Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies.

These companies aren’t recommendations, but tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“a company that raises its dividend is truly signaling the state of its business to investors. Picture a boardroom, and the classic board of directorsʼ table filled with wizened business people, people who know that there are fads and fashions and cycles, and things can go up and down, and even go bump in the night. These directors know just how well their company is doing or how poorly. They know how much will be needed to fund capital expansion or research and development, or the next takeover. They know the whole financial picture, and they also know that dividend reductions are death to stock prices. The one thing a board never wants to do is decrease the dividend, so increasing a dividend is a clear statement that the companyʼs fortunes are positive—or at least positive enough to keep paying and to raise the dividend.”

Source: The Single Best Investment: Creating Wealth with Dividend Growth by Lowell Miller (Affiliate link, but I personally own and highly recommend this book.)

This month was a busier one with 12 dividend increases which included four Canadian banks. It was CAE Inc (CAE.TO) that ended up having the largest dividend increase this month with an 11.1% raise.

August 2018 Dividend Increases in the Canadian Dividend All-Star List

Navigation – You can use the links below to jump ahead to the company you are interested in.

- CAE Inc (CAE.TO) – 11.1% Dividend Increase

- Hardwoods Distribution Inc. (HDI.TO) – 10.3% Dividend Increase

- Logistec Corporation (LGT-B.TO) – 10.0% Dividend Increase

- Keyera Corp. (KEY.TO) – 7.1% Dividend Increase

- Ritchie Bros. Auctioneers Inc (RBA.TO) – 5.9% Dividend Increase

- Fiera Capital Corporation (FSZ.TO) – 5.3% Dividend Increase, 2nd increase this year

- Royal Bank of Canada (RY.TO) – 4.3% Dividend Increase, 2nd increase this year

- Canadian Western Bank (CWB.TO) – 4.0% Dividend Increase, 2nd increase this year

- Emera Incorporated (EMA.TO) – 4.0% Dividend Increase

- Bank of Nova Scotia (BNS.TO) – 3.7% Dividend Increase, 2nd increase this year

- Saputo Inc. (SAP.TO) – 3.1% Dividend Increase

- Canadian Imperial Bank of Commerce (CM.TO) – 2.3% Dividend Increase, 2nd increase this year

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it has come to be one of the most popular resources of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

1. CAE Inc (CAE.TO) – 11.1% Dividend Increase

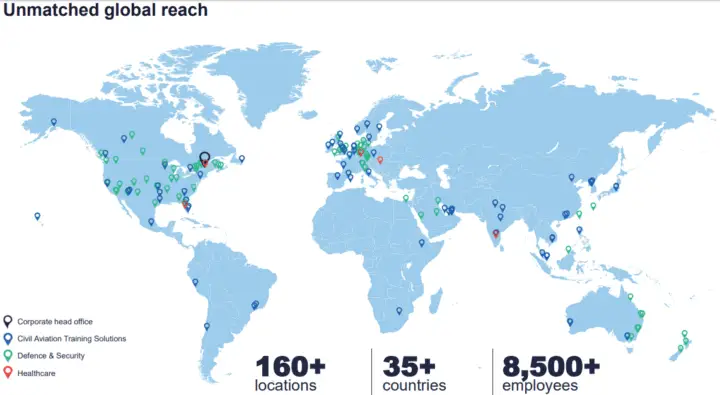

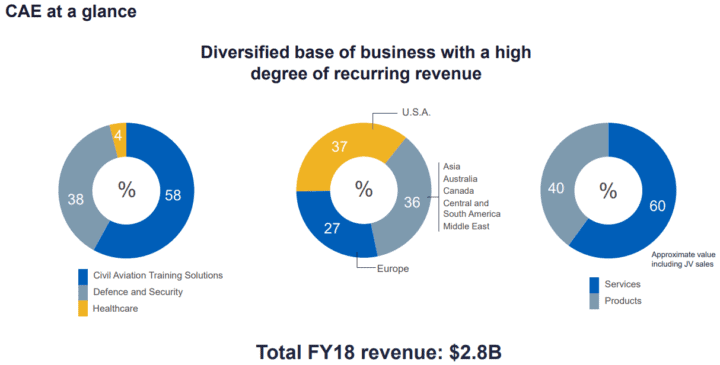

CAE is a global leader in training for the civil aviation, defence and security, and healthcare markets with virtual-to-live training solutions to make flying safer, maintain defence force readiness and enhance patient safety. They have over 160 sites and training locations in over 35 countries.

Source: June 2018 Investor Presentation

Source: June 2018 Investor Presentation

Source: June 2018 Investor Presentation

CAE Dividends

CAE Inc, which has a dividend streak of 10 years, recently increased their quarterly dividend 11.1% from $0.0900 CAD to $0.1000 CAD. This dividend increase comes into effect with the dividend recorded on Sep 14, 2018.

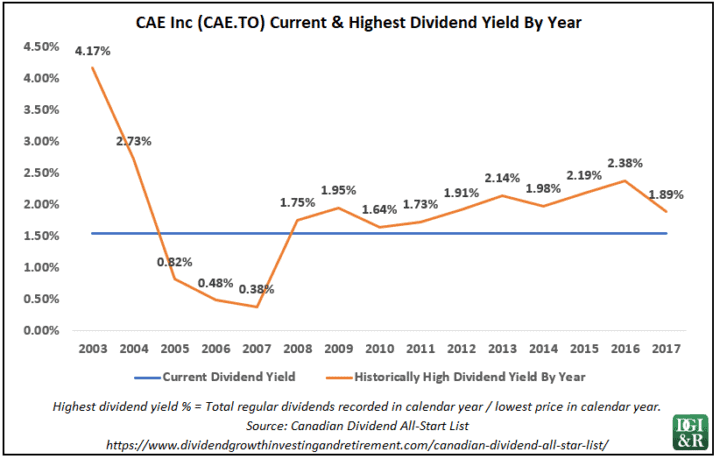

The dividend yield as of August 31, 2018, was 1.5%, and they have 5 and 10-year average annual dividend growth rates of 13.6% and 23.9% respectively.

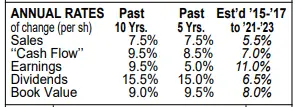

The company has strong 5 and 10-year dividend growth rates, but Value Line is estimating that future dividend growth will be lower over the next 3-5 years at 6.5% annually.

Source: CAE June 8, 2018 Value Line Report

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

CAE Financial Strength & Valuation

Value Line gives CAE a “B+” for financial strength, which is the minimum B+ rating I like to see.

From a P/E standpoint, CAE looks a bit pricey. Based on the average annual P/E ratios from Value for the past decade or so they’ve mostly been around the mid to high teens. The current P/E per Value Line is in the low 20’s.

CAE’s current yield is 1.5%. Per Value Line the average annual dividend yield has ranged from 1.1% to 2.0% over the past decade and if you look at the highest yield table below it looks like from a dividend yield perspective CAE is a little expensive too.

CAE Final Thoughts

Financial strength is an important metric to me as a long-term dividend growth investor so I don’t plan on investing in the company. If they can improve their financial strength then I’ll look further into them at that point.

[Back to Navigation] [Jump to Summary]

2. Hardwoods Distribution Inc. (HDI.TO) – 10.3% Dividend Increase

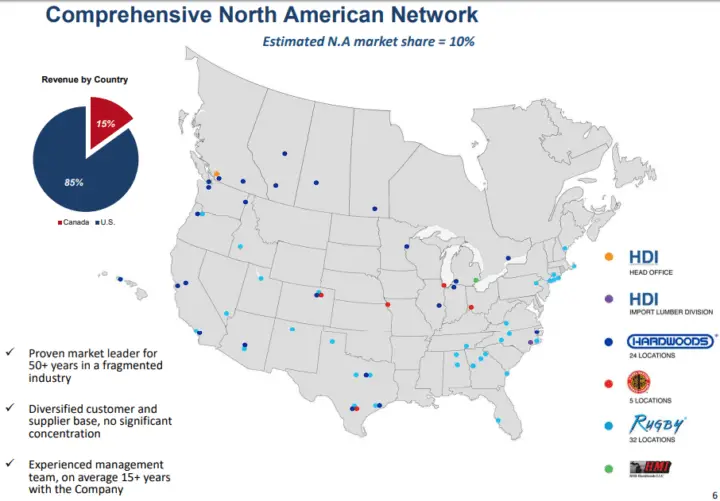

Hardwoods Distribution Inc. operates in Canada and the US as a wholesaler of hardwood lumber and related products. They are the largest distributor of architectural building products in North America.

Source: Investor Presentation Second Quarter 2018

Source: Investor Presentation Second Quarter 2018

Hardwoods Distribution Inc. Dividends

Hardwoods Distribution Inc. which has a dividend streak of 7 years recently increased their quarterly dividend 10.3% from $0.0725 CAD to $0.0800 CAD. This dividend increase comes into effect with the dividend recorded on Oct 15, 2018.

The dividend yield as of August 31, 2018, was 1.9%, and they have 5 and 10-year average annual dividend growth rates of 21.1% and -11.2% respectively.

FYI – The 10-year average dividend growth rate is negative because of a dividend cut in 2008.

Hardwoods Distribution Inc. Final Thoughts

While the company is doing better, they cut their dividend completely in late 2008 and didn’t start back up again until 2011.

From 2011 and on the company looks pretty good with steady earnings and dividend growth, but prior to that earnings were erratic and they lost money in 2008 and 2009.

I feel like the nature of this industry makes it hard to sustain a competitive advantage, so it is not a company I’m interested in from a long-term dividend growth perspective.

[Back to Navigation] [Jump to Summary]

3. Logistec Corporation (LGT-B.TO) – 10.0% Dividend Increase

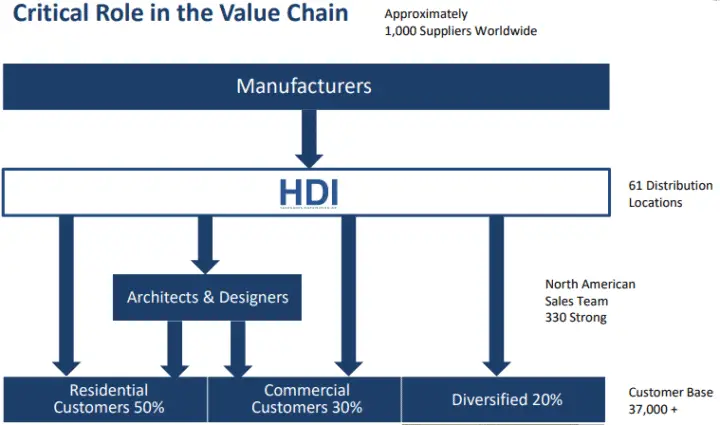

When I started looking into the history of Logistec Corporation two impressive streaks stuck out:

- Since they went public in 1969 they haven’t had an unprofitable year, and

- They’ve been paying dividends for almost 50 years without any dividend cuts.

The company was founded in 1952 by Roger Paquin and has been publicly traded since 1969. You can see from below that they haven’t had an unprofitable year, although they had some close calls in 1973 and 1982.

Source: https://www.logistec.com/revenue-profit-since-1969/

The Paquin family still controls Logistec Corp. through their ownership of Sumanic Investments Inc., which controls approximately 75% of the voting rights.

Logistec Corp. has a dual share class structure with Class A Common Shares and Class B Subordinate Voting Shares. Class A shares carry 30 votes per share and can be converted (on a one-for-one basis) to Class B shares. Class B shares carry one vote per share, entitle their holders to receive a dividend equal to 110% of dividends declared on Class A shares, and carry coattail provisions.

Headquartered in Montreal, Quebec, Logistec Corp. provides cargo handling and other services to the marine, industrial, and municipal sectors through its two business divisions: Marine Services and Environmental Services.

Marine Services (43% of annual revenue in 2017)

- One of Eastern Canada’s largest cargo handling companies and a growing player in the USA with cargo handling at some 35 ports and 58 terminals in Eastern Canada, in the Great Lakes, on the U.S. East Coast, and in the U.S. Gulf.

- Marine transportation services geared primarily to the Arctic coastal trade;

- Marine agency services to foreign shipowners and operators serving the Canadian market;

- Short-line rail transportation.

Environmental Services (57% of annual Revenues in 2017)

- Services to industrial and municipal organizations for the trenchless structural rehabilitation of underground water mains, regulated materials management, site remediation, risk assessment, and woven-hose manufacturing.

Logistec Dividends

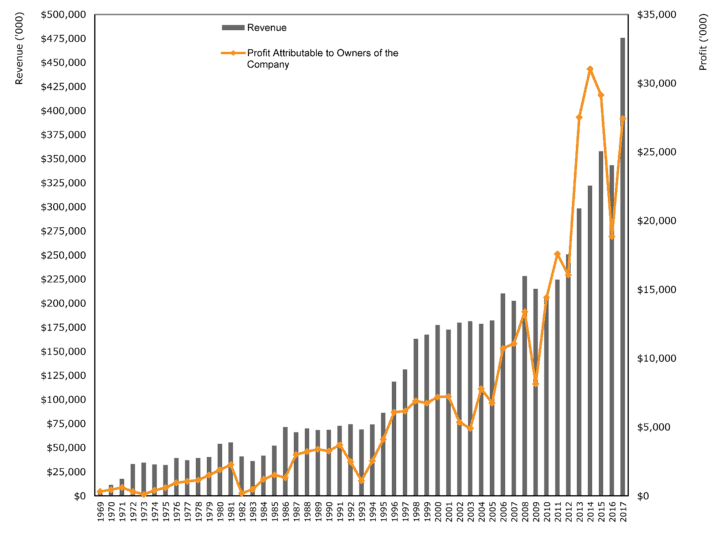

Logistec Corp. has been paying dividends for almost five decades and in that time has never had a dividend cut. Since 1971, they’ve been paying a quarterly dividend, without interruption or decrease. Keep in mind that in some of these years they didn’t increase the dividend, but still a fairly impressive dividend history for a Canadian company. (FYI – They also had special dividend payments in 2014, 2007, and 1995.)

Logistec Corporation, which has a dividend streak of 8 years, recently increased their quarterly dividend 10.0% from $0.0908 CAD to $0.0998 CAD. This dividend increase comes into effect with the dividend recorded on Sep 28, 2018.

The dividend yield as of August 31, 2018, was 0.8%, and they have 5 and 10-year average annual dividend growth rates of 11.8% and 7.9% respectively.

Logistec Corp. has decent dividend growth, but it has too low of a dividend yield for me to be interested at these levels. You can see from below that a low dividend yield has been a trend in recent years as the highest yield during this time only got up to around 1%.

Logistec Final Thoughts

Even if the dividend yield increased substantially I’m not sure I’d consider investing as their earnings are fairly erratic from year to year. Yes, it is true they haven’t had an unprofitable year since they went public in 1969, but I’d like to have more earnings growth consistency.

I haven’t completely made up my mind on this one, but as the yield is too low for me right now anyway, I’ll save the more in-depth research for when/if the yield gets up to around 2.5% to 3.0%. As it’s well off those levels, it could be some time before I revisit Logistec Corp.

[Back to Navigation] [Jump to Summary]

4. Keyera Corp. (KEY.TO) – 7.1% Dividend Increase

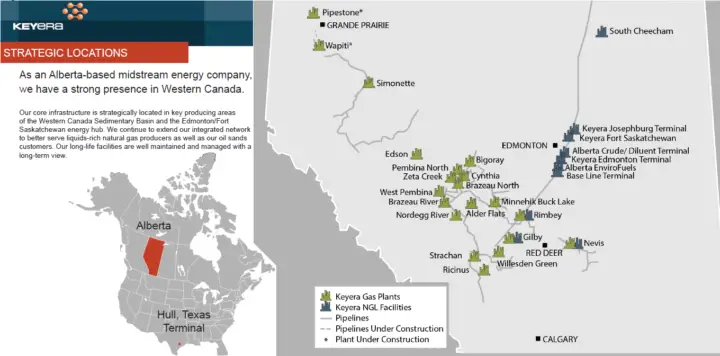

Keyera Corp. is a Canadian-based, independent midstream energy company that provides midstream energy solutions to oil and gas producers in Western Canada.

Source: 2018 Keyera Corporate Overview

Primary operations consist of:

- Raw natural gas gathering and processing,

- Natural gas liquids (NGL) fractionation, storage, transportation, logistics and marketing services,

- Diluent logistics for oil sands customers, and

- Iso-octane production, logistics and marketing

Source: Keyera Corporate Profile August 2018

Keyera Dividends

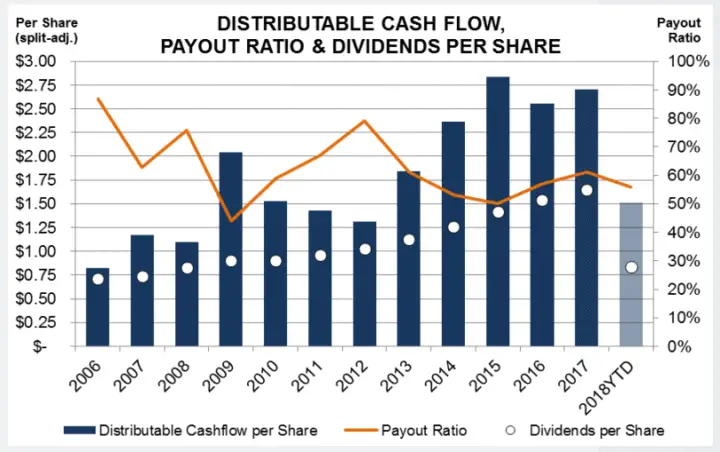

Keyera Corp., which has a dividend streak of 7 years, recently increased their monthly dividend 7.1% from $0.1400 CAD to $0.1500 CAD. This dividend increase comes into effect with the dividend recorded on Aug 22, 2018.

The dividend yield as of August 31, 2018, was 5.0%, and they have 5 and 10-year average annual dividend growth rates of 9.9% and 8.4% respectively.

Source: Keyera Corporate Profile August 2018

Keyera has a nice history of growing their dividend, and they appear to have a reasonable payout ratio based on distributable cash flow. Morningstar thinks that:

“Despite our expectation for the company to average 8% dividend growth over the next few years, the current yield stands at the bottom of the Canadian midstream sector.”

Source: August 9, 2018 Morningstar Analyst Note

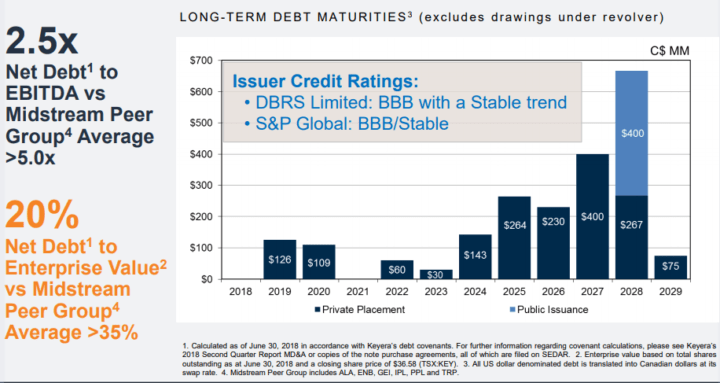

Keyera Financial Strength & Valuation

The dividend yield and dividend growth prospects are good, but their credit rating is a little too low for me at BBB.

Source: Keyera Corporate Profile August 2018

I like to see BBB+ credit rating or higher.

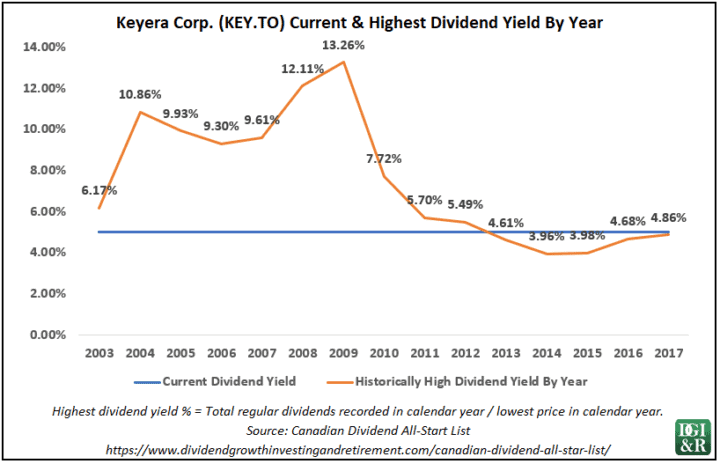

Using the dividend yield as a valuation tool makes it look like a 5% dividend yield is actually fairly low for them from a historical standpoint, but it is important to remember that in January 2011 they converted from an income trust structure to a corporate structure. Comparing today’s yield to a dividend yield prior to 2011 isn’t a fair comparison. When you factor this in, then Keyera looks more reasonable.

Morningstar has given them a “No moat” rating and a 3 stars valuation as they are trading close to their fair value estimate of $32.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Keyera Final Thoughts

The credit rating is a little too low at BBB for me to consider investing and the “No moat” rating is another knock against it.

[Back to Navigation] [Jump to Summary]

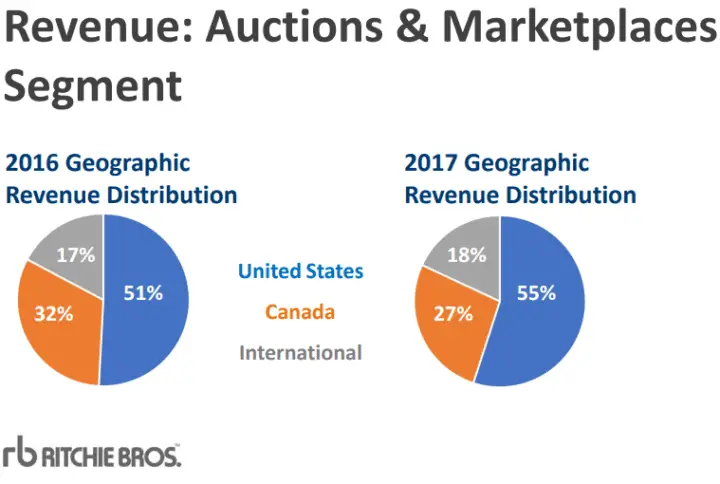

5. Ritchie Bros. Auctioneers Inc (RBA.TO) – 5.9% Dividend Increase

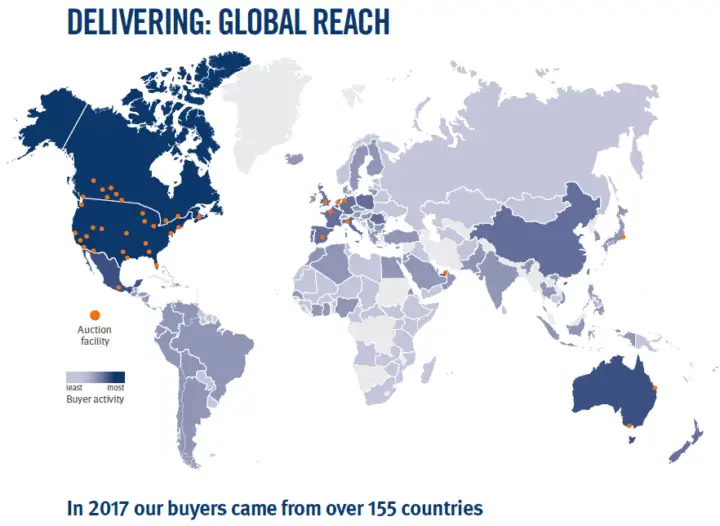

Ritchie Bros. Auctioneers is the world’s largest auctioneer of used industrial heavy equipment.

Source: 2018 Corporate Brochure

Source: June 13, 2018 William Blair 38th Annual Growth Stock Conference Presentation

Ritchie Bros. Auctioneers Dividends

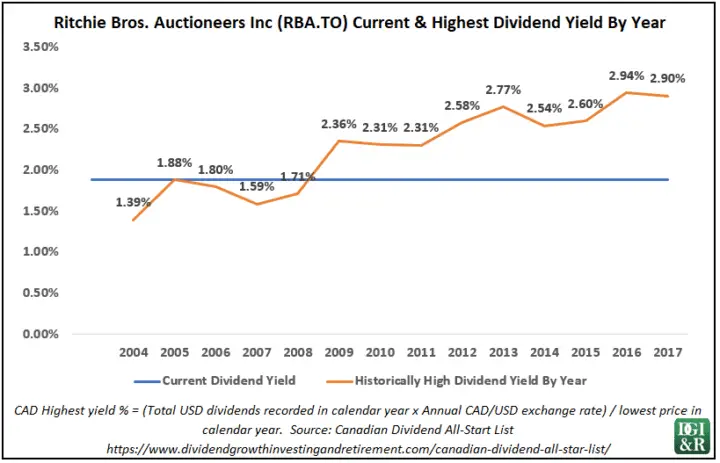

Ritchie Bros. Auctioneers Inc, which has a dividend streak of 15 years, recently increased their quarterly dividend 5.9% from $0.1700 USD to $0.1800 USD. This dividend increase came into effect with the dividend recorded on Aug 29, 2018.

The dividend yield as of August 31, 2018, was 1.9%, and they have 5 and 10-year average annual dividend growth rates of 7.7% and 8.5% respectively.

Source: June 13, 2018 William Blair 38th Annual Growth Stock Conference Presentation

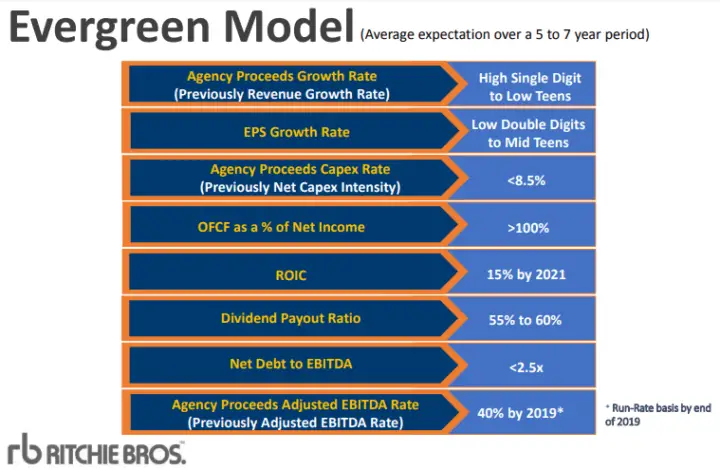

Analysts are estimating roughly $1.50 EPS for 2018 so the current payout ratio is probably around 50% which is a little under their 55% to 60% long-term target.

If, and I stress if, they meet their EPS growth rate of low double digits to mid-teens, then dividend growth could be pretty good going forward.

With credit ratings under investment grade, I wouldn’t be surprised if they decide to pay off more debt first before increasing the dividend in-line with EPS growth. This is another way of saying that until they improve their financial strength I’d expect dividend growth below future earnings growth.

Ritchie Bros. Auctioneers Financial Strength & Valuation

They have poor credit ratings. S&P has them at BB and Moody’s at Ba3. I look for BBB+/Baa1 or higher before I consider investing.

Using the dividend yield as a valuation tool suggests that they are over-valued. The historically high dividend has been higher than the current level every year going back to 2009.

Morningstar would seem to agree that the stock appears overvalued as they have given Ritchie Bros. a two-star valuation as they are currently trading above their fair value estimate of $39.

Per Morningstar, they have a narrow moat.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Ritchie Bros. Auctioneers Final Thoughts

Financial strength is an important metric to me as a long-term dividend growth investor so I don’t plan on investing in the company. If they can improve their financial strength then I’ll look further into them at that point.

[Back to Navigation] [Jump to Summary]

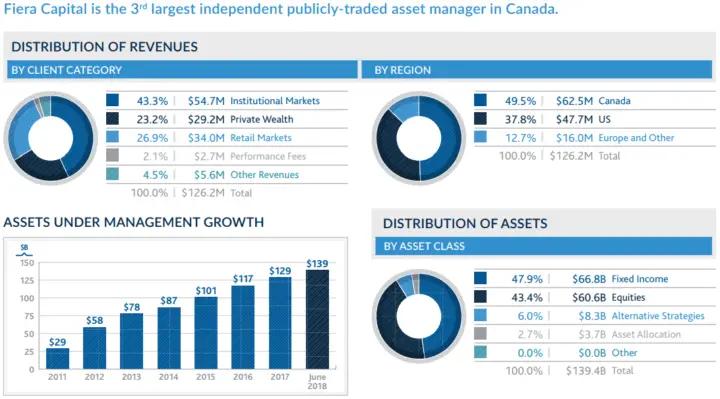

6. Fiera Capital Corporation (FSZ.TO) – 5.3% Dividend Increase

Fiera Capital is a Canadian asset management firm, providing investment advisory and related services to institutional investors, private wealth clients and retail investors. They offer integrated portfolio management solutions combining traditional and alternative asset classes.

As of June 30, 2018 they had $139 billion in assets under management.

Source: Fiera Capital Client Driven Approach Brochure

Source: 2018 Q2 Investor Fact Sheet

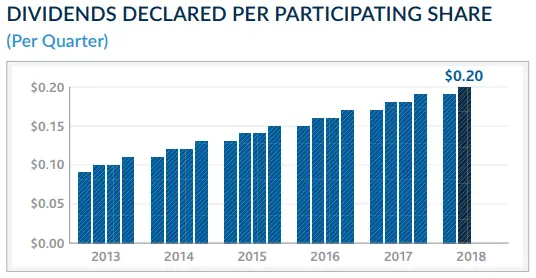

Fiera Capital Dividends

Fiera Capital Corporation, which has a dividend streak of 5 years, recently increased their quarterly dividend by 5.3% from $0.1900 CAD to $0.2000 CAD. This dividend increase came into effect with the dividend recorded on Aug 22, 2018.

This recent dividend increase was actually the second of the year, so if you factor in both increases, then the annual increase was 11.1% ($0.18 quarterly dividend to $0.19 and then most recently to $0.20).

Source: 2018 Q2 Investor Fact Sheet

The dividend yield as of August 31, 2018, was 6.5%, and they have 5 and 10-year average annual dividend growth rates of 16.9% and 6.0% respectively.

In 2009 they cut their dividend by 50% which is a red flag for me.

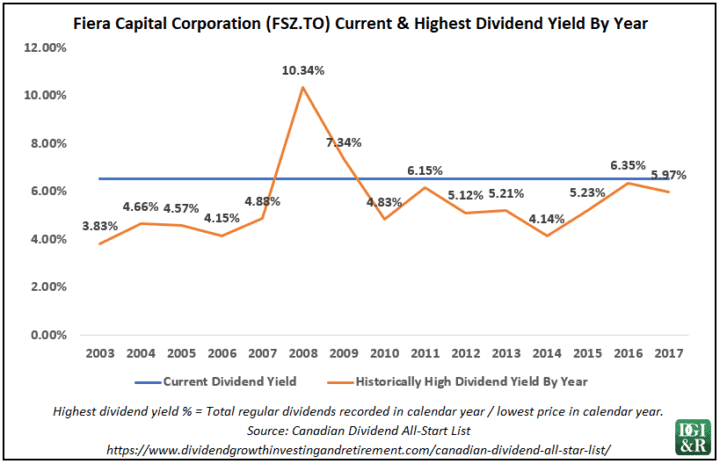

Fiera Capital Valuation

Using the dividend yield as a valuation tool suggests that they are reasonably cheap as the current 6.5% yield appears historically high.

Fiera Capital Final Thoughts

At first glance, I’m not interested in this company because of the 2009 dividend cut. In the short term, the company appears to be growing the dividend quite quickly while offering a high dividend yield, but the 2009 dividend cut is enough for me to look elsewhere.

I understand that the global financial crisis was a very difficult time for financial companies, but there were still some that managed to get through it without cutting their dividends. For instance, the Big 5 banks which I consider high-quality companies.

If you are looking to add Canadian financials start with the Big 5 banks first, before starting to look at other companies in this sector.

All that said, I don’t know much about this company. If you are more familiar with it, I’d be interested to hear your comments.

[Back to Navigation] [Jump to Summary]

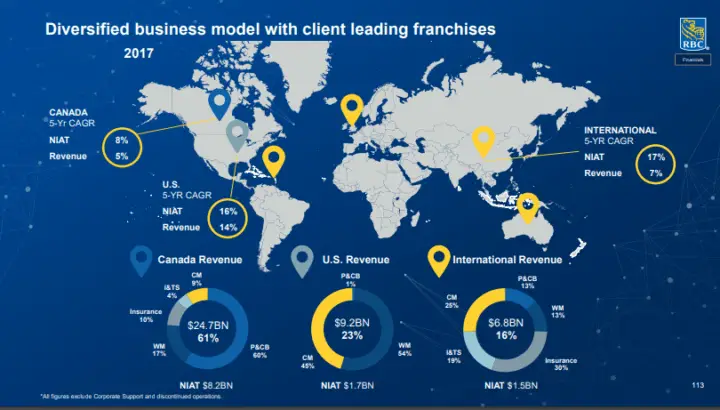

7. Royal Bank of Canada (RY.TO) – 4.3% Dividend Increase

Canada is known for its financial sector and the big banks. With Royal Bank of Canada, you are getting one of the best in this sector. Royal Bank of Canada is currently the largest of the “Big 5” Canadian banks and hasn’t missed a dividend payment since 1870.

Source: Investor Relations: RBC At A Glance

They have five main business segments:

Source: 2017 Annual Report

Despite being known as the largest Canadian bank they have a large number of international operations too.

Source: June 13, 2018, Investor Day 2018 Presentation

Royal Bank of Canada Dividends

Royal Bank of Canada, which has a dividend streak of 7 years, recently increased their quarterly dividend 4.3% from $0.9400 CAD to $0.9800 CAD. This dividend increase comes into effect with the dividend recorded on Oct 25, 2018.

Royal Bank has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 7.7% ($0.91 quarterly dividend to $0.94 and then most recently to $0.98).

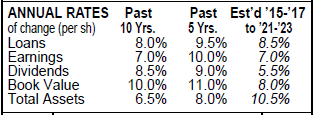

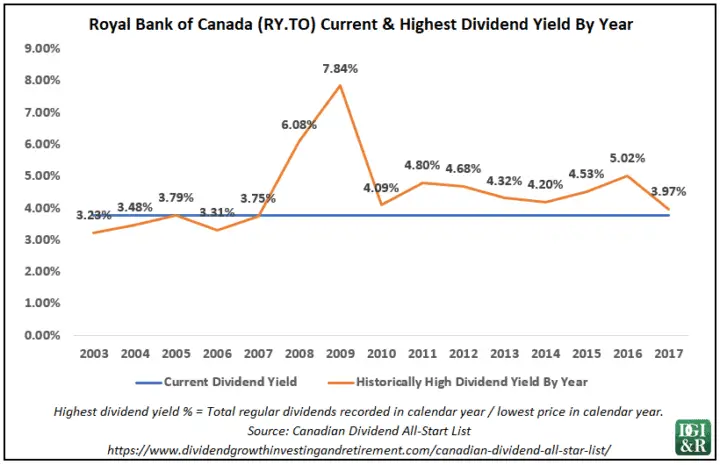

The dividend yield as of August 31, 2018, was 3.8%, and they have 5 and 10-year average annual dividend growth rates of 8.8% and 6.7% respectively.

The current payout ratio is around the high 40s and their target is 40-50%, so I’d expect dividend growth to mirror earnings growth going forward.

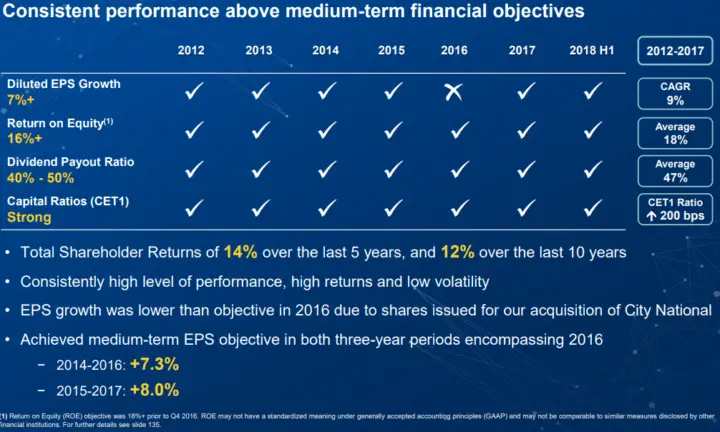

Source: 2018 Q2 Investor Presentation

If they can meet their EPS growth target of 7%+ then I’d expect dividend growth around the same amount. The good news is that they have a history of meeting their objectives.

Source: June 13, 2018, Investor Day 2018 Presentation

All that said, Value Line is estimating 5.5% annual dividend growth over the next 3-5 years with 7% earnings growth.

Source: Value Line Royal Bank of Canada report, August 10, 2018

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

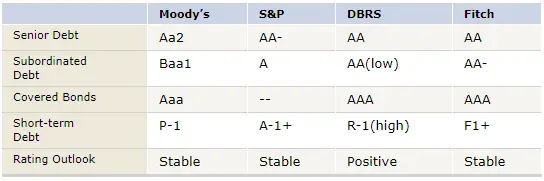

Royal Bank of Canada Financial Strength & Valuation

Value Line gives Royal Bank an “A” rating for financial strength, and the 4 rating agencies give them high ratings too. The company appears to have strong financial strength.

Source: Royal Bank of Canada Investor Relations Website: Debt Investors

Two of the Big 5 banks have wide moat ratings from Morningstar and Royal Bank is one of them. The other is TD.

Based on yield Royal Bank looks like it is trading around fair value, but in the past decade, there have been chances almost every year to buy at +4% dividend yields.

Morningstar gives Royal Bank a 3-star valuation as they are currently trading around their fair value estimate of $109.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Royal Bank of Canada Final Thoughts

With Royal Bank, you are getting a high-quality dividend growth company trading at around fair value.

PS. You can jump ahead to my final thoughts on Bank of Nova Scotia if you want to see how the Big 5 banks currently compare to each other.

PPS. If you want a slightly more detailed review of Royal Bank of Canada, take a look at my recent post on how I use Value Line to quickly assess dividend growth stocks. I used Royal Bank as the example in that post.

[Back to Navigation] [Jump to Summary]

8. Canadian Western Bank (CWB.TO) – 4.0% Dividend Increase

Canadian Western Bank is one of the lesser know Canadian banks, but it is the 7th largest in Canada and has the longest dividend streak of the Canadian banks with 26 consecutive years of dividend increases. They provide financial services in banking, trust and wealth management primarily in Western Canada and Ontario.

Source: Canadian Western Bank 2018 Q3 Investor Fact Sheet

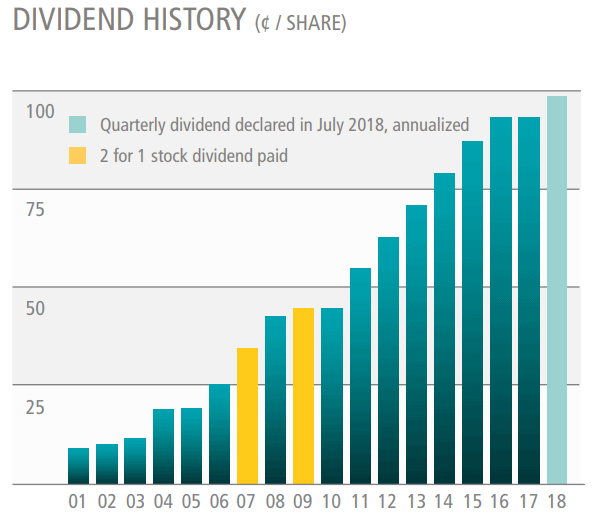

Canadian Western Bank Dividends

Source: Canadian Western Bank 2018 Q3 Investor Fact Sheet

Canadian Western Bank, which has a dividend streak of 26 years, recently increased their quarterly dividend by 4.0% from $0.2500 CAD to $0.2600 CAD. This dividend increase comes into effect with the dividend recorded on Sep 14, 2018.

Canadian Western Bank has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 8.3% ($0.24 quarterly dividend to $0.25 and then most recently to $0.26).

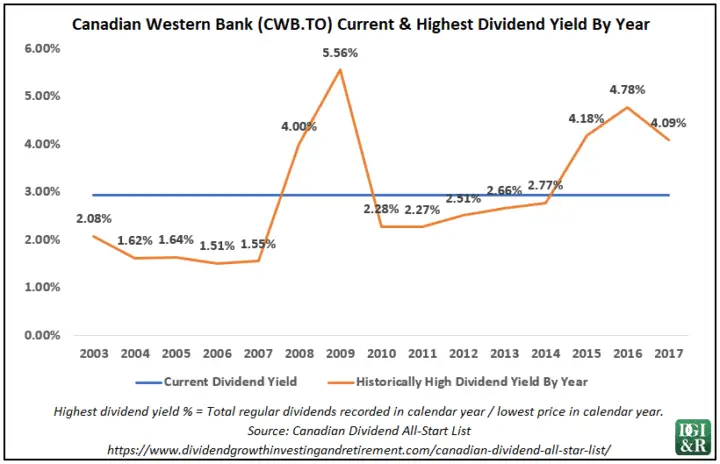

The dividend yield as of August 31, 2018, was 2.9%, and they have 5 and 10-year average annual dividend growth rates of 8.0% and 10.1% respectively.

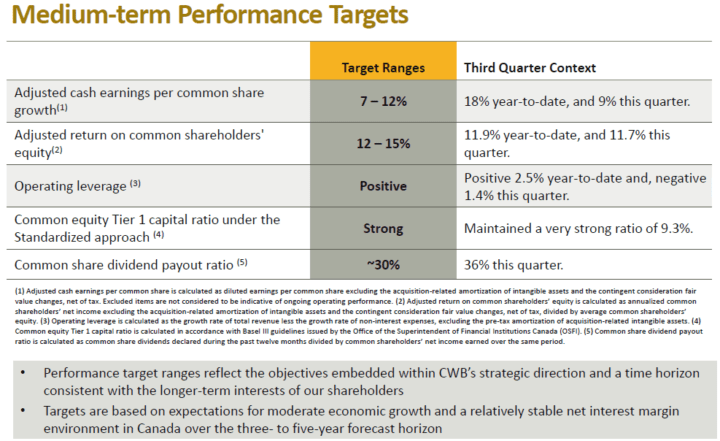

The current payout ratio (36%) is above their 30% target, so I’d expect dividend growth to be slower than earnings growth going forward until they can get back down to their desired 30%.

Source: Canadian Western Bank Corporate Presentation 3rd Quarter 2018

In the medium term they are targeting 7-12% earnings growth, so if they can hit their targets then expect dividend growth a little lower than this.

Canadian Western Bank Financial Strength & Valuation

DBRS gives them a decent credit rating of A (low).

Source: Canadian Western Bank Investor Relations – Debt Security Information

Based on the dividend yield the stock looks like it is trading around fair value. The time to buy this stock might have passed as you could’ve got +4% yields in 2015 to 2017.

Canadian Western Bank Final Thoughts

It’s a decent regional bank with a long dividend streak that I own, but the bigger Canadian banks have better credit ratings and higher dividend yields. If you are interested in the Canadian banking sector, then I’d start looking at the big ones first.

Disclosure: I own shares of Canadian Western Bank.

[Back to Navigation] [Jump to Summary]

9. Emera Incorporated (EMA.TO) – 4.0% Dividend Increase

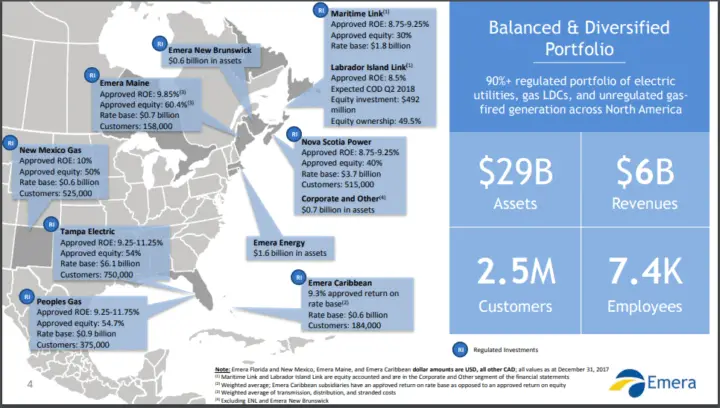

Emera Incorporated is a diversified utility company operating in North America and four Caribbean countries.

Source: Emera Investor Presentation 2018 J.P. Morgan Energy Conference June 18-20, 2018

Emera Dividends

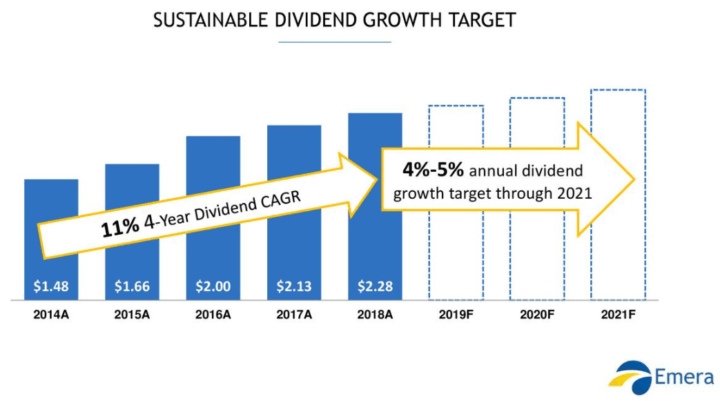

Emera Incorporated, which has a dividend streak of 11 years, recently increased their quarterly dividend by 4.0% from $0.5650 CAD to $0.5875 CAD. This dividend increase comes into effect with the dividend recorded on Nov 01, 2018.

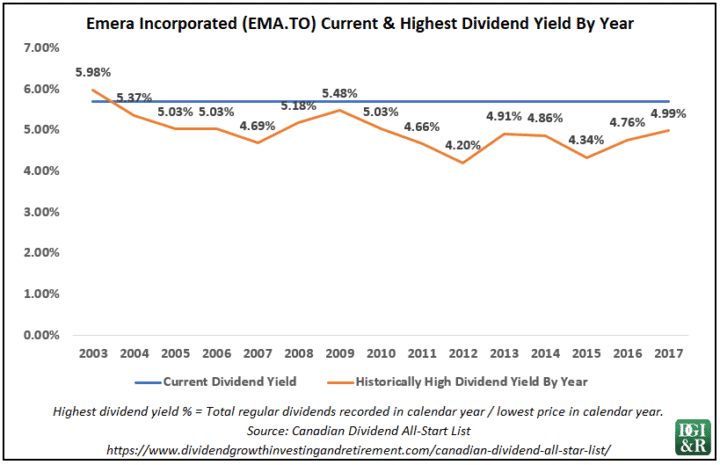

The dividend yield as of August 31, 2018, was 5.7%, and they have 5 and 10-year average annual dividend growth rates of 9.4% and 9.0% respectively.

The 4% dividend increase was a bit of a surprise as management had previously guided for 8% dividend growth to 2020.

“we announced a modification to our dividend growth target from 8% through 2020 to a range of 4% to 5% through to 2021. We also announced an increase of the annual dividend to $2.35.

The decision to modify our dividend growth target was not taken lightly. We believe that this new target will better balance the need for funding flexibility for the business while still providing a reasonable target growth profile and dividends for shareholders. In this, it’s important to understand that the $6.7 billion investment we are making in rate base over the next three years is expected to drive adjusted earnings per share growth over the same period at a level that exceeds the new targeted dividend growth guidance.”

Source: Scott Balfour, Emera CEO, August 10, 2018 Q2 Earnings Call

The payout ratio around the low to mid-80s is currently higher than my 70% or less target for utilities and also higher than Emera’s own target ratio of 70-75%.

Source: August 10, 2018, Second Quarter 2018 Presentation: Business Update and Financial Results

If they continue to grow the dividend at 4% per year and are able to grow EPS by 7% annually (Lesser of Morningstar and Value Line estimate) then according to my rough calculations they should have a payout ratio a little bit above 75% by 2021.

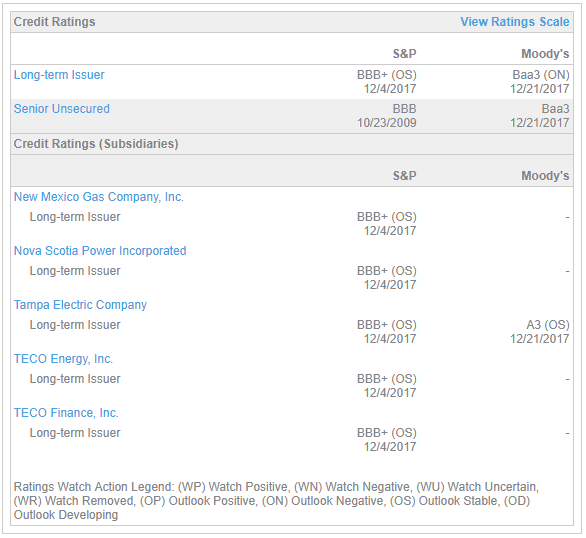

Emera Financial Strength & Valuation

Value Line gives Emera a “B+” rating for financial strength.

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

Moody’s rated them Baa3, but S&P rated them BBB+, so the average of the two is BBB which is the bare minimum I’ll accept for a utility (For non-utility stocks I want BBB+ or higher).

FYI – I’m looking at the Long-term Issuer credit ratings below.

Source: Emera > Investors > Shareholder Information > Credit Ratings

Based on the dividend yield, the stock looks undervalued. You have to go all the way back to 2003 before we see a higher dividend yield than its current 5.7%.

Morningstar appears to agree that its under-valued. They’ve given Emera a narrow moat rating with a four-star valuation as they are currently trading under their fair value estimate of $46. The five-star price is $36.80.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Emera Final Thoughts

Investors looking for an undervalued stock with a higher yield with some low to moderate dividend growth might be interested in Emera.

It is a riskier choice from some of the other names in the utility sector as it has a lower credit profile and the payout ratio is on the high side.

Based on my rough calculations they’d need a little bit higher than 7% annual EPS growth to maintain 4% annual dividend growth and still hit the top of their 70-75% payout ratio target by 2021. This is achievable, but doesn’t give a lot of wiggle room should something happen between now and 2021.

Despite its risks, it has a high yield at 5.7%, an 11-year dividend streak, and 4-5% annual dividend growth prospects to 2021.

I bought shares at $46.62 and $43.00 in May 2017 and Feb 2018. That was when I thought they’d stick to their plan of 8% dividend growth till 2020. My average price on those purchases is $45.37 and I still have an open limit order out for more at $38.

I’m struggling to make a decision with Emera. Should the price drop a bit more I’m not sure if I should buy more? What do you think, should I cancel or keep the $38 limit order?

Disclosure: I own shares of Emera.

[Back to Navigation] [Jump to Summary]

10. Bank of Nova Scotia (BNS.TO) – 3.7% Dividend Increase

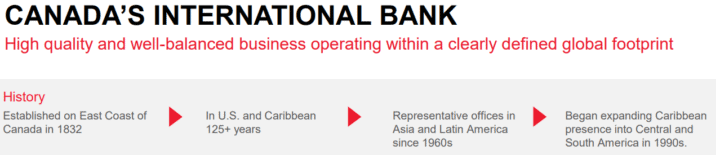

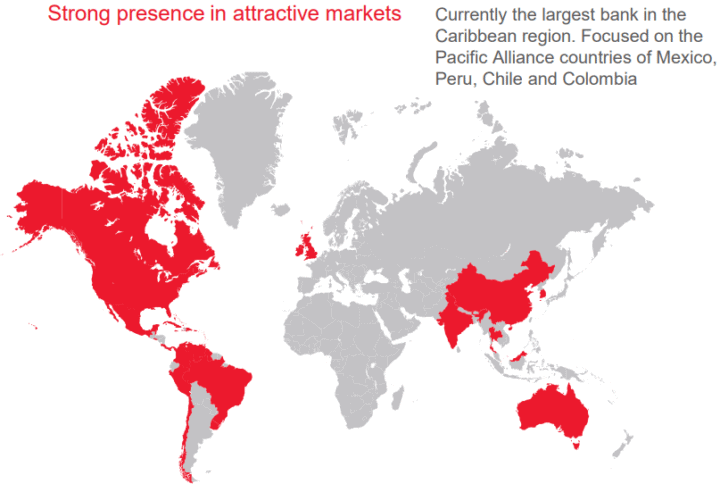

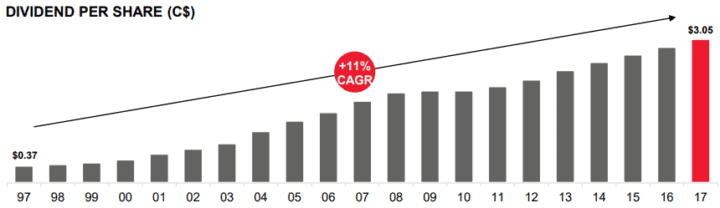

Bank of Nova Scotia is the third largest bank of the “Big 5” Canadian banks and is known as Canada’s international bank. Bank of Nova Scotia declared its first dividend on July 1, 1833, and hasn’t missed one since!

Source: Scotiabank Investor Presentation Second Quarter 2018

Source: Scotiabank Investor Presentation Second Quarter 2018

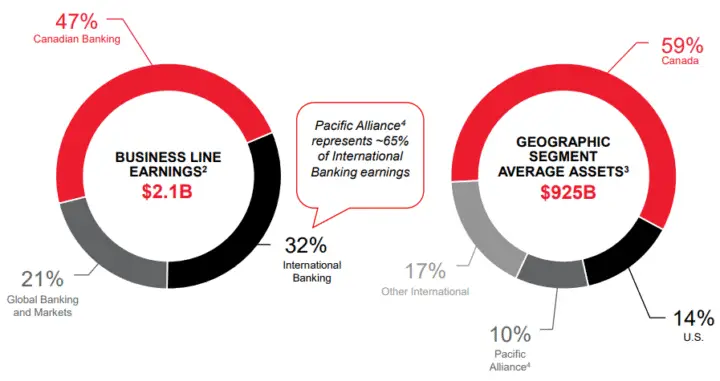

The bank has three business lines: Canadian banking, International banking, and Global banking and markets. Their international operations are mostly focused in Central and South America.

Source: Scotiabank Investor Presentation Second Quarter 2018

Bank of Nova Scotia Dividends

Source: Scotiabank Investor Presentation Second Quarter 2018

“Scotiabank’s practice has been to relate dividends to the trend earnings, while ensuring that capital levels are sufficient for both growth and depositor protection.

This practice, coupled with the Bank’s strong earnings growth, has led to dividend increases in 43 of the last 45 years – one of the most consistent records for dividend growth among major Canadian corporations.”

Source: https://www.scotiabank.com/ca/en/about/investors-shareholders/common-share-dividends.html

Increases in 43 of the last 45 years is impressive. The two years without increases were 2009 and 2010, which is why Bank of Nova Scotia currently has a dividend streak of 7 years.

They recently increased their quarterly dividend by 3.7% from $0.8200 CAD to $0.8500 CAD. This dividend increase comes into effect with the dividend recorded on Oct 02, 2018.

Bank of Nova Scotia has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 7.6% ($0.79 quarterly dividend to $0.82 and then most recently to $0.85).

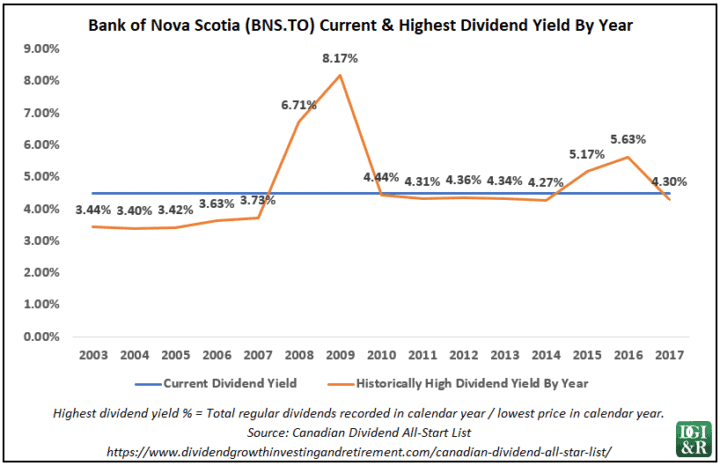

The dividend yield as of August 31, 2018, was 4.5%, and they have 5 and 10-year average annual dividend growth rates of 6.8% and 5.8% respectively.

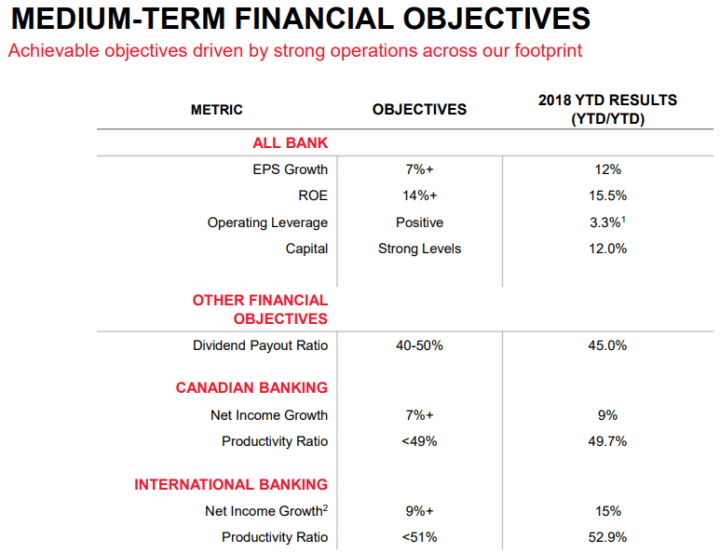

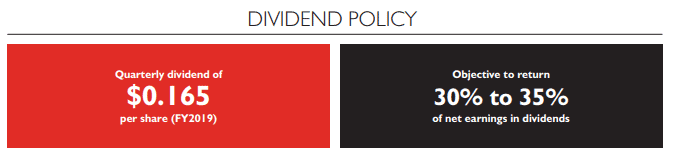

The current payout ratio is around their target is 40-50%, so I’d expect dividend growth to mirror earnings growth going forward.

Source: Scotiabank Investor Presentation Second Quarter 2018

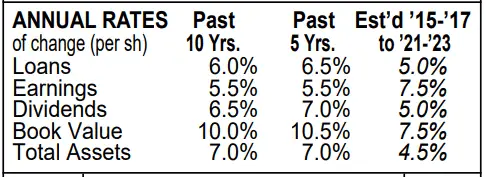

If they meet their EPS growth target of 7%+ then I’d expect dividend growth around the same. Value Line is estimating 5.0% annual dividend growth over the next 3-5 years with 7.5% earnings growth.

Source: Value Line Bank of Nova Scotia report, August 10, 2018

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

Bank of Nova Scotia Financial Strength & Valuation

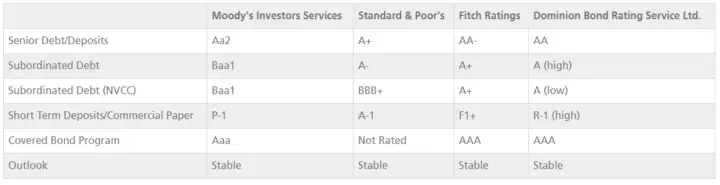

Value Line gives Bank of Nova Scotia an “A” rating for financial strength, and the 4 rating agencies give the bank high credit ratings too. The company appears to have strong financial strength.

Source: Scotiabank Investor Presentation Second Quarter 2018

Using the dividend yield as a valuation tool suggests that they are reasonably priced. There have been a few years where the yield was higher than its current 4.5%, but overall, 4.5% seems to be a moderately high yield for Bank of Nova Scotia.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around their fair value estimate of $80.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Bank of Nova Scotia Final Thoughts

Any of the Big 5 Canadian banks are worth considering as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects.

Bank of Nova Scotia is a quality bank with the highest yield (4.5%) of the Big 5 and decent dividend growth prospects trading around fair value.

I think Bank of Nova Scotia will be able to do a bit better than 5% dividend growth per year, but if you want a higher dividend growth estimate than 5% from Value Line, then look at the big two:

- Royal Bank of Canada 3.8% yield, 5.5% dividend growth estimate, and 3 star Morningstar valuation.

- Toronto Dominion Bank 3.4% yield and 8.5% dividend growth estimate, and 3 star Morningstar valuation.

The trade-off with these two is the lower dividend yields, but they also are the only two of the Big 5 that have a wide moat rating. The other three all have narrow moat ratings.

Bank of Montreal currently yields 3.6% and has a 5% dividend growth estimate from Value Line. They get a 3-star valuation from Morningstar.

CIBC has a 4.45% yield, 5.0% dividend growth estimate, and 3-star valuation.

It all comes down to picking the one or more that suit you best.

Disclosure: I own shares of Bank of Nova Scotia.

[Back to Navigation] [Jump to Summary]

11. Saputo Inc. (SAP.TO) – 3.1% Dividend Increase

Saputo is one of the top ten dairy processors in the world. It is the largest cheese manufacturer and the leading fluid milk and cream processor in Canada, the top dairy processor in Australia, and the second largest in Argentina. In the US, Saputo ranks among the top three cheese producers and is one of the largest producers of extended shelf-life and cultured dairy products.

Saputo Dividends

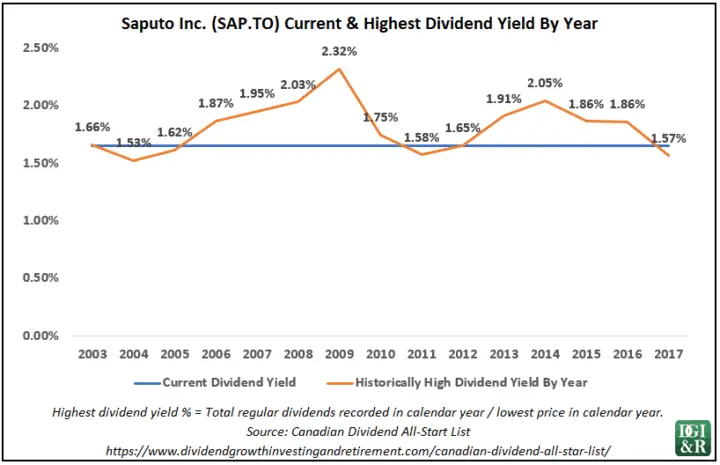

Saputo Inc., which has a dividend streak of 18 years, recently increased their quarterly dividend 3.1% from $0.1600 CAD to $0.1650 CAD. This dividend increase comes into effect with the dividend recorded on Sep 04, 2018.

The dividend yield as of August 31, 2018, was 1.7%, and they have 5 and 10-year average annual dividend growth rates of 14.5% and 13.2% respectively.

A 3.1% increase is slow dividend growth for Saputo. You can see that it hasn’t been close to this low except around 2009.

Saputo Dividend Increases by Calendar Year

Source: Canadian Dividend All-Star List

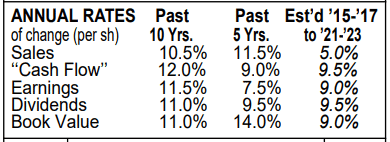

Source: Saputo Financial Fact Sheet Q1 – FY2019

Saputo is targeting a payout ratio of 30-35%. They are currently around that target, so I’d expect future dividend growth to mirror earnings growth.

Despite the low recent dividend increase, Value Line appears to estimate a higher dividend growth rate of 9.5% annually over the next 3-5 years. It should be noted though that this is from a July 20, 2018 report which is before the low 3.1% dividend increase was announced.

Source: Value Line Saputo report, July 20, 2018

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

Saputo Financial Strength & Valuation

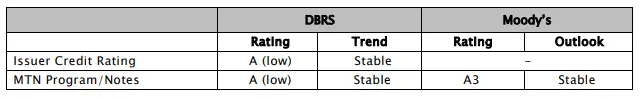

Value Line gives Saputo an “A” rating for financial strength, and it has decent credit ratings from DBRS and Moody’s. The company appears to have a good financial strength.

FYI – From Value Line I want a B+ rating or higher and from the credit rating agencies a BBB+/Baa1/BBB (high) rating or higher.

Source: Saputo June 7, 2018 Annual Information Form

Based on dividend yield the stock looks overvalued.

Morningstar rates them a narrow moat stock with a two-star valuation as they are currently trading above their fair value estimate of $33.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Saputo Final Thoughts

This most recent dividend increase is quite low for them. This suggests that management isn’t too optimistic about the future. Despite that the Value Line estimates for dividend growth are encouraging.

Saputo has a low dividend yield and that the stock appears overvalued so it’s not a company I’m currently considering. If the valuation and dividend growth improve then I’d re-consider Saputo at that time.

[Back to Navigation] [Jump to Summary]

12. Canadian Imperial Bank of Commerce (CM.TO) – 2.3% Dividend Increase

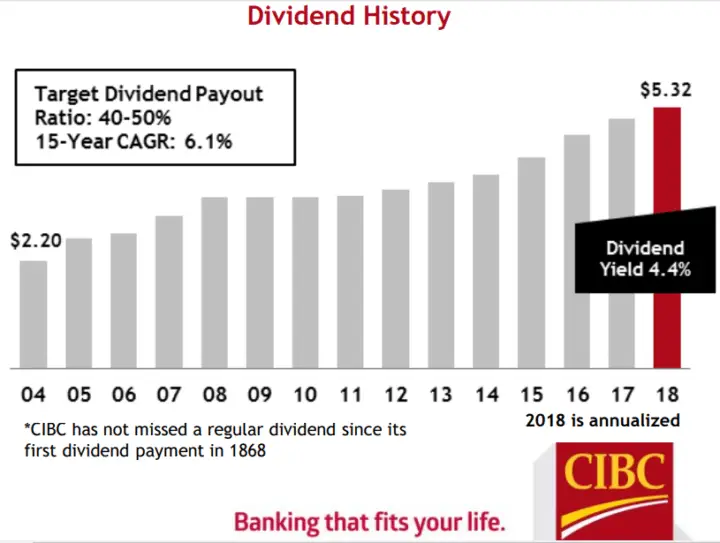

Canadian Imperial Bank of Commerce commonly known as CIBC is the smallest of Canada’s “Big 5” banks. Just like the other Big 5 banks, CIBC has an impressive dividend history having paid uninterrupted dividend since they first started in 1868.

They have four business units that provide a full range of financial products and services to 11 million individual, small business, commercial, corporate, and institutional clients in Canada, the U.S. and around the world.

Source: CIBC Investor Fact Sheet Q3 2018

CIBC Dividends

Canadian Imperial Bank of Commerce, which has a dividend streak of 7 years, recently increased their quarterly dividend 2.3% from $1.3300 CAD to $1.3600 CAD. This dividend increase comes into effect with the dividend recorded on Sep 28, 2018.

CIBC has been increasing their dividend twice a year, so if you factor in both increases, then the annual increase was 4.6% ($1.30 quarterly dividend to $1.33 and then most recently to $1.36).

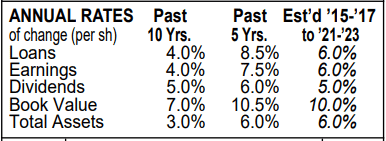

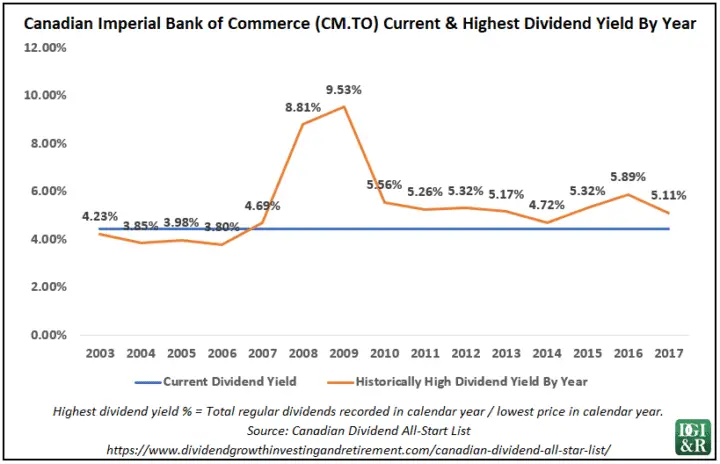

The dividend yield as of August 31, 2018, was 4.4%, and they have 5 and 10-year average annual dividend growth rates of 6.9% and 4.6% respectively.

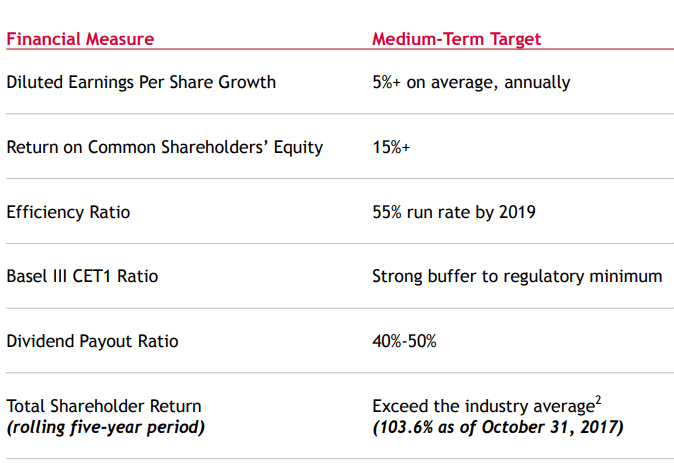

Source: CIBC Investor Fact Sheet Q3 2018

The current payout ratio is around their 40-50% target, so I’d expect dividend growth to mirror earnings growth going forward.

Source: Building the Relationship Oriented Franchise May 2018 Investor Presentation

If they meet their EPS growth target of 5%+ (Which is lower than Royal Bank’s and Bank of Nova Scotia’s 7%+ target) then I’d expect dividend growth around the same. Value Line is estimating 5.0% annual dividend growth over the next 3-5 years with 6.0% earnings growth.

Source: Value Line CIBC report, August 10, 2018

Related article: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks

CIBC Financial Strength & Valuation

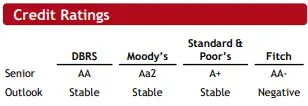

Value Line gives CIBC an “A+” rating for financial strength, and the 4 rating agencies give the bank high credit ratings too. The company appears to have strong financial strength.

Source: CIBC Investor Fact Sheet Q3 2018

Based on yield CIBC looks like it is trading around fair value, but in the past decade, there have been chances almost every year to buy at +5% dividend yields.

Morningstar rates them a narrow moat stock with a 3-star valuation as they are currently trading around their fair value estimate of $132.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

CIBC Final Thoughts

It’s hard to go wrong with one of the Big 5 banks, but as CIBC’s recent dividend increases have been a bit slower than some of the other big banks it’s probably not my first pick.

You can go back to my final thoughts on Bank of Nova Scotia if you want to see how the Big 5 banks currently compare to each other.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the future prospects of the company.

There were 12 August 2018 dividend increases (Including 4 increases from Canadian banks) in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- CAE Inc (CAE.TO) – 11.1% Dividend Increase

- Hardwoods Distribution Inc. (HDI.TO) – 10.3% Dividend Increase

- Logistec Corporation (LGT-B.TO) – 10.0% Dividend Increase

- Keyera Corp. (KEY.TO) – 7.1% Dividend Increase

- Ritchie Bros. Auctioneers Inc (RBA.TO) – 5.9% Dividend Increase

- Fiera Capital Corporation (FSZ.TO) – 5.3% Dividend Increase, 2nd increase this year

- Royal Bank of Canada (RY.TO) – 4.3% Dividend Increase, 2nd increase this year

- Canadian Western Bank (CWB.TO) – 4.0% Dividend Increase, 2nd increase this year

- Emera Incorporated (EMA.TO) – 4.0% Dividend Increase

- Bank of Nova Scotia (BNS.TO) – 3.7% Dividend Increase, 2nd increase this year

- Saputo Inc. (SAP.TO) – 3.1% Dividend Increase

- Canadian Imperial Bank of Commerce (CM.TO) – 2.3% Dividend Increase, 2nd increase this year

Of these 12 companies, I own three: Emera, Bank of Nova Scotia, and Canadian Western Bank.

I’m currently struggling with Emera since the changed their dividend guidance from 8% annual dividend growth until 2020 to 4-5% until 2021.

Emera is a riskier choice from some of the other names in the utility sector as it has a lower credit profile and the payout ratio is on the high side. Despite its risks, it has a high yield at 5.7%, an 11-year dividend streak, and 4-5% annual dividend growth prospects to 2021.

Should the price drop a bit more I’m not sure if I should buy more? What do you think?

Disclosure: I own shares in Canadian Western Bank, Emera, and Bank of Nova Scotia. You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

![Screening the Canadian Market for Dividend Growth Consumer Staples [Spreadsheet included]](https://dividendgrowthinvestingandretirement.com/wp-content/uploads/2018/03/Saputo.png)

Excellent article and analysis of dividend growth stocks. I was introduced to the strategy and concepts of Dividend Growth Investment 2-1/2 years ago by a review of your site after reading the book “The Single Best Investment: Creating Wealth with Dividend Growth” by Lowell Miller which I borrowed from my local library. I have never turned back and I must thank you for the valuable information and inspiration that your site has provided. Before I started I had a managed investment account with RBC. With the awakening, I transferred to RBC Direct Investment and currently hold a portfolio of 20 dividend growth stocks. I follow your monthly Canadian Dividend All-Star list and apply filters in Excel to narrow down to my specific selection criteria. I also have adopted “Portfolio Slicer” by created by Vidas Matelis to monitor and analyze my portfolio. This free Excel and DAX application is amazing and I would highly recommend any investor managing their own portfolio to download and use it!

Glad I could be of help, and thanks for the tip about Portfolio Slicer. I’ll have to check it out.

How much manually entry does it require? Will I have to enter in each dividend manually or does it do it automatically?

Cheers,

DGI&R

Portfolio Slicer is well designed and can be adapted to most portfolio and trading needs. With this tool you have a choice of automatic or manual dividend entry. You also can choose cash account tracking or not so the choices allow for minimal data entry if you want. I personally use cash tracking and manual dividend payment and reinvestment entry. I prefer this approach as it totally mirrors RBC Direct Investment reporting and allows me to fully analyze my portfolio. I have also added DAX formulas that permit extended analysis of my holdings including things like annual projected dividend income, current P/E ratios, percent payout ratios, current yield, yield on cost, etc.

Nice article and summary.

I own Emera and won’t be adding to my position as I don’t have the capital right now.

However if I did, I would split that capitals between Fortis and Emera. I believe Emera will do well over the long term (10+ years).

Their price, along with other utilities, pipelines, etc have dropped because interest rates have risen.

Regulated utilities take several years to pass increases to rate payers but eventually they always do.