Dividend Growth Investing & Retirement is supported by its readers through donations and affiliate links. If you purchase through a link on my site, I may earn a commission. Thanks! Learn more.

Each month I update readers of all the dividend increases in the Canadian Dividend All-Star List (Canadian companies that have increased their dividend for 5 or more years in a row.) along with a summary of these companies. I’m playing a bit of catch-up so this article will cover all 11 dividend increases from August 2019.

Tracking recent dividend increases can be a good way to generate new dividend growth stock ideas as dividend increases can be a sign from management that they feel good about the future.

“even if earnings releases make much more interesting reading, dividends speak louder than earnings.” … “Dividends are more than mere information; they provide insight that any investor can use to make successful investments.”

Josh Peters, The Ultimate Dividend Playbook (AL), Chapter 4

Out of the 101 companies in August’s Canadian Dividend All-Star List, there were 11 dividend increases, with the largest coming from Ritchie Bros. Auctioneers Inc (TSE:RBA; NYSE:RBA) at 11.1%.

August 2019 Dividend Increases in the Canadian Dividend All-Star List

Table of Contents – You can use the links below to jump ahead to the company you are interested in.

- Ritchie Bros. Auctioneers Inc (TSE:RBA; NYSE:RBA) – 11.1% Dividend Increase

- CAE Inc (TSE:CAE; NYSE:CAE) – 10.0% Dividend Increase

- Keyera Corp. (TSE:KEY) – 6.7% Dividend Increase

- Sylogist Ltd. (CVE:SYZ) – 5.3% Dividend Increase

- Exchange Income Corporation (TSE:EIF) – 4.1% Dividend Increase

- Canadian Western Bank (TSE:CWB) – 3.7% Dividend Increase (2nd increase in the past year)

- Bank of Nova Scotia (TSE:BNS; NYSE:BNS) – 3.4% Dividend Increase (2nd increase in the past year)

- Logistec Corporation (TSE:LGT.B) – 3.0% Dividend Increase

- Saputo Inc. (TSE:SAP) – 3.0% Dividend Increase

- Royal Bank of Canada (TSE:RY; NYSE:RY) – 2.9% Dividend Increase (2nd increase in the past year)

- Canadian Imperial Bank of Commerce (TSE:CM; NYSE:CM) – 2.9% Dividend Increase (2nd increase in the past year)

Before we dig into the dividend increases you should understand…

What is the Canadian Dividend All-Star List (CDASL)?

The CDASL is an excel spreadsheet with a lot of stock information that is typically used as a starting point to identify and screen Canadian dividend growth stocks. The list has been updated monthly since early 2013 and it is the most popular resource of my website.

Download CDASL

Subscribe to the Dividend Growth Investing & Retirement newsletter and you'll be emailed the download link for the most recent version of the Canadian Dividend All-Star List (CDASL).

If you want to learn more: what the Canadian Dividend All-Star List is, how dividend streaks are calculated, and an example on how to use the Canadian Dividend All-Star List to find high-quality dividend growth stocks, check this article out.

OK, now on to the dividend increases…

1. Ritchie Bros. Auctioneers Inc (TSE:RBA; NYSE:RBA) – 11.1% Dividend Increase

Ritchie Bros. Auctioneers is the world’s largest auctioneer of used industrial heavy equipment.

Ritchie Bros. Auctioneers Dividends

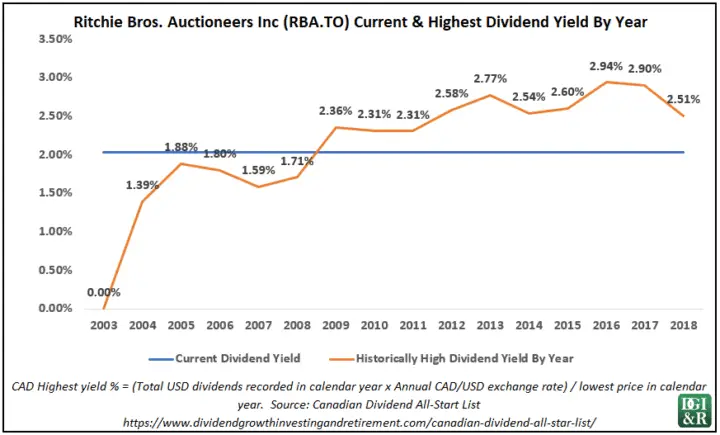

Ritchie Bros. Auctioneers Inc which has a dividend streak of 16 years recently increased its quarterly dividend 11.1% from $0.1800 USD to $0.2000 USD. This dividend increase comes into effect with the dividend recorded on Aug 28, 2019.

The dividend yield as of October 11, 2019, was 2.0%, and they have 5 and 10-year average annual dividend growth rates of 6.7% and 7.5% respectively.

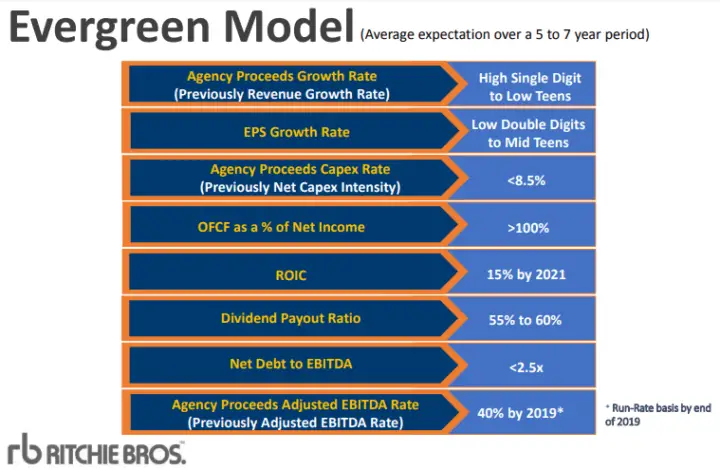

Source: June 13, 2018 William Blair 38th Annual Growth Stock Conference Presentation

Analysts are estimating roughly $1.47 EPS for the next twelve months so the current payout ratio is 54% which is a little under their 55% to 60% long-term target.

If, and I stress if, they meet their EPS growth rate of low-double-digits to mid-teens, then dividend growth could be pretty good going forward. This recent 11% increase is an improvement over last year’s increase, which sends a positive signal.

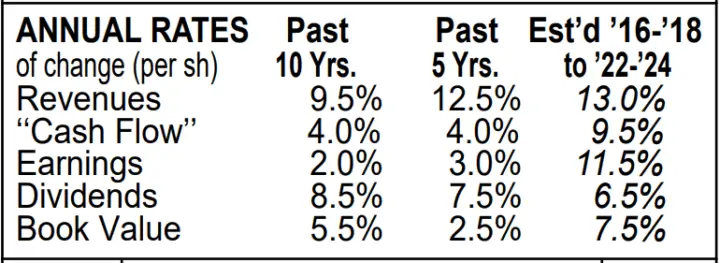

That said, Valueline is estimating 6.5% annual dividend growth over the next 3-5 years. Keep in mind that Valueline covers the NYSE listing RBA and not the TSE listing.

Source: ValueLine Aug 23, 2019 NYSE-RBA Report

With credit ratings under investment grade, I wouldn’t be surprised if they decide to pay off more debt first before increasing the dividend in-line with EPS growth. This is another way of saying that until they improve their financial strength, I’d expect dividend growth below future earnings growth.

Ritchie Bros. Auctioneers Financial Strength & Valuation

They have poor credit ratings. S&P has them at BB and Moody’s at Ba2. I look for BBB+/Baa1 or higher before I consider investing. Valueline gives them a B++ financial strength rating.

Using the dividend yield as a valuation tool suggests that they are over-valued. The historically high dividend has been higher than the current level every year going back to 2009.

Morningstar would seem to agree that the stock appears overvalued as they have given Ritchie Bros. a two-star valuation as they are currently trading above their fair value estimate of $40 CAD.

Per Morningstar, they have a narrow moat.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Ritchie Bros. Auctioneers Final Thoughts

Financial strength is an important metric to me as a long-term dividend growth investor so I don’t plan on investing in the company. If they can improve their financial strength then I’ll look further into them at that point.

[Back to Navigation] [Jump to Summary]

2. CAE Inc (TSE:CAE; NYSE:CAE) – 10.0% Dividend Increase

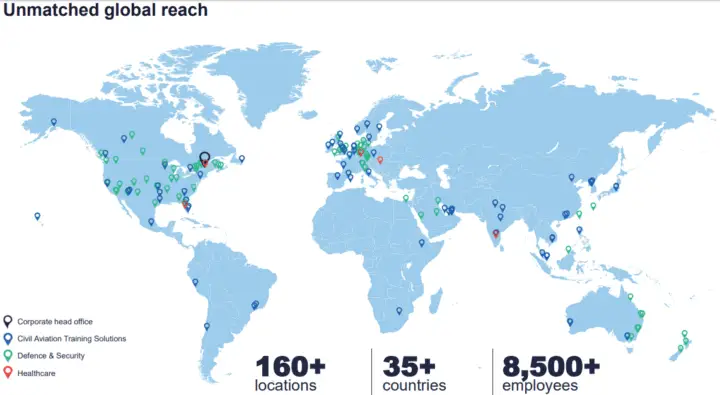

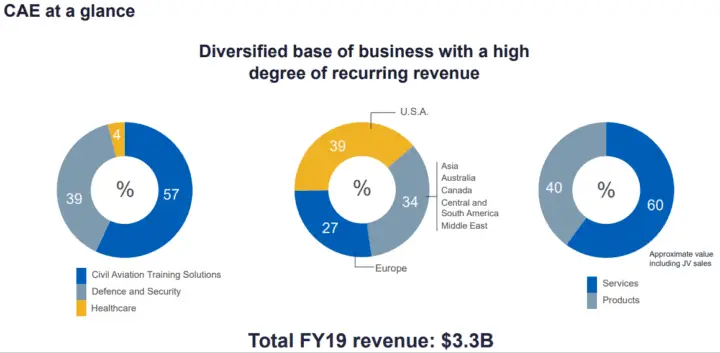

CAE is a global leader in training for civil aviation, defence and security, and healthcare markets with virtual-to-live training solutions to make flying safer, maintain defence force readiness and enhance patient safety. They have over 160 sites and training locations in over 35 countries.

Source: June 2018 Investor Presentation

Source: May 17, 2019 Investor Presentation

Source: May 17, 2019 Investor Presentation

CAE Dividends

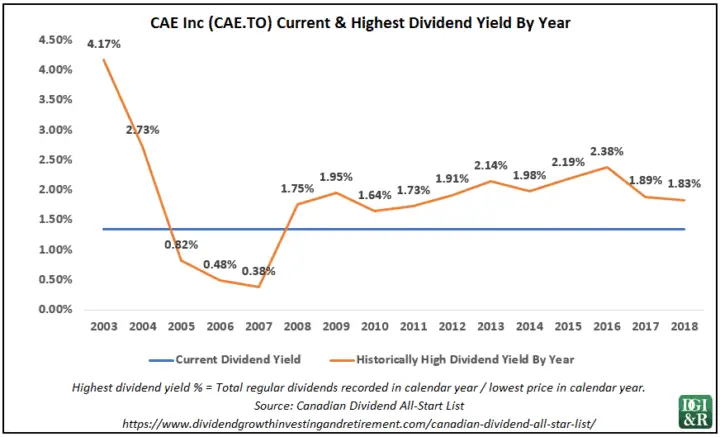

CAE Inc which has a dividend streak of 11 years recently increased its quarterly dividend 10.0% from $0.1000 CAD to $0.1100 CAD. This dividend increase comes into effect with the dividend recorded on Sep 13, 2019.

The dividend yield as of October 11, 2019, was 1.3%, and they have 5 and 10-year average annual dividend growth rates of 12.6% and 14.3% respectively.

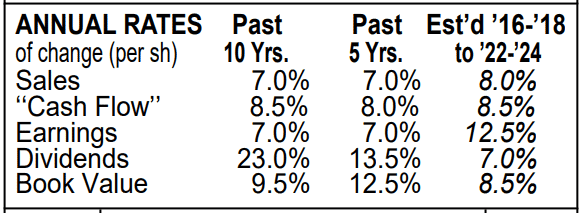

The company has strong 5 and 10-year dividend growth rates, but Value Line is estimating that future dividend growth will be lower over the next 3-5 years at 7.0% annually.

Source: CAE September 6, 2019 Value Line Report

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

CAE Financial Strength & Valuation

Value Line gives CAE a “B+” for financial strength, which is the minimum rating I like to see.

From a P/E standpoint, CAE looks a bit pricey. Based on the average annual P/E ratios from Value for the past decade or so they’ve mostly been around the mid to high teens. The current P/E per Value Line is in the mid-20s.

CAE’s current yield is 1.3%. Per Value Line the average annual dividend yield has ranged from 1.1% to 2.0% over the past decade and if you look at the highest yield table below it looks like from a dividend yield perspective CAE is a little expensive too.

CAE Final Thoughts

The recent 10% dividend increase is a good sign and they have a strong history of dividend growth with 5 and 10-year annual dividend growth rates of 12.6% and 14.3%, but …

- CAE looks expensive right now, and

- the dividend yield of 1.3% is just too low for me to be interested.

Should the dividend yield increase substantially, I’ll look more into them at that time.

[Back to Navigation] [Jump to Summary]

3. Keyera Corp. (TSE:KEY) – 6.7% Dividend Increase

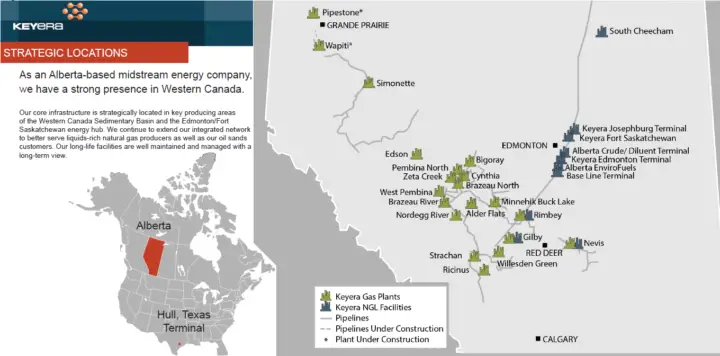

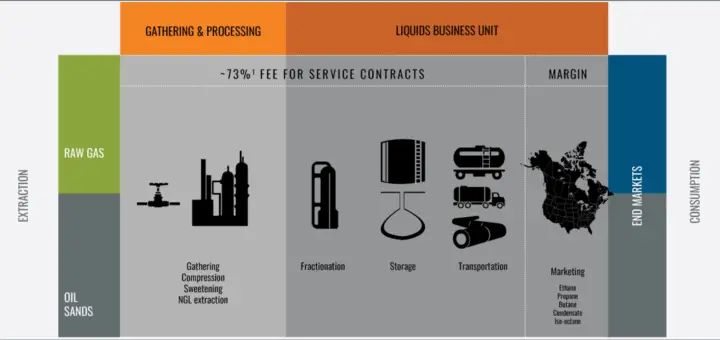

Keyera Corp. is a Canadian-based, independent midstream energy company that provides midstream energy solutions to oil and gas producers in Western Canada.

Source: 2018 Keyera Corporate Overview

Primary operations consist of:

- Raw natural gas gathering and processing,

- Natural gas liquids (NGL) fractionation, storage, transportation, logistics and marketing services,

- Diluent logistics for oil sands customers, and

- Iso-octane production, logistics and marketing

Source: Keyera Corporate Profile August 2018

Keyera Dividends

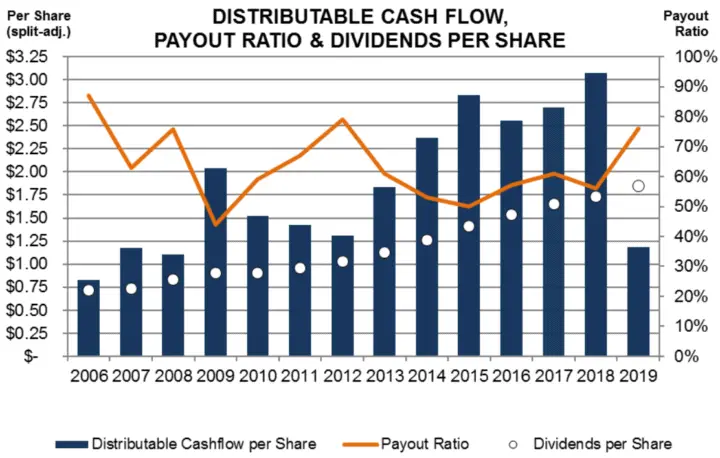

Keyera Corp. which has a dividend streak of 8 years recently increased its monthly dividend by 6.7% from $0.1500 CAD to $0.1600 CAD. This dividend increase comes into effect with the dividend recorded on Aug 22, 2019.

The dividend yield as of October 11, 2019, was 6.3%, and they have 5 and 10-year average annual dividend growth rates of 8.9% and 7.5% respectively.

Source: Keyera Corporate Profile August 2019

Keyera has a nice history of growing their dividend, but the payout ratio based on distributable cash flow (less conservative than EPS) looks a bit on the high side.

That said, Morningstar thinks that:

“We also expect Keyera to increase its dividend at an average rate of 8% annually over the next five years.”

Source: August 7, 2019 Morningstar Analyst Note

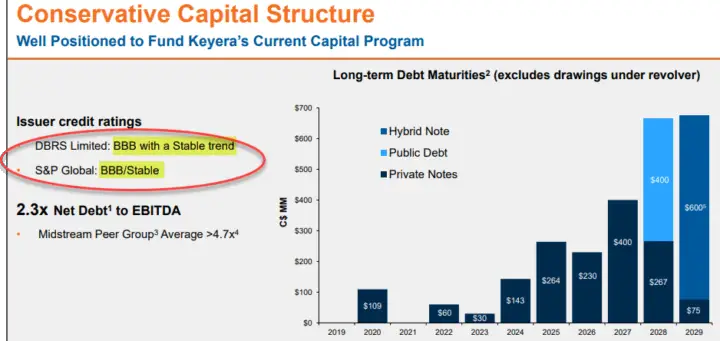

Keyera Financial Strength & Valuation

The dividend yield and dividend growth prospects are good, but their credit rating is a little too low for me at BBB.

Source: Keyera Corporate Profile August 2019

I like to see a BBB+ credit rating or higher.

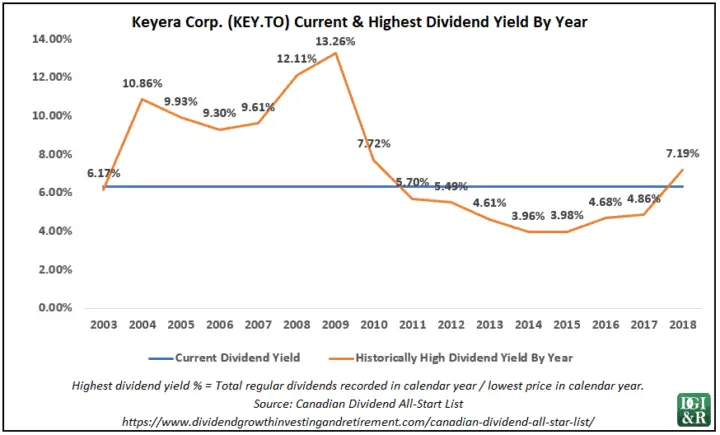

Using the dividend yield as a valuation tool makes it look like a 6.3% dividend yield is actually fairly low for them from a historical standpoint, but it is important to remember that in January 2011 they converted from an income trust to a corporation.

Comparing today’s yield to a dividend yield prior to 2011 isn’t a fair comparison. When you factor this in, then Keyera looks reasonably cheap.

Morningstar has given them a 3 stars valuation as they are trading close to their fair value estimate of $34.

Morningstar has a “No moat” rating for Keyera Corp. explaining that …

“Keyera’s operations don’t enjoy many of the regulatory protections afforded to pipeline operators, highlighted by the absence of strict approval requirements for new projects. Most of the company’s operations are not underpinned by long-term contracts and can be terminated on short notice. Keyera’s gathering and processing operations are tied directly into natural gas producers’ wellheads, which exposes the company to production cuts.”

Source: August 7, 2019 Morningstar Analyst Note

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Keyera Final Thoughts

I can understand why investors would be tempted by a high 6.3% yield and decent dividend growth. Especially when Morningstar is estimating 8% dividend growth over the next 5 years, but …

The credit rating is a little too low at BBB for me to consider investing and the “No moat” rating is another knock against it.

[Back to Navigation] [Jump to Summary]

4. Sylogist Ltd. (CVE:SYZ) – 5.3% Dividend Increase

Sylogist is a small-cap software company that has no long-term debt. They provide enterprise resource planning (“ERP”) solutions, including fund accounting, grant management and payroll to public service organizations.

Sylogist’s public service customers include Local Governments, Non-Profit Organizations (“NPO”), Non-Governmental Organizations (“NGO”), Education Boards and Districts and Defense and Safety Contractors.

The vast majority of the Company’s customers are in USA and Canada and the remainder in “UK and other” (which encompasses Latin America, Lebanon, Africa and Europe). Most of Sylogist’s customers are on annual contracts, which automatically renew. Given the nature of the Company’s product offering and the importance to its customers, the average customer life is more than 10 years.

Sylogist Dividends

Sylogist Ltd. which has a dividend streak of 8 years recently increased its quarterly dividend by 5.3% from $0.0950 CAD to $0.1000 CAD. This dividend increase comes into effect with the dividend recorded on Aug 30, 2019.

The dividend yield as of October 11, 2019, was 3.8%, and they have a 5-year average annual dividend growth rate of 14.5%.

Sylogist Future Dividend Growth

Their 5.3% dividend increase is decent, and it comes 3 quarters from the last increase, but it is still low for the company. Its last increase was 18.8% and its 5-year average annual dividend growth rate was 14.5%. Is this a signal that dividend growth may start to slow in the future? I’m not sure …

They have a TTM EPS payout ratio of 75% but have been a fast-growing company. They use a growth by acquisition strategy and have been funding that growth with existing cash flows and cash-on-hand, which is why they have no long-term debt. An enviable position to be in.

If the plan is to remain debt-free then they need enough cash flow to pay the dividend and also fund future growth. A payout ratio of 75% seems high for this type of strategy. If they keep growing the business at a fast pace, they will be able to lower the payout-ratio and still grow dividends by a reasonable level, but dividend growth is unlikely to be at the same high levels it was doing previously.

They also have $48 million in cash sitting on the balance sheet. This is not insignificant when you consider that their market cap is roughly $240-$250 million, and in FY 2018 they paid out $8.3 million in dividends for the whole year.

I think they are in a decent position, but I do think this recent lower dividend increase of 5.3% is a signal that future dividend growth won’t be as high. That said, if they can continue to grow at a fast pace then lower dividend growth for them is still going to be around 5-12% per year.

One last thing to remember is that smaller companies will sometimes cut the dividend even when it appears safe and it is usually to do with a large expansion where they need the additional funding or they want to make a change in the capital allocation strategy.

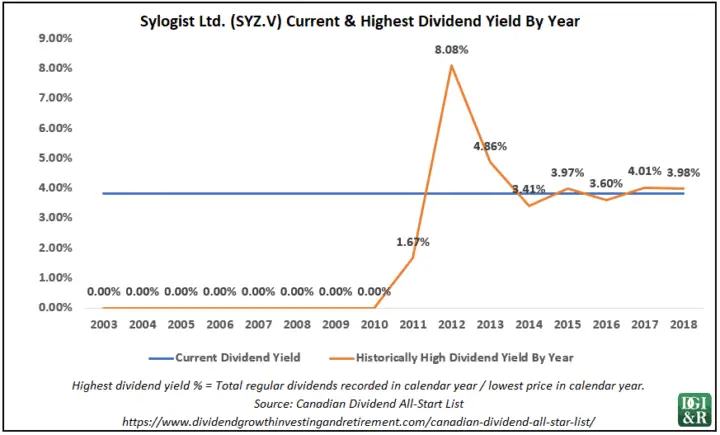

Sylogist Historically High Dividend Yields

Sylogist has been around since March of 1993 but didn’t start paying dividends until 2011. They’ve been increasing each year since then.

For a smaller company like this, it might be prudent to wait for a 10-year streak before investing. If you are interested now, I’d wait for a higher dividend yield of +4% as this is more in line with its historical highs. The wait might not be long as we are close to those levels already.

Sylogist Financial Strength

The company doesn’t have any credit ratings, but that isn’t an issue because the company has no long-term debt. With no debt, I’d say they have very good financial strength.

Sylogist Final Thoughts

Generally, I like to see a 10-year dividend streak before investing and for a smaller company like this, I think it could be prudent.

Sometimes smaller companies will cut the dividend even when it appears safe and it is usually to do with a large expansion where they need the additional funding or change in the capital allocation strategy. I’m not saying this will happen with Sylogist, but in general, smaller companies have more flexible capital allocation policies so I’m a bit more cautious with them.

Overall Sylogist has been a good little company. It is fast-growing, has no debt and has good dividend growth metrics. I’d try for a higher dividend yield of +4% if you are interested in them. I plan to wait and see if the dividend streak makes it to 10 years or if the yield gets over 4% and then dig further into my analysis to determine if they have a sustainable competitive advantage or not.

[Back to Navigation] [Jump to Summary]

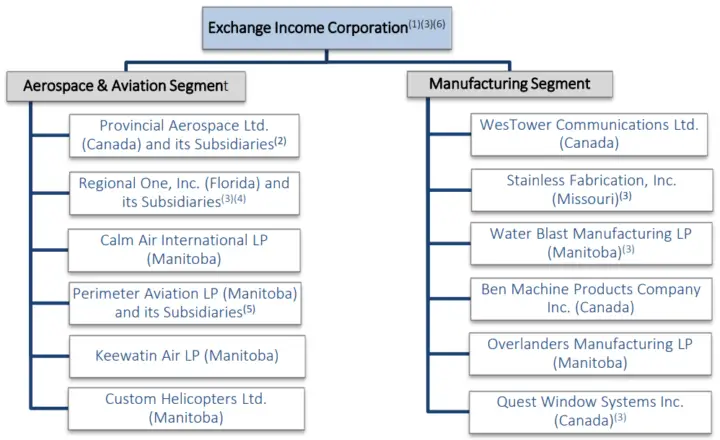

5. Exchange Income Corporation (TSE:EIF) – 4.1% Dividend Increase

Exchange Income Corp is a diversified, acquisition-oriented industrial company that focuses on opportunities in aerospace and aviation services and equipment, and manufacturing.

Source: 2018 Annual Information Form

Exchange Income Corp Dividends

Exchange Income Corporation which has a dividend streak of 8 years recently increased its monthly dividend 4.1% from $0.1825 CAD to $0.1900 CAD. This dividend increase comes into effect with the dividend recorded on Aug 30, 2019.

The dividend yield as of October 11, 2019, was 5.9%, and they have 5 and 10-year average annual dividend growth rates of 5.3% and 3.7% respectively.

Exchange Income Corporation started paying a dividend in 2004 and has never cut the dividend even though it used to be an income trust but converted to a corporation on July 29, 2009.

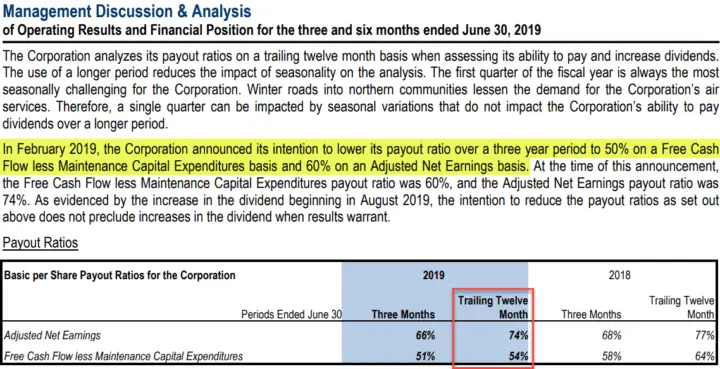

Exchange Income Corp Payout Ratios

Even though the dividend has never been cut, the payout ratio is too high for my liking. I typically look for a payout ratio based on EPS of 60% or less. Exchange Income Corp is 105% based on TTM EPS, and 69% based on estimated EPS over the next 12 months.

Exchange Income Corp prefers to use TTM Free Cash Flow and what they call TTM Adjusted Net Earnings to calculate payout ratios that they use for dividend decisions. Management has recognized that payout ratios have been too high and are trying to lower them over the next three years to 50% of FCF and 60% of Adjusted Net Earnings.

Because they are trying to lower payout ratios, I don’t expect future dividend growth to be high over the next 3 years. Their most recent 4% increase seems to signal this intent too.

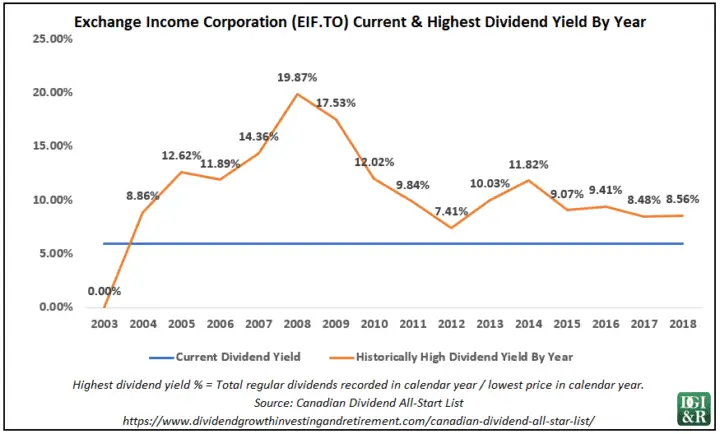

Exchange Income Corp Historically High Dividend Yields

Normally you’d think a 5.9% dividend yield would be high, but for Exchange Income Corp it’s actually historically quite low for the company.

Remember: They converted from an income trust to a corporation in 2009, so I’d focus on the yields after the conversion for a better comparison to today.

Using the dividend yield as a valuation tool suggests that it might be prudent to wait for a higher dividend yield.

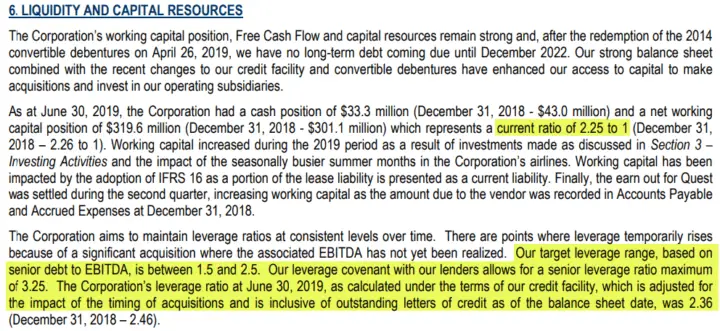

Exchange Income Corp Financial Strength

Normally I look for a BBB+ or equivalent credit rating or higher as a quick way to check financial strength. Because this is a small company, none of the credit rating agencies cover them.

Instead, let’s look at the interest coverage and debt/equity ratios. According to Morningstar, the TTM Interest Coverage is 2.6 (I want 4 or higher) and Debt to Equity Ratio is 1.81 (I want 0.5 or less).

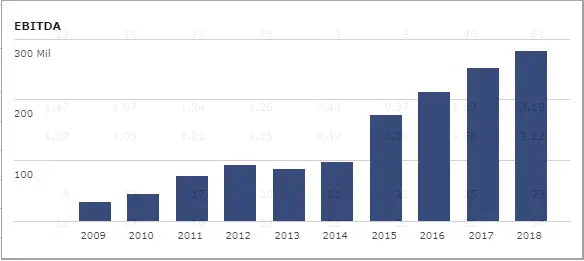

Exchange Income Corp doesn’t have a strong enough financial strength for me. They are working on improving it, but it’s not there yet.

If you are considering investing, keep in mind that they have bank covenants. They have a 2.36 senior debt to EBITDA ratio right now. If they go over 3.25 then they breach the bank covenants (Not a good thing).

Source: June 30, 2019 MD&A

The bank covenants aren’t a huge worry right now, but just something to be aware of if you are considering investing.

EBITDA would have to drop by more than 27% before they would start breaching the bank covenants and a 27% drop in EBITDA has never happened in their history.

Source: 2010 Annual Report

Source: Morningstar

Exchange Income Corp Final Thoughts

It’s not for me. I can see why the high dividend yield at almost 6% might be tempting, but the payout ratio is too high and the financial strength profile is too low. I don’t like how much debt they have.

I think it’s good that they plan to lower their payout ratio over the next three years, but this likely means low dividend growth in order to achieve this.

[Back to Navigation] [Jump to Summary]

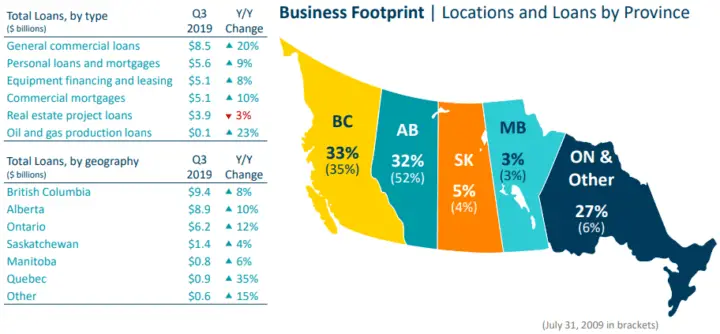

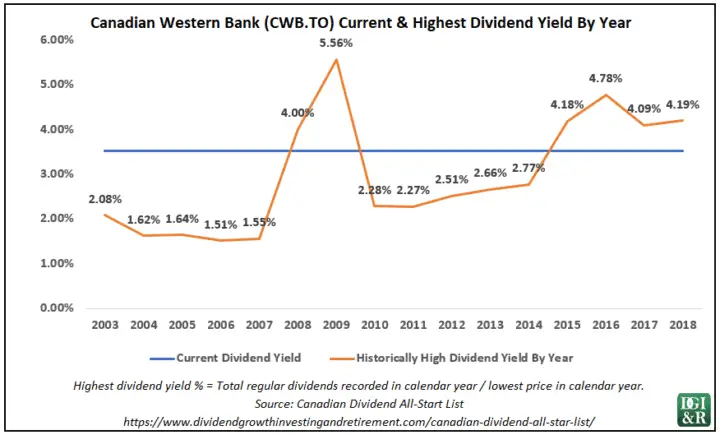

6. Canadian Western Bank (TSE:CWB) – 3.7% Dividend Increase (2nd increase in the past year)

Canadian Western Bank is one of the lesser know Canadian banks, but it is the 7th largest in Canada and has the longest dividend streak of the Canadian banks with 27 consecutive years of dividend increases. They provide financial services in banking, trust and wealth management primarily in Western Canada and Ontario.

Source: Canadian Western Bank 2019 Q3 Conference Call Presentation

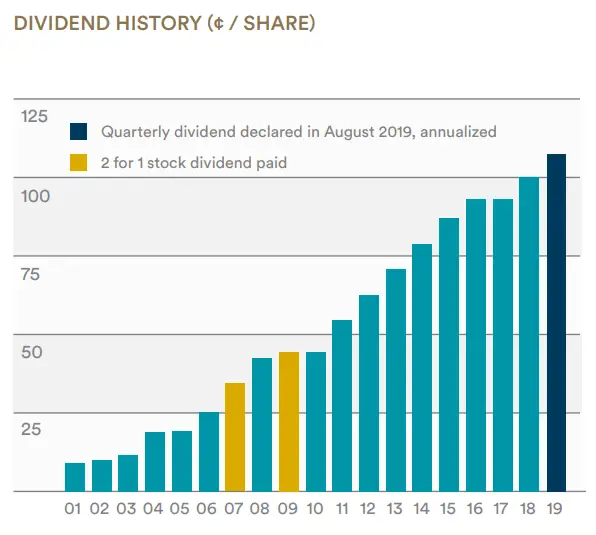

Canadian Western Bank Dividends

Source: Canadian Western Bank 2019 Q3 Investor Fact Sheet

Canadian Western Bank which has a dividend streak of 27 years recently increased its quarterly dividend by 3.7% from $0.2700 CAD to $0.2800 CAD. This dividend increase comes into effect with the dividend recorded on September 13, 2019.

Canadian Western Bank has been increasing its dividend twice a year, so if you factor in both increases, then the annual increase was 7.7% ($0.26 quarterly dividend to $0.27 and then most recently to $0.28).

The dividend yield as of October 11, 2019, was 3.4%, and they have 5 and 10-year average annual dividend growth rates of 7.2% and 9.0% respectively.

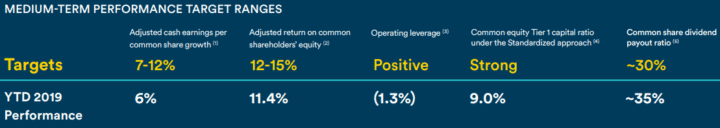

The current payout ratio (~35%) is above their 30% target, so I’d expect dividend growth to be slower than earnings growth going forward until they can get back down to their desired 30%.

Source: Canadian Western Bank Medium Term Performance Targets 2019 Q3 Investor Fact Sheet

In the medium term they are targeting 7-12% earnings growth, so if they can hit their targets then expect dividend growth a little lower than this.

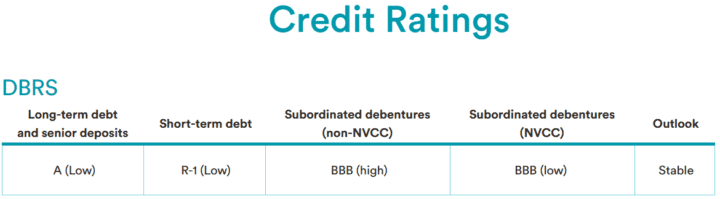

Canadian Western Bank Financial Strength & Valuation

DBRS gives them a decent credit rating of A (low).

Source: Canadian Western Bank Investor Relations – Debt Security Information

Based on the dividend yield the stock looks like it is trading around fair value. The time to buy this stock might have passed as you could’ve got +4% yields from 2015 to 2017.

Canadian Western Bank Final Thoughts

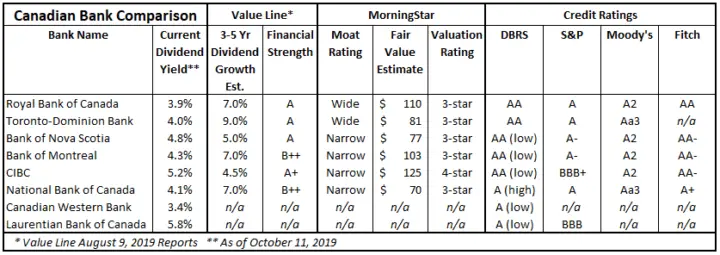

It’s a decent regional bank with a long dividend streak that I own, but the bigger Canadian banks have better credit ratings and higher dividend yields. If you are interested in the Canadian banking sector, then I’d start looking at the big ones first.

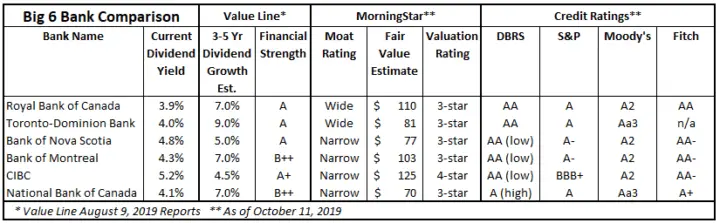

Here’s a little summary of the Canadian dividend growth banks (The big 6 are the top 6 in the list below):

Any of the Big 6 Canadian banks are worth considering as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects. I’d stay away from the smaller Laurentian Bank (TSE:LB) as its S&P credit rating of BBB is too low for me.

It all comes down to picking the one or more that suits you best.

Disclosure: I own shares of Canadian Western Bank (TSE:CWB).

[Back to Navigation] [Jump to Summary]

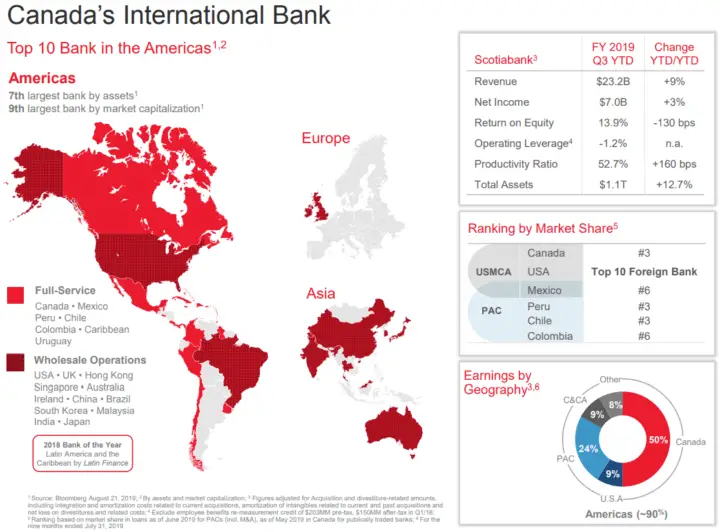

7. Bank of Nova Scotia (TSE:BNS; NYSE:BNS) – 3.4% Dividend Increase (2nd increase in the past year)

Bank of Nova Scotia is the third-largest bank of the “Big 5” Canadian banks and is known as Canada’s international bank. Bank of Nova Scotia declared its first dividend on July 1, 1833, and hasn’t missed one since!

Source: Scotiabank Investor Presentation Third Quarter 2019

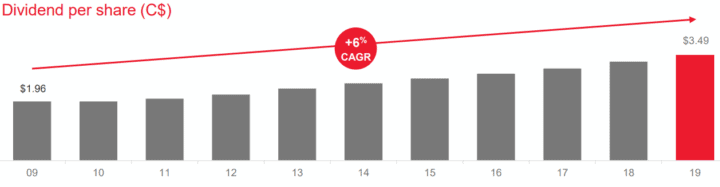

Bank of Nova Scotia Dividends

Source: 2019 Q3 Investor Presentation

“Scotiabank’s practice has been to relate dividends to the trend earnings, while ensuring that capital levels are sufficient for both growth and depositor protection.

This practice, coupled with the Bank’s strong earnings growth, has led to dividend increases in 43 of the last 45 years – one of the most consistent records for dividend growth among major Canadian corporations.”

Source: https://www.scotiabank.com/ca/en/about/investors-shareholders/common-share-dividends.html

Increases in 43 of the last 45 years are impressive. The two years without increases were 2009 and 2010, which is why Bank of Nova Scotia currently has a dividend streak of 8 years.

Bank of Nova Scotia recently increased its quarterly dividend 3.4% from $0.8700 CAD to $0.9000 CAD. This dividend increase comes into effect with the dividend recorded on Oct 01, 2019.

Bank of Nova Scotia has been increasing its dividend twice a year, so if you factor in both increases, then the annual increase was 5.9% ($0.85 quarterly dividend to $0.87 and then most recently to $0.90).

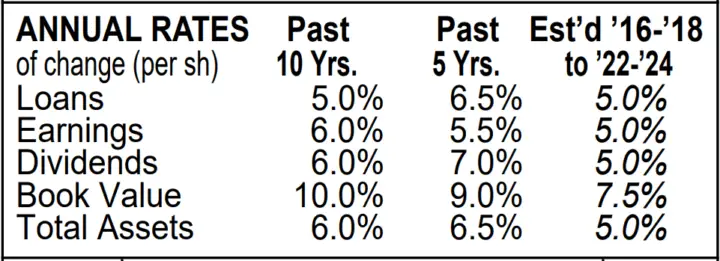

The dividend yield as of October 11, 2019, was 4.8%, and they have 5 and 10-year average annual dividend growth rates of 6.5% and 5.5% respectively.

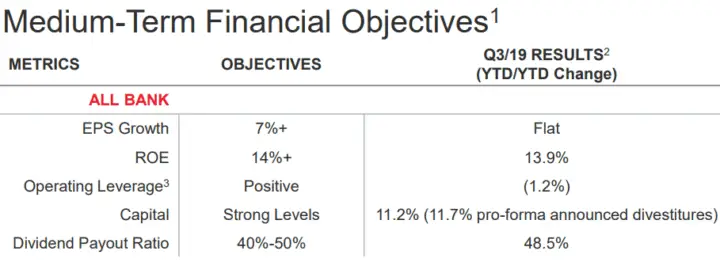

The current payout ratio is at the high-end of their target of 40-50%, so I’d expect dividend growth to mirror earnings growth going forward.

Source: Scotiabank Investor Presentation Third Quarter 2019

If they meet their EPS growth target of 7%+ then I’d expect dividend growth around the same. Value Line is estimating 5.0% annual dividend growth over the next 3-5 years with 5.0% earnings growth.

Source: Value Line Bank of Nova Scotia report, August 9, 2019

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

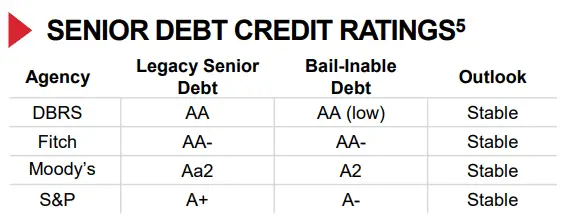

Bank of Nova Scotia Financial Strength & Valuation

Value Line gives Bank of Nova Scotia an “A” rating for financial strength, and the 4 rating agencies give the bank high credit ratings too. The company appears to have strong financial strength.

Source: 2019 Q3 Investor Fact Sheet

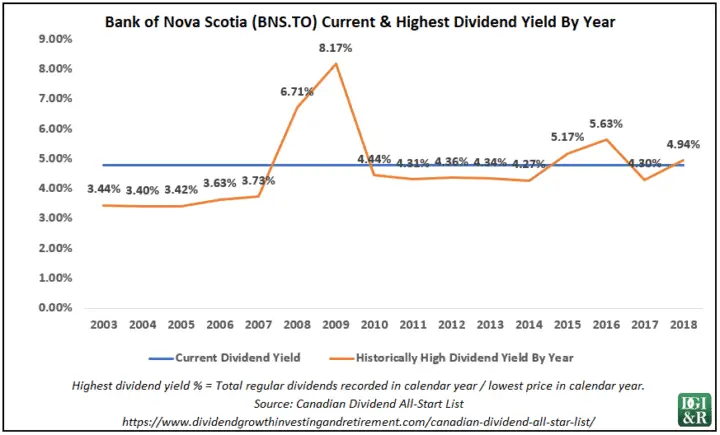

Using the dividend yield as a valuation tool suggests that they are reasonably priced. There have been a few years where the yield was higher than its current 4.5%, but overall, 4.5% seems to be a moderately high yield for Bank of Nova Scotia.

Morningstar rates them a narrow moat stock with a three-star valuation as they are currently trading around their fair value estimate of $77.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Bank of Nova Scotia Final Thoughts

Any of the Big 6 Canadian banks are worth considering as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects.

Bank of Nova Scotia is a quality bank with the 2nd highest yield (4.8%) of the Big 6 and decent dividend growth prospects trading around fair value.

I think Bank of Nova Scotia will be able to do a bit better than 5% dividend growth per year.

If you want a higher dividend growth estimate than 5% from Value Line, then consider the big two (Royal Bank & TD). The trade-off with these two is the lower dividend yields, but they are the only two that have a wide moat rating.

It all comes down to picking the one or more that suits you best.

Disclosure: I own shares of Bank of Nova Scotia (TSE:BNS; NYSE:BNS).

[Back to Navigation] [Jump to Summary]

8. Logistec Corporation (TSE:LGT.B) – 3.0% Dividend Increase

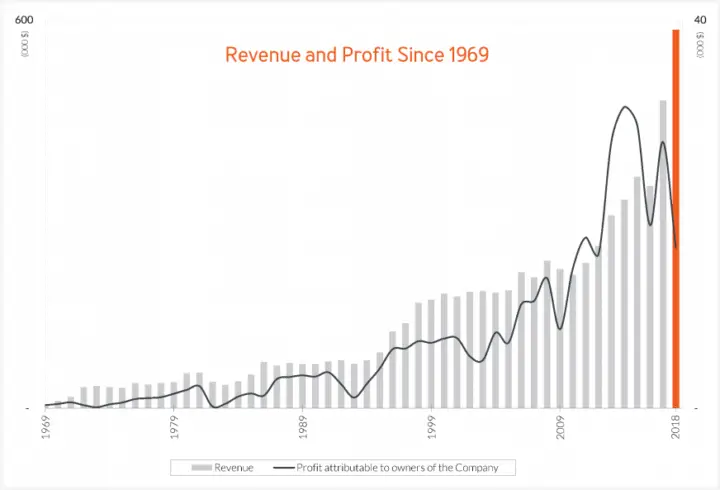

When I started looking into the history of Logistec Corporation two impressive streaks stuck out:

- Since they went public in 1969 they haven’t had an unprofitable year, and

- They’ve been paying dividends the whole time too (since 1969) without any dividend cuts.

The company was founded in 1952 by Roger Paquin and has been publicly traded since 1969. You can see from below that they haven’t had an unprofitable year, although they had some close calls in 1973 and 1982.

Source: https://www.logistec.com/revenue-profit-since-1969/

The Paquin family still controls Logistec Corp. through their ownership of Sumanic Investments Inc., which controls approximately 75% of the voting rights.

Logistec Corp. has a dual share class structure with Class A Common Shares and Class B Subordinate Voting Shares. Class A shares carry 30 votes per share and can be converted (on a one-for-one basis) to Class B shares. Class B shares carry one vote per share, entitle their holders to receive a dividend equal to 110% of dividends declared on Class A shares, and carry coattail provisions.

Headquartered in Montreal, Quebec, Logistec Corp. provides cargo handling and other services to the marine, industrial, and municipal sectors through its two business divisions: Marine Services and Environmental Services.

Marine Services (58% of annual revenue in 2018)

- One of Eastern Canada’s largest cargo handling companies and a growing player in the USA with cargo handling at some 37 ports and 63 terminals in Eastern Canada, in the Great Lakes, on the U.S. East Coast, and in the U.S. Gulf.

- Marine transportation services geared primarily to the Arctic coastal trade;

- Marine agency services to foreign shipowners and operators serving the Canadian market;

- Short-line rail transportation.

Environmental Services (42% of annual Revenues in 2018)

- Services to industrial and municipal organizations for the trenchless structural rehabilitation of underground water mains, regulated materials management, site remediation, risk assessment, and woven-hose manufacturing.

Logistec Dividends

Logistec Corp. has been paying dividends for five decades and in that time has never had a dividend cut. Since 1971, they’ve been paying a quarterly dividend, without interruption or decrease. Keep in mind that in some of these years they didn’t increase the dividend, but still a fairly impressive dividend history for a Canadian company. (FYI – They also had special dividend payments in 2014, 2007, and 1995.)

Logistec Corporation which has a dividend streak of 9 years recently increased its quarterly dividend 3.0% from $0.0998 CAD to $0.1029 CAD. This dividend increase comes into effect with the dividend recorded on Sep 27, 2019.

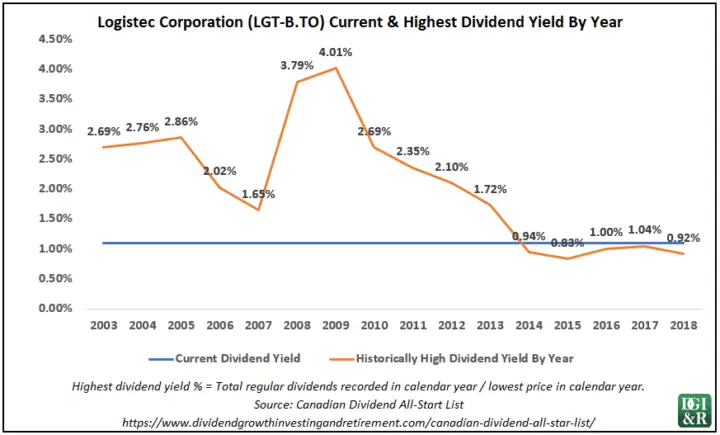

The dividend yield as of October 11, 2019, was 1.1%, and they have 5 and 10-year average annual dividend growth rates of 12.5% and 8.1% respectively.

This recent 3% dividend growth is low for such a typically low yielding company, so it’s not a company that currently interests me. If dividends send signals, then a 3% dividend increase isn’t sending a very strong signal.

Logistec Historically High Dividend Yields

Logistec’s yield has dropped substantially over the years and its current 1.1% yield is low.

Based on dividend yield the stock looks overvalued.

It’s important to remember that using dividend yield as a valuation tool for lower-yielding companies is usually less reliable, which I why it’s good practice to look at a variety of different valuation metrics.

Logistec Final Thoughts

Even if the dividend yield increased substantially, I’m not sure I’d consider investing as their earnings are fairly erratic from year to year. Yes, it is true they haven’t had an unprofitable year since they went public in 1969, but I’d like to have more earnings growth consistency.

I haven’t completely made up my mind on this one, but as the yield is too low for me right now anyway, I’ll save the more in-depth research for when/if the yield gets up to around 2.5% to 3.0%. As it’s well off those levels, it could be some time before I revisit Logistec Corp.

[Back to Navigation] [Jump to Summary]

9. Saputo Inc. (TSE:SAP) – 3.0% Dividend Increase

Do you eat cheese, or drink milk? …

Then chances are you’ve eaten or drank one of Saputo’s products.

Saputo is one of the top ten dairy processors in the world. It is the largest cheese manufacturer and the leading fluid milk and cream processor in Canada, the top dairy processor in Australia, and the second largest in Argentina. In the US, Saputo ranks among the top three cheese producers and is one of the largest producers of extended shelf-life and cultured dairy products.

Source: Saputo Financial Fact Sheet Q1 – FY2020

Saputo Dividends

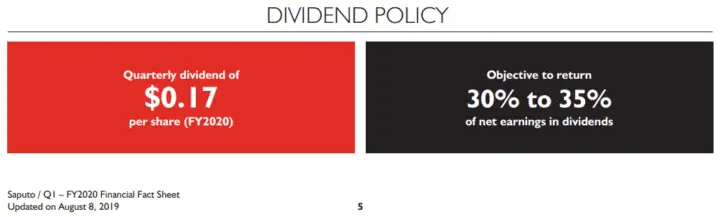

Saputo Inc. which has a dividend streak of 19 years recently increased its quarterly dividend by 3.0% from $0.1650 CAD to $0.1700 CAD. This dividend increase comes into effect with the dividend recorded on Sep 03, 2019.

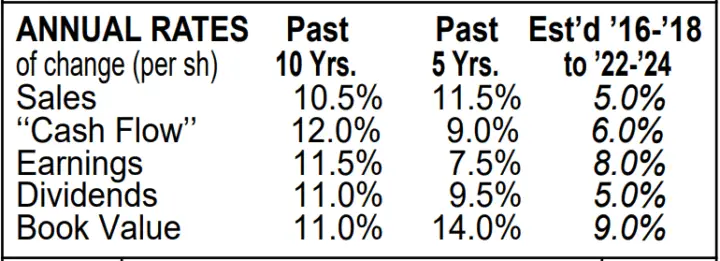

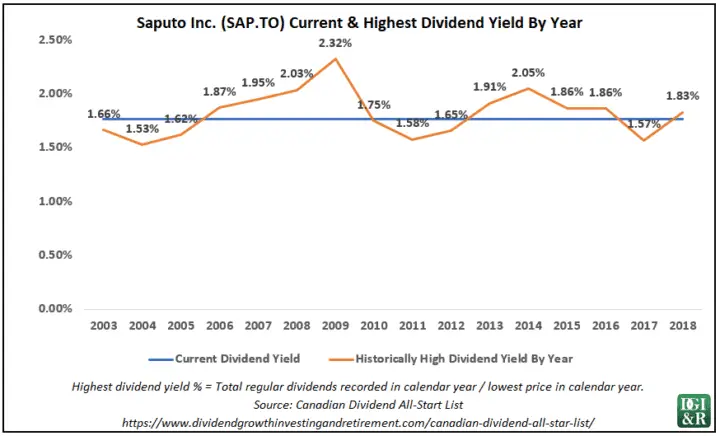

The dividend yield as of October 11, 2019, was 1.8%, and they have 5 and 10-year average annual dividend growth rates of 8.1% and 12.0% respectively.

A 3% raise means that this is the 2nd year in a row of slow dividend growth for Saputo. Last year was 3.1%. If dividends send signals, then the signal isn’t very good.

Source: Saputo Financial Fact Sheet Q1 – FY2020

Saputo is targeting a payout ratio of 30-35%. They are currently around the high end of their target, so the low recent dividend increase isn’t too surprising. I’d expect future dividend growth to mirror or be slightly less than earnings growth.

A payout ratio of around 35% is low, but lower payout ratios are more common for companies like Saputo where part of the growth strategy involves acquisitions.

Source: Saputo Financial Fact Sheet Q1 – FY2020

Value Line is estimating 5.0% annual dividend growth over the next 3-5 years and 8.0% earnings growth.

Source: Value Line Saputo report, July 19, 2019

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

Saputo Financial Strength & Valuation

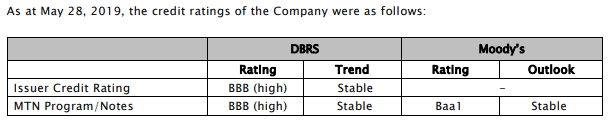

Value Line gives Saputo an “A” rating for financial strength, and it has OK credit ratings from DBRS and Moody’s. The company appears to have OK financial strength.

FYI – From Value Line I want a B+ rating or higher and from the credit rating agencies a BBB+/Baa1/BBB (high) rating or higher.

Source: Saputo June 6, 2019 Annual Information Form

Based on dividend yield the stock looks overvalued.

It’s important to remember that using dividend yield as a valuation tool for lower-yielding companies is usually less reliable, which I why it’s good practice to look at a variety of different valuation metrics.

Morningstar rates them a narrow moat stock with a two-star valuation as they are currently trading above their fair value estimate of $33.50.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Saputo Final Thoughts

To be interested in Saputo I’d want high dividend growth with such a low current yield of 1.8%, but that’s not what you get.

The most recent dividend increase was only 3% and last year was 3.1%. This suggests that management isn’t too optimistic about the future. Value Line is estimating 5% annual dividend growth over the next 3-5 years.

Saputo has a low dividend yield and that the stock appears overvalued so it’s not a company I’m currently considering. If the valuation and dividend growth improve then I’d re-consider Saputo at that time.

[Back to Navigation] [Jump to Summary]

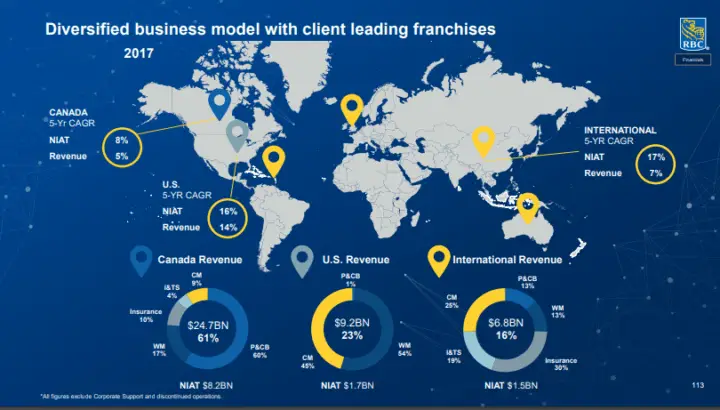

10. Royal Bank of Canada (TSE:RY; NYSE:RY) – 2.9% Dividend Increase (2nd increase in the past year)

Royal Bank of Canada is Canada’s biggest bank.

Canada is known for its banks and with Royal Bank, you are getting one of the best in the sector. They haven’t missed a dividend payment since 1870.

Source: Investor Relations: RBC At A Glance

They have five main business segments:

Source: 2017 Annual Report

Despite being known as the largest Canadian bank they have a large number of international operations too.

Source: June 13, 2018, Investor Day 2018 Presentation

Royal Bank of Canada Dividends

Royal Bank of Canada which has a dividend streak of 8 years recently increased its quarterly dividend 2.9% from $1.0200 CAD to $1.0500 CAD. This dividend increase comes into effect with the dividend recorded on Oct 24, 2019.

Royal Bank has been increasing its dividend twice a year, so if you factor in both increases, then the annual increase was 7.1% ($0.98 quarterly dividend to $1.02 and then most recently to $1.05).

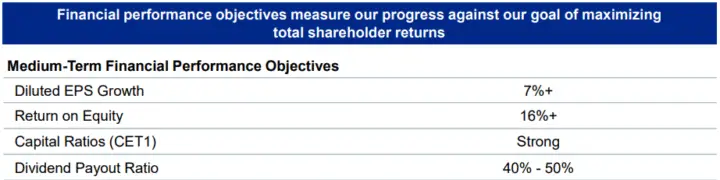

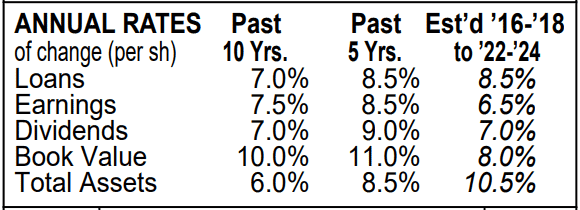

The dividend yield as of October 11, 2019, was 3.9%, and they have 5 and 10-year average annual dividend growth rates of 8.3% and 6.5% respectively.

The current payout ratio is around the mid-to-high 40s and their target is 40-50%, so I’d expect dividend growth to mirror earnings growth going forward.

Source: 2019 Q3 Investor Presentation

If they can meet their EPS growth target of 7%+ then I’d expect dividend growth around the same amount.

Coincidently, Value Line is estimating 7.0% annual dividend growth over the next 3-5 years with 6.5% earnings growth.

Source: Value Line Royal Bank of Canada report, August 9, 2019

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

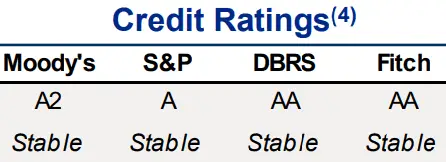

Royal Bank of Canada Financial Strength & Valuation

Value Line gives Royal Bank an “A” rating for financial strength, and the 4 rating agencies give them high ratings too. The company appears to have strong financial strength.

Source: Investor Relations: RBC At A Glance

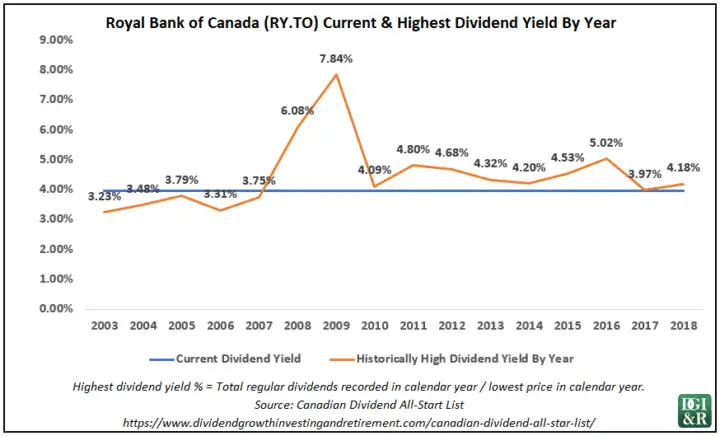

Based on yield Royal Bank looks like it is trading around fair value, but in the past decade, there have been chances almost every year to buy at +4% dividend yields.

Morningstar gives Royal Bank a wide moat rating and a 3-star valuation as they are currently trading around their fair value estimate of $110.

Morningstar only rates two Canadian banks with a wide moat and Royal Bank is one of them. The other is TD.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

Royal Bank of Canada Final Thoughts

With Royal Bank, you are getting a high-quality dividend growth company trading around fair value.

Any of the Big 6 Canadian banks are worth considering as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects.

Royal Bank is a quality bank, but you can get a slightly higher yield from TD. Also, Value Line is estimating higher dividend growth for TD too.

TD is the only other bank with a wide moat rating, but if you are OK with the narrow moat rating then you have some even higher-yielding options.

It all comes down to picking the one or more that suits you best.

[Back to Navigation] [Jump to Summary]

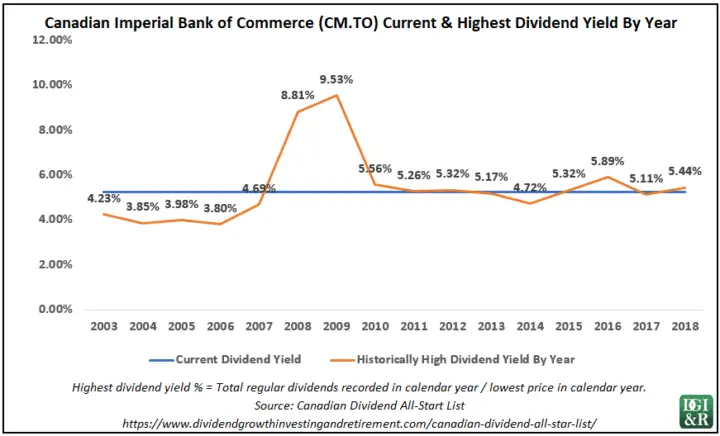

11. Canadian Imperial Bank of Commerce (TSE:CM; NYSE:CM) – 2.9% Dividend Increase (2nd increase in the past year)

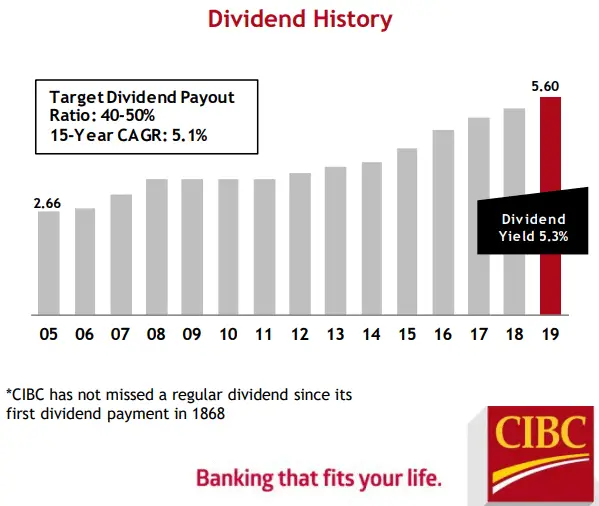

Canadian Imperial Bank of Commerce, aka CIBC, is the smallest of Canada’s “Big 5” banks. Just like the other Big 5 banks, CIBC has an impressive dividend history having paid uninterrupted dividends since they first started in 1868.

They have four business units that provide a full range of financial products and services to 10 million individual, small business, commercial, corporate, and institutional clients in Canada, the U.S. and around the world.

Source: CIBC Investor Fact Sheet Q3 2018

CIBC Dividends

Canadian Imperial Bank of Commerce which has a dividend streak of 8 years recently increased its quarterly dividend 2.9% from $1.4000 CAD to $1.4400 CAD. This dividend increase comes into effect with the dividend recorded on Sep 27, 2019.

CIBC has been increasing its dividend twice a year, so if you factor in both increases, then the annual increase was 5.9% ($1.36 quarterly dividend to $1.40 and then most recently to $1.44).

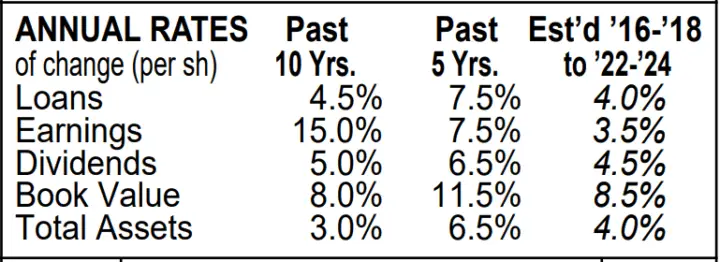

The dividend yield as of October 11, 2019, was 5.2%, and they have 5 and 10-year average annual dividend growth rates of 7.1% and 4.5% respectively.

Source: CIBC Investor Fact Sheet Q3 2019

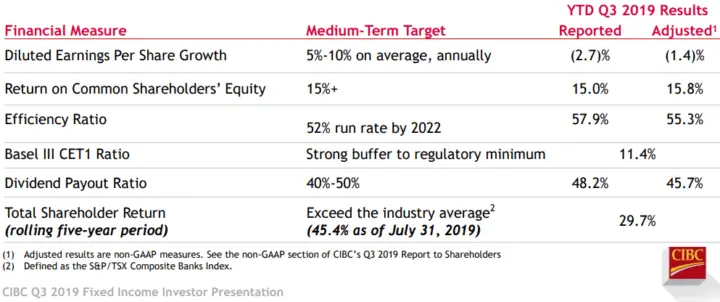

The current payout ratio is around the mid-to-high end of their 40-50% target, so I’d expect dividend growth to mirror earnings growth going forward.

Source: Q3 2019 Fixed Income Investor Presentation

If they meet their EPS growth target of 5%-10% (Royal Bank’s and Bank of Nova Scotia’s are 7%+) then I’d expect dividend growth around the same. Value Line is estimating 4.5% annual dividend growth over the next 3-5 years with 3.5% earnings growth.

Source: Value Line CIBC report, August 9, 2019

Related articles: How to use Value Line Investment Survey Reports to Quickly Assess Dividend Growth Stocks & How to get free online access to the Value Line Investment Survey in Canada [+ list of Canadian stocks covered by Value Line]

CIBC Financial Strength & Valuation

Value Line gives CIBC an “A+” rating for financial strength, and the 4 rating agencies give the bank decent credit ratings too.

S&P’s BBB+ for the Bail-In Senior rating does stand out as on the low end for the big banks though. The company appears to have decent financial strength.

FYI – I typically look for a B+ rating or higher from Value Line and from the credit rating agencies a BBB+/BBB (high)/Baa1 rating or higher.

Source: CIBC Investor Fact Sheet Q3 2019

Based on yield CIBC looks like it is trading at a reasonably cheap price.

Morningstar rates them a narrow moat stock with a 4-star valuation as they are currently trading below their fair value estimate of $125.

TIP – Check to see if your broker provides access to Morningstar. I use Questrade which has free access to Morningstar research. (Affiliate link, but I’ve been using Questrade for years and I consider them the best low-cost broker in Canada)

CIBC Final Thoughts

It’s hard to go wrong with one of the Big 6 banks, and CIBC currently has the highest yield of all of them at 5.2%. CIBC also looks the cheapest also as it is the only 4-star rated bank of the bunch.

There is a trade-off though, as it looks like future dividend growth might be a bit lower than some of the others and CIBC only has a narrow moat compared to the wide moat of Royal Bank and TD.

Any of the Big 6 Canadian banks are worth considering as they have similar appealing profiles: high, but not too high dividend yield with decent dividend growth prospects.

It all comes down to picking the one or more that suits you best.

Summary

Monitoring dividend increases is a good idea because it can be a sign from management that they feel good about the prospects of the company.

In August 2019 there were 11 dividend increases in the Canadian Dividend All-Star List (An excel spreadsheet with a lot of stock information on all Canadian companies that have increased their dividend for 5 or more calendar years in a row.):

- Ritchie Bros. Auctioneers Inc (TSE:RBA; NYSE:RBA) – 11.1% Dividend Increase

- CAE Inc (TSE:CAE; NYSE:CAE) – 10.0% Dividend Increase

- Keyera Corp. (TSE:KEY) – 6.7% Dividend Increase

- Sylogist Ltd. (CVE:SYZ) – 5.3% Dividend Increase

- Exchange Income Corporation (TSE:EIF) – 4.1% Dividend Increase

- Canadian Western Bank (TSE:CWB) – 3.7% Dividend Increase (2nd increase in the past year)

- Bank of Nova Scotia (TSE:BNS; NYSE:BNS) – 3.4% Dividend Increase (2nd increase in the past year)

- Logistec Corporation (TSE:LGT.B) – 3.0% Dividend Increase

- Saputo Inc. (TSE:SAP) – 3.0% Dividend Increase

- Royal Bank of Canada (TSE:RY; NYSE:RY) – 2.9% Dividend Increase (2nd increase in the past year)

- Canadian Imperial Bank of Commerce (TSE:CM; NYSE:CM) – 2.9% Dividend Increase (2nd increase in the past year)

Out of the 11, the big banks looked the most interesting to me, but I already have a little over 20% of my portfolio in financials so it’s not a sector I’m looking to add to.

Sylogist Ltd. was the other company that caught my eye as it has a decent yield of 3.8% and no debt. It’s a very small company and the payout ratio is on the high side (~75%), but they have a lot of cash and no debt so it’s a bit difficult to assess. I’d like to learn more about them, so please comment if you have some insight.

Keyera is a company that I see investors being tempted by because of its high yield (6.3%) and decent dividend growth prospects. The BBB credit rating is too low for me though and the other big issue was the no-moat rating by Morningstar. Unlike other pipeline operators, most of Keyera’s contracts can be terminated on short notice and they don’t have a lot of the regulatory protections that other pipeline companies have.

Disclosure: I own shares of Bank of Nova Scotia and Canadian Western Bank. You can see my portfolio here.

Newsletter Sign-Up & Bonus

Have you enjoyed our content?

Then subscribe to our newsletter and you'll be emailed more great content from Dividend Growth Investing & Retirement (DGI&R).

BONUS: Subscribe today and you'll be emailed the most recent version of the Canadian Dividend All-Star List (CDASL).

The CDASL is an excel spreadsheet with an abundance of useful dividend screening information on Canadian companies that have increased their dividend for five or more years in a row.

The CDASL is one of the most popular resources that DGI&R offers so don't miss out!

This is truly an incredible article. The amount of time and focus you put into it is great and very helpful! Thanks for taking the time to make this available to people like me.

Just initiated a small position in Sylogist at average price of 9.98$ with a yield of 4.10%. No short/long term debt. I like that they have a SaaS (Software as a Service) payment system.This forces the companies to pay for the software on a monthly basis (or quarterly/yearly). This creates a recurring cash flow stream that is predictable and stable. Especially, when a lot of there clients are government institutions, where once something is “adopted” it tends to stay like that for a long time.

It’s still a under-covered stock, I think it has potential for growth.