I recently could access to the value line using a library account, but I can’t find those one-page reports on the website. could you please help how we can access the one-page reports on the website?

Look for the PDFs in the top right of the individual stock pages. Here is a screenshot with Fortis FTS.TO:

Cheers,

DGI&R