Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“The serious investor knows that among the many signposts that point to corporate and investment growth, a rising dividend trend is perhaps the most significant.”

Source: Geraldine Weiss/Janet Lowe, Dividends Don’t Lie (AL), Chapter 6

This month there were 6 dividend increases with the largest increase coming from Canadian National Railway (CNR.TO) at 18.1%.

January 2019 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Canadian National Railway (CNR.TO) – 18.1% Dividend Increase

- Metro Inc (MRU.TO) – 11.1% Dividend Increase

- Atco Ltd. (ACO-X.TO) – 7.5% Dividend Increase

- Canadian Utilities (CU.TO) – 7.5% Dividend Increase

- Exco Technologies Ltd (XTC.TO) – 5.9% Dividend Increase

- Richelieu Hardware Ltd. (RCH.TO) – 5.5% Dividend Increase

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it has come to be one of the most popular resources of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

1. Canadian National Railway (CNR.TO) – 18.1% Dividend Increase

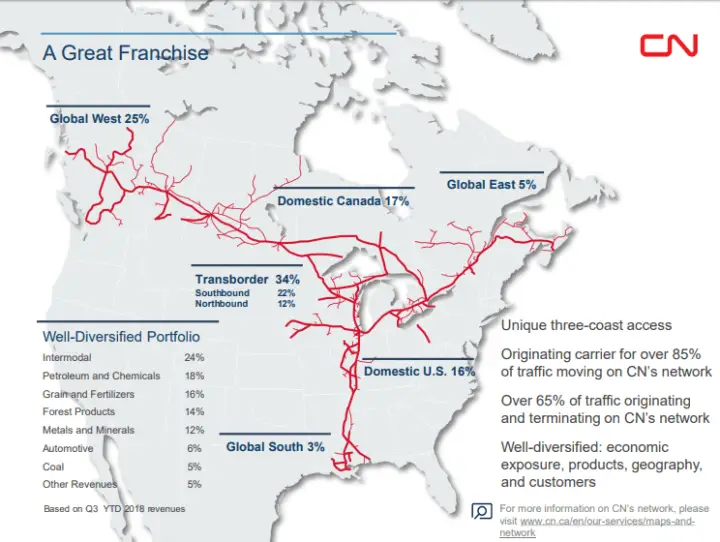

Canadian National Railway operates Canada’s largest railroad system with approximately 20,000 route miles spanning Canada and mid-America, uniquely connecting three coasts: the Atlantic, the Pacific and the Gulf of Mexico, and serving the cities and ports of Vancouver, Prince Rupert (British Columbia), Montreal, Halifax, New Orleans, and Mobile (Alabama), and the metropolitan areas of Toronto, Edmonton, Winnipeg, Calgary, Chicago, Memphis, Detroit, Duluth (Minnesota)/Superior (Wisconsin), and Jackson (Mississippi), with connections to all points in North America.

Source: December 2018 Investor Presentation

Canadian National Railway Dividends & Future Dividend Growth

Canadian National Railway which has a dividend streak of 23 years recently increased their quarterly dividend 18.1% from $0.4550 CAD to $0.5375 CAD. This dividend increase comes into effect with the dividend recorded on Mar 08, 2019.

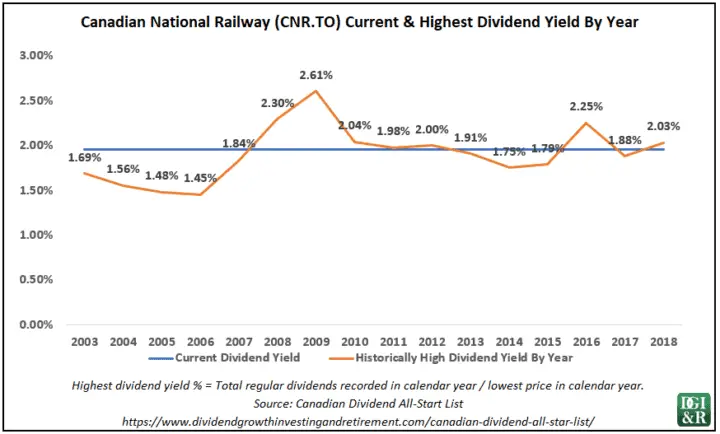

The dividend yield as of January 31, 2019, was 2.0%, and they have 5 and 10-year average annual dividend growth rates of 16.2% and 14.7% respectively.

I think of CN Rail as a low yield, high dividend growth stock.

Source: December 2018 Investor Presentation

Canadian National Railway’s target payout ratio is 35% of adjusted net income. The current payout ratio is around this already so I’d expect future dividend growth to be similar to future earnings growth.

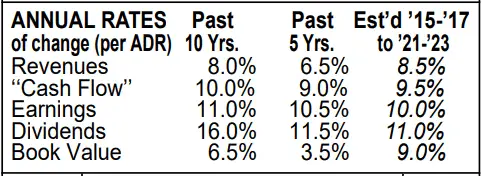

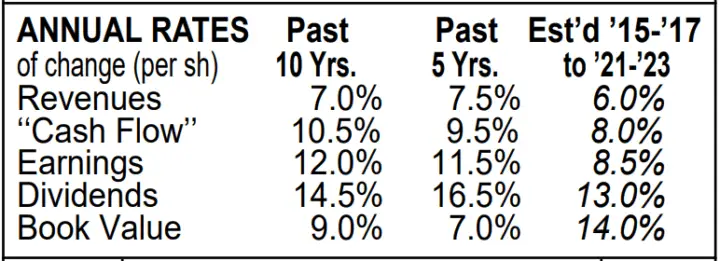

Value Line is estimating 11% annual dividend growth over the next 3-5 years with 10% earnings growth.

Source: Canadian National Railway (NYSE:CNI) November 23, 2018 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

The Value Line dividend growth estimate may even be a bit on the conservative side when you factor in this most recent 18% dividend increase and 5 and 10-year average dividend growth rates around +15%. Time will tell…

Canadian National Railway Financial Strength & Valuation

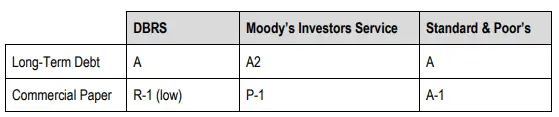

CN Rail has good financial strength. Value Line gives them an “A” rating for financial strength and they have “A” or equivalent credit ratings from 3 rating agencies.

Source: 2017 Annual Information Form

Using the dividend yield as a valuation tool suggests that CN Rail is around fair value or maybe slightly undervalued. This is typically a low yielding stock, so a high yield for CN Rail is +2%.

One thing to keep in mind when using dividend yield as a valuation tool is that for lower yielding companies it is usually less reliable. This is why it’s good practice to look at a variety of different valuation metrics.

Morningstar rates them a wide moat stock with a three-star valuation as they are currently trading around their fair value estimate of $104 CAD.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade (AL) which has free access to Morningstar research.

Canadian National Railway Final Thoughts

I like Canadian National Railway and it’s a stock I’d like to own one day, but there are two things holding me back right now: valuation and low dividend yield.

The rest is all good: Long dividend streak, good dividend growth history, strong financial strength, and a wide moat.

I’ll start to reconsider them if they get closer to a 2.5% dividend yield.

[Back to Table of Contents] [Jump to Summary]

2. Metro Inc (MRU.TO) – 11.1% Dividend Increase

METRO is one of Canada’s largest grocery and drugstore operators in Québec and Ontario. They have a network of more than 600 food stores operating under several banners including Metro, Metro Plus, Super C and Food Basics, as well as of more than 650 drugstores operating primarily under the Jean Coutu, Brunet, Metro Pharmacy and Drug Basics banners.

Metro Dividends & Future Dividend Growth

Metro Inc which has a dividend streak of 24 years recently increased their quarterly dividend 11.1% from $0.1800 CAD to $0.2000 CAD. This dividend increase comes into effect with the dividend recorded on Feb 14, 2019.

The dividend yield as of January 31, 2019, was 1.7%, and they have 5 and 10-year average annual dividend growth rates of 16.7% and 16.0% respectively.

“The board of directors of the Corporation maintains its dividend policy aimed at offering an annual dividend that represents 20% to 30% of the preceding financial year’s adjusted net earnings with a target payout of 25%.”

Source: 2018 Annual Information Form

Metro’s target payout ratio is 25%. The current payout ratio is around this already so I’d expect future dividend growth to be similar to future earnings growth.

Value Line is estimating 13% annual dividend growth over the next 3-5 years with 8.5% earnings growth.

Source: January 18, 2019 Metro Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Metro Financial Strength & Valuation

Value Line gives Metro a “B++” rating for financial strength. They have BBB ratings from both S&P and DBRS which is one notch below the BBB+ or equivalent I typically like to see.

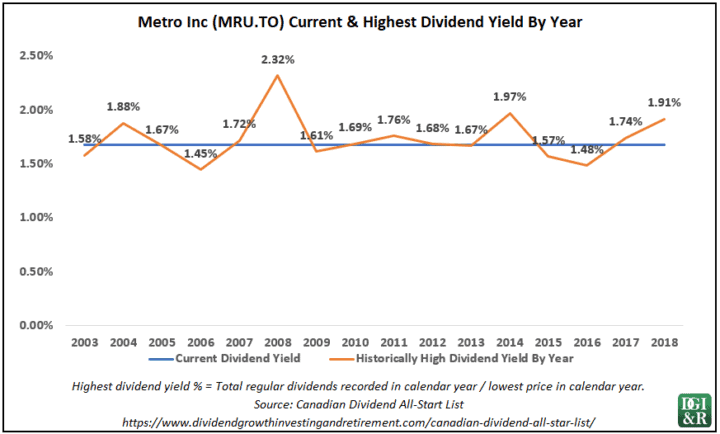

Looking at Metro’s historic yield, a +2% yield would be considered high.

Morningstar rates them a no-moat stock with a two-star valuation as they are currently trading above their fair value estimate of $37 CAD.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Metro Final Thoughts

Metro has a long dividend streak at 24 years and a history of high dividend growth, but they are not a company I’m currently interested in.

They have no moat, a low dividend yield, credit ratings one notch too low for me at BBB, and appear slightly over-valued.

Normally I like to see a higher yield around 4% before investing. I will consider lower yielding companies, but they should be very high quality. With a no-moat rating from Morningstar and BBB credit ratings I don’t consider them to be the type of high-quality company I look for.

[Back to Table of Contents] [Jump to Summary]

3. Atco Ltd. (ACO-X.TO) – 7.5% Dividend Increase

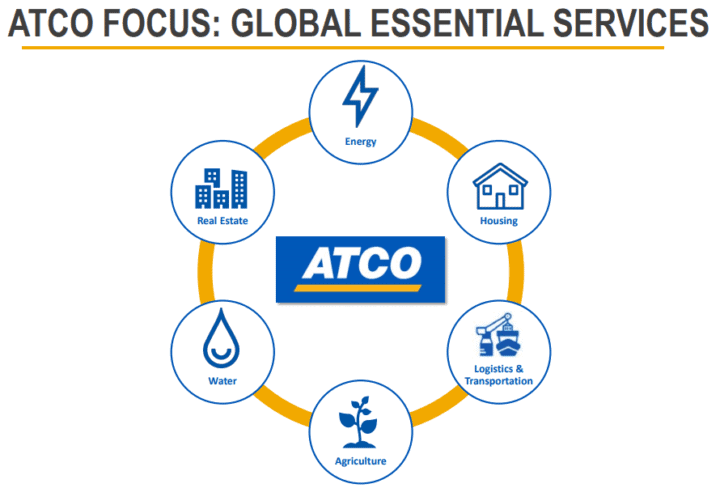

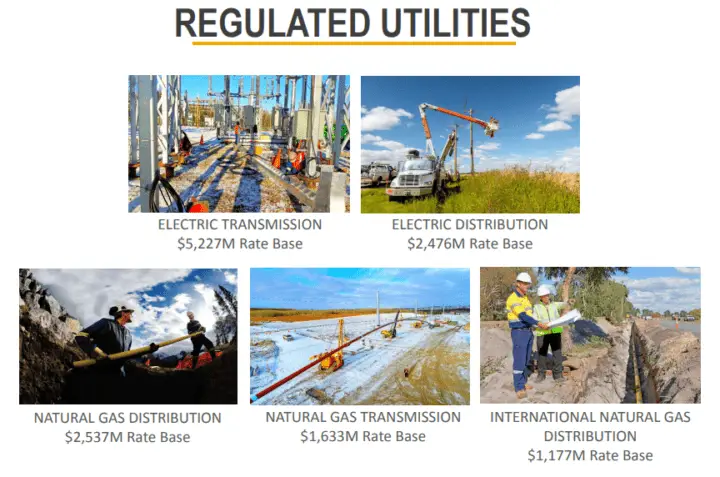

Based in Alberta, ATCO is a diversified global holding corporation with investments in:

- Structures & Logistics (workforce housing, innovative modular facilities, construction, site support services, and logistics and operations management);

- Energy Infrastructure (electricity generation, transmission, and distribution; natural gas transmission, distribution and infrastructure development; energy storage and industrial water solutions; and electricity and natural gas retail sales);

- Transportation (ports and transportation logistics); and

- Commercial Real Estate.

Source: ATCO January 2019 Investor Presentation

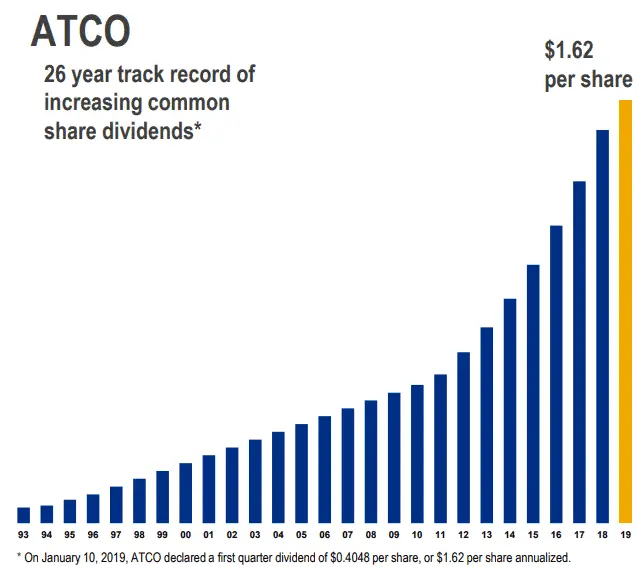

Atco Dividends

Atco Ltd., which has a dividend streak of 25 years recently increased their quarterly dividend 7.5% from $0.3766 CAD to $0.4048 CAD. This dividend increase comes into effect with the dividend recorded on Mar 07, 2019.

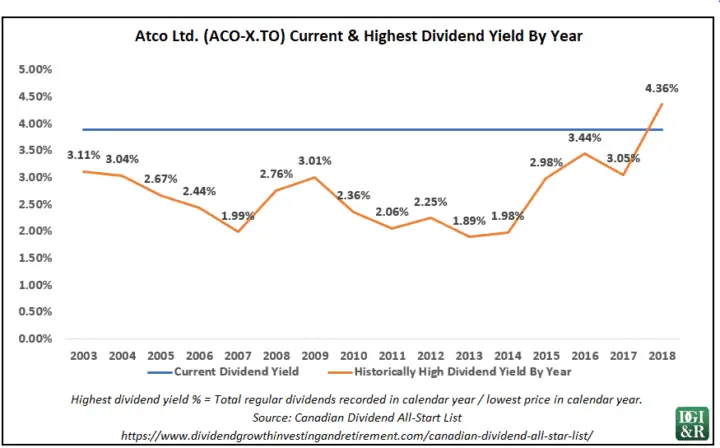

The dividend yield as of January 31, 2019, was 3.9%, and they have 5 and 10-year average annual dividend growth rates of 15.0% and 12.4% respectively.

Source: ATCO January 2019 Investor Presentation

Atco has a strong history of high dividend growth. Prior to this most recent increase, they had been doing roughly 15% increases for the past 7 years in a row. Looking back over this period, their payout ratio was quite a bit lower (low 20’s) and then in 2015 and on it started creeping up.

Source: Morningstar

The payout ratio based on the $3.02 EPS estimate for the next 12 months is 54%. This is reasonable as I’ll usually look for 60% or less and will go up to 70% for utilities where earnings are usually a bit more predictable.

Because the payout ratio is higher than it used to be, I’m not expecting the same level of high dividend growth that Atco gave during the past decade. I’m still expecting decent dividend growth, just not 15% like it used to. I’d expect future dividend growth to be more in-line with EPS growth.

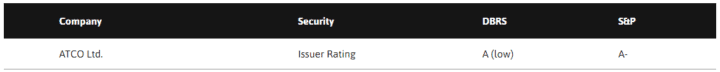

Atco Financial Strength & Valuation

Atco has good financial strength with credit ratings of A- or equivalent from S&P and DBRS.

Source: https://www.atco.com/en-ca/about-us/investors/credit-ratings.html

Using the dividend yield as a valuation tool suggests that Atco could be undervalued as the current yield of 3.9% is high for the company.

Atco Final Thoughts

Atco offers a decent yield, good credit ratings/financial strength, a long dividend streak of 25 years (4th longest in Canada), a history of strong dividend growth, and it appears undervalued.

Yes, the recent 7.5% dividend increase is lower than the roughly 15% per year they’d been doing for the past 7 years, but it’s still good. I think this recent dividend increase is a signal that dividend growth will still be good, but not at the high levels that investors were previously used to.

All-in-all, I think Atco is a worthy dividend growth consideration which is why I bought shares of Atco in September 2018 at $37.00 when the dividend yield was around 4.1%.

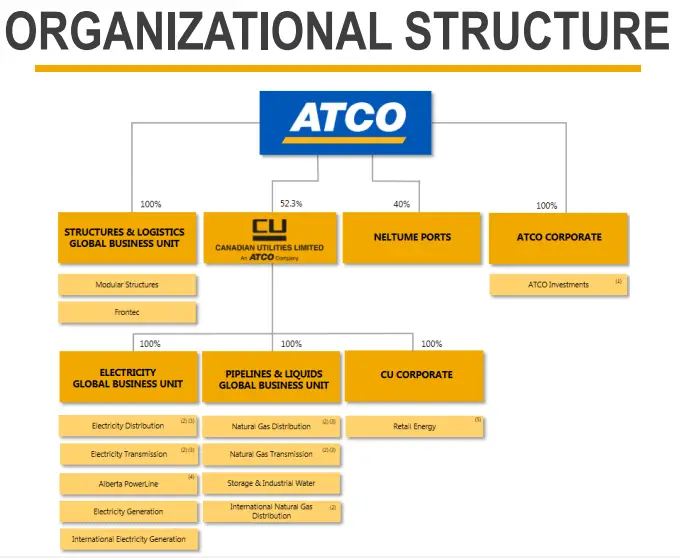

Because Atco owns a bit more than half of Canadian Utilities (CU.TO) investors sometimes pick Canadian Utilities to invest in vs. Atco. Canadian Utilities is more a pure-play utility company and has traditionally offered a higher dividend yield, but slower (but still good) dividend growth compared to Atco. I personally own both.

Disclosure: I own shares of Atco (ACO-X.TO) and Canadian Utilities (CU.TO).

[Back to Table of Contents] [Jump to Summary]

4. Canadian Utilities (CU.TO) – 7.5% Dividend Increase

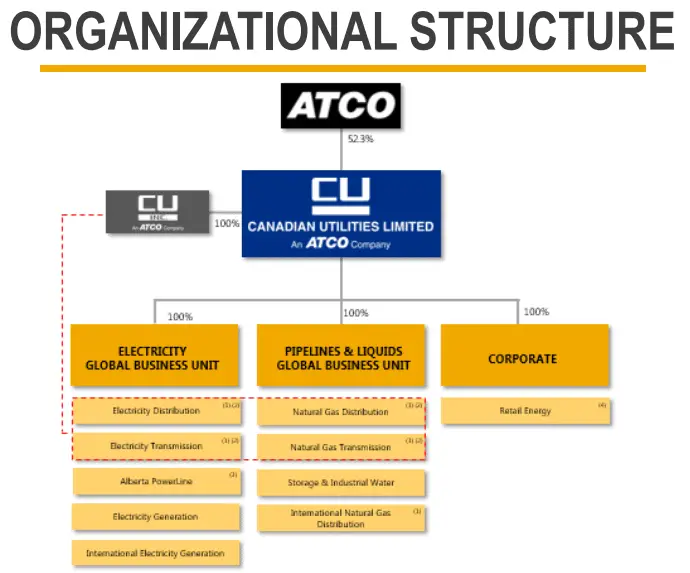

Canadian Utilities Limited is a diversified utility that has two main business units: Pipelines & Liquids and Electricity. Almost all of its earnings are regulated and it has the longest dividend streak (47 years) of any company listed on the Toronto Stock Exchange.

Source: ATCO January 2019 Investor Presentation

Canadian Utilities Dividends

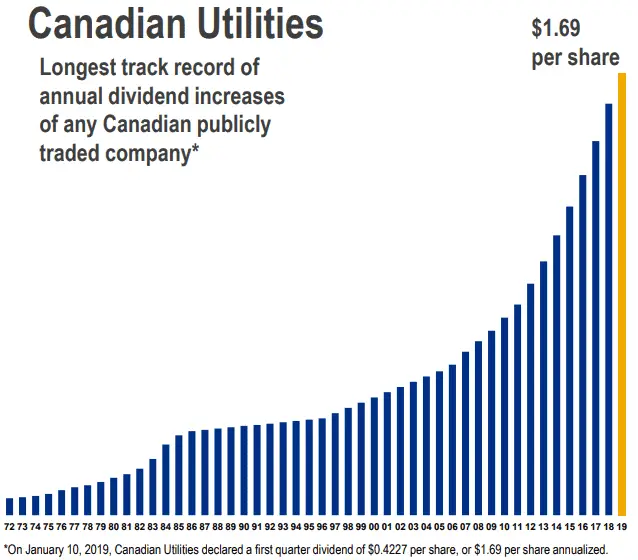

Canadian Utilities, which has a dividend streak of 47 years recently, increased their quarterly dividend 7.5% from $0.3933 CAD to $0.4227 CAD. This dividend increase comes into effect with the dividend recorded on Feb 07, 2019.

The dividend yield as of January 31, 2019, was 5.0%, and they have 5 and 10-year average annual dividend growth rates of 10.2% and 9.0% respectively.

Source: ATCO January 2019 Investor Presentation

From a dividend growth standpoint, there is a lot to like about the company. It has a 5 and 10-year dividend growth rates of 10.2% and 9.0% and the longest dividend streak for a Canadian listed company (47 years).

Prior to this most recent increase, they had been doing roughly 10% increases for the past 7 years in a row, so this recent 7.5% increase is not the norm.

A word of caution is that their payout ratio has been creeping up over the years. The payout ratio based on the $2.24 EPS estimate for the next 12 months is 75%. This is a bit above the 70% or less threshold I like to see for utilities.

Because the payout ratio is higher than it used to be, I’m not expecting the same level of high dividend growth that Canadian Utilities gave during the past decade. I’m still expecting OK dividend growth, just not 10% like it used to.

Whenever you have a payout ratio that is a bit above your threshold it’s good practice to also look at the companies financial strength as this also plays an important part in dividend safety analysis.

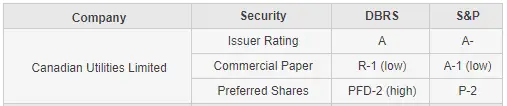

Canadian Utilities Financial Strength & Valuation

Canadian Utilities has good financial strength with credit ratings of A and A- from DBRS and S&P.

Source: http://www.canadianutilities.com/Investors/Credit-Ratings

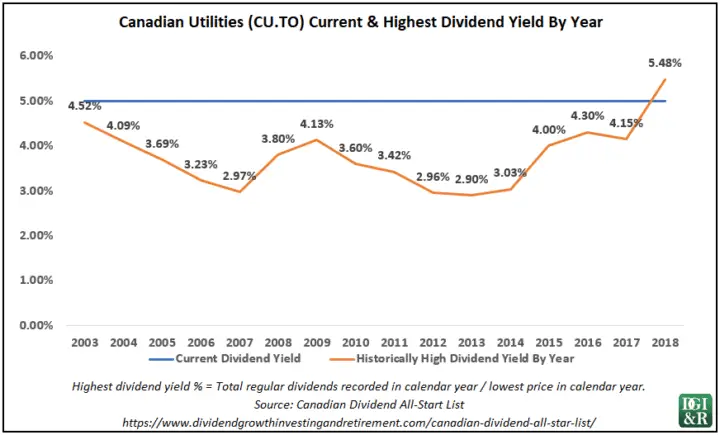

It is also currently yielding 5.0%, which historically is very high for the company. This suggests the stock could be undervalued.

Canadian Utilities Final Thoughts

All-in-all I like Canadian Utilities which is why I bought shares back in 2015 at $30 per share and more recently I added to my position at $32.90 in May 2018.

Canadian Utilities offers a decent yield, good credit ratings/financial strength, a long dividend streak of 47 years (Longest in Canada), a history of strong dividend growth, and it appears undervalued. My one word of caution is the highish payout ratio of 75%.

Yes, the recent 7.5% dividend increase is lower than the roughly 10% per year they’d been doing for the past 7 years, but it’s still good. I think this recent dividend increase and the 75% payout ratio are signalling that dividend growth will still be OK to good, but not at the high levels that investors were previously used to.

If you are looking for a way to invest in Canadian Utilities with a lower payout ratio, take a look at Atco (ACO-X.TO) which has a payout ratio around 54%, but also lower dividend yield at 3.9%. Atco is a holding company that owns a bit more than half of Canadian Utilities (CU.TO) along with some other investments.

Canadian Utilities is more a pure-play utility company and has traditionally offered a higher dividend yield, but slower (but still good) dividend growth compared to Atco. I personally own both.

Disclosure: I own shares of Canadian Utilities (CU.TO) and Atco (ACO-X.TO).

[Back to Table of Contents] [Jump to Summary]

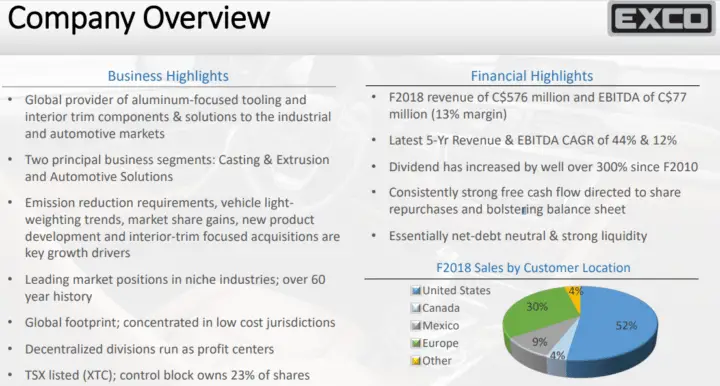

5. Exco Technologies Ltd (XTC.TO) – 5.9% Dividend Increase

Exco Technologies Ltd is a global designer, developer and manufacturer of dies, moulds, equipment, components and assemblies to the die-cast, extrusion and automotive industries. They operate with three business groups: Automotive Solutions, Extrusion Tooling Solutions and Die Cast Solutions.

- The Die Casting and Extrusion Technology groups design, develop and manufacture die-casting and extrusion tooling and equipment. Operations are based in Canada, U.S., Mexico, Colombia, Brazil and Thailand and primarily serve automotive and industrial markets throughout the world.

- The Automotive Solutions Group designs, develops and manufactures automotive interior trim components and assemblies primarily for passenger and light truck vehicles. Our facilities are located in Canada, U.S., Mexico, Morocco and Bulgaria and supply the North American, European and Asian markets.

Source: November 2018 Investor Presentation

Exco Technologies Dividends

Exco Technologies Ltd which has a dividend streak of 13 years recently increased their quarterly dividend 5.9% from $0.0850 CAD to $0.0900 CAD. This dividend increase comes into effect with the dividend recorded on Mar 15, 2019.

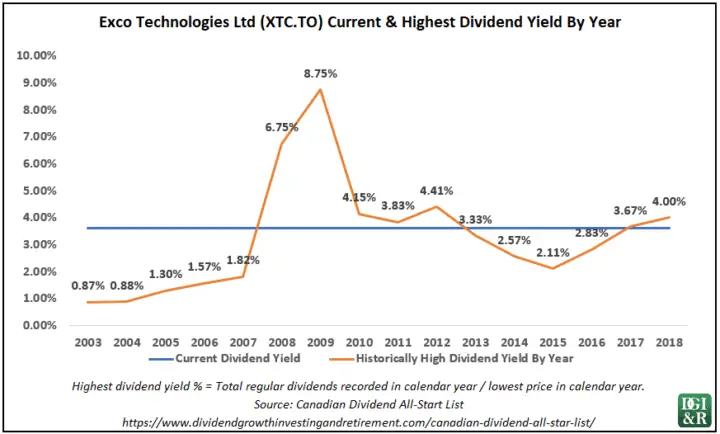

The dividend yield as of January 31, 2019, was 3.6%, and they have 5 and 10-year average annual dividend growth rates of 13.6% and 17.5% respectively.

Exco Technologies Financial Strength & Valuation

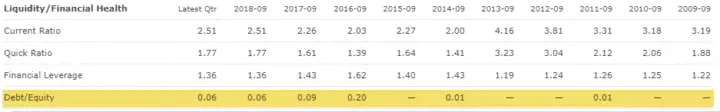

Exco doesn’t have credit ratings from any of the rating agencies, but they have very low debt. Because of this they are financially strong.

As they’ve pointed out, they are essentially net-debt neutral. This means that the cash and cash equivalents that Exco currently has is enough to offset their short and long-term debt.

Source: November 2018 Investor Presentation

Looking over the past decade we can see that the company has a long history of keeping their debt very low.

Source: Morningstar – Exco Technologies Ltd Key Ratios

Using the dividend yield as a valuation tool suggests that Exco could be a bit undervalued as the current yield of 3.6% is highish for the company.

A good entry point could be around the +4% level, but in a recession don’t be surprised if the yield gets to well above this, like in 2008 and 2009.

Does Exco have a long-term sustainable competitive advantage (Moat)?

My guess, probably not.

Companies that have economic moats are typically able to increase earnings on a regular basis, but with Exco it looks like they’ve been stagnant for the past 4 years with EPS roughly flat.

Source: Morningstar – Exco Technologies Ltd Key Ratios

They have carved out a bit of a niche in some of their business lines, but a lot of their income comes from supplying the automotive industry. This income is reliant on the demand for automobiles, the type of automobiles and the level of automobile production, which can fluctuate significantly with consumer confidence, general economic conditions, etc.

Don’t get me wrong, they appear to be well managed and can mitigate not having a moat with their low debt and strong financial strength, but just be prepared for some rough years if the auto industry tanks.

Exco Technologies Final Thoughts

Exco is an interesting company and I’ll keep it on my radar, but it’s not something I plan to invest in right now.

From a dividend growth perspective, I can see why some would be tempted as the yield is reasonably high, they have a good dividend growth history, very little debt and a low payout ratio (Mid-to-low 30s).

My biggest worry is the lack of moat and the highly competitive nature of supplying auto parts.

Ultimately, I’m on the fence with this one, so if you have any comments, please share.

[Back to Table of Contents] [Jump to Summary]

Richelieu Hardware Ltd. (RCH.TO) – 5.5% Dividend Increase

Richelieu Hardware Ltd is an importer, distributor and manufacturer of specialty hardware and complementary products. They operate across North America and their products include a wide variety of categories including furniture, glass and building decorative and functional hardware, lighting systems, finishing and decorating products, ergonomic workstation components, kitchen and closet storage solutions, sliding door systems, decorative and functional panels, high-pressure laminates and floor protection products.

Source: https://www.richelieu.com/html/An/statique/reseau.html

Richelieu Hardware Dividends

Richelieu Hardware Ltd. which has a dividend streak of 9 years recently increased their quarterly dividend 5.5% from $0.0600 CAD to $0.0633 CAD. This dividend increase comes into effect with the dividend recorded on Feb 07, 2019.

The dividend yield as of January 31, 2019, was 1.1%, and they have 5 and 10-year average annual dividend growth rates of 6.7% and 8.4% respectively.

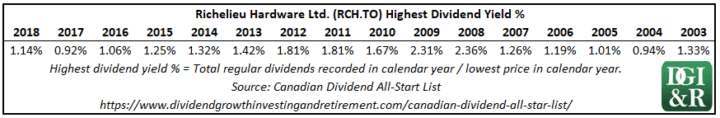

Richelieu Hardware Historically High Dividend Yields

Richelieu Hardware is a low yielding company with the highest yield only getting up to 2.4% (in 2008) over the past 15 years.

Richelieu Hardware Final Thoughts

Richelieu Hardware Ltd. isn’t really on my radar because its dividend yield is typically quite low. To interest me in a low yielding company I want to see high dividend growth, but Richelieu Hardware doesn’t really offer that.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the future prospects of the company.

There were 6 January 2019 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Canadian National Railway (CNR.TO) – 18.1% Dividend Increase

- Metro Inc (MRU.TO) – 11.1% Dividend Increase

- Atco Ltd. (ACO-X.TO) – 7.5% Dividend Increase

- Canadian Utilities (CU.TO) – 7.5% Dividend Increase

- Exco Technologies Ltd (XTC.TO) – 5.9% Dividend Increase

- Richelieu Hardware Ltd. (RCH.TO) – 5.5% Dividend Increase

Of these 6 companies, I’d like to own three, but I only own two: Atco Ltd. and Canadian Utilities.

Canadian National Railway is the third I’d like to own. It is a high-quality low yield, but high dividend growth stock that I’ve been waiting on for a while now. My problem is that I keep waiting for a +2.5% dividend yield which doesn’t come around that much with this stock.

What are your thoughts on these 6 companies?

Disclosure: I own shares of Atco Ltd. (ACO-X.TO) and Canadian Utilities (CU.TO). You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

I always look forward and appreciate your blog, I’m a mid-30’s father of two and am relatively new to building a DG growth RRSP (July 2018). Your blog, another blog, a fee for service advisor and a discount brokerage were what I needed to get started, and Value Line at my local library is a great resource too.

Thanks for doing a great job and keep up the excellent work!

Thanks for the feedback! I’m curious, what is the other blog you like?

Consider ENB.

The other blog I follow is TC’s dividendgrowth.ca

Yeah that’s a good one!

Thanks, your report is awesome. I’ve always believed that keeping a portfolio of 12-20 companies that consistently increase their earnings and dividends over time will lead you to beat the market. Plus your dividend income increases over time, usually at a rate much faster than inflation!

I can certainly understand keeping to 4% dividend stocks. I lean in that direction too. For the lower dividend stocks like Metro they often have a much faster dividend growth which ends up driving their stock price. I don’t completely agree they don’t have a moat because they have locked in real estate positions in established neighbourhoods. It is close to a guaranteed customer base. They are very well run compared to the other two big chains. CNR is a similar high dividend growth stock with a giant moat. You have to hold these stocks for more than 15 years for the dividend growth to overtake the higher yield stocks so that in itself is a risk. With the new small business passive income tax rules lower dividend is actually a feature because more of the return is capital gains.

Retired. Small Fed pension for 25 years, defined contributory pension for the other 16 years. Just recently picked up CNR. I don’t worry too much about the timing on purchases for long term plays. Watch the P/E more. Will continue to add to holdings from RSP every year, for the next several years and eventually move out of drip after the age of 72. Atco looks interesting. Thanks for your input and research.