Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Today, I’m taking a break from The Great Canadian Banking Series to look into Potash Corporation of Saskatchewan Inc (Click for a FREE trend analysis of TSE:POT) which I recently purchased. I’m interested in this company for a number of reasons. The first is that Morningstar has it rated as a wide moat stock. Awhile ago I wrote an article about US dividend champions with a wide moat rating from Morningstar. During my research for this article I looked at a few Canadian companies with wide moat ratings and Potash was one of them. Since then it has been on my radar.

If you look at my portfolio, you’ll notice that it is not the most diversified. I’m working to fix this, so I’ve been looking for a basic material company. This is my second reason.

The third reason is that the stock price has dropped about 25% because of the dismantling of a Russian potash cartel. This is expected to significantly reduce potash prices (people are estimating a 25% drop to around $300/tonne). I’m always looking for a bargain, and negative news usually sparks my interest.

Before I start the dividend stock analysis I want to mention to new readers that there is another article that you may want to read first. The other article better explains what I’m looking for in a company from a dividend growth perspective and why I analyze specific company components and ratios. The other article is meant more as an educational tool so that readers can better understand my dividend stock analyses. This dividend stock analysis will look at Potash Corporation of Saskatchewan Inc. to identify if it is a good dividend growth candidate to invest in.

Company Description

From Google Finance:

“Potash Corporation of Saskatchewan Inc. (PCS) is an integrated fertilizer and related industrial and feed products company. The Company operates in three segments: potash, phosphate and nitrogen. The Company owns and operates five potash mines in Saskatchewan and one in New Brunswick. Its phosphate operations include the manufacture and sale of solid and liquid phosphate fertilizers, phosphate feed and industrial acid, which is used in food products and industrial processes. The Company also has a phosphate mine and two mineral processing plant complexes in northern Florida and five phosphates feed plants in the United States. It produces phosphoric acid at its Geismar, Louisiana facility. The nitrogen operations involve the production of nitrogen fertilizers and nitrogen feed and industrial products, including ammonia, urea, nitrogen solutions, ammonium nitrate and nitric acid. It has nitrogen facilities in Georgia, Louisiana, Ohio and Trinidad.”

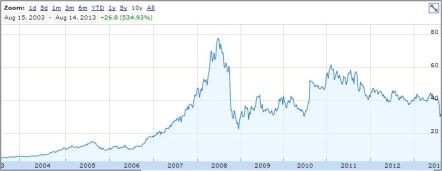

10 Year Stock Chart

There is a 10 year annual average return of 20.3%. If we include the dividend payments over the past 10 fiscal years (Total dividends paid of $1.57) then the total average annual return would be 20.9% with the average return from dividends representing 0.6%.

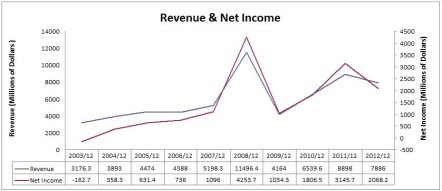

Revenue and Earnings

Potash Corporation of Saskatchewan’s revenue and net income have been trending up. In 2003 they lost a little money, but overall the trend has been good.

Normally I like to see revenue increase every year, so it’s not a perfect chart. Earnings spiked in 2008 and 2011, but it is still a good chart.

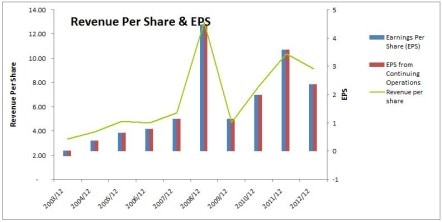

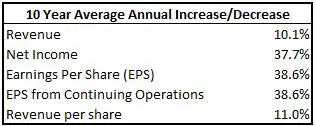

Potash Corporation of Saskatchewan has OK earnings charts. I’d like to see more consistent and growing earnings, but when looking at companies in the basic materials sector there are usually fluctuations because revenue is tied to the price of a commodity.

All earnings growth rates are good and above the 8% I like to see.

Dividends

Potash Corporation of Saskatchewan has increased their dividend for 2 consecutive years in a row. I had a look at their dividends going back as far as 1990 and they don’t typically increase their dividend every year. I like a company that increases its dividend every year and Potash Corporation of Saskatchewan seems to increase every year for a few years, and then keep it steady for a few years and then start increasing again.

While this is a Canadian company the dividends are and have been paid out in US dollars since 1999. Prior to this they were in Canadian dollars.

The quarterly dividend recorded in July 2013 of $0.35 (up from $0.28) was their most recent increase, but they’ve been increasing their dividend twice a year for the past few years. The quarterly dividend recorded in April 2013 was increased from $0.21 to $0.28. The most recent annual dividend increase would be from $0.21 to $0.35 which is a whopping increase of 66.7%.

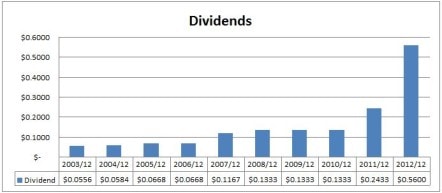

In the chart you can see the large dividend increases in 2011 and 2012. The overall trend is good, and it looks like management may be changing their dividend growth policy to pay out higher dividends.

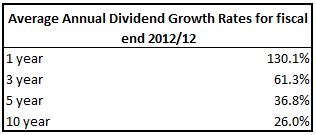

Dividend Growth

As you can see from the table below Potash Corporation of Saskatchewan shows outstanding dividend growth rates. These are good rates, but the averages are largely skewed by the huge increases in 2011 and 2012. I looked at the rates prior to this and the 10 year average annual dividend growth rate ending in 2010 is 9.1%, which is still good.

Overall the dividend growth is quite good, but it comes in waves. I wouldn’t expect dividend increases every year, but rather a steady dividend for a few years followed by some large dividend increases. With these recent large increases I find it difficult to guess future dividend growth as it looks like the dividend policy is changing to allow a higher payout ratio than in the past.

Dividend Sustainability

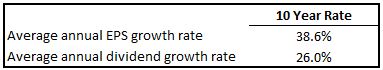

The 10 year average annual dividend growth has been below earnings growth which points to sustainable dividend growth.

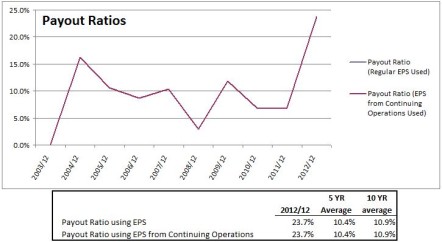

Let’s take a look at the payout ratio to see how much room for further dividend growth there is.

In the past the payout ratio has been around 5-15%, but with the recent large dividend increases it looks like management plans to increase its payout ratio. In 2012 the payout ratio jumped to 23.7%. Analysts are estimating EPS of $2.53 for 2013. If you assume the last dividend payment in 2013 will be the same as the last quarterly payment of $0.35 this would result in $1.19 in dividends paid in 2013. This is an estimated payout ratio of 47% ($1.19/$2.53), which is significantly higher than past levels. With a payout ratio of around 50% the dividend appears sustainable and below the 60-70% I like to see, but still well above historic levels.

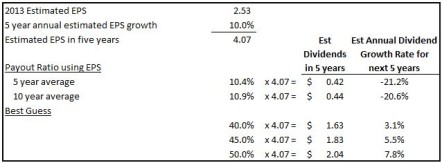

Estimated Future Dividend Growth

Analysts expect annual EPS growth to be 10.0% for the next 5 years. Accepting this EPS growth rate and using various payout ratios we can guess future dividend growth rates.

It looks like the dividend policy is changing to allow for a higher payout ratio. In this transition period I found it very difficult to guess future dividend growth. My payout ratio estimate for 2013 is 47%, so I put the best guess payout ratios at 40, 45 and 50%. These levels are well above historic rates, so I don’t have a huge amount of confidence in these estimates.

Based on the previous dividend history of the company I think they will continue dividend increases in a sporadic manner. I expect a few years of increases followed by a stalled dividend for a few more years. Rinse and repeat.

The dividend recorded in July was announced in May 2013, and at the time the company seemed fairly optimistic, with the CEO stating:

“The confidence we have in our ability to generate strong cash flow in the years ahead has enabled us to strengthen our dividend for the fifth time since 2011”

With the Russian cartel breaking up and the price of Potash expected to drop to around $300 per tonne, I don’t know that I’d expect a lot of dividend growth in the near future. I think overall it would be reasonable to assume an annual dividend growth ranging from 5-10%, but this is a long term estimate. I expect this average dividend growth to include a number of years of stalled dividend growth with larger increases in certain years.

In these types of situations I typically look for a higher dividend yield so I get paid a decent dividend to wait. The current yield is around 4.5%, which is quite good. At this point I’m still interested even with the uncertainty related to the company and dividend growth.

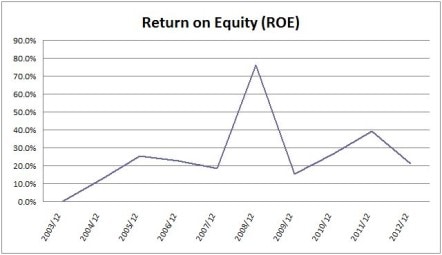

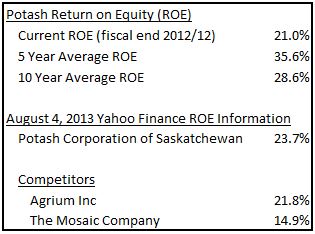

Competitive Advantage & Return on Equity (ROE)

Since 2005 ROE has been around or above 20% which is good.

Looking at the table below, it looks like the company’s ROE has been above or close to its competitors.

Potash Corporation of Saskatchewan has about 20% of the market share which makes it the world’s largest producer by capacity of Potash. Morningstar has a wide moat rating for the company and I would agree with this rating.

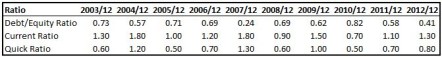

Debt & Liquidity

I want to invest in companies that are fiscally responsible, so it is important to look at debt levels and see that they are at reasonable levels.

Overall the company looks like it is in good financial health. I wouldn’t mind seeing the quick ratio a bit higher.

Shares Outstanding

It looks like shares outstanding have been trending down overall. The company also recently announced a $2 billion share buyback program.

Valuation

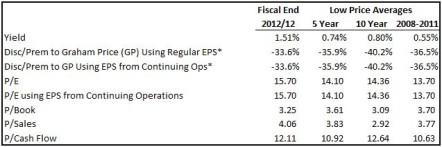

I use the low price averages for 6 main ratios to determine a fair price: Yield, Discount/Premium of the low price compared to the Graham Price, P/E, P/B, P/Sales and P/Cash flow. I like to look at both EPS and EPS from continuing operations so it ends up being a total of 8 ratios as the Graham Price an P/E both use EPS. You can read more about my valuation method here.

I get the following for Potash Corporation of Saskatchewan.

* The discount or premium to Graham Price hasn’t been calculated in the normal fashion. For the details read this article.

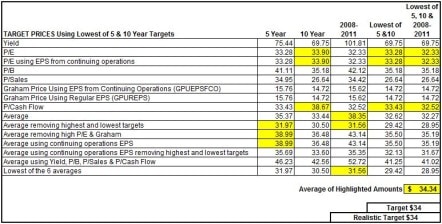

I use the averages from the previous table to determine my target price. Using these averages creates a lot of different target prices, so I back-test this strategy over the past 10 years. I identify which of the 8 valuation techniques would have given me a chance to buy the stock in two to three fiscal years in the past 10 fiscal years. It’s not always possible to test my strategy back 10 years, due to limited financial information, but I do my best. The results are highlighted below.

The average of the highlighted amount gives me a target price of $34. This would result in a dividend yield of 4.12% (assumes 1:1 CDN:USD exchange rate) with the current annual dividend of $1.40 USD. I think this a reasonable target, so I left the realistic target at $34 CDN.

Morningstar’s estimated fair value is $39. Prior to the news that the Russian cartel was breaking up and Potash prices were expected to drop Morningstar’s fair value estimate was $50. For Morningstar to rate Potash Corporation of Saskatchewan as a 5 star undervalued stock the price would have to fall below their “consider buy price” of $23.40.

Right now there is a lot of uncertainty around this stock and potash prices, so for an extra margin of safety you might want to look for a target price closer to Morningstar’s target of $23.40. I bought in at $30.30, but I still think the price could drop more. You can see all of my target prices here.

Trend Analysis

I also like to look at INO`s Free Trend Analysis prior to investing to see if I should hold off or not. Sometimes it is nice to see if the stock is trending down or up before buying it. For August 9, 2013 INO is showing a down trend for Potash Corporation of Saskatchewan.

To see the most recent trend analysis for Potash or to sign up for free trend analysis’s click here. INO also has a list of the top 50 trending stocks and free trading seminars and videos.

Other Investment Options in the Same Industry

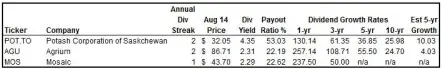

Potash Corporation of Saskatchewan shares the industry with Agrium and Mosaic. I found it difficult to find good dividend growth candidates in the industry as the competitors have only recently started increasing dividends each year. You can see from the table below that the dividend streaks are not that impressive with the highest streaks coming in at two years.

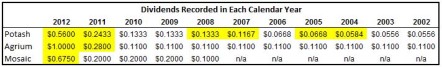

If you look at the dividend growth rates they look very impressive, but these averages are skewed by recent very large increases. I decided it would be better to look at the dividends recorded in each calendar year for the past 11 years to get a better picture.

You can see from the table above that both Agrium and Mosaic only recently started increasing their dividend. I’ve highlighted the years where dividends recorded were higher than the previous year. Mosaic started dividend payments in the middle of 2008 so while it looks like there was an increase from $0.10 to $0.20 in 2009; it is only because the first quarterly dividends started in the middle of 2008 which only led to two $0.05 dividends in the year. There was no actual increase in the quarterly dividend amount until 2012. There was a special dividend in 2009 of $1.30 that is not shown in the table above.

In Agrium’s case you can see that the dividend was held at $0.11 for a long time before increases in 2011 and 2012. The increase from $0.11 to $1.00 in 2012 is an 809% increase. While it is nice to see large increases, I wouldn’t consider it a great dividend growth candidate because it hasn’t been increasing its dividend for a very long time. When you compare this to Potash you can see that while Potash hasn’t been increasing dividends every year, they have been doing it on and off over the past decade as opposed to just in the past few years.

Agrium has a low payout ratio, but its current yield of 2.31% is below the 2.50% I like to invest in. Its estimated 5 year annual EPS growth is only 4% compared to Potash’s 10%. I wouldn’t consider investing in Agrium because I think there are better US dividend growth candidates out there. Typically when I invest in a US company I’m looking for a dividend streak of around 10 years. Agrium only has a streak of two years. If a company has a streak of less than 10 years I like to see that they had a history of increasing dividends prior to the stalled dividend. I don’t get this with Agrium which is why I don’t plan on investing in it.

For similar reasons as Agrium I also wouldn’t invest in Mosaic. The dividend yield of 2.29% is below my 2.5% threshold, the dividend streak is low at 1 year and they don’t have a history of dividend increases. Mosaic’s short dividend history is another reason why I wouldn’t invest in the company. I like to see a longer dividend history so I can get a better sense of management’s dividend policy. Mosaic has only been paying dividends since 2008, and I like to see around 10 years of dividend payments.

Conclusion

For the conclusion I thought I would answer some important questions.

Is Potash Corporation of Saskatchewan a great dividend growth candidate?

Because of its sporadic dividend increases and uncertain future dividend growth, probably not. Potash seems to have a history of increasing the dividend for a few years, and then keeping it steady for a few years. Ideally I like to see increases every year and I don’t think you will get that with Potash. Overall, I’d say it is an OK to good dividend growth candidate.

As a long term investment do I think Potash will increase dividends above the average annual growth rate of 8% I target?

Yes… probably. Because of the recent large increases in the dividend and payout ratio I found it difficult to guess future dividend growth with the changing dividend policy. I don’t have a huge amount of confidence in my estimate, but if I had to guess I’d say that over the next 5 years or so the average annual dividend growth rate will be 5-10%. In the long term I think annual average dividend growth will be above 8%, but don’t expect consistent raises.

So why did I invest?

- Potash Corporation of Saskatchewan has a wide moat as it has about 20% of the market share which makes it the world’s largest producer by capacity of Potash.

- While I expect sporadic dividend growth I think the annual average growth will be above my 8% target long term.

- There is a lot of negative news out there right now (July/August 2013) about low Potash prices and how this will negatively affect the company. I think the stock price could drop further, but as a long term investment I think I’ll make money, and in the meantime I’ll be earning a dividend yield of over 4.5%.

- The price is right. The negative news resulted in a 25% stock price drop in July 2013 which is why I was able to buy shares at $30.30 which is below my target price of $34.

- Diversification. Prior to this investment I didn’t own any basic materials companies, now I do. I’ve been trying to diversify my portfolio better, and with this purchase I have.

Disclaimer

I own shares of Potash Corporation of Saskatchewan. You can see my portfolio here. I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

In your stock analyses you always mention the Morningstar estimated fair value in addition to your estimations. Does one have to be a premium member of Morningstar to obtain the fair values or are they made available for free?

I get access to them for free through my online broker Questrade. All Questrade users get access to morningstar information through their research services.

If you aren’t a Questrade user then you don’t have access to the information, but you can get a general idea of it based on their star rating. 3 stars = close to fair value.

I, too, became interested in POT after the drop. I’ve since read a lot of really positive and really negative articles on the company. I’m still trying to digest all of the facts and opinions. I lean positive at this point, but not with conviction. Like you, I’m also looking to increase exposure to the basic materials sector. I’m still undecided whether this company is the right idea for that sector at this time.

I consider POT a cyclical stock and therefore prefer to stick to many of your good long-term DG stocks.

very well written analysis. Thanks for sharing. I am thinking of buying some shares. But will wait for it to go little lower. They are all time high right now