Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Last week I went over how you can compare the current dividend yield to historical averages to see if a stock is undervalued. The idea being that if the dividend is sustainable and the current yield is higher than the 3, 5, and 10 year high yield averages then the stock is likely undervalued.

You can run into problems with this technique in a few situations however. Sometimes a company has a high yield because they are going through problems or because the market expects a dividend cut. If you look at the yield before a dividend cut, it will usually be higher than the historically high yield averages. No one likes to invest in a company right before a dividend cut, so it is important to see if the dividend is sustainable before using this valuation technique. AGF Management Ltd comes to mind when I look at the May 31, 2013 version of Canadian Dividend All-Star List. AGF Management Ltd’s current yield of 9.44% is 32.7% above its 10 year average highest yield, but by looking at the payout ratio I can see that dividend payments are roughly 235% of earnings. This means that they are currently paying out more than double their earnings as a dividend. While the company has shown a commitment to increasing their dividend in the past their last dividend increase was in 2011 when the quarterly dividend was increased a paltry one cent from $0.26 to $0.27. AGF Management has had a high payout ratio for a while and it is well over 100%. This is not a sustainable trend and unless they can turn things around I expect a dividend cut.

Another example of problems with using dividend yield as a valuation method is if the company recently changed its dividend policy. Looking at past high yield averages when the company treatment of dividends was different, will result in less useful valuations. An example of this could be Suncor. When I look at the May 31, 2013 version of the Canadian Dividend All-Star List I can see that Suncor’s dividend yield of 2.54% is 57.4%, 73.7%, and 145.7% higher than its 3, 5 and 10 year highest yield averages. This would suggest that Suncor is significantly undervalued, but Suncor recently announced a large dividend increase of 53.85%. Suncor increased its quarterly dividend of $0.13 to $0.20 and now has a payout ratio around 50%. This payout ratio is a lot higher than in the past as it their payout ratio was typically around 20-30%. If a company shifts its dividend policy and starts paying out a significantly larger or lower portion of its earnings as dividends then the past highest dividend yields aren’t as useful as the dividend policy has changed.

While these problems exist I still find it useful to use yield as a valuation method in conjunction with additional research. I use the dividend yield as a quick screen to identify a few investing options and then I use a variety of different historical measures to determine target prices. I believe that investing in high quality dividend growth stocks at good valuations is a winning strategy, so coming up with a target price is an important part of the process.

It can take a lot of time and a rather complicated excel spreadsheet to come up with my target prices, but it doesn’t have to be this hard. For beginner investors or for those that don’t have the time or interest, calculating a target price can be cumbersome. The good news is that if you don’t know how calculate the fair value of a company, or don’t have a lot of time there are other resources available.

- Morningstar – This is my favorite and I use the website often to check against my targets prices and to find new opportunities. Morningstar has a 5 star rating system to value stocks which can be viewed by anyone. I have a Questrade account which gives me access to Morningstar’s company reports. These reports have target prices that show a price to consider buying, a fair value and a price to consider selling. If the current price is below the “consider buying price” then it will have a 5 star rating. Fair value prices are shown as 3 stars and 1 star means you should consider selling. I like Morningstar because their 5 star values are usually quite conservative which matches my investing style.

- Your broker – Most brokers will have some sort of research available to investors. Utilize these stock reports and research to quickly find target prices. I have a Questrade account which gives me access to the Morningstar information.

- Stock Analysis On – This website will show you a stock’s present or intrinsic value using a variety of different valuation methods. They use a variety of different methods like the discounted cash flow (DCF) method and dividend discount model (DDM). They show you the calculations and assumptions they use in their calculations which can be very useful if you are trying to learn more about these methods.

- Guru Focus – This website can be useful if you want to see how the current price compares to a bunch of different target values. Some of these targets are based on famous investor strategies.

- Seeking Alpha or The Motley Fool – You can find tons of investing articles on either of these websites. With a little digging you should be able to find some articles on a company’s fair value.

- My Dividend Watch List – Every time I complete a dividend stock analysis I add my target price to the watch list if it is a company I’d consider investing in.

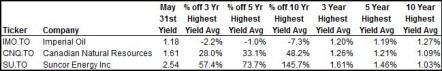

I already mentioned Suncor, so I thought I would look at some companies in the Canadian energy industry as an example of how you can use the dividend yield to identify options and Morningstar to come up with a target price. Below is some information on three companies in the energy industry taken from the May 31, 2013 Canadian Dividend All-Star List.

You can see from the table that Suncor and Canadian Natural Resources are currently yielding above their historic averages, while Imperial Oil is within 1.0% to 7.3% of its averages. Based on this table I’d look into Suncor and Canadian Natural Resources further by looking at some more information from the same list.

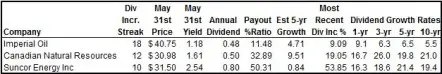

All companies have reasonable payout ratios, long dividend streaks and good dividend growth which suggest a sustainable growing dividend. I like to see a yield of 2.5%, but will go down to 2.0% in cases where I think future dividend growth will be strong. Based on Canadian Natural Resources’ past annual dividend growth usually around 20%, their reasonable payout ratio and their expected strong annual earnings growth of 9.51% I would be willing to buy Canadian Natural Resources at a 2.0% yield level. With its current annual dividend at $0.50 a 2.0% yield would occur at $25.00. Now that I’ve confirmed that the dividend looks sustainable for these companies, let’s look at some Morningstar data to get target buy prices.

Suncor and Canadian Natural Resources both have a five star rating as they are below Morningstar’s “consider buy price”. This confirms the high yield valuation test that these stocks are undervalued and now you also have some target prices without having to dig into a complicated spreadsheet. I’m still hoping prices come down more as I want a yield of at least 2.0% for Canadian Natural Resources which makes my target buy price $25.00. In Suncor’s case my personal target price came in at $32, which is the 2.5% yield price. Imperial Oil has a very low yield and the price would have to drop significantly to get to a yield ranging from 2.0% to 2.5% so I didn’t bother determining my target price.

Investing can be time consuming and confusing at times, but it doesn’t have to be. You can see in my example how I was able to quickly identify undervalued dividend growth stocks and determine a target price. Hopefully after reading this article finding a reasonable target price is a little easier.

Disclosure

I have a small amount of shares in Suncor and Imperial Oil left over from when I sold starter shares to individuals who wanted to enrol in DRIPs. It wasn’t my intention, but after writing this article I plan on buying additional shares of Suncor in the next 72 hours assuming the price remains below my target price of $32. You can see my portfolio here.

I am a blogger and not a financial expert. These writings are my own opinions and should not be considered financial advice. Always perform your own due diligence before purchasing a stock. I mention target prices in this article, but this is not a recommendation to buy this stock, it is just a target price I use for my own personal investing that I have chosen to share.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!