Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

A good investment strategy requires a long-term mindset => a long-term mindset needs high-quality companies => high-quality companies are wide moat stocks.

How do you find wide moat stocks?

Wide moat stocks are high-quality companies that can maintain competitive advantages for decades. If you are looking for a first-rate company to invest in, wide moat stocks are a natural starting point.

So… how do we uncover these top of the line companies?

3 Ways to Find Wide Moat Stocks

- Morningstar Research (+ How to get free access)

- Wide Moat ETFs

- Wide Moat Articles from Dividend Growth Investing & Retirement

1. Morningstar Moat Ratings

To quickly identify wide moat stocks I use Morningstar.

You can see in this Royal Bank of Canada (TSE:RY; NYSE:RY) example that the moat rating is easy to find in Morningstar’s analysis summary.

Morningstar, along with moat ratings, provides a variety of investment research and investment management services.

They provide economic moat ratings of wide, narrow, or no-moat for stocks they cover.

The wide, narrow and no-moat ratings reflect how sustainable a competitive advantage is.

In other words, how long will this competitive advantage last?

Wide moat = +20 years

Narrow moat = 10-19 years

No-moat = 0-9 years

How To Get Free Access To Morningstar Research

The easiest way is to check your online discount broker. Failing that, try the library.

I use Questrade (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada), which has free access to Morningstar research.

Most other online brokers in Canada provide free access to Morningstar stock reports too.

Canadian Brokers That Have Morningstar

As far as I can tell these are all Canadian brokers that provide Morningstar as one of their free research tools:

As of November 2020

- BMO InvestorLine

- CIBC Investor’s Edge

- Desjardins Online Brokerage

- HSBC InvestDirect

- National Bank Direct Brokerage

- Qtrade Investor

- Questrade

- RBC Direct Investing

- TD Direct Investing

Canadian brokers that don’t provide free Morningstar research:

- Interactive Brokers Canada – $15 US/month for Morningstar.

- Laurentian Bank Discount Brokerage – No Morningstar access.

- Scotia iTrade – No Morningstar access.

- Virtual Brokers – No Morningstar access.

- Wealthsimple Trade – No Morningstar access.

Check your library

If your broker doesn’t provide access to Morningstar and you happen to be in business school, check the university library. A lot of business school libraries in Canada and the US provide free access to their students.

If you are in the US, check your public library’s “Databases and online research tools” as some (more common in larger cities) also provide free Morningstar access.

Canadian public libraries, even in the bigger cities, likely won’t have Morningstar.

2. Check the holdings of wide moat indexes/ETFs to find undervalued wide moat stocks.

Because there aren’t that many Canadian wide moat stocks there isn’t an index that tracks only Canadian wide moat stocks.

You will find some Canadian wide moat stocks in the GOAT and MOTI ETFs below though:

The links below are geared towards US investors. After you click the link they may ask you which country you are from. If they do, select US. If you don’t select US, the 3 links below might not work.

- GOAT – Morningstar Global Wide Moat ETF Holdings – Global (including Canada and US) undervalued wide moat stocks

- MOTI – Morningstar International Moat ETF Holdings – Global (excludes US, includes Canada) undervalued wide moat stocks

- MOAT – Morningstar Wide Moat ETF Holdings – US undervalued wide moat stocks

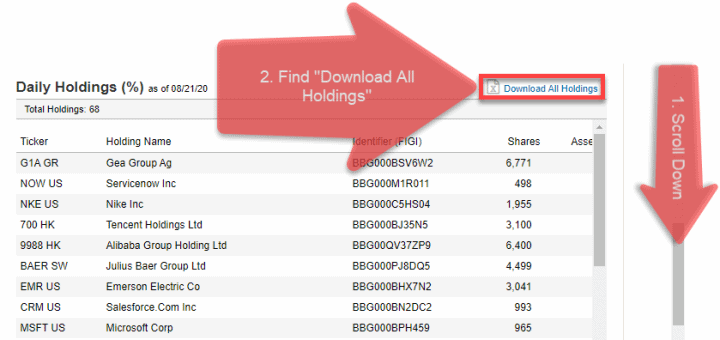

Look for the “Download All Holdings” link to get a spreadsheet of all the current holdings.

All the holdings in these ETFs will be undervalued wide moat stocks.

3. Wide Moat Articles from Dividend Growth Investing & Retirement

Just want a list of all the wide moat stocks?

Check out my other wide moat list articles:

- Each & Every Wide Moat Stock in Canada

- Every Wide Moat Stock in the USA

- International Wide Moat Stocks – Every Single One Listed

- 8 Canadian Wide Moat Dividend Growth Stocks

- 76 US Wide Moat Dividend Growth Stocks

- 23 International Wide Moat Dividend Growth Stocks

- 100 Canadian Narrow Moat Stocks

- 44 Canadian Wide & Narrow Moat Dividend Growth Stocks

Please keep in mind that I only plan to update these lists about once a year so remember to check the updated date in these articles.

Because wide moats are meant to be sustainable for 20+ years most of the information in these articles will still be relevant even with only annual updates.

If you want to learn more about what a moat is check out the articles:

Summary

When hunting for high-quality companies to invest in, wide moat stocks are a natural starting point.

Here are 3 ways to find these elite companies:

#1 Use Morningstar

To identify wide moat stocks I use Morningstar which provides moat ratings for stocks.

Check your broker, as most Canadian brokers provide free access to Morningstar research. Failing that, check the library as some provide free online access to Morningstar too.

#2 Check the holdings of wide moat ETFs like MOAT, GOAT, and MOTI for US, Canadian and international undervalued wide moat stocks.

#3 Read Dividend Growth Investing & Retirement wide moat articles for full lists of all the Canadian, US, and International wide moat stocks.

Hope you enjoyed the article and good luck on your search for these high-quality wide moat companies.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

Thanks for this information. I know in previous articles you referred to a wide moat quantitative rating vs. a wide moat rating made by an analyst. How can you tell the difference?

Morningstar makes it pretty clear on their own website. A lot of people access through their broker (I’m assuming this will be your case too), so it depends what type of Morningstar research your broker provides. Often brokers will just have the morningstar analyst reports/ratings, and don’t provide the quantitative ones. If it’s not obvious then I’d assume it’s an analyst rating. Also look out for a “Q” beside ratings, this is an indication it’s a quantitative rating.