Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

“Dividends may not be the only path for an individual investor’s success, but if there’s a better one, I have yet to find it”

Josh Peters – The Ultimate Dividend Playbook: Income, Insight and Independence for Today’s Investor

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a brief summary of these companies. This month was a quiet one with only 3 dividend increases, the largest coming from Andrew Peller Ltd. (ADW-A.TO), which increased their dividend by 13.9%.

Before I go over the dividend increases in detail there are two questions that should be answered first:

Question 1: Why are dividend increases good?

A dividend increase is a sign from management that they feel good about the future prospects of the company. There is a theory; Dividend Signaling, that suggests that dividend increases generally indicate the stock will perform well in the future. Conversely, the same theory suggests that if the dividend is cut or decreased it is signal that stock won’t perform well.

The Dividend Signaling Theory is a bit controversial but testing of the theory suggest that generally, dividend signaling does occur.

Dividend signaling also makes sense from a common-sense perspective:

- It is common knowledge that companies that cut or decrease their dividend are typically punished quite severely in the stock market. Companies know this, so they try to avoid increasing the dividend if it isn’t sustainable or think it might have to be decreased in the near future. To try and avoid a dividend cut or decrease, the company will typically only increase the dividend to a sustainable level based on their outlook for the company.

- Future dividend payments are typically paid for with future cash flows. By increasing the dividend, management is signaling that they think future cash flows will be enough to pay for the increased dividend.

Beyond dividend signaling, there is another reason that dividend increases are good. Dividend growth stocks typically outperform the market.

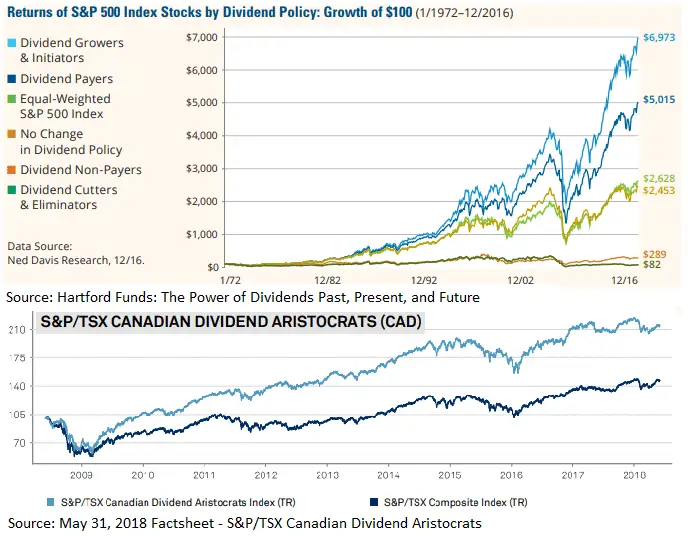

Companies that regularly increase their dividend typically do better than those that don’t and will typically do so with less volatility. You can see this from the two charts below.

The first chart was from a study done on US stocks in the S&P 500 index and the second chart is of the Canadian dividend aristocrats (Companies that have a history of increasing their dividend each year) vs. a Canadian benchmark index.

Related article: The Number One Reason to be a Dividend Growth Investor (And it’s not what you were expecting)

Question 2: What is the Canadian Dividend All-Star List (CDASL)?

The Canadian Dividend All-Star List is an excel spreadsheet with a lot of stock information on Canadian companies that have increased their dividend for 5 or more calendar years in a row.

It’s a valuable resource that is typically used as a starting point to identify and screen Canadian dividend growth stocks.

The list has been updated monthly since early 2013 and it has come to be one of the most popular parts of the Dividend Growth Investing & Retirement website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

OK, now on to the dividend increases…

June 2018 Dividend Increases in the Canadian Dividend All-Star List

In total there were 3 dividend increases from companies in the Canadian Dividend All-Star List during the month of June 2018. They are listed below, starting with the largest dividend increase and ending with the lowest.

1. Andrew Peller Ltd. (ADW-A.TO) – 13.9% Dividend Increase

Andrew Peller Limited is one of Canada’s leading producers and marketers of quality wines and craft spirits. The company was founded 1961 and has been paying dividends every year since 1979. With wineries in British Columbia, Ontario, and Nova Scotia, the Company markets wines produced from grapes grown in Ontario’s Niagara Peninsula, British Columbia’s Okanagan and Similkameen Valleys, and from vineyards around the world.

Source: Q4 FY18 Fact Sheet

Andrew Peller Ltd. which has a dividend streak of 12 years recently increased their quarterly dividend 13.9% from $0.0450 CAD to $0.0513 CAD. This dividend increase comes into effect with the dividend recorded on Jun 29, 2018. The dividend yield as of June 29, 2018, was 1.2%, and they have 5 and 10-year average annual dividend growth rates of 7.9% and 6.2% respectively.

I’m interested in this company, but the dividend yield is simply too low right now. Should the yield get closer to the 3% level I’ll start looking into them more at that time.

2. Empire Company Ltd (EMP-A.TO) – 4.8% Dividend Increase

Empire Company operates a Canadian chain of grocery stores through wholly-owned subsidiary Sobeys Inc. They have more than 1,500 retail stores (corporate, franchise, affiliate) as well as over 350 retail fuel locations, operating in every province and in more than 900 communities across Canada. They also have a 41.5% equity accounted interest in Crombie REIT.

Sobeys is one of only two national grocery retailers in Canada, serving the food shopping needs of Canadians under retail banners that include Sobeys, Safeway, IGA, Foodland, FreshCo, Price Chopper, Thrifty Foods and Lawtons Drugs.

Empire Company Ltd which has a dividend streak of 23 years recently increased their quarterly dividend 4.8% from $0.1050 CAD to $0.1100 CAD. This dividend increase comes into effect with the dividend recorded on Jul 13, 2018. The dividend yield as of June 29, 2018, was 1.7%, and they have 5 and 10-year average annual dividend growth rates of 6.0% and 7.0% respectively.

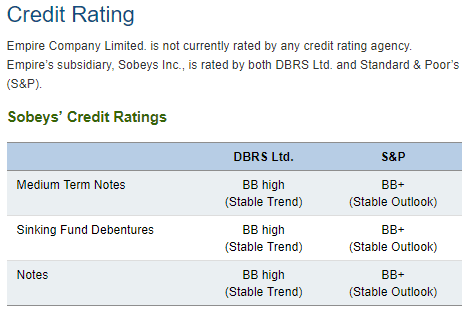

At 23 years, its dividend streak is impressive as this is the sixth longest dividend streak among Canadian companies, but its credit ratings are too low for me to consider it at this time. I generally want to see a credit rating of BBB+ before I invest. The company or I should say its main subsidiary Sobey’s has a BB+ rating right now. Empire Company Ltd is not currently rated by any agencies.

Source: Empire Company Limited Investor Centre website

The poor financial strength of this company and the low dividend yield make it a pass for me.

3. Laurentian Bank of Canada (LB.TO) – 1.6% Dividend Increase

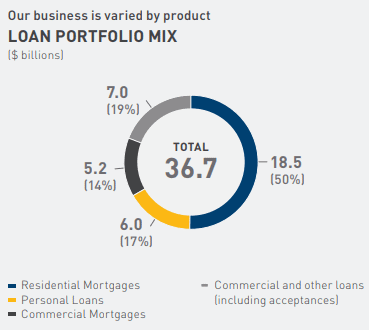

Laurentian Bank is a Canadian bank primarily based in the province of Quebec. The bank was founded in 1846 and has been paying uninterrupted dividends since 1871. They provide diversified financial services including a range of advice-based solutions and services to its customers through its businesses: Retail Services, Business Services, B2B Bank and Capital Markets.

Source: 2017 Annual Report

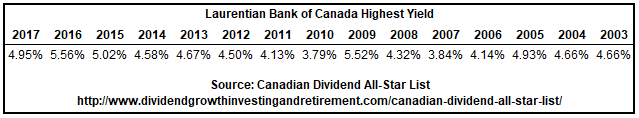

Laurentian Bank Of Canada which has a dividend streak of 10 years recently increased their quarterly dividend 1.6% from $0.6300 CAD to $0.6400 CAD. This dividend increase comes into effect with the dividend recorded on Jul 02, 2018. The dividend yield as of June 29, 2018, was 5.7%, and they have 5 and 10-year average annual dividend growth rates of 6.0% and 7.8% respectively.

While this recent dividend increase may appear low at only 1.6% the bank has been increasing their dividend twice a year. If you factor in both increases; both were one cent increases, then the annual increase was 3.2% (Quarterly dividend of $0.62 to $0.64 over the year).

Laurentian Bank of Canada Dividend Policy

The Bank aims to pay a dividend on its common shares that falls within the range of 40% to 50% of adjusted earnings per share. The Bank’s common share dividend payout ratio could, however, fall outside this range when:

- Management believes the measure is necessary to ensure that capital is maintained at an optimal level for supporting the Bank’s operations, while complying with regulatory requirements, for instance as a result of significant investments in technology;

- Net earnings per share is affected by the result of operations or events of a non-recurring nature;

- Net earnings per share is at an atypical level and the forecasts indicate a return of the net income per share to a normal level.

Dividend Policy Source: 2017 Annual Information Form

Laurentian: Tempting, but I’d pass…

I can understand why some investors might be tempted by Laurentian Bank’s long history of paying dividends and its historically high dividend yield of 5.7%, but just make sure to look into their financial strength first.

DBRS has given them an A (low) credit rating with a negative outlook which is OK, but S&P has given them a BBB rating with a negative outlook. S&P is below the BBB+ level I like to see.

If you are looking for Canadian banks with better credit ratings focus on the “Big 5”.

Summary

Monitoring dividend increases is a good idea because it is a sign from management that they feel good about the future prospects of the company.

Dividend signaling; while a slightly controversial theory, suggests that dividend increases generally indicate the stock will perform well in the future. Conversely, the same theory suggests that if the dividend is cut or decreased it is signal that stock won’t perform well.

Dividend growth stocks typically outperform the market. Companies that regularly increase their dividend typically do better than those that don’t and will do so with less volatility.

There were three June 2018 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Andrew Peller Ltd. (ADW-A.TO) – 13.9% Dividend Increase

- Empire Company Ltd (EMP-A.TO) – 4.8% Dividend Increase

- Laurentian Bank of Canada (LB.TO) – 1.6% Dividend Increase

Disclosure: I do not own any of the three shares mentioned in this article. You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

I thought of buying Laurentian bank given that the stock price is low. However, I bought more Bank of nova scotia instead. I rather go for the big 5 banks + national bank.

For dividend growth investing to work, you need a long-term mindset. The goal is to create a portfolio of high-quality companies that can increase their dividend on a regular basis.